TIDMHHI

RNS Number : 2092M

Henderson High Income Trust PLC

13 September 2023

LEGAL ENTITY IDENTIFIER: 213800OEXAGFSF7Y6G11

HERSON HIGH INCOME TRUST PLC

Unaudited results for the half-year ended 30 June 2023

This announcement contains regulated information

Investment Objective

The Company invests in a prudently diversified selection of both

well-known and smaller companies to provide investors with a high

dividend income stream while also maintaining the prospect of

capital growth.

Performance for the six months to 30 June 2023

-- Net asset value (NAV) total return (debt at fair value)(1) of

3.0% compared with a total return from the benchmark(2) of

1.9%

-- Mid-market share price total return (including dividends reinvested) of 2.0%

Financial highlights

at 30 June 2023 at 31 December

2022

----------------------------------------- ------------------ -----------------

NAV per share (3) 164.1p 164.2p

Mid-market price per share 163.5p 165.3p

Net assets GBP213.6m GBP214.3m

Dividends paid/payable 5.15p 10.15p

Dividend yield 6.2% 6.1%

Gearing 21.3% 21.4%

(Discount)/premium to NAV (debt at fair

value) (0.4%) 0.6%

Total return performance (including dividends reinvested and excluding

transaction costs)

6 months 1 year 3 years 5 years 10 years

% % % % %

------------------------------------------ --------- ------- -------- -------- ---------

NAV total return (debt at fair value)(1) 3.0 7.7 30.9 17.9 86.9

Share price total return(4) 2.0 8.3 36.4 23.1 78.9

Benchmark(2) 1.9 5.0 21.6 12.5 67.4

FTSE All-Share Index 2.6 7.9 33.2 16.5 78.0

ICE BofA Sterling Non-Gilts Index -1.1 -7.1 -17.6 -7.0 22.4

------------------------------------------ --------- ------- -------- -------- ---------

1. Net asset value with debt at fair value per ordinary share total return

(including dividends reinvested and excluding transaction costs)

2. The benchmark is a composite of 80% of the FTSE All-Share Index (total

return) and 20% of the ICE BofA Sterling Non-Gilts Index (total return)

rebalanced annually

3. Net asset value per share with debt at fair value as published by the

Association of Investment Companies (AIC)

4. The mid-market share price total return (including dividends reinvested)

Sources: Morningstar Direct and Janus Henderson

INTERIM MANAGEMENT REPORT

CHAIRMAN'S STATEMENT

Markets/Performance

The first half of 2023 has been a volatile period for financial markets.

With high inflation globally, policy makers have continued to raise interest

rates in an attempt to cool economic activity and reduce price increases.

Investors are focused on how much further rates will rise and trying to

assess the impact on corporate profitability from increased borrowing

costs. From a global perspective, there are some signs that the UK economy

might see inflationary pressure take a little longer to abate, not least

due to the very tight labour market in the UK and the pressure in particular

from recent public and private sector pay settlements.

Against this backdrop the Company has made modest positive progress in

the first half of 2023 achieving a net asset value total return of +3.0%

compared with a benchmark return of +1.9%, outperformance of 1.1%. The

Company's share price total return has been in line with the benchmark

at +2.0%.

Gearing/Asset Allocation

The Company started 2023 with an overweight position in equities and an

underweight position in fixed interest investments compared with its benchmark

(80% equities, 20% bonds). This position has not changed markedly during

the first half of 2023 and the Company's gearing is also largely unchanged

at 21.3% as at 30 June 2023 (21.4% as at 31 December 2022).

The Board regularly reviews the level of gearing with the Company's Fund

Manager, and this has continued to be the case not least due to the increase

in interest rates which impact the Company's overall borrowing costs,

notwithstanding the fact that a proportion of the Company's borrowings

are at fixed rates.

Dividends

The first interim dividend of 2.575 pence per share was paid on 28 April

2023 and a second interim dividend of the same amount was paid on 28 July

2023.

A third interim dividend, to be paid from the Company's revenue account,

of 2.575 pence per share was announced on 17 July 2023 and this dividend

will be paid on 27 October 2023 to shareholders registered at the close

of business on 15 September 2023 (with the shares being quoted ex-dividend

on 14 September 2023).

Looking across the corporate sector at recent results announcements it

is encouraging that dividend payout levels continue to be relatively healthy

and, notwithstanding the impact of higher borrowing costs on end demand

and corporate profitability, UK corporate balance sheets remain in generally

good health.

David Smith continues to regularly update the Board on prospective income

levels from the Company's portfolio of investments and combined with the

Company's current dividend reserves, the Board continues to have confidence

in the Company's ability to deliver a high income return to shareholders.

Outlook

In the near term the outlook for markets will be driven by inflation expectations

and the impact this will have on monetary policy. There are certainly

some signs that inflation is easing a little, particularly in the US and

across Europe. However, inflation in the UK is proving more problematic,

and although the Bank of England has increased interest rates significantly

in the first half of 2023, the expectation in the market is that they

may have to rise a little further.

The UK corporate sector is in the midst of the interim results season

and whilst there are certainly pockets of weakness, corporate results

are for the most part holding up well. In particular, UK banks have announced

positive updates showing relatively little sign of corporate and personal

sector weakness, and capital levels within the banks are at very positive

levels. In addition, the UK housing market, which is very important to

the UK economy, is holding up reasonably well at this stage.

UK companies, where the majority of the Company's assets remain invested,

still appear to be relatively attractively valued in a global context

and are still delivering the income levels which will assist the Company's

Fund Manager to deliver a high income return for shareholders whilst also

retaining exposure to longer term capital growth.

Jeremy Rigg

Chairman

12 September 2023

Fund Manager's Report

Markets

After a strong start to the year for equity markets on fading recessionary

fears and good corporate earnings, the UK market pared back some of those

gains as a result of higher-than-expected inflation and the subsequent

rise in interest rates. The FTSE All-Share Index returned 2.6% on a total

return basis, which lagged both US and European equity markets. While

inflation continued to fall from its peak in October last year, it remained

stubbornly high in the UK, with the Consumer Price Index (CPI) rising

8.7% in May. This prompted the Bank of England to raise interest rates

four times in the period, from 3.5% to 5.0% as at the end of June. UK

government bond yields also rose during the period due to concerns about

inflation and the prospect of interest rates staying higher for longer,

with the 10-year gilt yield increasing to 4.4% at the end of June, from

3.7% at the beginning of the period.

Larger cap companies continued to outperform mid-caps with the FTSE 100

up 3.2% versus the 0.6% decline in the FTSE 250. Sectors such as consumer

discretionary, industrials and financials performed best, while consumer

staples, basic materials and telecoms lagged.

Performance

The Company's NAV (with debt at fair value) rose by 3.0% during the period,

outperforming the Company's benchmark return of 1.9%. Within the equity

portfolio, holdings in 3i, B&M European Retail and Whitbread were positive

for performance. Private equity group 3i announced strong trading from

its largest holding, European discount retailer Action, which supported

a significant uplift to its NAV. B&M is another discount retailer held

by the portfolio which also delivered robust results, as pressure on consumer

spending led to an increase in customers "trading down" to B&M's value

proposition. Whitbread, the owner of budget hotel chain Premier Inn, reported

good trading momentum with the company benefitting from the investment

it made during the pandemic to emerge in a strong position versus its

competitors. Elsewhere the portfolio's positions in Anglo American and

British American Tobacco (BAT) detracted from returns. Anglo American

shares came under pressure from falling commodity prices and fears the

Chinese economic recovery was stalling, while BAT's underperformed after

it stopped its share buyback program and announced it was to pay $635

million to the US Department of Justice for a historic breach of sanctions

in North Korea.

Portfolio Activity

During the period the allocation to bonds was increased, taking advantage

of the move higher in yields on UK investment grade credit. Bonds were

purchased in typically non-cyclical businesses such as Sky (media) and

EDF (utilities). The bond portfolio represented 11.5% and 13.9% of portfolio

gross and net assets respectively as at the end of June.

Within the equity portfolio new holdings were established in MoneySuperMarket.com,

Conduit Re and DCC . MoneySuperMarket.com is the market leading price

comparison website in the UK and should benefit from consumers looking

to manage their bills in the current high inflation environment. Conduit

Re is a specialist property and casualty reinsurer with a diversified

portfolio of reinsurance risks. Capacity has reduced significantly in

the reinsurance market after a number of years of large losses, and as

a result, the market is entering a period of strong premium rate rises

which should underpin high returns over the medium term. DCC, an international

sales, marketing and distribution company operating in the LPG, oil, technology

and health care sector, has a resilient business with strong free cash

flow, high returns and a robust balance sheet which should support further

accretive acquisitions. The Company sold some of its overseas holdings

during the period, including McDonalds, Deutsche Post and Nordea after

a period of good performance.

David Smith

Fund Manager

12 September 2023

INVESTMENT PORTFOLIO

Classification of Investments by Sector

Total Total

30 June 2023 31 December 2022

Company % %

------------------------------------------- ---------------------------- -------------------

FIXED INTEREST

Preference shares 1.6 1.8

Other fixed interest 9.9 9.4

------ ------

Total Fixed Interest 11.5 11.2

------ ------

EQUITIES

Energy

Oil, gas and coal 6.0 5.6

------ ------

Total Energy 6.0 5.6

------ ------

Basic Materials

Chemicals 1.7 1.6

Industrial metals and mining 3.8 5.7

------ ------

Total Basic Materials 5.5 7.3

------ ------

Industrials

Electronic and electrical equipment 1.3 0.8

General industrials 1.0 1.2

Industrial engineering 0.9 0.8

Industrial support services 2.0 1.2

Industrial transportation - 0.9

------ ------

Total Industrials 5.2 4.9

------ ------

Consumer Discretionary

Consumer services 1.8 1.6

Household goods and home construction 1.0 1.6

Media 3.1 2.7

Personal goods 1.2 1.4

Retailers 2.4 2.0

Travel and leisure 1.8 2.6

------ ------

Total Consumer Discretionary 11.3 11.9

------ ------

Health Care

Pharmaceuticals and biotechnology 4.7 4.9

------ ------

Total Health Care 4.7 4.9

------ ------

Consumer Staples

Beverages 5.0 5.1

Food producers 2.6 3.5

Personal care, drug and grocery stores 5.9 5.8

Tobacco 5.6 6.8

------ ------

Total Consumer Staples 19.1 21.2

------ ------

Utilities

Electricity 2.0 1.8

Gas, water and multi-utilities 5.1 3.8

------ ------

Total Utilities 7.1 5.6

------ ------

Financials

Banks 6.7 7.3

Closed end investments 2.1 2.3

Finance and credit services 0.9 1.1

Investment banking and brokerage services 7.9 7.0

Life insurance 2.8 2.5

Non-life insurance 3.5 2.6

------ ------

Total Financials 23.9 22.8

------ ------

Technology

Software and computer services 2.4 1.2

Technology hardware and equipment 1.0 0.9

------ ------

Total Technology 3.4 2.1

------ ------

Real Estate

Real estate investment trusts 2.3 2.5

------ ------

Total Real Estate 2.3 2.5

-------- --------

Total investments 100.0 100.0

===== =====

TWENTY LARGEST INVESTMENTS Fair value Fair value

as at as at

30 June % 31 December %

2023 of portfolio 2022 of portfolio

Company Sector GBP'000 2023 GBP'000 2022

-------------- -------------- ------------- ------------- ------------- -------------

British

American Consumer

Tobacco Staples 9,543 3.7 11,775 4.5

Consumer

Unilever Staples 9,433 3.6 9,628 3.7

Relx Consumer

(Netherlands) Discretionary 8,121 3.1 7,102 2.7

3i Financials 6,725 2.6 6,389 2.5

Consumer

Diageo Staples 6,571 2.5 7,100 2.7

HSBC Financials 6,441 2.5 3,943 1.5

NatWest Financials 6,095 2.4 7,165 2.8

Consumer

Tesco Staples 5,910 2.3 5,520 2.1

BP Energy 5,900 2.3 6,114 2.4

Shell Energy 5,753 2.2 4,845 1.9

Basic

Rio Tinto Materials 5,702 2.2 6,034 2.3

AstraZeneca Healthcare 5,528 2.1 7,182 2.8

SSE Utilities 5,101 2.0 4,542 1.7

Imperial Consumer

Brands Staples 5,022 1.9 5,984 2.3

Lloyds

Banking Financials 4,912 1.9 4,819 1.9

National Grid Utilities 4,889 1.9 4,488 1.7

Phoenix Financials 4,712 1.8 4,253 1.6

Consumer

Compass Discretionary 4,696 1.8 4,091 1.6

Immediate

Capital Financials 4,365 1.7 3,299 1.3

Anglo Basic

American Materials 4,315 1.7 7,062 2.7

------------ ------------ ------------ ------------

Total 119,734 46.2 121,335 46.7

======= ======= ======= =======

EQUITY PORTFOLIO SECTOR EXPOSURE AS AT 30 JUNE 2023

Equity portfolio FTSE All-Share

weight Index

% %

-------------------------------------------------- ------------------------------------------- ---------------

Basic Materials 6.2 7.2

Consumer Discretionary 12.6 12.0

Consumer Staples 21.2 15.0

Energy 6.7 10.7

Financials 28.3 23.2

Health Care 5.2 11.6

Industrials 5.7 11.9

Real Estate 2.6 2.3

Technology 3.7 1.2

Telecommunications -- 1.3

Utilities 7.8 3.6

Total -------- --------

100.0 100.0

===== =====

Source: Janus Henderson

Principal Risks and Uncertainties

The principal risks associated with the Company's business can be divided

into the following main areas:

-- Climate change risk

-- Investment risk

-- Market/financial risk

-- Operational risks including cyber risks, pandemic risks and epidemic

risks and risks relating to terrorism and international conflicts

-- Tax, legal and regulatory risk

Information on these risks and how they are managed is given in the Company's

Annual Report for the year-ended 31 December 2022. The Board has completed

a thorough review of the principal risks and considers that these risks

have not changed over the last six months and are as applicable to the

remaining six months of the financial year as they were to the six months

under review.

Statement OF Directors' ResponsibilitIES

The Directors (listed in note 12) confirm that, to the best of their knowledge:

a) the condensed set of financial statements has been prepared in

accordance with FRS 104 "Interim Financial Reporting" issued by

the Financial Reporting Council;

b) this report includes a fair review of the information required

by Disclosure Guidance and Transparency Rule 4.2.7R (indication

of important events during the first six months and description

of principal risks and uncertainties for the remaining six months

of the year); and

c) this report includes a fair review of the information required

by Disclosure Guidance and Transparency Rule 4.2.8R (disclosure

of related party transactions and changes therein).

For and on behalf of the Board

Jeremy Rigg

Chairman

12 September 2023

Condensed Statement of Comprehensive Income

Half-year ended Half-year ended Year-ended

30 June 2023 30 June 2022 31 December 2022

(Unaudited) (Unaudited) (Audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

return return return return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Losses on

investments

held at fair

value through

profit or

loss - (420) (420) - (25,159) (25,159) - (22,469) (22,469)

Income from

investments

held at fair

value through

profit or

loss 8,415 - 8,415 8,203 - 8,203 14,632 - 14,632

Other interest

receivable

and similar

income 275 - 275 176 - 176 307 - 307

----------- ----------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Gross revenue

and capital

losses 8,690 (420) 8,270 8,379 (25,159) (16,780) 14,939 (22,469) (7,530)

----------- ----------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Expenses

Management

fees (note

2) (282) (422) (704) (276) (415) (691) (557) (836) (1,393)

Other

administrative

expenses (227) - (227) (232) - (232) (498) - (498)

----------- ----------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Net return

before finance

costs and

taxation 8,181 (842) 7,339 7,871 (25,574) (17,703) 13,884 (23,305) (9,421)

Finance costs (304) (914) (1,218) (163) (487) (650) (380) (1,140) (1,520)

----------- ----------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Net return

before

taxation 7,877 (1,756) 6,121 7,708 (26,061) (18,353) 13,504 (24,445) (10,941)

Taxation on

net return (157) - (157) (54) - (54) (81) - (81)

----------- ----------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Net return

after taxation 7,720 (1,756) 5,964 7,654 (26,061) (18,407) 13,423 (24,445) (11,022)

----------- ----------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Return/(loss)

per ordinary

share (note

3) 5.94p (1.35p) 4.59p 5.93p (20.20p) (14.27p) 10.37p (18.89p) (8.52p)

======= ======= ======= ======= ======= ======= ======= ======= =======

The total columns of this statement represent the Company's Income Statement,

prepared in accordance with FRS 104. The revenue and capital columns

are supplementary to this and are published under guidance from the Association

of Investment Companies.

The Company has no other comprehensive income items recognised other

than those disclosed in the Income Statement.

All items in the above statement derive from continuing operations. No

operations were acquired or discontinued during the period.

The accompanying notes are an integral part of the condensed financial

statements.

Condensed Statement of Changes in Equity

Called

up Share Capital Other

Half-year ended 30 share premium redemption capital Revenue

June 2023 capital account reserve reserves reserve Total

(Unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------- ------------- ------------- ------------- ------------- -------------

At 1 January 2023 6,490 128,827 26,302 43,870 8,788 214,277

Net return after

taxation - - - (1,756) 7,720 5,964

Fourth interim

dividend

(2.575p per share)

for the year-ended

31 December 2022,

paid

27 January 2023 - - - - (3,342) (3,342)

First interim

dividend

(2.575p per share)

for the

year-ending

31 December 2023,

paid

28 April 2023 - - - - (3,342) (3,342)

Refund of unclaimed

dividends - - - - 14 14

------------ ------------ ------------ ------------ ------------ ------------

At 30 June 2023 6,490 128,827 26,302 42,114 9,838 213,571

======= ======= ======= ======= ======= =======

Called

up Share Capital Other

Half-year ended 30 share premium redemption capital Revenue

June 2022 capital account reserve reserves reserve Total

(Unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------- ------------- ------------- ------------- ------------- -------------

At 1 January 2022 6,430 126,783 26,302 68,315 8,404 236,234

Net return after

taxation - - - (26,061) 7,654 (18,407)

Issue of new shares 60 2,044 - - - 2,104

Fourth interim

dividend

(2.525p per share)

for the year-ended

31 December 2021,

paid

28 January 2022 - - - - (3,247) (3,247)

First interim

dividend

(2.525p per share)

for the year-ended

31 December 2022,

paid

29 April 2022 - - - - (3,255) (3,255)

Refund of unclaimed

dividends - - - - 15 15

------------ ------------ ------------ ------------ ------------ ------------

At 30 June 2022 6,490 128,827 26,302 42,254 9,571 213,444

======= ======= ======= ======= ======= =======

Called

up Share Capital Other

Year-ended 31 share premium redemption capital Revenue

December capital account reserve reserves reserve Total

2022 (Audited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------- ------------- ------------- ------------- ------------- -------------

At 1 January 2022 6,430 126,783 26,302 68,315 8,404 236,234

Net return after

taxation - - - (24,445) 13,423 (11,022)

Issue of new shares 60 2,044 - - - 2,104

Fourth interim

dividend

(2.525p per share)

for the year-ended

31 December 2021,

paid

28 January 2022 - - - - (3,247) (3,247)

First interim

dividend

(2.525p per share)

for the year-ended

31 December 2022,

paid

29 April 2022 - - - - (3,255) (3,255)

Second interim

dividend

(2.525p per share)

for the year-ended

31 December 2022,

paid

29 July 2022 - - - - (3,275) (3,275)

Third interim

dividend

(2.525p per share)

for the year-ended

31 December 2022,

paid

28 October 2022 - - - - (3,277) (3,277)

Refund of unclaimed

dividends - - - - 15 15

------------ ------------ ------------ ------------ ------------ ------------

At 31 December 2022 6,490 128,827 26,302 43,870 8,788 214,277

======= ======= ======= ======= ======= =======

The accompanying notes are an integral part of the condensed financial

statements.

Condensed STATEMENT OF FINANCIAL POSITION

31 December

30 June 2023 30 June 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

---------------------------------- --------------- ------------- -------------

Non-current assets

Investments held at fair value

through profit or loss (note

4) 259,000 259,292 260,053

------------ ------------ ------------

Current assets

Debtors 4,496 3,514 1,928

Cash at bank and in hand 2,843 3,258 2,873

------------ ------------ ------------

7,339 6,772 4,801

------------ ------------ ------------

Creditors: amounts falling due

within one year (32,906) (32,767) (30,719)

------------ ------------ ------------

Net current liabilities (25,567) (25,995) (25,918)

------------ ------------ ------------

Creditors: amounts falling due

after more than one year (19,862) (19,853) (19,858)

------------ ------------ ------------

Net assets 213,571 213,444 214,277

======= ======= =======

Capital and reserves

Called up share capital (note

6) 6,490 6,490 6,490

Share premium account 128,827 128,827 128,827

Capital redemption reserve 26,302 26,302 26,302

Other capital reserves 42,114 42,254 43,870

Revenue reserve 9,838 9,571 8,788

------------ ------------ ------------

Total shareholders' funds 213,571 213,444 214,277

======= ======= =======

Net asset value per ordinary

share (note 5) 164.54p 164.45p 165.09p

======= ======= =======

The accompanying notes are an integral part of the condensed

financial statements.

Condensed Statement of Cash Flows

Half-year

ended Half-year ended Year-ended

31 December

30 June 2023 30 June 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

---------------------------------------- ----------------------- ---------------- ---------------

Cash flows from operating activities

Net return/(loss) before taxation 6,121 (18,353) (10,941)

Add back: finance costs 1,218 650 1,520

Add: losses on investments held

at fair value through profit or

loss 420 25,159 22,469

Withholding tax on dividends deducted

at source (157) (54) (81)

(Increase)/decrease in debtors (189) (484) 6

(Decrease)/increase in creditors (292) 36 287

-------------- -------------- --------------

Net cash inflow from operating

activities 7,121 6,954 13,260

-------------- -------------- --------------

Cash flows from investing activities

Sales of investments held at fair

value through profit or loss 28,282 40,692 60,179

Purchases of investments held at

fair value through profit or loss (31,134) (34,604) (51,435)

-------------- -------------- --------------

Net cash (outflow)/inflow from

investing activities (2,852) 6,088 8,744

-------------- -------------- --------------

Cash flows from financing activities

Issue of ordinary share capital - 2,104 2,104

Equity dividends paid (net of refund

of unclaimed distributions) (6,670) (6,487) (13,039)

Drawdown/(repayment) of loans 2,837 (9,519) (11,330)

Interest paid (1,213) (645) (1,512)

-------------- -------------- --------------

Net cash outflow from financing

activities (5,046) (14,547) (23,777)

-------------- -------------- --------------

Net decrease in cash and cash

equivalents (777) (1,505) (1,773)

Cash and cash equivalents at beginning

of period 2,873 3,942 3,942

Exchange movements 747 821 704

-------------- -------------- --------------

Cash and cash equivalents at end

of period 2,843 3,258 2,873

Comprising: -------------- -------------- --------------

Cash at bank 2,843 3,258 2,873

======== ======== ========

The accompanying notes are an integral part of the condensed

financial statements.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

1. Accounting policies: basis of accounting

The Company is a registered investment company as defined by Section 833

of the Companies Act 2006 and operates as an investment trust in accordance

with Section 1158 of the Corporation Tax Act 2010.

The condensed set of financial statements has been prepared in accordance

with FRS 104, Interim Financial Reporting, FRS 102, the Financial Reporting

Standard applicable in the UK and Republic of Ireland and the Statement

of Recommended Practice for "Financial Statements of Investment Trust

Companies and Venture Capital Trusts", which was updated by the Association

of Investment Companies in July 2022.

For the period under review the Company's accounting policies have not

varied from those described in the Annual Report for the year-ended 31

December 2022. The condensed set of financial statements has been neither

audited nor reviewed by the Company's auditor.

2. Management fees

Management fees are charged in accordance with the terms of the management

agreement which are set out in the Company's Annual Report for the year-ended

31 December 2022.

3. Revenue return/(loss) per ordinary share

The revenue return/(loss) per ordinary share is based on the following

figures:

Year-ended

Half-year Half-year 31 December

ended ended 2022

30 June 2023 30 June 2022

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

---------------------------------------- ---- ----------------- ---------------- -------------

Net revenue return 7,720 7,654 13,423

Net capital return (1,756) (26,061) (24,445)

---------------------------------------------- ----------------- ----------------

Total return 5,964 (18,407) (11,022)

---------------------------------------------- ----------------- ---------------- -------------

Weighted average number of

ordinary shares 129,796,278 128,999,455 129,401,141

---------------------------------------------- ----------------- ---------------- -------------

Pence Pence Pence

---------------------------------------- ---- ----------------- ---------------- -------------

Revenue return per ordinary

share 5.94 5.93 10.37

Capital return/(loss) per

ordinary share (1.35) (20.20) (18.89)

---------------------------------------------- ----------------- ----------------

Total return/(loss) per ordinary

share 4.59 (14.27) (8.52)

---------------------------------------------- ----------------- ---------------- -------------

The Company does not have any dilutive securities therefore the basic

and diluted returns per share are the same.

4. Fair values of financial assets and financial liabilities

The fair values of the financial assets and liabilities are either carried

in the Statement of Financial Position at their fair value (investments

and derivatives), or the statement of financial position amount is a reasonable

approximation of fair value (due from brokers, dividends, and interest

receivable, due to brokers, accruals, cash at bank, bank overdrafts and

amounts due under the multi-currency loan facility). At 30 June 2023 the

fair value of the senior unsecured note has been estimated to be GBP17,043,000

(30 June 2022: GBP19,636,000; 31 December 2022: GBP17,653,000) and is

categorised as Level 3 in the fair value hierarchy.

The current estimated fair value of the senior unsecured note is calculated

using a discount rate based on the redemption yield of the relevant existing

reference UK Gilt plus a suitable estimated credit spread. The estimated

credit spread is based on the spread between the yield of the ICE BofA

10-15 Year A Sterling Non-Gilt Index and the redemption yield of the ICE

BofA 10-15 Year UK Gilt Index. The discount rate is calculated and updated

at each month end and applied daily to determine the Company's published

fair value NAVs.

Categorisation within the hierarchy has been determined on the basis of

the lowest level input that is significant to the fair value measurement

of the relevant asset:

* Level 1: the unadjusted quoted price in an active

market for identical assets or liabilities that the

entity can access at the measurement date.

* Level 2: valued by reference to valuation techniques

using observable inputs other than quoted prices

included in Level 1.

* Level 3: valued by reference to valuation techniques

using inputs that are not based on observable market

data.

Financial assets and financial liabilities Level Level Level

at fair value through profit or loss at 30 1 2 3 Total

June 2023 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ----------- ----------- ---------- ---------

Equity investments 229,312 - - 229,312

Fixed interest investments:

- Preference shares 3,870 - - 3,870

- Other 25,818 - - 25,818

- Options - (5) - (5)

------------------------------------------------------- ----------- ----------- ---------- ---------

Total 259,000 (5) - 258,995

------------------------------------------------------- ----------- ----------- ---------- ---------

Financial assets and financial liabilities Level Level Level

at fair value through profit or loss at 30 1 2 3 Total

June 2022 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ----------- ----------- ---------- ---------

Equity investments 232,005 - - 232,005

Fixed interest investments:

- Preference shares 4,842 - - 4,842

- Other 22,445 - - 22,445

- Options - (209) - (209)

------------------------------------------------------- ----------- ----------- ---------- ---------

Total 259,292 (209) - 259,083

------------------------------------------------------- ----------- ----------- ---------- ---------

Financial assets and financial liabilities Level Level Level

at fair value through profit or loss at 31 1 2 3 Total

December 2022 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ----------- ----------- ---------- ---------

Equity investments 230,977 - - 230,977

Fixed interest investments:

- Preference shares 4,585 - - 4,585

- Other 24,491 - - 24,491

------------------------------------------------------- ----------- ----------- ---------- ---------

Total 260,053 - - 260,053

------------------------------------------------------- ----------- ----------- ---------- ---------

The Company's holdings in options are included within Level 2 and are

included in creditors amounts falling due within one year in the Statement

of Financial Position.

Premiums from written options during the half-year ended 30 June 2023

were GBP239,000 (half-year ended 30 June 2022: GBP175,000; year-ended

31 December 2022: GBP289,000).

5. Net asset value per ordinary share

The net asset value per ordinary share is based on the net assets attributable

to the ordinary shares of GBP213,571,000 (half-year ended 30 June 2022:

GBP213,444,000; year ended 31 December 2022: GBP214,277,000) and on the

129,796,278 ordinary shares in issue at 30 June 2023 (30 June 2022: 129,796,278;

31 December 2022: 129,796,278).

6. Share capital

During the six months under review, the Company issued no shares (half-year

ended 30 June 2022: 1,200,000; year ended 31 December 2022: 1,200,000).

Between 1 July and 12 September 2023, no further shares have been issued.

The Company has no shares held in Treasury.

7. Dividends

The Company pays dividends on a quarterly basis. In respect of the year

ended 31 December 2022, a fourth interim dividend of 2.575p per share

(2021: 2.525p) was paid on 27 January 2023 to shareholders on the register

at close of business on 9 December 2022. In respect of the year ending

31 December 2023, a first interim dividend of 2.575p per share (2022:

2.525p) was paid on 28 April 2023 to shareholders on the register at close

of business on 11 April 2023. These dividends are reflected in the half-year

financial statements.

A second interim dividend of 2.575p per share (2022: 2.525p) for the year

ending 31 December 2023 was paid on 28 July 2023 to shareholders on the

register at close of business on 16 June 2023. A third interim dividend

of 2.575p per share (2022: 2.525p) for the year ending 31 December 2023

will be paid on 27 October 2023 to shareholders on the register at close

of business on 15 September 2023. The shares will be quoted ex-dividend

on 14 September 2023. In accordance with FRS 102, the second and third

interim dividends have not been accrued for in the half-year financial

statements as they will be paid after the period end.

8. Net debt reconciliation

Bank loans Other debt repayable

Cash and repayable within after more than

cash equivalents one year one year Total

GBP'000 GBP'000 GBP'000 GBP'000

Net debt as at 1 January

2023 2,873 (29,141) (19,858) (46,126)

Cash flows (777) (2,837) - (3,614)

Exchange movements 747 257 - 1,004

Non cash flow:

Effective interest

movements - - (4) (4)

------------------------------ ------------------ ------------------ --------------------- ---------

Net debt as at 30 June

2023 2,843 (31,721) (19,862) (48,740)

------------------------------ ------------------ ------------------ --------------------- ---------

Bank loans Other debt repayable

Cash and repayable within after more

cash equivalents one year than one year Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------------------ ------------------ --------------------- ---------

Net debt as at 1 January

2022 3,942 (37,593) (19,849) (53,500)

Cash flows (1,505) 9,519 - 8,014

Exchange movements 821 (2,525) - (1,704)

Non cash flow:

Effective interest movements - - (4) (4)

------------------------------ ------------------ ------------------ --------------------- ---------

Net debt as at 30 June

2022 3,258 (30,599) (19,853) (47,194)

------------------------------ ------------------ ------------------ --------------------- ---------

Bank loans Other debt repayable

Cash and repayable within after more

cash equivalents one year than one year Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------------------ ------------------ --------------------- ---------

Net debt as at 1 January

2022 3,942 (37,593) (19,849) (53,500)

Cash flows (1,773) 11,330 - 9,557

Exchange movements 704 (2,878) - (2,174)

Non cash flow:

Effective interest movements - - (9) (9)

------------------------------ ------------------ ------------------ --------------------- ---------

Net debt as at 31 December

2022 2,873 (29,141) (19,858) (46,126)

------------------------------ ------------------ ------------------ --------------------- ---------

9. Related party transactions

The Company's current related parties are its Directors and Janus Henderson.

There have been no material transactions between the Company and its Directors

during the period and the only amounts paid to them were in respect of

expenses and remuneration, for which there were no outstanding amounts

payable at the period end.

In relation to the provision of services by Janus Henderson, other than

fees payable by the Company in the ordinary course of business and the

provision of marketing services, there have been no material transactions

with Janus Henderson affecting the financial position of the Company during

the period under review.

10. Going concern

The assets of the Company consist of securities that are readily realisable

and, accordingly, the Directors believe that the Company has adequate

resources to continue in operational existence for at least twelve months

from the date of approval of the financial statements.

The Company's shareholders are asked every five years to vote for the

continuation of the Company. An ordinary resolution to this effect was

passed by the shareholders at the annual general meeting held on 23 June

2020.

The Directors have considered the risks associated with rising interest

rates and its impact on the broader financial system, as well as considering

cash flow forecasting, a review of covenant compliance including the headroom

above the most restrictive covenants and an assessment of the liquidity

of the portfolio. They have concluded that they are able to meet their

financial obligations, including the repayment of the bank loan, as they

fall due for a period of at least twelve months from the date of issuance.

Having assessed these factors, the principal risks and other matters discussed

in connection with the viability statement, the Board has determined that

it is appropriate for the financial statements to be prepared on a going

concern basis.

11. Half-year report

The half-year report is available at www.hendersonhighincome.com or in

hard copy from the Corporate Secretary by emailing itsecretariat@janushenderson.com

. An abbreviated version of this half-year report, the 'Update', will

be circulated to shareholders in September 2023.

12. General information

a) Company Status

The Company is a UK domiciled investment trust company with registered

number 02422514.

SEDOL/ISIN number: 0958057

London Stock Exchange (TIDM) code: HHI

Global Intermediary Identification Number (GIIN): JBA08I.99999.SL.826

Legal Entity Identifier (LEI): 213800OEXAGFSF7Y6G11

b) Directors, Corporate Secretary and Registered Office

The Directors of the Company are Jeremy Rigg (Chairman), Jonathan Silver

(Chairman of the Audit & Risk Committee), Zoe King (Senior Independent

Director), Richard Cranfield and Francesca Ecsery. The Corporate Secretary

is Janus Henderson Secretarial Services UK Limited, represented by Samantha

McDonald, ACG. The registered office is 201 Bishopsgate, London EC2M 3AE.

c) Website

Details of the Company's share price and net asset value, together with

general information about the Company, monthly factsheets and data, copies

of announcements, reports and details of general meetings can be found

at www.hendersonhighincome.com

For further information please contact:

David Smith Dan Howe

Fund Manager Head of Investment Trusts

Janus Henderson Investors Janus Henderson Investors

Telephone: 020 7818 4443 Telephone: 020 7818 4458

Harriet Hall

Investment Trust PR Manager

Janus Henderson Investors

Telephone: 020 7818 2919

Neither the contents of the Company's website nor the contents of any

website accessible from hyperlinks on the Company's website (or any other

website) are incorporated into, or form part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDCXDBDGXD

(END) Dow Jones Newswires

September 13, 2023 02:00 ET (06:00 GMT)

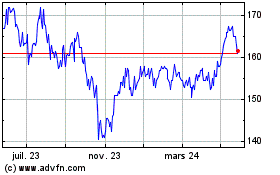

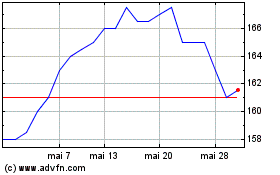

Henderson High Income (LSE:HHI)

Graphique Historique de l'Action

De Mai 2024 à Mai 2024

Henderson High Income (LSE:HHI)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024