TIDMHLMA

RNS Number : 1380T

Halma PLC

16 March 2023

Trading update

Halma, the global group of life-saving technology companies

focused on growing a safer, cleaner, healthier future for everyone,

every day, today releases its scheduled trading update.

Good progress to date; expect Adjusted profit in line with

consensus

Halma has made good progress in the financial year to date.

Based on current trading and forecasts, the Board expects Adjusted

profit before tax for the year ending 31 March 2023 to be in line

with consensus market expectations (see notes 1 and 2).

Good organic constant currency revenue momentum

Revenue growth in the year to date has been strong and includes

good momentum on an organic constant currency basis, as well as a

benefit from recent acquisitions (net of disposals), and currency

translation (see note 3).

Our order book remains strong and our order intake is broadly in

line with revenue and ahead of the same period last year.

Organic constant currency revenue growth in all regions and

sectors

We have delivered organic constant currency revenue growth in

all sectors and regions in the year to date.

All sectors are expected to deliver strong revenue growth on a

reported basis for the full year. Sector revenue growth trends in

the second half of the year on an organic constant currency basis

have been broadly consistent with those seen in the first half.

Of the major regions, the USA and Mainland Europe have seen

strong organic constant currency revenue growth in the year to

date; their reported results will also benefit from recent

acquisitions and currency translation effects. The United Kingdom

also saw good growth, although its reported results will reflect

the disposal of a Safety sector business in the prior period. Asia

Pacific's organic constant currency revenue growth was modest,

reflecting a decline in China. Organic constant currency revenue

growth in the remaining smaller regions was strong in

aggregate.

Record investment in M&A; promising acquisition pipeline

We have made six acquisitions in the year to date across our

three sectors, investing a record maximum total consideration of

GBP264m (see note 4). These acquisitions, which include three new

standalone companies and three bolt-on acquisitions for existing

Halma companies, increase our technological capabilities and expand

our opportunities for future growth in line with our purpose of

growing a safer, cleaner, healthier future for everyone, every

day.

Our acquisition pipeline remains promising in all three sectors.

We continue to actively manage our portfolio of global businesses

to ensure that it remains aligned with our purpose and delivers

strong growth and returns.

Strong financial position; continue to expect stronger full year

cash conversion

Our strong balance sheet and continued cash generation underpin

our ongoing investment in growth. As expected, cash generation in

the second half of the year has been substantially higher than in

the first half, and therefore we continue to expect stronger cash

conversion at the full year than at the half year.

The Group's financial position remains strong. The cash

generative nature of our businesses has enabled us to support

record levels of investment in both organic growth and growth

through acquisitions, while ensuring modest balance sheet leverage

and retaining substantial capacity for investment in the

future.

Board succession

As previously announced, Steve Gunning joined Halma as Chief

Financial Officer on 16 January 2023 and Marc Ronchetti will take

over from Andrew Williams as Group Chief Executive on 1 April 2023

(see note 5).

Water for Life

In line with our purpose of growing a safer, cleaner, healthier

future for everyone, every day, we launched our Water for Life

charitable campaign in late 2020. We have worked in partnership

with WaterAid, the international water charity, with the aim of

improving access to clean water for villagers in two districts in

India. The campaign, which has now closed, has transformed the

lives of over 10,000 people in India by ensuring that they have

sustainable access to clean drinking water, thanks to projects

supported by our people and funds raised across Halma totalling

over GBP400,000.

Full Year Results

The results for the year ending 31 March 2023 will be released

on 15 June 2023.

For further information, please contact:

Halma plc

Andrew Williams, Group Chief Executive +44 (0)1494 721111

Marc Ronchetti, Group Chief Executive Designate

Steve Gunning, Group Chief Financial Officer

Charles King, Head of Investor Relations +44 (0) 7776 685948

Clayton Hirst, Director of Corporate Affairs +44 (0) 7384 796 013

MHP

Simon Hockridge / Rachel Farrington +44 (0)20 3128 8789 / 8613

/ Ollie Hoare / 8276

A copy of this announcement, together with other information

about Halma, is available at www.halma.com.

Notes:

1. Adjusted profit before tax is before amortisation and

impairment of acquired intangible assets, acquisition items,

restructuring costs and profit or loss on disposal of

businesses.

2. The Board believes current market forecasts for Adjusted

profit before tax for the year ending 31 March 2023 to be in the

range of GBP353.1m to GBP369.6m, with a consensus of GBP359.9m.

3. Sterling has weakened in the financial year relative to many

currencies, including the US Dollar and Euro and the currency

translation impact on the Group's results for the financial year

ending 31 March 2023 is expected to be positive. Based on the

forecast mix of currency denominated revenue and profit for the

2023 financial year, a 1% movement in the US Dollar changes full

year revenue by GBP9.2m and profit by GBP2.0m. Similarly, a 1%

movement in the Euro changes full year revenue by GBP2.1m and

profit by GBP0.4m.

4. Of the six acquisitions made in the year to date, those of

Deep Trekker, IZI Medical Products and WEETECH Holding were

reported in the Group's half year results announcement. Since that

time, we have made three further acquisitions (considerations given

are all on a cash- and debt-free basis):

-- Thermocable, a UK-based developer and manufacturer of linear

heat detectors, for a consideration of GBP22m, as a bolt-on for

Apollo Fire Detectors;

-- ZoneGreen Limited, a UK-based provider of complete rail depot

protection solutions, for GBP3m, as a bolt-on for our Sentric

interlocks business;

-- Ocean Insight has acquired technology from Rigaku Analytical

Devices that uses light to assess scrap aluminium quickly and

efficiently for recycling purposes, for an undisclosed sum.

5. As announced on 16 June 2022, Marc Ronchetti will succeed

Andrew Williams as Group Chief Executive from 1 April 2023. Andrew

will step down from his role as Group Chief Executive with effect

from 31 March 2023 and will remain as an Executive Director of the

Company until he retires from the Group on 30 June 2023.

6. This Trading Update is based upon unaudited management

accounts information. Forward-looking statements have been made by

the Directors in good faith using information available up until

the date that they approved this statement. Forward-looking

statements should be regarded with caution because of the inherent

uncertainties in economic trends and business risks.

7. A copy of this announcement, together with other information

about Halma, may be viewed on our website www.halma.com

About Halma

Halma is a global group of life-saving technology companies,

focused on growing a safer, cleaner, healthier future for everyone,

every day. Its purpose defines the three broad markets it operates

in:

-- Safety - Protecting people's safety and the environment as

populations grow, and enhancing worker safety.

-- Environment - Addressing the impacts of climate change,

pollution and waste, protecting life-critical resources and

supporting scientific research.

-- Health - Meeting the increasing demand for better healthcare

as chronic illness rises, driven by growing and ageing populations

and lifestyle changes.

It employs over 7,000 people in more than 20 countries, with

major operations in the UK, Mainland Europe, the USA and Asia

Pacific. Halma is listed on the London Stock Exchange (LON: HLMA)

and is a constituent of the FTSE 100 index.

For the past three years Halma has been named one of Britain's

Most Admired Companies by Management Today.

For more information www.halma.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSFWESIEDSEFD

(END) Dow Jones Newswires

March 16, 2023 03:00 ET (07:00 GMT)

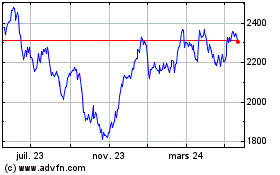

Halma (LSE:HLMA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

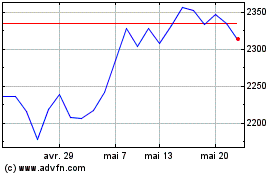

Halma (LSE:HLMA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025