Trading Statement

23 Août 2007 - 9:01AM

UK Regulatory

RNS Number:6735C

International Greetings PLC

23 August 2007

Trading statement and Announcement of US acquisition

International Greetings plc ("International Greetings"), the designer,

manufacturer and distributor of greetings, stationery and licensed published

products, today announces an update on current trading, future prospects and on

its continuing overseas expansion and acquisition strategy.

Since 2003, International Greetings has pursued a twin strategy of developing

new distribution channels in the UK away from the private label sector and

expanding internationally in order to reduce its historic dependency on the

challenging UK retail market. This strategy has proved to be successful and

International Greetings has become a key player in the global markets in which

it operates.

The recent acquisitions of Anker and Alligator/Pinwheel in the UK, which,

together with our US and European businesses, are performing in line with

expectations, have reduced the proportion of the Group's turnover to the UK

private label sector to approximately a third of total revenues.

However, as has been well documented in recent months, the UK retail climate

remains extremely tough with many large retail groups continuing to put pressure

on suppliers' margins. As a consequence, our projected turnover and profits for

the year to 31 March 2008 are anticipated to be below current market estimates,

with *profit before tax now expected to be in the region of #17m. This is based

on the existing business and does not take into account any benefits of further

acquisitions made during the remainder of this financial year.

With regard to our acquisition strategy, we have recently concluded the purchase

of a 50% shareholding in Halloween Express LLC, a profitable US based seasonal

and internet retail business, where we intend to add value by extending its

product offering beyond Halloween to include our ranges of Christmas

merchandise.

We are also close to finalising two further international acquisitions which

will provide entry into new product and geographical areas. Heads of terms have

been agreed and we will disclose further information on these exciting additions

to the Group as soon as the deals are completed.

Nick Fisher, Joint Chief Executive commented: "Whilst the shorter term outlook

has been clouded by the difficult UK market, we remain confident that the

business strategy we have adopted will provide long term growth and stability,

and create value for our shareholders."

For further information:

Nick Fisher/Mark Collini: 01707 630630

Graeme Cull, Arden Partners plc: 0121 423 8960

Jeremy Carey, Tavistock Communications: 020 7920 3150

* Profit before tax and exceptional items, stated under IFRS, which will be

adopted for the first time in the current year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBRGDISDDGGRD

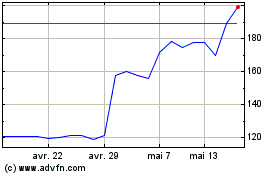

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024