TIDMIGR

RNS Number : 1977T

International Greetings PLC

11 December 2012

11(th) December 2012

International Greetings PLC ("the Company" or "the Group")

Interim Results

International Greetings PLC, one of the world's leading

designers, innovators and manufacturers of gift packaging and

greetings, stationery and creative play products, announces its

interim results for the six months ended 30 September 2012.

Financial highlights

-- Sales up 4.5% to GBP115.2 million (2011 H1: GBP110.3 million)

-- Operating profit before exceptional items level at GBP5.2

million

-- Profit before tax and exceptional items up 2% to GBP3.3 million

(2011 H1: GBP3.2 million)

-- Profit before tax up 19% at GBP2.5 million (2011 H1: GBP2.1

million) after exceptional costs of GBP0.75 million (2011

H1: GBP1.1 million)

-- Net debt down GBP4 million at GBP84.5 million (2011 H1: GBP88.5

million)

Operational highlights

-- Double digit sales and profits growth in the US

-- Continued sales and profit progression in UK/Asia with operational

streamlining in the UK

-- First season in our new manufacturing facility in China completed

-- Upgraded logistics facilities in Australia including completion

of semi-automated systems

-- Record levels of giftwrap volumes produced supported by new

state of the art manufacturing facilities in Holland

-- Global sales of Everyday single cards on course to grow by

over 25% in the UK and USA in the current year

-- Order book for FY 13/14 well advanced

Paul Fineman, Chief Executive said:

"During the first half of the year we have focused on completing

a number of operational improvements to drive efficiencies

including the installation of our new "state of the art" printing

press in Holland, our upgraded logistics facilities in Australia

and further operational streamlining in the UK. The relocation of

our manufacturing operation in China is also complete and by the

end of 2012 we will have manufactured a record 65 million Christmas

crackers during the year.

"The Group continues to trade profitably in all regions despite

challenging market conditions. We remain focused on delivering

earnings growth and debt reduction across our diverse geographical

portfolio and identifying opportunities for further growth."

For further information, please contact:

International Greetings plc Tel: 01525 887 310

Paul Fineman, Chief Executive

Anthony Lawrinson, Chief Financial

Officer

Cenkos Securities plc Tel: 0207 397 8900

Bobbie Hilliam

Adrian Hargrave

Arden Partners plc Tel: 020 7614 5917

Richard Day

Jamie Cameron

FTI Consulting Tel: 020 7831 3113

Jonathon Brill

Georgina Goodhew

Chief Executive's Review

Overview

Sales and profit for the six months ended 30(th) September 2012

are overall in line with expectations.

Operational Review

The first half of this year has featured a number of key

operational highlights including the first season of production

following the relocation of our manufacturing facilities in China.

Despite initial challenges we completed a substantial amount of the

output in the period, with over 65 million Christmas crackers due

to be manufactured during 2012.

Profits in the UK and Asia have grown during the period with

further operational streamlining within the UK having been

achieved. We are also pleased to report that our success in United

States has continued to gain momentum with excellent sales and

profit growth across all major categories. In this market we

continue to see new consumer trends emerging including the

increasing popularity of Christmas crackers. Growth of Everyday

greeting cards averaged over 25% in these territories.

Record levels of giftwrap volumes continue to be sold, now

supported by new high speed state of the art manufacturing

equipment which was successfully installed in the Netherlands

during the Spring. Whilst the market in continental Europe

continues to be particularly challenging, the recent investment

made in gift wrap production, amongst other factors, helped to

ensure that our operations remained profitable. At Artwrap, our

Joint Venture in Australia, we have upgraded logistics facilities

including semi-automation in order to increase efficiencies.

However, our Joint Venture in Australia is now experiencing some of

the macroeconomic market conditions which the Group has

successfully managed in recent years in the US, UK and European

markets.

Financial Review

Revenue from continuing operations for the period increased by

4.5% to GBP115.2 million (2011: GBP110.3 million), with

particularly good progress in the UK and USA where sales increased

by 4% and 15% respectively. Together these more than compensated

for continuing challenges in the European marketplace and signs of

slowdown at our Joint Venture in Australia.

Inflationary pressures on costs continued with sea freight on

average 24% higher than over the equivalent period last year but

our efforts succeeded in mitigating this. Gross profit margins at

18.4% (compared to 19.1% in 2011 and 18.3% in H1 2010) were 0.7%

lower as a result of the reducing contribution from our higher

margin Australian Joint Venture.

At GBP16.6 million (2011 H1: GBP16.2 million), overheads as a

percentage of sales continued to fall from 14.7% to 14.4%.

Operating profit before exceptional costs was flat at GBP5.2

million (2011 H1: GBP5.2 million) or up 1.3% at constant exchange

rates. Profit before tax and exceptional items was up 2.2% to

GBP3.3 million (2010 H1: GBP3.2 million) or 4% at constant exchange

rates.

Profit before tax and after exceptional items was up 19% to

GBP2.5 million (2011 H1: GBP2.1 million).

Finance expenses in the period were GBP1.9 million (2011 H1:

GBP2.0 million). This overall reduction reflects the full year

effect of higher borrowing margins and one-off charges associated

with the refinancing and extension of the maturity of our

facilities but has been significantly offset by lower debt levels

throughout the period. Shorter dated facilities were renewed in the

period for a further year with improved facility headroom and

flexibility and the first 0.5% of a series of potential margin

reductions was achieved as leverage fell to qualifying levels. Debt

reduction remains a key focus and our programme for this is

on-track.

The effective underlying tax rate was 26% (2011 H1: 27.5%)

reflecting the mix of profits shifting slightly away from the

higher tax jurisdictions and also lower UK rates. There are still

unrecognised losses with a tax value of $6.2 million in the USA and

GBP0.4 million in the UK which can be reflected in the balance

sheet as US profitability progresses.

As recently announced and subsequent to the end of the period, a

major customer of Artwrap, our Joint Venture in Australia, went

into voluntary administration. This has placed the recoverability

of the outstanding debt at risk and AUS$1.2 million has been

provided as an exceptional adjusting item in the H1 accounts. As a

result exceptional costs relating to the period were provided at

GBP0.75 million (2011 H1: GBP1.1 million). However the effect on

earnings will only be impacted by GBP0.3 million reflecting tax and

the minority interest.

Stated before exceptional items, basic earnings per share were

3.9p (2011 H1: 3.4p), and 3.4p (2011 H1: 1.8p) after exceptional

items. Diluted earnings per share before exceptional items were

3.7p (2011 H1: 3.2p), up 15.6% on the prior year. See note 6 of the

interim financial statements.

Capital expenditure in the six months was GBP1.4 million (2011

H1: GBP1.4 million). Some surplus land in Wales and machines in

Australia were sold in the period generating proceeds of GBP0.4

million in cash.

Cash used by operations was GBP39.1 million (2011 H1: GBP39.9

million), which reflects the seasonality of the business as 58% of

the sales in the six month period occurred in the last two

months.

Debtors and receivables at GBP69.3 million have reduced slightly

from GBP69.4 million at H1 2011 and stock levels actually fell by

5.6% from GBP64.2 million (H1 2011) to GBP60.6 million (H1 2012)

despite the sales increase of 4.5%.

Net debt at 30 September 2012 was down GBP4.0 million to GBP84.5

million (2011 H1: GBP88.5 million).

The Board will not be declaring an interim dividend and will

keep this policy under review (2011 H1: nil).

Current Trading Outlook

Our Group continues to trade profitably in all regions with

overall sales growth in the first half of 4.5%. At the same time

our debt reduction programme remains on track and we have reduced

debt by GBP4.0 million during the period. Driving strong earning

per share growth also remains a core objective and this is

underpinned by our encouraging performance in our major

markets.

Our Joint Venture in Australia is now experiencing some of the

macroeconomic market conditions which the Group has successfully

managed in recent years in the US, UK and European markets and this

may slow the pace of growth to headline profitability but the

effect on earnings is much reduced after allowing for tax and the

minority interest.

Our track record over recent years of prudent investment

combined with the provision of innovative and competitive products

has enabled us to combat competitive market dynamics across our

global customer base. This underlines the importance of creating

efficiencies across the Group, leveraging scale and continuing to

balance the geography, product category and seasonality of our

activities.

Paul Fineman

Chief Executive

Consolidated income statement

six months ended 30 September 2012

Unaudited Unaudited

six months six months 12 months

ended 30 ended Ended

September 30 March

September 31

2012 2011 2012 2011 2011 2011 2012 2012 2012

Before Exceptional Before Exceptional Before Exceptional

exceptional items exceptional items exceptional items

items (note 10) Total items (note Total items (note Total

10) [10])

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Continuing

operations

Revenue 115,207 - 115,207 110,227 - 110,277 220,755 - 220,755

Cost of

sales (94,056) - (94,056) (89,194) - (89,194) (178,190) - (178,190)

Gross profit 21,151 - 21,151 21,083 - 21,083 42,565 - 42,565

18.4% 18.4% 19.1% 19.1% 19.3% 19.3%

Selling

expenses (6,723) (750) (7,473) (6,451) - (6,451) (13,003) - (13,003)

Administration

expenses (9,849) - (9,849) (9,734) (1,080) (10,814) (19,580) (3,635) (23,215)

Other operating

income 382 - 382 287 - 287 678 - 678

Profit/(loss)

on sales

of

property,

plant

and equipment 251 - 251 22 - 22 63 (283) (220)

Operating

profit/(loss) 5,212 (750) 4,462 5,207 (1,080) 4,127 10,723 (3,918) 6,805

Finance

expenses (1,929) - (1,929) (1,994) - (1,994) (3,635) - (3,635)

Profit/(loss)

before tax 3,283 (750) 2,533 3,213 (1,080) 2,133 7,088 (3,918) 3,170

Income tax

(charge)/credit (854) 224 (630) (884) 222 (662) (1,948) 195 (1,753)

Profit/(loss)

from

continuing

operations

for the

period 2,429 (526) 1,903 2,329 (858) 1,471 5,140 (3,723) 1,417

Attributable

to:

Owners of

the Parent

Company 1,874 993 177

Non-controlling

interest 29 478 1,240

Consolidated income statement

six months ended 30 September 2012

Unaudited six Unaudited six

months months

ended 30 September ended 30 September 12 months ended

31 March

2012 2011 2012

--------------------- --------------------- ------------------

Earnings per ordinary Diluted Basic Diluted Basic Diluted Basic

share

------------------------------- ----------- -------- ----------- -------- --------- -------

Adjusted earnings per

share excluding

exceptional items 3.7p 3.9p 3.2p 3.4p 6.7p 7.2p

Loss per share on exceptional

items (0.5)p (0.5)p (1.5)p (1.6)p (6.4)p (6.9p)

------------------------------- ----------- -------- ----------- -------- --------- -------

Earnings per share from

continuing operations 3.2p 3.4p 1.7p 1.8p 0.3p 0.3p

Earnings per share 3.2p 3.2p 1.7p 1.8p 0.3p 0.3p

------------------------------- ----------- -------- ----------- -------- --------- -------

Consolidated statement of comprehensive income

six months ended 30 September 2012

Unaudited Unaudited

six months six months

ended 30 ended 30 12 months

September September ended 31 March

2012 2011 2012

GBP000 GBP000 GBP000

------------------------------------ ----------- ----------- ---------------

Profit for the year 1,903 1,471 1,417

Other comprehensive income:

------------------------------------ ----------- ----------- ---------------

Exchange difference on translation

of foreign operations (473) (155) (88)

Net (loss)/profit on cash flow

hedges (net of tax) (181) 274 (322)

------------------------------------ ----------- ----------- ---------------

Other comprehensive income for

period, net of tax (654) 119 (410)

Total comprehensive income for

the period, net of tax 1,249 1,590 1,007

Attributable to:

Owners of the Parent Company 1,260 1,018 (475)

Non-controlling interests (11) 572 1,482

------------------------------------ ----------- ----------- ---------------

1,249 1,590 1,007

------------------------------------ ----------- ----------- ---------------

Consolidated statement of changes in equity

six months ended 30 September 2012

Share

premium

and Non-

capital

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 31

March

2012 2,750 4,480 17,164 (446) 446 23,410 47,804 4,744 52,548

Profit

for

the year - - - - - 1,874 1,874 29 1,903

Other comprehensive

income - - - (181) (433) - (614) (40) (654)

Total comprehensive

income for the

year - - - (181) (433) 1,874 1,260 (11) 1,249

Equity-settled

share-based

payment - - - - - 55 55 - 55

Options exercised 78 159 - - - - 237 - 237

Equity dividends

paid - - - - - - - (968) (968)

At 30 September

2012 2,828 4,639 17,164 (627) 13 25,339 49,356 3,765 53,121

Consolidated statement of changes in equity

six months ended 30 September 2012

For the six months ended 30 September 2011

Share

premium

and Non-

capital

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April

2011 2,698 4,386 17,164 (124) 776 23,190 48,090 4,220 52,310

Profit for

the period - - - - - 993 993 478 1,471

Other comprehensive

income - - - 274 (249) - 25 94 119

Total comprehensive

income for

the year - - - 274 (249) 993 1,018 572 1,590

Equity-settled

share-based

payment - - - - - 53 53 - 53

Options exercised 14 25 - - - - 39 - 39

Equity dividends

paid - - - - - - - (958) (958)

At 30 September

2011 2,712 4,411 17,164 150 527 24,236 49,200 3,834 53,034

Consolidated statement of changes in equity

six months ended 30 September 2012

For the year ended 31 March 2012

Share

premium

and Non-

capital

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April

2011 2,698 4,386 17,164 (124) 776 23,190 48,090 4,220 52,310

Profit for

the year - - - - - 177 177 1,240 1,417

Other comprehensive

income - - - (322) (330) - (652) 242 (410)

Total comprehensive

income for

the year - - - (322) (320) 177 (475) 1,482 1,007

Equity-settled

share-based

payment - - - - - 43 43 - 43

Options exercised 52 94 - - - - 146 - 146

Equity dividends

paid - - - - - - - (958) (958)

At 31 March

2012 2,750 4,480 17,164 (446) 446 23,410 47,804 4,744 52,548

Consolidated balance sheet

as at 30 September 2012

Unaudited Unaudited

as at 30 as at 30 As at

September September 31 March

2012 2011 2012

Note GBP000 GBP000 GBP000

------------------------------- ----- ---------- ---------- ---------

Non-current assets

Property, plant and equipment 30,360 31,130 31,533

Intangible assets 32,502 33,082 32,916

Deferred tax assets 4,159 4,758 4,640

------------------------------- ----- ---------- ---------- ---------

Total non-current assets 67,021 68,970 69,089

------------------------------- ----- ---------- ---------- ---------

Current assets

Inventory 60,615 64,202 42,628

Trade and other receivables 69,289 69,360 20,942

Cash and cash equivalents 4 3,403 1,734 3,168

------------------------------- ----- ---------- ---------- ---------

Total current assets 133,307 135,296 66,738

------------------------------- ----- ---------- ---------- ---------

Total assets 200,328 204,266 135,827

------------------------------- ----- ---------- ---------- ---------

Equity

Share capital 2,828 2,712 2,750

Share premium 3,299 3,071 3,140

Reserves 17,890 19,181 18,504

Retained earnings 25,339 24,236 23,410

------------------------------- ----- ---------- ---------- ---------

Equity attributable to owners

of the

Parent Company 49,356 49,200 47,804

------------------------------- ----- ---------- ---------- ---------

Non-controlling interests 3,765 3,834 4,744

------------------------------- ----- ---------- ---------- ---------

Total equity 53,121 53,034 52,548

------------------------------- ----- ---------- ---------- ---------

Non-current liabilities

Loans and borrowings 4 28,854 34,926 33,622

Deferred income 1,604 2,154 1,879

Provisions 899 1,847 1,003

Other financial liabilities 526 355 447

------------------------------- ----- ---------- ---------- ---------

Total non-current liabilities 31,883 39,282 36,951

------------------------------- ----- ---------- ---------- ---------

Current liabilities

Bank overdraft 5,820 5,940 1,945

Loans and borrowings 4 53,199 49,383 9,329

Deferred income 550 550 550

Provisions 172 - 317

Income tax payable 580 585 855

Trade and other payables 45,191 42,324 23,133

Other financial liabilities 9,812 13,168 10,199

------------------------------- ----- ---------- ---------- ---------

Total current liabilities 115,324 111,950 46,328

------------------------------- ----- ---------- ---------- ---------

Total liabilities 147,207 151,232 83,279

------------------------------- ----- ---------- ---------- ---------

Total equity and liabilities 200,328 204,266 135,827

------------------------------- ----- ---------- ---------- ---------

Consolidated cash flow statement

six months ended 30 September 2012

Unaudited Unaudited

six months six months

ended ended 12 months

30 September 30 ended 31

September March

2012 2011 2012

GBP000 GBP000 GBP000

---------------------------------------------- ------------- ----------- ----------

Cash flows from operating activities

Profit for the year 1,903 1,471 1,417

Adjustments for:

Depreciation 1,914 1,951 3,753

Impairment of tangible fixed assets - 214 -

Amortisation of intangible assets 318 261 534

Finance expenses - continuing operations 1,929 1,994 3,635

Income tax credit - continuing operations 630 662 1,753

(Profit)/loss on sales of property, plant

and equipment (251) (7) 220

Loss on external sale of intangible fixed

assets 1 - 4

Profit on disposal of assets held for

resale - (15) (8)

Equity-settled share-based payment 55 53 43

---------------------------------------------- ------------- ----------- ----------

Operating profit after adjustments for

non-cash items 6,499 6,584 11,351

Change in trade and other receivables (48,675) (48,188) 224

Change in inventory (18,116) (18,643) 2,840

Change in trade and other payables 21,754 20,658 (1,799)

Change in provisions and deferred income (524) (275) (1,102)

---------------------------------------------- ------------- ----------- ----------

Cash (used by)/generated from operations (39,062) (39,864) 11,514

Tax paid (452) (388) (1,131)

Interest and similar charges paid (1,757) (1,628) (3,491)

Receipts from sales of property for resale - 528 528

Net cash (outflow)/inflow from operating

activities (41,271) (41,352) 7,420

---------------------------------------------- ------------- ----------- ----------

Cash flow from investing activities

Proceeds from sale of property, plant

and equipment 403 42 122

Acquisition of intangible assets (88) (166) (399)

Acquisition of property, plant and equipment (1,339) (1,187) (4,015)

---------------------------------------------- ------------- ----------- ----------

Net cash outflow from investing activities (1,024) (1,311) (4,292)

---------------------------------------------- ------------- ----------- ----------

Cash flows from financing activities

Proceeds from issue of share capital 237 39 146

Repayment of secured borrowings (3,504) (1,118) (1,473)

Net movement in credit facilities 43,543 11,799 (27,785)

Payment of finance lease liabilities (37) (35) (49)

New bank loans raised - 30,170 30,170

Loan arrangement fees (444) - (370)

Payment of deferral consideration - - (111)

Dividends paid to non-controlling interests (968) (918) (918)

Net cash inflow/(outflow) from financing

activities 38,827 39,937 (390)

---------------------------------------------- ------------- ----------- ----------

Net increase in cash and cash equivalents (3,468) (2,726) 2,738

Cash and cash equivalents at end of period 1,223 (1,735) (1,735)

Effect of exchange rate fluctuations

on cash held (172) 255 220

---------------------------------------------- ------------- ----------- ----------

Cash and cash equivalents at end of the

period (2,417) (4,206) 1,223

---------------------------------------------- ------------- ----------- ----------

Notes to the interim financial statements

1 Accounting policies

Basis of preparation

The financial information contained in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006 and is unaudited.

The Group interim report has been prepared and approved by the

Directors in accordance with International Financial Reporting

Standards as adopted by the EU ("Adopted IFRSs"). The financial

information for the year ended 31 March 2012 is extracted from the

statutory accounts of the Group for that financial year and does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The report of the auditors was (i) unqualified;

(ii) did not include a reference to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report; and (iii) did not contain a statement under Section 498 (2)

of the Companies Act 2006.

Going concern basis

The financial statements have been prepared on the going concern

basis. Following the restructure of its principal banking

facilities in July 2011 the Group now shows net current assets of

GBP18.0 million (2011 H1: GBP23.3 million).

The borrowing requirement of the Group increases steadily over

the period from July and peaks in September and October, due to the

seasonality of the business, as the sales of wrap and crackers are

mainly for the Christmas market, before then reducing.

As with any company placing reliance on external entities for

financial support, the Directors acknowledge that there can be no

certainty that this support will continue although, at the date of

approval of this interim report, they have no reason to believe

that it will not do so.

After making enquiries, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Thus, they continue to adopt the going concern basis of accounting

in preparing the financial statements.

The interim report does not include all the information and

disclosures required in the annual financial statements and should

be read in conjunction with the Group's annual financial statements

as at 31 March 2012.

Significant accounting policies

The accounting policies adopted in the preparation of the

interim report are consistent with those followed in the

preparation of the Group's annual financial statements for the year

ended 31 March 2012.

2 Segmental information

The Group has one material business activity being the design,

manufacture and distribution of gift packaging and greetings,

stationery and creative play products.

For management purposes the Group is organised into four

geographic business units.

The results below are allocated based on the region in which the

businesses are located; this reflects the Group's management and

internal reporting structure. The decision was made last year to

focus Asia as a service provider of manufacturing and procurement

operations, whose main customers are our UK businesses. Both the

China factory and the majority of the Hong Kong procurement

operations are now overseen by our UK operational management team

and we therefore continue to include Asia within the internal

reporting of the UK operations, such that UK and Asia comprise an

operating segment. The chief operating decision maker is the

Board.

Intra-segment pricing is determined on an arm's length basis.

Segment results include items directly attributable to a segment as

well as those that can be allocated on a reasonable basis.

Financial performance of each segment is measured on operating

profit. Interest expense or revenue and tax are managed on a Group

basis and not split between reportable segments.

Segment assets are all non-current and current assets, excluding

deferred tax and income tax receivable. Where cash is shown in one

segment, which nets under the Group's banking facilities, against

overdrafts in other segments, the elimination is shown in the

eliminations column. Similarly inter-segment receivables and

payables are eliminated.

2 Segmental information continued

UK and Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Six months ended

30 September 2012

Continuing operations

Revenue - external 63,527 11,122 27,322 13,236 - 115,207

- inter-segment 968 143 - - (1,111) -

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Total segment revenue 64,495 11,265 27,322 13,236 (1,111) 115,207

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Segment result before

exceptional items 3,277 488 1,519 826 - 6,110

Exceptional items - - - (750) - (750)

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Segment result 3,277 488 1,519 76 - 5,360

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Central administration

costs (898)

Net finance expenses (1,929)

Income tax (630)

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Profit from continuing

operations for the

six months ended

30 September 2012 1,903

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Balances at 30 September

2012

Continuing operations

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Segment assets 137,888 23,891 23,225 12,559 2,765 200,328

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Segment liabilities (80,031) (21,370) (40,100) (6,520) 814 (147,207)

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

Capital expenditure

- property, plant

and equipment 405 91 159 684 - 1,339

- intangible 49 8 19 12 - 88

Depreciation 1,079 403 342 90 - 1,914

Amortisation 228 28 18 44 - 318

-------------------------------------- ----------- --------- --------- ---------- ------------- ----------------

2 Segmental information continued

UK and Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ -------------- --------- --------- ---------- ------------- ----------

Six months ended

30 September 2011

Continuing operations

Revenue - external 59,945 12,409 23,764 14,159 - 110,277

- inter-segment 1,889 360 - - (2,249) -

------------------------ -------------- --------- --------- ---------- ------------- ----------

Total segment

revenue 61,834 12,769 23,764 14,159 (2,249) 110,277

------------------------ -------------- --------- --------- ---------- ------------- ----------

Segment result

before exceptional

items 3,058 701 1,145 1,405 - 6,309

Exceptional items (225) - - - - (225)

------------------------ -------------- --------- --------- ---------- ------------- ----------

Segment result 2,833 701 1,145 1,405 - 6,084

------------------------ -------------- --------- --------- ---------- ------------- ----------

Central administration

costs (1,102)

Central administration

exceptional items (855)

Net finance expenses (1,994)

Income tax (662)

------------------------ -------------- --------- --------- ---------- ------------- ----------

Profit from continuing

operations for

the

six months ended

30 September 2011 1,471

------------------------ -------------- --------- --------- ---------- ------------- ----------

Balances at 30 September

2011

Continuing operations

------------------------ -------------- --------- --------- ---------- ------------- ----------

Segment assets 143,246 24,324 19,158 12,781 4,757 204,266

------------------------ -------------- --------- --------- ---------- ------------- ----------

Segment liabilities (81,867) (21,766) (39,632) (7,388) (579) (151,232)

------------------------ -------------- --------- --------- ---------- ------------- ----------

Capital expenditure

- property, plant

and equipment 232 746 147 62 - 1,187

- intangible 72 29 48 17 - 166

Depreciation 1,119 395 346 91 - 1,951

Amortisation 178 29 12 42 - 261

Impairment of

property, plant

and equipment 214 - - - - 214

------------------------ -------------- --------- --------- ---------- ------------- ----------

The six months ended 30 September 2011 comparatives have been

amended to reflect revisions to the inter-segment reporting and

eliminations between segments.

2 Segmental information continued

UK and Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ -------------- --------- --------- ---------- ------------- ---------

Year ended 31 March

2012

Continuing operations

Revenue - external 117,007 29,147 45,044 29,557 - 220,755

- inter-segment 4,746 1,009 - - (5,755) -

------------------------ -------------- --------- --------- ---------- ------------- ---------

Total segment

revenue 121,753 30,156 45,044 29,557 (5,755) 220,755

------------------------ -------------- --------- --------- ---------- ------------- ---------

Segment result

before exceptional

items

and discontinued

operations 4,089 1,712 3,248 3,613 - 12,662

Exceptional items (3,068) - - - - (3,068)

------------------------ -------------- --------- --------- ---------- ------------- ---------

Segment result 1,021 1,712 3,248 3,613 - 9,594

------------------------ -------------- --------- --------- ---------- ------------- ---------

Central administration

costs (1,939)

Central administration

exceptional items (850)

Net finance expenses (3,635)

Income tax (1,753)

------------------------ -------------- --------- --------- ---------- ------------- ---------

Profit from continuing

operations year

ended 31 March

2012 1,417

------------------------ -------------- --------- --------- ---------- ------------- ---------

Balances at 31 March

2012

Continuing operations

Segment assets 97,100 16,885 6,224 11,317 4,301 135,827

------------------------ -------------- --------- --------- ---------- ------------- ---------

Segment liabilities (40,562) (13,950) (25,029) (3,222) (516) (83,279)

------------------------ -------------- --------- --------- ---------- ------------- ---------

Capital expenditure

- property, plant

and equipment 1,185 2,437 331 62 - 4,015

- intangible 263 30 87 19 - 399

Depreciation 2,135 742 696 180 - 3,753

Amortisation 368 57 24 85 - 534

------------------------ -------------- --------- --------- ---------- ------------- ---------

3 Exceptional items

6 months 6 months 12 months

ended 30 ended 30 ended 31

September September March

2012 2011 2012

GBP000 GBP000 GBP000

-------------------------------------------- ----------- ----------- ----------

Restructuring of operational activities

Bad debt provision (note a) 750 - -

Redundancies (note b) - 855 1,201

Impairment of leasehold land and buildings

in China

(note c) - 225 283

China factory move (note d) - - 2,434

-------------------------------------------- ----------- ----------- ----------

Total restructuring costs 750 1,080 3,918

Income tax credit (224) (222) (1,951)

-------------------------------------------- ----------- ----------- ----------

526 858 3,723

-------------------------------------------- ----------- ----------- ----------

(a) Provision for debtor now in voluntary administration

relating to our Joint Venture in Australia

(b) Redundancies relate to the termination costs of key

executives who left the business following a review of Board

responsibilities and as a result of business re-organisation in the

UK subsidiaries

(c) Loss on disposal of leasehold land and buildings in China as

a result of the decision to move the China factory

(d) Costs associated with moving the China factory

4 Cash, loans and borrowing

6 months 6 months 12 months

ended 30 ended 30 ended 31

September September March

2012 2011 2012

GBP000 GBP000 GBP000

---------------------------------------- ----------- ----------- ----------

Secured bank loan (short term) (4,685) (3,918) (3,974)

Secured bank loan (long term) (29,340) (34,926) (33,880)

Asset backed loans (30,860) (36,811) (5,467)

Revolving credit facilities (17,839) (8,654) -

Loan arrangement fees 671 - 370

---------------------------------------- ----------- ----------- ----------

Total loans (82,053) (84,309) (42,951)

Cash and bank deposits 3,403 1,734 3,168

Bank overdraft (5,820) (5,940) (1,945)

---------------------------------------- ----------- ----------- ----------

Cash and cash equivalents per cash

flow statement (2,417) (4,206) 1,223

---------------------------------------- ----------- ----------- ----------

Net debt used in the Chief Executive's

Review (84,470) (88,515) (41,728)

---------------------------------------- ----------- ----------- ----------

5 Taxation

Six months Six months 12 months

ended 30 ended 30 ended 31

September September March

2012 2011 2012

GBP000 GBP000 GBP000

-------------------------------------- ----------- ----------- ----------

Current tax expenses

Current income tax charge (149) (825) (1,789)

Deferred tax expense

Relating to original and reversal of

temporary differences (481) 163 36

-------------------------------------- ----------- ----------- ----------

Total tax in income statement (630) (662) (1,753)

-------------------------------------- ----------- ----------- ----------

Taxation for the six months ended 30 September 2012 is based on

the effective rate of taxation, which is estimated to apply in each

country for the year ended 31 March 2013.

6 Earnings per share

As at As at As at

30 September 30 September 31 March 2012

2012 2011

----------------- ----------------- -----------------

Diluted Basic Diluted Basic Diluted Basic

------------------------------- -------- ------- -------- ------- -------- -------

Adjusted earnings per

share excluding

exceptional items 3.7p 3.9p 3.2p 3.4p 6.7p 7.2p

Loss per share on exceptional

items (0.5)p (0.5)p (1.5)p (1.6)p (6.4)p (6.9p)

------------------------------- -------- ------- -------- ------- -------- -------

Earnings per share from

continuing operations 3.2p 3.4p 1.7p 1.8p 0.3p 0.3p

Earnings per share 3.2p 3.4p 1.7p 1.8p 0.3p 0.3p

------------------------------- -------- ------- -------- ------- -------- -------

The basic earnings per share is based on the profit attributable

to equity holders of the Parent Company of GBP1,874,000 (2011:

GBP993,000) and the weighted average number of ordinary shares in

issue of 55,799,000 (2011: 54,103,000) calculated as follows:

September September March

Weighted average number of shares 2012 2011 2012

in thousands of shares

---------------------------------------- ---------- ---------- -------

Issued ordinary shares at 1 April 55,007 53,967 53,967

Shares issued in respect of exercising

of share options 792 136 239

---------------------------------------- ---------- ---------- -------

Weighted average number of shares

at end of the period 55,799 54,103 54,206

---------------------------------------- ---------- ---------- -------

Total number of options, over 5p ordinary shares, in issue at 30

September 2012 was 3,451,956.

Adjusted basic earnings per share excludes exceptional items

charged of GBP375,000 (2011: GBP1,080,000) being the share of our

Joint Venture attributable to shareholders, along with the tax

relief attributable to those items of GBP112,000 (2011:

GBP222,000). This gives an adjusted profit of GBP2,137,000 (2011:

GBP1,851,000).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFVTFALILIF

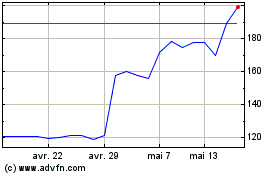

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024