TIDMIGR

RNS Number : 1523L

International Greetings PLC

02 July 2014

2 July, 2014

International Greetings PLC

Preliminary Results for the year ended 31 March 2014

International Greetings PLC ('International Greetings' or 'the

Group'), one of the world's leading designers, innovators and

manufacturers of gift packaging and greetings, social expression

giftware, stationery and creative play products, announces its

audited Preliminary Results for the year ended 31 March 2014.

Financial Highlights:

* Revenue at GBP224.5 million after rationalisation of

some non-core activities in the UK

* Profit before tax, exceptional items and LTIP charges

up 4% to GBP7.6 million (2013: GBP7.3 million)

* Gross margin slightly up on prior year at 18.4%

(2013: 18.3%)

* Fully diluted earnings per share before exceptional

items increased 6.4% to 8.3 pence (2013: 7.8 pence)

* Cash generated from operations before exceptional

items up 101% at GBP15.2 million (2013: GBP7.5

million)

* Net debt down 12.3% to GBP36.9 million (2013: GBP42.1

million) and leverage down 0.4 times to 2.4 times

despite major capital investment programme of GBP8.3

million (2013: GBP1.9 million)

Operational Highlights:

* Profits in Continental Europe up over 100% reflecting

progress achieved since upgrade of gift wrap

production facilities in Holland in 2012

* Major capital upgrade of our gift wrap manufacturing

facilities in Wales remain on time and on budget

* Growth achieved with internet based retailers,

including the introduction of new products through

Ocado and Amazon

* Excellent year of production and service levels from

relocated factory in China

* Withdrawal from non-core generic book activity in UK

* Royal Warrant granted to the Tom Smith brand of gift

wrapping products

Post period end event:

* Acquisition of trade and certain assets of Enper Gift

Wrap BV for EUR1.9 million, in June, 2014, providing

further commercial and operational opportunities in

European markets

Paul Fineman, CEO commented:

"We are pleased to report a strong year in which all our

operating regions traded profitably and delivered excellent cash

generation. This was achieved whilst continuing to invest in the

Group's infrastructure, to enable us to deliver enhanced future

performance. In particular, the transformation of our UK based gift

wrap manufacturing operation in Wales marked the completion of the

second phase of upgrading our global gift wrap production

facilities. This strategic initiative began in Holland in 2012 and

has underpinned our strong progress in Continental Europe.

"Our recent acquisition of the trade and certain assets of Enper

Gift Wrap, demonstrates our determination to identify new

opportunities for profitable incremental growth. As we enter the

second year of our new three year plan, we are on plan to deliver

double digit cumulative average growth in earnings per share and

are ahead of schedule to meet our commitment to reduce debt and

leverage below two times debt/EBITDA. We look forward to the future

with confidence."

For further information, please contact:

International Greetings plc Tel: 01525 887310

Paul Fineman, Chief Executive

Anthony Lawrinson, Chief Financial

Officer

Cenkos Securities plc Tel: 0207 397 8900

Bobbie Hilliam

FTI Consulting Tel: 020 7831 3113

Jonathon Brill

Georgina Goodhew

Chief Executive Officer's review

Key achievements

-- Focus on cash generation improves leverage by 14% from 2.8 to 2.4 times

-- Net debt improved by GBP5.2 million (12.3%) to GBP36.9

million despite record capital investment (GBP8.3 million) in

manufacturing efficiency

-- On track to meet our three year plan of overall double digit EPS growth

-- Profits in Continental Europe up over 100%

-- Major capital expenditure project in UK on time and on budget

-- Excellent year of production and service levels from recently relocated China factory

-- Announced acquisition of trade and certain assets of Enper

Giftwrap BV for EUR1.9 million on 5 June 2014

I am able to report a year in which all regions traded

profitably and our objectives, both to meet short term targets and

also to create the foundation for incremental profits growth for

the future, were met.

Our team was focused on balancing the delivery of cash

generative sales and profits, reducing leverage and doing so whilst

investing in fast payback opportunities across our global

manufacturing activities. This has required the careful management

of working capital whilst simultaneously delivering continued

excellent standards of customer service.

We are therefore delighted that a year in which sales were

GBP224.5 million and profit before tax, exceptional items and LTIP

charges was GBP7.6 million, net debt reduced by 12% (from GBP42.1

million in 2013 to GBP36.9 million in 2014) whilst leverage has

reduced from 2.8 times in 2013 to 2.4 times in 2014. This is a

particularly satisfactory result when capital expenditure increased

by GBP6.4 million to GBP8.3 million in 2014 from GBP1.9 million in

2013. We now look forward to reaping the significant future

benefits of this through manufacturing efficiencies and product

quality.

In 2012, we commenced the first phase of an upgrade to our

global manufacturing facilities with an environmentally friendly,

high speed, high definition giftwrap printing capability at our

operation in Holland. 2014 has seen the installation of a similar

capability within our facility in Wales. This major project has

been completed on time and on budget.

We were privileged and absolutely delighted that Her Majesty the

Queen together with His Royal Highness Prince Phillip officially

opened our new Welsh facilities on 30 April 2014 - an event that

captured the transformation of our business, our confidence in the

future and the enthusiasm and energy of our team.

Geographical highlights

UK and ASIA

The UK and Asia business accounted for 49% (2013 53%) of the

Group's revenue for the year, with the cohesive efforts of our

manufacturing, sourcing, operational and commercial teams once

again delivering industry leading customer service. We were pleased

to receive the Sainsbury's Gold Standard Award acknowledging this

exemplary supplier performance.

The ever closer collaboration between our UK and Far East based

operations ensures a joined up commercial and strategic approach to

the market. Our competitive advantage in the UK was further

enhanced by focussed investments at our existing facilities in

China this included semi automated processes for cracker

manufacturing together with enhanced production capability in gift

bags.

Both investments were operational from Spring 2014. This

provides our customers with the ability to source a broad portfolio

of complementary product categories from one fully compliant and

competitive source.

Towards the end of the year, reflecting our strategy to focus on

product categories with scope for profitable growth, we withdrew

from a small noncore product category in generic books under the

Alligator brand. We will continue to grow the larger licensed

product segment, consolidating under our Copywrite brand in the

UK.

Our broadening customer base showed growth achieved with

Internet based retailers, including the introduction of new

products through Ocado and Amazon.

Mainland Europe

Our mainland European businesses accounted for 15% (2013: 13%)

of the Group's sales.

Although overall market conditions have not improved we are

delighted to report an outstanding outcome with strong efficiencies

and record volumes.

A first full year of utilising our new state-of-the-art printing

facilities based in Holland, together with the creation across all

categories of innovative highly customer focused product offerings,

resulted in increased market share and the creation of even greater

future opportunities.

In June 2014, we were delighted to announce the acquisition of

the trade and certain assets of Enper Giftwrap, strengthening our

market share in the Benelux and a further demonstration of our

commitment to delivering a key strategic objective to be the best

and most successful supplier of gift packaging products in the

European Union.

Having now established relationships with mainland Europe's ten

largest retail Groups who trade in our product categories, scope

now exists for our future expansion in existing and new markets,

both with core and developing product categories.

USA

The US business accounted for 24% (2013: 22%) of the Group's

revenue. Strong sales growth continued, building on recent years of

double digit progress with 31% of Group revenues by destination in

2014 (2013: 27%). However the final quarter proved to be very

challenging with extreme weather conditions impacting results in

what was otherwise on track to be a record trading year. Sales

developed well during the year, including to neighbouring markets

in Canada, Mexico and to other South American regions, but higher

margin sales in the US of Everyday product categories were largely

rescheduled and therefore below expectations during the final three

months of the trading year.

Nevertheless positive progress was made on several fronts during

the year. We completed negotiation of banking facilities with Sun

Trust on improved terms, building on improvements achieved with

HSBC in April 2013.

To further enhance production efficiencies, we installed new

automated case packing equipment in our Savannah operation, which

was fully operational from Spring 2014.

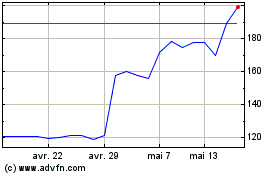

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024