This note provides information about the contractual terms of

the Group's interest-bearing loans and borrowings. For more

information about the Group's exposure to interest rate and foreign

currency risk, see note 26.

2014 2013

GBP000 GBP000

-------------------------------------- ------ ------

Non-current liabilities

Secured bank loans 28,222 29,775

Loan arrangement fees (77) (296)

-------------------------------------- ------ ------

28,145 29,479

-------------------------------------- ------ ------

Current liabilities

Asset backed loan 5,336 7,683

Revolving credit facilities - 658

Current portion of secured bank loans 4,535 4,763

-------------------------------------- ------ ------

Bank loans and borrowings 9,871 13,104

Loan arrangement fees (176) (257)

-------------------------------------- ------ ------

9,695 12,847

-------------------------------------- ------ ------

The asset backed loans are secured on the inventory and

receivables of the larger business units within the UK, USA and

European business segments.

The revolving credit facilities are secured on the assets of the

Group, in the same way as the bank overdraft above. The interest

rate is 3.2% over LIBOR. The facilities are drawn for periods from

one day up to six months.

Following the negotiations of new banking facilities in April

2013, the Group accrued arrangement fees which are being spread

over the life of the facility.

Terms and debt repayment schedule

2014 2013

-------------------------------------- ---- ------ ------

Repayment analysis of bank loans and

overdrafts Note GBP000 GBP000

Due within one year:

Bank loans and borrowings (see below) 9,871 13,104

Bank overdrafts 16 2,529 336

Due between one and two years:

Secured bank loans (see below) 6,071 4,725

Due between two and five years:

Secured bank loans (see below) 18,525 20,984

Due after more than five years:

Secured bank loans (see below) 3,626 4,066

-------------------------------------- ---- ------ ------

40,622 43,215

-------------------------------------- ---- ------ ------

During the year the facility with the Group's major bank was

amended to include a new GBP5,000,000 facility to fund the new

investment in Wales.

Secured bank loans

Loan 1

The principal of GBP303,000 (2013: GBP487,000) is repayable

monthly on a reducing balance basis over a 15 year period, ending

in March 2016. The loan is secured over the freehold land and

buildings and the contents therein of International Greetings USA,

Inc. and is subject to a variable rate of interest linked to the US

Federal Funds Rate (US FFR). The currency of denomination of the

loan is US Dollars.

Loan 2

The principal of GBP275,000 (2013: GBP470,000) is repayable

monthly on a reducing balance basis over a nine year period ending

in March 2016. The loan is secured over the freehold land and

buildings and the content therein of International Greetings USA,

Inc. and is subject to a variable rate of interest linked to the US

FFR. The currency of denomination of the loan is US Dollars.

Loan 3

The principal of GBP5,486,000 (2013: GBP5,956,000) is repayable

quarterly over a 20 year period ending in July 2028. The loan is

secured over the freehold land and buildings and the content

therein of Hoomark BV and is subject to a variable rate of interest

linked to EURIBOR, that has been swapped to a fixed rate for a

notional amount of GBP5,785,000 (2013: GBP5,882,000) over a period

of five years ending in January 2017. The currency of denomination

of the loan is Euros.

Loan 4

The principal of GBPNil (2013: GBP218,000) was repayable monthly

over a five year period ending November 2013. The loan was secured

over the plant and machinery of International Greetings UK Ltd and

was subject to a variable rate interest linked to the UK base rate.

The currency of denomination of the loan was Sterling.

Loan 5

The principal of GBP14,659,000 (2013: GBP15,208,000) is

repayable over a five year period with a bullet repayment in May

2016. GBP9,100,000 is denominated in Sterling and GBP5,559,000 is

denominated in US Dollars. They are subject to a variable interest

rate linked to LIBOR except for the element that has been swapped.

At 31 March 2014 the Group had an interest rate cap on a notional

amount of GBP8 million, and a notional amount of $8 million,

whereby interest payable has been capped at 1.5% on both notional

amounts. The terms of the hedge have been negotiated to match the

terms of the commitments.

Loan 6

The principal of GBP8,035,000 (2013: GBP12,199,000) is repayable

and amortised over a four year period to May 2015. GBP4,800,000 is

denominated in Sterling and GBP3,235,000 is denominated in US

Dollars. They are subject to a variable interest rate linked to

LIBOR except for the elements that have been swapped. At 31 March

2014, the Group had an interest rate swap in place with a notional

amount of GBP2.9 million whereby it receives a floating rate of

interest based on LIBOR and pays a fixed rate of interest at 0.92%

on the notional amount. The terms of the hedge have been negotiated

to match the terms of the commitments. At 31 March 2014, the Group

had an interest rate swap in place with a notional amount of $5.4

million whereby it receives a floating rate of interest based on

LIBOR and pays a fixed rate of interest at 0.77% on the notional

amount. The terms of the hedge have been negotiated to match the

terms of commitment.

Loan 7

The principal of GBP4,000,000 (2013: GBPNil) is repayable over a

three year period to May 2016. It is subject to a variable interest

rate linked to LIBOR. The currency of denomination of the loan is

Sterling.

18 Deferred income

2014 2013

GBP000 GBP000

----------------------------------------- ------ ------

Included within non--current liabilities

Deferred grant income 1,592 1,329

----------------------------------------- ------ ------

Included within current liabilities

----------------------------------------- ------ ------

Deferred grant income 620 550

Other deferred income 582 -

----------------------------------------- ------ ------

1,202 550

----------------------------------------- ------ ------

The deferred grant income is in respect of government grants

relating to the development of the site in Wales.

During the year GBP1,049,000 new grant was received in relation

to the new investment in Wales. This is being amortised in line

with depreciation on the new investment. All conditions on the old

grant have been met and there is no requirement to repay. It is

being amortised in line with the depreciation on the site

development.

19 Provisions

Property

GBP000

---------------------------------- ------ --------

Balance at 1 April 2013 969

New provisions made during the

year 120

Unwinding of fair value discounts 7

Provisions utilised during the

year (71)

---------------------------------- ------ --------

Balance at 31 March 2014 1,025

---------------------------------- ------ --------

2014 2013

GBP000 GBP000

---------------------------------- ------ --------

Non--current 860 862

Current 165 107

---------------------------------- ------ --------

1,025 969

---------------------------------- ------ --------

The provision represents the estimated reinstatement cost of two

of the Group's leasehold properties under fully repairing leases

and provision for an onerous lease for one of those properties. A

professional valuation was performed during 2012 for one of the

leasehold properties and the provision was reassessed and is stated

after discounting. GBP664,000 of the non-current balance relates to

a lease expiring in 2025, the balance relates to items between two

and five years.

20 Other financial liabilities

2014 2013

GBP000 GBP000

------------------------------------------ ------ ------

Included within non-current liabilities

Finance lease 4,087 1,540

Other creditors and accruals 115 263

------------------------------------------ ------ ------

4,202 1,803

------------------------------------------ ------ ------

Included within current liabilities

Finance lease 602 237

Other creditors and accruals 9,210 8,212

Interest rate swaps and forward foreign

currency contracts carried at fair value

through the income statement 115 54

Interest rate swaps and forward foreign

exchange contracts carried at fair value

through the hedging reserve 577 451

------------------------------------------ ------ ------

10,504 8,954

------------------------------------------ ------ ------

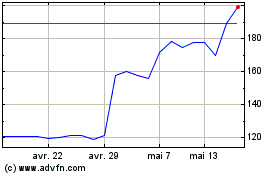

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024