Finance lease liabilities

Finance lease liabilities are payable as follows:

Minimum Minimum

lease lease

payments Interest Principal payments Interest Principal

2014 2014 2014 2013 2013 2013

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------- -------- -------- --------- -------- -------- ---------

Less than one year 795 (193) 602 314 (77) 237

Between one and five

years 3,538 (400) 3,138 1,717 (177) 1,540

More than five years 968 (19) 949 - - -

--------------------- -------- -------- --------- -------- -------- ---------

5,301 (612) 4,689 2,031 (254) 1,777

--------------------- -------- -------- --------- -------- -------- ---------

During the year two new finance leases were entered into for

GBP3,239,000 to fund new printing machines in the Group's

facilities in Wales. The interest rate on these leases is

3.88%.

21 Trade and other payables

2014 2013

GBP000 GBP000

-------------------------------------- ------ ------

Trade payables 25,031 28,291

Other payables including income taxes

and social security 787 704

-------------------------------------- ------ ------

25,818 28,995

-------------------------------------- ------ ------

22 Share capital

Authorised share capital at 31 March 2014 and 2013 was

GBP6,047,443 divided into 120,948,860 ordinary shares of 5p

each.

Ordinary shares

-----------------

In thousands of shares 2014 2013

---------------------------------- -------- -------

In issue at 1 April 56,768 55,007

Options exercised during the year 1,158 1,761

---------------------------------- -------- -------

In issue at 31 March - fully paid 57,926 56,768

---------------------------------- -------- -------

2014 2013

GBP000 GBP000

--------------------------------- ------- -------

Allotted, called up and fully

paid

Ordinary shares of GBP0.05 each 2,896 2,838

--------------------------------- ------- -------

Share options exercised during the year amounted to 1,158,000

(2013: 1,761,000) which generated cash proceeds of GBP176,000

(2013: GBP266,000).

The holders of ordinary shares are entitled to receive dividends

as declared from time to time and are entitled to one vote per

share at meetings of the Company.

23 Earnings per share

2014 2013

--------------- ---------------

Diluted Basic Diluted Basic

------------------------------- ------- ------ ------- ------

Adjusted earnings per share

excluding

exceptional items and LTIP

charges 8.4p 8.6p 7.8p 7.8p

Loss per share on LTIP charges (0.1p) (0.1p) - -

------------------------------- ------- ------ ------- ------

Adjusted earnings per share

excluding

exceptional items 8.3p 8.5p 7.8p 8.1p

Loss per share on exceptional

items (3.2p) (3.3p) (2.0p) (2.1p)

------------------------------- ------- ------ ------- ------

Earnings per share 5.1p 5.2p 5.8p 6.0p

------------------------------- ------- ------ ------- ------

The basic earnings per share is based on the profit attributable

to equity holders of the Company of GBP3,010,000 (2013:

GBP3,401,000) and the weighted average number of ordinary shares in

issue of 57,519,000 (2013: 56,245,000) calculated as follows:

Weighted average number of shares

in thousands of shares 2014 2013

--------------------------------------- ------ -------

Issued ordinary shares at 1 April 56,768 55,007

Shares issued in respect of exercising

of share options 751 1,238

--------------------------------------- ------ -------

Weighted average number of shares

at 31 March 57,519 56,245

--------------------------------------- ------ -------

Adjusted basic earnings per share excludes exceptional items

charged of GBP2,298,000 (2013: GBP1,376,000) and the tax relief

attributable to those items of GBP381,000 (2013: GBP221,000), to

give adjusted profit of GBP4,927,000 (2013: GBP4,556,000).

Diluted earnings per share

The average number of share options outstanding in the year is

2,281,351 (2013: 3,664,232), at an average exercise price of 19.6p

(2013: 19.6p). The diluted earnings per share is calculated

assuming all these options were exercised. At 31 March the diluted

number of shares was 59,098,460 (2013: 58,794,617).

24 Dividends

No dividends were paid in the year (2013: nil). The Directors do

not propose a final dividend for 2014.

25 Share-based payments

Options

Options to subscribe for ordinary shares have been granted,

pursuant to the Company's approved and unapproved Employee Share

Option Schemes, which are exercisable at dates ranging up to

January 2021. At 31 March 2014, outstanding options were as

follows:

Number of Exercise Exercise

ordinary shares price (p) dates

------------ --------------- --------- -------------------------------

Approved: 1,667,140 14 December 2011 - December 2018

38,000 31.25 July 2012 - July 2019

12,000 50 September 2012 - September 2019

48,387 62 January 2014 - January 2021

Unapproved: 107,145 14 December 2011 - December 2018

1,613 62 January 2014 - January 2021

------------ --------------- --------- -------------------------------

1,874,285

------------ --------------- --------- -------------------------------

All share-based payments are equity-settled.

There were no performance or profitability conditions attached

to the approved options (other than continued employment), except

for 48,387 shares issued at 62p, which relate to specific

performance targets related to sales of new product areas in the

US. Conditions related to profitability for the two years to March

2011 are attached to the unapproved options awarded to Executive

Directors and these conditions have now been fully met.

For the share options outstanding at 31 March 2014, the weighted

average remaining contract life was 4.7 years (2013: 5.8

years).

The numbers and weighted average exercise prices of share

options are as follows:

2014 2013

Weighted Weighted

average Number of average Number of

exercise Exercise

price options price options

----------------------------- -------- ----------- -------- -----------

Outstanding at the beginning

of the period 17p 3,141,956 18p 5,002,556

Approved options granted

during the period 0p - 0p -

Unapproved options granted

in the period 0p - 0p -

Lapsed during the year 58p (110,000) 0p (100,000)

Exercised during the period 15p (1,157,671) 15p (1,760,600)

----------------------------- -------- ----------- -------- -----------

Outstanding at the end of

the period 16p 1,874,285 17p 3,141,956

----------------------------- -------- ----------- -------- -----------

Exercisable at the end of

the period 16p 1,874,285 14p 2,991,956

----------------------------- -------- ----------- -------- -----------

The weighted average share price at the date of exercise of

share options exercised during the period was 47.4p (2013:

54.9p).

No share options were granted during the year or the previous

year.

Long Term incentive Plan (LTIP)

During the year the Group introduced a new Long Term Incentive

Plan.

The Company will issue up to 1,400,000 ordinary shares under the

LTIP to Anthony Lawrinson, a Director of the Company. The ordinary

shares are being issued as part of Anthony Lawrinson's remuneration

package agreed at the time of his appointment to the Board in

October 2011. Vesting is conditional upon and proportionate to the

cumulative average growth (CAGR) in fully diluted earnings per

share before exceptional items over a defined period from 1 April

2012 to 31 March 2015 with CAGR of 20% required for the whole

amount to vest. The cost to Anthony Lawrinson of the ordinary

shares to be issued under the LTIP if the performance criterion is

met, will be nil. Anthony Lawrinson has no other options over

ordinary shares.

The fair value of the LTIP granted during the year was based on

the share price on the date the scheme was approved and the

expected number of shares to vest.

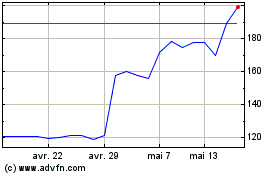

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024