RNS Number:2357A

International Greetings PLC

29 June 2004

Embargoed until 0700, 29th June 2004

International Greetings plc

("International Greetings" or "the Group")

Record preliminary results

Management signal confidence with 13% dividend increase

International Greetings plc (AIM: IGR), the leading designer and manufacturer of

private label greetings products and film and television character based licensed

stationery, announces today its preliminary results for the year ended 31st March 2004.

Financial highlights

*Turnover up 11% to #126.7m (2003: #113.7m) and profit before tax up 3% to #11.2m (2003: #10.9m)

*Turnover, excluding Hoomark, increased 10% to #124.6m (2003: #113.7m)

*Adjusted profit before tax*, excluding Hoomark, increased 14% to #12.7m (2003: #11.1m)

*Adjusted EPS*, excluding Hoomark, increased 15% to 21.6p (2003: 18.8p)

*Final dividend of 5p per share (2003: 4.45p) increases full year dividend 13% to 6.5p per share (2003: 5.75p)

*Hoomark trading since acquisition (loss before tax of #0.6m) in-line with expectations

*US division performed well with operating profit (in $US) rising 14% to $2m.

* figure excludes goodwill amortisation of #233,000 (2003 : #175,000) and

exceptional item of #684,000 (2003 : nil).

Operational highlights

*Strong organic growth and platforms created for further growth through acquisitions

*Acquisition of leading Dutch gift wrap business, Hoomark, strengthens the Group's position in Europe

*Licensing agreements secured for summer blockbusters including Harry Potter and the

Prisoner of Azkaban, Shrek 2 and Thunderbirds

*Increased production and sourcing from the Far East

*New licensed Christmas decorations product range launched which is already contributing sales to the Group.

Post year-end event

*Acquisition of Krakajack, a cracker manufacturer, for a consideration of approximately

#900,000, providing entry in to in the important Irish and catering markets.

Commenting, Nick Fisher, CEO of International Greetings said:

"This strong set of results demonstrates International Greetings' focus on and

ability to deliver growth, both organically and through acquisition. We are

encouraged by the performance of our US division and by progress being made in

the Far East, as well as looking forward to receiving a full year's contribution

from Hoomark. As ever, our licensed products sold well and we anticipate a

strong performance from both Shrek 2 and Thunderbirds, with further demand at

Christmas, coinciding with DVD releases. We are confident about the year ahead,

as evidenced by the improved dividend, and look forward to delivering further

shareholder value."

For further information:

Nick Fisher, International Greetings: 01707 630630

Richard Sunderland/ Tim McCall, mj2 ltd: 020 7491 7776

Richard.sunderland@mj2.co.uk

Graeme Cull, Arden Partners: 0121 423 8960

CHAIRMAN'S STATEMENT

International Greetings is a business focused on growth. During the past year

the Group has seen impressive organic growth from its existing businesses, and

created new platforms for future growth through acquisitions.

For the year ended 31st March 2004, adjusted profit before tax* increased to

#12.1m with turnover increasing to #126.7m. Excluding the results attributable

to Hoomark, the leading Dutch gift wrap business which was acquired in November

last year, turnover increased by 10% to #124.6m with adjusted profit before

taxation* increasing by 14% to #12.7m. These are excellent results which reflect

the continuing success of the Group in meeting the challenge of satisfying both

the quality and value demands of its customers. They also demonstrate the

benefits of continued investment in product development and design, together

with ongoing cost control and improved manufacturing efficiency. This was

particularly apparent in the strong performance of the US division where, in

US$, operating profit increased by 14% on turnover up 3%.

Work continues with the integration of Hoomark, which was in its seasonally

loss-making period when it was acquired by International Greetings in November

last year. Its performance since then has been in line with expectations and it

is expected to make a positive contribution to the group's next annual results.

Since the year end, we have also further strengthened the Group's offering

through the purchase of Krakajack, one of the leading suppliers of Christmas

crackers to the Irish and catering markets.

Licensing remains an important area of the Group's core business and coinciding

with this results announcement are the release of two major film properties,

Shrek 2 and Thunderbirds. We have exclusive licences in our product categories

for these properties and have launched ranges of merchandise this summer

utilising characters from these films. We expect further sales opportunities

during the autumn period when DVD's are released for Christmas.

Once again I would like to commend all our employees for their continued

commitment in ensuring our business achieves its desired objectives. This year's

performance in all divisions illustrates their dedication to International

Greetings.

The business continues to perform well, and the Board is confident in the future

prospects for the Group. As a result, and reflecting the strong financial

position, with net funds at the year end of #10.3m, we are recommending a final

dividend of 5p per share. This makes a total for the year of 6.5p, and

represents an increase of 13% over last year.

John Elfed Jones CBE DL

Chairman

*figure excludes goodwill amortisation of #233,000 (2003: #175,000) and

exceptional item of #684,000 (2003: nil).

REVIEW OF OPERATIONS

The last 12 months have been an active and successful period for International

Greetings. We have seen impressive growth in both turnover and profits from our

core businesses, and in addition to establishing a new licensed Christmas

decorations product category, the Group's range of activities have been

broadened with the acquisitions of Hoomark and Krakajack.

UK and European Market

The core business has performed extremely well during the last year, with

turnover of the UK business increasing by 14% to #108m. This includes a turnover

contribution from the newly established licensed Christmas decorations product

category of #2.4m. We are encouraged by the favourable response this new area of

business has received from customers, and are confident in its future growth

potential.

The acquisition of Hoomark represents a major step forward in the Group's

development into mainland Europe. In addition to the sales opportunities it

gives to supply the Group's products into this important market place, there are

also many synergy benefits. Manufacturing facilities in the UK will benefit from

the extra capacity now available and efficiency gains and economies of scale

arising in areas such as printing and sourcing of raw materials are expected.

On 1st June 2004, the Group completed the purchase of the assets and trade of

Krakajack, a cracker manufacturing business based in Ireland, for a total

consideration of approximately #900,000. This acquisition has enabled

International Greetings to acquire, for a relatively low cost, a unique high

speed automated cracker production line, complementing its existing hand-made

manufacturing facilities in South Wales and the Far East. The production

equipment will be relocated to South Wales, and the acquisition provides the

Group with an entry into the catering side of the cracker market as well as a

significant market share in Ireland.

US Market

The US division has also performed well during the year. The results of this

division, translated into sterling, have been negatively affected by movements

in exchange rates during the year. However, in US$, although turnover only

increased by 3%, efficiency improvements resulted in operating profit increasing

by 14%. These improvements in productivity have primarily arisen from increasing

in-house printing and conversion, following recent investments in new equipment.

The Group continues with its strategy of developing further into the US mass

market sector, and has now set up a dedicated sales and marketing division to

maximise this opportunity. Additional sales from this division are expected to

start coming through in the current year.

Far East Production

Production and sourcing from Hong Kong and China continues to be of increasing

importance to the Group. In April last year we opened a cracker production

facility in China. All production targets for last year's Christmas orders were

met and as a result, an increase in production from this facility is expected

during the next 12 months. The Group continues to develop new products and

source new materials and finishes from the region, in order to maintain our

competitive market position.

Design and Licensing

The trend by consumers to constantly demand new and fresh ideas is very apparent

in greetings and stationery products. The Group's design teams have once again

demonstrated their ability to create new ranges and designs, which can be

manufactured economically to meet consumers' demands. An important measure of

the Group's success is the sell-through of its products by its retail customers,

and we are pleased to report excellent retail sales during the past year, not

only for Christmas products, but also for everyday ranges.

Sales targets for new licensed properties launched during the past 12 months

were met, and coinciding with this results announcement are the release of two

major film properties, Shrek 2 and Thunderbirds. Sales of merchandise from these

two films will be generated during the current financial year, together with

those from the Group's perennial Disney, Barbie, Simpsons and other licences.

The Group's policy of maintaining a strong core licence portfolio together with

new film signings complements its customers' range requirements for licensed

merchandise, and new licensed properties will continue to be sourced.

Conclusion

Following another successful year for the Group, the focus will remain on what

International Greetings does best - innovation and excellence in design,

efficient manufacturing and exemplary service to customers. The Group will also

continue to pursue its strategy of organic growth, supplemented by selective

acquisitions of complementary businesses that create additional value. We are

confident that all these initiatives will ensure that International Greetings

continues to be a successful, thriving growth business.

Nick Fisher Joint Chief Executive

Anders Hedlund Joint Chief Executive

FINANCIAL REVIEW

Group Performance

Turnover for the year to 31st March 2004 increased to #126.7m. Excluding the

sales of #2.1m attributable to Hoomark since its acquisition, turnover increased

by 10% to #124.6m.

Adjusted operating profit* for the year to 31st March 2004 increased to #12.3m.

Excluding the operating loss attributable to Hoomark since acquisition, adjusted

operating profit* increased by 8% to #12.7m, and represents an adjusted

operating margin* of 10.2%. Hoomark made an operating loss of #0.4m for the

period it was part of the Group. However, in common with the rest of the Group,

Hoomark's business has a considerable degree of seasonality, and the results for

this period are not representative of the full year's performance. Based on

unaudited management accounts figures, Hoomark had turnover for the 12 months to

31st March 2004 of #9.2m and made an operating profit of #0.5m.

The exceptional item of #0.7m represents the one-off start up costs associated

with setting up the new licensed Christmas decorations product category, which

is already contributing sales to the Group.

Lower borrowing levels throughout the year have been primarily responsible for

the interest charge for the year to 31st March 2004 of #0.1m being significantly

lower than last year's #0.7m.

Adjusted profit before tax* increased to #12.1m. Excluding the loss before tax

attributable to Hoomark since acquisition, adjusted profit before tax* increased

by 14% to #12.7m.

Earnings Per Share and Dividend

Adjusted basic earnings per share* for the year ended 31st March 2004 were

20.7p, an increase of 10%. Excluding the loss per share attributable to Hoomark

since acquisition, adjusted basic earnings per share* for the year ended 31st

March 2004 increased by 15% to 21.6p. Basic earnings per share were 19.2p, an

increase of 3%.

The final dividend for the year of 5p (2003: 4.45p) makes a total dividend for

the year of 6.5p, an increase of 13% and is covered three times by basic

earnings per share.

Balance Sheet and Cash Flow

The Group has once again produced a strong cash flow performance and

strengthened its financial position. Shareholders' funds increased by #6.2m to

#44.1m, and net funds have increased by #6.8m to #10.3m, notwithstanding the

additional net debt of #8.2m arising as a result of the acquisition of Hoomark.

Treasury Operations

The Board continues to assess and manage the risks associated with the treasury

function as the business develops. The Group's business has a strong seasonal

focus, resulting in large variations in working capital, with net funds for

certain periods of the year and net borrowings in other periods. As a result,

the Board considers that long term reduction of exposure to fluctuations in

interest rates on working capital is unlikely to be economically viable.

A significant proportion of the Group's purchases are denominated in US$. The

effect of exchange rate fluctuations is reduced through a combination of

measures including hedging and forward exchange contracts.

Mark Collini

Finance Director

*figure excludes goodwill amortisation of #233,000 (2003: #175,000) and

exceptional item of #684,000 (2003: nil).

Consolidated profit and loss account

for the year ended 31 March 2004

Note Continuing operations

Pre-exceptional Exceptional Acquisition Total Total

item item

2004 2004 2004 2004 2003

#000 #000 #000 #000 #000

Turnover 2 124,639 - 2,050 126,689 113,732

Cost of sales (86,917) - (1,756) (88,673) (78,239)

--- --- --- --- ---

Gross profit 37,722 - 294 38,016 35,493

Distribution expenses (11,529) - (325) (11,854) (11,357)

Administrative expenses (13,714) (684) (427) (14,825) (12,515)

--- --- --- --- ---

Operating profit 2 12,479 (684) (458) 11,337 11,621

Net interest payable (40) - (97) (137) (690)

--- --- --- --- ---

Profit on ordinary

activities

before taxation 2-3 12,439 (684) (555) 11,200 10,931

--- --- --- --- ---

Tax on profit on

ordinary

activities 4 (3,142) (3,299)

--- --- --- --- ---

Profit for the

financial year 8,058 7,632

Dividends -

equity 5 (2,774) (2,385)

--- --- --- --- ---

Retained

profit for the

financial year 5,284 5,247

=== === === === ===

Earnings per

share 6

Basic 19.2p 18.5p

Adjusted basic

excluding

goodwill and

exceptional

item 20.7p 18.8p

Diluted 19.1p 18.3p

=== === === === ===

Consolidated statement of total recognised gains and losses

for the year ended 31 March 2004

2004 2003

#000 #000

Profit for the financial year 8,058 7,632

Currency translation differences arising on

foreign currency net investments (835) (602)

--- ---

Total recognised gains and losses relating to the financial

year 7,223 7,030

=== ===

Consolidated balance sheet

at 31 March 2004

Note 2004 2003

#000 #000 #000 #000

Fixed assets

Intangible assets - goodwill 2,737 1,071

Tangible assets 23,271 21,721

--- ---

26,008 22,792

Current assets

Stocks 22,069 21,860

Debtors 11,492 9,856

Cash at bank and in hand 16,233 10,547

--- ---

49,794 42,263

Creditors: amounts falling due

within one year (25,583) (21,438)

--- ---

Net current assets 24,211 20,825

--- ---

Total assets less current 50,219 43,617

liabilities

Creditors: amounts falling due

after more than one year (3,059) (2,278)

Provisions for liabilities and charges (243) (394)

Deferred income (2,802) (3,016)

--- ---

Net assets 44,115 37,929

=== ===

Capital and reserves

Called up share capital 2,112 2,077

Share premium account 1,703 1,081

Potential issue of shares 8 1,080 -

Other reserves 181 1,016

Profit and loss account 39,039 33,755

--- ---

Equity shareholders' funds 7 44,115 37,929

=== ===

Consolidated cash flow statement

for the year ended 31 March 2004

2004 2003

#000 #000

Net cash inflow from operating activities 23,695 22,510

Returns on investments and servicing of (191) (707)

finance

Taxation (3,175) (2,980)

Capital expenditure (4,842) 752

Acquisitions and disposals (7,777) -

Equity dividends paid (2,511) (1,892)

---------------- ----------------

Cash inflow before financing 5,199 17,683

Financing 1,440 (1,553)

---------------- ----------------

Increase in cash 6,639 16,130

================ ================

Reconciliation of net cash flow to movement in net funds

for the year ended 31 March 2004

2004 2003

#000 #000

Increase in cash in the year 6,639 16,130

Cash (inflow)/outflow from debt and lease (783) 1,877

financing

---------------- ----------------

Change in net funds resulting from cash flows 5,856 18,007

New finance leases (180) (695)

Finance leases acquired with subsidiary (393) -

Translation differences 1,552 1,028

---------------- ----------------

Movement in net funds in the year 6,835 18,340

Net funds/(debt) at beginning of year 3,433 (14,907)

---------------- ----------------

Net funds at end of year 10,268 3,433

================ ================

Notes

1 Basis of preparation

The financial information set out above does not constitute the Company's statutory

financial statements for the years ended 31 March 2004 or 2003. Statutory financial

statements for 2003 have been delivered to the registrar of companies, and

those for 2004 will be delivered following the company's annual general meeting.

The auditors have reported on those accounts; their reports were unqualified and

did not contain statements under section 237(2) or (3) of the Companies Act 1985.

2 Segmental analysis

(a) Geographical area of operation

UK & Europe USA Group

2004 2003 2004 2003 2004 2003

#000 #000 #000 #000 #000 #000

Turnover 110,338 95,260 16,351 18,472 126,689 113,732

=== === === === === ===

Operating profit

before exceptional

item 10,944 10,524 1,077 1,097 12,021 11,621

Exceptional item (see

below) (684) - - - (684) -

--- --- --- --- --- ---

Operating profit

after exceptional

item 10,260 10,524 1,077 1,097 11,337 11,621

--- --- --- ---

Net interest (137) (690)

--- ---

Profit on ordinary

activities before

taxation 11,200 10,931

=== ===

Net assets 38,408 31,961 5,707 5,968 44,115 37,929

=== === === === === ===

The above results relate entirely to continuing operations.

Exceptional item

During the year ended 31 March 2004 the group established a new product category

involved in the design and selling of licensed decorations. The exceptional item

of #684,000 (2003: #Nil) represents the one-off start-up costs associated with

this category.

(b) Geographical analysis of turnover by destination

2004 2003

#000 #000

UK 90,986 79,101

USA 23,287 27,180

Europe 10,427 6,977

Rest of world 1,989 474

------------- ---------------

126,689 113,732

============= ===============

3 Profit on ordinary activities before taxation

2004 2003

#000 #000

Profit on ordinary activities before taxation is stated after

charging/(crediting)

Auditors' remuneration- audit fees paid to the company's

auditor and its associates 73 68

- non audit fees paid to the company's

auditor and its associates 52 68

Hire of plant and machinery - rentals payable under operating

leases 309 341

Hire of other assets - operating leases 741 307

Release of deferred grant income (299) (293)

Depreciation - owned 4,327 3,821

- leased 139 101

Amortisation of goodwill 233 175

=== ===

Audit fees payable by the company for the year were #14,000 (2003: #6,000).

4 Taxation

2004 2003

#000 #000 #000 #000

Current tax

UK corporation tax on profits of the year 3,414 3,278

Adjustments in respect of previous periods (63) 55

-------- --------

3,351 3,333

Foreign tax

On profits of the year 166 264

Adjustments in respect of previous periods (205) 92

-------- --------

(39) 356

-------- --------

Total current tax 3,312 3,689

Deferred taxation

Origination and reversal of timing

differences (190) (316)

Adjustments in respectof previous periods 20 (74)

-------- --------

Total deferred tax (170) (390)

-------- --------

Tax on profits onordinary activities 3,142 3,299

-------- --------

5 Dividends

2004 2003

#000 #000

Interim paid - 1.5p per share (2003: 1.3p) 662 536

Final proposed - 5.0p per share (2003: 4.45p) 2,112 1,849

---------------- ----------------

2,774 2,385

---------------- ----------------

6 Earnings per share

2004 2003

Adjusted basic earnings per share excluding

goodwill and exceptional item 20.7p 18.8p

Loss per share on goodwill (0.4p) (0.3p)

Loss per share on exceptional item (1.1p) -

---------------- ----------------

Basic earnings per share 19.2p 18.5p

================ ================

Diluted earnings per share 19.1p 18.3p

================ ================

The basic earnings per share is based on the earnings of #8,058,000 (2003:

#7,632,000) and the weighted average number of ordinary shares in issue of

41,995,174 (2003: 41,229,758). The calculation of diluted earnings per share is

based on 42,180,513 (2003: 41,760,588) ordinary shares. The difference of

185,339 (2003: 530,830) represents the dilutive effect of outstanding employee

share options which has been calculated in accordance with FRS 14.

Adjusted basic earnings per share excluding goodwill and exceptional item is

calculated after adjusting for amortisation of goodwill of #233,000 (2003:

#175,000), the exceptional item of #684,000 (2003: #Nil), and the tax relief

attributable to these items.

7 Reconciliations of movements in shareholders' funds

Group

2004 2003

#000 #000

Profit for the financial year 8,058 7,632

Dividends (2,774) (2,385)

--- ---

5,284 5,247

Other recognised gains and losses relating to

the year (net) (835) (602)

New share capital subscribed 657 324

Potential issue of shares (see below) 1,080 -

--- ---

Net addition to shareholders' funds 6,186 4,969

Opening shareholders' funds 37,929 32,960

--- ---

Closing shareholders' funds 44,115 37,929

=== ===

8 Acquisition

On 19 November 2003 the company acquired 100% of the issued share capital of

Hoomark Gift-wrap Partners BV, a manufacturer of gift wrapping paper based in

The Netherlands. The provisional fair value of total assets acquired was as

follows:

Book value of Provisional fair value Provisional fair value

acquired adjustments (note (a) at date of acquisition

business below)

#000 #000 #000

Fixed assets 1,352 393 1,745

Stock 2,860 (158) 2,702

Debtors 4,681 (133) 4,548

Creditors (1,525) (393) (1,918)

Bank loans

and (6,551) - (6,551)

overdraft

---------------- ---------------- ----------------

Net assets

acquired 817 (291) 526

================ ================ ===============

Satisfied by:

#000

Cash paid 1,226

Estimated future deferred consideration (see note (b) below) 1,217

----------------

Total consideration 2,443

----------------

Goodwill 1,917

================

The goodwill relating to the acquisition is written off over 10 years, being its

estimated useful economic life.

(a) The adjustments made to the net book values of the assets and liabilities of

Hoomark represent the capitalisation of fixed assets held under finance leases

and adjustments to bring stock and debtor provisioning into line with group

policies.

(b) The estimated future deferred consideration, of which #1,080,000 may be paid

by the issuance of new ordinary shares at the company's option, consists of:

i) an amount of Euro1,000,000 due in June 2004, payable in either cash or by the

issuance of new ordinary shares, at the company's option.

ii) an amount equivalent to 50% of the estimated profit after tax of Hoomark

Gift-wrap Partners BV for the 3 years ended 31 March 2007. This is payable in 3

annual instalments commencing 31 July 2005. Up to 75% of this element of the

deferred consideration may be payable by the issuance of new ordinary shares, at

the company's option.

(c) In January 2003, Hoomark Gift-wrap Partners BV bought certain assets and the

business previously carried out by Hoomark BV from the trustee in bankruptcy of

Hoomark BV, and commenced trading. As a result no accounts are available for the

year ended 31 March 2003. For the period 1 April 2003 to 18 November 2003,

unaudited management accounts figures (translated at the 31 March 2004 exchange

rate) reflect turnover of #7.14m, operating profit of #0.95m and interest

payable of #0.34m, resulting in a profit before tax of #0.61m.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR VVLFLZQBEBBQ

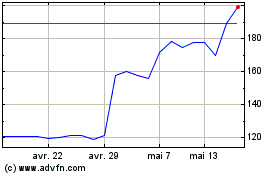

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024