RNS No 4423r

INTERNATIONAL GREETINGS PLC

15 July 1999

Earnings up 20% at International Greetings

Strong core performance supported by acquisitions

Two for one bonus issue proposed

International Greetings PLC today reported a strong set

of results for the year ended March 31 1999, showing

earnings per share 20% ahead at 40.4p compared with 33.7p

last year.

The Board is recommending a final dividend of 7p per

share, payable on September 7 1999 to shareholders on the

register on August 20 1999. Dividends for the year total

10p, an increase of 16% over last year.

A resolution to make a two for one bonus issue, to

further enhance the liquidity in the company's shares,

will be proposed at the Annual General Meeting.

Highlights of the year's performance include:

* Pre-tax profits up 18% at #7.8 million (1998: #6.6

million)

* Earnings per share up 20% at 40.4p (1998: 33.7p)

* Final dividend per share 7p up 16% (1998: 6.0p)

* Strong performance from core business

* Initial contributions from Copywrite and The Cracker

Company acquisitions

Nick Fisher, Joint Chief Executive, said: "We are

delighted with this year's results. Our established

businesses have performed well and both acquisitions made

last year have exceeded our expectations.

"We continue to invest in all areas of our business and

this year have committed significant sums to new

lithographic printing and conversion machinery. Such

investments ensure that we continue to provide our

customers with the very best levels of service and

product development.

"With our US division meeting its growth targets for this

year, together with a strong UK order book for this

Christmas, we are confident in the outlook for the

future."

Copies of this announcement will be available at the

company's offices at Belgrave House, Acrewood Way, St

Albans AL4 OJY, until July 29 1999.

For further information, contact:

International Greetings PLC 01727 844 888

Nick Fisher, Joint Chief Executive

Grandfield 0171 417 4170

Michael Henman/Clare Abbot

CHAIRMAN'S STATEMENT

I am delighted to report that your company has again

performed impressively during the year ended 31 March

1999, highlighted as follows:

* Profit before tax #7.8m up 18%

* Earnings per share 40.4p up 20%

* Dividend for the year 10p up 16%

These are very pleasing results which demonstrate the

continuing strength of our business. The core activities

have again performed well. This has been achieved with

the continued commitment of our employees, for which I

would like to take this opportunity to thank them all.

Many members of our workforce took up the opportunity

during the year to acquire shares under the recently

established Employee Share Purchase Scheme, and I welcome

them as shareholders in our company.

The purchase of the Copywrite and Cracker Company

businesses during the year confirmed our commitment to

expand and to seek new areas of opportunity. Their

integration into the Group's operations has gone

extremely well. I am pleased to report that both

businesses made positive, albeit small contributions to

net profit, even after associated financing costs. The

underlying strength of the Copywrite business, together

with the improvements implemented since last July, are

encouraging for the future.

We have taken steps after the year-end to broaden our

institutional shareholder base and enhance the

marketability and liquidity of the company's shares. In

April, the directors successfully arranged a placing of

part of their shareholding to increase the free float in

the company's shares. In addition, a resolution to make a

two for one bonus issue to ordinary shareholders will be

proposed at the forthcoming Annual General Meeting on 3

September 1999.

Outlook

The Group continues to perform well and the focus on

quality and service throughout the Group's activities

gives the Board confidence in the future. Accordingly,

the Board is recommending a final dividend of 7p, making

a total for the year of 10p per share, an increase of 16%

over last year. The final dividend will be paid on 7

September 1999 to shareholders on the register at the

close of business on 20 August 1999.

John Elfed Jones CBE DL

Chairman

REVIEW OF OPERATIONS

The strength of the Group's core business continues to

lie in the strong and long term nature of our

relationships with major multiple retailers in the UK.

The 15% increase in turnover over last year (excluding

acquisitions) demonstrates this strength. Investment in

the core activities of the business is essential to

maintain our leading market position. It is a vital part

of our commitment to continual improvement in design,

product quality and customer service.

Gift wrap

In the gift wrap division, #600,000 has been invested in

new conversion machinery. This increase in capacity

supplements the increase in print capacity that has

resulted from investment in gravure printing equipment in

recent years. Further investment in this area has also

enabled us to improve and broaden the range of products

available to our customers by applying sophisticated

finishing processes to the printed paper.

Cards

The rapid expansion of the Group over recent years has

meant that our base in St Albans has become too small and

a move to larger premises is underway. A suitable

building in Hatfield was acquired last December. Work to

adapt the building to our required specification

commenced in February and it is anticipated that the move

into the building will be completed by the end of August

this year.

In addition to providing a more suitable and efficient

environment for the Group's head office, sales and design

functions, the move will provide the opportunity for a

considerable expansion in the cards and tags divisions'

manufacturing operations. Over #700,000 has been

committed in the current year to investment in a new six

colour litho printing press, embossing, foiling and other

finishing machinery. This will enable these divisions to

bring in-house a number of operations previously

subcontracted and should result in improved operational

efficiency. It is expected that this project should be

completed by the end of this year in time to be able to

reap the benefits for next year.

Crackers

The Cracker division successfully completed the

integration of The Cracker Company (acquired in May 1998)

into its operations during the year and has proved an

excellent acquisition at minimal cost.

The Cracker division's product range has also been

extended by an agreement with a leading US manufacturer

of Halloween and party products to sell and distribute

their range in the UK.

USA

In the US, the strength of our range of gift wrap designs

and relationship with independent sales organisations

means we are now generally recognised as the preferred

supplier of gift wrap and related products to the leading

department and speciality stores in the country. A

considerable amount of management commitment and

investment has been involved in reaching this strategic

objective, and we look forward with confidence to the

benefits we expect to accrue from attaining this

position.

Stationery

The acquisition of the Copywrite business in July last

year added a new product category, character stationery

and bags, to the Group's operations. The recovery and

rejuvenation of the business, which had gone into

receivership under the previous ownership, has been a key

objective of senior management this last year. A

programme of action was instituted to rationalise the

company's product ranges and improve customer service and

operational efficiency. We have also been most impressed

by the quality and commitment of the employees retained

within the Copywrite business. It is very much as a

result of their considerable efforts that performance has

exceeded initial expectations and the business has made a

small, but positive contribution to net profit. Under the

direction of a newly appointed Managing Director, who has

extensive experience in all areas of the gift stationery

business, we are optimistic about the future potential of

this business.

Summary

The last year has been a busy one for the Group. Ensuring

the continuing development of the Group's core

activities, alongside the work associated with the

acquisitions made during the year has been a considerable

challenge to all concerned. We believe the results

demonstrate this challenge has been met with considerable

success to date, and are confident will continue to be

met in the future. We will continue to pursue a balanced

policy of organic growth supplemented by selective

acquisitions.

Anders Hedlund Nick Fisher

Joint Chief Executive Joint Chief Executive

FINANCE REVIEW

The strong performance of the Group's core activities is

reflected in this year's results.

* Turnover #72.2m up 35%

* Operating profit # 9.4m up 23%

* Shareholders' funds #17.8m up 33%

Turnover for the year to 31 March 1999 showed an increase

of 35% to #72.2m (1998: #53.5m) with operating profit up

by 23% to #9.4m (1998: #7.6m). Turnover and operating

profit attributable to the acquisitions was #10.5m and

#0.4m respectively. Excluding these figures, turnover

would have shown a 15% increase and operating profit an

18% increase over the previous year's figures.

Overall, the operating profit margin showed a reduction

from 14.3% to 13.1% although excluding acquisitions, the

operating profit margin would have shown an increase from

14.3% to 14.6%. The acquisitions accounted for 15% of the

Group's enlarged turnover but contributed only 5% to the

Group's operating profit. The performance of our major

acquisition, Copywrite Designs, exceeded initial

expectations, making a positive contribution to profit

for the eight months it was part of the Group and

representing a rapid turnaround from the losses it made

previously.

Interest payable increased from #1.0m to #1.6m, of which

#0.2m related to the acquisitions during the year. Profit

before taxation rose to #7.8m, an increase of 18% over

last year's #6.6m.

This year's overall tax charge of #2.4m represents an

effective tax charge of 30.8%, compared with last year's

32.4%.

Earnings per share and dividends

Earnings per share for the year to 31 March 1999 were

40.4p, an increase of 20%.

The final dividend of 7p makes a total dividend for the

year of 10p, which is covered four times by earnings per

share.

Balance sheet and cash flow

Shareholders' funds increased by #4.4m to #17.8m, #4.1m

from retained profits and #0.3m from new shares issued.

Cash outflow during the year amounted to #8.1m. Of this

outflow, #5.2m resulted from acquisitions made, #4.1m

initially invested and #1.1m from post-acquisition

cashflows, primarily working capital movements. A further

#3.4m outflow (including recoverable value added tax)

resulted from the purchase of our new property in

Hatfield (see review of operations). Various long-term

financing arrangements are currently being reviewed in

relation to this property and it is anticipated that the

outcome of this review will result in a significant cash

inflow and reduction in overall gearing in the current

year.

Group debt at 31 March 1999 amounted to #14.5m, and

gearing was 81% compared with last year's 49%. This

increase is entirely as a result of the acquisitions and

property purchase referred to above, in the absence of

which gearing would have reduced to 35%.

Treasury operations

The directors have established a framework for managing

the risks associated with the treasury function which are

continually evolving as the Group's business activities

grow. The most significant treasury exposures faced by

the Group are considered at Board level.

The Group's business has a strong seasonal element

resulting in large variations in working capital

requirements. As a result, the Board has considered that

long term restriction of the exposure to interest rate

fluctuations on working capital funding is unlikely to be

economically viable. Where opportunities exist, however,

for short term fixing of elements of this funding at

attractive rates, for example, through the use of

acceptance credits, these options are considered.

The seasonality of the Group's business means that

interest cover is considered the most appropriate

indicator of the Group's financial strength. Operating

profits covered the interest expense for the year six

times, and reflects the continuing strength of the

Group's finances.

Mark Collini

Finance Director

Consolidated Profit & Loss Account for the year ended 31

March 1999

1999 1998

Continued Acquisitions Total

Note #000 #000 #000 #000

2

Turnover 61,638 10,513 72,151 53,496

Cost of sales (41,135) (7,742) (48,877) (35,597)

--------------------------------------

Gross profit 20,503 2,771 23,274 17,899

Distribution expenses (3,997) (1,058) (5,055) (3,784)

Administrative expenses (7,522) (1,281) (8,803) (6,479)

-------------------------------------

Operating profit 8,984 432 9,416 7,636

Interest payable

and similar charges (1,363) (218) (1,581) (1,014)

------------------------------------

Profit on ordinary

activities before

taxation 2 7,621 214 7,835 6,622

------------------

Tax on profit on

ordinary activities 3 (2,414) (2,149)

-------------------------------------

Profit on ordinary

activities after taxation 5,421 4,473

Minority interests - (27)

-------------------------------------

Profit for the financial year 5,421 4,446

Dividends - equity 4 (1,372) (1,135)

-------------------------------------

Retained profit for

the financial year 4,049 3,311

-------------------------------------

Earnings per share 5

Basic 40.4p 33.7p

Diluted 39.8p 32.8p

Consolidated Statement of Total Recognised Gains &

Losses for the year ended 31 March 1999

1999 1998

#000 #000

Profit for the financial year 5,421 4,446

Currency translation differences arising on

foreign currency net investments 57 (22)

Total recognised gains and losses relating to 5,478 4,424

the financial year

Consolidated Balance Sheet at 31 March 1999

1999 1998

#000 #000 #000 #000

Fixed assets

Intangible assets -

goodwill 1,574 214

Tangible assets 19,343 12,291

--------------------------------

20,917 12,505

Current assets

Stocks 15,687 14,135

Debtors 14,265 9,747

Cash at bank and in hand - -

--------------------------------

29,952 23,882

Creditors: amounts falling

due within one year (29,910) (19,712)

--------------------------------

Net current assets 42 4,170

--------------------------------

Total assets less current

liabilities 20,959 16,675

Creditors: amounts falling

due after more than one

year (1,878) (2,128)

Provisions for liabilities

and charges (685) (479)

Deferred income (552) (624)

-------------------------------

Net assets 17,844 13,444

-------------------------------

Capital and reserves

Called up share capital 677 661

Share premium account 1,909 1,631

Other reserves 1,289 1,232

Profit and loss account 13,969 9,920

------------------------------

Equity shareholders' funds 17,844 13,444

Consolidated Cash Flow Statement for the year ended 31

March 1999

1999 1998

#000 #000

Net cash inflow from operating

activities 8,071 4,867

Returns on investments and servicing

of finance (1,522) (900)

Taxation (2,157) (1,447)

Capital expenditure (7,275) (3,770)

Acquisitions and disposals (4,111) (250)

Equity dividends paid (1,216) (937)

----------------------

Cash outflow before financing (8,210) (2,437)

Financing 158 1,065

----------------------

Decrease in cash (8,052) (1,372)

----------------------

Reconciliation of Net Cash Flow to Movement in Net

Debt for the year ended 31 March 1999

1999 1998

#000 #000

Decrease in cash in the year (8,052) (1,372)

Cash inflow/(outflow) from financing 423 (852)

--------------

Change in net debt resulting from

cash flows (7,629) (2,224)

Inception of finance leases (137) (650)

Translation differences (87) 46

----------------

Movement in net debt in the year (7,853) (2,828)

Net debt at beginning of year (6,637) (3,809)

----------------

Net debt at end of year (14,490) (6,637)

----------------

Notes:

1. Basis of Information

The financial information set out above does not

constitute the company's statutory accounts for the years

ended 31 March 1999 or 1998. Statutory accounts for 1998

have been delivered to the registrar of companies, and

those for 1999 will be delivered following the company's

annual general meeting. The auditors have reported on

those accounts; their reports were unqualified and did

not contain statements under section 237(2) or (3) of the

Companies Act 1985.

This statement has been prepared on the basis of the

accounting policies as set out in the Group's Annual

Report for the year ended March 31 1998.

2. Segmental analysis

UK and Europe USA Group

1999 1998 1999 1998 1999 1998

#000 #000 #000 #000 #000 #000

Turnover 63,347 45,713 8,804 7,783 72,151 53,496

------------------------------------------

Operating profit 8,826 6,969 590 667 9,416 7,636

Net interest (1,581)(1,014)

------------

Profit on ordinary

activities before taxation 7,835 6,622

------------------------------------------

Net assets 15,566 11,349 2,278 2,095 17,844 13,444

------------------------------------------

There is no material difference between turnover by

origin, as shown above, and turnover by destination. The

above results relate entirely to continuing operations.

3. Taxation

1999 1998

#000 #000

UK Corporation tax 2,312 1,844

Deferred taxation 32 137

Overseas taxation - current 113 62

- deferred (28) 38

Adjustments relating to an earlier

year:

UK Corporation tax (2) 70

Overseas taxation (13) -

Deferred taxation - (2)

---------------

2,414 2,149

---------------

4. Dividends

1999 1998

#000 #000

Interim paid - 3p per share (1998:2.6p) 424 343

Final proposed - 7p per share (1998:6.0p) 948 792

---------------

1,372 1,135

---------------

5. Earnings per share

1999 1998

Earnings per share 40.4p 33.7p

Diluted earnings per share 39.8p 32.8p

Earnings per share have been calculated in accordance

with Financial Reporting Standard 14 and the comparative

figures restated accordingly. The basic earnings per

share is based on earnings of #5,421,000 (1998:

#4,446,000) and the weighted average number of ordinary

shares in issue of 13,418,445 (1998: 13,198,969). The

calculation of diluted earnings is based on 13,624,155

(1998: 13,575,562) ordinary shares. The difference of

205,710 (1998: 376,593) represents the dilutive effect of

outstanding employee share options which has been

calculated in accordance with FRS 14.

6. This preliminary announcement was approved by the

Board of Directors on July 15 1999.

END

FR CCQCQFDKDNOD

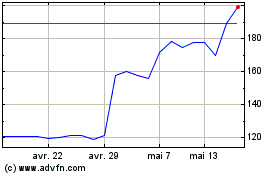

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024