RNS Number:1402G

International Greetings PLC

08 December 2004

International Greetings plc

Interim results show continued growth

8 December 2004. International Greetings plc ("International Greetings" or "the

Group") (AIM: IGR), the leading designer and manufacturer of private label

greetings products and film and television character based licensed stationery,

announces today interim results for the six months ended 30 September 2004.

Financial highlights

* Turnover for the period grew 16% to #61.8m (2003: #53.5m)

* Adjusted profit* before tax increased 17% to #6.3m

* Adjusted earnings* per share also increased 17% to 10.5p

* The first full six month contribution turnover from Hoomark, the Group's

Netherlands based European subsidiary, was in-line with expectations with an

operating profit of #0.4m on turnover of #4.5m

* Excluding Hoomark's results, Group turnover increased by 7% and adjusted

profit* before tax improved by 12%

* US$ like-for-like sales up 23% in the US

* Interim dividend up 17% to 1.75p per share (2003: 1.5p)

* excluding amortisation of goodwill of #182,000 (6 months to 30th September

2003 : #87,000) and exceptional item of #nil (6 months to 30th September 2003:

#684,000)

Operational highlights

* New long term licence signed with Disney extending geographical coverage

and encompassing all the forthcoming Disney film releases, including the recently

released blockbuster "The Incredibles"

* Board strengthened with the appointment of Keith James, the former Chairman

of Eversheds LLP

* Design teams already working with major retail clients on designs for Christmas 2005

Commenting on the results, Nick Fisher, CEO of International Greetings said:

"I am delighted that we have delivered another strong set of interim results for

the Group. Hoomark, the gift wrap manufacturer we acquired last year, has

performed well and has strengthened our business in Europe. Our decision to

refocus the US division has been successful, with US$ like-for-like sales up

23%. We are now well into the second half of the year and are optimistic about

the full-year's performance."

For further information:

Nick Fisher, International Greetings: 01707 630630

Richard Sunderland, Tavistock Communications: 020 7920 3150

rsunderland@tavistock.co.uk

Graeme Cull, Arden Partners: 0121 423 8960

Interim Statement - 2004

I am delighted to announce strong interim results for the six months to 30th

September 2004. Turnover for the period grew 16% to #61.8m, with adjusted profit*

before taxation and adjusted basic earnings* per share both increasing 17% to

#6.3m and 10.5p respectively. These results include a full six month turnover of

#4.5m and operating profit contribution of #0.4m from Hoomark, our Netherlands

based subsidiary, which was acquired in November 2003. The integration of

Hoomark into the Group has proceeded well and I am pleased to report that its

performance is in line with our expectations. Excluding Hoomark's results, the

Group's turnover increased by 7% and adjusted profit* before tax improved by

12%.

The refocusing of the US division during the past 18 months has resulted in a

strong performance, with US$ like-for-like sales up 23%. Movements in period-end

exchange rates mean that, after translation into sterling, the reported increase

in turnover is 12%.

The acquisition of Hoomark and the licensed Christmas decoration business last

year, has significantly strengthened our trading relationship with Disney

Consumer Products and, as a result, we recently signed a new long term licence

for our core product categories with them. This new licence encompasses all the

forthcoming Disney film releases, including the recently released blockbuster

"The Incredibles", for which we have supplied stationery and Christmas based

merchandise. Krackajack, which we acquired in June this year, has been

successfully integrated into our cracker division and has helped to further

strengthen our position in that market.

As part of our on-going strategy of reducing costs and maintaining our

competitive position, we recently made the decision to transfer the

manufacturing of greetings cards and tags from the UK to a new facility in

Eastern Europe, currently in the process of being established. It is anticipated

that this new facility will be operational by 31st March 2005, in time to meet

next year's production requirements for these products. The exceptional one-off

costs of transferring this production facility, which are estimated to be

approximately #700,000, will be mostly incurred during the six month period to

31st March 2005. We are confident that this lower cost base will not only enable

us to add value to existing products but will provide a platform for further

growth in Europe.

On 1st August 2004, we announced the appointment of Keith James as a

non-executive board director. Keith has an extensive background in domestic and

international corporate law and recently retired as Chairman of Eversheds LLP,

one of the largest legal practices in Europe. His vast experience in all aspects

of business will be invaluable to the Group during our next important period of

growth. Hugh Child, a non-executive director since January 2002 retired from the

Board, and we thank him for the considerable contribution he made during his

time with us.

* excluding amortisation of goodwill of #182,000 (6 months to 30th September

2003 : #87,0000) and exceptional item of #nil (6 months to 30th September 2003 :

#684,000)

Current Trading

Whilst the trend continues for consumers to carry out their Christmas shopping

later each year, we have now completed the bulk of the season's deliveries to

our customers and are optimistic about our full year's performance. In a

challenging retail environment, we have demonstrated our ability to deliver

quality, design-based products to our customers that meet their margin

requirements and satisfy the ever more sophisticated demands of the consumer.

Our creative and sales teams are already working with the in-house teams of many

of our major retail clients and are clearly focussed on the range and design

developments for the Christmas 2005 season.

Reflecting our continued confidence in the future prospects and financial

strength of the Group, we are proposing an interim dividend of 1.75p per share,

an increase of 17% over last year. The dividend will be paid on 21st January

2005 to all shareholders on the register on 17th December 2004.

John Elfed Jones CBE DL

Chairman

International Greetings PLC

Interim Report 2004

Consolidated profit and loss account

for the six months to 30th September 2004

Note Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March 2004

2004 2003

#000 #000 #000

------------- ------------- ----------

Turnover 2 61,781 53,471 126,689

----------------------- --- ------------- ------------- ----------

Operating profit

before exceptional

item 2 6,140 5,444 12,021

----------------------- --- ------- ------- --------

Exceptional item 3 - (684) (684)

----------------------- --- ------------- ------------- ----------

Operating profit 6,140 4,760 11,337

------------------ ------- ------- --------

Net interest

payable (30) (154) (137)

----------------------- ------------- ------------- ----------

Profit before

taxation 6,110 4,606 11,200

------------------------ ------- ------- --------

Taxation 5 (1,809) (1,403) (3,142)

----------------------- --- ------------- ------------- ----------

Profit after

taxation 4,301 3,203 8,058

----------------------- ------- ------- -------

Dividend proposed (759) (662) (2,774)

----------------------- ------------- ------------- ----------

Retained profit 3,542 2,541 5,284

----------------------- ------------- ------------- ----------

Earnings per share 4

-------------------- ---

Basic 10.1p 7.7p 19.2p

------- ------ -------

Adjusted basic

excluding goodwill

and exceptional

item 10.5p 9.0p 20.7p

Diluted 10.0p 7.6p 19.1p

----------------------- ------------- ------------- ----------

Dividend per

ordinary share 1.75p 1.5p 6.5p

----------------------- ------------- ------------- ----------

Statement of recognised gains and losses

for the six months to 30 September 2004

-----------------------------------------

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2004 2003 2004

#000 #000 #000

Profit for the period 4,301 3,203 8,058

----------------------- ------------- ------------- ----------

Currency translation differences

arising on foreign currency net investments 99 (243) (835)

----------------------- ------------- ------------- ----------

Total recognised gains and losses

relating to the period 4,400 2,960 7,223

----------------------- ------ ------------- ------------- ----------

International Greetings PLC

Interim Report 2004

Consolidated balance sheet

at 30th September 2004

Note Unaudited Unaudited Audited

30 September 30 September 31 March 2004

2004 2003

#000 #000 #000

Fixed assets

Intangible assets -

goodwill 2,557 978 2,737

Tangible assets 25,484 21,856 23,271

----------------------- ------ ------------- ------------- ----------

28,041 22,834 26,008

Current assets

Stocks 39,110 36,629 22,069

Debtors 45,873 44,059 11,492

Cash at bank and in

hand 5 1 16,233

----------------------- ------ ------------- ------------- ----------

84,988 80,689 49,794

Creditors: amounts

falling due within

one year (60,257) (56,172) (25,583)

----------------------- ------ ------------- ------------- ----------

Net current assets 24,731 24,517 24,211

----------------------- ------ ------------- ------------- ----------

Total assets less

current liabilities 52,772 47,351 50,219

Creditors: amounts

falling due after

more than one year (1,999) (3,315) (3,059)

Provisions for

liabilities and

charges (199) (382) (243)

Deferred income (2,656) (2,824) (2,802)

----------------------- ------ ------------- ------------- ----------

Net assets 47,918 40,830 44,115

----------------------- ------ ------------- ------------- ----------

Capital and reserves

Called up share

capital 2,129 2,109 2,112

Share premium

account 2,515 1,652 1,703

Potential issue of

shares 413 - 1,080

Other reserves 280 773 181

Profit and loss

account 42,581 36,296 39,039

----------------------- ------ ------------- ------------- ----------

Equity shareholders'

funds 6 47,918 40,830 44,115

----------------------- ------ ------------- ------------- ----------

International Greetings PLC

Interim Report 2004

Consolidated cash flow statement

for the six months to 30th September 2004

Note Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March 2004

2004 2003

#000 #000 #000

Net cash

(outflow)/inflow

from operating

activities 7 (28,585) (27,105) 23,695

Returns on

investments and

servicing of

finance 8 (21) (151) (191)

Taxation (1,399) (1,165) (3,175)

Capital expenditure 8 (3,408) (2,221) (4,842)

Acquisitions and

disposals 8 (1,520) - (7,777)

Equity dividends

paid (2,126) (1,878) (2,511)

----------------------- ------ ------------- ------------- ----------

Cash (outflow)/

inflow before

financing (37,059) (32,520) 5,199

Financing 8 (1,276) 4,977 1,440

----------------------- ------ ------------- ------------- ----------

(Decrease)/increase

in cash (38,335) (27,543) 6,639

----------------------- ------ ------------- ------------- ----------

Reconciliation of net cash flow to movement in net (debt)/funds

for the six months to 30th September 2004

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30tSeptember 31 March 2004

2004 2003

#000 #000 #000

(Decrease)/increase in

cash in the period (38,335) (27,543) 6,639

Cash outflow/(inflow)

from debt and lease

financing 1,438 (4,374) (783)

----------------------- ------------- ------------- ----------

Change in net

(debt)/funds resulting

from cash flows (36,897) (31,917) 5,856

Inception of finance

leases - - (180)

Finance leases

acquired with

subsidiary - - (393)

Translation

differences (276) 327 1,552

----------------------- ------------- ------------- ----------

Movement in net

(debt)/funds in the

period (37,173) (31,590) 6,835

Net funds at beginning

of period 10,268 3,433 3,433

----------------------- ------------- ------------- ----------

Net (debt)/funds at

end of period (26,905) (28,157) 10,268

----------------------- ------------- ------------- ----------

Notes:

1 Basis of Preparation

The interim statement has been prepared under the same accounting policies as

those used for the financial statements for the year ended 31st March 2004.

The comparative figures for the year ended 31st March 2004 are an abridged

version of the published accounts and are not the company's statutory accounts

for that financial year. Those accounts have been reported on without

qualification by the auditors, and without any statement under Section 237 (2)

or (3) of the Companies Act 1985, and have been delivered to the Registrar of

Companies.

2 Acquisitions

(a) On 19th November 2003, the Group acquired 100% of the issued

share capital of Hoomark Giftwrap Partners BV. During the period from the date

of acquisition to 31st March 2004, the Group's results included turnover of

#2.05m and an operating loss of #458,000 attributable to Hoomark.

(b) On 1st June 2004, the Group purchased certain assets and the business of

Krakajack Limited, a supplier of Christmas crackers to the catering market, for

an initial consideration of #1.52m. This represented #800,000 in respect of

plant and machinery and #720,000 in respect of stock. No goodwill arose on this

acquisition. In addition to this amount, an agreed percentage of sales made to

Krakajack customers in 2004 and 2005 will be payable to the vendors. This amount

is expected to amount to approximately #100,000. During the period to 30th

September 2004, sales to Krakajack customers totalled #182,000. Following

Krakajack's integration into the Group's Christmas cracker division, it is not

possible to separately identify the operating profit attributable to these

sales.

3 Exceptional Item

The exceptional item of #684,000 during the six months to 30th September 2003

and the year ended 31st March 2004 represented the one-off start-up costs

associated with the establishment of a new business division involved in the

design and selling of licensed Christmas decorations.

4 Earnings Per Share

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March 2004

2004 2003

Adjusted basic earnings per

share excluding goodwill and

exceptional item 10.5p 9.0p 20.7p

Loss per share on goodwill (0.4p) (0.2p) (0.4p)

Loss per share on exceptional

item - (1.1p) (1.1p)

----------------------- ------------- ------------- ----------

Basic earnings per share 10.1p 7.7p 19.2p

----------------------- ------------- ------------- ----------

Diluted earnings per share 10.0p 7.6p 19.1p

----------------------- ------------- ------------- ----------

The calculation of basic earnings per share is based on 42,378,290 (6 months to

30th September 2003: 41,788,924, 12 months to 31st March 2004: 41,995,174)

ordinary shares being the average number of shares in issue during the period.

The calculation of diluted earnings per share is based on 42,883,669 (6 months

to 30th September 2003: 41,993,399, 12 months to 31st March 2004: 42,180,513)

ordinary shares. The difference of 505,380 (6 months to 30th September 2003:

204,475, 12 months to 31st March 2004: 185,339) represents the dilutive effect

of outstanding employee share options which have been calculated in accordance

with FRS 14.

Adjusted basic earnings per share excluding goodwill and exceptional item is

calculated after adjusting for amortisation of goodwill of #182,000 (6 months to

30th September 2003: #87,000, 12 months to 31st March 2004: #233,000), the

exceptional item of #nil (6 months to 30th September 2003: #684,000, 12 months

to 31st March 2004: #684,000) and the tax relief thereon.

5 Taxation

The taxation charge for the six months ended 30th September 2004 is based on the

estimated tax rate for the full year.

6 Reconciliation of movements in shareholders' funds

Unaudited Unaudited Audited

6 months to 6 months to 12 months

30 September 30 September 31 March 2004

2004 2003

#000 #000 #000

Profit for the period 4,301 3,203 8,058

Dividend (759) (662) (2,774)

----------------------- ------------- ------------- ----------

3,542 2,541 5,284

------- -------- -------

Other recognised gains

and losses relating to

the period (net) 99 (243) (835)

New share capital

subscribed 829 603 657

Potential issue of

shares (667) - 1,080

----------------------- ------------- ------------- ----------

Net addition to

shareholders' funds 3,803 2,901 6,186

Opening shareholders'

funds 44,115 37,929 37,929

----------------------- ------------- ------------- ----------

Closing shareholders'

funds 47,918 40,830 44,115

----------------------- ------------- ------------- ----------

7 Reconciliation of operating profit to

net cash (outflow)/ inflow from operating activities

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March 2004

2004 2003

#000 #000 #000

Operating profit

before exceptional

item 6,140 4,760 12,021

Exceptional item - - (684)

Depreciation charge 2,102 1,896 4,466

(Increase)/decrease in stocks (16,129) (15,027) 1,454

(Increase)/decrease in debtors (34,364) (34,556) 2,073

Increase in creditors 13,634 15,927 4,431

Grant income (150) (192) (299)

Goodwill amortisation 182 87 233

------------------------- ------------- ------------- ----------

Net cash

(outflow)/inflow from

operating activities (28,585) (27,105) 23,695

------------------------- ------------- ------------- ----------

8 Gross Cash Flows

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March 2004

2004 2003

#000 #000 #000

Returns on investment and servicing

of finance

Net interest paid (11) (137) (153)

Interest element of

finance lease

repayments (10) (14) (38)

------------------------- ------------- ------------- ----------

(21) (151) (191)

------------- ------------- ----------

Capital expenditure

Purchase of tangible fixed assets (3,438) (2,322) (5,016)

Disposal of tangible fixed assets 30 101 174

------------- ------------- ----------

(3,408) (2,221) (4,842)

------------- ------------- ----------

Acquisition and disposals

Acquisition cost (1,520) - (1,226)

Net overdraft acquired

with subsidiary - - (6,551)

------------------------- ------------- ------------- ----------

(1,520) - (7,777)

------------- ------------- ----------

Financing

New shares issued 162 603 657

New net loans (1,269) 4,466 970

Capital element of

finance lease payments (169) (92) (187)

------------- ------------- ----------

(1,276) 4,977 1,440

------------- ------------- ----------

9 Analysis of movement in net (debt)/funds

At 31 March Cash Flow Exchange At 30 September

2004 Movement 2004

#000 #000 #000 #000

Cash at bank

and in hand 16,233 (16,228) - 5

Overdrafts (2,324) (22,107) (219) (24,650)

------------ ----------- ------------- --------------

13,909 (38,335) (219) (24,645)

------------ ----------- ------------- --------------

Bank loans (2,557) 1,269 (42) (1,330)

Finance leases (1,084) 169 (15) (930)

--------------- ------------ ----------- ------------- --------------

(3,641) 1,438 (57) (2,260)

------------ ----------- ------------- --------------

Total net

funds/(debt) 10,268 (36,897) (276) (26,905)

--------------- ------------ ----------- ------------- --------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFSDFVLDIIS

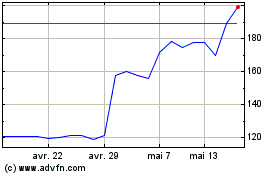

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024