TIDMJAGI

JPMorgan Asia Growth & Income PLC

19 December 2023

JPMorgan Asia Growth & Income (JAGI)

19/12/2023

Results analysis from Kepler Trust Intelligence

JPMorgan Asia Growth & Income (JAGI) has released its

results for the year ending 30/09/2023. The trust delivered strong

absolute and relative returns, with NAV and share price total

returns of 6.4% and 7.3% respectively. The trust's benchmark, the

MSCI Asia ex-Japan Index, delivered equivalent returns of 1.4% over

the period.

Long-term performance remains strong. JAGI has outperformed

every year bar one over the last decade. Annualised NAV total

returns in that period were 8.5%, compared to 6.5% for the

benchmark.

The trust continued its policy of paying four quarterly

dividends, equal to 1% of NAV at quarter end. Dividends for the

year totalled 15.7p, representing a small decline on the prior

year, when dividends totalled 16.5p.

JAGI's discount tightened during the year, from 9.6% to 9.2% at

the period end. This has since widened to 10% as at 13/12/2023. The

trust engages in buybacks to manage the discount. In the year, the

trust repurchased 5.7m shares, equal to 5.9% of share capital at

the start of the period.

JAGI Chairman Sir Richard Stagg said: "The Company has the

chance to invest in innovative, often world-leading businesses.

With valuations across most of the region at long-term lows

relative to both historic levels and to the US and Europe, now

seems a particularly auspicious moment to be investing in Asia. We

are therefore confident of the Company's capacity to continue

delivering capital gains and an attractive income to shareholders

over the long term."

JPMorgan Asia Growth & Income (JAGI) aims to provide

investors with core exposure to Asia by investing in a portfolio of

quality companies. The trust makes full use of its closed-ended

structure to pay a dividend equal to 1% of NAV at the end of each

quarter, paying from both revenue and capital reserves. We believe

this approach allows the managers to focus on the best

opportunities to drive total returns, rather than having to factor

in yield considerations.

The trust has delivered consistent outperformance over the past

decade, with only one year in which the managers failed to

outperform. Last year was no different and, after a tough 2022 for

Asia investors, the managers managed to deliver strong performance

despite negative sentiment around China.

We think the managers' stock picking process also proved itself

in 2023. Partly that was reflected in underweight positions to

Chinese e-commerce. This is a sector which has become increasingly

competitive and subject to more regulatory pressure, crimping

returns for investors in the sector. At the same time, JAGI's

overweight position to technology companies supported

outperformance. We would note that this was not confined to 'mega'

caps like TSMC or Samsung, as Taiwanese hardware company Wiwynn and

Korean semiconductor manufacturer SK Hynix also drove

outperformance for the trust.

We think those positions reflect the huge opportunity that Asia

represents today. The continent looks set to be the engine of

global growth in the next quarter century. Research from the

Brookings Institute, a US think tank, indicates that the proportion

of the global consumer class in Asia will rise to 80% by the end of

this decade, up from approximately 50% today and barely 20% at the

start of the century.

Demography is not destiny but the JAGI managers have proven

themselves capable of sorting the wheat from the chaff in the

region. As we noted in our latest research on the trust, JAGI is

now trading at a discount that is substantially wider than its five

year average. With rate hikes potentially having peaked and Asian

companies also trading at low valuations, relative to both other

regions and their own historical average, it's plausible we'll see

a tightening of that discount if performance continues to be strong

into 2024.

CLICK HERE TO READ THE FULL REPORT

Visit Kepler Trust Intelligence for more high quality

independent investment trust research.

Important information

This report has been issued by Kepler Partners LLP. The analyst

who has prepared this report is aware that Kepler Partners LLP has

a relationship with the company covered in this report and/or a

conflict of interest which may impair the objectivity of the

research.

Past performance is not a reliable indicator of future results.

The value of investments can fall as well as rise and you may get

back less than you invested when you decide to sell your

investments. It is strongly recommended that if you are a private

investor independent financial advice should be taken before making

any investment or financial decision.

Kepler Partners is not authorised to make recommendations to

retail clients. This report has been issued by Kepler Partners LLP,

is based on factual information only, is solely for information

purposes only and any views contained in it must not be construed

as investment or tax advice or a recommendation to buy, sell or

take any action in relation to any investment.

The information provided on this website is not intended for

distribution to, or use by, any person or entity in any

jurisdiction or country where such distribution or use would be

contrary to law or regulation or which would subject Kepler

Partners LLP to any registration requirement within such

jurisdiction or country. In particular, this website is exclusively

for non-US Persons. Persons who access this information are

required to inform themselves and to comply with any such

restrictions.

The information contained in this website is not intended to

constitute, and should not be construed as, investment advice. No

representation or warranty, express or implied, is given by any

person as to the accuracy or completeness of the information and no

responsibility or liability is accepted for the accuracy or

sufficiency of any of the information, for any errors, omissions or

misstatements, negligent or otherwise. Any views and opinions,

whilst given in good faith, are subject to change without

notice.

This is not an official confirmation of terms and is not a

recommendation, offer or solicitation to buy or sell or take any

action in relation to any investment mentioned herein. Any prices

or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and

representatives) or a connected person may have positions in or

options on the securities detailed in this report, and may buy,

sell or offer to purchase or sell such securities from time to

time, but will at all times be subject to restrictions imposed by

the firm's internal rules. A copy of the firm's Conflict of

Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial

Conduct Authority (FRN 480590), registered in England and Wales at

70 Conduit Street, London W1S 2GF with registered number

OC334771.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAFLFFSFELALIV

(END) Dow Jones Newswires

December 19, 2023 09:27 ET (14:27 GMT)

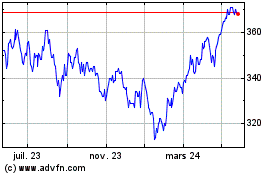

Jpmorgan Asia Growth & I... (LSE:JAGI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

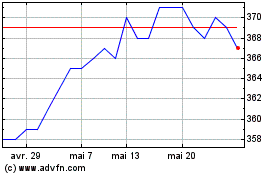

Jpmorgan Asia Growth & I... (LSE:JAGI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025