TIDMJFJ

RNS Number : 4076B

JPMorgan Japanese Inv. Trust PLC

02 June 2023

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN JAPANESE INVESTMENT TRUST PLC

UNAUDITED HALF YEAR RESULTS FOR THE SIX MONTHS

ED 31ST MARCH 2023

Legal Entity Identifier: 549300JZW3TSSO464R15

Information disclosed in accordance with DTR 4.2.2

CHAIRMAN'S STATEMENT

Investment Performance

Inflation remains one of the main concerns for the global

economy, as rising interest rates and the war in Ukraine continue

to weigh on economic activity, mitigated in part by China's recent

reopening.

Given this backdrop, our Company performed as per its benchmark.

In the six months ended 31st March 2023, the Company returned +8.5%

on a net asset basis (in sterling terms), broadly consistent with

its benchmark, the TOPIX index, which also returned +8.5%. While

the one, three and five year performance numbers (as set out on

page 6 of the Half Year Report) are disappointing, largely because

of the six month period ending 31st March 2022, the long term

absolute and relative performance remain strong with an annualised

return of +10.2% over ten years to the end of March 2023, versus

the benchmark return of +7.3%.

Since 31st March 2023, through to 31st May 2023, I am pleased to

report that relative performance has begun to recover and the

Company returned +3.1%, while the TOPIX index returned +2.0%.

I am also delighted to report that the Company's Morningstar

Analyst rating has been maintained at the highest level, Gold, same

as from the previous rating in April 2022. The Morningstar report

recognises the strength of the Company's Investment Managers and

their investment process. As such, your Manager remains one of only

two active Japanese equity managers with a Gold Morningstar Analyst

rating across some 900 Japanese equity funds and share classes

which Morningstar classify as 'Japan Large-Cap equity' and on which

they provide data on their UK website.

You can find further details of the Morningstar research and

rating at www.morningstar.co.uk. The Company continues to maintain

the highest Morningstar sustainability rating of five globes.

The Investment Managers' Report below discusses performance, the

investment rationale behind recent portfolio activity and the

outlook in more detail.

Gearing

The Board of Directors believes that gearing can be beneficial

to performance and sets the overall strategic gearing policy and

guidelines and reviews these at each Board meeting. The Investment

Managers then manage the gearing within the agreed limits of 5% net

cash to 20% geared in normal market conditions. During the period,

gearing ranged from 9.8% to 14.4%, with an average of 12.2%. As at

31st March 2023, gearing was equivalent to 13.2% of net assets.

After the period end the Company took out a Yen10 billion

revolving credit facility with Industrial and Commercial Bank of

China Limited, London Branch, which is in addition to the existing

credit facility with Mizuho Bank Limited and the long-term fixed

rate debt.

Revenue and Dividends

Japanese companies often have stronger balance sheets than many

of their international counterparts. Dividends have been rising

strongly over the last few years and have continued to do so in the

results announcements we have seen since 31st March 2023. This is

in good measure a function of the improving corporate governance in

Japan and is one of several reasons why investors might consider

Japan a relatively attractive equity market. Nonetheless it cannot

be assumed that dividends will be maintained and prior year

dividends should not therefore be taken as a guide to future

payments.

For the year ended 30th September 2022, the Company paid a

dividend of 6.2p per share on 3rd February 2023, reflecting the

available revenue for distribution. Consistent with previous years

the Company will not be declaring an interim dividend.

Discount Management and Share Repurchases

The Board monitors the discount to NAV at which the Company's

shares trade and believes that, over the long term, for the

Company's shares to trade close to NAV the focus has to remain on

consistent, strong investment performance over the key one, three

and five year timeframes, combined with effective marketing and

promotion of the Company.

The Board recognises that a widening of, and volatility in, the

Company's discount is seen by some investors as a disadvantage of

investments trusts. The Board has restated its commitment over the

long run to seek a stable discount or premium commensurate with

investors' appetite for Japanese equities and the Company's various

attractions, not least the quality of the investment team and the

investment process, and the strong long-term performance these have

delivered. Since 2020, this commitment has resulted in both

increased marketing spend and a series of targeted buybacks.

As of 31st March 2023, the share price discount to NAV with debt

at fair value was 7.7%, compared to 7.3% at the end of 30th

September 2022.

Over the six month period to 31st March 2023, the Company's

share price discount to net asset value ranged from 1.2% to 11.3%

(average: 6.8%) and the Company repurchased 1,110,000 shares at an

average discount of 9.0% and at a cost of GBP5 million.

Since 31st March 2023, the Company has repurchased a further

865,000 shares at an average discount of 8.9% at a cost of

GBP4.1million.

Shares are only repurchased at a discount to the prevailing net

asset value, which increases the Company's net asset value per

share, and may either be cancelled or held in Treasury for possible

reissue at a premium to net asset value.

Environmental, Social and Governance Issues

As detailed in the Investment Managers' Report, Environmental,

Social and Governance ('ESG') considerations are fully integrated

into their investment process. The Board shares the Investment

Managers' view of the importance of ESG factors when making

investments for the long term and the necessity of continued

engagement with investee companies over the duration of the

investment. We are pleased that the Company retains the highest

Morningstar Sustainability rating of five globes.

Further information on JPMorgan's ESG process and engagement is

set out in the ESG Report in the 2022 Annual Report of the Company

on pages 10 to 23 and also in the JPMorgan Asset Management 2022

Investment Stewardship Report, which can be accessed at

https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/sustainableinvesting/

The Board

As mentioned in the Annual Report, having served as a Director

for nine years next year, I will be retiring from the Board and as

Chairman at the AGM in 2024. The Board has announced that Stephen

Cohen, the current Audit Chair, will replace me as Chairman.

Following the retirement of Sir Stephen Gomersall from the Board at

the Annual General Meeting ('AGM') of the Company held earlier this

year, Sally Macdonald, has succeeded Sir Stephen as the Company's

Senior Independent Director, effective from the conclusion of the

AGM.

As also outlined in the Annual Report, the Board undertook a

recruitment process to find a suitably qualified Director to join

the Board and to take over from Stephen Cohen as Audit Chair in

January 2024. After a thorough selection process, in October 2022

we announced the appointment of Sally Duckworth, effective from

31st October 2022. Sally is an established entrepreneur with a

focus on technology and has a background in finance and investment.

She qualified as a Chartered Accountant with PricewaterhouseCoopers

LLP.

Outlook

Pent-up demand for consumer spending and accommodative monetary

policy amid modest wage growth will likely result in reasonable

economic growth in the near term for Japan. At the same time the

trend of the last few years of substantial equity buybacks has been

reinforced by multiple announcements over the last few weeks. The

Investment Managers express their optimism for the market in their

Outlook comments and highlight in particular the possibility that

Japan's protracted deflation may be coming to an end. The Board

retains its confidence in the Investment Managers' high conviction,

unconstrained approach which focuses on finding the best investment

ideas in Japan.

The Investment Managers have set out their views on the outlook

for markets and your Company in their Report below. .

On behalf of the Board, I would like to thank you for your

ongoing support.

Christopher Samuel

Chairman

INVESTMENT MANAGERS' REPORT

Performance

In the six months ended 31st March 2023, the Company returned

+8.5% on a net asset basis (in sterling terms), consistent with its

benchmark, the TOPIX index, which returned +8.5%. Long term

absolute and relative performance remain strong with an annualised

return of +10.2% over ten years to the end of March 2023, versus

the benchmark return of +7.3%.

Performance attribution

Six months ended 31st March 2023

% %

---------------------------------------------- ----- -----

Contributions to total returns

---------------------------------------------- ----- -----

Benchmark return 8.5

---------------------------------------------- ----- -----

Stock selection -1.0

---------------------------------------------- ----- -----

Currency 0.0

---------------------------------------------- ----- -----

Gearing/Cash 1.3

---------------------------------------------- ----- -----

Investment Manager contribution 0.3

---------------------------------------------- ----- -----

Portfolio return(A) 8.8

---------------------------------------------- ----- -----

Management fee/other expenses -0.4

---------------------------------------------- ----- -----

Share Buy-Back 0.1

---------------------------------------------- ----- -----

Other effects -0.3

---------------------------------------------- ----- -----

Return on net assets - Debt at par value(A) 8.5

---------------------------------------------- ----- -----

Impact of fair value of debt 0.0

---------------------------------------------- ----- -----

Return on net assets - Debt at fair value(A) 8.5

---------------------------------------------- ----- -----

Return to shareholders(A) 8.2

---------------------------------------------- ----- -----

Source: JPMAM and Morningstar. All figures are on a total return

basis.

Performance attribution analyses how the Company achieved its

recorded performance relative to its benchmark.

(A) Alternative Performance Measure ('APM').

A glossary of terms and APMs is provided on pages 33 and 34 of

the Half Year Report.

Economic and market background

After volatile markets during the first half of 2022 (discussed

in detail in our last annual report), conditions steadied in the

past six months, as global inflation and interest rates showed

possible signs of peaking. The recent collapse of Silicon Valley

Bank in the US and the fire sale of Credit Suisse to UBS have added

to hopes that US rates are unlikely to rise much further, further

boosting market sentiment.

While last year's aggressive interest rate rises cast the shadow

of possible recession over other major economies, Japan is in a

very different, and more positive, phase of its economic cycle. It

was much slower to re-open post Covid-19 than most other developed

economies, only lifting its ban on foreign visitors in October

2022. However, since then it has seen strong growth, driven in part

by a dramatic recovery in the number of tourists visiting and

demand recovery from China's re-opening. In addition, many Japanese

businesses, including some of the Company's key holdings, have

major operations in China, which have resumed normal production

after three years of severe restrictions and rolling lockdowns.

Examples in the portfolio include Daikin, which produces

ultra-efficient air conditioners, Keyence and SMC, both global

leaders in the field of factory automation, Nippon Paint and

medical equipment companies Sysmex and Terumo.

Japan's aging population means that it is experiencing shortages

of skilled labour in many fields. Typically, companies have been

resistant to raising wages to attract and retain workers, and wages

growth has stagnated for around 30 years. However, more recently,

larger corporations have begun to increase salaries significantly

and this trend is likely to spread across the economy, as

businesses continue to compete for workers.

Wage pressures have so far had little impact on Japanese

inflation. However, inflation is now at a 42-year high of around

4%, driven by rising energy and commodity prices and last year's

sharp depreciation in the yen, which is still relatively low

compared to current inflation rates in the US and other major

economies. The yen has started to recover as the gap between US and

Japanese interest rates has stabilised, helping to ease

inflationary pressures. The Bank of Japan ('BoJ') made a small

adjustment to its yield curve control policy in December, and the

newly appointed BoJ Governor may make further changes to monetary

policy.

Investment philosophy and process

Our investment strategy remained unchanged over the review

period. We maintain an unconstrained investment approach that seeks

out the very best Japanese companies with excellent long-term

outlooks. Specifically, we focus on high-quality companies with

strong balance sheets and leading competitive positions. We favour

companies with pricing power demonstrated over many years, which

are well-positioned to continue to prosper, largely regardless of

the macroeconomic environment.

The portfolio has a strong bias towards high-quality growth

names. This leads to volatile performance at times, such as during

the last financial year, when growth stocks fall out of favour with

investors, but nonetheless, we believe that our focus on quality

businesses will achieve the best results over a multi-year period,

as evidenced by the Company's long term performance track

record.

In identifying potential investments, we are supported by

JPMorgan Asset Management's well-resourced investment team on the

ground in Tokyo and JPMAM's extensive team of analysts, both in

Japan and globally. Our bottom-up, unconstrained approach means the

portfolio can, and does, look very different from the benchmark.

Typically, we do not hold many of the well-known names covered by

most analysts and included in the benchmark. We steer clear of many

of these large companies as they operate in structurally impaired

sectors, such as department stores and railway operators, which are

vulnerable to long-term declines in demand. As of 31st March, the

portfolio, including borrowings, had a very high active share

(which is a measure of how much the portfolio differs from the

benchmark) of 91%. This is a strong indicator of active

management.

As an indicator of the quality in the portfolio, as of 31st

March 2023, the Company's return on equity was 16% compared to 12%

for the market, while the operating margin was 22% versus the

market's 14%. At the same time, the portfolio's price to earnings

(P/E) ratio was 20x, above the market's 12.5x. We believe the

portfolio's higher-than-average P/E ratio is justified by the

significantly better long-term prospects of the companies we hold,

compared to others in traditional, declining sectors.

We use gearing judiciously to enhance returns and have recently

renewed our debt facility. Portfolio gearing has recently increased

as we have taken advantage of opportunities to purchase high

quality stocks at attractive levels. At the end of the review

period, gearing stood at 13.2%, compared to a 12-month average of

12.3%, and up from 11.8% at the end of September 2022.

Portfolio themes

The portfolio is constructed entirely on a stock-by-stock basis

as we seek out the best, most attractive companies. Nonetheless,

certain themes tend to underpin our investment decisions. In fact,

C0VID-19 accelerated several tech-based trends in which we were

already invested, strengthening the appeal of sectors such as

online shopping, gaming and cloud computing.

Japan remains well behind most other advanced economies in these

and many other areas, leaving plenty of scope for such trends to

continue developing over coming years. For example, the penetration

of e-commerce within the Japanese retail market is just over 10%

and remains much lower than in China, the UK, South Korea or the

US. Portfolio holdings such as Zozo, Japan's number one online

apparel retailer, and Monotaro, a top-ranked business-to-business

(B2B) e-commerce company, are well placed to benefit, as is Nomura

Research Institute (NRI), a consultancy that advises companies on

their digital strategy.

Elsewhere in the portfolio, Nintendo and Sony both own

impressive stables of games and related intellectual property that

will ensure growing revenue streams over the medium to long term.

Standardised cloud-based software for businesses is another digital

theme. Historically, many Japanese companies have used internal

software solutions, but now that the first generation of software

engineers is reaching retirement age, there is an imperative for

businesses to switch to standardised software solutions. Japan's

poor demographics will add impetus to this as a structural shift

over time and companies such as OBIC, a supplier of business

administrative systems, provide the portfolio with exposure to this

theme.

Deglobalisation is another trend gathering momentum. The

pandemic, and subsequent events such as widespread supply chain

shortages, the conflict in Ukraine and mounting US/China

geo-political tensions, have increased companies' desire to move

production nearer to end customers. With wage inflation now an

issue in the US and other markets, businesses establishing new

production plants and warehouses have a stronger incentive to

incorporate factory automation into these facilities wherever

feasible. Japan is fortunate to be home to some of the world's

leading automation companies, of which the Company holds several,

including Keyence, SMC and MISUMI.

Even before the outbreak of hostilities in Ukraine there was

already a clear need for Japan, along with many other Asian and

European countries, to shift its energy mix away from a heavy

reliance on imported fossil fuels. The war only highlighted the

need for Japan to speed up its transition to renewable energy

sources and to make faster progress towards realising its

commitment to reduce carbon emissions to net zero by 2050. Our

portfolio includes shares in Japan's leading solar energy REIT

(Canadian Solar Infrastructure) and in several companies that help

reduce energy usage, such as Daikin, which produces

energy-efficient air conditioners and Shimano, which has a dominant

market position in components for bicycles and e-bicycles. During

the past year, we have also bought shares in JGC, which constructs

liquid natural gas (LNG) production plants.

Japan is only at the beginning of its journey towards

digitalisation and renewable energy, but these trends are already

spawning many exciting new businesses, especially in the small and

mid-cap space. Such growth-oriented companies are set to gather

momentum over time and provide resilient, long-term sources of

returns for investors. For example, we expect our position in Tokyo

Electron, the semiconductor equipment supplier, to gain from

associated increases in demand for data processing and storage. As

of 31st March 2023, the thematic breakdown of the portfolio,

compared to the position 12 months ago, was as follows:

Significant contributors and detractors to performance

Top contributors

The largest contributors to returns over the six months to end

March 2023 included Keyence, Asics and ShinEtsu Chemical. Keyence's

performance was supported by its leading position in the growing

factory automation sector, and it has maintained its track record

of strong execution. ASICS manufactures and distributes sporting

goods and equipment. Following a change in management a few years

ago, the company re-focused on its core product, running shoes, and

profitability is rising as a result. ShinEtsu Chemical is the

world's largest supplier of semi-conductor materials, including

silicon wafers and PVC. The company's good results have been

supported by strong demand, and management efforts to improve

shareholder returns have been welcomed by the market.

Biggest detractors

The major detractors from performance over the review period

included Monotaro, Japan's top B2B eCommerce company. Monotaro's

growth has disappointed expectations, but we remain confident in

its long-term investment case, and the stock remains in our

portfolio. Another detractor was NRI. Despite recent share price

weakness, the company's results have been steady, and we do not see

any deterioration in its favourable long-term outlook, as

businesses digitalise their operations and administrative

processes. We continue to hold this stock. However, we have reduced

our position in Nihon M&A, the leading provider of mergers and

acquisitions related services in Japan and globally. The share

price has been under pressure for some time following an accounting

scandal, and recent results have remained sluggish. Concerns about

increased competition from new entrants to the sector prompted us

to trim our holding.

Portfolio activity

Last year's sharp market sell-off left Japanese stocks trading

cheaply relative to historical levels - on both a price to earnings

and price-to-book basis, the market is presently trading at its

lowest levels in over 20 years. This, combined with the more recent

improvement in market conditions, has created many interesting

investment opportunities, and we added several new names to the

portfolio over the review period.

The largest and most significant addition was Seven & I, the

leading convenience store operator in Japan. The company has also

operated in the United States for some time, and a recent

acquisition has significantly increased its share of the US market.

While Japan is a very mature market, we believe the US represents a

substantial growth opportunity for the company. We also opened a

position in Unicharm, the leading producer of household and

personal products, including adult incontinence pads and pet

products - both markets experiencing structural growth.

Our investment in leading life insurer T&D Holdings was

motivated by our expectation of a significant change in the

company's shareholder return policy. We also purchased I-NE, a new

and disruptive player in cosmetic and beauty products sector,

Seiko, which is increasing its focus on high-end watches, Sosei, a

biotech company with several promising drugs on license to major

pharmaceutical companies, and Japan Material, a company that is

generating high recurring revenues by providing low-cost services

to semiconductor plants.

These purchases were funded by the outright sale of several

holdings. The largest disposal was Yamashin Filter. This company

provides filters for industrial and precision machines, but the

execution of its business plan has been poor for some time. We also

closed positions in several long-standing names that we have been

steadily reducing on valuation grounds. These included M3, an

online medical services provider, CyberAgent, a web-based media and

advertising company, and Lasertec, which develops laser microscopes

for use in semi-conductors and a variety of high-tech products.

Recent events related to the bankruptcy of Silicon Valley Bank

in the US and UBS's acquisition of Credit Suisse, whilst creating

great uncertainty in the financial markets as a whole, did not, in

our view, directly impact any of the Company's portfolio holdings,

and have not elicited any portfolio adjustments. In all, annualised

portfolio turnover was 19.5% in the six months to the end of March

2023, implying an average holding period of around five years.

Outlook

We are heartened by some recent improvements in Japan's

near-term economic prospects, and on balance we expect activity to

continue to expand, supported by the re-opening of both the

Japanese and Chinese economies. We are also encouraged by early

signs of upward pressures on wages and by rising inflation, as this

provides hope that Japan may be pulling out of its long period of

damaging and seemingly intractable deflation. This would be a

welcome development from the BoJ's perspective, so, unlike the case

in other major economies, we do not expect the central bank to try

to quash nascent inflation pressures by implementing aggressive

rate hikes.

The outlook for Japanese corporates is also positive. Company

balance sheets are very strong compared to the rest of the world,

and the focus on corporate governance and shareholder returns is

increasing. For example, in February 2023 the Tokyo Stock Exchange

announced that it will require companies trading below book value

to devise and implement capital improvement plans. We expect

progress in corporate governance and shareholder returns to

continue apace, and in our view, this remains the single most

compelling reason to invest in Japanese equities on a multi-year

view. Half of Japan's listed companies still have net cash

positions, so there is significant scope for this cash to be

returned to shareholders over the longer term, while in the short

term, cash-rich businesses have greater scope to weather global

recession and other unforeseen events.

Another key factor supporting our favourable view on Japanese

equities is that the country is undergoing major technological

transformation. Businesses and government are increasing their

efforts to digitalise and automate their processes and

administrative procedures, creating the potential for significant

growth and productivity gains over the medium term. This should

prove a very supportive environment for the dynamic, quality growth

businesses in which we invest.

The Japanese market continues to offer many opportunities to

invest in innovative, interesting companies at the heart of Japan's

new growth, at attractive valuations. We believe that we are

especially well-placed to capitalise on these opportunities, thanks

to our active investment approach and our large, Tokyo-based

research team. We remain confident that our investment approach

will ensure the Company continues to deliver absolute gains and

outperformance to its shareholders over the long term.

Nicholas Weindling

Miyako Urabe

Investment Managers

INTERIM MANAGEMENT REPORT

The Company is required to make the following disclosures in its

half year report.

Principal and Emerging Risks and Uncertainties

The Board believes that the principal and emerging risks and

uncertainties faced by the Company fall into the following broad

categories:

Market and Economic Risks - including currency; global inflation

and global recession.

Trust Specific Risks - including underperformance; widening

discount; loss of investment team or investment manager;

outsourcing; cybercrime; loss of investment trust status; statutory

and regulatory compliance.

Geopolitical Risks - including climate change; natural

disasters; social dislocation & conflict.

Information on each of these areas is given on pages 33 to 35 of

the Strategic Report within the Annual Report and Financial

Statements for the year ended 30th September 2022.

Related Parties Transactions

During the first six months of the current financial year, no

transactions with related parties have taken place which have

materially affected the financial position or the performance of

the Company during the period.

Going Concern

In accordance with The Financial Reporting Council's guidance on

going concern and liquidity risk, including its Covid-19 guidance,

the Directors have undertaken a rigorous review of the Company's

ability to continue as a going concern. The Board has, in

particular, considered the impact of heightened market volatility

since the Covid-19 outbreak and more recently the Russian invasion

of Ukraine, but does not believe the Company's going concern status

is affected. The Company's assets, the vast majority of which are

investments in quoted securities which are readily realisable,

exceed its liabilities significantly under all stress test

scenarios reviewed by the Board. Gearing levels and compliance with

borrowing covenants are reviewed by the Board on a regular basis.

Furthermore, the Directors are satisfied that the Company and its

key third party service providers have in place appropriate

business continuity plans.

Accordingly, having assessed the principal and emerging risks

and other matters, the Directors believe that there are no material

uncertainties pertaining to the Company that would prevent its

ability to continue in such operational existence for at least 12

months from the date of the approval of this half yearly financial

report.

Directors' Responsibilities

The Board of Directors confirms that, to the best of its

knowledge:

(i) the condensed set of financial statements contained within

the interim financial report has been prepared in accordance with

FRS 104 'Interim Financial Reporting' and gives a true and fair

view of the state of the affairs of the Company and of the assets,

liabilities, financial position and net return of the Company, as

at 31st March 2023, as required by the UK Listing Authority

Disclosure Guidance and Transparency Rule ('DTR') 4.2.4R; and

(ii) the interim management report includes a fair review of the

information required by DTR 4.2.7R and DTR 4.2.8R.

In order to provide these confirmations, and in preparing these

financial statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business;

and the Directors confirm that they have done so.

For and on behalf of the Board

Christopher Samuel

Chairman

Condensed Statement of Comprehensive Income

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

31st March 2023 31st March 2022 30th September 2022

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- -------- -------- ----------- ----------- -------- ---------- -----------

Gains/(Losses)

on

investments

held at fair

value

through

profit or

loss(1) - 55,483 55,483 - (288,357) (288,357) - (418,203) (418,203)

Net foreign

currency

gains(2) - 1,986 1,986 - 7,163 7,163 - 8,328 8,328

Income from

investments 7,516 - 7,516 6,719 - 6,719 14,016 - 14,016

Other interest

receivable

and

similar income 301 - 301 357 - 357 682 - 682

----------------- -------- -------- -------- -------- ----------- ----------- -------- ---------- -----------

Gross

return/(loss) 7,817 57,469 65,286 7,076 (281,194) (274,118) 14,698 (409,875) (395,177)

Management fee (221) (1,992) (2,213) (283) (2,550) (2,833) (512) (4,612) (5,124)

Other

administrative

expenses (601) - (601) (482) - (482) (959) - (959)

----------------- -------- -------- -------- -------- ----------- ----------- -------- ---------- -----------

Net

return/(loss)

before

finance costs

and

taxation 6,995 55,477 62,472 6,311 (283,744) (277,433) 13,227 (414,487) (401,260)

Finance costs (65) (580) (645) (61) (549) (610) (141) (1,272) (1,413)

----------------- -------- -------- -------- -------- ----------- ----------- -------- ---------- -----------

Net

return/(loss)

before

taxation 6,930 54,897 61,827 6,250 (284,293) (278,043) 13,086 (415,759) (402,673)

Taxation (752) - (752) (671) - (671) (1,400) - (1,400)

----------------- -------- -------- -------- -------- ----------- ----------- -------- ---------- -----------

Net

return/(loss)

after taxation 6,178 54,897 61,075 5,579 (284,293) (278,714) 11,686 (415,759) (404,073)

----------------- -------- -------- -------- -------- ----------- ----------- -------- ---------- -----------

Return/(loss)

per

share (note 3) 4.01p 35.66p 39.67p 3.56p (181.58)p (178.02)p 7.48p (266.28)p (258.80)p

----------------- -------- -------- -------- -------- ----------- ----------- -------- ---------- -----------

(1) Includes foreign currency gains or losses on investments.

(2) Foreign currency gains are due to yen denominated loan notes and bank loans.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or

discontinued in the period.

The 'Total' column of this statement is the profit and loss

account of the Company and the 'Revenue' and 'Capital' columns

represent supplementary information prepared under guidance

issued by the Association of Investment Companies.

The net return/(loss) after taxation represents the profit for

the period and also the total comprehensive income.

CONDENSED STATEMENT OF CHANGES IN EQUITY

Called Capital

up

share redemption Other Capital Revenue

capital reserve(1) reserve(1) reserves(1) reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------- ----------- ----------- ------------ ----------- -----------

Six months ended 31st March

2023 (Unaudited)

At 30th September 2022 40,312 8,650 166,791 496,089 18,532 730,374

Repurchase of shares into Treasury - - - (4,967) - (4,967)

Net return - - - 54,897 6,178 61,075

Dividends paid in the period

(note 4) - - - - (9,546) (9,546)

------------------------------------ -------- ----------- ----------- ------------ ----------- -----------

At 31st March 2023 40,312 8,650 166,791 546,019 15,164 776,936

------------------------------------ -------- ----------- ----------- ------------ ----------- -----------

Six months ended 31st March

2022 (Unaudited)

At 30th September 2021 40,312 8,650 166,791 842,661 13,750 1,072,164

Repurchase of shares into Treasury - - - (4,580) - (4,580)

Net (loss)/return - - - (284,293) 5,579 (278,714)

Dividends paid in the period

(note 4) - - - - (8,295) (8,295)

------------------------------------ -------- ----------- ----------- ------------ ----------- -----------

At 31st March 2022 40,312 8,650 166,791 553,788 12,425 780,575

------------------------------------ -------- ----------- ----------- ------------ ----------- -----------

Year ended 30th September

2022 (Audited)

At 30th September 2021 40,312 8,650 166,791 923,650 15,141 1,154,544

Repurchase of shares into Treasury - - - (11,802) - (11,802)

Net (loss)/return - - - (415,759) 11,686 (404,073)

Dividends paid in the year

(note 4) - - - - (8,295) (8,295)

------------------------------------ -------- ----------- ----------- ------------ ----------- -----------

At 30th September 2022 40,312 8,650 166,791 496,089 18,532 730,374

------------------------------------ -------- ----------- ----------- ------------ ----------- -----------

(1) In accordance with the Company's Articles of Association and

with ICAEW Technical Release 02/17BL on Guidance on Realised and

Distributable Profits under the Companies Act 2006, the Capital

reserves may be used as distributable profits for all purposes and,

in particular, the repurchase by the Company of its ordinary shares

and for payments as dividends.

As at 31st March 2023, the GBP546,019,000 Capital reserves are

made up of net gains on the sale of investments of GBP399,519,000,

a gain on the revaluation of investments still held of

GBP128,115,000 and an exchange gain on the foreign currency loans

of GBP18,835,000. The GBP18,835,000 of Capital reserves, arising on

the exchange gain on the foreign currency loan, is not

distributable. The remaining amount of Capital reserves totalling

GBP527,634,000 is subject to fair value movements, may not be

readily realisable at short notice and as such may not be entirely

distributable.

The Capital redemption reserve is not distributable under the

Companies Act 2006.

The Other reserve of GBP166,791,000 was created during the year

ended 30th September 1999, following a cancellation of the share

premium account, and forms part of the Company's distributable

reserves.

The investments are subject to financial risks, as such Capital

reserves (arising on investments sold) and Revenue reserve may not

be entirely distributable if a loss occurred during the realisation

of these investments.

CONDENSED STATEMENT OF FINANCIAL POSITION

(Unaudited) (Unaudited) (Audited)

At At At

31st March 31st March 30th September

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ------------ ---------------

Fixed assets

Investments held at fair value through profit

or loss 879,381 971,236 815,789

----------------------------------------------- ------------ ------------ ---------------

Current assets

Debtors 5,874 5,838 7,161

Cash and cash equivalents 974 9,099 27,974

----------------------------------------------- ------------ ------------ ---------------

6,848 14,937 35,135

Creditors: amounts falling due within one

year (372) (42,346) (9,619)

----------------------------------------------- ------------ ------------ ---------------

Net current (liabilities)/assets 6,476 (27,409) 25,516

----------------------------------------------- ------------ ------------ ---------------

Total assets less current liabilities 885,857 943,827 841,305

----------------------------------------------- ------------ ------------ ---------------

Creditors: amounts falling due after more

than one year (108,921) (80,872) (110,931)

----------------------------------------------- ------------ ------------ ---------------

Net assets 776,936 862,955 730,374

----------------------------------------------- ------------ ------------ ---------------

Capital and reserves

Called up share capital 40,312 40,312 40,312

Capital redemption reserve 8,650 8,650 8,650

Other reserve 166,791 166,791 166,791

Capital reserves 546,019 634,777 496,089

Revenue reserve 15,164 12,425 18,532

----------------------------------------------- ------------ ------------ ---------------

Total shareholders' funds 776,936 862,955 730,374

----------------------------------------------- ------------ ------------ ---------------

Net asset value per share (note 5) 505.8p 552.3p 472.1p

----------------------------------------------- ------------ ------------ ---------------

CONDENSED STATEMENT OF CASH FLOWS

(Unaudited) (Unaudited) (Audited)

Six months Six months For the year

ended ended ended

31st March 31st March 30th September

2023 2022(1) 2022(1)

GBP'000 GBP'000 GBP'000

------------------------------------------------ ------------ ------------ ---------------

Cash flows from operating activities

Net profit/(loss) before finance costs

and taxation 62,472 (277,433) (401,260)

Adjustment for:

Net (gains)/losses on investments held

at fair value through profit or loss (55,483) 288,357 418,203

Net foreign currency gains (1,986) (7,163) (8,328)

Dividend income (7,516) (6,719) (14,016)

Realised gain on foreign exchange transactions (102) (692) (1,215)

Decrease/(increase) in accrued income

and other debtors 13 (43) (19)

Increase/(decrease) in accrued expenses 86 (92) (29)

Dividends received 6,063 4,554 10,967

------------------------------------------------ ------------ ------------ ---------------

Net cash inflow from operating activities 3,547 769 4,303

------------------------------------------------ ------------ ------------ ---------------

Purchases of investments and derivatives (94,379) (87,563) (176,268)

Sales of investments and derivatives 88,243 130,855 242,438

Settlement of foreign currency contracts - (41) -

------------------------------------------------ ------------ ------------ ---------------

Net cash (outflow)/inflow from investing

activities (6,136) 43,251 66,170

------------------------------------------------ ------------ ------------ ---------------

Equity dividends paid (9,546) (8,295) (8,295)

Repurchase of shares into Treasury (4,965) (4,596) (11,820)

Drawdown of bank loan - - 30,979

Repayment of bank loan (9,225) (29,385) (60,364)

Interest paid (671) (721) (1,390)

------------------------------------------------ ------------ ------------ ---------------

Net cash outflow from financing activities (24,407) (42,997) (50,890)

------------------------------------------------ ------------ ------------ ---------------

(Decrease)/increase in cash and cash

equivalents (26,996) 1,023 19,583

------------------------------------------------ ------------ ------------ ---------------

Cash and cash equivalents at start of

period/year 27,974 8,299 8,299

Unrealised (losses)/gains on foreign

currency cash and

cash equivalents (4) (223) 92

------------------------------------------------ ------------ ------------ ---------------

Cash and cash equivalents at end of

period/year 974 9,099 27,974

------------------------------------------------ ------------ ------------ ---------------

Cash and cash equivalents consist of:

------------------------------------------------ ------------ ------------ ---------------

Cash and short term deposits 974 9,099 27,974

------------------------------------------------ ------------ ------------ ---------------

(1) The presentation of the Cash Flow Statement, as permitted

under FRS 102, has been changed so as to present the reconciliation

of 'net profit/(loss) before finance costs and taxation' to 'cash

from operating activities' on the face of the Cash Flow Statement.

Previously, this was shown by way of note. Other than changes in

presentation of the certain cash flow items, there is no change to

the cash flows as presented in previous periods.

Reconciliation of net debt

As at Other As at

30th September non-cash 31st March

2022 Cash flows changes 2023

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------------- ----------- --------- -----------

Cash and cash equivalents

Cash 27,974 (26,996) (4) 974

--------------------------- --------------- ----------- --------- -----------

27,974 (26,996) (4) 974

Borrowings

Debt due within one year (9,283) 9,225 58 -

Debt due after one year (110,931) - 2,010 (108,921)

--------------------------- --------------- ----------- --------- -----------

(120,214) 9,225 2,068 (108,921)

--------------------------- --------------- ----------- --------- -----------

Net Debt (92,240) (17,771) 2,064 (107,947)

--------------------------- --------------- ----------- --------- -----------

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

For the six months ended 31st March 2023

1. Financial statements

The information contained within the financial statements in

this half year report has not been audited or reviewed by the

Company's auditors.

The information contained within the financial statements in

this half year report does not constitute statutory accounts as

defined by sections 434 and 436 of the Companies Act 2006 and has

not been audited or reviewed by the Company's auditors.

The figures and financial information for the year ended 30th

September 2022 are extracted from the latest published financial

statements of the Company. The financial statements for the year

ended 30th September 2022 have been delivered to the Registrar of

Companies including the report of the auditors which was

unqualified and did not contain a statement under either section

498(2) or 498(3) of the Companies Act 2006.

2. Accounting policies

The condensed financial statements are prepared in accordance

with the Companies Act 2006, United Kingdom Generally Accepted

Accounting Practice ('UK GAAP') including FRS 102 'The Financial

Reporting Standard applicable in the UK and Republic of Ireland'

and with the Statement of Recommended Practice 'Financial

Statements of Investment Trust Companies and Venture Capital

Trusts' (the 'SORP') issued by the Association of Investment

Companies in July 2022.

FRS 104, 'Interim Financial Reporting', issued by the Financial

Reporting Council ('FRC') in March 2015 has been applied in

preparing this condensed set of financial statements for the six

months ended 31st March 2023.

All of the Company's operations are of a continuing nature.

The accounting policies applied to this condensed set of

financial statements are consistent with those applied in the

financial statements for the year ended 30th September 2022.

3. Return/(loss) per share

(Unaudited) (Unaudited) (Audited)

Six months ended Six months Year ended

ended

31st March 31st March 30th September

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------- ----------------- ------------ ---------------

Return/(loss) per share is

based on the following:

Revenue return 6,178 5,579 11,686

Capital return/(loss) 54,897 (284,293) (415,759)

------------------------------- ----------------- ------------ ---------------

Total return/(loss) 61,075 (278,714) (404,073)

------------------------------- ----------------- ------------ ---------------

Weighted average number of

shares in issue 153,963,270 156,568,539 156,138,247

Revenue return per share 4.01p 3.56p 7.48p

Capital return/(loss) per

share 35.66p (181.58)p (266.28)p

------------------------------- ----------------- ------------ ---------------

Total return/(loss) per share 39.67p (178.02)p (258.80)p

------------------------------- ----------------- ------------ ---------------

4. Dividends paid

(Unaudited) (Unaudited) (Audited)

Six months ended Six months Year ended

ended

31st March 31st March 30th September

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------ ----------------- ------------ ---------------

2022 final dividend paid of

6.2p (2021: 5.3p) per share 9,546 8,295 8,295

------------------------------ ----------------- ------------ ---------------

All dividends paid in the period have been funded from the

revenue reserve (2022: same).

No interim dividend has been declared in respect of the six

months ended 31st March 2023 (2022: nil).

5. Net asset value per share

(Unaudited) (Unaudited) (Audited)

Six months Six months Year ended

ended ended

31st March 31st March 30th September

2023 2022 2022

-------------------------------------- ------------ ------------ ---------------

Net assets (GBP'000) 776,936 862,955 730,374

Number of shares in issue (excluding

shares held

in Treasury) 153,592,089 156,233,489 154,702,089

-------------------------------------- ------------ ------------ ---------------

Net asset value per share 505.8p 552.3p 472.1p

-------------------------------------- ------------ ------------ ---------------

JPMORGAN FUNDS LIMITED

01 June 2023

For further information, please contact:

Priyanka Vijay Anand

For and on behalf of

JPMorgan Funds Limited - Company Secretary

020 7742 4000

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

ENDS

A copy of the 2023 Half Year Report will be submitted to the

National Storage Mechanism and will be available shortly for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The 2023 Half Year Report will also be available shortly on the

Company's website at www.jpmjapanese.co.uk where up to date

information on the Company, including daily NAV and share prices,

factsheets and portfolio information can also be found.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDLCUGDGXB

(END) Dow Jones Newswires

June 02, 2023 02:00 ET (06:00 GMT)

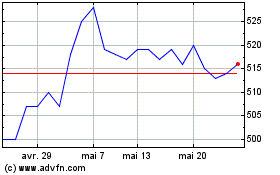

Jpmorgan Japanese Invest... (LSE:JFJ)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Jpmorgan Japanese Invest... (LSE:JFJ)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024