TIDMMAB1

RNS Number : 5223I

Mortgage Advice Bureau(Holdings)PLC

26 March 2015

MORTGAGE ADVICE BUREAU (HOLDINGS) PLC

26 March 2015

Final Results for the year ended 31st December 2014 and Board

Changes.

Mortgage Advice Bureau (Holdings) PLC is pleased to announce its

final results for the year ended 31 December 2014.

Financial highlights

-- Revenue up 41% to GBP56.6m (2013: GBP40.1m)

-- Profit before exceptional items(1) and tax up 52% to GBP7.97m (2013: GBP5.24m)

-- Strong profit to cash conversion(2) of 122% (2013: 101%)

-- Adjusted EPS(1,3) 12.7p up 55% (2013: 8.2p(3) )

-- Proposed final stub(4) dividend of 2.00p

-- Strong financial position with unrestricted net cash balances of GBP5.28 m (2013: GBP6.70m)

(1) Before IPO-related costs and provision against loan

(2) Cash flow from operating and investing activities as a % of

operating profit.

(3) Adjusted EPS is based on 50.5m shares being in issue

throughout in order to allow comparability

(4) Period from listing on AIM on 14 November 2014 to 31

December 2014.

Operational highlights

-- Adviser numbers up 22% to 634 at 31 December 2014 (2013 : 521)

-- Adjusted profit margin(5) increased to 14.1% (2013: 13.1%)

-- Successful listing on AIM in November 2014

(5) Net profit before tax and before IPO-related costs and

provision against loan as a proportion of revenue

Peter Brodnicki, Chief Executive commented:

"I am pleased to report that despite the obvious time commitment

by senior management that went into our successful listing on AIM

in November, the Group enjoyed a record year in terms of both

revenues and profits.

MAB's strategy is to deliver strong revenue growth and

attractive returns to investors by continuing to expand its network

and leverage its scalable model."

Board changes

Lucy Tilley ACA will join the Board on 5 May 2015 as Finance

Director subject to regulatory approval, on which date Paul

Robinson will resign from the Board. Paul will remain as Company

Secretary.

Peter Brodnicki, said:

"At the time of the IPO we stated that we would be recruiting a

full time Finance Director, and are delighted to announce the

appointment of Lucy Tilley. Lucy was most recently at Canaccord

Genuity Limited where she was a director in the corporate broking

team that worked with us on MAB's recent admission to AIM. Lucy

qualified as a Chartered Accountant in 1996 with KPMG. Her skills

and experience strengthen the Board and we look forward to working

with her."

Outlook

2015 being an election year may inevitably generate some

uncertainty for the economy generally. However, we are encouraged

by the political consensus around the importance of the housing

market to the UK economy.

Adviser numbers have continued to grow since the year end, in

part due to the Group's expansion into Northern Ireland, further

diversifying the Group's geographical revenue spread. The Group had

661 advisers at 20 March 2015.

The Board remains confident of delivering further growth in

2015, and building our position as both a leading UK consumer

intermediary brand and a specialist Appointed Representative

Network .

For further information please contact:

Mortgage Advice Bureau (Holdings) Tel: +44 (0) 1332

Plc 525007

Peter Brodnicki - Chief Executive

David Preece - Chief Operating

Officer

Paul Robinson - Finance Director

Canaccord Genuity Limited

Martin Green Tel: +44 (0) 20

7523 8350

Peter Stewart

Media enquiries:

Instinctif Partners

Nick Woods Tel: +44 (0)

20 7866 7904

Strategic report - Chief Executive's review

Introduction

I am pleased to report that despite the obvious time commitment

by senior management that went into our successful listing on AIM

in November, the Group enjoyed a record year in terms of both

revenues and profits.

Our strategy

Mortgage Advice Bureau's ("MAB") strategy is to deliver strong

revenue growth and attractive returns to investors by continuing to

expand its network and leverage its scalable model. The Group

intends to deliver this strategy through:

-- Increasing the number of advisers in existing Appointed

Representatives ('ARs')

-- Recruiting new ARs

-- Further development of its client servicing via AR regional

telephone centres

Our business model

MAB is directly authorised by the Financial Conduct Authority

("FCA") and operates an AR network which specialises in providing

independent mortgage advice to customers, as well as advice on

protection and general insurance products.

MAB seeks to develop long term strategic relationships with its

AR firms so that there is a close alignment of interests.

Our proposition appeals most to multiple adviser firms with

ambition to grow both their market share and business, with the MAB

brand becoming an increasingly important USP that is adopted by a

majority of our AR partners.

Under the MAB model almost all the advisers are engaged directly

by the ARs themselves. However, MAB carries out all the compliance

supervision on behalf of the AR firms, ensuring greater control and

helping to achieve consistently high standards of consumer

outcomes.

Relationships

The Group's performance and value to our shareholders is

influenced by other stakeholders, principally our employees, our

ARs (and their advisers), our customers and our suppliers. Our

approach to all these parties is founded on the principle of open

and honest dialogue, based on a mutual understanding of needs and

objectives.

Our relationship with our ARs is fundamental to the success of

MAB, and is based on that of a strategic business partner, with

both parties benefiting from any improvement in the ARs

business performance.

Sector focus and specialisations

MAB has developed bespoke support services for intermediary

firms that operate in specialist sectors such as estate agency, new

build, mortgage shops and telephone based mortgage advice. These

specialist sectors are typically rich in generating new customers

and sales, and offer intermediaries the greatest opportunity to

grow their businesses.

The Group has a broad geographic spread across the United

Kingdom, with expansion into Northern Ireland having taken place in

early 2015. Less than 10% of the Group's revenue is derived from

the London market.

Products available through the Group

The Group's network offers advice on over 8,000 residential and

buy-to-let mortgage products, including those that are only

available through mortgage intermediaries.

The Group's network also offers advice on a range of both

protection and general insurance products, which are sourced from a

panel of insurers.

The Group generates revenue from 3 core areas which can be

broken down as follows:

Proportion of 2014 2013

Revenue

Insurance commission 41% 39%

Mortgage procuration

fees 42% 44%

Client fees 16% 15%

Other income 1% 2%

Total 100% 100%

Proprietary Software

The Group has developed its own technology system that is the

trading platform for the Group and its advisers. This system,

MIDAS, is a significant USP of the Group, and has seen some major

enhancements released in recent months ensuring the customer and

adviser experience is further improved.

Protection is a key part of the advice process, and the most

recent enhancements to MIDAS will ensure a far more visual and

interactive customer experience which we expect to generate an

increase in Insurance sales such as critical illness, income

protection and life insurance.

Market trends favour Intermediaries

Market recovery

In 2014 the UK mortgage market exceeded GBP200 billion of gross

lending for the first time since 2008. Between 2009 and 2012 gross

lending varied between GBP135bn and GBP145bn per annum. 2013 saw a

rise of 23% over 2012 to GBP179bn, whilst 2014 showed a further

rise of 14% to GBP204bn. In December 2014 the Council for Mortgage

Lenders were forecasting further increases to GBP222bn in 2015 and

GBP240bn for 2016.

Whilst bank base rates are not expected to rise in the near

future, rate rises will be inevitable at some point in the economic

cycle.

Although the bank base rate has stayed at 0.5% for 6 years,

mortgage pay rates have been falling, with fixed rates now at

record low levels, with some lenders indicating that further cuts

are unlikely. This makes it an opportune time for borrowers to

consider remortgaging, with the mortgage intermediary in an ideal

position to review the options available to their customers.

Customer reviews are a key focus for MAB, and with fixed rate

mortgages at such incredibly low levels, we see the remortgage

market as a major opportunity.

The government remains committed to growth in housing stock and,

to further support this policy, as recently as February 2015 it was

announced that a discount of up to 20% was being offered to certain

first time buyers, and in the March 2015 budget a 'help to buy' ISA

was announced. Housing is a core policy for all major political

parties who all appear extremely committed to increasing housing

stock and recognising the shortage of affordable homes.

Industry trends

Around 62% of UK mortgage transactions (excluding buy to let

mortgages) were via an intermediary in 2014, up from around 55% in

2013. The share in the fourth quarter of 2014 was around 64%, and

the Board expects this to grow further in 2015 with some industry

commentators expecting it to grow to a 75% market share in the next

few years.

Individual market sectors such as buy-to-let, first time buyers

and remortgaging are performing strongly; intermediaries enjoy a

larger than average share of these sectors.

Impact of Mortgage Market Review ("MMR")

Prior to MMR, customers could obtain mortgages directly from

some lenders without receiving full advice. This typically took

less time than a fully-advised service such as that provided

through MAB. Following MMR, all mortgage sales (with the current

exception of buy-to-let), including direct sales by lenders, must

be made on a fully advised basis in order to comply with the FCA's

requirements.

A customer who now wishes to secure a mortgage directly from a

lender (and not an intermediary) may be required to repeat this

more time consuming fully-advised process with each potential

lender they visit. This enhances the attractiveness of the

intermediary sector.

As MAB already provided a fully-advised service prior to the

introduction of MMR, the Group's procedures were largely unaffected

by the MMR changes.

How we performed

We measure the development, performance and position of our

business against a number of key indicators.

http://www.rns-pdf.londonstockexchange.com/rns/5223I_-2015-3-26.pdf

Financial performance and future developments

Revenues

Revenues were up 41% to GBP56.6m (2013: GBP40.1m). A key driver

of revenue is the average number of ARs in each financial year. Our

business model attracts forward thinking ARs seeking to expand and

grow their market share. Average adviser numbers increased by 19%

to 581 (2013: 489) from a combination of the recruitment of new

ARs, and the expansion of existing ARs.

Profit before exceptional items and tax

To facilitate a like-for-like comparison with prior years, the

costs associated with the Company's admission to AIM in November

2014 and a one-off provision made during 2014 against a loan

advanced in 2011 have been treated as exceptional costs when

calculating adjusted profit before tax.

Profit before exceptional items and tax rose by 52% to GBP7.97m

(2013: GBP5.24m) with the inherent scalability of MAB's model

delivering a 52% increase in pre-exceptional, pre-tax profit

compared with a 41% increase in revenue.

Margins

The gross profit margin fell slightly to 24.1% (2013: 25.9%).

MAB has attracted, and continues to attract, ambitious ARs with

actual or potential scale. Some existing ARs have achieved

significant scale themselves by working alongside MAB. As the scale

of an AR's business grows, the AR might be able to move to a higher

commission tier which can lead to some margin erosion for the

Group, and as a result we expect to see some further contraction in

the gross profit margin. However, the increased revenue these

growing ARs generate does leverage MAB's scalable business model

and is expected to more than offset any margin erosion.

I am pleased to report that overheads as a percentage of revenue

fell to 11.1% (2013: 14.3%). The Group's cost base is largely fixed

in nature, and is expected to grow at a slower rate than revenue.

Certain costs, primarily those relating to compliance, are closely

correlated to the growth in the number of advisers, due to the

requirement to maintain regulatory spans of control.

Overall, these factors resulted in an improvement in profit

before exceptional items and tax as a percentage of revenue to

14.1% (2013: 13.1%).

Net finance revenue

The Group's model is highly cash generative as our income is

received before we pay our ARs. This results in a negative working

capital requirement. Net finance revenues of GBP0.12m (2013:

GBP0.25m) reflect continued low interest rates but are a useful

additional revenue stream.

Profit before Tax

Unadjusted reported profit before tax increased to GBP6.88m

(2013; GBP5.24m), an increase of 31%.

Taxation

The effective rate of taxation on profit before tax rose to

21.6% (2013: 20.8%) principally due to the costs of the AIM listing

being disallowed for tax purposes, partly offset by reductions in

the UK corporation tax rate.

Earnings per share and dividend

Adjusted EPS amounted to 12.69 pence. Comparison to 2013 is

difficult as the share structure was significantly changed in

preparation for the IPO. Had there been a similar number of

ordinary shares in issue in 2013, adjusted EPS would have been 8.21

pence per share.

Basic EPS amounted to 9.63 pence. I am pleased to confirm a

proposed final dividend for the year of 2.0p per share in respect

of the period from Admission to AIM, amounting to a total of

GBP1.01 million.

Cash flow

The Group's operations produce positive cash flow. This is

reflected in the net cash inflow from operating activities of

GBP7.96m (2013: GBP4.95m).

Net cash flow from operating and investing activities as a % of

operating profit

2014 122%

2013 101%

2012 65%

The Group's operations are capital light with our main

investment being in computer equipment. The Group has a regulatory

capital requirement amounting to 2.5% of regulated revenue. At the

end of 2014 this regulatory capital requirement was GBP1.31

million. Only GBP0.14m of capital expenditure was required during

the year (2013: GBP0.07m). Group policy is not to provide company

cars, and no significant capital expenditure is foreseen in the

coming year. All development work on MIDAS is treated as revenue

expenditure.

The Group had no bank borrowings at 31 December 2014 (2013:

GBPnil) with unrestricted bank balances of GBP5.3m (2013:

GBP6.7m).

The following demonstrates how cash generated from operations

was applied

Unrestricted bank balances at the GBP6.7m

beginning of the year

Cash generated from operating activities GBP8.9m

before

IPO costs and loans advanced for

commercial return

Interest received GBP0.1m

Share issue GBP0.1m

Repayment of loans advanced for GBP1.4m

commercial return

New loans advanced for commercial (GBP1.0m)

return

Taxes paid (GBP1.5m)

Capital expenditure (GBP0.1m)

Costs incurred in relation to IPO (GBP0.7m)

Redemption of shares (GBP4.6m)

Dividends paid (GBP4.0m)

Unrestricted bank balances at the GBP5.3m

end of the year

The Group's emphasis is to reduce risk by spreading deposits

over a number of institutions rather than to seek marginal

improvements in returns.

Further information on Board Changes

Lucy Claire Tilley (nee Haythorn), age 43, was most recently a

director in the corporate broking team at Canaccord Genuity Limited

and was part of the team that worked on MAB's recent admission to

AIM. She is a chartered accountant having qualified with KPMG in

1996.

Save as disclosed above and detailed below, there are no other

details to be disclosed regarding Lucy Tilley's appointment as

required under paragraph (g) of Schedule 2 of the AIM Rules.

Directorships held during the past five years

None

The following information is an extract from the audited

financial statements. See Note 19 for further information.

2014 Financial Statements

Consolidated statement of comprehensive income for the year

ended 31 December 2014

Note

2014 2013

GBP GBP

------------------------------------- ----- ------------- -------------

Revenue 3 56,577,613 40,066,719

Cost of sales 4 (42,932,390) (29,684,918)

------------------------------------- ----- ------------- -------------

Gross profit 13,645,223 10,381,801

Administrative expenses (6,257,174) (5,745,335)

Share of profit of associates 458,074 344,573

------------------------------------- ----- ------------- -------------

Operating profit before exceptional

costs 7,846,123 4,981,039

Exceptional costs 5 (1,093,944) -

Operating profit 6,752,179 4,981,039

Finance income 124,066 254,094

Profit before tax 6,876,245 5,235,133

Tax expense 6 (1,485,042) (1,090,644)

------------------------------------- ----- ------------- -------------

Profit for the year attributable

to equity holders of parent

company 5,391,203 4,144,489

------------------------------------- ----- ------------- -------------

Total comprehensive income

attributable to equity holders

of parent company 5,391,203 4,144,489

------------------------------------- ----- ------------- -------------

Earnings per share attributable

to the owners of the parent

Basic 7 9.626p 5.924p

------------------------------------- ----- ------------- -------------

Diluted 7 9.588p 5.924p

------------------------------------- ----- ------------- -------------

Consolidated statement of financial position as at 31 December

2014

2014 2013

Note GBP GBP

------------------------------- ------ ----------- -----------

Assets

Non-current assets

Property, plant and

equipment 204,228 176,832

Goodwill 9 4,114,107 4,114,107

Other intangible assets 9 45,118 63,165

Investments 252,766 198,743

Total non-current assets 4,616,219 4,552,847

------------------------------- ------ ----------- -----------

Current assets

Trade and other receivables 3,265,224 3,698,180

Cash and cash equivalents 10 9,270,006 9,388,153

------------------------------- ------ ----------- -----------

Total current assets 12,535,230 13,086,333

------------------------------- ------ ----------- -----------

Total assets 17,151,449 17,639,180

------------------------------- ------ ----------- -----------

Equity and liabilities

Equity attributable

to owners of the parent

Share capital 13 50,510 69,960

Share premium 3,042,255 2,988,891

Capital redemption

reserve 19,532 46

Share option reserve 10,553 -

Retained earnings 4,497,264 7,621,981

------------------------------- ------ ----------- -----------

Total equity 7,620,114 10,680,878

------------------------------- ------ ----------- -----------

Liabilities

Non-current liabilities

Provisions 11 750,679 588,783

Deferred tax liability 12 25,121 18,146

------------------------------- ------ ----------- -----------

Total non-current liabilities 775,800 606,929

------------------------------- ------ ----------- -----------

Current liabilities

Trade and other payables 8,252,905 5,805,437

Corporation tax liability 502,630 545,936

------------------------------- ------ ----------- -----------

Total current liabilities 8,755,535 6,351,373

------------------------------- ------ ----------- -----------

Total liabilities 9,531,335 6,958,302

------------------------------- ------ ----------- -----------

Total equity and liabilities 17,151,449 17,639,180

------------------------------- ------ ----------- -----------

Consolidated statement of changes in equity for the year ended

31 December 2014

Capital Share

Share Share redemption option Retained Total

capital premium reserve reserve earnings Equity

GBP GBP GBP GBP GBP GBP

----------------------- --------- ----------- ------------ --------- ------------ -------------

Balance at 1

January 2013 69,960 2,988,891 46 - 4,118,272 7,177,169

Profit for the

year - - - - 4,144,489 4,144,489

----------------------- --------- ----------- ------------ --------- ------------ -------------

Total comprehensive

income - - - - 4,144,489 4,144,489

----------------------- --------- ----------- ------------ --------- ------------ -------------

Transactions

with owners

Dividends paid - - - - (640,780) (640,780)

----------------------- --------- ----------- ------------ --------- ------------ -------------

Transactions

with owners - - - - (640,780) (640,780)

----------------------- --------- ----------- ------------ --------- ------------ -------------

Balance at 31

December 2013

and 1 January

2014 69,960 2,988,891 46 - 7,621,981 10,680,878

Profit for the

year - - - - 5,391,203 5,391,203

----------------------- --------- ----------- ------------ --------- ------------ -------------

Total comprehensive

income - - - - 5,391,203 5,391,203

----------------------- --------- ----------- ------------ --------- ------------ -------------

Transactions

with owners

Share based

payment transactions - - - 10,553 - 10,553

Issue of new

shares 36 53,364 - - - 53,400

Redemption of

shares (19,486) - 19,486 - (4,558,168) (4,558,168)

Dividends paid - - - - (3,957,752) (3,957,752)

Transactions

with owners (19,450) 53,364 19,486 10,553 (8,515,920) (8,451,967)

----------------------- --------- ----------- ------------ --------- ------------ -------------

At 31 December

2014 50,510 3,042,255 19,532 10,553 4,497,264 7,620,114

----------------------- --------- ----------- ------------ --------- ------------ -------------

Consolidated statement of cash flows for the year ended 31

December 2014

Cash flows from operating activities

Profit for the year before tax 6,876,245 5,235,133

Adjustments for

Depreciation of property, plant

and equipment 112,083 74,515

Profit on disposal of property,

plant and equipment - (315)

Amortisation of intangibles 18,047 20,048

Share based payments 10,553 -

Share of profit of associates (458,074) (344,573)

Finance income (124,066) (254,094)

--------------------------------------- ------------ ----------

6,434,788 4,730,714

Changes in working capital

Decrease/(increase) in trade

and other receivables 432,956 (740,747)

Increase in trade and other payables 2,447,419 1,687,956

Increase/(decrease) in provisions 161,896 (20,961)

Cash generated from operating

activities 9,477,059 5,656,962

Income taxes paid (1,521,373) (709,190)

--------------------------------------- ------------ ----------

Net cash inflow from operating

activities 7,955,686 4,947,772

--------------------------------------- ------------ ----------

Cash flows from investing activities

Purchase of property, plant and

equipment (139,479) (112,537)

Proceeds from sale of property,

plant and equipment - 526

Acquisitions of associates and

investments (150) (50,300)

Proceeds from disposal of associates - 766

Dividends received from associates 404,250 245,367

--------------------------------------- ------------ ----------

Net cash inflow from investing

activities 264,621 83,822

--------------------------------------- ------------ ----------

Cash flows from financing activities

Interest received 124,066

Redemption of shares (4,558,168)

Issue of shares 53,400

Dividends paid (3,957,752)

--------------------------------------- ------------

Net cash outflow from financing

activities (8,338,454)

--------------------------------------- ------------

Net (decrease)/increase in cash

and cash equivalents (118,147)

Cash and cash equivalents at

the beginning of year 9,388,153

--------------------------------------- ------------

Cash and cash equivalents at

the end of the year 9,270,006

--------------------------------------- ------------

Notes to the financial statements

for the year ended 31 December 2014

1. Accounting policies

New Standards, interpretations and amendments not yet

effective

The following new standards, interpretations and amendments

which will or may have an effect on the Group, are effective for

annual periods beginning on or after 1 January 2015 and have not

yet been applied in preparing these financial statements. None of

these new standards or interpretations are expected to have a

material impact on the financial statements of the Group.

-- IFRS 9 will eventually replace IAS 39 in its entirety.

However, the process has been divided into three main components

(classification and measurement, impairment and hedge accounting).

This standard becomes effective for accounting periods beginning on

or after 1 January 2018. Its adoption may result in changes to the

classification and measurement of the Group's financial

instruments, including any impairment thereof.

-- IFRS 15 'Revenue from Contracts with Customers' was issued by

the IASB on 28 May 2014 and applies to an entity's first annual

IFRS financial statements for a period beginning on or after 1

January 2017.It sets out the requirements for recognising revenue

that apply to contracts with customers, except for those covered by

standards on leases, insurance contracts and financial

instruments.

-- Amendments to IFRS11 "Accounting for Acquisitions of

Interests in Joint Operations" provides guidance on how to account

for the acquisition of joint operations that constitute a business

as defined in IFRS 3 Business Combinations. It is effective for

accounting periods beginning on or after 1 January 2016.

-- Amendments to IAS 16 and IAS 38 "Clarification of Acceptable

Methods of Depreciation and Amortisation". The amendment to IAS 16

prohibits entities from using a revenue-based depreciation method

for items of property, plant and equipment. The amendment to IAS 38

introduces a rebuttable presumption that revenue is not an

appropriate basis for amortisation of intangible assets. It is

effective for accounting periods beginning on or after 1 January

2016.

Basis of consolidation

Where the company has control over an investee, it is classified

as a subsidiary. The company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

De-facto control exists in situations where the company has the

practical ability to direct the relevant activities of the investee

without holding the majority of the voting rights. In determining

whether de-facto control exists the company considers all relevant

facts and circumstances, including:

- The size of the company's voting rights relative to both the

size and dispersion of other parties who hold voting rights

- Substantive potential voting rights held by the company and by other parties

- Other contractual arrangements

- Historic patterns in voting attendance.

The consolidated financial statements present the results of the

company and its subsidiaries ("the Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of

business combinations using the acquisition method. In the

statement of financial position, the acquiree's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their fair values at the acquisition date. The

results of acquired operations are included in the consolidated

statement of comprehensive income from the date on which control is

obtained. They are deconsolidated from the date on which control

ceases.

Entities that are not subsidiaries but where the group has

significant influence (i.e. the power to participate in the

financial and operating policy decisions) are accounted for as

associates.

The results and assets and liabilities of the associates are

included in the consolidated accounts using the equity method of

accounting.

Property, plant and equipment

Items of property, plant and equipment are initially recognised

at cost. As well as the purchase price, cost includes directly

attributable costs.

Depreciation is provided on all items of property, plant and

equipment at rates calculated to write off the cost of each asset

on a straight line basis over its expected useful lives, as

follows:

Fixtures and fittings 20%

Computer equipment 33%

Gains and losses on disposal are determined by comparing the

proceeds with the carrying amount and are recognised in the income

statement. The directors reassess the useful economic life of the

assets annually.

Goodwill

Goodwill represents the excess of the cost of a business

combination over, in the case of business combinations completed

prior to 1 January 2011, the Group's interest in the fair value of

identifiable assets, liabilities and contingent liabilities

acquired. For business combinations completed after 1 January 2011,

the goodwill represents the excess of a cost of a business

combination over the Group's interest in the fair value of

identifiable assets under IFRS 3 Business Combinations.

Goodwill is capitalised as an intangible asset with any

impairment in carrying value being charged to the consolidated

statement of comprehensive income. Where the fair value of

identifiable assets, liabilities and contingent liabilities exceed

the fair value of consideration paid, the excess is credited in

full to the consolidated statement of comprehensive income on the

acquisition date.

Other intangible assets

Intangible assets other than goodwill acquired by the Group

comprise licences and are stated at cost less accumulated

amortisation and impairment losses. Amortisation is charged to

statement of comprehensive income within administrative expenses on

a straight line basis over the period of the licence agreements.

Assets are tested annually for impairment or more frequently if

events or circumstances indicate potential impairment.

Amortisation is provided on licences at 16.7% per annum,

calculated to write off the cost of the asset on a straight line

basis over its expected useful life.

Impairment of non-financial assets

Impairment tests on goodwill and other intangible assets with

indefinite useful economic lives are undertaken annually at the

financial year end. Other non-financial assets are subject to

impairment tests whenever events or changes in circumstances

indicate that their carrying amount may not be recoverable. Where

the carrying value of the asset exceeds its recoverable amount

(i.e. the higher of value in use and fair value less costs to

sell), the asset is written down accordingly.

Where it is not possible to estimate the recoverable amount of

an individual asset, the impairment test is carried out on the

smallest Group of assets to which it belongs for which there are

separately identifiable cash flows, its cash generating units

('CGUs'). Goodwill is allocated on initial recognition to each of

the Group's CGUs that are expected to benefit from the synergies of

the combination giving rise to the goodwill.

Unquoted investments

Unquoted investments are shown at cost less provision for

impairment.

Financial assets

The Group classifies its financial assets as loans or

receivables. The classification depends on the purpose for which

the financial assets were acquired. Loans and receivables are

non-derivative financial assets with fixed or determinable payments

which arise principally through the provision of services (e.g.

trade receivables). These are recognised at original fair value

cost, less appropriate provision for impairment.

The Group's loans and receivables comprise trade and other

receivables and cash and cash equivalents in the consolidated

statement of financial position.

Impairment provisions are recognised when there is objective

evidence (such as significant financial difficulties on the part of

the counterparty or default or significant delay in payment) that

the Group will be unable to collect all of the amounts, the amount

of such a provision being the difference between the net carrying

amount and the present value of the future expected cash flows

associated with the impaired receivable. For trade receivables,

which are reported net; such provisions are recorded in a separate

allowance account with the loss being recognised within

administrative expenses in the consolidated statement of

comprehensive income. On confirmation that the trade receivable

will not be collectable, the gross carrying value of the asset is

written off against the associated provision.

Cash and cash equivalents

Cash and cash equivalents include cash in hand and deposits held

at call with banks with an original maturity of three months or

less.

Trade and other payables

Trade and other payables are recognised initially at fair value

and subsequently carried at amortised cost.

Retirement benefits: Defined contribution schemes

Contributions to defined contribution pension schemes are

charged to the consolidated statement of comprehensive income in

the year to which they relate.

Provisions

A provision is recognised in the statement of financial position

when the Group has a present legal or constructive obligation as a

result of a past event, and it is probable that an outflow of

economic benefits will be required to settle the obligation.

Share capital

Financial instruments issued by the Group are treated as equity

only to the extent that they do not meet the definition of a

financial liability. The Company's ordinary shares are classified

as equity instruments. Incremental costs directly attributable to

the issue of new shares are shown in share premium as a deduction

from the proceeds.

Revenue

Revenue comprises commissions and fees receivable. Commissions

are included at the gross amounts receivable by the Group in

respect of all services provided. Commissions payable to trading

partners in respect of their share of the commissions earned are

included in cost of sales.

Commissions earned are accounted for when received, as until

received it is not possible to be certain that the transaction will

be completed. In the case of life commissions there is a

possibility for a period after the inception of the policy that

part of the commission earned may have to be repaid if the policy

is cancelled during this period. A provision is made for the

expected level of commissions repayable.

Other income comprises income from ancillary services such as

survey and conveyancing fees and is credited to the statement of

comprehensive income on an accruals basis.

Leased assets

Rentals under operating leases are charged on a straight line

basis over the lease term, even if the payments are not made on

such a basis. Benefits received and receivable as an incentive to

sign an operating lease are similarly spread on a straight line

basis over the lease term, except where the period to the review

date on which the rent is first expected to be adjusted to the

prevailing market is shorter than the full lease term, in which

case the shorter period is used.

Finance income

Finance income comprises interest receivable on cash at bank.

Interest income is recognised in statement of comprehensive

incomeas it accrues.

Exceptional items

As permitted by IAS 1 'Presentation and disclosure' certain

items are presented separately in the statement of comprehensive

income as exceptional where, in the judgement of the directors,

they need to be disclosed by virtue of their nature, size or

incidence in order to obtain a clear and consistent presentation of

the Group's underlying business performance. Examples of material

and non-recurring costs which may give rise to disclosure as

exceptional items include asset impairments and costs associated

with acquiring new businesses.

Taxation

Income tax comprises current and deferred tax. Income tax is

recognised in profit or loss except to the extent that it relates

to items recognised in other comprehensive income in which case it

is recognised in other comprehensive income.

Current tax is the expected tax payable on the taxable income

for the year using tax rates enacted or substantively enacted by

the statement of financial position date and any adjustment to tax

payable in respect of previous years.

Deferred tax assets and liabilities are recognised where the

carrying amount of an asset or liability in the consolidated

statement of financial position differs from its tax base, except

for differences arising on:

-- Investments in subsidiaries and jointly controlled entities

where the Group is able to control the timing of the reversal of

the difference and it is probably that the difference will not

reverse in the foreseeable future.

Recognition of deferred tax assets is restricted to those

instances where it is probable that taxable profit will be

available against which the difference can be utilised.

The amount of the asset or liability is determined using tax

rates that have been enacted or substantially enacted by the

statement of financial position date and are expected to apply when

the deferred tax liabilities or assets are settled or recovered.

Deferred tax balances are not discounted.

Deferred tax assets and liabilities are offset when the Group

has a legally enforceable right to offset current tax assets and

liabilities and the deferred tax assets and liabilities relate to

taxes levied by the same tax authority on either:

-- the same taxable group company, or

-- different company entities which intend either to settle

current tax assets and liabilities on a net basis, or to realise

the assets and settle the liabilities simultaneously, in each

future period in which significant amounts of deferred tax assets

and liabilities are expected to be settled or recovered.

Segment Reporting

An operating segment is a distinguishable segment of an entity

that engages in business activities from which it may earn revenues

and incur expenses and whose operating results are reviewed

regularly by the entity's chief operating decision maker ("CODM")

The Board reviews the Group's operations and financial position as

a whole and therefore considers that it has only one operating

segment, being the provision of financial services operating solely

within the UK. The information presented to the CODM directly

reflects that presented in the financial statements and they review

the performance of the Group by reference to the results of the

operating segment against budget.

Operating profit is the profit measure, as disclosed on the face

of the combined income statement that is reviewed by the CODM.

Dividends

Dividends are recognised when they become legally payable. In

the case of interim dividends to equity shareholders, this is when

they are paid. In the case of final dividends, this is when they

are approved by the shareholders.

Share based payments

Where equity settled share options are awarded to employees, the

fair value of the options at the date of grant is charged to the

statement of comprehensive income over the vesting period.

Non-market vesting conditions are taken into account by adjusting

the number of equity instruments expected to vest at each reporting

date so that, ultimately, the cumulative amount recognised over the

vesting period is based on the number of options that eventually

vest. Non-vesting conditions and market vesting conditions are

factored into the fair value of the options granted. As long as all

other vesting conditions are satisfied, a charge is made

irrespective of whether the market vesting conditions are

satisfied. The cumulative expense is not adjusted for failure to

achieve a market vesting condition or where a non-vesting condition

is not satisfied.

Where the terms and conditions of options are modified before

they vest, the increase in the fair value of the options, measured

immediately before and after the modification, is also charged to

the statement of comprehensive income over the remaining vesting

period.

Where options are granted to persons other than employees, the

statement of comprehensive income is charged with the fair value of

the options at the date of the grant over the vesting period.

2 Critical Accounting Estimates and Judgements

The Group makes certain estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions. The directors consider that the

following estimates and judgements that have the most significant

effect on the carrying amounts of assets and liabilities within the

financial statements are discussed below.

(a) Impairment of goodwill

The Group is required to test, on an annual basis, whether

goodwill has suffered any impairment. The recoverable amount is

determined based on value in use calculations. The use of this

method requires the estimation of future cash flows and the choice

of a discount rate in order to calculate the present value of the

cash flows. Actual outcomes may vary. More information including

carrying values is included in note 9.

(b) Impairment of trade and other receivables

Judgement is required when determining if there is any

impairment to the trade and other receivable balances. Trade

receivables are reviewed for impairment if they are past due and

are not repaid within the terms of the contracts. Other

receivables, which include loans, are reviewed for impairment when

there are any indications that they may not be recoverable or that

security held against the balance may be inadequate to fully cover

the amount outstanding. A provision for impairment will be made if

following review of the balances, the Group considers it unlikely

that any balance will be recovered.

(c) Clawback Provision

The provision relates to the estimated cost of repaying

commission received on life assurance policies that may lapse in a

period of up to four years following inception. The provision is

calculated using a model that has been developed over several

years. The model uses a number of factors including the total

unearned commission at the point of calculation, the age profile of

the commission received, the Group's proportion of any clawback,

likely future lapse rates, and the success of the Group's team that

focuses on preventing lapses and/or generating new income at the

point of a lapse. More information is included in note 11.

3 Revenue

The Group operates in one segment being that of the provision of

financial services in the UK.

Revenue is derived as follows:

2014 2013

GBP GBP

Mortgage related products 32,148,696 21,594,777

Insurance and other protection

products 23,702,415 17,667,253

Conveyancing and survey fees

and other income 726,502 804,689

--------------------------------- ----------- ------------

56,577,613 40,066,719

-------------------------------- ----------- -----------

4 Cost of sales

Costs of sales are as follows:

2014 2013

GBP GBP

Commissions paid 41,886,947 28,159,716

Wages and salary costs 1,045,443 1,525,202

------------------------- ----------- -----------

42,932,390 29,684,918

------------------------ ----------- -----------

5 Exceptional costs

The following items have been included in arriving at profit

before tax:

2014 2013

GBP GBP

--------------------------- ------------ -----

Costs incurred in relation 746,053 -

to the IPO

Provision against loan 347,891 -

--------------------------- ------------ -----

Total 1,093,944 -

--------------------------- ------------ -----

In November 2014, the Group was listed on the Alternative

Investment Market ("AIM"). The costs charged to the consolidated

statement of comprehensive income relate to costs incurred as a

result of the listing. These costs include such items as marketing

expenditure and legal and professional fees relating to work

performed for the listing.

At 31 December 2014 there was a loan outstanding to Client Data

Systems Group Limited of GBP347,891 (2013: GBP347,891), a company

in which Mortgage Advice Bureau Limited had a 7% shareholding. The

loan was fully provided for in the year.

6. Income Tax

2014 2013

GBP GBP

-------------------------------- ---------- ----------

Current tax expense

UK corporation tax charge on

profit for the year 1,555,390 1,138,516

Adjustments for over provision

in prior years (77,323) (62,109)

-------------------------------- ---------- ----------

Total current tax 1,478,067 1,076,407

-------------------------------- ---------- ----------

Deferred tax expense

Origination and reversal of

timing differences 9,355 12,522

Effect of change in tax rate

on opening liability (2,380) 1,715

-------------------------------- ---------- ----------

Total Deferred Tax (see note

12) 6,975 14,237

-------------------------------- ---------- ----------

Total tax expense 1,485,042 1,090,644

-------------------------------- ---------- ----------

The reasons for the difference between the

actual charge for the year and the standard

rate of corporation tax in the United Kingdom

of 21.5% (2013: 23.25%) applied to profit for

the year is as follows:

2014 2013

GBP GBP

-------------------------------- ---------- ----------

Profit for the year before

tax 6,876,245 5,235,133

-------------------------------- ---------- ----------

Expected tax charge based on

corporation tax rate 1,478,393 1,217,168

Expenses not deductible for

tax purposes

amortisation and impairment 184,838 14,742

Utilisation of tax losses - (5,377)

Adjustments to tax charge in

respect of prior periods (77,323) (62,109)

Profits from associate (98,486) (75,495)

Rate change on deferred tax

liability (2,380) 1,715

-------------------------------- ---------- ----------

Total tax expense 1,485,042 1,090,644

-------------------------------- ---------- ----------

Changes in the taxation rate

The standard rate of corporation tax in the United Kingdom

changed from 24% to 23% with effect from 1 April 2013 and from 23%

to 21% from 1 April 2014. Further changes have also been enacted

which reduced the main rate of corporation tax to 21% from 1 April

2015 and so the deferred tax balance has been calculated at that

enacted rate.

7. Earnings Per Share

a) Earnings per share

2014 2013

Basic earnings per share GBP GBP

----------------------------------- ----------- -----------

Profit for the year attributable

to the owners of the parent 5,391,203 4,144,489

----------------------------------- ----------- -----------

Weighted average number of shares

in issue (see note below) 56,009,100 69,960,000

----------------------------------- ----------- -----------

Basic earnings per share (in

pence per share) 9.626p 5.924p

----------------------------------- ----------- -----------

For diluted earnings per share, the weighted

average number of ordinary shares in existence

is adjusted to include all dilutive potential

ordinary shares arising from share options.

2014 2013

Diluted earnings per share GBP GBP

----------------------------------- ----------- -----------

Profit for the year attributable

to the owners of the parent 5,391,203 4,144,489

----------------------------------- ----------- -----------

Weighted average number of shares

in issue (see note below) 56,229,933 69,960,000

----------------------------------- ----------- -----------

Basic earnings per share (in

pence per share) 9.588p 5.924p

----------------------------------- ----------- -----------

b) Adjusted earnings per share

2014 2013

GBP GBP

----------------------------------- ----------- -----------

Profit for the year attributable

to the owners of the parent 5,391,203 4,144,489

Adjusted for the following items

net of tax:

Exceptional costs 1,019,147 -

----------------------------------- ----------- -----------

Adjusted earnings net of tax 6,410,350 4,144,489

----------------------------------- ----------- -----------

Weighted average number of shares

in issue 56,009,100 69,960,000

----------------------------------- ----------- -----------

Adjusted basic earnings per share

(in pence per share) 11.445p 5.924p

Adjusted diluted earnings per

share (in pence per share) 11.400p 5.924p

----------------------------------- ----------- -----------

Until 11 November 2014 the Company's share capital comprised

ordinary shares of GBP1 each, at which point these were subdivided

into 0.1 pence shares each. To allow comparability, the weighted

average has therefore been restated based on shares being 0.1 pence

shares throughout both 2014 and 2013

8. Dividends

2014 2013

Dividends paid during the year GBP GBP

On A ordinary shares at GBPnil

per share (2013: GBP60) - 240,000

On B ordinary shares at GBP52.078

per share (2013: GBP8) 2,083,154 320,000

On C ordinary shares at GBP10 24,600 -

per share (2013: GBPnil)

On D ordinary shares at 0.0p

per share (2013: 0.0578p) - 780

On E ordinary shares at GBPnil

per share (2013: GBP8) - 80,000

On ordinary shares at GBP36.625 1,849,998 -

per share (2013: GBPnil)

------------------------------------ ---------- ---------

3,957,752 640,780

9. Intangible Assets

Goodwill 2014 2013

GBP GBP

------------------------ ---------- ----------

Cost

At 1 January 4,267,453 4,267,453

At 31 December 4,267,453 4,267,453

-------------------------- ---------- ----------

Accumulated impairment

At 1 January 153,346 153,346

At 31 December 153,346 153,346

-------------------------- ---------- ----------

Net book value

At 31 December 4,114,107 4,114,107

-------------------------- ---------- ----------

The goodwill relates to the acquisition of Talk Limited in 2012,

and in particular its main operating subsidiary Mortgage Talk

Limited. The goodwill is deemed to have an indefinite useful life.

It is currently carried at cost and is reviewed annually for

impairment.

Under IAS 36, "Impairment of assets", the Group is required to

review and test its goodwill annually each year or in the event of

a significant change in circumstances. The impairment review

conducted at the end of 2014 concluded that there had been no

impairment of goodwill.

The Board considers that it now has only one operating segment,

so accordingly it is necessary to assess the impact of the

acquisition of Mortgage Talk Limited to the Group. The value in use

of Mortgage Talk Limited has therefore been estimated based on the

improvements in net profits which that unit continues to bring to

the Group. The forecast on-going profits generated by the

acquisition of Mortgage Talk Limited significantly exceed the value

of goodwill and therefore no impairment of the goodwill is

required. On this basis it has not been possible to apply a

discount rate to these calculations. Management has considered

forecast profits over a three year period in determining the value

in use. Management believes that any reasonably possible change to

any of the key assumptions applied in determining the value in use

would not cause the carrying amount of goodwill to exceed the

forecast ongoing profits.

Licences 2014 2013

GBP GBP

-------------------------- -------- --------

Cost

At 1 January 108,461 108,461

At 31 December 108,461 108,461

---------------------------- -------- --------

Accumulated Amortisation

At 1 January 45,296 25,248

Charge for the year 18,047 20,048

At 31 December 63,343 45,296

---------------------------- -------- --------

Net book value

At 31 December 45,118 63,165

---------------------------- -------- --------

10. Cash and cash equivalents

2014 2013

GBP GBP

-------------------------------- ---------- ----------

Unrestricted cash and bank

balances 5,281,117 6,702,642

Bank balances held in relation

to retained commissions 3,988,889 2,685,511

-------------------------------- ---------- ----------

Cash and cash equivalents 9,270,006 9,388,153

-------------------------------- ---------- ----------

Bank balances held in relation to retained commissions are held

to cover potential future lapses in AR commissions. Operationally,

the Group does not treat these balances as available funds. An

equal and opposite liability is shown within Trade Payables.

11. Provisions

Clawback provision 2014 2013

GBP GBP

------------------------------------- -------- ---------

At 1 January 588,783 609,744

Charged/(released) to the statement

of comprehensive income 161,896 (20,961)

------------------------------------- -------- ---------

At 31 December 750,679 588,783

------------------------------------- -------- ---------

The provision relates to the estimated cost of repaying

commission income received on life assurance policies that may

lapse in the four years following issue. Provisions are held in the

financial statements of three of the group's subsidiaries: Mortgage

Advice Bureau Limited, Mortgage Advice Bureau (Derby) Limited and

Mortgage Talk Limited. The exact timing of any clawbacks is

uncertain and the provision was based on the directors' best

estimate, using industry data where available, of the probability

of clawbacks to be made.

12. Deferred Tax Liability

Deferred tax liability is calculated in full on temporary

differences under the liability method using the tax rates enacted.

The reduction in the main rate of corporation tax as set out in

note 6 has been applied to deferred tax balances which are expected

to reverse in the future.

The movement in deferred tax is shown below:

2014 2013

GBP GBP

----------------------------- ------- -------

Deferred tax liability

- opening balance 18,146 3,909

Recognised in the statement

of comprehensive income 6,975 14,237

----------------------------- ------- -------

Deferred tax liability

- closing balance 25,121 18,146

----------------------------- ------- -------

The deferred tax liability is made up as follows:

2014 2013

GBP GBP

-------------------------------- ------- -------

Accelerated capital allowances 25,121 18,146

-------------------------------- ------- -------

Deferred tax liabilities have arisen due to capital allowances

which have been received ahead of the depreciation charged in the

accounts.

13. Share Capital

Issued and fully paid

2014 2013

GBP GBP

--------------------------- ------- -------

A Ordinary shares of GBP1

each - 4,000

B Ordinary shares of GBP1

each - 40,000

C Ordinary shares of GBP1

each - 2,460

D Ordinary shares of GBP1

each - 13,500

E Ordinary shares of GBP1

each - 10,000

Ordinary shares of 0.001p 50,510 -

each

--------------------------- ------- -------

Total share capital 50,510 69,960

--------------------------- ------- -------

The holders of the A Ordinary shares were entitled to a dividend

in preference to any dividend voted to any other class of share and

were redeemable at the option of the company. The A Ordinary shares

were entitled to priority of proceeds upon a winding up or return

of capital and carried voting rights totalling 5%.

The B Ordinary shares were not entitled to dividends other than

at the discretion of the board but not if there were any arrears on

the A dividends or if there remained any A shares to be bought back

after the 1 January 2019. In the event of a winding up or return of

capital the proceeds were payable to the holders of the B shares

after any amounts paid to the A and C shareholders. The B shares

with the E shares carried voting rights totalling 65%.

The C Ordinary shares were not entitled to dividends other than

at the discretion of the board. The C shares were repayable at par

upon a winding up or return of capital and did not carry voting

rights.

The D Ordinary shares were not entitled to dividends other than

at the discretion of the board but not if there were any arrears on

the A dividends or if there remain any A shares to be bought back

after the 1 January 2019. The D shares were repayable at par upon a

winding up or return of capital. The D shares carried voting rights

totalling 30%.

The E Ordinary shares were not entitled to any dividends other

than at the discretion of the board but not if there were any

arrears on the A dividends or if there remained any A shares to be

bought back after the 1 January 2019. In the event of a winding up

or return of capital the proceeds were payable to the holders of

the E shares after any amounts paid to the A shareholders. The E

shares with the B shares carried voting rights totalling 65%.

On 3 January 2014 all 4,000 A Ordinary shares of GBP1 in issue

were purchased by the company and cancelled for a total

consideration of GBP4,521,816. On the same date 4,500 D Ordinary

shares of GBP1 were purchased by the company and cancelled for a

total consideration of GBP4,500.

On 25 June 2014, 1,188 of the E Ordinary shares of GBP1 were

redesignated as B Ordinary shares of GBP1 and the 2,460 C Ordinary

shares of GBP1 were converted to B Ordinary shares of GBP1 at the

rate of 1 B Ordinary share for every 3.56 C Ordinary shares held.

On the same date the remaining 9,000 D Ordinary shares of GBP1 were

purchased by the company and cancelled for a total consideration of

GBP9,000.

On 8 September 2014 217 Ordinary shares of GBP1 each were

purchased by the company and cancelled for a consideration of

GBP217.

Stamp duty of GBP22,635 was incurred on the cancellation of the

shares referred to above.

On 31 October 2014 all remaining shares were redesignated as

Ordinary shares and the 50,474 Ordinary shares of GBP1 each were

redesignated as 50,474,000 Ordinary shares of 0.001p each. All

shares rank pari passu in all respects.

On 4 November 2014, 35,600 Ordinary shares of 0.1 pence were

issued for a total consideration of GBP53,400.

14. Reserves

The following describes the nature and purpose of each reserve

within equity

Reserve Description and purpose

Share premium Amount subscribed for share

capital in excess of nominal

value.

Capital redemption The capital redemption reserve

reserve represents the cancellation

of part of the original share

capital premium of the company

at par value of any shares

Share option repurchased.

reserve

The fair value of equity instruments

granted by the Company in

respect of share based payment

transactions.

Retained earnings All other net gains and losses

and transactions with owners

(e.g. dividends) not recognised

elsewhere.

There is no restriction on the distribution of retained

earnings.

15. Related Party Transactions

On 3 January 2014 all 4,000 A Ordinary shares of GBP1 in issue

were purchased by the company and cancelled for a total

consideration of GBP4,521,816. On the same date 4,500 D Ordinary

shares of GBP1 were purchased by the company and cancelled for a

total consideration of GBP4,500. The recipients of all of this

consideration were directors of the company at this date.

On 25 June 2014 9,000 D Ordinary shares of GBP1 were purchased

by the company and cancelled for a total consideration of GBP9,000.

The recipients of GBP4,500 of this consideration were directors of

the company at this date.

On 8 September 2014 217 Ordinary shares of GBP1 each were

purchased by the company and cancelled for a consideration of

GBP217. The recipient of this consideration was a director of the

company at this date.

At 31 December 2014 included in other receivables there was an

amount of GBP1,000,000 (2013: GBPnil) due to the Group from HBB

Bridging Loans Limited, a company in which S Blunt and D Preece are

directors and shareholders. This loan is secured, by a fixed and

floating charge over the assets of the company and personal

guarantees from certain directors of HBB Bridging Loans Limited. It

accrues interest at a rate of 9.5% per annum above RBS bank base

rate and has no fixed repayment date, although three months' notice

to terminate can be given by either party.

At 31 December 2013 included in other receivables there was an

amount of GBP906,563 due to the Group from House Buyer Bureau

Limited, a company in which S Blunt is a director and shareholder.

This loan was unsecured, accrued interest at a rate of 8.75% per

annum and had no fixed repayment date. The loan was repaid in full

in January 2014.

The Group made purchases of GBP45,283 (2013: GBP46,046) and

sales of GBP2,606 (2013: GBP4,781) to BriefYourMarket Limited. At

31 December 2014 there was an amount of GBP521 due to the Group by

BriefYourMarket Limited (2013: GBP488,926), and GBP4,627 (2013:

GBP1,448) was due to BriefYourMarket Limited, a company in which R

Palmer, P Robinson and P Brodnicki are or were directors and are

shareholders. The amount due at 31 December 2013 of GBP488,926

included in other receivables represented an unsecured loan, which

accrued interest at a rate of 8.75% per annum and had no fixed

repayment date. The loan was repaid in full in January 2014.

At 31 December 2014 there was a loan outstanding by Client Data

Systems Group Limited included in other receivables of GBP347,891

(2013: GBP347,891), a company in which Mortgage Advice Bureau

Limited had a 7% shareholding. This loan is secured by personal

guarantees and on the freehold property owned by one of the

guarantors. The loan attracts interest at a rate of 10% per annum

and has no fixed repayment date. The loan was fully provided for in

the year.

Accounting services were provided to the Group by Robconsult

Limited, a company in which P Robinson is a director and

shareholder. Services supplied were on an arm's length basis and

amounted to GBP9,065 plus VAT during the year (2013: GBP19,078 plus

VAT). At the year-end GBPnil (2013: GBP1,813) was owing to

Robconsult Limited included in trade payables in respect of these

transactions.

During the year the Group made purchases from Astute Insurance

Solutions Limited of GBP5,514 (2013: GBP3,535), a company in which

P Robinson is a shareholder and was a director.

During the year the Group received introducer fees of GBP34,038

(2013: GBP26,267) from Capital Private Finance Limited, an

associated company. At 31 December 2014 there was a balance due

from Capital Private Finance Limited of GBP3,566 (2013: GBP3,410)

included in trade receivables.

At 31 December 2014 there was a loan outstanding by Pinnacle

Surveyors (England & Wales) Limited an associated company, of

GBP15,000 (2013: GBP18,600) included in trade receivables.

At 31 December 2014, Buildstore Limited, an associated company

owed GBP114,000 (2013: GBPnil) included in trade receivables.

During the year the Group received dividends from associated

companies as follow:

2014 2013

GBP GBP

--------------------------------- -------- --------

CO2 Commercial Limited 191,100 117,967

Capital Private Finance Limited 213,150 127,400

--------------------------------- -------- --------

Total 404,250 245,367

--------------------------------- -------- --------

16. Share based payments

The Group operates two equity-settled share based remuneration

schemes for executive directors and certain senior management, one

being an approved scheme, the other unapproved, but with similar

terms. Half of the options are subject to a total shareholder

return ("TSR") performance condition and the remaining half is

subject to an earnings per share ("EPS") performance condition. The

options in both schemes vest as follows:

-- 25% based on performance to 31 March 2017, exercisable between that date and 11 November 2022,

-- 25% based on performance to 31 March 2018, exercisable between that date and 11 November 2022,

-- 25% based on performance to 31 March 2018, exercisable

between 31 March 2019 and 11 November 2022,

-- 25% based on performance to 31 March 2018, exercisable

between 31 March 2020 and 11 November 2022.

Weighted

average

exercise

price 2014

2014 GBP

GBP

---------------------------- ---------- --------------------------

Outstanding at 1 January - -

Granted during the year 1.60 1,325,000

---------------------------- ---------- --------------------------

Outstanding at 31 December 1.60 1,325,000

---------------------------- ---------- --------------------------

Of the total number of options outstanding at 31 December 2014,

none had vested. There were no options exercised during the year.

For the share options outstanding as at 31 December 2014, the

weighted average remaining contractual life is 3.75 years (2013:

not applicable).

The following information is relevant in the determination of

the fair value of options granted during the year under the

equity-settled share based remuneration scheme operated by the

Group.

2014 2013

--------------------------- -------------- -----

Equity settled

Option pricing model - EPS Black-Scholes -

Option pricing model - TSR Stochastic -

Exercise price GBP1.60 -

Expected volatility 30% -

Expected dividend yield 5.4% -

Risk free interest rate 0.81 - 1.58% -

--------------------------- -------------- -----

Expected volatility is a measure of an amount by which the share

price is expected to fluctuate during a period. As the Company has

only recently listed historical data is not available. Management

have therefore used a proxy volatility figure based on the median

volatilities, of dividend paying FTSE AIM 100 companies over each

of the expected terms.

Dividends paid on shares reduce the fair value of an award as

participant does not receive the dividend income on these shares.

For the purpose of these valuations we have used a dividend yield

of 5.4%, being the dividend projected by Canaccord Genuity Limited

for investors at IPO.

The Options offer participants the opportunity to benefit from

increasing per share value without risking the current per share

price. The risk-free rate used is the rate of interest obtainable

from UK government securities as at the date of grant over the

expected terms

The option has vesting period of 2.38, 3.38, 4.48 or 5.39 years

from the date of grant and the calculation or the share based

payment is based on these vesting periods.

The share-based remuneration expense comprises the

equity-settled schemes of GBP10,553 and also a payment of GBP53,400

into a Share Incentive Plan - Free Share Award. The Free Share

award consisted of 35,600 new ordinary shares issued on 4 November

2014 into the Share Incentive Plan for all employees. Every

employee employed by the Group at 1 January 2014 and still employed

by the Group on 2 December 2014 was each awarded 400 free

shares.

The Group did not enter into any share-based payment

transactions with parties other than employees during the current

or previous period.

17. Contingent Liabilities

The group had no contingent liabilities at 31 December 2014 or

31 December 2013.

18. Events after the Reporting Date

Financial Services Compensation Scheme levy

On 19 March 2015 the Financial Services Compensation Scheme

("FSCS") confirmed a GBP20m interim levy for life and pensions

intermediaries in respect of the year to 31 March 2015, driven by

an unexpected increase in the cost of claims relating to bad advice

by certain financial advisers to transfer funds from existing

pension schemes into self-invested personal pensions. MAB does not

provide pension scheme advice, but the levy is made on the class of

intermediaries to which MAB belong. This interim levy will cover

the costs of compensation claims until the next annual levy becomes

available in July 2015.

MAB will contribute GBP89,449 to the interim levy. No provision

has been made in these financial statements for this or any

additional FSCS levies that may be raised during the year ending

31

19 . Distribution of the annual report and accounts to

members

The announcement set out above does not constitute a full

financial statement of the Group's affairs for the year ended 31

December 2014. The Group's auditors have reported on the full

accounts of each year and have accompanied them with an unqualified

report. The accounts have yet to be delivered to the Registrar of

Companies.

The annual report and accounts will be posted to shareholders in

due course, and will be available on our website

(www.investor.mortgageadvicebureau.com) and for inspection by the

public at the Group's head office address: Capital House, Pride

Place, Pride Park, Derby DE24 8QR during normal business hours on

any weekday. Further copies will be available on request.

The Company's annual general meeting will take place on 20 May

2015 at the offices of Canaccord Genuity Limited, 88 Wood Street,

London EC2V 7QR.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JFMRTMBMTMLA

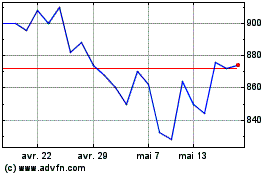

Mortgage Advice Bureau (... (LSE:MAB1)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Mortgage Advice Bureau (... (LSE:MAB1)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024