Mortgage Advice Bureau(Holdings)PLC Pre-close Trading Update (8291T)

23 Juillet 2015 - 8:00AM

UK Regulatory

TIDMMAB1

RNS Number : 8291T

Mortgage Advice Bureau(Holdings)PLC

23 July 2015

23 July 2015

Mortgage Advice Bureau (Holdings) plc

Pre-close Trading Update

Mortgage Advice Bureau (Holdings) plc (the "Company" and

together with its subsidiaries, "Mortgage Advice Bureau", "MAB" or

the "Group"), one of the UK's leading consumer mortgage brands and

networks for mortgage intermediaries, today issues a pre-close

trading update for the six months ended 30 June 2015, ahead of

publishing its interim results announcement on Thursday, 24

September 2015.

MAB has continued its ongoing recruitment of Advisers and

Appointed Representative firms. The average number of Advisers is a

key driver of revenue. The number of Advisers had increased to 722

at 30 June 2015, an increase of 88 since the year end (634 at 31

December 2014). The average number of Advisers in the 12 months to

30 June 2015 was 638, an increase of 109 or 20% on the average

number of Advisers in the 12 months to 30 June 2014 of 529.

The Council of Mortgage Lenders recently published their revised

estimates for gross mortgage lending of GBP209 billion for 2015

(previously GBP222 billion) and GBP230 billion for 2016 (previously

GBP240 billion). MAB welcomes these more realistic figures which

show a small increase for 2015 on 2014 gross mortgage lending of

GBP203 billion and is encouraged by the estimate for 2016 which

reflects the positive trends in the mortgage market.

Activity levels have continued to be high, with Group revenue

continuing its upward trend. In the six months to 30 June 2015, MAB

generated revenue of GBP31 million, representing a 27% increase

over the comparative period in 2014. This strong revenue growth has

allowed MAB to absorb ongoing listing costs and increased FSCS

levies in the six month period to 30 June 2015. Current trading is

in line with the Board's expectations. At 30 June 2015, the Company

had a balance sheet cash position of over GBP11.5 million,

including over GBP6.9 million of unrestricted cash balances.

Peter Brodnicki, CEO of Mortgage Advice Bureau (Holdings) plc,

said:

"I am delighted with the progress we have made post our IPO in

November 2014. MAB continues to be an attractive home for

ambitious, forward thinking and growing Appointed Representative

firms. It is also pleasing to see positive trends in terms of the

mortgage and housing markets, new lenders coming to market, and

intermediary market share, all contributing to MAB's great deal of

optimism for the future."

Enquiries

Mortgage Advice Bureau (Holdings)

plc +44 (0)1332 525007

Peter Brodnicki, Chief Executive

Officer

David Preece, Chief Operating

Officer

Lucy Tilley, Finance Director

Nominated Adviser and Broker:

Canaccord Genuity

Martin Green

Sunil Duggal +44 (0)20 7523

Pippa Underwood 8350

Media Enquiries:

Instinctif Partners +44 (0)20 7866

Nick Woods 7904

Mortgage Advice Bureau Overview

Mortgage Advice Bureau is one

of the UK's leading consumer

mortgage brands and networks

for mortgage intermediaries

with over 120 Appointed Representatives

("ARs") and over 700 Advisers.

The vast majority of its Advisers

are employed or engaged directly

by the Appointed Representatives,

although a small number are

self-employed and engaged directly

by MAB. Many of the ARs trade

under the recognised and respected

Mortgage Advice Bureau brand

through a franchise model operated

by the Group. MAB branded mortgage

shops also form part of the

franchise model. The Group's

network specialises in providing

independent mortgage advice

to customers, as well as advice

on protection and general insurance

products. Mortgage Advice Bureau

is particularly well known in

the estate agency sector with

circa 900 estate agency branches

introducing their customers

to the Group's ARs across the

UK. The Group has also sought

to diversify in other specialist

sectors, including the new build

market through its New Build

Network.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSEWFAEFISESW

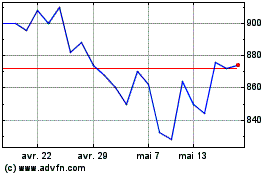

Mortgage Advice Bureau (... (LSE:MAB1)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Mortgage Advice Bureau (... (LSE:MAB1)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024