Mortgage Advice Bureau(Holdings)PLC Pre-Close Trading Update (5169M)

21 Janvier 2016 - 8:00AM

UK Regulatory

TIDMMAB1

RNS Number : 5169M

Mortgage Advice Bureau(Holdings)PLC

21 January 2016

21 January 2016

Mortgage Advice Bureau (Holdings) plc

Pre-close Trading Update

Mortgage Advice Bureau (Holdings) plc (the "Company" and

together with its subsidiaries, "Mortgage Advice Bureau", "MAB" or

the "Group"), one of the UK's leading networks for mortgage

intermediaries, today issues a pre-close trading update for its

financial year ended 31 December 2015, ahead of publishing its

final results announcement on Tuesday, 22 March 2016.

Activity levels have continued to be high, with Group revenue

continuing its upward trend. In the year ended 31 December 2015,

MAB generated revenue of GBP75m, representing a 33% increase over

2014. Following a particularly strong end to the year in terms of

both commission banked and performance from our associated

businesses, the Company's underlying trading performance for the

year ended 31 December 2015 is ahead of the Board's expectations.

At 31 December 2015, the Company had a balance sheet cash position

of GBP14m, including over GBP8m of unrestricted cash balances.

MAB has continued its ongoing recruitment of Advisers and

Appointed Representative firms. The average number of Advisers is a

key driver of revenue. The number of Advisers had increased to 790

at 31 December 2015, an increase of 156 or 25% since last year end

(634 at 31 December 2014). The average number of Advisers in the 12

months to 31 December 2015 was 720, an increase of 139 or 24% on

the average number of Advisers in the 12 months to 31 December 2014

of 581.

The Council of Mortgage Lenders ("CML") recently published their

revised estimates for gross mortgage lending for 2015 and 2016.

Going into 2015, the CML estimate for gross lending was GBP222bn,

which they revised down to GBP209bn in July 2015. The CML now

estimates that gross mortgage lending was GBP214bn in 2015, and

have increased their estimate to GBP237bn (was GBP230bn) for 2016.

These figures suggest that modest growth of circa 5% in mortgage

lending was achieved in 2015, which was lower than their original

expectation of circa 7%. The CML has also estimated gross mortgage

lending of GBP261bn for 2017, and are therefore now projecting that

gross lending growth will be sustained at circa 10% for each of

2016 and 2017.

Peter Brodnicki, CEO of Mortgage Advice Bureau (Holdings) plc,

said:

"I am delighted with our performance in our first full year post

IPO. This is our seventh consecutive year of strong profit growth,

demonstrating our understanding of the market in which we operate

and our focus on building a high quality business with sustainable

profitability."

Enquiries:

Mortgage Advice Bureau (Holdings) plc +44 (0)1332

525007

Peter Brodnicki, Chief Executive Officer

David Preece, Chief Operating Officer

Lucy Tilley, Finance Director

Nominated Adviser and Joint Broker:

Zeus Capital +44 (0)20 3829 5000

Nicholas How

Pippa Underwood

Joint Broker:

Canaccord Genuity +44 (0)20 7523 8350

Roger Lambert

Media Enquiries:

Instinctif Partners +44 (0)20 7866 7904

Mike Davies

Giles Stewart

Louis Supple

Mortgage Advice Bureau Overview

Mortgage Advice Bureau is one of the UK's leading

consumer mortgage brands and networks for mortgage

intermediaries with over 120 Appointed Representatives

("ARs") and over 790 Advisers. The vast majority

of its Advisers are employed or engaged directly

by the Appointed Representatives, although

a small number are self-employed and engaged

directly by MAB. Many of the ARs trade under

the recognised and respected Mortgage Advice

Bureau brand through a franchise model operated

by the Group. MAB branded mortgage shops also

form part of the franchise model. The Group's

network specialises in providing independent

mortgage advice to customers, as well as advice

on protection and general insurance products.

Mortgage Advice Bureau is particularly well

known in the estate agency sector with circa

900 estate agency branches introducing their

customers to the Group's ARs across the UK.

The Group has also sought to diversify in other

specialist sectors, including the new build

market through its New Build Network.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSEDEFSFMSEIF

(END) Dow Jones Newswires

January 21, 2016 02:00 ET (07:00 GMT)

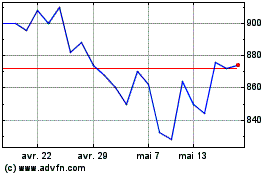

Mortgage Advice Bureau (... (LSE:MAB1)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Mortgage Advice Bureau (... (LSE:MAB1)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024