TIDMMATD

RNS Number : 9055N

Petro Matad Limited

28 September 2023

Petro Matad Limited

('Petro Matad' or the 'Company' or the 'Group')

Interim results for the six months ended 30 June 2023 and

Operational Update

LONDON, 28 September 2023: Petro Matad Limited, the AIM quoted

Mongolian oil company, announces its unaudited interim results for

the six months ended 30 June 2023 and provides an operational

update.

Key Company Updates

-- The Company continues to push the Government to complete the

regulatory formalities to allow completion operations at Heron 1 to

commence. The Provincial Government has been very slow to respond

which is putting the plan to complete the well before winter at

risk.

-- The local district authorities have however indicated that

they are open to the Company operating in parallel with the

slow-moving bureaucracy if Central Government supports the Company

in doing so. This option is now being pursued as a priority.

-- The 2022/23 Mongolian Exploration Tender Round continues with

Petro Matad submitting two applications for new blocks and actively

looking at one more area to determine if a third application is

merited.

-- Our renewable energy JV, SunSteppe Renewable Energy, is

actively pursuing two projects, a battery energy storage facility

and a green hydrogen project as it continues to push into the

Mongolian renewable energy sector. Both projects have the potential

to generate revenue in the near term.

Financial Summary 1H 2023

The Group posted a loss of USD 1.90 million for the 6-month

period ended 30 June 2023, which compares to a loss of USD 1.62

million for the comparable period in 2022. The Company's cash

balance at 30 June 2023 was USD 8.39 million (USD 0.82 million in

cash and USD 7.57 million in Financial Assets - which are term

deposits with a term of 3 months or more), which compares to a cash

balance of USD 6.62 million (USD 3.10 million in cash and USD 3.52

million in Financial Assets) on 30 June 2022.

As previously announced, a successful fundraise totalling USD

6.6 million of gross proceeds was completed in February 2023,

primarily to fund exploration drilling in the Company's operated

Block V and to advance renewable energy opportunities through a

newly established joint venture. Despite the continuing frustration

with the delays in progressing the development of the Heron

discovery it was very encouraging that both the placing and retail

offer were over-subscribed.

Operational Summary 1H 2023

On the Company's Block XX where the Heron discovery is ready for

the first phase of development to begin, the land access issue, and

thus commencement of production operations, remained delayed

through the first half of 2023 subject to registration of the

Exploitation Area as Special Purpose Land in accordance with

Mongolia's Land Law. Significant progress was made to secure the

certification and all ministries in the Mongolian Government

confirmed their support. The documentation for the certification

was completed by end June for submission to Cabinet in July

2023.

In parallel, the Company finalised negotiations with DQE

Drilling on a long-term drilling contract which will be submitted

to industry regulator the Mineral Resources and Petroleum Authority

of Mongolia (MRPAM) for discussion and approval. Commercial

negotiations advanced with PetroChina for the use of its production

infrastructure on neighbouring Block XIX.

On the Company's Block V exploration PSC in central Mongolia,

the Velociraptor 1 well was drilled on a high impact prospect in

June/July with the full support of the local communities. The well

was drilled on schedule and within budget but as has been reported

previously, despite encountering more than 350 metres of good

quality reservoir sections, the well was dry and it has been

plugged and abandoned.

MRPAM's 2022/23 Exploration Tender Round continued through the

first half of the year and the Company has made applications for

two blocks. Negotiations of the contractual terms are ongoing.

In early 2023, Petro Matad completed the formation of a joint

venture company, SunSteppe Renewable Energy (SRE), to develop

renewable energy projects in Mongolia with the goal of reaching

construction ready status on its first projects within 24 months.

Priority projects included a battery energy storage system project

designed to help improve the stability of Mongolia's electricity

grid and so reduce coal consumption for power generation and allow

the dispatch of more renewable energy from projects already in

operation. The joint venture is also pursuing off-grid projects to

supply renewable energy to mining projects where operators are keen

to decarbonise their operations.

Operational Update and look ahead

Block XX: The Cabinet approved the special purpose certification

of the Block XX Exploitation Area in early July, following which

the Company has been pushing hard for the Government to complete

the regulatory formalities and so allow completion operations at

Heron 1 to commence. Whilst good progress has been made with

Central Government agencies, the Tripartite Agreement between the

Land Agency, the Ministry of Mining and Heavy Industry (MMHI) and

the Provincial Government which regulates the management of special

purpose land has yet to be finalized. The Land Agency issued the

draft in July and MMHI quickly responded positively but the

Provincial Government wants to complete herder compensation first

and this further bureaucratic delay may jeopardise the chance to

put Heron 1 on production before the winter operational shut down.

In response, the Company is urging central and provincial

authorities to speed up the remainder of the process and, with the

special purpose certification now approved, Petro Matad has asked

the district authorities to allow Heron 1 operations to go ahead in

parallel with the slow-moving bureaucracy at central and provincial

levels. The district representatives have signaled their

willingness to consider this so long as the Central Government

supports the initiative and MRPAM has confirmed its support and is

preparing a letter to that effect. The Company continues to direct

all its efforts at getting Heron 1 on stream before the oilfield

contractors shut down for the winter.

Block V: The post-well evaluation of Velociraptor 1 is

progressing.

New acreage: In addition to the two applications lodged for new

blocks earlier in the year, Petro Matad is looking at one more area

in the 2022/23 exploration tender round to determine if a third

application is merited.

Renewables: Post the period end, the Company's renewable energy

vehicle, SRE, has made very good progress. In consultation with the

Ministry of Energy, the need for a 50MW/150MWh battery energy

storage facility in central Mongolia was defined. SRE's team has

completed the required feasibility studies and the grid connection

study for the project has been approved by the National Dispatching

Centre. All required documentation has been submitted to and

accepted by the Technology Committee of the Ministry of Energy.

Once the committee's approval is in hand, the License for

Construction of the facility will be requested. SRE expects that

this project can be brought to construction ready status with a

power purchase agreement and tariffs in place by mid-2024. SRE has

access to land already under lease for the facilities within two

kilometres of the tie in point and the footprint is small. The

development costs of this project are low and the project is

expected to offer a double-digit rate of return and could be online

and generating revenue by 2025.

A second project involving a utility scale wind farm to supply

renewable energy to generate green hydrogen for use at a mine

operation in the South Gobi is also progressing with a forecast

timescale similar to SRE's battery storage project. The project is

designed to demonstrate the viability of green hydrogen as a fuel

for use in the mining industry in Mongolia and SRE is very excited

to be involved. This initiative has the strong support of the

Mongolian Government and a memorandum of understanding has been

signed with the Ministry of Energy.

SRE and Petro Matad will determine, once these two projects

reach construction ready status, how best to fund them. Debt

funding for similar projects is already established in Mongolia,

leaving open the possibility that SRE can aspire to stay involved

in the construction phase and establish itself as a key renewable

power producer in the country.

The potential for renewable energy in Mongolia is huge with

solar and wind power set to make up an increasing part of the

country's energy mix in the coming decades. This has been embraced

by lawmakers, with Mongolia ratifying international conventions

including the Paris Agreement. SRE has made good progress so far

and has identified several other projects for consideration. We

look forward to progressing this exciting new venture that has the

potential to generate revenue in the near term.

Mike Buck, CEO of Petro Matad, said:

"The slow pace of the completion of the regulatory process that

will allow us to commence the Heron development is extremely

frustrating. Whilst we are pushing hard with all agencies, and we

have equipment and contractors ready to mobilise, unless the pace

suddenly quickens it is now unlikely that we will get the

Tripartite Agreement signed in time. However, we are working on a

limited access agreement at district level and leaving no stone

unturned to give us the chance to achieve our goal of getting Heron

1 onstream before winter.

Meanwhile, it is pleasing to see that our renewable energy

initiative is moving ahead. The battery storage project has

considerable follow-on potential since the Ministry of Energy has

identified a significant need for energy storage in various

locations throughout the country. The Government is very keen to

see if green hydrogen can be used effectively, whilst the mine

operators are looking to decarbonise their operations and SRE's

project targets these goals whilst also providing the potential for

an excellent commercial return for the developer.

As ever we appreciate our shareholders' patience as we work

through the final stages of getting Heron 1 on stream and in

particular, those shareholders that have been with us on this

journey since the Heron discovery and before. I look forward to

updating you further on our renewable energy initiative and our

other ventures."

Further operational updates will be provided in due course.

- Ends -

Further information please contact:

Petro Matad Limited

+976 7014 1099 / +976 7575

Mike Buck, CEO 1099

Shore Capital (Nominated Adviser and Broker)

Toby Gibbs +44 (0) 20 7408 4090

Zeus (Joint Broker)

Simon Johnson, Louisa Waddell +44 (0) 20 3829 5000

FTI Consulting (Communications

Advisory Firm)

Ben Brewerton

Christopher Laing +44 (0) 20 3727 1000

About Petro Matad

Petro Matad is the parent company of a group focussed on oil

exploration, as well as future development and production in

Mongolia. At the current time, Petro Matad holds 100% working

interest and the operatorship of two Production Sharing Contracts

with the Government of Mongolia. Block XX has an area of 218 square

kilometres in the far eastern part of the country and Block V has

an area of 7,937 square kilometres in the central western part of

the country.

Petro Matad Limited is incorporated in the Isle of Man under

company number 1483V. Its registered office is at Victory House,

Prospect Hill, Douglas, Isle of Man, IM1 1EQ.

STATEMENT OF COMPREHENSIVE INCOME

FOR THE HALF-YEARED 30 JUNE 2023

Consolidated

30 Jun

2023 30 Jun 2022

$'000 $'000

---------------------------------------------------- ----------- ---------------

Continuing Operations

Revenue

Consulting service revenue 100 -

Interest Income 11 20

Other Income 30 -

----------- ---------------

141 20

Expenditure

Consultancy fees (62) (79)

Depreciation and amortisation (89) (73)

Employee benefits expenses (892) (874)

Exploration expenditure (52) (75)

Other expenses (948) (542)

Profit/(Loss) from continuing operations

before income tax (1,902) (1,623)

Income tax expense - -

----------- ---------------

Profit/(Loss) from continuing operations

after income tax (1,902) (1,623)

----------- ---------------

Net Loss (1,902) (1,623)

----------- ---------------

Other comprehensive income/(loss)

Exchange rate differences on translating

foreign operations 5 (82)

----------- ---------------

Other comprehensive income/(loss), net

of income tax 5 (82)

----------- ---------------

(1, 897

Total comprehensive loss ) (1,705)

=========== ===============

Profit/(Loss) attributable to owners

of the parent (1,902) (1,623)

=========== ===============

Total comprehensive income/(loss) attributable (1, 897

to owners of the parent ) (1,705)

=========== ===============

Earnings/(loss) per share (cents per

share)

* Basic and diluted earnings/(loss) per share (0.18) (0.18)

STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

Consolidated

31 Dec 30 Jun

30 Jun 2023 2022 2022

$'000 $'000 $'000

------------------------------- ----------------- -------------- -------------

ASSETS

Current Assets

Cash and cash equivalents 815 1,476 3,096

Trade and other receivables 346 2,607 9

Prepayments 215 138 183

Financial assets 7,572 1,017 3,524

Inventory 218 215 218

----------------- -------------- -------------

Total Current Assets 9,166 5,453 7,030

----------------- -------------- -------------

Non-Current Assets

Exploration and evaluation 15,275 15,275 15,275

Investment in SunSteppe Power

LLC 468 - -

Property, plant and equipment 266 261 90

Right-of-Use asset 38 92 30

----------------- -------------- -------------

Total Non-Current assets 16,047 15,628 15,395

----------------- -------------- -------------

TOTAL ASSETS 25,213 21,081 22,425

----------------- -------------- -------------

LIABILITIES

Current liabilities

Trade and other payables 317 456 392

Lease liability - - -

Total Current Liabilities 317 456 392

----------------- -------------- -------------

TOTAL LIABILITIES 317 456 392

----------------- -------------- -------------

NET ASSETS 24,896 20,625 22,033

================= ============== =============

EQUITY

Issued capital 160,17 7 154,057 154,057

Reserves 61 8 93

Accumulated losses (135,342) (133,440) (132,117)

----------------- -------------- -------------

TOTAL EQUITY 24,896 20,625 22,033

================= ============== =============

CONDENSED CASH FLOW STATEMENT

FOR THE HALF-YEARED 30 JUNE 2023

Consolidated

30 Jun 2023 30 Jun 2022

$'000 $'000

------------------------------------------- ------------ ------------

Cash flows from operating activities

Payments to suppliers and employees 166 (1,509)

Consulting service revenue 100 -

Interest received 11 20

Net cash flows from/(used in) operating

activities 277 (1,489)

------------ ------------

Cash flows from investing activities

Purchase of property, plant and equipment (26) (16)

Purchase of financial assets (6,555) 3,521

Investment in SunSteppe Power LLC (468) -

Proceeds from the disposal of plant

and equipment - -

Net cash flows from/(used in) investing

activities (7,049) 3,505

------------ ------------

Cash flows from financing activities

Proceeds from issue of shares 6,523 -

Capital raising costs (403) -

Payments of lease liability principal (13) -

Net cash flows from/(used in) financing

activities 6,107 -

------------ ------------

Net increase/(decrease) in cash and

cash equivalents (665) 2,016

Net foreign exchange differences 4 (82)

Cash and cash equivalents at beginning

of period 1,476 1,162

------------ ------------

Cash and cash equivalents at end

of period 815 3,096

============ ============

STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEARED 30 JUNE 2023

Consolidated

Attributable to equity holders of the parent

Issued Capital Accumulated Losses Other

$'000 $'000 Reserves $'000 Total

$'000

As at 1 January 2022 154,057 (130,524) 182 23,715

Income/(Loss) for the period - (1,623) - (1,623)

Other comprehensive income - - (82) (82)

----------------- --------------------- ----------------- --------

Total comprehensive income/(loss) for the

period 154,057 (132,147) 100 22,010

Transactions with owners in their capacity as

owners

Issue of share capital - - - -

Cost of capital raising - - 23 23

Share based payments - 30 (30) -

----------------- --------------------- ----------------- --------

As at 30 June 2022 154,057 (132,117) 93 22,033

----------------- --------------------- ----------------- --------

As at 1 January 2023 154,057 (133,440) 8 20,625

Income/(Loss) for the period - (1,902) - (1,902)

Other comprehensive income - - 5 5

----------------- --------------------- ----------------- --------

Total comprehensive income/(loss) for the

period 154,057 (135,342) 13 18,72 8

Transactions with owners in their capacity as

owners

Issue of share capital 6,52 3 - - 6,52 3

Cost of capital raising (40 3 ) - - (40 3 )

Share based payments - - 48 48

As at 30 June 2023 160,17 7 (135,3 4 2) 61 24,896

----------------- --------------------- ----------------- --------

1. CORPORATE INFORMATION

The financial report covers the consolidated entity of Petro

Matad Limited and its controlled entities.

Petro Matad Limited, a company incorporated in the Isle of Man

on 30 August 2007, has six wholly owned subsidiaries: Capcorp

Mongolia LLC and Petro Matad LLC (both incorporated in Mongolia),

Central Asian Petroleum Corporation Limited ("Capcorp"), Petromatad

Invest Limited and Petro Matad Energy Limited (all incorporated in

the Cayman Islands), Petro Matad Energy Limited (incorporated in

the Isle of Man) and Petro Matad Singapore Pte Ltd (incorporated in

Singapore). The Company has also entered into a joint venture with

SunSteppe Power LLC (a renewables energy company focused on

generation of clean energy in Mongolia), which is incorporated in

Mongolia and is a 50% owned subsidiary of Petro Matad LLC.

Petro Matad Limited trades on the Alternative Investment Market

(AIM), which is a sub-market of the London Stock Exchange, under

the symbol MATD. Its major shareholder is Petrovis Matad Inc.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The half-year financial report does not include all of the notes

of the type normally included within the annual financial report

and therefore cannot be expected to provide as full an

understanding of the financial performance, financial position and

financing and investing activities of the consolidated entity as

the full financial report.

The half-year financial report should be read in conjunction

with the annual Financial Report of Petro Matad Limited as at 31

December 2022. The half-year consolidated financial statements have

been prepared using the same accounting policies as used in the

annual financial statements for the year ended 31 December

2022.

It is also recommended that the half-year financial report is

considered together with any public announcements made by Petro

Matad Limited and its controlled entities during the half-year

ended 30 June 2023.

(a) Basis of Preparation

The half-year consolidated financial report is a general purpose

financial report, which has been prepared in accordance with the

requirements of International Financial Reporting Standards

("IFRS") as issued by the International Accounting Standards Board

('IASB'). The half-year financial report has been prepared on a

historical cost basis, except where stated.

The financial report is presented in US dollars and all values

are rounded to the nearest thousand dollars ($'000).

For the purpose of preparing the half-year financial report, the

half-year has been treated as a discrete reporting period.

(b) Basis of consolidation

The consolidated financial statements comprise the financial

statements of the Group as at 31 December each year.

Subsidiaries are entities controlled by the Group. Control

exists when the Group has the power to govern the financial and

operating policies of an entity so as to obtain benefits from its

activities. In assessing control, potential voting rights that

presently are exercisable or convertible are taken into account.

The financial statements of the subsidiaries are included in the

consolidated financial statements from the date that control

commences until the date that control ceases.

The financial statements of subsidiaries are prepared for the

same reporting period as the parent company, using consistent

accounting policies. Adjustments are made to bring into line any

dissimilar accounting policies that may exist.

A change in the ownership interest of a subsidiary that does not

result in a loss of control is accounted for as an equity

transaction.

All intercompany balances and transactions, including unrealised

profits arising from intra-group transactions, have been eliminated

in full. Unrealised losses are eliminated unless costs cannot be

recovered.

3. CONTRIBUTED EQUITY

CONSOLIDATED

30 Jun 31 Dec

2023 2022

$'000 $'000

---------- ----------------

Ordinary shares (i)

1,113,883,601 shares issued and

fully paid.

(31 Dec 2022: 898,761,649) 160,177 154,057

160,177 154,057

============= ==========

(i) Ordinary shares

Full paid ordinary shares carry one vote per share and carry the

right to dividends.

Movement in ordinary shares on issue Number Issue $'000

of Shares Price$

At 1 January 2023 898,761,649 154 ,057

Issue of shares through direct subscriptions

on 10 Feb 2023 1,025

33,333,332 $0.031 5,340

Issue of shares through its broker, Shore

Capital on 10 Feb 2023

2023 94,787,994 $0.030 2,866

Issue of shares through its broker, Zeus

on 10 Feb 2023 67,000,626 $0.030 2,027

Open Offer shares on 10 Feb 2023 20,000,000 $0.030 605

Cost of capital raising (403)

Share based payment -

At 30 June 2023 1,113,883,601 160,177

4. RESERVES

A detailed breakdown of the reserves of the Group is as

follows:

Equity Foreign

Merger benefits currency

reserve reserve translation Total

Consolidated $'000 $'000 $'000 $'000

---------- ---------- ------------- ------

As at 1 July 2022 831 563 (1,301) 93

Currency translation differences - - (67) (67)

Expiry of Options - (3) - (3)

Share based payments - (15) - (15)

---------- ---------- ------------- ------

As at 31 December 2022 831 545 (1,368) 8

Currency translation differences - - 5 5

Share based payments - 48 - 48

As at 30 June 2023 831 593 (1,363) 61

========== ========== ============= ======

EARNINGS/(LOSS) PER SHARE

The following reflects the income and share data used in the

total operations basic and diluted earnings/(loss) per share

computations:

CONSOLIDATED

30 Jun 30 Jun

2023 2022

Basic earnings/(loss) per share

Total basic earnings/(loss) per share (US$

cents per share) (note a) (0.18) (0.18)

---------- --------

Diluted earnings/(loss) per share

Total diluted earnings/(loss) per share (US$

cents per share) (note b) (0.18) (0.18)

---------- --------

(a) Basic earnings/(loss) per share

The profit/(loss) and weighted average number

of ordinary shares used in the calculation

of basic loss per share are as follows:

Net profit/(loss) attributable to ordinary

shareholders (US$'000) (1,902) (1,623)

---------- --------

Weighted average number of ordinary shares

for the purposes of basic earnings per share

('000) 1,067,531 898,762

(b) Diluted earnings/(loss) per share

The profit/(loss) and weighted average number

of ordinary shares used in the calculation

of diluted earnings per share are as follows:

Net profit/(loss) attributable to ordinary

shareholders (US$'000) (1,902) (1,623)

---------- --------

Weighted average number of ordinary shares

for the purposes of basic earnings per share

('000) 1,067,531 898,762

---------- --------

Share Options and Conditional Share Awards could potentially

dilute basic loss per share in the future, however they have been

excluded from the calculation of diluted loss per share because

they are anti-dilutive for both years presented.

5. EVENTS AFTER THE REPORTING DATE

None.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDAEIDFIV

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

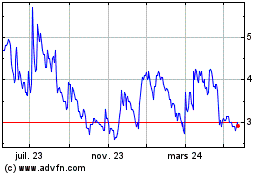

Petro Matad (LSE:MATD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

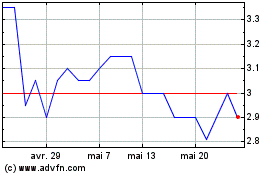

Petro Matad (LSE:MATD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024