TIDMOMIP

RNS Number : 8863S

One Media iP Group PLC

19 July 2022

19 July 2022

One Media iP Group Plc

("One Media", the "Group" or the "Company")

Interim Results for the six months ended 30 April 2022

Strong first half performance with double digit revenue and

earnings growth

One Media iP (AIM: OMIP), the digital media content provider

which specialises in the active exploitation of music and video

intellectual property rights together with copyright infringement

technology, announces its unaudited interim results for the six

months ending 30 April 2022.

Financial Highlights

-- 13% increase in revenue to GBP2.4m (H1 2021: GBP2.1m), driven

by contribution from new acquisitions, organic growth and active

management of portfolio

-- 39% uplift in EBITDA to GBP1.0m (H1 2021: GBP0.7m),

notwithstanding addition of TCAT overhead expenses

-- 20% uplift in net revenue to GBP1.6m (H1 2021: GBP1.3m)

-- EPS up 24% to 0.19p (H1 2021: 0.15p)

-- Net margin increased to 67% (H1 2021: 63%)

-- Cash balances at 30 April 2022 of GBP2.1m (H1 2021: GBP6.4m)

-- Operative NAV per Ordinary Share of 17p*

-- Final dividend of 0.055p per share distributed in June 2022

Operational Highlights

-- Acquisition of the licensor's share of the royalties to the

Orbital Digital Ltd/Rapier Music catalogue of rights c omprising

over 40 branded record labels and several thousand diversified

recordings with proven revenue streams from artists including Joe

Strummer, Chic, Kool & The Gang, Sid Vicious and the Irish

Tenor Trio

-- TCAT business plan progressing, with software operating

across 178 territories and trials with three major record labels

expected to translate into long term contracts

Outlook

-- Ongoing supportive market backdrop with music industry growth

projections continuing to accelerate and increasing opportunities

to generate royalty income through digital platforms

-- Positive industry developments, including Copyright Royalty

Board ruling in July 2022 increasing headline royalty rate in the

US from 10.5% to 15.1%

Michael Infante, CEO said: "We are very pleased with the results

delivered for the first half of this year, building on the positive

progress we made in 2021. Our core strategic focus on diversified

catalogues of songs that have proven their value over many years

continues to deliver, with our specialist teams helping to maximise

their revenue potential alongside our other investments. Against a

strengthening industry backdrop, our expertise in driving royalty

income from digital recordings and disciplined approach to

acquisitions have enabled us to deliver significant growth that

positions us well for the remainder of the year."

* Operative NAV is calculated by using the IFRS NAV, adjusting

for the revaluation of catalogues assets to fair value and then

adding back the catalogue amortisation.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation. The person who arranged the

release of this information is Michael Infante, Chief Executive

Officer of the Company.

For further information, please contact:

One Media IP Group Plc

Michael Infante Chief Executive

Tel: +44 (0)175 378

5500

Claire Blunt Chairman

Tel: +44 (0)175 378

5501

Cairn Financial Advisers LLP Nominated Adviser

Liam Murray / Jo Turner / Ludovico Tel: +44 (0)20 7213

Lazzaretti 0880

Cenkos Securities plc Broker

Max Gould/Giles Balleny Corporate Tel: +44 (0)20 7397

Finance) 8900

Michael Johnson (Sales)

Claire Turvey, Fourth Pillar Financial PR

Tel: +44 (0)7850 548

198

About One Media iP Group Plc

One Media is a digital music rights acquirer, publisher and

distributor with a catalogue independently valued at GBP34.8

million (as at April 2022). The Group specialises in purchasing and

monetising intellectual property rights with proven, repeat income

streams. One Media adds value to its content by maximising its

availability in over 600 digital stores globally, including Apple

Music, YouTube, Amazon and Spotify.

One Media's music is also widely used for synchronisation in

film and TV whilst its video content is primarily viewed on YouTube

where One Media operates over 20 YouTube channels as a certified

partner. Additionally its copyright infringement and digital music

audit tool software TCAT is used by major record labels and the

world leading digital international distributor. Men & Motors,

the Company's branded car channel, is now available via YouTube

www.youtube.com/channel/UCNLiybn_9jgQaV0NZlSRwCg

One Media is listed on the AIM Market of the London Stock

Exchange under the ticker 'OMIP'.

For further information, please visit www.omip.co.uk and

www.harmonyip.com/

Chairman's Statement

Financial performance

In the first half of 2022, the Company has continued to build on

the momentum created during the prior year enabling the delivery of

another set of positive results from our diversified portfolio of

music and video intellectual property rights, which includes

investments in Take That's 'A Million Love Songs'; Culture Club's

'Karma Chameleon'; as well as music performed by artists such as

Kid Creole and the Coconuts, Joe Strummer, Sex Pistols, Kool &

the Gang and Chic.

Revenues have increased by 13% to GBP2.4 million (H1 2021:

GBP2.1 million), driven by contributions from new acquisitions,

organic growth and active management of portfolio. EBITDA grew by

an impressive 39% to GBP1.0 million (H1 2021: GBP0.7m),

notwithstanding the new inclusion of TCAT overhead expenses in this

period. As a result, Earnings Per Share increased by 24% to

0.19p.

A 20% uplift in net revenue was delivered and net margin was

increased to 67% (H1 2021: 63%) reflecting the relatively low

overall cost base and ongoing efforts of the specialist team to

sweat the portfolio and maximise its income potential. The

Operative NAV per Ordinary Share was 17p.

One Media trades in a global market and is therefore required to

convert its digital income from the many territories' currencies in

which it operates on a monthly basis. All of these local currencies

are converted to US Dollars which are ultimately reported in

Sterling. With approximately 89% of the Company's revenues

generated in US dollars, management carefully monitors exchange

rates to ensure the Company can seek to take advantage of the best

exchange rates available. The average monthly rate for the first

half of 2022 moved to 1.3325 from 1.3678 in the same period last

year.

Following a positive performance in 2021, on 22 April 2022 the

Company declared a final dividend of 0.055p per ordinary share

which was distributed to shareholders in June 2022.

When we released our full year results in April, we also

announced that our content catalogue had been independently valued

at GBP34.8 million, which reflects an implied value of 16.1p per

share and the fair value of the portfolio that has been carefully

assembled over the last 16 years. With the results the Company has

announced today, we are well positioned for the year ahead and

continue to work hard on behalf of our shareholders to maintain our

positive performance and deliver returns.

Operations and investments

During the period the Company acquired the licensor's share of

the royalties to the Orbital Digital Ltd/Rapier Music catalogue of

rights comprising over 40 branded record labels and several

thousand diversified recordings with proven revenue streams from

artists including Joe Strummer, Chic, Kool & The Gang, Sid

Vicious and the Irish Tenor Trio. The investment is fully meeting

performance expectations and brings further diversification and

additional income to our portfolio at a multiple that is in line

with our acquisition strategy.

The transaction was undertaken through One Media's Harmony IP

asset release initiative which enables rights owners to release

portions of equity from their music, providing greater flexibility

to access future earnings while retaining majority ownership of

their intellectual property.

The acquisition opportunity resulted from an existing long-term

relationship that management had with the vendor, reflecting the

importance of the team's long and respected track record in the

music industry, which is built on relationships. It continues to

exploit these carefully held networks and is actively seeking new

opportunities that meet our investment criteria as we look to

deploy our cash into proven income streams.

In August 2020 the Company raised GBP5.6 million of equity (net

of costs), of which GBP5.4 million has been invested into the

acquisition of eight portfolios of rights. These transactions have

been completed at an attractive blended multiple of 9x with an 11%

yield.

Alongside our core focus on royalties, the business plan for the

Company's proprietary anti-privacy software platform investment,

TCAT Ltd ("TCAT") continues to progress in line with expectations.

Established in 2016 to automate the difficult and time-consuming

task of detecting copyright infringement, TCAT operates across the

major digital stores, including Apple, Spotify, Amazon Deezer and

YouTube, and is currently being deployed across 178

territories.

The TCAT team are working with three major record labels

globally with the expectation of entering into long term

contracts.

A full board has been appointed, including CEO Nick Stewart, and

TCAT now employs a team of 10 people plus two consultants. Nick

Stewart is deploying his extensive experience of the global music

market, royalty collection and music piracy to build the profile of

TCAT and its ground-breaking A.I. software, which monitors millions

of music tracks across the world, saving rights holders millions in

unpaid or fraudulently claimed royalties.

The One Media Board together with the newly formed TCAT board

has been active in seeking funding directly into the TCAT

subsidiary. Currently that process is undergoing due diligence and

we will report to the market when it is completed.

Market backdrop and outlook

The outlook for the music industry grows ever stronger, with

technology advancements and positive developments creating a fairer

and more efficient system for all of us who depend on royalty

streams for income.

In June 2022, Goldman Sachs issued its 'Music in the Air' report

into the global music industry, reiterating its confidence that

music streaming will remain resilient in an economic downturn. It

once again raised its global revenue forecasts, projecting a 24%

increase in 2022 revenues across all sectors followed by 8% growth

in 2023, driven by higher streaming revenues, revenues from

emerging platforms and physical sales.

In July 2022, a legal ruling in the US paved the way for an

increase in the headline royalty rate paid from streaming services

in the US from 10.5% to 15.1%, which has been backdated to 2018.

The new rates imposed by the Copyright Royalty Board (CRB) is the

largest rate increase in the history of the CRB.

With the headline rate change, the streaming services are about

to pay out arrears to publishers and songwriters/composers to cover

the now official 15.1% CRB (2022) rate for the five years covered

by the ruling on a prorated basis. The CRB has commenced

negotiations for the next five-year period (2023 to 2027) on behalf

of the composers and publishers and want to see a mechanical

streaming royalty rate of 20%. The Company does not expect this to

be a material payment.

Not only will this ruling have a positive impact on the

Company's revenues, but it sets another welcome marker for the

industry generally, in recognising the value of music and its

creators as well as underlining the robust investment potential of

music composition and publishing rights.

Against this positive backdrop we'd finally like to thank our

shareholders for their ongoing support, and also pay tribute to the

One Media team for their efforts on your behalf.

Claire Blunt

Chairman of One Media

Unaudited Consolidated Statement of Comprehensive Income

For the six months ended 30 April 2022

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended 31 October

30 April 30 April 2021

2022 2021

GBP GBP GBP

Revenue 2,381,784 2,102,848 4,389,581

Distribution charges (526,466) (529,501) (1,107,127)

Royalty costs (232,036) (212,125) (435,386)

Other costs (26,155) (31,436) (66,542)

_________ _________ _________

Net revenue 1,597,127 1,329,786 2,780,526

Amortisation of catalogues (378,251) (256,998) (599,308)

Administration expenses (611,342) (555,026) (1,040,706)

FOREX gains/(losses) 18,134 (35,564) (64,554)

_________ _________ _________

Operating profit 625,668 482,198 1,075,958

Share based payments (30,228) (30,125) (77,178)

Finance costs (90,205) (92,956) (184,045)

Finance income - - 1

_________ _________ _________

Profit from continuing

activities 505,235 359,117 814,736

Asset disposal - - (93,939)

Profit on ordinary

activities before

taxation 505,235 359,117 720,797

Tax expense (90,031) (61,780) (176,222)

_________ _________ _________

Profit for period

attributable to equity

shareholders and total

comprehensive income

for the year 415,204 297,337 544,575

========= ========= =========

Basic earnings per

share 0.19p 0.15p 0.24p

========= ========= =========

Unaudited Consolidated Statement of Financial Position

As at 30 April 2022

Unaudited Unaudited Audited

30 April 30 April 31 October

2022 2021 2021

GBP GBP GBP

Assets

Non-current assets

Intangible assets 14,562,132 9,403,844 13,484,077

Property, plant

and equipment 23,486 86,849 44,007

_________ _________ _________

14,585,618 9,490,693 13,528,084

_________ _________ _________

Current assets

Trade and other

receivables 1,443,787 1,385,946 1,481,077

Cash and cash equivalents 2,138,294 6,373,525 2,565,813

_________ _________ _________

Total current assets 3,582,081 7,759,471 4,046,890

_________ _________ _________

Total assets 18,167,699 17,250,164 17,574,974

========= ========= =========

Liabilities

Current liabilities

Trade and other

payables 1,055,961 821,704 937,622

Deferred tax 137,512 117,356 132,830

_________ _________ _________

1,193,473 939,060 1,070,452

Borrowings 1,769,987 1,724,243 1,745,735

_________ _________ _________

Total liabilities 2,963,460 2,663,303 2,816,187

_________ _________ _________

Equity

Called up share

capital 1,112,231 1,112,231 1,112,231

Share redemption

reserve 239,546 239,546 239,546

Share premium account 9,484,577 9,484,577 9,484,577

Share based payment

reserve 534,627 457,346 504,399

Retained earnings 3,833,258 3,293,161 3,418,054

_________ _________ _________

Total equity 15,204,239 14,586,861 14,758,807

_________ _________ _________

_________ _________ _________

Total equity and

liabilities 18,167,699 17,250,164 17,574,974

========= ========= =========

Unaudited Consolidated Statement of Changes in Equity

For the six months ended 30 April 2022

Share Share Share Share Retained Total

capital redemption premium based earnings equity

reserve payment

reserve

GBP GBP GBP GBP GBP GBP

At 1 November

2020 1,109,731 239,546 9,473,327 427,221 2,995,824 14,245,649

Proceeds

from the

issue of

new shares 2,500 - 11,250 - - 13,750

Profit for

the six months

to

30 April

2021 - - - - 297,337 297,337

Share based

payment charge - - - 30,125 - 30,125

________ _________ _________ ________ _________ _________

At 30 April

2021 1,112,231 239,546 9,484,577 457,346 3,293,161 14,586,861

Proceeds

from the

issue of

new shares - - - - - -

Dividends

paid - - - - (122,345) (122,345)

Profit for

the six months

to

31 October

2021 - - - - 247,238 247,238

Share based

payment charge - - - 47,053 - 47,053

________ _________ _________ ________ _________ _________

At 31 October

2021 1,112,231 239,546 9,484,577 504,399 3,418,054 14,758,807

Proceeds

from the

issue of

new shares - - - - - -

Profit for

the six months

to

30 April

2021 - - - - 415,204 415,204

Share based

payment charge - - - 30,228 - 30,228

________ _________ _________ ________ _________ _________

Balance at

30 April

2022 1,112,231 239,546 9,484,577 534,627 3,833,258 15,204,239

======== ========= ========= ======== ========= ========

Unaudited Consolidated Cash Flow Statement

For the six months ended 30 April 2022

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

30 April 30 April 31 October

2022 2021 2021

GBP GBP GBP

Cash flows from operating

activities

Profit before taxation 529,487 386,118 720,798

Amortisation 384,388 240,411 599,169

Depreciation 24,840 7,552 50,509

Share based payments 30,228 30,125 77,178

Finance income - - (1)

Finance costs 90,205 92,455 184,045

(Increase)/decrease in

receivables 3,703 (252,240) (313,783)

(Decrease)/increase in

payables 30,031 (94,780) (69,144)

Corporation tax paid - - (72,063)

_________ _________ _________

Net cash inflow from

operating activities 1,092,882 409,641 1,176,708

_________ _________ _________

Cash flows from investing

activities

Investment in copyrights

/ licenses (1,050,897) (303,733) (4,356,814)

Net TCAT Investment (411,548) (456,362) (842,273)

Investment in fixed assets (4,319) (3,141) (3,257)

Finance income - - 1

_________ _________ _________

Net cash used in investing

activities (1,466,764) (763,236) (5,202,343)

_________ _________ _________

Cash flow from financing

activities

Proceeds from the issue

of new shares - 13,750 13,750

Finance cost paid (53,637) (53,054) (114,873)

Loan notes - - 48,492

Dividend paid - - (122,345)

_________ _________ _________

Net cash inflow from

financing activities (53,637) (39,304) (174,976)

_________ _________ _________

Net change in cash and

cash equivalents (427,519) (392,899) (4,200,611)

Cash at the beginning

of the period 2,565,813 6,766,424 6,766,424

_________ _________ _________

Cash at end of the period 2,138,294 6,373,524 2,565,813

========= ========= =========

Notes to the Interim Report

For the six months ended 30 April 2022

1. Nature of operations and general information

One Media iP Group Plc and its subsidiaries' ("the Group")

principal activities are the acquisition and licensing of

audio-visual intellectual copyrights and publishing for

distribution through the digital medium and to a lesser extent

through traditional media outlets.

One Media iP Group Plc is the Group's ultimate parent company

incorporated under the Companies Act in England and Wales. The

address of One Media iP Group Plc registered office is 623 East

Props Building, Goldfinger Avenue, Pinewood Road, Iver Heath,

Buckinghamshire, SL0 0NH.

The financial information set out in this Interim Report does

not constitute statutory accounts. The Group's statutory financial

statements for the year ended 31 October 2021 are available from

the Group's website. The auditor's report on those financial

statements was unqualified.

2. Accounting Policies

Basis of Preparation

These interim consolidated financial statements are for the six

months ended 30 April 2022. They have been prepared following the

recognition and measurement principles of IFRS. They do not include

all the information required for full annual statements, and should

be read in conjunction with the consolidated financial statements

of the Group for the year ended 31 October 2021.

This unaudited interim statement has not been subject to a

review by the Group's auditors James Cowper Kreston.

Comparatives

The comparative periods represent the unaudited results for the

six months period ended 30 April 2022 and the audited twelve months

figures for the year ended 31 October 2021.

3. Earnings per share

The calculation of the earnings per share is based on the profit

for the financial period divided by the weighted average number of

shares in issue during the period.

Unaudited Unaudited Audited

Basic earnings 6 months ended 6 months ended 12 months

per share 30 April 2022 30 April 2021 ended

31 October

2021

Profit for period

attributable to

equity shareholders 415,204 297,337 544,575

Weighted average

number of shares

in issue at period

end 222,446,249 192,069,005 222,446,249

_________ _________ _________

Basic earnings

per share 0.19p 0.15p 0.24p

========= ========= =========

The diluted earnings per share would be lower than the basic

profit per share as the exercise of warrants and options would be

dilutive.

4. Share capital

Unaudited Unaudited Audited

30 April 30 April 31 October

2022 2021 2021

Group and company GBP GBP GBP

Authorised:

200,000,000 ordinary shares

of 0.5p each 1,000,000 1,000,000 1,000,000

========== ========== ==========

Issued:

Ordinary shares of 0.5p

each

222,446,249 ordinary shares

of 0.5p each 1,112,231 1,112,231 1,112,231

========== ========== ==========

5. Interim statement

Copies of this statement are available from the Group's

registered Office at:

623 East Props Building, Goldfinger Avenue, Pinewood Road, Iver

Heath, Buckinghamshire, SL0 0NH.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identified by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements reflect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSTDSITLIF

(END) Dow Jones Newswires

July 19, 2022 02:00 ET (06:00 GMT)

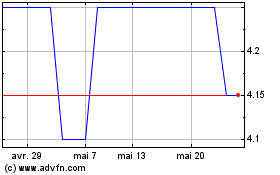

One Media Ip (LSE:OMIP)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

One Media Ip (LSE:OMIP)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024