TIDMOPG

RNS Number : 2126D

OPG Power Ventures plc

20 June 2023

20 June 2023

OPG Power Ventures plc

("OPG", the "Group" or the "Company")

Trading update for the year ended 31 March 2023

OPG Power Ventures plc (AIM: OPG), the developer and operator of

power generation plants in India, announces a trading update in

respect of the full year ended 31 March 2023 ("FY23").

Summary

For the year ended 31 March 2023 and to date:

-- Total generation in FY23 was 1.5 billion units (FY22: 1.8

billion units). The reduction in generation was primarily due to

high coal prices and the Company's strategy to focus on profitable

operations, resulting in revenues, EBITDA and PAT in line with FY23

market expectations.

-- Plant Load Factor ("PLF") was 42.1 per cent in FY23, compared to 51.5 per cent in FY22.

-- Average tariff for FY23 was Rs. 8.71 (FY22: Rs. 5.82) per kwh.

-- During FY23, the Company repaid debt totalling Rs.1.72

billion (equivalent to GBP17 million based on an exchange rate of

101.44/GBP1).

-- PLF for April 2023 was 74.6 per cent (March 2023 PLF: was 70.7 per cent).

-- Non-Convertible Debentures (NCDs) totalling Rs. 2 billion were repaid in May 2023

Indian Economy Update

-- India's electricity demand in the financial year 2022-23

increased by 9.5 per cent compared to the previous financial year,

a record high in the past decade, per data released by the Central

Electricity Authority (CEA).

-- In May 2023, India's daily peak power demand reached 221

gigawatts (GW) - the highest daily peak ever in the history of the

country.

-- To de-risk the country from international coal price

increases and to make the country self- sufficient in terms of

energy security, India has increased coal production in FY23 by

14.62 per cent.

-- Over the next two years, it is expected that there will be

major capacity expansion along with commercial coal mining. The

country has set the target of producing one billion tons and is

expected to become a net exporter of thermal coal by FY

2025-26.

-- The Russia and Ukraine conflict, as well as the lasting

effects of the COVID-19 pandemic, have impacted economic growth

across the globe. Demand dropped while sanctions on Russia led to

unprecedented increases in gas & power prices, fuelling

inflation which remains a concern. In addition, central banks

raised interest rates, and this further eroded demand.

-- The International Monetary Fund "IMF" has reduced its growth

projections for the global economy in 2023, predicting a growth

rate of 2.8 per cent and 3 per cent in 2024, both down 10 basis

points from its January 2023 forecasts.

-- The IMF has revised its forecast for India's GDP growth

forecast to 5.9 per cent for FY 2023-24 and 6.3 per cent for FY

2024-25.

-- As per the latest World Economic Outlook figures released by

the IMF, India remains the fastest-growing economy in the world,

despite a drop in growth rate projections from 6.8 per cent in 2022

to 5.9 per cent in 2023.

-- The Indian economy has shown resilience amidst these external

headwinds and a weakening global economic scenario. For the last

few years, the Indian government has focused on infrastructure

development and its capital expenditure plan continues to reflect

this. Capex spending by the Government has steadily increased in

the last few years and is expected to be the highest to date in

FY24.

-- The private sector in India has also seen a capex revival

with credit growth being at a four-year high, as the balance sheets

of both banks and corporates remain healthy.

N. Kumar, Non Executive Chairman commented

" I congratulate the team in successfully navigating FY23 in the

wake of high coal prices. The Company zeroed in on profitable

operations and delivered an exceptional performance and cash

generation in what may be termed as 'a difficult year'. With the

softening of global coal demand and increase in coal production,

most of the global benchmarks are now moving closer to their long

term averages signifying return to rationality in the markets.

OPG has repaid its entire project debt in FY23 as well as the

NCDs availed in June 2020 .

With revenues , EBITDA and PAT in line with FY23 market

expectations , the Company can now focus upon enhancing shareholder

value."

For further information, please visit www.opgpower.com or

contact:

OPG Power Ventures PLC Via Tavistock

below

Ajit Pratap Singh

Cenkos Securities (Nominated Adviser +44 (0) 20 7397

& Broker) 8900

Stephen Keys/Katy Birkin

+44 (0) 20 7920

Tavistock (Financial PR) 3150

Simon Hudson / Nick Elwes

Enhancing shareholders' value

In 2018, the Board took the conscious decision to focus on

profitable, long-life assets in Chennai, and to prioritise

deleveraging as a method to grow shareholders' equity. With

reduction in debt, significant portion of free cash flows will be

earmarked to enhance shareholders' value and to capitalize on

future growth opportunities.

As at 31 March 2023, total borrowings were GBP32.54 million

comprising term loans and NCDs of GBP30.6 million and working

capital loans of GBP1.9 million. This represents a 25% reduction in

gross debt from GBP43.3 million at 31 March 2022.

Further , the Company has repaid NCDs totaling Rs. 2 billion in

May 2023. The repayment has been financed by a mix of internal

accruals and new debt comprising both, term loans and a new tranche

of NCDs. This refinancing pares down the debt as well as elongates

the tenure to five years thereby providing more flexibility in

managing cash flows.

Group Operations Summary

FY22 FY23

Total Generation (in billion

units) 1.8 1.5

------ ------

Average PLF 51.5% 42.1%

------ ------

Average Tariff Realised 5.82 8.71

------ ------

-- Total Generation in FY23, at the Chennai plant was 1.5

billion units. The generation was lower due to the Company's

increased focus on profitable operations in light of substantial

increases in international coal prices.

-- The average tariff realised in FY23 improved by 49.7 per cent

as the Company focused solely on supply of electricity under

profitable contracts.

Coal Prices

-- Coal prices surged sharply to over US$150/Ton in Oct'21 and

remained at higher levels largely due to Russia's invasion of

Ukraine, the ensuing gas crisis in Europe and higher demand from

both China and India. The prices have come down to below US$75/Ton

and are expected to soften further.

-- The Company is consciously focusing on increased consumption

of domestic coal and participating in various auctions to mitigate

the increase in the weighted average landed price of coal. The

weighted average landed price of coal was Rs. 7,811/Ton in FY23 as

compared to Rs. 5,461/Ton for FY22.

Power Sector

-- India's per capita electric consumption in FY22 was 1,255 kWh

which is one third of the global average. Significant scope of

growth exists in energy consumption and generation in the country

and thermal power will remain the backbone of this growth.

-- India's energy demand in the financial year 2022-23 increased

by 9.5 per cent compared to the previous financial year due to the

rebound of economic activities after COVID-19 lockdowns eased,

leading to increased consumption. The Central Electricity Authority

(CEA) has projected a peak power demand of 335 GW and 2.28 trillion

units of electricity for the year 2029-30. The projected peak

demand for FY30 is 45 per cent higher than the about 230 GW

estimate for the current financial year.

-- An additional 16,204.5 MW of coal-based power will be

required to meet the electricity demand in 2029-30 in addition to

the 26,900 MW currently under construction.

Environmental, Social and Governance ("ESG") strategy

development

OPG continues to develop its ESG strategy which, among other

matters, will include objectives to reduce its carbon footprint. As

part of this strategy, the Company is evaluating various options to

increase its plant efficiency and to establish joint ventures to

roll out various energy transition technologies including fuel

substitution for power generation. These initiatives will ensure

that OPG delivers year-on-year improvements to reach the Company's

emissions reduction targets in the medium and longer-term and

should generate attractive returns for shareholders.

During FY23, Company has replaced burners in two units to meet

the environmental norms in terms of controlling Nitrogen Oxide

(NOX) emissions, well ahead of the required deadline announced by

the Government of India.

Outlook

Despite the disruption caused by high coal prices and as a

result of our strategy of maximising operational performance and

deleveraging, we expect that the Company will meet FY23 market

expectations for revenue, EBITDA and PAT.

Profitable generation and continued leveraging of opportunities

have significantly strengthened the Company's balance sheet and its

liquidity position.

Notwithstanding the volatility in coal prices, the Company's

medium-term and long-term fundamentals remain unchanged with strong

cash flows and a reduction in debt enabling the achievement of the

Company's long-term profitable business model and sustainable

returns to shareholders.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCQKLFFXQLLBBQ

(END) Dow Jones Newswires

June 20, 2023 02:00 ET (06:00 GMT)

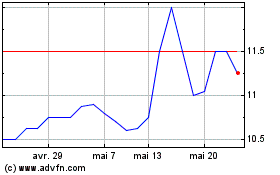

Opg Power Ventures (LSE:OPG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Opg Power Ventures (LSE:OPG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024