TIDMPGHZ TIDMPCGH

RNS Number : 2860J

PCGH ZDP PLC

12 December 2022

PCGH ZDP PLC

Legal Entity Identifier: 5493004C3YRF9HEVQI09

Annual Report and Financial Statements

for the year ended 30 September 2022

COMPANY INFORMATION

PCGH ZDP plc (the 'Company') is a public limited company

incorporated and domiciled in England and Wales on 30 March 2017,

with registration number 10700107. The principal legislation under

which the Company operates is the Companies Act 2006. The Company

has a standard listing on the London Stock Exchange.

KEY CONTACTS

Board of Directors Registered Office

Lisa Arnold (Chair) 16 Palace Street

Neal Ransome London

Andrew Fleming SW1E 5JD

Jeremy Whitley

Investment Manager and AIFM Company Secretary

Polar Capital LLP Polar Capital Secretarial Services

16 Palace Street Limited

London 16 Palace Street

SW1E 5JD London

SW1E 5JD

Independent Auditors Depositary

PricewaterhouseCoopers LLP HSBC Bank plc

7 More London Riverside 8 Canada Square

London London

SE1 2RT E14 5HQ

Legal Adviser

Registrar Herbert Smith Freehills LLP

Equiniti Limited Exchange House, Primrose Street

Aspect House, Spencer Road London

Lancing, West Sussex EC2A 2EG

BN99 6DA

Company identification codes: TICKER: PGHZ LEI: 5493004C3YRF9HEVQI09

SEDOL: BDHXP96 ISIN: GB00BDHXP963

STRATEGIC REPORT for the year ended 30 September 2022

The Strategic Report has been prepared under s414A of the

Companies Act 2006 (Strategic Report and Directors' Report)

Regulations 2013 and the Companies Act 2006 (the 'Act'). Its

purpose is to inform members of the Company and help them assess

how the directors have performed their statutory duties listed in

s171-177 of the Companies Act 2006. Under s172, Directors have a

duty to promote the success of the Company for the benefit of its

members (our Shareholders) as a whole and in doing so have regard

to the consequences of any decision in the long term, as well as

having regard to the Company's stakeholders amongst other

considerations. The fulfilment of this duty ensures decisions are

made in a responsible and sustainable way for Shareholders.

The Compan y is a financing vehicle with neither employees nor

premises. The Board seeks to understand the needs and priorities of

the Company's stakeholders and these are taken into account during

all of its discussions and as part of its decision-making. The

Board considers its key stakeholders to be its shareholders, its

Investment Manager and its third-party service providers while also

taking into account the Company's responsibilities to regulators

and the wider community.

This Strategic Report is intended to provide information about

the Company's strategy and business, its performance and the

results for the year under review. The Company is a public limited

company with the sole purpose of issuing Zero Dividend Preference

('ZDP') shares. The Company is managed by a board of non-executive

directors and the day-to-day operations of the Company are

delegated to the Investment Manager, Polar Capital LLP. The

Company's entire ordinary share capital is owned by Polar Capital

Global Healthcare Trust plc (the 'parent' or 'PCGH') while the

Company's ZDP shares are listed on the London Stock Exchange. PCGH

and the Company form the Group (the 'Group').

Chair's Statement

My report on the activities of the Group for the year ended 30

September 2022 is provided in the Annual Report of the parent

company which can be found on both the National Storage Mechanism

('NSM') at https://data.fca.org.uk/#/nsm/nationalstoragemechanism

and the following website

www.polarcapitalglobalhealthcaretrust.com

Performance and Divi dends

The sole purpose of the Company is to issue ZDP shares and to

advance the proceeds of the issue by way of a loan to PCGH. The

sole objective of the Company is to repay the ZDP shareholders on

19 June 2024 (the 'ZDP Repayment Date') their entitlement of 122.99

pence per ZDP share (the 'Final Capital Entitlement') and the

performance of the Company in meeting this objective is directly

linked to the performance of the portfolio of the parent company.

The Directors do not recommend the payment of a dividend.

Key Performance Indicators

Due to the limited nature of the Company's activities, the Board

does not consider it necessary to assess the performance of its

activities using key performance indicators.

Loan Agreement

The Company and PCGH entered into an intra-group loan agreement

(the 'Agreement') on 20 June 2017. Under the Agreement the gross

initial ZDP placing proceeds were lent to PCGH. The Agreement

provides that interest will accrue daily at an annual rate of 2.5%

compounded annually on each anniversary of the ZDP shares admission

to listing and will be rolled up and paid to the Company along with

any repayment of the principal amount on a date falling 2 business

days before the ZDP Repayment Date. PCGH has further provided an

Undertaking (the 'Undertaking') to provide additional funding in

the event of a shortfall between the final capital entitlement of

122.99 pence per ZDP share and the aggregate principal amount and

interest due pursuant to the Agreement at that date. Further

information is provided in the notes to the Financial

Statements.

The Board and Diversity

The Board has considered the targets published within the FCA

policy, Diversity and Inclusion on Company Boards and

Executive Committees (PS22/3), issued in April 2022. For

financial years commencing on or after 1 April 2022, the policy

requires under new Listing Rules 9.8.6R(9) and 14.3.33R(1), all UK

listed companies, on a comply or explain

basis, to meet the following targets:

-- At least 40% of the Board are women;

-- At least one senior board position is held by a woman;

-- At least one member of the Board is from a minority ethnic background.

The Company has no employees and the Board is comprised of one

female and three male Independent non-executive Directors. The

Board is aware that, with the exception of the requirement to have

a senior woman on the Board, Lisa Arnold has been the Chair of the

Company since February 2020, the above targets are not currently

met. The composition of the Board is considered regularly to

determine whether the needs of the Company in terms of experience

and areas of expertise are met by the directors in office. While

the Board agree that a company can benefit from greater diversity,

at present, it has not been deemed necessary to make a change to

the composition of the Board.

Management and Service Providers

As the Company's only purpose is to issue ZDP Shares, all of the

day-to-day operational, administration and other activities are

outsourced to third party service providers. The key service

providers are listed on page 2.

Corporate and Social Responsibility and Modern Slavery

As a financing vehicle, the Company has no direct social,

community, employee or environmental responsibilities. The Company

has no direct investments as its sole purpose is to provide

financing to the Group through the issue of ZDP shares . As the

Company does not make any investments it does not subscribe to a

socially responsible investment policy and does not exercise any

voting powers. The Compan y does no t provide goods or services i n

the normal course of business and does no t ha ve an y customers.

Acco r d i ng ly , it is con si d ere d t ha t the Compan y is no t

re qu ire d t o mak e an y statements in relation to modern

slavery, human trafficking or human rights .

The Environment and Greenhouse Gas Emissions

The Compan y ' s co re activities are undertaken b y its

Investment M anag er , wh i ch seeks t o li m it the use of

non-renewable res ou r c es and t o re duc e waste where possible.

Further details of the Investment Manager's ESG policy can be found

in the document library of the Company's website. The Compan ies

Act 2006 ( S tr a te g i c Report and Directors' Reports) Re gu l a

ti on s 2013 re qu ire compan ies listed on the Main Ma r k et of

the London S t ock Exchange t o report on the greenhouse gas (

'GHG' ) emissions fo r wh i ch they a re res pon si b le . The

Compan y is a financing vehicle as described above, with neither

employees nor premises, con se qu e n tly , it ha s no GHG

emissions t o report f r om its operations nor does it ha ve

responsibility fo r an y o t h er emissions.

Principal Risks and Uncertai nti es

The Board acknowledges its ultimate responsibility for managing

the risks associated with the Company. The principal risks and

uncertainties as identified by the Board are:

Capital Value:

The primary risk to the ZDP shareholders is that the assets of

the Company are insufficient to repay the final capital entitlement

of the ZDP Shares of 122.99 pence per share on the repayment date

of 19 June 2024. The payment will be dependent on the parent

company's ability to comply with its obligations under the

Agreement and the Undertaking.

Investment tenure:

There is a risk that there may not be a liquid secondary market

for the ZDP Shares. The investment should therefore be regarded as

long-term in nature and should not be considered a suitable

short-term investment.

Further details of financial risk management policies and

procedures are set out in note 10.

Future Developments

The Company does not have, and does not expect to have, any

other business interests, and the current activities of the Company

are expected to continue until the scheduled ZDP Repayment Date of

19 June 2024 at which time the Company will enter into voluntary

liquidation to wind up its operations.

Approved by the Board of Directors on 9 December 2022 and signed

on its behalf by:

Lisa Arnold,

Chair

REPORT OF THE DIRECTORS for the year ended 30 September 2022

The Directors have pleasure in submitting the audited Annual

Financial Report of the Company for the year to 30 September

2022.

Principal Activities

The Company was incorporated for the sole purpose of issuing ZDP

shares to raise finance for the Group and consequently it has no

investment policy. The Company has a limited life and unless prior

alternative arrangements are made, the Directors shall convene a

general meeting of the Company on 19 June 2024 for the purposes of

proposing a resolution to wind up the Company voluntarily. The

Company's only material financial obligations are in respect of the

ZDP shares and the only material assets are its loan to the parent

company.

Directors

The Directors who served in office during the year under review

and to the date of signing were as follows:

Lisa Arnold (Chair)

Neal Ransome

Andrew Fleming

Jeremy Whitley

Each Director was appointed pursuant to a letter of appointment

entered into with the Group. No Director had a service contract

with the Company, nor are any such contracts proposed. Apart from

the exception noted below none of the Directors had a direct

material beneficial interest in any contract to which the Company

was a party and which is or was significant in relation to the

Company's business during the year under review.

All of the current Directors are Directors of PCGH and therefore

have an indirect non-beneficial interest in the Agreement and

Undertaking entered into by the Company and PCGH. The Directors are

also shareholders in PCGH and their interests in that company's

shares are set out in the annual report of that company.

In accordance with the Articles of Association each Director is

required to retire and may offer themselves for re-election at

every third AGM. However, in line with good corporate governance

practice and the proceedings of the parent company, all directors

shall offer themselves for re-election annually.

Directors' Share Interests

None of the Directors had an interest in the share capital of

the Company at any time during the year, or between the year end

and the date of this report.

Directors' Indemnity

Directors' and Officers' Liability insurance has been put in

place. In addition, the Group provides, subject to the provisions

of s234 of the Companies Act 2006, qualifying third party indemnity

provision, an indemnity for Directors in respect of costs incurred

in the defence of any proceedings brought against them and also

liabilities owed to third parties, in either case arising out of

their positions as Directors. This was in place throughout the

financial year under review and up to and including the date of the

Financial Statements.

Share Capital

The Company was incorporated with a share capital of 50,000

ordinary shares of nominal value GBP1.00 each; on 16 June 2017,

following an initial placing, 32,128,437 Zero Dividend Preference

('ZDP') shares were issued for consideration of 100 pence each and

a nominal value of 1 pence each. The ZDP shares were admitted to a

standard listing on the London Stock Exchange on 20 June 2017.

The ZDP Shares have a limited life of seven years and, on that

basis, a final capital entitlement of 122.99 pence per ZDP share on

the ZDP Repayment Date, equivalent to a redemption yield of 3.0 per

cent. per annum (compounded annually) on the initial ZDP placing

price of 100 pence per share. The Redemption Yield of a ZDP Share

is not, and should not be taken as, a forecast of profits. The

final capital entitlement is not a guaranteed or a secured

repayment amount and there can be no assurance that the final

capital entitlement will be repaid in full on the ZDP Repayment

Date (or at all).

The final capital entitlement will rank behind any liabilities

of the Group and in priority to the capital entitlements of the

Company's ordinary shares.

The ZDP shares carry no entitlement to income and the whole of

their return accordingly takes the form of capital. The ZDP

shareholders are not entitled to receive any part of the revenue

profits (including any accumulated revenue reserves) of the Company

on a winding-up, even if the accrued capital entitlement of the ZDP

Shares will not be met in full.

The ZDP shares do not carry the right to vote at general

meetings of the Company, although they carry the right to vote as a

class on certain matters affecting their class in accordance with

paragraph 1.5 of Part VI (The ZDP Shares and Principal Bases and

Assumptions) of the Prospectus published on 12 May 2017. Further

information on the rights attaching to the ZDP Shares are set out

in Part VI of the Prospectus which is available on the parent

company's website www.polarcapitalglobalhealthcaretrust.com.

Substantial Share Interests

The Company's ordinary share capital is wholly owned by the

parent company. The Company's ZDP share capital has limited voting

capacity and as a result, ZDP shareholders are not required to

disclose holdings to the Company or the market. The ZDP share

capital is publicly traded on the London Stock Exchange.

Going Concern

The Board has considered the ability of the Company to adopt the

going concern basis for the preparation of the Financial Statements

and considered the financial position of the Company, its

cash-flows and its liquidity position. The Board has also

considered in making its assessment any material uncertainties and

events that might cast significant doubt upon the Company's ability

to continue as a going concern, such as sessment included the

stress testing carried out by the parent company using a variety of

falling parameters to demonstrate the effects on the parent

company's share price and net asset value. With regard to the

information available and the assessment of the financial position

of the Company the Board believes the going concern basis should be

adopted for the preparation of the Financial Statements for the

year ended 30 September 2022 and that the Company can continue in

operational existence for at least 12 months from the date of

signing of this report.

The Company has a standard listing on the London Stock Exchange

and is therefore not required to comply with the enhanced UK

corporate governance requirement to provide a longer-term viability

statement. The Company was incorporated with a limited life of

seven years ending on 19 June 2024 on which date the ZDP Shares

will be repaid and the Board will convene a general meeting to

propose a resolution to voluntarily wind up the operations of the

Company.

STATEMENT ON CORPORATE GOVERNANCE AND INTERNAL CONTROLS

As referred to above the Company's ZDP shares are subject to a

standard listing and the Board is therefore not required to provide

a statement of compliance with the principles of the UK Corporate

Governance Code.

The Board has overall responsibility for the Company's internal

controls. The Board aims to maintain full and effective control

over appropriate strategic, financial, operational and compliance

issues. There is no separate audit or other committee given the

activities of the Company are limited.

It is the Company's policy to achieve the best terms available

for all services provided to the Company from suppliers and there

is therefore no single policy adopted when negotiating terms. The

Company had no trade creditors at the year-end.

Each of the Directors, at the date of approval of this report,

confirms that:

a) so far as the Director is aware, there is no relevant audit

information of which the Company's auditors are unaware; and

b) the Directors have taken all the steps that they ought to

have taken as Directors to make themselves aware of any relevant

audit information and to establish that the Company's auditors are

aware of that information.

This confirmation is given and should be interpreted in

accordance with the provisions of s418 of the Companies Act

2006.

Independent Auditors

PricewaterhouseCoopers LLP (PwC) were selected to continue as

independent auditors of both the parent and the Company. PwC have

confirmed their independence and have expressed their willingness

to be re-appointed, in accordance with s489 of the Companies Act

2006. A resolution proposing their re-appointment will be proposed

to the AGM.

Annual General Meeting

The sixth AGM of the Company will be held at the conclusion of

the parent company AGM on 9 February 2023.

A Notice of Meeting incorporated at the end of this Annual

Report sets out in full the resolutions to be proposed at the

meeting. Resolutions shall be proposed to receive the Annual Report

and Financial Statements, receive and approve the Directors'

Remuneration Implementation Report, re-elect Lisa Arnold, Neal

Ransome, Andrew Fleming and Jeremy Whitley, re-appoint the auditors

and authorise the Directors to set their fees. The Directors are

also seeking renewal of the authorisation to make market purchases

of the Company's ZDP shares.

Listing Rule 9.8.4

Listing Rule 9.8.4 requires the Company to include certain

further information in relation to the Company which is not

otherwise disclosed. The Directors confirm there are no additional

disclosures to be made pursuant to this rule.

By order of the Board

Tracey Lago, FCG

Polar Capital Secretarial Services Ltd

Company Secretary

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RESPECT OF THE

FINANCIAL STATEMENTS

The Directors are responsible for preparing the Annual Report

and Financial Statements in accordance with applicable law and

regulation.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

have prepared the Financial Statements in accordance with

UK-adopted International Accounting Standards ("UK-adopted IAS").

Additionally, the Financial Conduct Authority's Disclosure Guidance

and Transparency Rules require the directors to prepare the group

financial statements in accordance with UK-adopted IAS standards.

Under company law, the Directors must not approve the Financial

Statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and of the profit or

loss of the Company for that year. In preparing the Financial

Statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- state whether, for the group and company, UK-adopted IAS have

been followed, subject to any material departures disclosed and

explained in the financial statements;

-- make judgements and accounting estimates that are reasonable and prudent; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the Financial Statements and the Directors' Remuneration

Implementation Report comply with the Companies Act 2006.

The Directors are also responsible for safeguarding the assets

of the Company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the Company's information on the parent company's website.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Directors' Confirmations

Each of the Directors, whose names and functions are listed in

Company Information section confirm that, to the best of their

knowledge:

-- the Company financial statements, which have been prepared in

accordance with UK-adopted IAS, give a true and fair view of the

assets, liabilities, financial position and results of the Company;

and

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company, together with a description of the principal risks and

uncertainties that it faces.

The financial statements were approved by the Board on 9

December 2022 and the responsibility statements were signed on its

behalf by Lisa Arnold, Chair of the Board.

Lisa Arnold,

Chair

DIRECTORS' REMUNERATION IMPLEMENTATION REPORT

The Board has prepared this report, in accordance with the

requirements of Schedule 8 to the Large and Medium-sized Companies

and Groups (Accounts and Reports) Regulations 2008 (as amended)

(the 'Regulations'). An ordinary resolution for the approval of the

Directors' Remuneration Policy will be proposed to shareholders at

least every three years. The Remuneration Implementation Report

shall be put to shareholders at the AGM annually.

The law requires the Group's Auditors, PricewaterhouseCoopers

LLP, to audit certain disclosures provided. Where disclosures have

been audited, they are indicated as such. The Auditors' opinion is

included in their report on page 11.

Report from the Company Chair

As set out in the Directors' Report, the Company has a standard

listing and is not required to report on its compliance with the

provisions or application of the principles of the UK Corporate

Governance Code. The parent company considers the Directors'

remuneration for the Group as a whole and the Directors see no

benefit in creating a separate Remuneration Committee. The Board,

with Mrs Arnold as Chair, considers and approves Directors'

remuneration, for services provided to the Company.

Directors' Remuneration Policy

In accordance with the Company's Articles of Association, the

Directors' Remuneration Policy is that no fees, expenses or any

other financial benefits are payable to the Directors in connection

with their duties to the Company. Directors are also not eligible

for bonuses, pension benefits, share options or long-term incentive

schemes as the Board does not consider such arrangements or

benefits necessary or appropriate.

The Directors receive fees relating to their duties to the

parent company. This policy will continue for future years and is

set out in full in the Directors' Remuneration Report of the parent

company.

The Remuneration Policy was last approved by shareholders at the

AGM in February 2020 for the period from 1 October 2020 to 30

September 2023. As stated above, a resolution to approve the

Remuneration Policy will be put to shareholders at least once in

every three-year period. Accordingly, a resolution to approve the

Directors' Remuneration Policy will be put to shareholders at the

AGM to be held on 9 February 2023 and if approved, the Remuneration

Policy will remain in force for the period 1 October 2023 to the

end of life of the Company's fixed life or 30 September 2026,

whichever is the sooner.

Directors' service contracts and terms

None of the Directors have a contract of service with the

Company or the parent company, nor has there been any contract or

arrangement between the Company and any Director at any time during

the year. The terms of their appointment provide that a Director

shall retire and be subject to re-election at the first AGM after

their appointment, and at least every three years thereafter. A

Director's appointment can be terminated in accordance with the

Articles and without compensation.

Directors' interests and emoluments for the year (audited)

None of the Directors had interests in the ZDP shares at the

year end of 30 September 2022 and no personal account transactions

have been undertaken since the year end. The ordinary shares are

wholly owned by the parent company. No fees are payable to the

Directors regarding their duties to the Company.

The Directors' interests in the shares of the parent company are

shown in the Annual Report of the parent company.

Company's performance

As a finance company which has lent all of its assets (other

than the cash received on the initial allotment of its ordinary

share capital) to the parent company the performance of the Company

is therefore best reflected by looking at the performance of the

parent company. The Directors' remuneration report within the

Annual Report of the parent company contains a graph comparing the

total return (assuming all dividends are reinvested) to the parent

company ordinary shareholders, compared to the total shareholder

return of the MSCI ACWI Healthcare Index. A copy of the parent

company's Annual Report can be found on the following website

www.polarcapitalglobalhealthcaretrust.com and the National Storage

Mechanism (NSM) at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

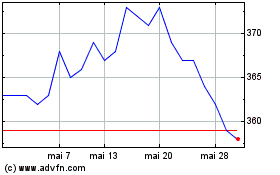

In accordance with the Regulations, the graph below compares the

share price of ZDP shares with the MSCI ACWI Healthcare Index over

the period since listing of the ZDP shares on 20 June 2017 to the

end of the period on 30 September 2022. The MSCI ACWI Healthcare

Index has been selected as it is considered to represent a broad

equity market index against which the performance of the parent

company's assets may be adequately assessed.

There has been no demonstration of relative importance of spend

on pay for the Company as no remuneration is payable to

Directors.

Approval

The Directors' Remuneration Implementation Report was approved

by the Board on 9 December 2022.

On behalf of the Board of Directors

Lisa Arnold

Chair

INDEPENT AUDITORS' REPORT TO THE MEMBERS OF PCGH ZDP PLC

Report on the audit of the financial statements

Opinion

In our opinion, PCGH ZDP plc's financial statements:

-- give a true and fair view of the state of the company's

affairs as at 30 September 2022 and of its result and cash flows

for the year then ended;

-- have been properly prepared in accordance with UK-adopted

international accounting standards; and

-- have been prepared in accordance with the requirements of the Companies Act 2006.

We have audited the financial statements, included within the

Annual Report and Financial Statements (the "Annual Report"), which

comprise: the Balance Sheet as at 30 September 2022; the Statement

of Comprehensive Income, Cash Flow Statement, and the Statement of

Changes in Equity for the year then ended; and the Notes to the

Financial Statements, which include a description of the

significant accounting policies.

Our opinion is consistent with our reporting to the Audit

Committee of Polar Capital Global Healthcare Trust plc.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) ("ISAs (UK)") and applicable law. Our

responsibilities under ISAs (UK) are further described in the

Auditors' responsibilities for the audit of the financial

statements section of our report. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Independence

We remained independent of the company in accordance with the

ethical requirements that are relevant to our audit of the

financial statements in the UK, which includes the FRC's Ethical

Standard, as applicable to listed public interest entities, and we

have fulfilled our other ethical responsibilities in accordance

with these requirements.

To the best of our knowledge and belief, we declare that

non-audit services prohibited by the FRC's Ethical Standard were

not provided.

We have provided no non-audit services to the company in the

period under audit.

Our audit approach

Overview

Audit scope

-- The Company is a wholly-owned subsidiary of Polar Capital

Global Healthcare Trust plc, and it serves as a financing vehicle

which issues Zero Dividend Preference (ZDP) shares and loans the

proceeds to its parent company.

-- The Company and engages Polar Capital LLP (the "Manager") to

manage its day to day operations.

-- We conducted our audit of the financial statements using

information from HSBC Securities Services (the "Administrator") to

whom the Manager has, with the consent of the Directors, delegated

the provision of certain administrative functions.

-- We tailored the scope of our audit taking into account the

types of investments within the Company, the involvement of the

third parties referred to above, the accounting processes and

controls, and the industry in which the Company operates.

Key audit matters

-- Accounting for the Zero Dividend Preference shares and loan to parent company

Materiality

-- Overall materiality: GBP376,000 (2021: GBP365,000) based on 1% of total assets.

-- Performance materiality: GBP282,000 (2021: GBP273,750).

The scope of our audit

As part of designing our audit, we determined materiality and

assessed the risks of material misstatement in the financial

statements.

Key audit matters

Key audit matters are those matters that, in the auditors'

professional judgement, were of most significance in the audit of

the financial statements of the current period and include the most

significant assessed risks of material misstatement (whether or not

due to fraud) identified by the auditors, including those which had

the greatest effect on: the overall audit strategy; the allocation

of resources in the audit; and directing the efforts of the

engagement team. These matters, and any comments we make on the

results of our procedures thereon, were addressed in the context of

our audit of the financial statements as a whole, and in forming

our opinion thereon, and we do not provide a separate opinion on

these matters.

This is not a complete list of all risks identified by our

audit.

The key audit matters below are consistent with last year.

Key audit matter How our audit addressed the key audit matter

Accounting for the Zero Dividend Preference shares and

loan to parent company

----------------------------------------------------------

Refer to the Accounting Policies and the Notes to the We performed testing to agree the loan balance to the

Financial Statements. loan agreement and payment schedule

between the Company and Polar Capital Global Healthcare

On 19 June 2017, the Company issued Zero Dividend Trust plc. We recalculated the loan

Preference (ZDP) shares and entered into interest and contribution received from the parent

an agreement to lend the gross initial ZDP Placing Company and the appropriation to ZDP shares

proceeds to its parent, Polar Capital Global to test that they have been accounted for in accordance

Healthcare Trust plc. with this stated accounting policy.

We focused on the appropriateness of the accounting No material misstatements were identified by our testing.

policy for the ZDP shares and the loan

due from the parent, and the presentation of these

balances in the financial statements as

set out in the requirements of accounting standards.

----------------------------------------------------------

How we tailored the audit scope

We tailored the scope of our audit to ensure that we performed

enough work to be able to give an opinion on the financial

statements as a whole, taking into account the structure of the

company, the accounting processes and controls, and the industry in

which it operates.

In particular, we looked at where the Directors made subjective

judgements, for example in respect of accounting estimates that

involved making assumptions and considering future events that are

inherently uncertain.

Materiality

The scope of our audit was influenced by our application of

materiality. We set certain quantitative thresholds for

materiality. These, together with qualitative considerations,

helped us to determine the scope of our audit and the nature,

timing and extent of our audit procedures on the individual

financial statement line items and disclosures and in evaluating

the effect of misstatements, both individually and in aggregate on

the financial statements as a whole.

Based on our professional judgement, we determined materiality

for the financial statements as a whole as follows:

Overall company materiality GBP376,000 (2021: GBP365,000).

How we determined it 1% of total assets

------------------------------------------------------------------------------------

Rationale for benchmark applied We have applied this benchmark because the Company's total assets reflect its

purpose to raise

financing and represent its contribution to its parent company.

------------------------------------------------------------------------------------

We use performance materiality to reduce to an appropriately low

level the probability that the aggregate of uncorrected and

undetected misstatements exceeds overall materiality. Specifically,

we use performance materiality in determining the scope of our

audit and the nature and extent of our testing of account balances,

classes of transactions and disclosures, for example in determining

sample sizes. Our performance materiality was 75% (2021: 75%) of

overall materiality, amounting to GBP282,000 (2021: GBP273,750) for

the company financial statements.

In determining the performance materiality, we considered a

number of factors - the history of misstatements, risk assessment

and aggregation risk and the effectiveness of controls - and

concluded that an amount at the upper end of our normal range was

appropriate.

We agreed with the Audit Committee of Polar Capital Global

Healthcare Trust plc that we would report to them misstatements

identified during our audit above GBP18,800 (2021: GBP18,200) as

well as misstatements below that amount that, in our view,

warranted reporting for qualitative reasons.

Conclusions relating to going concern

Our evaluation of the directors' assessment of the company's

ability to continue to adopt the going concern basis of accounting

included:

-- evaluating the Directors' updated risk assessment and

considering whether it addressed relevant threats, including the

ongoing impact of COVID-19, rising inflation, Russia's Invasion of

Ukraine, and the subsequent economic uncertainty;

-- evaluating the Directors' assessment of potential operational

impacts, considering their consistency with other available

information and our understanding of the business and assessed the

potential impact on the financial statements; and

-- reviewing the Directors' assessment of the Company's

financial position in the context of its ability to meet future

expected finance costs, their assessment of liquidity as well as

their review of the operational resilience of the Company and

oversight of key third-party service providers.

Based on the work we have performed, we have not identified any

material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the

company's ability to continue as a going concern for a period of at

least twelve months from when the financial statements are

authorised for issue.

In auditing the financial statements, we have concluded that the

directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate.

However, because not all future events or conditions can be

predicted, this conclusion is not a guarantee as to the company's

ability to continue as a going concern.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Reporting on other information

The other information comprises all of the information in the

Annual Report other than the financial statements and our auditors'

report thereon. The directors are responsible for the other

information. Our opinion on the financial statements does not cover

the other information and, accordingly, we do not express an audit

opinion or, except to the extent otherwise explicitly stated in

this report, any form of assurance thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit, or otherwise appears to be materially misstated. If we

identify an apparent material inconsistency or material

misstatement, we are required to perform procedures to conclude

whether there is a material misstatement of the financial

statements or a material misstatement of the other information. If,

based on the work we have performed, we conclude that there is a

material misstatement of this other information, we are required to

report that fact. We have nothing to report based on these

responsibilities.

With respect to the Strategic report and Report of the

Directors, we also considered whether the disclosures required by

the UK Companies Act 2006 have been included.

Based on our work undertaken in the course of the audit, the

Companies Act 2006 requires us also to report certain opinions and

matters as described below.

Strategic report and Report of the Directors

In our opinion, based on the work undertaken in the course of

the audit, the information given in the Strategic report and Report

of the Directors for the year ended 30 September 2022 is consistent

with the financial statements and has been prepared in accordance

with applicable legal requirements.

In light of the knowledge and understanding of the company and

its environment obtained in the course of the audit, we did not

identify any material misstatements in the Strategic report and

Report of the Directors.

Directors' Remuneration

In our opinion, the part of the Directors' Remuneration Report

to be audited has been properly prepared in accordance with the

Companies Act 2006.

Responsibilities for the financial statements and the audit

Responsibilities of the directors for the financial

statements

As explained more fully in the Statement of Directors'

Responsibilities in Respect of the Financial Statements, the

directors are responsible for the preparation of the financial

statements in accordance with the applicable framework and for

being satisfied that they give a true and fair view. The directors

are also responsible for such internal control as they determine is

necessary to enable the preparation of financial statements that

are free from material misstatement, whether due to fraud or

error.

In preparing the financial statements, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditors' responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditors' report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

Irregularities, including fraud, are instances of non-compliance

with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements

in respect of irregularities, including fraud. The extent to which

our procedures are capable of detecting irregularities, including

fraud, is detailed below.

Based on our understanding of the company and industry, we

identified that the principal risks of non-compliance with laws and

regulations related to Chapter 17 of the Listing Rules, and we

considered the extent to which non-compliance might have a material

effect on the financial statements. We also considered those laws

and regulations that have a direct impact on the financial

statements such as Companies Act 2006. We evaluated management's

incentives and opportunities for fraudulent manipulation of the

financial statements (including the risk of override of controls),

and determined that the principal risks were related to posting

inappropriate journal entries to increase revenue or to increase

total assets. Audit procedures performed by the engagement team

included:

-- discussions with the manager and the Audit Committee of Polar

Capital Global Healthcare Trust plc, including consideration of

known or suspected instances of non-compliance with laws and

regulation and fraud;

-- reviewing relevant meeting minutes, including those of the

Audit Committee of Polar Capital Global Healthcare Trust plc;

-- evaluation of the controls implemented by the Company and the

Administrator designed to prevent and detect irregularities;

and

-- identifying and testing journal entries, in particular year end journal entries posted by the administrator during the preparation of the financial statements and any journals with unusual account combinations.

There are inherent limitations in the audit procedures described

above. We are less likely to become aware of instances of

non-compliance with laws and regulations that are not closely

related to events and transactions reflected in the financial

statements. Also, the risk of not detecting a material misstatement

due to fraud is higher than the risk of not detecting one resulting

from error, as fraud may involve deliberate concealment by, for

example, forgery or intentional misrepresentations, or through

collusion.

Our audit testing might include testing complete populations of

certain transactions and balances, possibly using data auditing

techniques. However, it typically involves selecting a limited

number of items for testing, rather than testing complete

populations. We will often seek to target particular items for

testing based on their size or risk characteristics. In other

cases, we will use audit sampling to enable us to draw a conclusion

about the population from which the sample is selected.

A further description of our responsibilities for the audit of

the financial statements is located on the FRC's website at:

www.frc.org.uk/auditorsresponsibilities. This description forms

part of our auditors' report.

Use of this report

This report, including the opinions, has been prepared for and

only for the company's members as a body in accordance with Chapter

3 of Part 16 of the Companies Act 2006 and for no other purpose. We

do not, in giving these opinions, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

Other required reporting

Companies Act 2006 exception reporting

Under the Companies Act 2006 we are required to report to you

if, in our opinion:

-- we have not obtained all the information and explanations we require for our audit; or

-- adequate accounting records have not been kept by the

company, or returns adequate for our audit have not been received

from branches not visited by us; or

-- certain disclosures of directors' remuneration specified by law are not made; or

-- the financial statements and the part of the Directors'

Remuneration Report to be audited are not in agreement with the

accounting records and returns.

We have no exceptions to report arising from this

responsibility.

Appointment

Following the recommendation of the Audit Committee of Polar

Capital Global Healthcare Trust plc, we were appointed by the

members on 30 March 2017 to audit the financial statements for the

year ended 30 September 2017 and subsequent financial periods. The

period of total uninterrupted engagement is 6 years, covering the

years ended 30 September 2017 to 30 September 2022.

Kevin Rollo (Senior Statutory Auditor)

for and on behalf of PricewaterhouseCoopers LLP

Chartered Accountants and Statutory Auditors

London

9 December 2022

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 September 2022

Year ended Year ended

30 September 30 September

2022 2021

Notes GBP GBP

-------------- --------------

Loan interest 1 892,850 871,073

Contribution from parent 2 201,158 191,073

-------------- --------------

Total income 1,094,008 1,062,146

-------------- --------------

Total expenses 3 - -

-------------- --------------

Profit before finance costs and

tax 1,094,008 1,062,146

Finance costs

Appropriation to ZDP shares 4 (1,094,008) (1,062,146)

-------------- --------------

Total finance costs (1,094,008) (1,062,146)

-------------- --------------

Result before taxation - -

Taxation 5 - -

-------------- --------------

Net result for the year and total

comprehensive income - -

-------------- --------------

The amounts dealt with in the Statement of Comprehensive Income

are all derived from continuing activities.

The notes to follow form part of these financial statements.

STATEMENT OF CHANGES IN EQUITY

For the year ended 30 September 2022

Year ended 30 September

2022

----------------------------

Called

up share Capital Total

capital reserve equity

GBP GBP GBP

--------- -------- -------

Total equity at 1 October 2021 50,000 - 50,000

Result and total comprehensive income

for the year ended 30 September 2022 - - -

Total equity at 30 September 2022 50,000 - 50,000

--------- -------- -------

Year ended 30 September

2021

----------------------------

Called

up share Capital Total

capital reserve equity

GBP GBP GBP

--------- -------- -------

Total equity at 1 October 2020 50,000 - 50,000

Result and total comprehensive income

for the year ended 30 September 2021 - - -

Total equity at 30 September 2021 50,000 - 50,000

--------- -------- -------

The notes to follow form part of these financial statements.

BALANCE SHEET

As at 30 September 2022

30 September 30 September

2022 2021

Notes GBP GBP

------------ -------------

Non-current assets

Loan to parent company 6 37,560,975 36,466,967

Current assets

Cash and cash equivalents 50,000 50,000

------------ -------------

Total assets 37,610,975 36,516,967

------------ -------------

Non-current liabilities

Zero Dividend Preference shares 7 (37,560,975) (36,466,967)

------------ -------------

Total liabilities (37,560,975) (36,466,967)

------------ -------------

Net assets 50,000 50,000

------------ -------------

Equity attributable to equity

shareholders

Called up share capital 8 50,000 50,000

Capital reserve - -

------------ -------------

Total equity 50,000 50,000

------------ -------------

The financial statements of PCGH ZDP plc were approved by the

Board of Directors and authorised for issue on 9 December 2022.

They were signed on behalf of the Board by:

Lisa Arnold,

Chair

The notes to follow form part of these financial statements.

CASH FLOW STATEMENT

For the year ended 30 September 2022

Year ended Year ended

30 September 30 September

2022 2021

GBP GBP

Cash flows from operating activities

Profit before finance costs and taxation 1,094,008 1,062,146

Increase in receivable* (1,094,008) (1,062,146)

------------- -------------

Net cash inflow from operating activities - -

------------- -------------

Cash flows from financing activities

Net cash outflow from financing activities - -

------------- -------------

Net increase in cash and cash equivalents - -

Cash and cash equivalents at the beginning

of the year 50,000 50,000

------------- -------------

Cash and cash equivalents at the end

of the year 50,000 50,000

------------- -------------

The notes to follow form part of these financial statements.

* The 'increase in payables' under financing activities shown in

prior years has been moved and reclassified as an 'increase in

receivables' under operating activities. There have been no changes

to amounts shown in prior years and there is no impact on the final

cash flow position.

NOTES TO THE FINANCIAL STATEMENTS - POLICIES

A. General Information

The Company's presentational and functional currency is pounds

sterling as this is the currency of the primary economic

environment in which the Company operates.

The Directors believe it is appropriate to adopt the going

concern basis. In order to be able to continue as a going concern,

the Company relies on the parent company to pay the operational

costs and the repayment of the loan when it falls due. Based on the

assessment carried out against the parent company, the parent

company has adequate financial resources to meet its liabilities as

and when they fall due. In addition to the assessment, the parent

company carried out stress testing using a variety of falling

parameters to demonstrate the effects on the parent company's share

price and net asset value. The Company does not have, and does not

expect to have, any other business interests, and the current

activities of the Company are expected to continue until the

scheduled ZDP Repayment Date of 19 June 2024 at which time the

Company will enter into voluntary liquidation.

B. Accounting Policies

The principal accounting policies which have been applied

consistently throughout the year are set out below:

Basis of Preparation

In line with the Company's parent, the financial statements have

been prepared and approved by the Directors in accordance with

UK-adopted international accounting standards ("UK-adopted

IAS").

a) Income

(i) Loan Interest

Under a Loan Agreement the gross initial ZDP Placing proceeds

have been lent to the parent, Polar Capital Global Healthcare Trust

plc. The Loan Agreement provides that interest will accrue daily at

an annual rate of 2.5% compounded annually on each anniversary of

ZDP Admission and will be rolled up and paid to PCGH ZDP plc along

with any repayment of the principal amount on a date falling 2

business days before the ZDP Repayment Date.

(ii) Transfer re Parent Undertaking

Polar Capital Global Healthcare Trust plc and the Company, PCGH

ZDP plc, have entered into an Undertaking whereby to the extent

that the Final Capital Entitlement multiplied by the number of

outstanding ZDP shares as at the ZDP Repayment Date exceeds the

aggregate principal amount and accrued interest due pursuant to the

Loan Agreement as at that date (the Additional Funding

Requirement), the parent shall: (i) subscribe for additional

subsidiary shares to a value equal to or greater than the

Additional Funding Requirement; and (ii) make a capital

contribution or gift or otherwise pay an amount equal to or greater

than the Additional Funding Requirement.

b) Finance costs

The ZDP shares are designed to provide a pre-determined capital

growth from their original issue price of 100p on 20 June 2017 to a

Final Capital Entitlement of 122.99p on 19 June 2024. The initial

capital of 100p at 20 June 2017 will increase at an interest rate

of 3% compounding annually (see note 4). The provision for the

capital growth entitlement on the ZDP shares is included as a

finance cost. No dividends are payable on the ZDP shares.

c) Taxation

Taxation is currently payable based on the taxable profits for

the year ended 30 September 2022. Taxable profit differs from net

profit as reported in the Statement of Comprehensive Income because

it excludes items of income or expense that are taxable or

deductible in other years and it further excludes items that

are never taxable or deductible. The Company's liability for

current tax is calculated using tax rates that have been enacted or

substantively enacted at the balance sheet date.

Deferred tax is the tax expected to be payable or recoverable on

temporary differences between the carrying amounts of assets and

liabilities in the financial statements and the corresponding tax

bases used in the computation of taxable profit, and is accounted

for using the balance sheet liability method. Deferred tax

liabilities are recognised for all taxable temporary differences

and deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled, or the asset is

realised based on tax rates that have been enacted or substantively

enacted at the balance sheet date.

d) Investments Held at Fair Value Through Profit or Loss

The Company holds no investments, rather the proceeds from the

issue of the ZDP shares have been lent to the parent, Polar Capital

Global Healthcare Trust plc, for investment purposes.

e) Loan to the Parent Company

On 20 June 2017, the Company provided an interest-bearing loan

to its parent company, Polar Capital Global Healthcare Trust plc.

The loan is carried at amortised cost, which represents the initial

cost of the loan plus accrued interest and any contribution due

from the parent to meet the total ZDP entitlement.

f) Impairment

IFRS 9 requires the Company to record expected credit losses on

all financial assets measured at amortised cost, either on a

12-month or lifetime basis. At each reporting date, the Company

reviews the carrying amounts of financial assets to determine

whether there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where it is not possible to

estimate the recoverable amount of an asset, the Company estimates

the recoverable amount to which the asset belongs. If the

recoverable amount of an asset is estimated to be less than its

carrying amount, the carrying amount of the asset is reduced to its

recoverable amount. An impairment loss is recognised immediately in

the Statement of Comprehensive Income. Recognised impairment losses

are reversed if the reasons for the impairment loss have ceased to

apply.

g) Cash and Cash Equivalents

Cash comprises cash on hand and demand deposits. Cash

equivalents are short-term, highly liquid investments that are

readily convertible to known amounts of cash.

h) Segmental Reporting

Under IFRS 8, 'Operating Segments', operating segments are

considered to be the components of an entity about which separate

financial information is available that is evaluated regularly by

the chief operating decision maker in deciding how to allocate

resources and in assessing performance. The chief operating

decision maker has been identified as the Investment Manager (with

oversight from the Board). The Directors are of the opinion that

the Company has only one operating segment and as such no distinct

segmental reporting is required.

i) Key Estimates and Judgements

Estimates and assumptions used in preparing the financial

statements are reviewed on an ongoing basis and are based on

historical experience and various other factors that are believed

to be reasonable under the circumstances. The results of these

estimates and assumptions form the basis of making judgements about

carrying values of assets and liabilities that are not readily

apparent from other sources. The Company does not consider that

there have been any significant estimates or assumptions in the

current financial year.

j) New and Revised Accounting Standards

There were no new UK-adopted IAS or amendments to UK-adopted IAS

applicable to the current year which had any significant impact on

the Company's Financial Statements.

i) The following new or amended standards became effective for

the current annual reporting period and the adoption of the

standards and interpretations have not had a material impact on the

Financial Statements of the Company.

Standards & Interpretations Effective

for periods

commencing

on or after

IFRS 9, IAS 39, IBOR Reform - Phase 2 addresses 1 January

IFRS 7, IFRS 16 issues that might affect financial 2021

and IFRS 4: Interest reporting during the reform of

Rate Benchmark Reform an interest rate benchmark, including

- phase 2 (amended) the effects of changes to contractual

cash flows or hedging relationships

arising from the replacement of

an interest rate benchmark with

an alternative benchmark rate.

The Phase 2 amendments apply only

to changes required by the interest

rate benchmark reform to financial

instruments and hedging relationships.

---------------------------------------- -------------

ii) At the date of authorisation of the Company's financial

statements, there were no relevant standards that potentially

impact the Company that are in issue but are not yet effective.

NOTES TO THE FINANCIAL STATEMENTS - NOTES

1. Loan Interest

Under a Loan Agreement the gross initial ZDP Placing proceeds

have been lent to the Parent. The Loan Agreement provides that

interest will accrue daily at an annual rate of 2.5% compounded

annually.

2. Contribution from parent

The contribution represents the additional funding required from

the parent to meet the entitlement due to the ZDP shareholders at

the year end. The contribution from the parent for the year ended

30 September 2022 was GBP201,158 (2021: GBP191,073).

3. Total expenses

The Directors receive no remuneration in respect of their

services to the Company. Auditors' fees for audit services are paid

by the Company's parent, Polar Capital Global Healthcare Trust plc

and amounted to GBP6,875 (2021: GBP6,250).

4. Finance costs

The ZDP shares are designed to provide a pre-determined capital

growth from their original issue price of 100p on 20 June 2017 to a

final capital entitlement of 122.99p on 19 June 2024. The initial

capital of 100p at 20 June 2017 will increase at a growth rate of

3% compounding annually. The provision for the capital growth

entitlement for the year on the ZDP shares is included as a finance

cost.

5. Taxation

a) Analysis of tax charge for the year

The corporation tax for the year ended 30 September 2022 was

GBPnil (2021: GBPnil).

b) Factors affecting tax charge for the year

The charge for the year can be reconciled to the result per the

Statement of Comprehensive Income. The result before taxation for

the year ended 30 September 2022 was GBPnil (2021: GBPnil).

6. Loan to parent company

Year ended Year ended

30 September 30 September

2022 2021

GBP GBP

-------------- --------------

Opening balance 36,466,967 35,404,821

Loan interest accrued 892,850 871,073

Additional contribution to meet ZDP

entitlement 201,158 191,073

-------------- --------------

Closing balance 37,560,975 36,466,967

-------------- --------------

The carrying value of receivables approximates to its fair

value.

PCGH ZDP plc has an outstanding inter-group loan with the

parent, Polar Capital Global Healthcare Trust plc. The Company

carried out an analysis which considers both historical and

forward-looking qualitative and quantitative information to

determine if the inter-group loan is low credit risk as at 30

September 2022. The results of the analysis demonstrated that the

risk of default or impairment was very low and that there has not

been a significant increase (if any) in credit risk since the loan

was first recognised. There is not expected to be material adverse

changes in the economic and investment conditions during the year

which would reduce the ability of Polar Capital Global Healthcare

Trust plc to repay the loan due on 19 June 2024.

7. Zero Dividend Preference shares

Year ended Year ended

30 September 30 September

2022 2021

GBP GBP

-------------- --------------

Opening balance 36,466,967 35,404,821

Capital growth entitlement of ZDP shares 1,094,008 1,062,146

-------------- --------------

Closing balance 37,560,975 36,466,967

-------------- --------------

8. Called up share capital

30 September 30 September

2022 2021

GBP GBP

------------- -------------

Allotted, called up and fully paid:

50,000 (2021: 50,000) Ordinary shares

of GBP1 each: 50,000 50,000

At 30 September 50,000 50,000

------------- -------------

9. Parent undertaking and controlling party

At 30 September 2022 the Company was a wholly owned subsidiary

undertaking of Polar Capital Global Healthcare Trust plc, the

Ultimate Parent Undertaking, a Company registered in England and

Wales, number 07251471. Copies of the Ultimate Parent Undertaking's

consolidated financial statements may be obtained from the Company

Secretary, Polar Capital Secretarial Services Ltd, 16 Palace

Street, London SW1E 5JD.

10. Financial instruments - Risk management policies and

procedures for the Company

The Company's exposure to financial instruments can comprise

cash, liquid resources and long-term receivables and payables that

arise directly from the Company's operations.

The main risks arising from financial instruments are liquidity

risk, credit risk and market risk. The risks have remained

unchanged since the beginning of the year to which these financial

statements relate and are summarised below:

(a) Liquidity risk

The Company's assets comprise cash and long-term receivables

which it is expected will be collectable to meet ZDP funding

requirements.

(b) Credit risk

This is the risk that a counterparty to a financial instrument

will fail to discharge an obligation or commitment that it has

entered into with the Company. As at 30 September 2022, the

Company's financial assets which are exposed to credit risk is the

loan to the parent company, Polar Capital Global Healthcare Trust

plc and it amounted GBP37,560,975 (2021: GBP36,466,967). The loan

to the parent company has low credit risk as the parent has a

strong capacity to meet its contractual cash flow obligations as

they fall due.

The Company does not consider this risk to be significant as it

has limited exposure to non-group third parties in respect of

amounts receivable. Cash balances are only deposited with financial

institutions with a high credit rating. The Company assesses all

external counterparties for the credit risk before contracting with

them.

(c) Market risk

The Company has no direct exposure to market risk as it does not

hold or trade any direct investment positions. Any indirect market

risks though the parent company are actively monitored throughout

the year as part of the parent company's risk management policies

and procedures.

11. Related party

On 20 June 2017, the Company provided an interest-bearing loan

to its parent company, Polar Capital Global Healthcare Trust plc.

The loan is carried at amortised cost, which represents the initial

cost of the loan plus accrued interest and any contribution due

from the parent to meet the total ZDP entitlement. At the year end,

GBP37,560,975 was due from the parent company in respect of the

loan.

NOTICE OF ANNUAL GENERAL MEETING of PCGH ZDP plc (the

'Company')

NOTICE IS HEREBY GIVEN that the sixth ANNUAL GENERAL MEETING of

the Company will be held following the conclusion of the Annual

General Meeting of the parent company Polar Capital Global

Healthcare Trust plc, on Thursday, 9 February 2023 at the offices

of Polar Capital LLP, 16 Palace Street, London SW1E 5JD to consider

and if thought fit to pass the following Resolutions of which

resolutions 1 to 9 will be proposed as Ordinary Resolutions and

resolutions 10 and 11 will be proposed as Special Resolutions:

Ordinary Resolutions

1. To receive the Annual Report and Financial Statements for the year ended 30 September 2022.

2. To approve the Directors' Remuneration Policy as contained in

the Report on Directors' Remuneration Implementation Report, such

approval to begin from the expiry of the current Policy on 30

September 2023 and until the end of life of the Company's fixed

life or 30 September 2026, whichever is the sooner.

3. To receive and approve the Directors' Remuneration

Implementation Report for the year ended 30 September 2022.

4. To re-elect Lisa Arnold as a Director of the Company.

5. To re-elect Neal Ransome as a Director of the Company.

6. To re-elect Andrew Fleming as a Director of the Company.

7. To re-elect Jeremy Whitley as a Director of the Company.

8. To re-appoint PricewaterhouseCoopers LLP as Auditors to the

Company to hold office until the conclusion of the next Annual

General Meeting of the Company.

9. To authorise the Directors to determine the remuneration of the Auditors.

Special Resolutions

10. THAT the Company be and is hereby generally and

unconditionally authorised pursuant to Section 701 of the Companies

Act 2006 (the "Act") to make market purchases (within the meaning

of Section 693 of the Act) of Zero Dividend Preference (ZDP) shares

of 1 pence each in the capital of the Company, on such terms and in

such manner as the Directors may from time to time determine

PROVIDED THAT:

(a) the maximum number of ZDP shares hereby authorised to be

purchased shall be 4,816,052; or such number representing

approximately 14.99% of the issued share capital at 9 December

2022;

(b) the minimum price excluding expenses which may be paid for an ZDP share is 1 pence;

(c) the maximum price excluding expenses payable by the Company

for each ZDP share is the higher of:

(i) 105 per cent. of the average of the middl e - market quo t

ations of the ZDP shar es for the five busi ne ss da ys prior to

the da te of the market pu rc has e; and

(ii) the price of the last inde pendent trade and the highe st

current independent bid for a ZDP share on the trading venues where

the market purchases by the Company pursuant to the authority

conferred by this Resolution 10 will be carried out.

(d) the authority hereby conferred shall expire at the

conclusion of the next AGM of the Company, unless such authority is

renewed prior to such time;

(e) the Company may make a contract to purchase ZDP shares under

the authority hereby conferred prior to the expiry of such

authority which will or may be executed wholly or partly after the

expiration of such authority and may make a purchase of ordinary

shares pursuant to any such contract; and

(f) any ZDP shares so purchased shall be cancelled immediately upon completion of the purchase.

11. THAT a general meeting, other than an annual general

meeting, may be called on not less than 14 clear days' notice.

BY ORDER OF THE BOARD

Tracey Lago, FCG

Polar Capital Secretarial Services Limited

Company Secretary

9 December 2022

Registered office:

16 Palace Street,

London

SW1E 5JD

NOTES TO THE NOTICE OF ANNUAL GENERAL MEETING of PCGH ZDP

plc

1. The holders of the Ordinary shares have the right to receive

notice, attend, speak and vote at the Annual General Meeting.

Holders of ZDP shares have the right to receive notice of general

meetings of the Company but do not have any right to attend, speak

or vote at any general meeting of the Company unless the business

of the meeting includes any resolution to vary, modify or abrogate

any of the special rights attached to ZDP shares.

2. A member entitled to attend, vote and speak at this meeting

may appoint one or more persons as his/her proxy to attend, speak

and vote on his/her behalf at the meeting. A proxy need not be a

member of the Company. If multiple proxies are appointed, they must

not be appointed in respect of the same shares. To be effective,

the enclosed form of proxy, together with any power of attorney or

other authority under which it is signed or a certified copy

thereof, should be lodged at the office of the Company Secretary,

16 Palace Street, London SW1E 5JD not later than 48 hours before

the time of the meeting. The appointment of a proxy will not

prevent a member from attending the meeting and voting and speaking

in person if he/she so wishes. A member present in person or by

proxy shall have one vote on a show of hands and on a poll, shall

have one vote for every Ordinary share of which he/she is the

holder.

3. A person to whom this notice is sent who is a person

nominated under Section 146 of the Companies Act 2006 to enjoy

information rights (a "Nominated Person") may, under an agreement

between him/her and the shareholder by whom he/she was nominated,

have a right to be appointed (or to have someone else appointed) as

a proxy for the Annual General Meeting. If a Nominated Person has

no such proxy appointment or does not wish to exercise it, he/she

may, under any such agreement, have a right to give instructions to

the shareholder as to the exercise of voting rights. The statements

of the rights of members in relation to the appointment of proxies

in Note 2 above do not apply to a Nominated Person. The rights

described in that Note can only be exercised by registered members

of the Company.

4. As at 9 December 2022 (being the last business day prior to

the publication of this notice) the Company's issued voting share

capital and total voting rights amounted to 50,000 Ordinary shares

of 100 pence each. In addition, there are 32,128,437 ZDP shares of

1 pence each nominal value in issue with no voting rights

attached.

5. The Company specifies that only those Ordinary shareholders

registered on the Register of Members of the Company as at 2.00pm

on 7 February 2023 (or in the event that the meeting is adjourned,

only those shareholders registered on the Register of Member of the

Company as at 11.30am on the day which is 48 hours prior to the

adjourned meeting) shall be entitled to attend in person or by

proxy and vote at the Annual General Meeting in respect of the

number of shares registered in their name at that time. Changes to

entries on the Register of Members after that time shall be

disregarded in determining the rights of any person to attend or

vote at the meeting.

6. Any question relevant to the business of the Annual General

Meeting may be asked at the meeting by anyone permitted to speak at

the meeting. You may alternatively submit your question in advance

by letter addressed to the Company Secretary at the registered

office.

7. In accordance with Section 319A of the Companies Act 2006,

the Company must cause any question relating to the business being

dealt with at the meeting put by a member attending the meeting to

be answered. No such answer need be given if:

a. to do so would: