TIDMPCGH TIDMPGHZ

RNS Number : 5538W

Polar Capital Global Health Tst PLC

13 December 2023

POLAR CAPITAL GLOBAL HEALTHCARE TRUST PLC

Legal Entity Identifier: 549300YV7J2TWLE7PV84

AUDITED RESULTS ANNOUNCEMENT FOR THE YEARED

30 SEPTEMBER 2023

FINANCIAL HIGHLIGHTS

For the year to 30 September 2023

Performance

Net Asset Value per Ordinary Share (Total Return)* 4.21%

Benchmark index

(MSCI ACWI Health Care Index (total return in sterling

with dividends reinvested)) 1.19%

Share Price Total Return* 1.92%

Since restructuring

Net asset value per Ordinary share (total return)

since restructuring * 67.56%

Benchmark index total return since restructuring 66.01%

Expenses 2023 2022

Ongoing charges* 0.87% 0.84%

------------------------------------------------------------ ---------------------- ------------------ ------------

Financials As at

As at 30 September

30 September 2023 2022 Change %

------------------------------------------------------------ ---------------------- ------------------ ------------

Total net assets (Group and Company) GBP419,182,000 GBP404,833,000 3.5%

Net asset value per Ordinary share 345.66p 333.83p 3.5%

Net asset value per ZDP share^ 120.41p 116.91p 3.0%

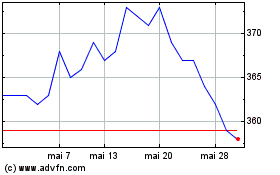

Price per Ordinary share 319.00p 315.00p 1.3%

Discount per Ordinary share* 7.7% 5.6%

Price per ZDP share^ 116.00p 114.00p 1.8%

Net gearing* 9.37% 7.41%

Ordinary shares in issue (excluding those held in treasury) 121,270,000 121,270,000 -

Ordinary shares held in treasury 2,879,256 2,879,256 -

ZDP shares in issue^ 32,128,437 32,128,437 -

------------------------------------------------------------ ---------------------- ------------------ ------------

Dividends

The Company has paid or declared the following dividends

relating to the financial year ended 30 September 2023:

Amount

per

Ordinary

Pay date share Record Date Ex-Date Declared Date

------------------------------ ----------- ------------- --------------- ----------------

First interim: 31 August 1.00p 4 August 2023 3 August 2023 11 July 2023

2023

Second interim: 29 February 1.20p 2 February 1 February 12 December 2023

2024 2024 2024

Total (2022: 2.10p) 2.20p

------------------------------ ----------- ------------- --------------- ----------------

* See Alternative Performance Measures provided in the Annual

Report.

The Company's portfolio was restructured on 20 June 2017. The

total return NAV performance since restructuring is calculated by

reinvesting the dividends in the assets of the Company from the

relevant payment date.

^ For information purposes.

For further information please contact:

Ed Gascoigne-Pees Tracey Lago, FCG John Regnier-Wilson

Camarco Polar Capital Global Healthcare Polar Capital LLP

Tele. 020 3757 Trust Plc Tele. 020 7227 2725

4984 Tele. 020 7227 2742

STATUS OF ANNOUNCEMENT

The figures and financial information contained in this

announcement are extracted from the Audited Annual Report for the

year ended 30 September 2023 and do not constitute statutory

accounts for the period. The Annual Report and Financial Statements

include the Report of the Independent Auditors which is unqualified

and does not contain a statement under either section 498(2) or

Section 498(3) of the Companies Act 2006.

The Annual Report and Financial Statements for the year ended 30

September 2023 have not yet been delivered to the Registrar of

Companies. The figures and financial information for the period

ended 30 September 2022 are extracted from the published Annual

Report and Financial Statements for the period ended 30 September

2022 and do not constitute the statutory accounts for that year.

The Annual Report and Financial Statements for the period ended 30

September 2022 have been delivered to the Registrar of Companies

and included the Report of the Independent Auditors which was

unqualified and did not contain a statement under either section

498(2) or Section 498(3) of the Companies Act 2006.

The Directors' Remuneration Report and certain other helpful

Shareholder information have not been included in this announcement

but forms part of the Annual Report which will be available on the

Company's website and will be sent to Shareholders in December

2023.

CHAIR'S STATEMENT

Dear Shareholders,

On behalf of the Board, I am pleased to provide to you the

Company's Annual Report for the year ended 30 September 2023.

Performance

The Company has performed well this year, ending the year 3.02%

ahead of its benchmark (MSCI ACWI Healthcare Index, Total Return),

performing well against the peer group and returning a NAV per

share total return of 4.21%. This was despite the year under review

continuing to be a difficult period for markets with challenging

macro-economic conditions and geo-political events, which have

sadly continued into the current year.

Whilst we are now seeing inflation and interest rates somewhat

stabilising, the longer term effects of this continue to be felt

and we have seen discounts across the investment trust sector in

general widen considerably. At the financial year end the discount

was 7.7% compared to the prior year figure of 5.6%.

The outperformance was driven by strong stock selection, largely

out of the focus on the three key themes highlighted in last year's

Annual report and Financial Statements, namely: rising utilisation,

disrupting the delivery of healthcare and consolidation.

Further detail is provided within the Manager's Report.

Outlook

Whilst the healthcare sector has been somewhat out of favour

against the broader market, fundamentals remain extremely strong

with valuations still very attractive. There is much to be excited

about, as demonstrated during the year by the delivery and

announcement of ground-breaking medical developments e.g. in

Alzheimer's research and the introduction onto the market of highly

effective weight-loss medications.

The Managers believe that while the themes that generated

performance last year will still be relevant, there are three

further areas which may drive shorter term returns: innovation, the

growing use of technology, such as AI and robotics, and Emerging

Markets. Further detail is provided in the Manager's Report.

We believe all of these factors support our optimism for

continued strong performance for the Company during the current

financial year.

Dividends

The Company's focus continues to remain on capital growth and

consequently dividends are expected to represent a relatively small

part of Shareholders' total return. The Company has a policy to pay

two small dividends per year.

In August 2023 the Company paid an interim dividend of 1.00p per

ordinary share. The Board has declared a further interim dividend

of 1.20p per ordinary share payable to shareholders on the register

as at 2 February 2024. This will bring the total dividend paid for

the financial year under review to 2.20p per ordinary share, a

small increase on the previous financial year.

Share Capital

The Company has 121,270,000 ordinary shares in issue as at the

date of writing and no shares have been bought back or issued

during the financial year under review. The Company's share price

on 30 September 2023 was 319.00p (2022: 315.00p). The Company's

market capitalisation at the financial year end was GBP386.9m

(2022: GBP382.0m). The Board has reconfirmed the authority given to

the Manager to use discretion to purchase shares in the market when

deemed appropriate to do so.

Subsidiary Undertaking

The Company is parent to a wholly owned subsidiary, PCGH ZDP

Plc. The subsidiary was created as part of the Company's

restructure in 2017; the purpose of the subsidiary is to issue zero

dividend preference ("ZDP") shares and provide a loan to the parent

in the form of structural gearing. The subsidiary has a fixed life

whereby the loan will be repaid and the ZDP shares will be redeemed

in June 2024 at which time the entity will be liquidated. The

Company remains in a strong position to repay the outstanding loan

amount at the time of redemption. Options for repayment are either

through new alternative gearing facilities or by raising cash via

the sale of stock within the portfolio. The Company has no current

intention to refinance the loan. Further information on the

redemption process is provided on the Company's website

www.polarcapitalglobalhealthcaretrust.co.uk .

The Board

As referenced in my statement to Shareholders last year, the

Board is aware of the FCA's Diversity and Inclusion Policy and

notes that its current composition does not meet the recommended

gender or ethnicity requirements. Given the Company's fixed life

and the potential reconstruction in 2025, the Board (via the

Nomination Committee) has concluded that the appropriate time for

recruitment would be shortly before or after any reconstruction

plans. We have engaged with some of our major shareholders via our

Company Secretary and they are understanding of this timeframe. It

is a priority of the Board to be able to meet all aspects of the

FCA's Diversity policy as part of future succession plans. At the

appropriate time, the Board will ensure that diversity continues to

be considered throughout any recruitment process, especially when

compiling a shortlist of candidates and selecting individuals for

interview.

There have been no changes to the membership of the Board during

the year under review. The Directors' biographical details are

available on the Company's website and are provided in the Annual

Report.

As reported in the last interim report, we have been joined by a

board apprentice, Ei-Lene Heng. Ei-Lene will sit with us as a Board

for c.12 months to gain experience before continuing her career and

potential future director roles. An interview with Ei-Lene on her

experience as a Board apprentice is contained in the Annual Report

and Accounts.

Annual General Meeting

The Company's Annual General Meeting ("AGM") will be held at 16

Palace Street at 2:30pm on Thursday, 8 February 2024. The notice of

AGM has been provided to Shareholders and will also be available on

the Company's website. Detailed explanations of the formal business

and the resolutions to be proposed at the AGM are contained within

the Shareholder Information section and in the Notice of AGM. We

will once again upload a copy of the Manager's Investment

Presentation to the Company's website ahead of the AGM and will

hold the formal business of the meeting in person. We have provided

a zoom link in the Notice of AGM which will enable anyone

interested to view the formal business and ask questions via the

on-line chat function. The Managers will be available to answer

questions and meet shareholders present. All formal business

resolutions will be voted on by a poll and we therefore encourage

shareholders to submit their votes ahead of the meeting by proxy

card which is provided with the Notice of Meeting.

Lisa Arnold

Chair

12 December 2023

INVESTMENT MANAGER'S REPORT - FOR THE YEARED 30 SEPTEMBER

2023

The objective of Polar Capital Global Healthcare Trust plc (the

Company) is to generate long-term capital appreciation by investing

in a globally diversified portfolio of healthcare companies.

The Company's diversification strategy, coupled with its focus

on large-capitalisation healthcare companies with robust,

medium-term growth outlooks, helps drive the positive risk/ return

profile of the underlying assets, relative to the more volatile

areas of healthcare. Further, the broad investment remit affords

the opportunity to invest in growth areas regardless of the

economic, political and regulatory environment. Importantly, the

Company also has the opportunity to invest in earlier-stage, more

innovative and disruptive companies that tend to be lower down the

market-capitalisation and liquidity scales. This is a key advantage

of the Company's closed ended structure. Regardless of size,

subsector or geography, stock selection is central to the process,

as we look to identify companies where there is a disconnect

between valuations and the near and medium-term growth drivers.

In terms of structure, the majority of the Company's assets

(calculated on a gross basis and referred to as the Growth

portfolio) will be invested in companies with a market

capitalisation >$5bn at the time of investment, with the balance

invested in companies with a market capitalisation <$5bn (a

maximum of 20% of gross assets, and referred to as the Innovation

portfolio). At the end of the reporting period, 31 companies in the

portfolio were Growth investments (95.0% of net assets) and 11 were

Innovation investments (14.3%). Structural debt, in the form of

Zero Dividend Preference shares, currently offers access to

additional liquidity and the opportunity to enhance returns.

Market Cap 30 September 30 September

at 2023 2022

Large (>US$10bn) 80.4% 78.5%

Medium (US$5bn -

US$10bn) 14.6% 16.0%

Small (<US$5bn) 14.3% 12.8%

Other net liabilities (9.3%) (7.3%)

100.0% 100.0%

============= =============

Over the financial year to 30 September 2023, the Company

delivered a NAV per share total return of 4.2%, a 3.0%

outperformance of its benchmark, the MSCI All Country World Daily

Net Total Return Health Care Index. The absolute performance of the

healthcare sector was modestly positive, up 1.2% over the reporting

period, but it underperformed the broader market, as tracked by the

MSCI All Country World Net Total Return Index (all figures above

are in sterling terms) which was up 10.5%.

A cautious investing environment, very much apparent in the

first three months of the financial year with investors favouring

more defensive sectors, changed in early 2023 and was replaced with

a heightened sense of optimism. That optimism, driven by

better-than-expected economic growth and receding fears of a

recession, was evident in the outperformance of more economically

sensitive areas of the market such as communication services,

information technology and consumer discretionary. This trend,

while volatile, persisted until the end of July, when investors

reverted once again to safety on the back of higher interest rates

and worries of a deteriorating macroeconomic environment should

interest rates stay higher for longer.

Reflecting on the Company's performance, there was strong stock

selection across the entire market-capitalisation spectrum,

partially offset by negative allocation, with the Company's above

benchmark exposure to small and mid-capitalisation stocks the

biggest drag on performance. Within the benchmark, distributors,

healthcare supplies and healthcare facilities all performed

strongly over the period, reflecting an acceleration in utilisation

and consumption - a central investment theme for the Company in

2023.

At the other end of the scale, the past 12 months have been

difficult for the healthcare services, life sciences tools and

services, and managed healthcare subsectors. The healthcare

services and managed care subsectors both struggled thanks to the

fear of elevated medical costs, driven by increased utilisation and

patient volumes. The life sciences tools and services subsector

suffered from a variety of earnings headwinds including post-Covid

destocking, a dramatic slowdown in China and more conservative

spending from their biopharmaceutical customers.

As set out in last year's annual report, the focus was very much

on three key investment themes:

-- Rising utilisation: during the year, medical device

companies, healthcare facilities and distributors all pointed to an

increase in both utilisation (i.e. patient volumes), and the

consumption of healthcare products and services.

-- Disrupting the delivery of healthcare: comments from the

managed care industry also underpinned our view that more and more

healthcare procedures are being delivered in lower-cost, outpatient

settings, especially among US seniors.

-- Consolidation: we witnessed the completion of several mergers

and acquisitions during the financial year, despite greater

scrutiny from the US Federal Trade Commission.

The themes discussed above will continue to be relevant as we

look forward to the next financial year, but we have modified our

emphasis into areas where we see the most interesting and

underappreciated near-term investment opportunities, namely

innovation, artificial intelligence (AI) and emerging markets. We

explore these themes in more detail below, under 'Healthcare:

Fundamentals remain strong'.

PERFORMANCE REVIEW

Over the financial year to the end of September 2023, the

Company achieved a positive return on net assets of 4.2%, which was

3.0% ahead of its benchmark. This performance was delivered despite

a challenging backdrop whereby the overall healthcare sector

underperformed the broader market. In sterling terms, global equity

markets posted muted returns in the first three months of the

financial year with investors adopting a cautious approach which

saw more defensive areas of the market (and healthcare)

outperform.

The Company entered the financial year with a large exposure to

healthcare facilities and biotechnology along with a positive view

on managed care. The biggest underweights were in the

pharmaceuticals, healthcare equipment and supply sectors, alongside

a smaller underweight in life sciences tools and services and

healthcare services. During the second quarter of this reporting

period, consistent with our view that utilisation of healthcare

would start to pick up in 2023, we turned more positive on

healthcare equipment, healthcare supplies and pharmaceuticals,

added additional exposure to healthcare facilities but reduced our

positioning in managed care to an underweight. Also, the exposure

to life sciences tools and services was switched to an overweight.

However, as 2023 progressed, with fear over the macroeconomic

picture became more challenging due to persistent inflation, and a

high interest rate environment, we closed the underweight in

managed care and reduced the holdings in life sciences tools and

services and biotechnology. From a subsector point of view, the

largest positive contributors to performance were biotechnology,

healthcare equipment and facilities thanks to strong selection and

positive allocation. On the other hand, stock-picking and

allocation in life sciences tools and services were the most

significant detractors to performance, together with weak selection

effect in distributors.

From a market-capitalisation perspective, stock selection was

positive across the entire range. For the larger-capitalisation

investments, in which the Company was underweight relative to the

benchmark, allocation was slightly negative but stock-picking was

substantially stronger. By contrast, small and midsized healthcare

companies had a very challenging period, especially at the start of

the financial year and towards the end of it.

To put this into perspective, the Russell 2000 Healthcare Index

underperformed the S&P 500 Healthcare index by over 32%, in

dollar terms, over the course of the year. Consequently, given the

Company's overexposure to small and mid-capitalisation stocks, the

allocation effect was negative.

On a geographical basis, all regions contributed positively

except the Middle East and Africa. The largest contributors were

Asia Pacific ex-Japan, where selection was productive; Europe,

where allocation was particularly favourable; and North America,

which benefitted from both good selection and allocation.

The active management of gearing did not have a meaningful

contribution to performance after accounting for foreign exchange

moves.

Top 10 Relative Contributors (%)

Average Active Stock Stock Total

Stock Weight Return Return Attribution

Top 10 Weight vs BM

----------------- -------- -------- -------- -------- -------------

Zealand Pharma

A/S 3.45 3.45 73.33 72.14 2.13

----------------- -------- -------- -------- -------- -------------

Pfizer 0.00 -3.15 -27.80 -28.99 1.13

----------------- -------- -------- -------- -------- -------------

Roche Holding

AG 0.00 -3.07 -20.71 -21.90 0.87

----------------- -------- -------- -------- -------- -------------

Legend Biotech

Corp 1.52 1.47 50.75 49.55 0.72

----------------- -------- -------- -------- -------- -------------

Seagen 1.14 0.82 41.97 40.77 0.67

----------------- -------- -------- -------- -------- -------------

CVS Health Corp 0.00 -1.42 -32.97 -34.16 0.62

----------------- -------- -------- -------- -------- -------------

Max Healthcare

Institute 1.60 1.58 25.05 23.86 0.61

----------------- -------- -------- -------- -------- -------------

AstraZeneca 4.48 1.64 11.65 10.45 0.60

----------------- -------- -------- -------- -------- -------------

HCA Healthcare 3.09 2.34 22.55 21.35 0.59

----------------- -------- -------- -------- -------- -------------

Bristol Myers

Squibb 0.00 -1.97 -25.24 -26.44 0.57

----------------- -------- -------- -------- -------- -------------

Source: Polar Capital, as at 30 September 2023.

Positive relative contributors to performance for the financial

year included Zealand Pharma, Pfizer, Roche Holding, Legend

Biotech, and Seagen.

Zealand Pharma is a Danish biotechnology company focused on

developing drugs for metabolic and gastrointestinal diseases.

During the period, the company reported encouraging clinical data

for its pipeline assets targeting short bowel syndrome and, more

importantly, obesity. The stock's strong performance reflects the

euphoria that surrounds obesity assets as witnessed with those of

Eli Lilly and Novo Nordisk (note the Company did not own Novo

Nordisk, during the reporting period).

The lack of exposure to Pfizer, a company that benefitted

significantly from the Covid pandemic by producing vaccines and

other therapeutics, was a positive contributor. The company's

relatively poor performance was mainly due to management's failure

to set the right expectations for sales of Covid-related products,

driving negative earnings revisions, and dramatically increased

spend on R&D for its non-Covid pipeline.

Also, not holding Roche Holding was beneficial to the

portfolio's performance. The Swiss pharmaceutical giant, like

Pfizer, saw its earnings estimates being cut throughout the

financial year as revenue for its Covid diagnostics portfolio

decreased faster than initially anticipated and other areas of its

portfolio also delivered sales below consensus. Additionally, the

company suffered from pipeline disappointments for important assets

in Alzheimer's disease and oncology.

Legend Biotech, a biotechnology company with a focus on tumour

treatment, released extremely compelling clinical data for a drug

called Carvykti. Used for the treatment of multiple myeloma, a bone

marrow cancer, the trial in question met its primary endpoint of a

significant improvement in progression-free survival. The stock was

further buoyed when partner Johnson & Johnson reported better

than expected sales for Carvykti.

Seagen, delivered a strong end to their 2022 financial year,

reported 2023 guidance that was well received by the market and

also highlighted significant progress and opportunities in the

pipeline. In February 2023, shares came under further upwards

pressure due to rumours that Pfizer was in discussion to acquire

Seagen. These rumours were confirmed in early March, when Pfizer

announced its intention to buy Seagen for a deal worth nearly

$43bn.

Bottom 10 Relative Contributors (%)

Average Active Stock Stock Total

Stock Weight Return Return Attribution

Bottom 10 Weight vs BM

---------------------- -------- -------- -------- -------- -------------

Novo Nordisk

A/S 0.00 -3.31 64.63 63.43 -1.71

---------------------- -------- -------- -------- -------- -------------

Cytokinetics 2.55 2.55 -44.32 -45.52 -1.66

---------------------- -------- -------- -------- -------- -------------

Revance Therapeutics 1.80 1.80 -61.10 -62.30 -1.01

---------------------- -------- -------- -------- -------- -------------

Bio-Rad Laboratories 2.07 1.95 -21.32 -22.51 -0.74

---------------------- -------- -------- -------- -------- -------------

Inspire Medical

Systems 1.24 1.24 2.44 1.25 -0.59

---------------------- -------- -------- -------- -------- -------------

Option Care

Health 1.33 1.33 -5.87 -7.07 -0.55

---------------------- -------- -------- -------- -------- -------------

Agilent Technologies 1.02 0.48 -15.19 -16.39 -0.48

---------------------- -------- -------- -------- -------- -------------

Acadia Healthcare 2.37 2.37 -17.65 -18.85 -0.42

---------------------- -------- -------- -------- -------- -------------

Merck KGaA 1.57 1.25 -5.60 -6.79 -0.40

---------------------- -------- -------- -------- -------- -------------

Novartis 1.17 -1.49 27.92 26.72 -0.38

---------------------- -------- -------- -------- -------- -------------

Source: Polar Capital, as at 30 September 2023. Past performance

is not indicative or a guarantee of future results.

Negative relative contributors to performance for the financial

year 2023 included Novo Nordisk, Cytokinetics, Revance

Therapeutics, Bio-Rad Laboratories, and Inspire Medical

Systems.

The lack of exposure to Novo Nordisk, a Danish pharmaceutical

business with the only commercialised latest-generation

Glucagon-Like Peptide-1 (GLP-1) drug to target obesity, was the

largest detractor during the financial year.

As mentioned earlier, and discussed in more detail below,

investors' appreciation for the market opportunity for Novo

Nordisk's weight-loss drug Wegovy and similar assets skyrocketed on

the back of exceptional commercial success and compelling new

clinical results.

Cytokinetics, a US biotechnology company developing drugs that

modulate muscle function to treat principally cardiovascular

diseases, was caught in the selloff of early-stage biotechnology

stocks after the collapse in March of Silicon Valley Bank, an

important institution that at the time financed over half the US

venture capital-backed healthcare and technology companies. In

addition, investors started to question the market opportunity for

Cytokinetics' key asset aficamten following a slow launch of

Bristol-Myers Squibb's Camzyos, a drug with a similar mechanism of

action and target indication as aficamten, although this is the

typical pattern for newly launched cardiovascular medicines.

Revance Therapeutics commercialises Daxxify, a toxin approved

for the treatment of frown lines and in development for

therapeutics use (cervical dystonia in adults, migraine etc).

Despite extremely encouraging sales from the very first month of

Daxxify's launch, subsequent quarters did not see such a rapid pace

of sales and sentiment soured on the product. Investors were

additionally disappointed when, during the capital market day in

September 2023, management announced their intention to pivot away

from its premium-pricing model for Daxxify, a decision that led the

market to question the differentiation of the product versus

Abbvie's market-leading product Botox.

Life sciences tools and services company Bio-Rad Laboratories

reported a series of downgrades to both their fiscal year 2023 and

medium-term expectations. Like many other businesses in the

industry, Bio-Rad Laboratories faced a number of challenges which

included customers' inventory destocking, biopharmaceutical funding

constraints and tighter sanctions in Russia.

Inspire Medical Systems is a medical technology company whose

sole focus is the treatment of obstructive sleep apnoea (OSA)

through hypoglossal-nerve stimulation. Despite delivering excellent

revenue growth and guidance upgrades in the first two quarters of

the calendar year, the stock lost over 35% of its value in August

and September 2023. The company's future growth was seen as being

negatively impacted by the significant potential growth in use of

the latest weight-loss drugs which could significantly shrink the

funnel of new patients with OSA, a condition which is often

associated with obesity.

Healthcare: Fundamentals remain strong

The 2022 Annual Report focused on three key themes we believed

were accelerating:

-- Healthcare delivery disruption accelerating including the

shift to value-based care: Not just driving patient volumes through

lower-cost settings but coordinating care to drive better

outcomes.

-- Utilisation: Working through the ever-growing backlog of

patients as healthcare systems globally learn to live with

Covid.

-- Consolidation: Healthcare is highly fragmented and heavily

populated with companies that have robust cashflows and strong

balance sheets. M&A activity has increased of late and is

highly likely to continue on the same path.

We continue to believe the above themes will be important for

some time, however in a rapidly evolving environment the following

themes are not only topical but also have significant commercial

relevance:

-- Innovation: 2023 has witnessed a number of highly significant

medical breakthroughs in a broad range of therapeutic

categories.

-- Artificial intelligence and machine learning: Advancements in

machine learning algorithms, greater access to data and the

availability of more powerful mobile networks could materially

accelerate the pace of change in the healthcare industry.

-- Emerging markets: After a challenging period, especially in

China, emerging markets should be a source of growth driven by an

ever-increasing demand for healthcare products and services.

Innovation: Reaching new heights

It is stating the obvious that the biopharmaceutical sector, and

indeed the broader healthcare industry, is highly innovative as

scientists attempt to tackle difficult to treat diseases with novel

ground-breaking treatment modalities. This innovation has shifted

to a new level in 2023 where we have seen positive clinical data in

areas of high unmet medical need such as early-stage breast cancer,

late-stage lung cancer, chronic obstructive pulmonary disease

(smoker's cough), Alzheimer's disease and obesity. Focussing on

just one disease area as an example, with more than one billion

(Source: Obesity Statistics in 2023, Forbes Health) people

suffering from obesity worldwide, the societal challenge and

commercial opportunity is simply enormous.

GLP-1s and obesity: Weighing up pros and cons

One of the biopharmaceutical industry's most significant

breakthroughs in recent times has been in the field of obesity,

with the field led by Eli Lilly and Novo Nordisk, the former being

the largest holding in the Company at the end of the financial

year. In terms of development of this category, Eli Lilly has

developed tirzepatide which contains a GLP-1 that has utility in

both the treatment of diabetes and obesity. The drug has

multi-factorial mechanisms of action, all of which contribute to

the drug's efficacy. Not only do GLP-1s stimulate insulin synthesis

and secretion from the pancreas, they also increase insulin

sensitivity, reduce the pace of gastric emptying and appear to work

with the brain to reduce food intake. In terms of efficacy,

tirzepatide has demonstrated weight loss >20% over a 72-week

period. Novo Nodisk's drug, Wegovy, has demonstrated high-teens

percentage weight loss over a 68-week period.

The impact GLP-1s are having on weight loss is hugely

impressive, but there is just as much excitement with some of the

secondary benefits of the drug class. Novo Nordisk released the

top-line results of a cardiovascular outcomes study called SELECT

which revealed that Wegovy reduces the risk of major adverse

cardiovascular events by 20% in adults with obesity and established

cardiovascular disease. So not only does the drug help patients

lose weight, but it also reduces their risk of further serious

cardiovascular events, such as myocardial infarction (heart attack)

and stroke. Further, Novo Nordisk and Eli Lilly are also looking at

how these drugs could help patients with disorders such as

obstructive sleep apnoea (a disorder where breathing stops and

starts while you sleep), pain associated with osteoarthritis, heart

failure, non-alcoholic steatohepatitis (fatty liver disease) and

diabetes prevention. Clearly we need to see the final data from the

ongoing clinical trials, but it is easy to understand why the

scientific community, and indeed the investment community, is so

excited by the potential of these drugs. For context, by 2030 the

combined estimated sales of Eli Lilly' tirzepatide and Novo

Nordisk's Wegovy is c$40bn in obesity alone (Source: Bloomberg), a

figure that only represents modest penetration of the global

pandemic that is obesity.

The euphoria surrounding the positive implications of the

obesity drugs is easy to understand, but it is the potentially

negative long-term implications for other healthcare subsectors

that needs more careful consideration. Continuous glucose

monitoring, for example, is an area where the market is starting to

question the total addressable market given the GLP-1s' positive

effect on controlling blood sugar levels and, potentially, delaying

the need for diabetics to move on to insulin. An even bigger

concern for medical device companies that have exposure to diabetes

is the potential for GLP-1s to prevent diabetes. Obstructive sleep

apnoea is another area where GLP-1s could prove effective, as

illustrated by the pressure being seen on the valuations of

companies that manufacture continuous positive airway pressure

devices and implants that are used to open airways. Another

concern, albeit a bit more tenuous, is the impact that obesity

drugs could have on the demand for large joints such as hips and

knees. Novo Nordisk is running a clinical trial that is looking at

not just weight loss, but also at how much knee pain participants

suffer from and how this affects participants' daily life. With

osteoarthritis the most common cause of joint replacements, there

is some concern that the demand for large joint replacements will

wane over time.

In conclusion, obesity medications could have a hugely positive

impact on the health of millions of patients globally and could be

of financial benefit to healthcare systems spending huge amounts of

money to treat effects of the disease. In terms of investment

opportunities, the companies developing the drugs are

understandably attracting lots of attention, but it is also the

supply chain in areas like manufacturing and distribution that

should benefit from the huge demand for the therapies. Relevant

Company investments included Zealand Pharma, Aptar Group and

Beckton Dickinson, in addition to the holding in Eli Lilly.

However, it is important to remain measured given we are a very

long way from solving the world's obesity pandemic. Not because the

drugs aren't effective, but because access to care will remain a

challenge for many, and not just in emerging markets.

Artificial intelligence: Adding value today

Another hot topic of conversation in 2023 has been artificial

intelligence (AI) and machine learning (ML) and how they can be

used to make healthcare more productive. AI and ML technologies can

sift through enormous volumes of health data and analyse it much

faster than humans can. For example, AI can assist physicians with

note taking and content summaries that can help ensure that medical

records are as accurate and as thorough as possible. AI could also

automate coding in hospitals and the sharing of information between

departments and billing. Fraud prevention is another area where AI

and ML can be used to help identify unusual or suspicious patterns

in insurance claims, diagnostic procedures and billing. In essence,

the opportunities for AI and ML to add value in a very heavily

regulated industry are endless but it makes sense to focus on areas

where there is tangible evidence of progress and where we can

invest today.

Diagnostics is a field of medicine where AI and ML are starting

to have a material impact on accuracy and, more importantly,

patient outcomes. Take colonoscopy for example, a technique that

remains the gold standard in detecting and preventing colorectal

cancer. The current procedure does have limitations with some

studies suggesting that more than half of post-colonoscopy colon

cancer cases arise from lesions missed at patients' previous

colonoscopies. Researchers at the Mayo Clinic are investigating how

AI can be used to improve polyp detection. In the case of colon

cancer, the AI system works alongside the physician in real time,

scanning the colonoscopy video feed and drawing small, red boxes

around polyps that might otherwise get overlooked.

AI-based real-time image analysis software is also being used in

ultrasound machines to enhance sonographers' ability to interpret

images. Obstetrics has embraced the technology given its impact on

efficiency and workflow but more importantly its ability to reduce

omissions and errors. A good example is Intelligent Ultrasound's

SCANNAV Assist software that has been incorporated into GE

Healthcare's Volusion SWIFT ultrasound machines.

Revenue cycle management is also benefitting from intelligent

automation, with US company R1 RCM one of the leading protagonists.

Hospitals, health systems and physician groups can all benefit from

technologies and services that improve financial performance and

promote patient satisfaction. Patient scheduling, pre-registration

and clearance, coding and processes to deal with denials can all

benefit enormously from predictive, technology-driven solutions. As

for the patients, efficient and organised scheduling, registration,

admissions and payment can lead to high levels of satisfaction, and

importantly, high levels of retention.

Relevant Company investments included Intuitive Surgical, Iqvia,

Intelligent Ultrasound and R1 RCM.

Emerging markets: Is China on the road to recovery?

The lifting of the Covid lockdowns was the catalyst for a strong

rebound in economic activity in China in early 2023. However,

growth stalled, with falling consumer spending, a real estate

crisis and slumping exports all contributing factors. This macro

slowdown adversely affected a number of industries, including the

life sciences tools and services sector. There are also some

healthcare-specific challenges that have been weighing on the

sector in recent months, primarily an anti-corruption campaign that

is looking to "resolutely punish corruption" in the medical sector

"with a zero-tolerance attitude".

Promoting systematic governance throughout the entire healthcare

sector, the anti-corruption campaign seeks to uncover questionable

links between hospital managers, doctors and medical

representatives. If successful, the campaign could significantly

advance China's healthcare industry, making it more affordable and

freeing much-needed resources for innovative medicines, devices,

technologies and services. However, the initiative has resulted in

a slowdown in activity with doctors reluctant to participate in

academic conferences or prescribe imported drugs. There has also

been a marked decline in orthopaedic and ophthalmic surgeries as

clinicians and surgeons temporarily reduce activity. Further,

medical device companies have highlighted a modest impact on

capital placements in the short term with hospital procurement

processes also under the microscope.

As soon as the Chinese healthcare system has successfully

navigated its way through the anti-corruption campaign, investors

can once again focus on the strong, underlying fundamentals of the

region. Government policy is supportive for healthcare, encouraging

investment in research and development to satisfy the desire for

best-in-class medicines. Further, volume-based procurement (VBP),

which has weighed on the biopharmaceutical and medical device

industries for the past five years, appears to be stabilising. The

government is comfortable with the price adjustments VBP has put in

place and is easing up on its policies, seeking a greater balance

between cost control and innovation. With a more supportive

regulatory backdrop, coupled with a recovery in the economy,

companies with significant exposure to China could be interesting

as we look into 2024, with life sciences tools and services,

medical devices and biopharmaceuticals the most likely

beneficiaries stocks.

Positioning and process: Constructive on biotechnology,

healthcare facilities, healthcare supplies and equipment

We remain constructive on the healthcare sector as a whole, in

particular on biotechnology, healthcare facilities, healthcare

supplies and equipment, which were three of our largest overweight

subsector positions as at 29 September 2023. Despite the

challenging environment for early-stage biotechnology investing, we

remain constructive on the broader subsector, which continues to be

innovative and highly productive with many of the Company's

investments in businesses with either late-stage assets or

commercialised drugs or both. Consolidation was a key theme

highlighted in last year's report and we were pleased to see that

the pace of M&A activity picked up in 2023, with many large

biopharmaceutical companies announcing their intention to acquire

biotechnology assets in order to reinvigorate revenue growth and

strengthen their pipelines.

From a geographical perspective, the Company continues to have

an overweight stance in Europe and Japan. The biggest change to the

portfolio was moving North America from being an overweight to an

underweight, which does not reflect a less positive perspective on

the region but was an effect of stock selection and changes in the

allocation to subsectors.

We entered the year with an underweight in healthcare supplies

and equipment given the challenges the industry faced (supply-chain

constraints, low hospital volumes due to staffing shortages, a

strengthening US dollar). However, our stance turned more positive

towards the start of 2023 with the view that utilisation of

healthcare would start to reaccelerate after a period of low

hospital and procedural volumes during the pandemic. This thesis

proved accurate and we believe utilisation will continue to stay

elevated at least for the short term, hence our overweight in the

sector as at the end of the financial year. Additionally, the

medical technology sector is ripe to take advantage of the

opportunities afforded by AI which is already being deployed, for

instance to assist medical imaging reading (Intelligent Ultrasound

Group) and in robotic surgery (Intuitive Surgical).

Increased utilisation should also be beneficial for healthcare

facilities, therefore our overweight in the sector has not changed

significantly over the period under review. As delivery disruption

is an important secular trend in healthcare, our holdings in the

sector are in businesses providing access to healthcare services in

the lowest-cost settings such as the home and outpatient facilities

or Ambulatory Surgery Centres (ASC) and businesses involved in

behavioural health services.

As in the past, the pharmaceuticals sector remains a significant

underweight relative to the benchmark for the Company. We take the

view that, collectively, pharmaceutical companies have fairly

uninspiring revenue and earnings growth profiles. However, there

are therapeutic areas which are very attractive and could lead to

significant revenue and earnings growth. Such an area of interest

is metabolic health which covers diseases such as diabetes and

obesity. Over the year we increased our exposure to this theme by

adding to our holdings in Eli Lilly which, together with Zealand

Pharma (a biotechnology company), is the most direct expression of

our positive view on weight-loss therapies.

Geographical Exposure 30 September 2023 30 September 2022

at

----------------------- ------------------ ------------------

United States 65.1 % 72.3%

United Kingdom 10.6 % 6.4%

Denmark 8.3% 4.3%

Japan 7.6 % 6.9 %

Switzerland 7.1 % 6.4 %

France 3.9 % 2.6 %

Sweden 2.8 % 2.9 %

Germany 2.3% 2.2 %

India 0.8 % -

Ireland 0.8 % 1.0 %

Netherlands - 2.3 %

Other net liabilities (9.3%) (7.3%)

------------------ ------------------

Total 100% 100.0%

------------------ ------------------

Source: Polar Capital

Sector Exposure 30 September 2023 30 September 2022

at

-------------------------- ------------------ ------------------

Pharmaceuticals 30.8% 31.3%

Biotechnology 20.2% 28.3%

Healthcare Equipment 15.4% 12.1%

Managed Healthcare 11.1% 13.1%

Healthcare Facilities 9.7% 7.4%

Healthcare Supplies 7.6% 2.9%

Life Sciences Tools

& Services 6.8% 4.3%

Metal & Glass Containers 2.5% 2.4%

Healthcare Services 2.4% 2.1%

Healthcare Technology 2.0% 1.5%

Healthcare Distributors 0.8% 1.9%

Other net liabilities (9.3%) (7.3%)

------------------ ------------------

Total 100% 100%

------------------ ------------------

Source: Polar Capital

While the previous tables focus on subsector and geographical

weightings, bottom-up stock selection is central to the team's

investment process. The healthcare industry is extremely

complicated and dynamic, and subject to varied news flow which

lends itself to active management. We look to take advantage of

dislocations between near-term valuations and medium-term

fundamentals. Our own in-house idea generation is complemented by

input from external research, with conviction built through company

meetings, investor conferences and dialogue with expert physician

and consultant networks. The team also has a strong valuation

discipline, looking at a large number of metrics including sales

and earnings revisions, price-to-earnings, enterprise values and

free cashflow.

Zero Dividend Preference shares

In terms of a top-down strategy for the Company's portfolio,

active decisions are made on market capitalisation, subsector and

geographical exposure, depending on the current macro outlook of

the team which is formulated with the help of third-party research

and monitoring many key risk indicators. The debt raised through

the original issuance of Zero Dividend Preference (ZDP) shares

allows the ability to take on gearing with the aim of enhancing

returns. As a reminder, the PCGH ZDP plc was incorporated with a

limited life of seven years, ending on 19 June 2024, on which date

the ZDP Shares will be repaid and the PCGH ZDP plc Board will

convene a general meeting to propose a resolution to voluntarily

wind up the operations of the Company.

Net Gearing

During the financial year, gearing averaged 7.5%, but it has

been adjusted to reflect the risk/reward outlook throughout the

past 12 months. In the first eight months, gearing was kept at an

average of c7% in order to strike a balance between our

constructive outlook on the healthcare sector and more cautious

posturing with regards to broader equity markets and the

macroeconomic environment. However, as the year progressed and the

underperformance of the healthcare sector relative to the broader

market widened, gearing was increased to take advantage of the

opportunities this dislocation offered. We therefore exited the

2023 financial year with net gearing at 9.4%.

Outlook for healthcare: Primed for a change in fortunes

one for healthcare with investors favouring more economically

sensitive sectors as they ponder the idea of avoiding a recession

and enjoying a so-called soft landing. With sentiment weak, and

exchange-traded fund (ETF) outflows pointing to diminished appetite

for the healthcare sector, the classic contrarian indicators are

pointing to a more constructive stance. More importantly,

healthcare's fundamentals remain strong, as illustrated by the

delivery of ground-breaking medical breakthroughs, a material

pickup in utilisation and patient volumes plus much-needed progress

in shifting the site of care out of inpatient hospital settings and

in to lower-cost, more efficient outpatient settings such as

surgery day centres and ASCs.

As we look forward to the next financial year, there is much to

engage and excite. The introduction of highly effective weight-loss

medications has created huge amounts of interest, and is driving

significant dispersions in returns for the so-called GLP-1 winners

(the drug developers, device manufacturers and distributors) versus

the GLP-1 losers (medical device companies with exposure to areas

such as sleep apnoea, diabetes and orthopaedics). However, once the

market has all the relevant clinical data and the euphoria dies

down, there will likely be a wide range of interesting investment

opportunities driven by the recent dislocation.

The adoption of AI platforms machine and ML software could

revolutionise select diagnostic procedures, improving clinician

workflow and driving superior outcomes for patients. In a highly

complex and data-intensive industry, AI and ML are also being used

to drive efficiencies for healthcare systems in areas such as

revenue collection, patient scheduling and insurance claims.

Emerging markets, especially China, are another area of interest

which could see a renaissance in the coming months and years as the

healthcare system finds the right balance between cost control,

compliance and attracting innovative, best-in-class therapies,

devices and capital equipment.

In conclusion, the healthcare sector is heavily out of favour

but attractively valued, is delivering high levels of innovation

and has consistently shown the ability to deliver strong revenue

and earnings growth, regardless of the economic, political and

regulatory environment. It is these characteristics that fuel our

optimism for the year ahead.

James Douglas and Gareth Powell

Co-Managers of the Polar Capital Global Healthcare Trust plc

12 December 2023

PORTFOLIO REVIEW

Full Investment Portfolio

As at 30 September

Ranking Stock Sector Country Market Value % of total

GBP'000 net assets

2023 2022 2023 2022 2023 2022

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

1 (5) Eli Lilly Pharmaceuticals States 28,037 16,997 6.7% 4.2%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

2 (1) Johnson & Johnson Pharmaceuticals States 26,228 35,964 6.2% 8.9%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

3 (4) AstraZeneca Pharmaceuticals Kingdom 25,937 19,761 6.2% 4.9%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

4 (3) Abbvie Biotechnology States 25,463 24,932 6.1% 6.2%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

5 (-) Elevance Health Managed Healthcare States 21,404 - 5.1% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

6 (33) Zealand Pharma Biotechnology Denmark 19,655 7,437 4.7% 1.8%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

7 (-) Intuitive Surgical Healthcare Equipment States 17,482 - 4.2% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

8 (9) Humana Managed Healthcare States 14,748 13,908 3.5% 3.4%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

9 (10) Alcon Healthcare Supplies Switzerland 14,397 12,040 3.4% 3.0%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

10 (13) HCA Healthcare Healthcare Facilities States 13,830 10,872 3.3% 2.7%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Top 10 investments 207,181 49.4%

------------------------ ------------ ----------- -------- ------- -----

United

11 (-) Becton Dickinson Healthcare Equipment States 12,453 - 3.0% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

12 (20) Astellas Pharma Pharmaceuticals Japan 12,333 9,701 2.9% 2.4%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

13 (-) Takeda Pharmaceutical Pharmaceuticals Japan 12,312 - 2.9% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

14 (-) Zimmer Biomet Healthcare Equipment States 12,304 - 2.9% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

15 (16) Acadia Healthcare Healthcare Facilities States 10,787 10,082 2.6% 2.5%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

16 (23) Molina Healthcare Managed Healthcare States 10,611 9,603 2.5% 2.4%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

17 (18) DexCom Healthcare Equipment States 10,560 9,812 2.5% 2.4%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Metal & Glass United

18 (22) Aptargroup Containers States 10,480 9,623 2.5% 2.4%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Swedish Orphan

19 (11) Biovitrum Biotechnology Sweden 10,400 11,758 2.5% 2.9%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Life Sciences

20 (-) Lonza Tools & Services Switzerland 10,358 - 2.5% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Top 20 investments 319,779 76.2%

------------------------ ------------ ----------- -------- ------- -----

21 (-) Coloplast Healthcare Supplies Denmark 10,077 - 2.4% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

22 (32) Tenet Healthcare Healthcare Facilities States 10,069 7,582 2.4% 1.9%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Life Sciences United

23 (-) IQVIA Tools & Services States 9,993 - 2.4% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

24 (-) R1 RCM Healthcare Services States 9,878 - 2.4% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

25 (-) Merck KGaA Pharmaceuticals Germany 9,758 - 2.3% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

26 (-) Legend Biotech Biotechnology States 9,565 - 2.3% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

27 (-) BioMerieux Healthcare Equipment France 8,777 - 2.1% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

28 (6) Cytokinetics Biotechnology States 8,172 14,673 1.9% 3.6%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Life Sciences United

29 (30) Bio-Rad Laboratories Tools & Services States 8,099 7,879 1.9% 1.9%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

30 (-) Hikma Pharmaceuticals Pharmaceuticals Kingdom 8,026 - 1.9% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Top 30 investments 412,193 98.2%

------------------------ ------------ ----------- -------- ------- -----

31 (-) EssilorLuxottica Healthcare Supplies France 7,447 - 1.8% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

32 (15) Genmab Biotechnology Denmark 5,125 10,197 1.2% 2.5%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

MoonLake

33 (-) Immunotherapeutics Biotechnology Switzerland 5,022 - 1.2% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

34 (39) Medley Healthcare Technology Japan 4,953 2,901 1.2% 0.7%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

35 (-) Indivior Pharmaceuticals Kingdom 4,142 - 1.0% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

36 (-) Global Health/India Healthcare Facilities India 3,562 - 0.8% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Intelligent United

37 (37) Ultrasound Healthcare Technology Kingdom 3,272 3,049 0.8% 0.8%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

38 (34) Uniphar Healthcare Distributors Ireland 3,196 4,171 0.8% 1.0%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

39 (31) Revance Therapeutic Pharmaceuticals States 2,914 7,647 0.7% 1.9%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

United

40 (38) LivaNova Healthcare Equipment Kingdom 2,808 2,950 0.7% 0.7%

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Top 40 investments 454,634 108.4%

------------------------ ------------ ----------- -------- ------- -----

41 (-) Amvis Healthcare Facilities Japan 2,350 - 0.6% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Swedish Orphan

Biovitrum rights

42 (-) Issue Biotechnology Sweden 1,271 - 0.3% -

----- ------------------------ ------------------------ ------------ ----------- -------- ------- -----

Total equities 458,255 109.3%

------------------------ ------------ ----------- -------- ------- -----

Other net liabilities (39,073) (9.3%)

------------------------ ------------ ----------- -------- ------- -----

Net assets 419,182 100.0%

------------------------ ------------------------ ------------ ----------- -------- ------- -----

Note - Sectors are from the GICS (Global Industry Classification

Standard).

STRATEGIC REPORT

The Strategic Report section of this Annual Report comprises the

Chair's Statement, the Investment Manager's Report, including

information on the portfolio, and this Strategic Report. This

Report has been prepared to provide information to shareholders on

the Company's strategy and the potential for this strategy to

succeed, including a fair review of the Company's performance

during the year ended 30 September 2023, the position of the

Company at the year end and a description of the principal risks

and uncertainties, including both economic and business risk

factors underlying any such forward-looking information.

BUSINESS MODEL AND REGULATORY ARRANGEMENTS

The Company's business model follows that of an externally

managed investment trust providing Shareholders with access to a

global portfolio of healthcare stocks.

The Company is designated an Alternative Investment Fund ('AIF')

under the Alternative Investment Fund Management Directive

('AIFMD') and, as required by the Directive, has contracted with

Polar Capital LLP to act as the Alternative Investment Fund Manager

('AIFM') and HSBC Bank Plc to act as the Depositary.

Both the AIFM and the Depositary have responsibilities under

AIFMD for ensuring that the assets of the Company are managed in

accordance with the investment policy and are held in safe custody.

The Board remains responsible for setting the investment strategy

and operational guidelines as well as meeting the requirements of

the Financial Conduct Authority ('FCA') Listing Rules and the

Companies Act 2006.

The AIFMD requires certain information to be made available to

investors in AIFs before they invest and requires that material

changes to this information be disclosed in the Annual Report of

each AIF. Investor Disclosure Documents, which set out information

on the Company's investment strategy and policies, gearing, risk,

liquidity, administration, management, fees, conflicts of interest

and other Shareholder information are available on the Company's

website.

There have been no material changes to the information requiring

disclosure. Any information requiring immediate disclosure pursuant

to the AIFMD will be disclosed to the London Stock Exchange.

Statements from the Depositary and the AIFM can be found on the

Company's website.

INVESTMENT OBJECTIVE AND POLICY

The Company's Investment Objective is to generate capital growth

through investments in a global portfolio of healthcare stocks.

he Company will seek to achieve its objective by investing in a

diversified global portfolio consisting primarily of listed

equities. The portfolio is diversified by geography, industry

sub-sector and investment size.

The portfolio will comprise a single pool of investments, but

for operational purposes, the Investment Manager will maintain a

Growth portfolio and an Innovation portfolio. Innovation companies

are broadly defined by the Investment Manager as small/mid cap

innovators that are driving disruptive change, giving rise not only

to new drugs and surgical treatments but also to a transformation

in the management and delivery of healthcare. The Growth portfolio

is expected to comprise a majority of the Company's assets. For

this purpose, once an innovation stock's market capitalisation has

risen above US $5bn, it will ordinarily then be treated as a growth

stock.

The relative ratio between the two portfolios may vary over the

life of the Company due to factors such as asset growth and the

Investment Manager's views as to the risks and opportunities

offered by investments in each pool and across the combined

portfolio. The original make-up of the combined portfolio was of up

to 50 stocks, with growth stocks being primarily US listed. In

2018, the Board authorised an increase to the number of stocks able

to be held to 65 and confirmed there is no restriction on

geographical exposure.

The combined portfolio will therefore be made up of interests in

up to 65 companies, with no single investment accounting for more

than 10% (or 15% in the case of an investment in another fund

managed by the Investment Manager) of the Gross Assets at the time

of investment. The innovation portfolio may include stocks which

are neither quoted nor listed on any stock exchange but the

exposure to such stocks, in aggregate, will not exceed 5% of Gross

Assets at the time of investment. In the event that the Investment

Manager launches a dedicated healthcare innovation fund, the

Company's exposure to innovation stocks may be achieved in whole or

in part by an investment in that fund. In any event, the Company

will not, without the prior consent of the Board, acquire more than

15% of any such healthcare innovation fund's issued share

capital.

The Board remains positive on the outlook for healthcare and the

Company will continue to pursue its Investment Objective in

accordance with the stated investment policy and strategy. Future

performance is dependent to a significant degree on the world's

financial markets and their reactions to economic events and other

geo-political forces. The Chair's Statement and the Investment

Manager's Report comment on the development and performance of the

business during the financial year, the outlook and potential risks

to the performance of the portfolio.

STRATEGY AND INVESTMENT APPROACH

The Investment Manager's investment process is primarily based

on bottom-up fundamental analysis. The Investment Manager uses a

qualitative filter consisting of key criteria to build up a

watch-list of securities that is monitored on a regular basis. Due

diligence is then carried out on the individual securities on the

watch-list. Each individual holding is assessed on its own merits

in terms of risk: reward including ESG criteria. While the Company

expects normally to be fully or substantially invested, the Company

may hold cash or money market instruments pending deployment in the

portfolio. In addition, it will have the flexibility, when the

Investment Manager perceives there to be actual or expected adverse

equity market conditions, to maintain cash holdings as it deems

appropriate.

SERVICE PROVIDERS

Polar Capital LLP has been appointed to act as the Investment

Manager and AIFM as well as to provide or procure company

secretarial services, marketing and administrative services,

including accounting, portfolio valuation and trade settlement

which it has arranged to deliver through HSBC Securities Services

("HSS").

The Company also contracts directly, on terms agreed

periodically, with a number of third parties for the provision of

specialist services, namely:

-- Panmure Gordon & Co as Corporate Broker;

-- Herbert Smith Freehills LLP as Solicitors;

-- HSBC Securities Services as Custodian and Depositary;

-- Equiniti Limited as Share Registrars;

-- RD:IR for Investor Relations and Shareholder Analysis;

-- Camarco as PR advisors;

-- PricewaterhouseCoopers LLP as Independent Auditors;

-- Huguenot Limited as website designers and internet hosting services; and

-- Perivan Limited as designers and printers for shareholder communications.

GEARING

Following the restructure of the Company in June 2017, the

Company maintains long-term structural gearing in the form of a

loan from the wholly owned subsidiary PCGH ZDP Plc. No short-term

borrowings have been made and there are no arrangements made for

any bank loans. The Articles of Association provide that the

Company may borrow up to 15% of its Net Asset Value at the time of

drawdown, for tactical deployment when the Board believes that

gearing will enhance returns to shareholders.

In accordance with the Articles of Association of the subsidiary

company, PCGH ZDP Plc, and the loan agreement between the Company

as parent and subsidiary, the Board intends that the subsidiary

company will be put into voluntarily liquidation through a General

Meeting on 19 June 2024. The Company has no current intention to

refinance the loan made by the subsidiary company and remains in a

strong position to repay the outstanding amount at the time of

redemption of the ZDP shares.

Further details of the loan provided by the subsidiary are given

in the Annual Report and Accounts.

BENCHMARK

The Company will measure the Investment Manager's performance

against the MSCI ACWI Healthcare Index total return, in sterling

with dividends reinvested. Although the Company has a benchmark,

this is neither a target nor determinant of investment strategy.

The portfolio may diverge substantially from the constituents of

this index. The purpose of the Benchmark is to set a reasonable

measure of performance for shareholders above which the Investment

Manager earns a share for any outperformance it has delivered.

INVESTMENT MANAGEMENT COMPANY AND MANAGEMENT OF THE

PORTFOLIO

Directors have sought to ensure that the business of the Company

is managed by a leading specialist investment management team and

that the investment strategy remains attractive to shareholders.

The Directors believe that a strong working relationship with Polar

Capital LLP (the Investment Manager) will achieve the optimum

return for shareholders. As such, the Board and the Investment

Manager operate in a supportive, co-operative and open

environment.

The Investment Manager is Polar Capital LLP ('Polar Capital'),

which is authorised and regulated by the Financial Conduct

Authority, to act as Investment Manager and AIFM of the Company

with sole responsibility for the discretionary management of the

Company's assets (including uninvested cash) and sole

responsibility to take decisions as to the purchase and sale of

individual investments. The Investment Manager also has

responsibility for asset allocation within the limits of the

investment policy and guidelines established and regularly reviewed

by the Board, all subject to the overall control and supervision of

the Board. Polar Capital provides a team of healthcare specialists

and the portfolio is co-managed by Mr James Douglas and Mr Gareth

Powell. The Investment Manager has other resources which support

the investment team and has experience in managing and

administering other investment trust companies.

Under the terms of the IMA, the Investment Manager also provides

or procures accountancy services, company secretarial, marketing

and day-to-day administrative services, including the monitoring of

third-party suppliers, which are directly appointed by the Company.

The Investment Manager has, with the consent of the Directors,

delegated the provision of certain of these administrative

functions to HSBC Securities Services and to Polar Capital

Secretarial Services Limited .

Fee Arrangements

Management Fee

Under the terms of the IMA, the Investment Manager will be

entitled to a management fee together with reimbursement of

reasonable expenses incurred by it in the performance of its

duties. The management fee is payable monthly in arrears and is

charged at the rate of 0.75% (prior to 1 October 2020: 0.85%) per

annum based on the lower of the market capitalisation and adjusted

net asset value. In accordance with the Directors' policy on the

allocation of expenses between income and capital, in each

financial year 80% of the management fee payable is charged to

capital and the remaining 20% to income.

Performance Fee

The Investment Manager may receive a performance fee paid in

cash when various performance parameters are met. No performance

fee has been accrued or is due to be paid for the year ended 30

September 2023 (2022: nil). Further details on the termination

arrangements and performance fee methodology and calculation are

provided within the Shareholder Information in the Annual

Report.

PERFORMANCE AND KEY PERFORMANCE OBJECTIVES

The Board appraises the performance of the Company and the

Investment Manager as the key supplier of services to the Company

against key performance indicators ('KPIs'). The objectives of the

KPIs comprise both specific financial and Shareholder related

measures. These KPI's have not differed from the prior year.

KPI CONTROL PROCESS OUTCOME

The provision of investment The Board reviews As at 30 September 2023,

returns to shareholders the performance of the total net assets of

measured by long- the portfolio in detail the Company amounted to

term and hears the views GBP419,182,000 (2022:

NAV growth and relative of the Investment GBP404,833,000).

performance against Manager at each meeting.

the Benchmark. The Company's NAV total

The Board also considers return, over the year

the value delivered ended 30 September 2023,

to shareholders through was 4.21% while the Benchmark

NAV growth and dividends Index over the same period

paid. was 1.19%. The Company's

performance is explained

further in the Investment

Manager's Report.

Since restructuring on

20 June 2017, the total

return of the NAV was

67.56% and the benchmark

was 66.01%. Investment

performance is explained

in the Chair's Statement

and the Investment Manager's

Report.

------------------------------- ----------------------------------

The achievement of Financial forecasts Two dividends have been

the dividend policy. are reviewed to track paid or are payable in

income and distributions. respect of the year ended

30 September 2023 totalling

2.20p per share (2022:

two dividends totalling

2.10p per share).

The Company's focus remains

on capital growth. While

the Company continues

to aim to pay two dividends

per year these are expected

to be a small part of

a shareholder total return.

------------------------------- ----------------------------------

Monitoring and reacting The Board receives The discount of the ordinary

to issues created regular information share price to the NAV

by the discount or on the composition per ordinary share at

premium of of the share register the year ended 30 September

the ordinary share including trading 2023 was 7.7% (2022: 5.6%).

price to the NAV per patterns and discount/premium

ordinary share with levels of the Company's During the year ended

the aim of reduced ordinary shares. The 30 September 2023, no

discount volatility Board discusses and new shares were issued

for shareholders. authorises the issue or bought back.

or buy back of shares

when appropriate. The number of shares in

issue, as at the year