Real Good Food Company Plc (The) Trading Statement (1764Z)

04 Février 2014 - 8:00AM

UK Regulatory

TIDMRGD

RNS Number : 1764Z

Real Good Food Company Plc (The)

04 February 2014

The Real Good Food Company plc (AIM: RGD)

Third Quarter Trading Update

The Real Good Food Company plc ("the group" or "RGFC") is a

diversified food group, which owns Napier Brown (Europe's biggest

non-refining sugar distributor) as well as Renshaw and R&W

Scott (bakery ingredients), Garrett Ingredients (dairy ingredients)

and Haydens Bakery (patisserie and desserts).

Third Quarter trading activity - from 1 October to 31 December

2013 - proved to be mixed in what were challenging market

conditions for the food sector. Three of our businesses (Renshaw,

R&W Scott and Haydens) recorded EBITDA growth year-on-year, but

we continued to be affected by the well-publicised dramatic

reduction in sugar market prices. We have made good progress in

addressing this with a number of new supply sources secured in the

past three months and we see sugar margins being fully restored

during the course of 2014.

The Group will provide a further update on trading in April.

Divisional Commentary

Napier Brown's sales, following this year's main contract

season, have increased significantly in both the industrial and

retail sectors. The new listings for the Whitworths brand have come

into effect and utilisation at the Normanton packing facility has

increased substantially. Commissioning of the new site at Immingham

is virtually complete and will enable the business to utilise new

sources of sugar more cost effectively which is critical to our

future business model. Trading has inevitably been impacted by the

reduction in sugar prices, but we are confident that the steps we

have taken to mitigate against this will restore margins to

previous levels during 2014.

At Garrett Ingredients trading has been also been affected by

the instability in the sugar market and while contribution from

Dairy ingredients showed growth in the early part of the year,

recent market conditions have been challenging. This and some

increased costs associated with a management re-organisation will

impact this year's performance. We are very pleased, however, to

have successfully recruited a new, experienced management team and

believe that we now have the structure in place to deliver our

growth plans.

At Renshaw, the investment in sales and marketing is now

beginning to pay dividends and we anticipate reporting a

significant increase in EBITDA for the year. Sales growth has been

experienced in UK retail while export initiatives are also showing

positive signs with our business in Brussels now fully operational

and the Renshaw brand launched in the US with a bespoke range of

products.

R&W Scott has now recruited a full commercial team and is

ready to drive a series of added value product launches over the

next 18 months. The first of these, a range of premium desert

sauces, is now on sale in retail while a number of b2b

opportunities have been identified across all product sectors.

EBITDA will be similar to last year as the business absorbs the

increase in overhead which is required to meet its long term

ambitions.

EBITDA at Haydens is anticipated to increase YOY as sales

continue to grow and the remodeling of the bakery enables improved

labour utilisation. The customer base continues to broaden and the

commercial team has been expanded to reflect this.

Pieter Totté, Executive Chairman, comments:

"The investments which we have made in increased sales and

marketing resources were designed to transform our businesses from

being manufacturing-led to market-led and underpin our growth

strategy.

"It is pleasing to see that this strategy is now beginning to

bear fruit: volumes are showing good growth in Napier, Renshaw and

at Haydens, while we have now recruited sales and marketing teams

to deliver similar momentum at R&W Scott and Garrett

Ingredients.

"The instability in the sugar market is giving us short term

challenges but our strategic plans in this market remain sound and

we are encouraged by the support being given to us by customers who

recognise the valuable role we play in the market."

4 February 2014

ENQUIRIES:

Real Good Food

Pieter Totté, Chairman Tel: 020 3056

1516

Andrew Brown, Marketing Director Tel: 020 3056

Mike McDonough, Finance Director 1516

Tel: 0151 706

8200

Shore Capital & Corporate Tel: 020 7408

4090

Stephane Auton

Patrick Castle

Cubitt Consulting Tel: 020 7367

5100

Gareth David

Cebuan Bliss

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFFRFRIVIIS

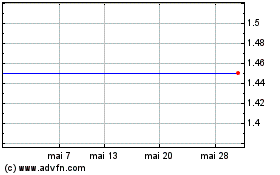

Real Good Food (LSE:RGD)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

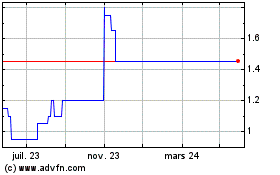

Real Good Food (LSE:RGD)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024