TIDMRKW

RNS Number : 1963U

Rockwood Strategic PLC

22 November 2023

Rockwood Strategic Plc

("RKW or the "Company")

Interim results for the six months to 30 September 2023

Rockwood Strategic Plc (LSE: RKW) is pleased to announce its

unaudited results for the six months ended 30 September 2023 (the

"Period").

Highlights for the period:

-- Net Asset Value (NAV) Total Return in the period of -5.5% to

1851.59p/share which compares to a decline in the FTSE AIM All

Share Index of -10.3% and an increase in the FTSE Small Cap

(ex-ITs) Index of 2.9%. Total Shareholder Return in the Period was

-2.5% (1) .

-- NAV Total Return performance in the year to 30th September

2023 of 28% which compares to the FTSE AIM All Share Index of -9.9%

and the FTSE Small Cap (ex-ITs) of 8.8%. The Total Shareholder

Return in the same one year period was 25.4% (1) .

-- NAV Total Return performance in the three years to 29th

September 2023 of 80.3% which compares to the FTSE AIM All Share

return of -24.3% and the FTSE Small Cap (ex-ITs) of 35%. The Total

Shareholder Return in the same three-year period was 114% (1) .

-- No. 1 ranked fund over the last 1, 3 and 5 years by Net Asset

Value Total Return in the AIC UK Small Companies sector. Ranked

No.2 over 1 year and No.1 over 3 and 5 years by Total Shareholder

Return ('TSR').

-- New shares issued via our block listing programme at a small

premium to Net Asset Value, growing the shareholder base by

5.7%.

-- Cash of GBP3.5m at the end of the Period (representing 7% of

NAV).

-- Four new investments were made across a range of industry

sectors and our investment in Trifast Plc was increased with the

holding re-categorised as 'Core'. Post period end Nick Mills from

the Rockwood Investment Team was appointed as a Non-Executive

Director of Trifast Plc.

-- Takeover approach for Finsbury Food Plc generating an

unrealised IRR of 38.5% at period end.

-- Post period end takeover offers were received for Smoove Plc

(69.3% premium to previous day's close before commencement offer

period), Onthemarket Plc (93.7% premium to three month volume

weighted average price) and The City Pub Group Plc (65% premium to

the three month volume weighted average price).

Noel Lamb, Chairman of Rockwood Strategic Plc, commented:

"The first half of our financial year has been a challenging one

for UK small company stock market investors, with sustained

outflows from the asset class amidst negative sentiment as interest

rates continued to rise against a subdued economic backdrop. For

those with sensible time horizons these are typically the

conditions for positive future medium-term returns, not least due

to the heavily depressed valuations of small company shares

relative to history. Private Equity and Trade Buyers are clearly

recognising the opportunities created by this environment with the

drumbeat of takeovers within Rockwood's portfolio continuing

throughout 2023. We are delighted that during the period the

long-standing share price discount to Net Asset Value was closed

and we were able to grow our shareholder base."

Richard Staveley, Fund Manager, Harwood Capital, commented:

" Illegitimi non carborundum" is our mentality currently. There

has been a wealth of managerial and Board changes at Rockwood

investee companies during the period. We are excited by the quality

of these appointments and their credentials for creating

operational and strategic change which should in time lead to

considerable growth in shareholder value. We are receiving takeover

approaches left, right and centre and expect more to be forthcoming

if the stock market does not recognise the deeply undervalued

future cashflow potential of our portfolio. The redeployment of

takeover receipts fills us with great excitement given our pipeline

of new opportunities and these 'buyer's' market conditions. When

the market environment eventually changes we expect the re-rating

of our holdings to be material as investors belatedly react to the

catalysts that are now in place across the portfolio for improved

profitability and value creation. This in turn should lead to a

re-acceleration of the compounding of Rockwood shareholders' wealth

via net asset value growth."

The full version of the RKW interim report will be available on

its website shortly at www.rockwoodstrategic.co.uk

For further information, please contact:

Rockwood Strategic Plc

Noel Lamb Chairman noellamb@finnebrogue.co.uk

Harwood Capital LLP Christopher

Investment Manager Hart 020 7640 3200

Singer Capital Markets Advisory James Maxwell

LLP Alex Bond

Broker James Fischer 020 7496 3000

About Rockwood Strategic Plc

Rockwood Strategic plc ("RKW") is an Investment Trust managed by

Harwood Capital LLP and listed on the premium segment of the Main

Market of the London Stock Exchange that invests in a focused

portfolio of smaller UK public companies. The strategy identifies

undervalued investment opportunities, where the potential exists to

improve returns and where the company is benefitting, or will

benefit, from operational, strategic or management changes. These

unlock, create or realise value for investors.

About Harwood

Harwood Capital LLP ("HC LLP") was incorporated in 2003 and is

the investment manager for RKW and of Harwood Private Clients. It

is an investment adviser to North Atlantic Smaller Companies

Investment Trust Plc. HC LLP is a wholly owned subsidiary of

Harwood Capital Management Limited and is authorised and regulated

by the Financial Conduct Authority ("FCA"), authorisation number

224915. Led by Christopher Mills, the funds managed and advised by

HC LLP follow an active value approach towards the businesses in

which they invest.

Chairman's Statement for the half year to 30 September 2023

While the UK stock market conditions have been subdued during

the first half of our financial year, the energy at Rockwood

Strategic has remained buoyant. Net Asset Value (NAV) Total Return

in the period reduced -5.5% to 1,851.62p/share which outperformed a

decline in the FTSE AIM All Share Index of -10.3%. However, I am

delighted to report that during the period we issued new shares via

our block listing programme at a small premium to Net Asset Value,

growing the shareholder base for our proven and differentiated

strategy by 5.7%. This is a significant achievement, as very few of

the 300 or more Investment Trusts across the entire industry are

valued at a premium to NAV at the end of this period and few have

been capable of issuing shares during it. Furthermore, the average

discount to NAV across the market for UK listed Investment Trusts

is currently wider than usual. UK equities appear out of favour

and, in the open- ended fund sector, have now experienced over two

years of monthly withdrawals. It is against this difficult backdrop

that Rockwood Strategic has managed to close its long-standing

discount and begin to grow the strategy with new investors who,

like the Board, can see the potential for positive medium-term

returns and the potential to continue our sector beating

performance. The Board believes that the current environment is

ripe for attractive investments to generate our performance

objective and pleased to observe the Investment Manager deploying

capital. A larger fund will benefit shareholders by allowing the

investment team to widen its practical universe for establishing

influential stakes in companies under GBP250m market capitalisation

and will of course lead to cost benefits with improved scale. There

is also a range of communication and marketing initiatives that are

being under taken by the Investment Manager to reach a wider

audience.

Following the successful vote at the AGM, we have also

conducted, post period end, a stock split of 10 for 1 which will

increase the accessibility of Rockwood Strategic to smaller

investors. It is these smaller investors, and indeed larger ones,

that the Treasury has begun to consider actively in terms of

improving the overall environment for UK equity investing. The

health of our market is clearly challenged. A number of investors

have migrated to global equity mandates, with others recently being

attracted to emerging alternative asset classes. The lure of higher

cash and bond yields has become a further distraction. The 'Mansion

House' reforms are but one step towards encouraging investment in

small British businesses; yet more is clearly needed to incentivise

further the savings of domestic investors into small, listed

companies which provide so many jobs within the UK, utilise our

world-class service sector and create capital investment.

Furthermore, the long-term returns from investing in UK small

companies have been excellent. There has been much made of the

recent 'de-equitisation', or reduction of number of companies, on

the London Stock Exchange and initiatives are seemingly under

review to address and reverse this. With well over 750 operating

companies in the combined indices of the AIM All-share, FTSE Small

and FTSE Fledgling, the board is confident that our concentrated

approach is well placed and needs only to identify a small number

of the very best opportunities which it is well equipped to do.

Noel Lamb

Chairman, Rockwood Strategic Plc

21 November 2023

Investment Manager's Report

Introduction

During the 6 month period to 30 September we increased the

number of holdings to twenty-one, alongside adding to a number of

existing holdings, as a soft UK stock- market provided the

opportunity to purchase investments we believe will at least meet

our 15% IRR criteria over the next 3-5 years. Stock specific risk

and hence stock specific returns are the primary factors producing

the NAV result for the period. We now have 8 'Core' holdings

(target 5-10) and 13 'Springboard / opportunities' (target 10-25)

with the top ten holdings accounting for 64.2% of NAV at period

end. Cash was GBP3.5m at the end of the period, representing 7% of

NAV having reduced from 21.2% in March 2023.

We continue to identify companies which will benefit from

operational, strategic or management initiatives. The stock market

valuations for these companies are usually depressed as they have

fallen out of favour due to reduced profitability, strategic error

or poor management. All of these can be reversed, typically

generating significant shareholder value recovery. However, the

current market backdrop is providing even greater valuation

anomalies; time horizons seem to be shortening and many investment

funds are experiencing outflows. Our approach of engaging with

stakeholders alongside our own material shareholding is

differentiated and proving effective. When the stock market doesn't

recognise the improvements subsequently made and the value on

offer, increasingly private equity investors and trade buyers

are.

Market Commentary

The last six months have surprised most market commentators.

Economies have proved reasonably resilient, at stagnant levels of

growth, whilst monetary policy has continued to tighten. The FTSE

Aim All Share Index fell 10.3% and is now down 44.7 % from its peak

in September 2021. OPEC co- ordination alongside resilient US

growth and regional geo-political tensions have caused the oil

price to rise 18% from $77.9 to $92.2. UK interest rates rose from

4.25% to 5.25%. There are some signs that inflation has peaked but

a material reduction has not occurred yet (Core inflation September

2023 6.3%) and Central Banks remain committed to this goal in their

public statements. The share-price rises of mega-US technology

stocks appears the only consensual positive trend and feels as if

its sucking in all spare capital, herd-like, whilst UK equity

valuations are at their lowest for a generation. The IPO market is

moribund. However, merger and acquisition activity is clearly

increasing as savvy trade buyers and private equity firms exploit

the liquidity hungry, redemption heavy UK equity market. The

'transmission mechanism' of higher interest rates has clearly had

slower effects than in previous rate cycles, albeit insolvencies

are picking up, as is unemployment off a very low base and house

prices are falling. We believe the lag is due to a hangover from

the COVID related government largesse to both consumers and

corporates, which we perceive has nearly fully unwound and the move

in recent years by large parts of both groups to extend their

interest rate protection on debt at the previously very low levels.

This is gradually unwinding.

The 'Mansion House' reforms hopefully represent the

'starting-gun' for more initiatives to improve the attractiveness

of small UK businesses, but it will take time. As we move into an

election year competing policy announcements will emerge, so we

urge all parties to take seriously the health of the UK stock

market. Its primary purpose is to raise capital and support UK

businesses when they reach a certain maturity and whilst many

schemes exist for very small private businesses, more is needed to

encourage investors to deploy capital to our public market. It is a

key source of employment, tax receipts and UK investment. The

alternative is everyone buys Nvidia, now valued at c.$1

trillion.

We stated in previous reports that we would anticipate limited

sustained market recovery until 'core' inflation is demonstrably

falling and the market can have real confidence to anticipate the

commencement of monetary easing. We believe the portfolio holdings

are deeply undervalued, almost all are very well financed, all have

the potential for operational improvements and strategic

improvements too which can drive shareholder value irrespective of

the doom and gloom. Takeover interest continues to emerge for a

number of our holdings due to their attractive cash flow generation

and market positions and we expect realisations to produce material

NAV uplifts and cash for re-investment. We do see a high

probability of a recession and expect market profit expectations to

fall further and have built this backdrop into the margin of safety

we expect in our holding valuations and the extent of profit

recovery we are expecting from the businesses and their management

teams many of which evolved positively during the period.

Portfolio performance

The portfolio is very concentrated and therefore it should be

expected that over any shorter period, such as a year, a dominant

stock or two will drive performance.

Performance 1 Year 3 Year

(all indices are excluding H1 2023 to 30 Sept to 30 Sept

investment trusts)

RKW TSR1(1) (2.5%) 25.4% 114.0%

--------- ----------- -----------

RKW NAV Total Return1(1) (5.5%) 28.0% 80.3%

--------- ----------- -----------

FTSE Small Cap Total Return

(SMXX) 2.9% 8.8% 35.0%

--------- ----------- -----------

FTSE AIM All Share Total Return

(TAXXG) (10.3%) (9.9%) (24.3%)

--------- ----------- -----------

FTSE All Share Total Return

(ASX) 1.4% 13.8% 39.8%

--------- ----------- -----------

Source: Bloomberg and Company as at 30 September 2023

The NAV fell due to modest weakness across the portfolio in

thinly traded markets dominated by negative investor sentiment and

increasing interest rates. Soft economic conditions led to reduced

short term profitability expectations at M&C Saatchi and

Flowtech Fluidpower whilst the recovery from one part of one

division at RM Plc has, to date, been slower than expected. Much

more positively, Finsbury Food received a takeover approach

(unrealised IRR 38.5% at period end) and Galliford Try announced

material special dividends, an enhanced dividend policy and strong

further recovery in profitability. Overall, the NAV Total Return

outperformed the AIM All Share Index where most of our investments

reside.

Portfolio highlights & investment activity

The period ended with 21 holdings, of which the top 10

constitute 64.2% of NAV.

Top ten shareholdings Shareholding Portfolio

(30 September 2023) GBPm in company NAV

RM Plc 4.8 9.8% 9.6%

------ ------------ ---------

Trifast Plc 4.1 3.7% 8.2%

------ ------------ ---------

M & C Saatchi Plc 3.5 2.0% 7.0%

------ ------------ ---------

Flowtech Fluidpower 3.3 6.1% 6.6%

------ ------------ ---------

Centaur Media Plc 3.2 6.0% 6.6%

------ ------------ ---------

Galliford Try Holdings

PLC 3.0 1.2% 6.1%

------ ------------ ---------

Finsbury Food 2.7 1.9% 5.4%

------ ------------ ---------

City Pub Co 2.6 2.9% 5.2%

------ ------------ ---------

Van Elle 2.5 5.6% 5.0%

------ ------------ ---------

Titon Holdings 2.3 26.7% 4.5%

------ ------------ ---------

Other investments (11) 14.3 - 28.7%

------ ------------ ---------

Cash and other working

capital items 3.5 - 7.1%

------ ------------ ---------

Total NAV 49.8 100.0%

------ ------------ ---------

Trifast , the distributor and manufacturer of fasteners, has

become a 'core' holding. During the period the Chair has been

replaced, a new CEO has been appointed and post period end Nick

Mills, member of the Investment Management team, has been appointed

a Non-Executive Director of the company. In line with all 'core'

holdings, the business has the opportunity for significant

operational improvements, is materially undervalued relative to our

estimates of the company's future cash flow generation and now has

the catalysts in place to ensure shareholder value is maximised

over the next 3-5 years. Its current operating margins are

depressed relative to history, however a new Enterprise Resource

Planning system has been deployed which should ultimately lead to

improved financial performance. The business is international, and

whilst much internal work must be done under the new CEO and

relatively recently appointed new CFO and COO, which will drive

profitability over the medium-term, industrial end-market

conditions are currently 'soft'.

Bonhill , the international B2B media business providing

Business Information, Events and Data & Insight propositions to

the global Financial Services community, de-listed after returning

capital from asset sales via a tender offer. This investment has

not met our target returns, however due to the 'margin of safety'

we identified at the outset and our subsequent efforts, via taking

a Non-Executive Director position at the company, we were able to

almost fully protect our invested capital through the break-up and

sale of the business. We remind shareholders that Rockwood

Strategic also made a profitable loan to the company during this

realisation phase and we await to receive, post the period end, a

final payment before the company enters voluntary insolvency.

New Investments

Four new investments were made and a number of existing holdings

were increased. We highlight two at the Interim stage.

These were all classified by the manager as either

"springboards" or "opportunities" and as such each individual

investment did not exceed 4% of NAV at inception. We target

eventually 10-25 of these style holdings as Rockwood Strategic

builds, we had 13 at period end. The former are investments which

meet our investment criteria of being able to deliver 15% IRRs over

a time horizon of five years (thereby doubling in value) which have

the opportunity for, or are experiencing, operational, strategic

and management or Board changes which should deliver, unlock or

create shareholder value. Once identified, we ideally want to

invest 5-15% of NAV in order to have material exposure within the

strategy and also a stake in the company of similar size, ensuring

an influential voice with which we can engage with the company and

stakeholders.

James Fisher & Sons

The stock is a classic 'fallen angel' in our view. They provide

specialist engineering services to the energy, defence, renewables

and marine markets and has a 175-year-old business history, 2367

employees with operations in 18 countries. Previous management

misfired on capital allocation through an over-energetic

acquisition strategy with the inevitable lack of integration, loss

of operational control and distressed balance sheet through a

build-up of excessive debt. Operating margins halved. A set-piece

Rockwood opportunity, we believe.

At c. GBP165m market capitalisation at period end, 2022 sales

were GBP478m, Ebitda GBP67.5m and PBT GBP16.2m. The financial

recovery opportunity is material with the company targeting a mean

reversion back to 10% margin and 15% ROCE. The Defence business was

loss-making in 2022 and Marine Services only made 3.5%, so it's

clear where critical improvements are needed. Our due diligence has

given us confidence the order book can grow, in particular in

Defence.

We believe a high quality new Chairman, CEO and CFO have been

appointed (in that order) and the highly experienced Jean Vernet

(formally divisional MD at Smiths Group Plc) has already

re-organised the group into 3 divisions and appointed new Heads of

each (2 of which are external). Net Debt remains elevated and thus

we expect further portfolio rationalisation to accelerate debt

reduction alongside improved cash generation.

The shares have been valued on significantly higher multiples

over the years and thus our thesis combines both improved

profitability and improved valuation multiples in time.

Restore

'Comebacks' in sport often raise mixed emotions, the same is

true in business, one only needs to ask Disney shareholders.

Restore, however, we believe has been exceptionally lucky to have

been able to bring back former CEO Charles Skinner. Charles built

the business very successfully between 2009 and 2019 and set the

company on the path to a market leadership position in a range of

office services, most importantly document storage. This division

has 22.4m boxes of records under management, 975 staff, 52 sites

and is UK no.2 after Iron Mountain, it makes over 30% profit

margins and is 70% of total profit.

At the end of the period the market capitalisation was GBP240

million having risen since our purchase on both Charles's

appointment and a new major HMRC contract win. In 2022 They had

sales of GBP279m and Ebitda of GBP76m with PBT of GBP41m.

Adjacencies such as shredding, scanning, digital storage,

technology recycling and office relocation have all developed over

the years, however following the departure of Charles, costs have

increased, operational control has slipped, financial management

deteriorated and a material de-rating of the company has occurred.

Typically for recovery situations it takes a decent period (often

up to a year) for new management to really get to grips with the

business they are going to be turning around. Seasoned

practitioners which populate Rockwood Strategic investments usually

hit the ground running. In Charles case he will hit the ground

sprinting. We look forward to the results from his leadership and

the fruits from this opportunistic investment in the period.

Portfolio Updates

There has been considerable progress across the portfolio,

particularly with regard to the appointment of key management and

Board members to our investments, all of which we are delighted

with and who we expect to make major positive impacts on the

companies in the years ahead leading to the unlocking, growth and

realisation of shareholder value. The importance of these

individuals should not be under-played as in many cases it de-risks

our investment theses as we move past the point of having the right

people in place to turnaround our target investments.

-- Mike England has been appointed CEO of Flowtech Fluidpower.

Mike was previously COO of FTSE 100 constituent RS Group

(previously Electrocomponents). He has already made a series of

senior management changes at the business and identified a number

of work-streams to improve operational performance. In the first

half of the year operating margins were 5.7%. The company is now

targeting "mid-teens" medium-term. We see achieving sustainable

double-digit margins as a catalyst for a material re-rating

alongside balance sheet improvements due to better working capital

management.

-- Simon Goodwin and Christopher Humphrey have been respectively

appointed CFO and NED of RM Plc. We are particularly pleased about

Christopher's appointment as we initially proposed him to the

Board. Christopher's deep and relevant corporate experience

including in particular his time at Anite Plc will be invaluable to

RM as they try to recover shareholder value. Since investing in

this stressed, turnaround situation there has been 4 newly

appointed NEDs, a CEO, a CFO, a Head of Transformation, new Heads

of Digital and Real Estate and their disastrous technology project

has been brought under control. We believe this represents huge

progress in just one year to deliver our medium-term investment

thesis, which, once debt has been reduced, should lead to

considerable upside for Rockwood Strategics NAV.

-- Zyllah Byng-Thorne has been appointed Executive Chair of

M&C Saatchi following the retirement of Moray McClennan. In

line with peers, M&C Saatchi's traditional creative advertising

division has had weak end-market conditions to contend with. This

means that the overdue and identified cost-cutting, streamlining

and efficiency opportunities are even more important to be

delivered. Zyllah's reputation is not pedestrian and we expect

swift progress over the next 18 months alongside an unemotional

appraisal of various agencies and activities within the group.

Progress on the removal of minority interests should also be

achieved.

-- Stephen Welker has been appointed Chair of Hostmore, the

owner of the TGI Fridays franchise in the UK. This household name

casual dining brand has stood the test of time and has been

achieving noticeably improved customer ratings in the last year.

With over 80 units, the business has entered a challenging phase

for the UK consumer. However, Stephen is no stranger to turnarounds

having been part of the Sherbourne team that have successfully

identified and led a number in the UK market. The CEO and CFO have

now also been replaced, the cash-consumptive store opening

programme paused and a series of initiatives to stabilise and

improve profitability put in place. Free cash flow generation

should ramp up allowing a reduction in elevated debt and eventually

material shareholder value creation.

-- Finally, breakthrough contract wins were announced by

Filtronic Plc with the European Space Agency and a leading global

provider of low earth orbit satellites, in addition to prestigious

grant funding with the Ministry of Defence's Technology

Exploitation Programme. Filtronic has a been a supplier to the MOD

for many years and also into telecommunications hardware markets

via a key market-leading client. Its IP and technology know-how in

the 'Radio frequency' sector is arguably unrivalled and as a

result, when a new end-market emerges, the company has found itself

in an enviable position. That end-market is 'Low earth orbiting'

satellites, whose growth prospects appear material due to the

advances in rocket technology in particular by SpaceX. Filtronic

needs to scale its revenues to grow shareholder value whilst it

increases its strategic value in the emerging supply chain for the

satellite industry. Progress in the Space sector might just be the

solution.

Outlook

We believe that the stock market continues to materially

undervalue our portfolio holdings. Identified measures to build

profitability should offset, and in many cases exceed, negative

impacts from a challenging external environment. Robust balance

sheets should protect the downside. We have material influence

through our large stakes and Board representations to help ensure

shareholder value remains a focus and strategies evolve

appropriately. 'Engagement' activities added value in the period

and we have a number of initiatives underway for the rest of the

year. We continue to identify new investments to deliver on our

investment objectives which will replace the realisations expected

in the second half.

As discussed above, this market down cycle is already quite

extended and the effect of higher interest rates is starting to

impact economies. Once Central Banks are comfortable inflation is

tamed, monetary policy should ease and a marked improvement in

stock-market conditions, if history is anything to go by, is

likely. In the first stages of a market recovery, if history does

rhyme or repeat then UK small companies should lead and those with

value and recovery characteristics will perform even better. We are

not overly focused on predicting the immediate market outlook

though, but sticking to identifying investments where our target

absolute returns can be achieved over the next 3-5 years,

irrespective.

Richard Staveley Investment Manager

21 November 2023

Unaudited Condensed Statement of Comprehensive Income

for the six months ended 30 September 2023

Six months Six months

to 30 September to 30 September

2023 2022

(Unaudited) (Unaudited)

Capital Total

Revenue Total

----- --------- ------------------------ --------- ------------------

Notes GBP'000 GBP'000 GBP'000 GBP'000

----- --------- ------------------------ --------- ------------------

Income 14 538 - 538 493

----- --------- ------------------------ --------- ------------------

Net (losses)/gains on

investments at fair

value - (3,126) (3,126) (3,850)

----- --------- ------------------------ --------- ------------------

Total income 538 (3,126) (2,588) (3,357)

----- --------- ------------------------ --------- ------------------

Expenses

----- --------- ------------------------ --------- ------------------

Investment management

fee 15 (60) - (60) (52)

----- --------- ------------------------ --------- ------------------

Performance fee 15 - - - -

----- --------- ------------------------ --------- ------------------

Other expenses (286) (44) (330) (875)

----- --------- ------------------------ --------- ------------------

Total expenses (346) (44) (390) (927)

----- --------- ------------------------ --------- ------------------

Return before taxation 192 (3,170) (2,978) (4,284)

----- --------- ------------------------ --------- ------------------

Taxation 11 - - - -

----- --------- ------------------------ --------- ------------------

Return for the period 192 (3,170) (2,978) (4,284)

----- --------- ------------------------ --------- ------------------

Basic and diluted earnings

per ordinary share (pence) 7.29p (120.36p) (113.07p) (168.58p)

----- --------- ------------------------ --------- ------------------

The total column of the statement is the Statement of

Comprehensive Income of the Company prepared in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the United Kingdom. The supplementary revenue and capital columns

are presented for information purposes as recommended by the

Statement of Recommended Practice ("SORP") issued by the

Association of Investment Companies ("AIC").

All items in the above Statement derive from continuing

operations. No operations were acquired or discontinued during the

period. The notes on pages 13 to 16 form part of these financial

statements.

Unaudited Condensed Statement of Financial Position

as at 30 September 2023

As at 30 As at As at 30

September 31 March September

2023 2023 2022

(Unaudited) (Audited) (Unaudited)

Notes GBP'000 GBP'000 GBP'000

------- -------------------------- -------------------- --------------------------

Non-current assets

------- -------------------------- -------------------- --------------------------

Investments at fair value

through profit or loss 16 46,242 39,255 34,318

------- -------------------------- -------------------- --------------------------

Current assets

------- -------------------------- -------------------- --------------------------

Trade and other receivables 146 73 125

------- -------------------------- -------------------- --------------------------

Cash and cash equivalents 3,879 11,631 4,970

------- -------------------------- -------------------- --------------------------

4,025 11,704 5,095

------- -------------------------- -------------------- --------------------------

Total assets 50,267 50,959 39,413

------- -------------------------- -------------------- --------------------------

Current liabilities

------- -------------------------- -------------------- --------------------------

Trade and other payables (498) (541) (1,109)

------- -------------------------- -------------------- --------------------------

Tax liability - - (1,580)

------- -------------------------- -------------------- --------------------------

Performance fee payable - (625) -

------- -------------------------- -------------------- --------------------------

Total liabilities (498) (1,166) (2,689)

------- -------------------------- -------------------- --------------------------

Total assets less current

liabilities 49,769 49,793 36,724

------- -------------------------- -------------------- --------------------------

Net assets 49,769 49,793 36,724

------- -------------------------- -------------------- --------------------------

Represented by:

------- -------------------------- -------------------- --------------------------

Share capital 1,344 1,281 1,281

------- -------------------------- -------------------- --------------------------

Share premium account 15,944 13,063 13,063

------- -------------------------- -------------------- --------------------------

Capital reserve 11,354 11,344 11,344

------- -------------------------- -------------------- --------------------------

Capital redemption reserve 2,711 - -

------- -------------------------- -------------------- --------------------------

Revenue reserve 18,416 24,105 11,036

------- -------------------------- -------------------- --------------------------

Total equity attributable

to equity holders of

the Company 49,769 49,793 36,724

------- -------------------------- -------------------- --------------------------

Basic and diluted net

asset value per ordinary

share (pence) 1,851.6p 1,959.6p 1,445.3p

------- -------------------------- -------------------- --------------------------

The financial statements were approved by the Board of Directors

on 21 November 2023 and signed on its behalf by:

Noel Lamb Kenneth Lever

Chairman Director

The notes form part of these financial statements.

Unaudited Condensed Statement of Cash Flows

for the six months ended 30 September 2023

Six months Period Six months

to 30 September ended to 30 September

2023 31 March 2022

Notes (Unaudited) 2023 (Unaudited)

GBP'000 (Audited) GBP'000

GBP'000

---------- ------------------ ----------- ------------------

Cash flow from operating

activities

---------- ------------------ ----------- ------------------

Return before tax (2,978) 8,430 (4,284)

------------------ ----------- ------------------

Losses/(gains) on investments

held at fair value through

profit and loss 3,126 (8,991) 3,850

------------------ ----------- ------------------

Decrease/(increase) in

receivables 1 (772) (360)

------------------ ----------- ------------------

(Decrease)/increase in

creditors (668) 663 290

------------------ ----------- ------------------

Dividend income (371) - -

------------------ ----------- ------------------

Portfolio dividend income

received 297 862 169

------------------ ----------- ------------------

Corporation tax paid - (1,581) -

------------------ ----------- ------------------

Net cash outflow from

operating activities (593) (1,389) (335)

------------------ ----------- ------------------

Cash flows from investing

activities

---------- ------------------ ----------- ------------------

Purchases of investments (11,636) (20,015) (9,594)

------------------ ----------- ------------------

Sales of investments 1,523 22,528 4,392

------------------ ----------- ------------------

Net cash (outflow)/inflow

from investing activities (10,113) 2,513 (5,202)

------------------ ----------- ------------------

Cash flows from financing

activities

---------- ------------------ ----------- ------------------

Gross proceeds of share

issue 2,997 - -

------------------ ----------- ------------------

Share issue costs (43) - -

------------------ ----------- ------------------

Net cash inflow from

financing activities 2,954 - -

------------------ ----------- ------------------

(Decrease)/increase in

cash and cash equivalents

for the period (7,752) 1,124 (5,537)

------------------ ----------- ------------------

Reconciliation of net

cash flow movements in

funds

---------- ------------------ ----------- ------------------

Cash and cash equivalents

at the beginning of the

period 11,631 10,507 10,507

------------------ ----------- ------------------

(Decrease)/increase in

cash and cash equivalents (7,752) 1,124 (5,537)

------------------ ----------- ------------------

Cash and cash equivalents

at end of period/year 3,879 11,631 4,970

------------------ ----------- ------------------

The notes form part of these financial statements.

Unaudited Condensed Statement of Changes in Equity

for the six months ended 30 September 2023

Capital

D shares Ordinary Share Revenue Capital Redemption Total

GBP'000 Share Premium Reserve* GBP'000 Reserve GBP'000

Capital GBP'000 GBP'000 GBP'000

GBP'000

---------- ---------- --------- ---------- --------- ----------- ---------

Period ended 30 September

2023 (unaudited)

--------------------------------------------------------------------------------

Opening balance as

at 1 April 2023 10 1,271 13,063 24,105 - 11,344 49,793

---------- ---------- --------- ---------- --------- ----------- ---------

Unrealised appreciation

transferred at 1 April

2023 - - - (5,881) 5,881 - -

---------- ---------- --------- ---------- --------- ----------- ---------

Cancellation of D shares (10) - - - - 10 -

---------- ---------- --------- ---------- --------- ----------- ---------

Gross proceeds of share

issue - 73 2,881 - - - 2,954

---------- ---------- --------- ---------- --------- ----------- ---------

Total comprehensive

income for the period - - - 192 (3,170) - (2,978)

---------- ---------- --------- ---------- --------- ----------- ---------

As at 30 September

2023 - 1,344 15,944 18,416 2,711 11,354 49,769

---------- ---------- --------- ---------- --------- ----------- ---------

for the six months ended 30 September 2022

Capital

D shares Ordinary Share Revenue Capital Redemption Total

GBP'000 Share Premium Reserve* GBP'000 Reserve GBP'000

Capital GBP'000 GBP'000 GBP'000

GBP'000

---------- ---------- --------- ---------- --------- ----------- ---------

Period ended 30

September 2022 (unaudited)

--------------------------------------------------------------------------------

Opening balance as

at 1 April 2022 10 1,271 13,063 15,320 - 11,344 41,008

---------- ---------- --------- ---------- --------- ----------- ---------

Total comprehensive

income for the period - - - (4,284) - - (4,284)

---------- ---------- --------- ---------- --------- ----------- ---------

As at 30 September

2022 10 1,271 13,063 11,036 - 11,344 36,724

---------- ---------- --------- ---------- --------- ----------- ---------

* The revenue reserve can be distributed in the form of

dividends. The notes form part of these financial statements.

Notes to the Unaudited Condensed Interim Financial

Statements

Rockwood Strategic Plc (the Company) is a public company

incorporated in the UK and registered in England and Wales

(registration number: 03813450).

The Company carries on the business as an investment trust

company within the meaning of Sections 1158/1159 of the Corporation

Tax Act 2010.

1. Principal Accounting Policies

These interim financial statements for the period ending 30

September 2023 have been prepared on a going concern basis, under

the historical cost convention, modified by the valuation of

investments at fair value.

Following the Company's approval as an investment trust company

on 1 April 2023, the annual financial statements of the Company for

the period to 31 March 2024 will be prepared in accordance with UK

adopted international accounting standards. They will also be

prepared in accordance with applicable requirements of England and

Wales company law and reflect the following summarised policies

which will be adopted and applied consistently. The financial

statements will also be prepared in accordance with the SORP for

investment trust companies issued in July 2022, except to any

extent where it conflicts with IFRS.

The interim financial statements information contained in this

interim report does not constitute full statutory accounts as

defined in Section 434 of the Companies Act 2006.

In order better to reflect the activities of an investment trust

company and in accordance with guidance issued by the AIC,

supplementary information which analyses the Statement of

Comprehensive Income between items of a revenue and capital nature

has been presented alongside the Statement of Comprehensive

Income.

The functional and presentational currency of the Company is

Pounds Sterling and has been determined on the basis of the

currency of the Company's share capital and the currency in which

dividends and expenses are paid. The Financial Statements are

presented to the nearest thousand (GBP'000).

2. Going concern

In assessing the Company as a going concern, the Directors have

considered the market valuations of the portfolio investments, the

current economic outlook and forecasts for Company costs.

The Company is in a net asset position of GBP49.8 million (March

2023: GBP49.8 million, September 2022: GBP36.7 million) and 100% of

the Company's portfolio of Investments consist listed equities

which, should the need arise, can be liquidated to settle

liabilities. There are no other contractual obligations other than

those already in existence and which are predictable.

The Company's forecasts and projections, taking into account the

current economic environment and other factors, including

reasonably possible changes in performance, show that the Company

is able to operate within its available working capital and

continue to settle all liabilities as they fall due for the

foreseeable future. The Company has consistent, predictable ongoing

costs and major cash outflows, such as for the payment of

dividends, are at the full discretion of the Board.

Therefore, the Directors taking into the consideration the above

assessment are satisfied that the Company's ability to continue as

a going concern and are satisfied that the Company has adequate

resources to continue in operational existence for a period of at

least 12 months from the date when these financial statements were

approved.

3. Segmental reporting

The Directors are of the opinion that the Company is engaged in

a single segment of business, being investment business.

4. Significant Accounting Judgements, Estimates and Assumptions

The preparation of financial statements requires the use of

estimates and assumptions that affect the reported amounts of

assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reported

period. It also requires Management to exercise their judgement in

the process of applying the accounting policies. The main area of

estimation is in the inputs used in determination of the valuation

of the unquoted investments in Note 16. Although these estimates

are based on management's best knowledge of the amount, event or

actions, actual results ultimately may differ from those

estimates.

Management believes that the underlying assumptions are

appropriate and that the Company's financial statements are fairly

presented.

5. Investments at fair value through profit or loss

All investments held by the Company are designated as "fair

value through profit or loss". As the Company's business is

investing in financial assets with a view to profiting from their

return in the form of interest, dividends or increase in fair

value. Listed equities, unquoted equities and fixed income

securities are classified as fair value through profit or loss on

initial recognition. The Company manages and evaluates the

performance of these investments on a fair value basis in

accordance with its investment strategy. Investments are initially

recognised at cost, being the fair value of the consideration.

After initial recognition, investments are measured at fair

value, with movements in fair value of investments and impairment

of investments recognised in the Condensed Statement of

Comprehensive Income and allocated to the capital column. For

quoted equity shares fair value is generally determined by

reference to quoted market bid prices or closing prices for SETS

(London Stock Exchange's electronic trading service) stocks.

IFRS 13 requires an entity to classify fair value measurements

using a fair value hierarchy that reflects the significance of the

inputs used in making the measurements. The fair value hierarchy

has the following classifications:

-- Level 1 - valued using quoted prices in active markets for identical investments.

-- Level 2 - valued using other significant observable inputs

(including quoted prices for similar investments, interest rates,

prepayments, credit risk, etc). There are no level 2 financial

assets (31 March 2023: GBPnil, 30 September 2022: GBPnil).

-- Level 3 - valued using significant unobservable inputs

(including the Company's own assumptions in determining the fair

value of investments). There are no level 3 financial assets (31

March 2023: GBPnil, 30 September 2022: GBPnil).

Unquoted investments are valued in accordance with the

International Private Equity and Venture Capital Valuation ("IPEV")

Guidelines. Their valuation incorporates all factors that market

participants would consider in setting a price. The primary

valuation techniques employed to value the unquoted investments are

earnings multiples, recent transactions and the net asset

basis.

6. Cash and cash equivalents

Cash and cash equivalents include cash in hand and deposits held

at call with banks and other short-term highly liquid investments

with original maturity of 3 months or less that are readily

convertible to a known amount of cash and are subject to an

insignificant risk of changes in value.

7. Foreign currency

Transactions in currencies other than Sterling are recorded at

the rate of exchange prevailing on the date of the transaction.

Items that are denominated in foreign currencies are retranslated

at the rates prevailing on Statement of Financial Positions. Any

gain or loss arising from a change in exchange rate subsequent to

the date of the transaction is included as an exchange gain or loss

in the capital reserve or the revenue reserve depending on whether

the gain or loss is capital or revenue in nature.

8. Trade debtors and creditors

Trade debtors and creditors are held at amortised cost and are

accounted for at fair value when an asset or liability is incurred

as these are short term in nature.

9. Revenue

Dividend income from investments is recognised when the

Company's right to receive payment has been established, normally

the ex-dividend date.

Where the Company has elected to receive its dividends in the

form of additional shares rather than cash, the amount of cash

dividend foregone is recognised as income. Any excess in the value

of shares received over the amount of cash dividend foregone is

recognised as a capital gain in the Statement of Comprehensive

Income.

Interest income is recognised in line with coupon terms on a

time-apportioned basis. Special dividends are credited to capital

or revenue according to their circumstances.

10. Expenses

All expenses are accounted for on an accruals basis and are

allocated wholly to revenue with the exception of Performance Fees

which are allocated wholly to capital, as the fee is payable by

reference to the capital performance of the Company, and

transaction costs which are also allocated to capital.

11. Taxation

The charge for taxation is based on the net revenue for the year

and takes into account taxation deferred or accelerated because of

temporary differences between the treatment of certain items for

accounting and taxation purposes. The Company has an effective tax

rate of 0%. The estimated effective tax rate is 0% as investment

gains are exempt from tax owing to the Company's status as an

investment trust and there is expected to be an excess of

management expenses over taxable income and thus there is no charge

for corporation tax.

Deferred tax is provided using the liability method on temporary

differences between the tax bases of assets and liabilities and

their carrying amount for financial reporting purposes at the

reporting date. Deferred tax assets are only recognised if it is

considered more likely than not that there will be suitable profits

from which the future reversal of timing differences can be

deducted. In line with recommendations of the SORP, the allocation

method used to calculate the tax relief expenses charged to capital

is the 'marginal' basis. Under this basis, if taxable income is

capable of being offset entirely by expenses charged through the

revenue account, then no tax relief is transferred to the capital

account.

12. Equity dividends payable

Equity dividends payable are recognised when the shareholders'

right to receive payment is established. For interim dividends this

is when they are paid and for final dividends this is when they are

approved by shareholders.

13. Share capital and reserves

The share capital represents the nominal value of the Company's

ordinary shares. As at 30 September 2023 there were 2,687,909 (31

March 2023 - 2,541,046) Ordinary shares of 50p each in issue.

Subsequent to the period end a share sub-division of its existing

ordinary shares on a ten for one basis took effect on the 11

October 2023.

The share premium account represents the accumulated premium

paid for shares issued above their nominal value less issue

expenses. This reserve cannot be distributed.

The capital reserve represents realised and unrealised capital

and exchange gains and losses on the disposal and revaluation of

investments and of foreign currency items. Realised gains can be

distributed, unrealised gains cannot be distributed.

The revenue reserve represents retained profits from the income

derived from holding investment assets less the costs associated

with running the company. This reserve can be distributed, if

positive.

14. Income

30 September 31 March 30 September

2023 2023 2022

Revenue Revenue Revenue

GBP'000 GBP'000 GBP'000

Income from

listed investments

------------ -------- ------------

UK dividends 371 925 226

------------ -------- ------------

Loan note interest

income - 274 232

------------ -------- ------------

Loan arrangement

fee - 40 -

------------ -------- ------------

371 1,239 458

------------ -------- ------------

Other income

------------ -------- ------------

Deposit income 167 109 35

------------ -------- ------------

Total income 538 1,348 493

------------ -------- ------------

15. Investment management and performance fees

30 September 31 March 30 September

2023 2023 2022

Revenue Capital Total Total Total

------- ------- ------- -------- ------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------- ------- ------- -------- ------------

Investment management

fee 60 - 60 112 52

------- ------- ------- -------- ------------

Performance

fees - - - 625 -

------- ------- ------- -------- ------------

60 - 60 737 52

------- ------- ------- -------- ------------

16. Investments at fair value through profit or loss

The Company is required to classify fair value measurements

using a fair value hierarchy that reflects the significance of the

inputs used in making the measurements. All Investments at 30

September 2023 are classified as Level 1.

30 September 31 March 30 September

2023 2023 2022

Level 1 Level 1 Level 1

GBP'000 GBP'000 GBP'000

Financial assets

Quoted equities at fair value 46,242 39,255 34,318

------------ -------- ------------

46,242 39,255 34,318

------------ -------- ------------

17. Half-Yearly Report

The financial information in this Report does not comprise

statutory accounts within the meaning of Section 434 - 436 of the

Companies Act 2006. The financial information for the year ended 31

March 2023 has been extracted from published accounts that have

been delivered to the Registrar of Companies, and on which the

report of the Company's auditor was unqualified and contained no

statement under Section 498 (2), (3) or (4) of the Companies Act

2006.

The financial information for the six months ended 30 September

2023 and 30 September 2022 has not been audited or reviewed by the

Company's auditor.

18. Net Asset Values

As at 30 September As at 31 March

2023 2023

Attributable net assets

(GBP'000) 49,769 49,793

----------------------------- ------------------

Number of Ordinary shares

in issue 2,687,909 2,541,046

----------------------------- ------------------

Net asset value per

share (pence) 1,851.62 1,959.56

----------------------------- ------------------

19. Related party transactions

The related parties of Rockwood Strategic Plc are its Directors,

persons connected with its Directors and its Investment Manager and

significant shareholder Harwood Capital LLP (Harwood).

The total payable to Harwood is as follows:

As at 30 September As at 31 March

2023 2023

GBP'000 GBP'000

Performance fee - 625

----------------------------- ------------------

Management fee 30 112

----------------------------- ------------------

Total 30 737

----------------------------- ------------------

As at 30 September 2023, the following shareholders of the

Company that are related to Harwood had the following interests in

the issued shares of the Company as follows:

As at 30 September As at 31 March

2023 2023

Ordinary Shares Ordinary Shares

Harwood Holdco Limited 734,000 734,000

------------------ ----------------

R Staveley 32,138 25,689

------------------ ----------------

There are no other material related party transactions of which

we are aware in the period ended 30 September 2023.

Alternative Performance Measures (APMS)

Alternative Performance Measures (APMs)

APMs are often used to describe the performance of investment

companies although they are not specifically defined under FRS 102.

The Directors assess the Company's performance against a range of

criteria which are viewed as relevant to both the Company and its

market sector. APM calculations for the Company are shown

below.

Total Return

A measure of performance that includes both income and capital

returns. This takes into account capital gains and reinvestment of

dividends paid out by the Company into its Ordinary Shares on the

ex-dividend date. This is calculated for both the Share Price and

the Net Asset Value.

Premium/(Discount)

The amount, expressed as a percentage, by which the share price

is more/(less) than the Net Asset Value per Ordinary Share.

Ongoing Expenses

A measure, expressed as a percentage of the average daily net

asset values during the period, of the regular, recurring costs of

running an investment company. This includes the Investment

Management fee and excludes any variable performance fees.

[1] These are considered to be Alternative performance Measures

(APMs). See APMs within the announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDLALLFIV

(END) Dow Jones Newswires

November 22, 2023 02:00 ET (07:00 GMT)

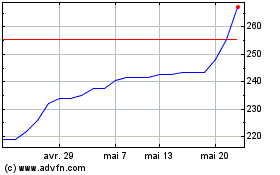

Rockwood Strategic (LSE:RKW)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Rockwood Strategic (LSE:RKW)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024