Rightmove Plc Trading Statement

27 Novembre 2023 - 8:00AM

UK Regulatory

TIDMRMV

27 November 2023

RIGHTMOVE PLC

TRADING UPDATE AND INVESTOR DAY

Robust trading continues

A clear investment plan to accelerate revenue and profit growth

Rightmove plc, the UK's largest property portal, issues the following update on

trading and on the outlook for the full year, ahead of an investor event to be

held later this afternoon.

Continued strong performance

Since we reported our interim results in July, overall revenue growth has

continued to track marginally ahead of consensus expectations, despite

uncertainty in the housing market. The increase is driven primarily by higher

-than-expected ARPA (average revenue per advertiser). Our performance

underscores the strength and resilience of the business, with both estate agent

subscriptions and new homes development listings stable. Our share of consumer

time in the second half to date remains unchanged - at c85% - demonstrating the

strength of our brand, our position with consumers and the established network

effect of our business model.

ARPA set to exceed previous guidance

The strength of demand for our products since we last reported means that we now

expect ARPA growth for the full year to be £112-116, exceeding our previous

guidance of £103-£105. The majority of the growth has been driven by new homes

developers, who have extended their usage of our Native Search Adverts and

Advanced Development Listing products to sell their developments. Estate agents

have continued to build their pipelines using a mix of branding, lead-generation

and property products.

Other business units performing as expected

Our Commercial Real Estate business unit remains on track to deliver its

expected full year revenues, continuing to grow as planned. We have also

continued to make good strategic progress with our Mortgages business, and just

last week, we took an important strategic step by launching our first broker

product, to enable consumers applying for a mortgage to access brokered advice

through our site.

Confidence in full year outlook

The overall full year outlook for 2023 remains at least in line with our

previous guidance. In terms of performance, we expect:

· ARPA growth of £112-£116

· Revenue growth of 8% -10%

· Underlying Operating Profit growth of 7-8%

· Underlying margin of c73%

Investor Day

As previously announced, we are hosting an Investor Day at the London Stock

Exchange today, where we will set out our plans to accelerate revenue and profit

growth in the medium and longer term, both in the core business and in our

identified strategic growth areas of Commercial Real Estate, Rentals and

Mortgages. We will set out the detail of our plans to deliver the following by

2028:

+------------------------------+-----------+

|Metric |2028 target|

+------------------------------+-----------+

|Revenue |>£600m |

+------------------------------+-----------+

|Commercial Real Estate revenue|>£35m |

+------------------------------+-----------+

|Mortgages revenues |>£25m |

+------------------------------+-----------+

|Underlying Operating Profit |>£420m |

+------------------------------+-----------+

The event will commence at 1:30pm at the London Stock Exchange for pre

-registered sell-side analysts and investors and will be available to view via

our webcast here: Rightmove Investor Day 2023 (media

-server.com) (https://edge.media-server.com/mmc/p/82cxiwws/) Our investor

website https://plc.rightmove.co.uk/investors will display both the webcast and

supporting materials post the event.

Johan Svanstrom, CEO, said:

"The momentum that we reported in July has continued through the third quarter

and beyond. The strength of our performance against an uncertain market backdrop

demonstrates the strength of the UK consumer affinity to our platform, the value

of the established network effect of our business model, the depth and richness

of our consumer data, and the value that our customers place in our products to

build their businesses. It also illustrates the resilience of our business model

in all phases of the property market cycle. We continue to look to the future

with confidence and remain focused on the delivery of our strategic plans, both

in our core business and in strategic growth areas. We look forward to providing

more detail at this afternoon's investor day about our plans to capitalise on

the significant growth opportunities ahead."

Enquiries: Investor Relations Investor.Relations@rightmove.co.uk

Powerscourtrightmove@powerscourt-group.com

About Rightmove:

Rightmove is the UK's largest property portal, advertising around 90% of all

homes for sale via estate agents across the UK, representing circa 95% of the

market. Its purpose is to make home moving easier in the UK by creating a

simpler and more efficient property marketplace.

People can search Rightmove for residential resale, new homes, rentals,

commercial property and overseas properties and can use tools and information on

the site - including getting a mortgage in principle, accessing a broker for

mortgage advice, checking local sold prices, property valuations, market trends,

maps and schools.

Customers include the following key groups: estate agents, lettings agents, new

homes developers, commercial property operators, mortgage brokers and overseas

property agents.

Founded in 2000, Rightmove listed on the London Stock Exchange in 2006 and is a

member of the FTSE 100 index, having produced substantial growth and consistent

returns for its shareholders since IPO.

The first Rightmove House Price Index was published in 2002 and is the largest

monthly sample of residential property asking prices and housing market activity

in the UK.

For more information, please visit https://plc.rightmove.co.uk/investors

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

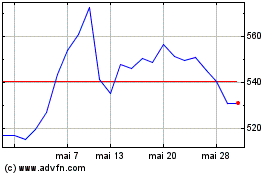

Rightmove (LSE:RMV)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

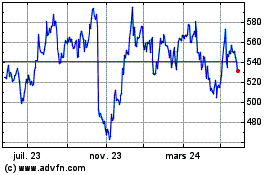

Rightmove (LSE:RMV)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024