RNS Number:8088M

Renew Holdings PLC

28 November 2006

Renew Holdings plc

("Renew" or the "Group")

The following replaces the final results release at 7am today under RNS number

7907M. The company website address has been updated and the record date of the

dividend should be 26 January 2007 not 24 January 2007 as previously stated. The

full amended release appears below.

Preliminary Results for the year ended 30 September 2006

Renew, the specialist construction services business, today announces a strong

cash generative performance across all its businesses, a strengthened order book

and an appropriate dividend increase.

Financial Highlights

* Turnover from ongoing operations of #341.7m (2005:

#330.1m)

* Profit before tax of #4.6m (2005: #1.2m)

* Earnings per share of 10.0p (2005: 3.46p)

* Net cash balance at 30 September of #19.4m (2005: #13.6m)

* Final dividend of 0.8p resulting in total dividend for the

year of 1.2p (2005: 0.2p)

Operational Highlights

* No exceptional items, legacy contract provisions reconfirmed

* Tightened strategic focus - operating through two distinct

business streams:

o Specialist Engineering

o Specialist Building

* Order book of #208.7m (2005: 193m) of which 70% is with

repeat clients

* Acquisition of PPS Electrical creating largest M&E

contractor at Sellafield

Roy Harrison, Chairman, commented:

"I am pleased to report that the Group has made good progress over the past

year. All our businesses are trading profitably and are generating

corresponding levels of cash.

"The positive actions taken by the new management team augur well for the

future, and the Board is confident of making further progress in both

profitability and cash generation in the new financial year."

28 November 2006

Enquiries:

Renew Holdings plc Tel: 020 7457 2020 (today)

Brian May, Chief Executive Tel: 020 7522 3228 (thereafter)

John Samuel, Finance Director

College Hill Tel: 020 7457 2020

Matthew Gregorowski

Mark Garraway

A presentation for analysts is taking place at 09.30 today at the offices of

College Hill, 78 Cannon Street, London EC4N.

The report and accounts will be posted to shareholders in due course and copies

of the preliminary announcement are available upon request from the Company

Secretary, 39 Cornhill, London, EC3V 3NU or via the company's website:

www.renewholdings.com

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report that the Group has made good progress over the past year.

All of the Group's businesses are trading profitably and are generating

corresponding levels of cash. These results do not include any exceptional items

and the Board remains confident that historic contract exposures are fully

provided for - evidence that the Group is in good health.

Further and stronger focus on particular areas of specialism where the Group has

strong skills and experience continues to enhance the quality and visibility of

earnings flow. This is highlighted in more detail in the Chief Executive's

report that follows. The Board remains committed to improving the Group's

Health & Safety performance and is pleased to note the progress made during the

year.

Results and Dividend

Group turnover from ongoing operations for the year ended 30 September 2006 was

#341.7m (2005: #330.1m) and profit before tax was #4.6m (2005: #1.2m). Earnings

per share were 10.00p (2005: 3.46p). The Group's net cash balance, exclusive of

a specific development loan of #9.8m, at 30 September was #19.4m (2005: #13.6m).

Net assets have increased to #5.3m from #4.8m after the impact of incorporating

a #2.8m net pension scheme deficit.

The Board is declaring a final dividend of 0.8p per share, which will be paid on

26 February 2007 to shareholders on the register as at 26 January 2007. This

will result in a dividend of 1.2p per share for the full year (2005: 0.2p),

reflecting the Group's progressive dividend policy and the Board's confidence in

the Group's future performance.

Acquisition

During the year the Group acquired PPS Electrical Limited, an electrical

contractor specialising in asset support for the nuclear sector, for #664,000 in

cash. PPS has been successfully integrated into Shepley Engineers and is

trading in line with expectations.

Pension Scheme

In line with many other UK companies, the Directors, in calculating the Group's

pension position, have adopted mortality tables which now reflect the

expectation of a longer lifespan for pension fund members. As a result, the

Directors have recognised a pension deficit of #2.8m on the Group balance sheet,

net of deferred tax, compared to a surplus of #1.6m at 30 September 2005.

Board Changes

On 1 May 2006, John Samuel FCA joined the Board as Group Finance Director and

Philip Underwood stepped down from the Board to concentrate on running VHE

Construction and Shepley Engineers. On 1 October 2006, John Bishop FCA joined

as non-executive director. John Bishop has extensive experience in the

construction industry and over 30 years PLC experience at main board level. On

31 October 2006, Arnold Wagner OBE stepped down from the Board to concentrate on

his executive responsibilities at Smiths Group plc.

Outlook

The positive actions taken by the new management team augur well for the future,

and the Board is confident of making further progress in both profitability and

cash generation in the new financial year.

Roy Harrison, Chairman

28 November 2006

CHIEF EXECUTIVE'S REVIEW

Overview and Strategy

This has been a year of further positive development for the Group, and I am

pleased to be reporting a good performance across all our businesses. This is

the result of our strategy of focusing on attractive market sectors in which we

have good skills and experience, whilst providing effective support and control

from the centre through our holding company structure.

This approach allows our individual specialist construction businesses to build

on the strength of their own brands within their areas of operation, whilst

benefiting from the financial strength, commercial controls and implementation

of best practice procedures from the Group's central function, thereby

maximising the use of Group resources.

This has resulted in a better quality order book, which at 30 September 2006 was

#208.7m compared to #193m at the same time last year, excluding the future

benefits of current frameworks. 78% of total orders now lie within our core

specialist activities, and 68% of new orders in 2006 were procured through a 2

stage, framework or negotiated process with key clients. Over 70% of our orders

won have been from clients with whom we have worked previously.

As a continuation of our strategy of specialism and project selectivity, and in

order to maximise the potential of our skills base and provide consistent and

cash generative growth, we will be aligning our activities into two focused

business streams, namely Specialist Engineering and Specialist Building.

Specialist Engineering will incorporate our Nuclear and Land Remediation

activities, and Specialist Building will operate across a range of regionally

based, selective markets including Social Housing, Retail, Restoration &

Refurbishment and Science & Education.

Through our Specialist Engineering activities we have established a good market

position and our intention is now to build on our reputation both through

organic growth and through strategic acquisitions. The objective of our

Specialist Building activities is to continue to generate reliable returns

whilst focusing on margin improvement and cash generation.

Review of Operations

In Nuclear, we were reappointed on major 3-year framework agreements with

British Nuclear Group to provide further operational asset support and

decommissioning and demolition services on a number of redundant facilities at

Sellafield. During the year, we acquired PPS Electrical Limited based at

Sellafield which has significantly enhanced our service offering, strengthening

Shepley Engineers' position as the largest mechanical and electrical contractor

at this site.

In Land Remediation, we project managed and carried out the reclamation of the

former Stella South Power Station in Gateshead for St Paul's Developments and

are currently delivering site clearance and infrastructure works at the former

Rugeley Power Station for Persimmon Homes, due for completion in September 2007.

We are also delivering remediation works for National Grid Property under a

framework agreement for its UK-wide portfolio of redundant gas works.

In Social Housing, we are now working in the South East with five of the top six

Housing Associations. During the year, we have successfully completed a #16.5m

project for Community Housing Association and have also been appointed by the

same client as a key framework contractor. In total, we have over #80m of

future work in negotiation with various Housing Associations as preferred

supplier.

In Retail, we completed a major distribution warehouse for Tesco during the year

as well as new build and refurbishment projects for three major stores. We have

been working with Tesco for over 20 years now, demonstrating the strength of our

relationship. We are also constructing a range of other retail projects

including a B&Q store in Folkestone and the refurbishment of the Cribbs Causeway

Retail Park in Bristol for Prudential Assurance.

In Science & Education, we secured a #13m project for the British Lending

Library. We are also carrying out a number of projects for The Department of the

Environment, Food and Rural Affairs through our current framework agreement

which is now in its sixth year. We have recently established another framework

agreement with the National Physical Laboratories. During the year we completed

schemes at a number of colleges and universities including a new build extension

at Imperial College, London and the new Institute of Cancer Therapeutics at

Bradford University as part of framework agreements with these clients.

In Restoration & Refurbishment, we are restoring the wrought and cast iron

Victorian roof and undercroft structures for the Grade 1 listed St Pancras

station in London, which will be the new hub for the Channel Tunnel Rail Link.

We continue to secure major contracts to restore and refurbish very high quality

residential properties in the west of London both for private individuals and

property investment businesses. Additionally, we have extended our customer base

in rail infrastructure refurbishment.

We are also starting to see the benefits of offering clients multiple and

complementary services, as is evidenced by a #15m public sector project in

Lancashire which was completed on time and to budget. This pre-sold integrated

development project combined the construction skills of Allenbuild and the land

remediation capabilities of VHE Construction.

Property

The Group continues its strategy of maximising the value of our portfolio of UK

and US property assets and progressively realising them for cash. During the

year, we sold our head office building at Cornhill in London for #12m, as well

as two other UK properties, which realised over #6m together. This enabled the

Group to eliminate over #12m of associated borrowings. In the USA, we have

generated more than #3m of cash through asset realisations.

People

The Group attaches great importance to the health and safety of all those

affected by our activities. At the start of the financial year I set out a

target of decreasing the accident incident rate by 10% per annum, and I am

pleased to report that we achieved a 19% reduction during the year.

The Group is now well on its way to recovery following what has been a difficult

period. The Board is pleased to note a significant improvement in the Group's

employee retention rate and is extremely grateful to all our people for their

hard work and dedication in helping to bring the business back to health. We

have an experienced management team in place and I am confident that with the

continued support of everyone in the Group we will see further success in

delivering on our strategy.

Prospects

Vigorous business processes are now established across all of the Group's

activities. Through increased focus on the strengths of our two specialist

business streams, which operate in robust and growing markets, we expect to

further develop our order book and to deliver consistent, growing profits

supported by strong cash generation.

Brian May, Chief Executive

28 November 2006

Group profit & loss account

For the year ended 30 September 2006

Note Total Total

2006 2005

#000 #000

Turnover: Group & share of joint ventures 344,521 457,750

Less share of joint ventures' turnover (2,823) (2,714)

Ongoing operations 341,698 330,113

Discontinuing operations 20,745 39,052

Total continuing operations 362,443 369,165

Discontinued operations 0 85,871

Group turnover 362,443 455,036

Cost of sales (328,393) (437,409)

Gross profit 34,050 17,627

Administrative expenses (30,577) (37,689)

Other operating income 0 53

Group operating profit/(loss) 3,473 (20,009)

Income from joint ventures - -

Profit from ongoing operations before exceptional items 3,473 2,687

Exceptional items - (19,845)

Profit/(loss) from ongoing operations after exceptional items 3,473 (17,158)

Profit/(loss) from discontinuing operations - (8,351)

Total profit/(loss) from continuing operations 3,473 (25,509)

Profit from discontinued operations - 5,500

Total operating profit/(loss) before interest, including share 3,473 (20,009)

of joint ventures

Profit on disposal of subsidiary company - 22,300

Profit on ordinary activities before interest 3,473 2,291

Interest receivable 1,561 921

Interest payable (1,437) (1,597)

Other finance income/(charges) - FRS17 pension 1,042 (440)

Profit on ordinary activities before taxation 4,639 1,175

Taxation credit on ordinary activities 4 1,349 899

Profit for the financial year 5,988 2,074

Basic earnings per Ordinary share 3 10.00p 3.46p

Diluted earnings per Ordinary share 3 9.95p 3.46p

Group statement of total recognised gains & losses Total Total

For the year ended 30 September 2006 2006 2005

#000 #000

Profit for the financial year 5,988 2,074

Dividends paid (360) -

Exchange movement in reserves (119) (171)

Movements in defined benefit pension scheme (6,175) (1,216)

Movement on deferred tax relating to the defined benefit 1,186 (1,006)

pension scheme

Total recognised gains and losses for the year 520 (319)

Group balance sheet

At 30 September 2006

Group

Note Group (restated)

2006 2005

#000 #000

Fixed assets

Intangible assets: Goodwill 4,527 4,602

Tangible assets 3,819 14,930

Investments - -

Investments in joint ventures:

Loans to joint ventures 561 438

Share of gross assets 4,429 9,704

Share of gross liabilities (1,722) (5,276)

3,268 4,866

11,614 24,398

Current assets

Stocks and work in progress 18,673 9,573

Debtors: due after more than one year 4,346 5,751

Debtors: due within one year 77,093 72,836

Current asset investments - 6,089

Cash at bank and in hand 19,735 13,590

119,847 107,839

Creditors: amounts falling due in less than one year (121,555) (115,020)

Net current liabilities (1,708) (7,181)

Total assets less current liabilities 9,906 17,217

Creditors: amounts falling due after more than one year

Long-term debt - (8,363)

Other creditors (1,821) (4,058)

Net assets excluding pension liability 8,085 4,796

Pension liability 5 (2,769) -

Net assets 5,316 4,796

Capital and reserves

Share capital 5,990 5,990

Share premium account 5,893 5,893

Capital redemption reserve 3,896 3,896

Revaluation reserve 73 73

Profit and loss account (10,536) (11,056)

Equity shareholders' funds 5,316 4,796

Group cash flow statement

For the year ended 30 September 2006

Note Total Total

2006 2005

#000 #000

Net cash inflow/(outflow) from operating activities 1 10,661 (25,338)

Returns on investments and servicing of finance

Interest received 1,561 921

Interest paid (1,437) (1,597)

124 (676)

Taxation

Net corporation tax paid (36) -

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (1,291) (640)

Proceeds on sale of tangible fixed assets 393 225

Loans (advanced to)/repaid by joint venture (149) 200

(1,047) (215)

Acquisitions and disposals

Acquisition of a subsidiary, net of cash acquired (664) -

Proceeds from sale of subsidiaries and businesses - 21,343

Proceeds from sale of equity loans - 1,894

Cash obtained/(disposed) on acquisition/(disposal) of subsidiaries 65 (3,380)

and businesses

(599) 19,857

Equity dividends paid to shareholders (360) -

Cash inflow/(outflow) before financing 8,743 (6,372)

Financing

Movement in short-term borrowings (3,600) 3,600

Repayment of mortgage (8,363) -

Additional development loans 9,795 -

Finance lease payments (686) (623)

(2,854) 2,977

Increase/(decrease) in cash during the year 5,889 (3,395)

Reconciliation of net cash flow to movement in net funds

Increase/(decrease) in cash during the year 5,889 (3,395)

Movement in borrowings 2,556 (2,977)

Changes in net funds arising from cash flows 8,445 (6,372)

Other non-cash movements 256 (1,680)

Movement in net funds during the year 8,701 (8,052)

Opening net funds 269 8,321

Closing net funds 8,970 269

Notes to the accounts

1. Cash flow

2006 2005

#000 #000

Operating profit/(loss) 3,473 (20,009)

Amortisation of subsidiary goodwill 306 303

Depreciation 1,523 2,657

Profit on sale of fixed assets - (78)

Impairment of fixed assets - 450

Impairment in current asset investments - 1,299

(Increase) in stocks and work in progress (9,551) (932)

(Increase)/decrease in operating debtors and prepayments (866) 7,705

Decrease in current asset investments 16,643 -

(Decrease) in creditors and accruals (1,152) (12,952)

Net movement on pension deficit included within operating profit 68 (3,552)

Cash contribution to defined benefit scheme (1,246) (1,457)

Profit on sale of shared equity loans - (412)

Realisation of joint venture assets 1,463 1,640

Net cash inflow/(outflow) from operating activities 10,661 (25,338)

2. Dividends

2006 2005

Pence/share Pence/share

Interim (related to the year ended 30 September 2006) 0.40 -

Final (related to the year ended 30 September 2005) 0.20 -

Total dividend paid 0.60 -

#000 #000

Interim (related to the year ended 30 September 2006) 240 -

Final (related to the year ended 30 September 2005) 120 -

Total dividend paid 360 -

In accordance with FRS 21, dividends are recorded only when paid and are shown as a movement in

equity rather than as a charge in the profit and loss account. The Directors are proposing that a

final dividend of 0.8p per ordinary share be paid in respect of the year ended 30 September 2006.

This will be accounted for in the 2006/07 financial year.

3. Earnings per Ordinary Share

2006 2005

Weighted Weighted

average number average

number

Earnings of shares EPS Earnings of shares EPS

#000 '000 Pence #000 '000 Pence

FRS 14 basis

Basic earnings per share 5,988 59,899 10.00 2,074 59,899 3.46

Dilutive effect of share options 254 - - -

Diluted earnings per share 5,988 60,153 9.95 2,074 59,899 3.46

4. Taxation credit on ordinary activities

(a) Analysis of credit in year 2006 2005

#000 #000

Current tax:

UK corporation tax on profits of the year - -

Adjustments in respect of previous periods (74) 1

(74) 1

Foreign tax (2) -

Total current tax (76) 1

Deferred tax 1,425 898

Taxation credit on profit on ordinary activities 1,349 899

5. Pension commitments

The Group operates a defined benefit pension scheme which was closed to new members in June 2000.

The following disclosures required by FRS 17 have been based on an actuarial valuation as at 30 September

2006 carried out by the scheme's actuaries.

As at As at As at As at

30 September 30 30 30

September September September

2006 2005 2004 2003

#000 #000 #000 #000

Total market value of assets 108,641 108,534 102,488 109,968

Present value of scheme liabilities (112,596) (106,906) (105,840) (143,128)

Surplus/(deficit) in the scheme (3,955) 1,628 (3,352) (33,160)

Deferred tax 1,186 - 1,006 9,948

Net (deficit)/surplus (2,769) 1,628 (2,346) (23,212)

Balance sheet adjustments to reduce surplus to nil at 30 - (1,628) - -

September 2005

Net deficit (2,769) - (2,346) (23,212)

All of the movements in the deferred tax amount related to the pension scheme deficit are shown as a

movement through the statement of total recognised gains and losses.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FEUSUASMSEEF

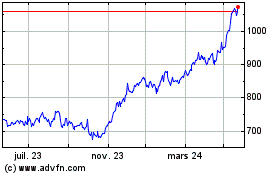

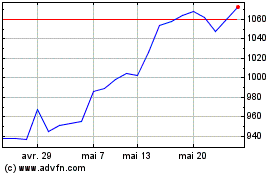

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024