RNS Number : 8383I

Renew Holdings PLC

25 November 2008

Renew Holdings plc

("Renew" or the "Group")

Preliminary results for the full year ended 30 September 2008

Renew, the specialist construction services business, announces pre-tax profits up 29%, prior to exceptional items and amortisation

charges.

Financial Highlights

2008 2008 2008 2007

Pre-exceptional Exceptional items Post-exceptional

items and and amortisation items and

amortisation charges charges amortisation charges

Revenue �390.6m - �390.6m �348.1m

Operating profit �7.6m (�2.8m) �4.8m �5.2m

Profit before tax �9.5m (�2.8m) �6.7m �7.4m

Earnings per share 12.2p (3.4p) 8.8p 12.2p

Dividend per share 3.0p 1.8p

Net cash balance �28.2m �24.4m

Net assets �14.3m �10.0m

Operational Highlights

* Group operating profit up 46%*

* Operating margin increased to 1.9%* (2007: 1.5%)

* Decisive action taken to reduce capacity and realign business, providing cost savings of over �5m per annum

* 83% of orders from specialist sectors

* 79% of order book from repeat business

* Net cash balance �28.2m (2007: �24.4m)

* Proposed full year dividend increase of 67% to 3.0p (2007: 1.8p)

* Post year end acquisition of C&A Pumps Limited, a specialist water services business

* Note - these figures are given prior to charges for exceptional items of �2.6m (2007: �Nil) comprising �1.5m redundancy costs, �1.2m

statutory debt provision increase and a �0.1m profit on sale of plant fleet together with amortisation of intangible assets of �0.2m (2007:

�Nil)

Roy Harrison OBE, Chairman, commented:

"The Group is strongly positioned with an experienced management team, substantial cash resources and a strong forward work position.

Our business model, which focuses on specialist markets, is resilient and able to withstand the impact of challenging market conditions".

25 November 2008

Enquiries:

Renew Holdings plc Tel: 0113 281 4200

Brian May, Group Chief Executive

John Samuel, Group Finance Director

College Hill Tel: 020 7457 2020

Mark Garraway

Adam Aljewicz

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report a strong set of results. We are successfully meeting our strategic objectives for our two main business streams.

In Specialist Engineering we have continued to grow revenue, which was bolstered by a full year's contribution from Seymour, while in

Specialist Building we saw a marked increase in revenue and particularly in operating profits prior to exceptional items.

Against a background of increasingly difficult market conditions, the results again illustrate the quality and sustainability of

earnings with our forward order book indicating an increased level of work in our specialist sectors.

Results

Group revenues for the year ended 30 September 2008 were �390.6m (2007: �348.1m), a 12% increase over the corresponding period last

year. Profit before tax for the year prior to exceptional items and amortisation charges was up 29% to �9.5m (2007: �7.4m). Profit after tax

and exceptional items and amortisation charges was �5.3m (2007: �7.3m).

At 30 September 2008, the Group's net cash position stood at �28.2m (2007: �24.4m).

As has been well documented, conditions in the house building market, which is the principal end market for our Land Remediation

business, have worsened considerably over the last six months. We are also seeing weaker market conditions for our non-specialist and retail

businesses which jointly accounted for 46% of Specialist Building revenues in 2008.

As stated in our pre-close announcement on 1 October 2008, the Board has taken decisive action to address these issues by realigning the

Land Remediation activities to address the more robust regional civil engineering market, whilst retaining its land remediation capability.

In Specialist Building, the Group has reduced capacity by 15%. Whilst these actions have resulted in an exceptional charge in 2008 of �1.5m

for redundancy costs, the resultant saving in annual costs will be in excess of �5m.

The Group's order book at 30 September 2008 stood at �219m (2007: �252m) with, pleasingly, 79% represented by repeat order work. The 13%

reduction, which is predominantly in non-specialist areas, is in line with the implemented capacity reductions. This reflects our emphasis

on project selectivity and quality of earnings as we seek to continue to improve percentage operating margins in these more challenging

market conditions.

Dividend

In accordance with the Group's progressive policy, a final dividend of 2.0p per share (2007: 1.0p) is being proposed. This takes the

total dividend for the year to 3.0p (2007: 1.8p), a 67% increase over last year. The dividend will be paid on 23 February 2009 to

shareholders on the register as at 30 January 2009 and in accordance with accounting standards will be accounted for in the 2009 financial

year. The shares will become ex-dividend on 28 January 2009.

Growth strategy

Our declared strategy of focusing on two distinct business streams, Specialist Engineering and Specialist Building, remains in place.

Our aim is to increase revenues in Specialist Engineering both organically and by acquisition, with operating margins of at least 4%. In

Specialist Building, our aim is to continue to increase operating margins with a medium-term target of 2%. Currently our Specialist Building

margin stands at 1.7%.

Our medium term objective remains to develop a Specialist Construction business with overall operating margins of 2.5% and with

Specialist Engineering providing 33% of revenues.

Outlook

Market conditions are more challenging but the Group is operating from a position of strength, supported by a strong balance sheet with

cash resources available to take advantage of carefully considered opportunities which may arise. Our management team, led by our Chief

Executive Brian May, is very experienced and I am confident in their ability to deliver excellent performance in the difficult economic

climate.

The impact of the decisive action taken in September to realign and reduce capacity, and the continued resilience of our specialist

markets, gives the Board confidence that we can continue to grow the Group's operating margin percentage albeit on reduced levels of

activity in 2009.

Roy Harrison OBE

Chairman

25 November 2008

CHIEF EXECUTIVE'S REVIEW

OVERVIEW

Our strategy of seeking growth in Specialist Engineering, whilst maintaining target margins, combined with growing margins in Specialist

Building continues.

In Specialist Engineering, revenue increased by 36%, which included a full year's contribution from Seymour which we acquired in July

2007. Whilst margins were lower due to falling demand for Land Remediation related to the house building sector, they remain at 3.7%, over

double that of the margins in Building. The forward order book in Specialist Engineering stands at �49m (2007: �54m).

Revenues in Specialist Building increased by 11% with a 34% increase in operating profit to �4.9m prior to exceptional charges. The

forward order book in Specialist Building is �170 million (2007: �198 million), 14% lower than last year which is in line with the capacity

reductions implemented in September.

Our total order book remains strong at �219m (2007: �252m), with 86% being in our specialist sectors and 79% in the form of repeat

business. These key performance indicators remain ahead of our targets of 66% in each case.

As part of our strategy of developing our Specialist Engineering business we continue to look for complementary acquisitions that can

meet our demanding criteria. Immediately following the year end, we completed the acquisition of C&A Pumps Limited, a specialist water

services business based in County Durham but which operates nationally. C&A will combine with Seymour to offer an extended package of

capability to the Water industry. This acquisition is a further demonstration of our commitment to grow our Specialist Engineering business

both organically and by acquisition and follows on from the previous acquisitions of Seymour itself and PPS Engineering Limited, in the

Nuclear sector.

Review of operations

Specialist Engineering

Nuclear

Shepley Engineers continues to be the largest Tier 2 mechanical and electrical contractor at Sellafield, operating in the fields of

asset support and decommissioning. Activity levels on the Multi Disciplined Site Wide framework were 70% above those anticipated. Our four

frameworks continue at Sellafield with extensions recently agreed on both Demolition and Decommissioning. Our PPS subsidiary, which we

acquired in 2006, had an exceptional year, outperforming forecasts and repaying its acquisition cost within two years. We have also secured

a position in a consortium with EnergySolutions to process Metals Recycling at Sellafield and Drigg. We continue to have activity at the

Springfield facility at Preston and have also been awarded a decommissioning project at Capenhurst, which is our first award at this site.

Land Remediation

In response to the downturn in the house building market, we have quickly realigned the VHE business to also access regional civil

engineering opportunities. This is demonstrated by the recent �15m award of the Cudworth by-pass which is the fifth major award in recent

years from Barnsley MBC. VHE retains its Land Remediation capability and has established itself as the leading specialist contractor for

local authority remediation works under Part llA of the Environment Act, completing five such residential projects during the year, with a

further recent �2m award in Glasgow. We are also seeing renewed activity for 2009 from the National Grid framework.

Water

The Seymour acquisition has been fully integrated into the Group and is performing in line with our expectations and acquisition plans,

with 15% organic growth achieved this year. The Northumbrian Water framework continues to provide a significant level of activity with good

visibility out to 2010. We have seen an encouraging increase in repeat business for regional industrial and local authority clients

including the award of a framework with Darlington MBC. The C&A Pumps acquisition enhances our offering to the water industry. In the year

ended 31 December 2007, C&A recorded an operating profit of �0.2m on a turnover of �4.7m. Organic expansion of civil engineering

capabilities in the South West under the Britannia Civil Engineering brand has also been achieved to enable access to regional specialist

water and environmental markets.

Specialist Building

Social Housing

Including the recent agreements with Sanctuary and Hexagon Housing Associations, Allenbuild now has eight framework agreements in place,

all with leading Housing Associations in the South East of England, for the delivery of their new build programmes. We secured �42m of new

projects during the year. New projects completed during the year include Cranes Farm and Clyde Terrace, each valued at over �8 million. This

business area is particularly well secured for 2009 and our pipeline of future projects for our existing framework partners remains in

excess of �100m.

Retail

Britannia Construction's first project with Marks & Spencer in Manchester has been completed. Four projects were completed for Tesco,

with another at Wells in progress. Allenbuild successfully completed a �26m negotiated hotel and mixed retail development at Southport which

included hotel, casino and retail outlets and incorporated restoration works to the historic Floral Hall.

Science and Education

Allenbuild has been appointed preferred bidder on a �58 million project to build the new Kirklees College Waterfront Project at

Huddersfield and has successfully completed the �18m Rossington School project in Doncaster. Elsewhere, Walter Lilly has continued good

progress on the �20 million Queen Mary Innovation Centre project in London and has received awards for two further projects from GSK

together with a �12m contract for Eisai Pharmaceuticals at Hatfield.

Restoration and Refurbishment

The high-end residential sector remains busy with a number of awards for Walter Lilly giving good visibility for 2009 and beyond. Five

projects have now been successfully completed under the Grosvenor Framework, with others being processed. Good progress continued on the

major contracts at Grosvenor Crescent and Regents Park. Our established relationship with Cadogan Estates continues with a further project

at Cadogan Gardens.

YJLI has been appointed to a five year LUL framework for tube network modernisations. During the year, further modernisation works were

secured for CTRL Platforms for South Eastern and for Network Rail at Waterloo where we are bringing a redundant Eurostar platform back into

operational use.

Property and other activities

We have successfully developed and sold a new factory in Cumbria for the Cumberland Pencil Company, but, in light of recent market

conditions, there are no current development activities ongoing in the UK. During the year, we completed and sold the Applied Research

Facility in the USA for Johns Hopkins University. We continue to look to realise value from our land assets in the US with our portfolio

particularly well located in Maryland, predominantly in the Baltimore/Washington corridor, near to the Fort Meade National Security Centre.

People

The health and safety of our people at work is our priority at all times. During the year, we achieved a further reduction in the

Accident Incidence Rate which has now reduced by 57% over the last three years. Our target for each of these years was a 10% reduction.

The Group's success derives from the quality and skills of our people. Throughout the Group, we have an excellent blend of experience,

youth, talent and ambition. The Board has great confidence in our staff and thanks them all for their commitment and effort.

Summary

The Group continues to make progress on the implementation of its strategy. Despite the prevailing economic environment, our specialist

markets are resilient and this is reflected in the quality of our forward order book.

Brian May

Chief Executive

25 November 2008

Group income statement

For the year ended 30 September 2008

Before Exceptional

exceptional items and

items and amortisation

amortisation of intangible

of intangible assets

assets

Note (see note 3) Total Total

2008 2008 2008 2007

�000 �000 �000 �000

Group revenue from continuing 390,557 - 390,557 348,149

activities

Cost of sales (347,820) - (347,820) (311,486)

Gross profit 42,737 - 42,737 36,663

Administrative expenses (35,137) (2,765) (37,902) (31,445)

Operating profit 2 7,600 (2,765) 4,835 5,218

Finance income 1,618 - 1,618 2,199

Finance costs (254) - -254 (768)

Other finance income - defined 543 - 543 745

benefit pension scheme

Profit before income tax 9,507 (2,765) 6,742 7,394

Income tax expense 4 (2,209) 727 (1,482) (74)

Profit for the year 7,298 (2,038) 5,260 7,320

attributable to equity holders

of the parent company

Basic earnings per share 6 12.2p (3.4p) 8.8p 12.2p

Diluted earnings per share 6 11.9p (3.3p) 8.6p 12.0p

Group statement of recognised income and expense

For the year ended 30 September 2008

Total Total

2008 2007

�000 �000

Profit for the year attributable to equity holders of the 5,260 7,320

parent company

Exchange movement in reserves 574 (150)

Movement in actuarial deficit (497) (1,804)

Movement on deferred tax relating to the defined benefit 116 427

pension scheme

Total recognised income and expense for the year

attributable to

equity holders of the parent company 5,453 5,793

Group balance sheet

At 30 September 2008

2008 2007

�000 �000

Note

Non-current assets

Intangible assets

- goodwill 8,548 8,516

- other 620 868

Property, plant and equipment 4,503 5,188

Deferred tax assets 4,069 4,987

17,740 19,559

Current assets

Inventories 6,367 6,391

Trade and other receivables 87,766 89,669

Current tax assets 455 -

Cash and cash equivalents 28,289 24,565

122,877 120,625

Total assets 140,617 140,184

Non-current liabilities

Obligations under finance leases (10) (118)

Retirement benefit obligations (1,479) (3,559)

Deferred tax liabilities (256) (418)

Provisions (1,068) (1,172)

(2,813) (5,267)

Current liabilities

Borrowings (110) (165)

Trade and other payables (119,246) (121,304)

Obligations under finance leases (67) (429)

Current tax liabilities (159) (480)

Provisions (3,941) (2,530)

(123,523) (124,908)

Total liabilities (126,336) (130,175)

Net assets 14,281 10,009

Share capital 5,990 5,990

Share premium account 5,893 5,893

Capital redemption reserve 3,896 3,896

Cumulative translation reserve 424 (150)

Share based payments reserve 233 97

Retained earnings (2,155) (5,717)

Total equity 7 14,281 10,009

Group cash flow statement

For the year ended 30 September 2008

Total Total

2008 2007

�000 �000

Profit for the year 5,260 7,320

Amortisation of intangible assets 248 41

Depreciation 1,708 1,326

Profit on sale of property, plant and equipment (262) (85)

Decrease in inventories 716 11,909

Decrease/(increase) in receivables 2,405 (1,766)

(Decrease)/increase in payables (1,599) 6,360

Current service cost in respect of defined benefit pension 72 79

scheme

Cash contribution to defined benefit pension scheme (2,106) (1,534)

Expense in respect of share options 136 97

Financial income (2,161) (2,944)

Financial expenses 254 768

Interest paid (254) (768)

Income taxes paid (1,344) (107)

Income tax expense 1,482 74

Net cash inflow from operating activities 4,555 20,770

Investing activities

Interest received 1,618 2,199

Proceeds on disposal of property, plant and equipment 1,267 309

Purchases of property, plant and equipment (2,028) (1,060)

Acquisition of subsidiary net of cash acquired (32) (5,932)

Net cash inflow/(outflow) from investing activities 825 (4,484)

Financing activities

Dividends paid (1,317) (839)

Repayments of obligations under finance leases (470) (542)

Repayment of development loans - (9,795)

Net cash outflow from financing activities (1,787) (11,176)

Net increase in cash and cash equivalents 3,593 5,110

Cash and cash equivalents at beginning of year 24,400 19,570

Effect of foreign exchange rate changes on cash and cash 186 (280)

equivalents

Cash and cash equivalents at end of year 28,179 24,400

Bank balances and cash 28,289 24,565

Bank overdrafts (110) (165)

28,179 24,400

Notes

1 International Financial Reporting Standards

The consolidated financial statements for the year ended 30 September 2008 have been prepared in accordance with International Financial

Reporting Standards ("IFRS"). These preliminary results are extracted from those financial statements which include the restatement of

comparative financial information to reflect the adoption of IFRS.

2 Segmental analysis

For management purposes the Group is organised into three operating divisions: Building, Engineering and Property & central activities.

Segment information about the Group's continuing operations is presented below:

2008 2007

�000 �000

Revenue is analysed as follows:

Building 294,553 265,668

Engineering 93,286 68,777

Property & central activities 8,213 16,969

Inter divisional revenue (5,495) (3,265)

Group revenue 390,557 348,149

Before exceptional Exceptional

items and items and

amortisation amortisation

of intangible of intangible

Analysis of operating profit assets assets 2008 2007

�000 �000 �000 �000

Building 4,892 (889) 4,003 3,652

Engineering 3,469 (361) 3,108 3,294

Property & central activities (761) (1,515) (2,276) (1,728)

Operating profit 7,600 (2,765) 4,835 5,218

Net financing income 1,907 - 1,907 2,176

Profit on ordinary activities 9,507 (2,765) 6,742 7,394

before income tax

3 Exceptional items and amortisation of intangible assets

2008 2007

�000 �000

Redundancy costs 1,471 -

Costs in relation to statutory debt provision increase 1,168 -

Profit on disposal of plant fleet (122) -

Total exceptional items 2,517 -

Amortisation of intangible assets 248 -

2,765 -

The Board has determined that certain charges to the income statement should be separately identified for better understanding of the

Group's results for the year ended 30 September 2008.

Following the deterioration in market conditions faced by certain of the Group's companies, the Group decided to reduce its cost base in

its Building business and to realign the activities of one of its Engineering businesses. As a result, the Group has incurred redundancy

costs of �1,471,000. Associated with the realignment, the Group disposed of its plant fleet in that Engineering business and the resultant

profit on disposal of �122,000 has also been separately identified.

Additionally, the Group has increased the provision in respect of the statutory debt on the employer liability arising from the pension

scheme of one of the Group's dormant subsidiary companies, British Building and Engineering Appliances plc, resulting in a charge of

�1,168,000. The winding up of the scheme commenced in 1999 and is expected to be completed in the year ending 30 September 2009.

The Board has also separately identified the charge of �248,000 for the amortisation of the fair value ascribed to certain intangible

assets other than goodwill arising from the acquisition of Seymour (C.E.C) Holdings Limited. This item was not separately identified in the

income statement for 2007 as the charge of �41,000 for that year was not considered by the Board to be material.

4 Income tax expense

Analysis of expense in year 2008 2007

�000 �000

Current tax:

UK corporation tax on profits of the year (159) (291)

Adjustments in respect of previous periods (409) -

(568) (291)

Foreign tax (51) (107)

Total current tax (619) (398)

Deferred tax - defined benefit pension scheme (699) (616)

Deferred tax - other timing differences (164) 853

Deferred tax - prior period adjustments - 87

Total deferred tax (863) 324

Taxation charge on profit (1,482) (74)

5 Dividends

2008 2007

Pence/share Pence/share

Interim (related to the year ended 30 September 1.00 0.60

2008)

Final (related to the year ended 30 September 2007) 1.20 0.80

Total dividend paid 2.20 1.40

�000 �000

Interim (related to the year ended 30 September 598 359

2008)

Final (related to the year ended 30 September 2007) 719 480

Total dividend paid 1,317 839

Dividends are recorded only when authorised and are shown as a movement in equity rather than as a charge in the income statement. The

Directors are proposing that a final dividend of 2.0p per Ordinary Share be paid in respect of the year ended 30 September 2008. This will

be accounted for in the 2008/09 financial year.

6 Earnings per share

2008 2007

Earnings EPS DEPS Earnings EPS DEPS

�000 Pence Pence �000 Pence Pence

Earnings before exceptional 7,298 12.18 11.87 7,320 12.22 11.99

costs & amortisation

Exceptional costs & (2,038) (3.40) (3.32) - - -

amortisation

Basic earnings per share 5,260 8.78 8.55 7,320 12.22 11.99

Weighted average number of 59,899 61,497 59,899 61,053

shares

The dilutive effect of share options is to increase the number of shares by 1,598,000 (2007: 1,154,000) and reduce basic earnings per

share by 0.23p (2007: 0.23p).

7 Reconciliation of movements in total equity

2008 2007

�000 �000

Profit for the year 5,260 7,320

Dividends paid (1,317) (839)

3,943 6,481

Other recognised income and expense for the year 193 (1,527)

Recognition of share based payments 136 97

Net movement in total equity 4,272 5,051

At 1 October 2007 10,009 4,958

At 30 September 2008 14,281 10,009

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR USUWRWVRAUAA

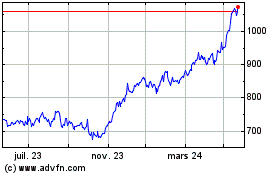

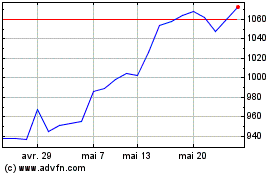

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024