TIDMRNWH

RNS Number : 4548S

Renew Holdings PLC

19 May 2009

Renew Holdings plc

("Renew" or the "Group")

Interim results for the half year ended 31 March 2009

Renew, the specialist engineering and construction services group, announces

results with operating profit* sustained at GBP3.2m and the interim dividend

maintained at 1.0p.

Financial Highlights

+---------------------------------+-----------+---------------+

| | H1 2009 | H1 2008 |

+---------------------------------+-----------+---------------+

| Revenue | GBP171.6m | GBP192.9m |

+---------------------------------+-----------+---------------+

| Operating profit* | GBP3.2m | GBP3.2m |

+---------------------------------+-----------+---------------+

| Profit before tax* | GBP3.5m | GBP3.9m |

+---------------------------------+-----------+---------------+

| Adjusted earnings per share* | 5.22p | 5.82p |

+---------------------------------+-----------+---------------+

| Earnings per share | 3.74p | 5.61p |

+---------------------------------+-----------+---------------+

| Dividend per share | 1.0p | 1.0p |

+---------------------------------+-----------+---------------+

*prior to exceptional items and amortisation charges

Operational Highlights

* Operating margin* increased to 1.8% (2008: 1.7%)

* Group order book at 31 March 2009 GBP221m (30 September 2008: GBP219m)

* 77% of orders secured in the period from specialist sectors

* Specialist Engineering growth of 15%

* Specialist Engineering now expected to represent 40% of Group revenue going

forward

* Decisive action taken to reduce capacity in Specialist Building, providing

annual savings of GBP7m

* Net cash balance GBP17.5m (2008: GBP25.7m)

* Two bolt-on Specialist Engineering acquisitions enhancing offering in Water and

Nuclear sectors

* Interim dividend maintained at 1.0p (2008: 1.0p)

Roy Harrison OBE, Chairman, commented:

"The economic climate continues to provide a challenging business environment.

Despite these difficult trading conditions, our Specialist Engineering business

has continued to grow with stable margins. Our healthy cash position and debt

free balance sheet adds security to the resilient characteristics of our

specialist businesses."

19 May 2009

+------------------------------------------------+--------------------------+

| Renew Holdings plc | Tel: 0113 281 4200 |

+------------------------------------------------+--------------------------+

| Brian May, Group Chief Executive | |

+------------------------------------------------+--------------------------+

| John Samuel, Group Finance Director | |

+------------------------------------------------+--------------------------+

| | |

+------------------------------------------------+--------------------------+

| Brewin Dolphin | Tel: 0845 213 4730 |

+------------------------------------------------+--------------------------+

| Andrew Kitchingman | |

+------------------------------------------------+--------------------------+

| Sean Wyndham-Quin | |

+------------------------------------------------+--------------------------+

| | |

+------------------------------------------------+--------------------------+

| College Hill | Tel: 020 7457 2020 |

+------------------------------------------------+--------------------------+

| Adam Aljewicz | |

+------------------------------------------------+--------------------------+

| Mark Garraway | |

+------------------------------------------------+--------------------------+

CHAIRMAN'S STATEMENT

The six months ended 31 March 2009 has produced satisfactory results with Group

operating profit, prior to exceptional items and amortisation charges, of

GBP3.2m (2008: GBP3.2m) on revenue of GBP171.6m (2008: GBP192.9m). This

improvement in operating margin from 1.7% to 1.8% reflects the Group's continued

emphasis on quality of earnings rather than revenue growth.

Group profit after tax, prior to exceptional items and amortisation charges, was

GBP3.1m (2008: GBP3.5m). An exceptional charge of GBP1.0m relating to the final

account settlement of the last legacy construction contract has been borne in

the first half. A tax charge of GBP0.1m has been sustained all of which relates

to deferred tax. No current year corporation tax charge is expected for the

year. Earnings per share, prior to exceptional items and amortisation charges,

were 5.22p (2008: 5.82p).

As previously announced, the deteriorating market conditions in Specialist

Building necessitate a 23% reduction in capacity and an exceptional charge of

GBP2.5m for redundancy and other restructuring costs in the second half of the

financial year. Annual savings of over GBP7m will result.

The Board is maintaining the interim dividend at 1.0p per share (2008: 1.0p)

which will be paid on 6 July 2009 to shareholders on the register on 5 June

2009.

In October 2008, we acquired C.&A. Pumps Limited ("C.&A.") which added to our

Water industry capability. In May 2009, we agreed to acquire Mothersill

Engineering, a specialist machining and fabrication business, which enhances our

offering to the Nuclear industry.

The Group's net cash balance was GBP17.5m (2008: GBP25.7m). The reduction mainly

comprises the outflow of working capital attributable to lower revenue, the

GBP1.8m acquisition of C.&A. and the GBP3.0m cash settlement of the legacy BB&EA

pension scheme statutory debt.

The Group's strategy remains to grow our Specialist Engineering business both

organically and by acquisition. Specialist Engineering is currently expected to

represent 40% of future revenue and 70% of operating profit. We remain active in

seeking out further complementary acquisitions.

In Specialist Building, the Board has acted promptly and decisively to reduce

the operational fixed cost base in response to deteriorating market conditions.

While the current trading conditions endure for Specialist Building, the Group

will continue to focus on project selectivity, risk management and cost control

to ensure that this business stream remains profitable albeit on lower levels of

activity.

Our balance sheet remains debt free with substantial cash resources enabling the

Group to take advantage of selective opportunities as they arise. The specialist

nature of our business provides a resilient platform for the Group to trade

profitably through the recession.

ROY HARRISON OBE

Chairman

19 May 2009

CHIEF EXECUTIVE'S REVIEW

Overview

Our Specialist Engineering business grew first half revenue by 15% from GBP50.4m

to GBP58.2m. Operating profit also grew by 14% from GBP1.9m to GBP2.2m in the

period. This represented 70% (2008: 63%) of Group operating profit and an

operating margin of 3.8% (2008: 3.9%), and reflects the growing importance of

Specialist Engineering to the Group. The Board has reclassified our Rail

infrastructure activities from Specialist Building to Specialist Engineering as

this reflects better the nature of work carried out.

Specialist Building recorded an operating profit of GBP1.7m (2008: GBP2.4m) on

revenue of GBP113.4m (2008: GBP139.7m). The lower operating margin of 1.5%

(2008: 1.7%) and the reduced revenue reflect the difficult economic

circumstances within which this business stream is operating, and, as previously

announced, further reductions in both revenue and margin are expected to occur

in the second half. Emphasis has remained on project selectivity both to manage

risk and to protect quality of earnings.

The Group's order book at 31 March 2009 was GBP221m compared to GBP219m at 30

September 2008 and GBP248m one year ago. 41% of this is in Specialist

Engineering. The order book excludes potential workflow from the Group's 35

framework agreements, 15 of which are in Specialist Engineering. It is the

Board's continuing view that the potential value of these frameworks should not

be included in the confirmed order book. During the first half, 85% of work

secured in the period was in the public sector. 77% of orders secured were in

our specialist sectors with 75% on negotiated or two stage terms and 86% with

repeat customers.

Review of Operations

Specialist Engineering

Nuclear

Shepley Engineers continues to be engaged at five different Nuclear licensed

sites including a major presence at Sellafield where it has been operating for

over 50 years and continues to be the largest Tier 2 mechanical and electrical

contractor.

The majority of the workload is secured through four Sellafield frameworks all

of which have been extended during the period. In addition, preferred bidder

positions are expected to provide a further GBP10m of revenue over the next two

years.

In May 2009, we agreed the acquisition of Mothersill Engineering, a specialist

machining and fabrication business located near Sellafield and serving the

Nuclear industry, for GBP0.4m in cash. In the year ended 31 December 2008,

Mothersill recorded revenue of GBP0.8m and an operating profit of GBP0.2m.

Safety remains of primary importance and, in addition to receiving a number of

awards during the period, both Shepley and its subsidiary PPS Electrical

achieved the milestone of 1m man hours without a reportable accident.

Land Remediation

As anticipated, due to the downturn in the UK house building industry, activity

in our specialist land remediation business, VHE, remains subdued and supports

our decision to reposition this business last year. This repositioning was

marked by the significant award of the GBP15m Cudworth and West Green Bypass for

Barnsley MBC, our fifth recent project for this client.

Remediation activity continues to be secured through opportunities arising under

Part 11A of the Environment Act and from our National Grid Properties framework.

Water

Seymour and C.&A. currently have five frameworks with Northumbrian Water ("NWL")

and the Environment Agency ("EA"). The largest framework, with NWL under AMP4,

continues until 2011 and during the period experienced good activity levels with

over GBP8m of new projects secured. Both businesses are in the process of new

framework negotiations with these and other clients.

In October 2008, we acquired C.&A. for GBP1.8m. Together, Seymour and C.&A. form

a GBP30m specialist Water business in the North East. Since the acquisition,

C.&A. has performed in line with expectations, securing one of its largest ever

projects, from NWL, during the period.

Rail

In October 2008, YJL Infrastructure was appointed to the Vendor Capital

Programme framework with London Underground. In the first six months, we have

received three significant orders. These include major upgrades to Marble Arch

and Notting Hill Gate underground stations jointly valued at GBP30m. During the

period, we have extended our client base and successfully completed a complex

GBP5m project to create a Peak Hour Subway at Waterloo for Network Rail.

Specialist Building

Social Housing

Following the recent success in securing a framework with Notting Hill Housing

Trust, Allenbuild now has a position on 10 frameworks which jointly provide

access to a GBP650m market. During the period we successfully completed the

GBP16m Mare Street project for Metropolitan Housing and secured over GBP40m of

new orders including projects for Network Housing (GBP14m), Hexagon Housing

(GBP13m) and Genesis Housing (GBP9m).

Retail

As anticipated the retail sector has been quiet throughout the first six months

of the year, although a number of smaller value projects have been secured with

repeat clients.

Science and Education

In addition to four existing frameworks in the North West, Allenbuild has also

been appointed to the LHC Education Framework for the North which is expected to

provide annual opportunities of GBP20m for a four year period. Contracts secured

in the period included projects for Liverpool Hope University and Wakefield MBC.

Work is nearing completion on the Queen Mary Innovation Centre (GBP20m) and the

science fit out project for Eisai Pharmaceuticals (GBP12m). Allenbuild remains

in preferred builder status for the GBP58m Kirklees College Waterfront project.

Restoration and Refurbishment

The high-end residential sector in London continues to provide good workload for

Walter Lilly. Work continues on the GBP37m scheme at Grosvenor Crescent and a

GBP25m private residence in Regents Park. We are preferred bidder on a further

GBP38m project for a private client in London. During the period we were also

awarded the 7 July Memorial in Hyde Park, work at Chiswick House and the first

phase of the restoration of the cast iron roof at the Palace of Westminster.

BRIAN MAY

Chief Executive

19 May 2009

Group Income Statement

for the six months ended 31 March 2009

+---------------------------+-------+--------------+--------------+------+------------+-----------+--------------+--------------+-----------+

| |Notes | Before | Exceptional | Six months | Six | Before | Exceptional | Year |

| | | Exceptional | items and | ended | months | Exceptional | items and | ended |

| | | items and | amortisation | 31 March | ended | items and | amortisation | 30 |

| | | amortisation | of | | 31 | amortisation | of | September |

| | | of | intangible | | March | of | intangible | |

| | | intangible | assets | | | intangible | assets | |

| | | assets | (see Note 2) | | | assets | (see Note 2) | |

+---------------------------+-------+--------------+--------------+-------------------+-----------+--------------+--------------+-----------+

| | | 2009 | 2009 | 2009 | 2008 | 2008 | 2008 | 2008 |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| | | Unaudited | Unaudited | Unaudited | Unaudited | Audited | Audited | Audited |

| | | | | | | | | |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| | | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Group revenue from | 2 | 171,602 | - | 171,602 | 192,850 | 390,557 | - | 390,557 |

| continuing activities | | | | | | | | |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Cost of sales | | (150,351) | (1,006) | (151,357) | (169,232) | (347,820) | - | (347,820) |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Gross profit | | 21,251 | (1,006) | 20,245 | 23,618 | 42,737 | - | 42,737 |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Administrative expenses | | (18,092) | (162) | (18,254) | (20,532) | (35,137) | (2,765) | (37,902) |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Operating profit | 2 | 3,159 | (1,168) | 1,991 | 3,086 | 7,600 | (2,765) | 4,835 |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Finance income | | 395 | - | 395 | 800 | 1,618 | - | 1,618 |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Finance costs | | (41) | - | (41) | (207) | (254) | - | (254) |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Other finance income - | | - | - | - | 250 | 543 | - | 543 |

| defined benefit pension | | | | | | | | |

| scheme | | | | | | | | |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Profit before income tax | 2 | 3,513 | (1,168) | 2,345 | 3,929 | 9,507 | (2,765) | 6,742 |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Income tax expense | 3 | (389) | 282 | (107) | (569) | (2,209) | 727 | (1,482) |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Profit for the period | | 3,124 | (886) | 2,238 | 3,360 | 7,298 | (2,038) | 5,260 |

| attributable to equity | | | | | | | | |

| holders of the parent | | | | | | | | |

| company | | | | | | | | |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Basic earnings per share | 4 | | | 3.74p | 5.61p | | | 8.78p |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Diluted earnings per | 4 | | | 3.62p | 5.47p | | | 8.55p |

| share | | | | | | | | |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| | | | | | | | | |

+---------------------------+-------+--------------+---------------------+------------+-----------+--------------+--------------+-----------+

| Proposed dividend | 5 | | | 1.00p | 1.00p | | | 2.00p |

+---------------------------+-------+--------------+--------------+------+------------+-----------+--------------+--------------+-----------+

There were no exceptional items in the six months ended 31 March 2008.

Administrative expenses for that period included an amortisation charge of

GBP124,000.

Group Statement of Recognised Income and Expense

for the six months ended 31 March 2009

+----------------------------------------------+--------------+---------------+------------+

| | Six months | Six months | Year ended |

| | ended 31 | ended 31 | 30 |

| | March | March | September |

+----------------------------------------------+--------------+---------------+------------+

| | 2009 | 2008 | 2008 |

+----------------------------------------------+--------------+---------------+------------+

| | Unaudited | Unaudited | Audited |

+----------------------------------------------+--------------+---------------+------------+

| | GBP000 | GBP000 | GBP000 |

+----------------------------------------------+--------------+---------------+------------+

| | | | |

+----------------------------------------------+--------------+---------------+------------+

| Profit for the period attributable to equity | 2,238 | 3,360 | 5,260 |

| holders of the parent company | | | |

+----------------------------------------------+--------------+---------------+------------+

| Exchange movements in reserves | 1,279 | 20 | 574 |

+----------------------------------------------+--------------+---------------+------------+

| Movements in actuarial deficit | - | - | (497) |

+----------------------------------------------+--------------+---------------+------------+

| Movement on deferred tax relating to the | - | - | 116 |

| defined pension scheme | | | |

+----------------------------------------------+--------------+---------------+------------+

| Total recognised income and expense for the | 3,517 | 3,380 | 5,453 |

| period attributable to equity holders of the | | | |

| parent company | | | |

+----------------------------------------------+--------------+---------------+------------+

+--------------------------+-------+------------+------------+----------------+

| Group Balance Sheet | | | |

+----------------------------------+------------+------------+----------------+

| at 31 March 2009 | | | | |

+--------------------------+-------+------------+------------+----------------+

| |Notes | 31 March | 31 March | 30 September |

+--------------------------+-------+------------+------------+----------------+

| | | 2009 | 2008 | 2008 |

+--------------------------+-------+------------+------------+----------------+

| | | Unaudited | Unaudited | Audited |

+--------------------------+-------+------------+------------+----------------+

| | | GBP000 | GBP000 | GBP000 |

+--------------------------+-------+------------+------------+----------------+

| Non-current assets | | | | |

+--------------------------+-------+------------+------------+----------------+

| Intangible assets: | | 9,351 | 8,516 | 8,548 |

| goodwill | | | | |

+--------------------------+-------+------------+------------+----------------+

| Intangible assets: other | | 621 | 744 | 620 |

+--------------------------+-------+------------+------------+----------------+

| Property, plant and | | 5,719 | 5,035 | 4,503 |

| equipment | | | | |

+--------------------------+-------+------------+------------+----------------+

| Deferred tax assets | | 3,962 | 4,987 | 4,069 |

+--------------------------+-------+------------+------------+----------------+

| | | 19,653 | 19,282 | 17,740 |

+--------------------------+-------+------------+------------+----------------+

| Current assets | | | | |

+--------------------------+-------+------------+------------+----------------+

| Inventories | | 8,557 | 8,499 | 6,367 |

+--------------------------+-------+------------+------------+----------------+

| Trade and other | | 80,008 | 94,149 | 87,766 |

| receivables | | | | |

+--------------------------+-------+------------+------------+----------------+

| Current tax assets | | - | - | 455 |

+--------------------------+-------+------------+------------+----------------+

| Cash and cash | | 17,656 | 25,817 | 28,289 |

| equivalents | | | | |

+--------------------------+-------+------------+------------+----------------+

| | | 106,221 | 128,465 | 122,877 |

+--------------------------+-------+------------+------------+----------------+

| | | | | |

+--------------------------+-------+------------+------------+----------------+

| Total assets | | 125,874 | 147,747 | 140,617 |

+--------------------------+-------+------------+------------+----------------+

| | | | | |

+--------------------------+-------+------------+------------+----------------+

| Non-current liabilities | | | | |

+--------------------------+-------+------------+------------+----------------+

| Obligations under | | (12) | (59) | (10) |

| finance leases | | | | |

+--------------------------+-------+------------+------------+----------------+

| Retirement benefit | | (518) | (2,702) | (1,479) |

| obligations | | | | |

+--------------------------+-------+------------+------------+----------------+

| Deferred tax liabilities | | (306) | (418) | (256) |

+--------------------------+-------+------------+------------+----------------+

| Provisions | | (1,068) | (1,172) | (1,068) |

+--------------------------+-------+------------+------------+----------------+

| | | (1,904) | (4,351) | (2,813) |

+--------------------------+-------+------------+------------+----------------+

| Current liabilities | | | | |

+--------------------------+-------+------------+------------+----------------+

| Borrowings | | (139) | (85) | (110) |

+--------------------------+-------+------------+------------+----------------+

| Trade and other payables | | (106,402) | (126,751) | (119,246) |

+--------------------------+-------+------------+------------+----------------+

| Obligations under | | (48) | (243) | (67) |

| finance leases | | | | |

+--------------------------+-------+------------+------------+----------------+

| Current tax liabilities | | - | (1,049) | (159) |

+--------------------------+-------+------------+------------+----------------+

| Provisions | | (689) | (2,530) | (3,941) |

+--------------------------+-------+------------+------------+----------------+

| | | (107,278) | (130,658) | (123,523) |

+--------------------------+-------+------------+------------+----------------+

| | | | | |

+--------------------------+-------+------------+------------+----------------+

| Total liabilities | | (109,182) | (135,009) | (126,336) |

+--------------------------+-------+------------+------------+----------------+

| | | | | |

+--------------------------+-------+------------+------------+----------------+

| Net assets | | 16,692 | 12,738 | 14,281 |

+--------------------------+-------+------------+------------+----------------+

| | | | | |

+--------------------------+-------+------------+------------+----------------+

| Share capital | | 5,990 | 5,990 | 5,990 |

+--------------------------+-------+------------+------------+----------------+

| Share premium account | | 5,893 | 5,893 | 5,893 |

+--------------------------+-------+------------+------------+----------------+

| Capital redemption | | 3,896 | 3,896 | 3,896 |

| reserve | | | | |

+--------------------------+-------+------------+------------+----------------+

| Cumulative translation | | 1,703 | (130) | 424 |

| adjustment | | | | |

+--------------------------+-------+------------+------------+----------------+

| Share based payments | | 323 | 165 | 233 |

| reserve | | | | |

+--------------------------+-------+------------+------------+----------------+

| Profit and loss account | | (1,113) | (3,076) | (2,155) |

+--------------------------+-------+------------+------------+----------------+

| Total equity | 6 | 16,692 | 12,738 | 14,281 |

+--------------------------+-------+------------+------------+----------------+

+-----------------------------------+------------+------------+--------------+

| Group Cash Flow Statement | | |

+------------------------------------------------+------------+--------------+

| for the six months ended 31 March 2009 | | |

+------------------------------------------------+------------+--------------+

| | Six months | Six months | Year ended |

| | ended | ended | |

+-----------------------------------+------------+------------+--------------+

| | 31 March | 31 March | 30 September |

+-----------------------------------+------------+------------+--------------+

| | 2009 | 2008 | 2008 |

+-----------------------------------+------------+------------+--------------+

| | Unaudited | Unaudited | Audited |

+-----------------------------------+------------+------------+--------------+

| | GBP000 | GBP000 | GBP000 |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Profit for the period | 2,238 | 3,360 | 5,260 |

+-----------------------------------+------------+------------+--------------+

| Amortisation of intangible assets | 162 | 124 | 248 |

+-----------------------------------+------------+------------+--------------+

| Depreciation | 796 | 834 | 1,708 |

+-----------------------------------+------------+------------+--------------+

| Profit on sale of property, plant | (19) | (94) | (262) |

| and equipment | | | |

+-----------------------------------+------------+------------+--------------+

| (Increase)/decrease in | (598) | (2,015) | 716 |

| inventories | | | |

+-----------------------------------+------------+------------+--------------+

| Decrease/(increase) in | 9,429 | (8,806) | 2,405 |

| receivables | | | |

+-----------------------------------+------------+------------+--------------+

| (Decrease)/increase in payables | (18,155) | 9,891 | (1,599) |

+-----------------------------------+------------+------------+--------------+

| Current service costs in respect | 36 | 36 | 72 |

| of defined benefit pension scheme | | | |

+-----------------------------------+------------+------------+--------------+

| Cash contribution to defined | (997) | (893) | (2,106) |

| benefit pension scheme | | | |

+-----------------------------------+------------+------------+--------------+

| Expense in respect of share | 90 | 68 | 136 |

| options | | | |

+-----------------------------------+------------+------------+--------------+

| Finance income | (395) | (1,050) | (2,161) |

+-----------------------------------+------------+------------+--------------+

| Finance costs | 41 | 207 | 254 |

+-----------------------------------+------------+------------+--------------+

| Interest paid | (41) | (207) | (254) |

+-----------------------------------+------------+------------+--------------+

| Income taxes received/(paid) | 296 | - | (1,344) |

+-----------------------------------+------------+------------+--------------+

| Income tax expense | 107 | 569 | 1,482 |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Net cash (outflow)/inflow from | (7,010) | 2,024 | 4,555 |

| operating activities | | | |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Investing activities | | | |

+-----------------------------------+------------+------------+--------------+

| Interest received | 395 | 800 | 1,618 |

+-----------------------------------+------------+------------+--------------+

| Proceeds on disposal of property, | 79 | 194 | 1,267 |

| plant and equipment | | | |

+-----------------------------------+------------+------------+--------------+

| Purchases of property, plant and | (1,191) | (781) | (2,028) |

| equipment | | | |

+-----------------------------------+------------+------------+--------------+

| Acquisition of subsidiary net of | (1,828) | - | (32) |

| cash acquired | | | |

+-----------------------------------+------------+------------+--------------+

| Net cash (outflow)/inflow from | (2,545) | 213 | 825 |

| investing activities | | | |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Financing activities | | | |

+-----------------------------------+------------+------------+--------------+

| Dividends paid | (1,196) | (719) | (1,317) |

+-----------------------------------+------------+------------+--------------+

| Repayment of obligations under | (71) | (245) | (470) |

| finance leases | | | |

+-----------------------------------+------------+------------+--------------+

| Net cash outflow from financing | (1,267) | (964) | (1,787) |

| activities | | | |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Net (decrease)/increase in cash | (10,822) | 1,273 | 3,593 |

| and cash equivalents | | | |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Cash and cash equivalents at | 28,179 | 24,400 | 24,400 |

| beginning of period | | | |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Effect of foreign exchange rate | 160 | 59 | 186 |

| changes | | | |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Cash and cash equivalents at end | 17,517 | 25,732 | 28,179 |

| of period | | | |

+-----------------------------------+------------+------------+--------------+

| | | | |

+-----------------------------------+------------+------------+--------------+

| Bank balances and cash | 17,656 | 25,817 | 28,289 |

+-----------------------------------+------------+------------+--------------+

| Bank overdrafts | (139) | (85) | (110) |

+-----------------------------------+------------+------------+--------------+

| | 17,517 | 25,732 | 28,179 |

+-----------------------------------+------------+------------+--------------+

NOTES TO THE ACCOUNTS

Note 1. Basis of preparation

(a) The interim financial report for the six months ended 31 March 2009 and the

equivalent period in 2008 have not been audited or reviewed by the Group's

auditors. They do not comprise statutory accounts within the meaning of Section

240 of the Companies Act 1985. They have been prepared under the historical cost

convention and on a going concern basis in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European Union. This

interim financial report does not comply with IAS34 "Interim Financial

Reporting", which is not currently required to be applied for AIM companies. The

Group has reclassified the activities of its rail infrastructure subsidiary, YJL

Infrastructure Limited, from its building segment to its engineering segment and

restated the comparative figures accordingly. This interim report was approved

by the Directors on 19 May 2009.

(b) The accounts for the year ended 30 September 2008 were prepared under IFRS.

The auditors issued an unqualified opinion on them and they have been delivered

to the Registrar of Companies. In this report, the comparative figures for the

year ended 30 September 2008 have been audited. The comparative figures for the

period ended 31 March 2008 are unaudited.

(c) The Directors are satisfied that the Group has adequate resources to

continue in operational existence for the foreseeable future.

This interim statement is being sent to all shareholders and is also available

upon request from the Company Secretary, Renew Holdings plc, Yew Trees, Main

Street North, Aberford, West Yorkshire LS25 3AA, or via the website

www.renewholdings.com.

Note 2. Segmental analysis

For management purposes the Group is organised into three business streams:

Building, Engineering, and Property and central activities. These operating

segments are the basis on which the Group reports its primary segmental

information.

Segmental information about the Group's continuing operations is presented

below:

+-------------------------------+------------------+---------------+--------------+

| | Six months ended | Six months | Year ended |

| | 31 March | ended | 30 September |

| | | 31 March | |

+-------------------------------+------------------+---------------+--------------+

| | 2009 | 2008 | 2008 |

+-------------------------------+------------------+---------------+--------------+

| | Unaudited | Unaudited | Audited |

+-------------------------------+------------------+---------------+--------------+

| Revenue is analysed as | GBP000 | GBP000 | GBP000 |

| follows: | | | |

+-------------------------------+------------------+---------------+--------------+

| | | | |

+-------------------------------+------------------+---------------+--------------+

| Building | 113,419 | 139,697 | 287,044 |

+-------------------------------+------------------+---------------+--------------+

| Engineering | 58,210 | 50,420 | 100,795 |

+-------------------------------+------------------+---------------+--------------+

| Property and central | 8 | 5,674 | 8,213 |

| activities | | | |

+-------------------------------+------------------+---------------+--------------+

| Inter divisional revenue | (35) | (2,941) | (5,495) |

+-------------------------------+------------------+---------------+--------------+

| | | | |

+-------------------------------+------------------+---------------+--------------+

| Group revenue from continuing | 171,602 | 192,850 | 390,557 |

| operations | | | |

+-------------------------------+------------------+---------------+--------------+

Note 2. Segmental analysis (continued)

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| | Before | Exceptional | Six | Six | Before | Exceptional | Year |

| | Exceptional | items and | months | months | Exceptional | items and | Ended |

| | items and | amortisation | ended | ended | items and | amortisation | 30 |

| | amortisation | of | 31 | 31 | amortisation | of | September |

| | of | intangible | March | March | of | intangible | 2008 |

| | intangible | assets | 2009 | 2008 | intangible | assets | Audited |

| | assets | 2009 | Unaudited | Unaudited | assets | 2009 | |

| | 2009 | Unaudited | | | 2009 | Audited | |

| | Unaudited | | | | Audited | | |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| Analysis of | | | | | | | |

| operating profit | | | | | | | |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| Building | 1,660 | - | 1,660 | 2,371 | 4,892 | (889) | 4,003 |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| Engineering | 2,214 | (1,006) | 1,208 | 1,942 | 3,469 | (361) | 3,108 |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| Property and central | (715) | (162) | (877) | (1,227) | (761) | (1,515) | (2,276) |

| activities | | | | | | | |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| Operating profit | 3,159 | (1,168) | 1,991 | 3,086 | 7,600 | (2,765) | 4,835 |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| Net finance income | 354 | - | 354 | 843 | 1,907 | - | 1,907 |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| Profit before income | 3,513 | (1,168) | 2,345 | 3,929 | 9,507 | (2,765) | 6,742 |

| tax | | | | | | | |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

| | | | | | | | |

+----------------------+--------------+--------------+-----------+-----------+--------------+--------------+-----------+

Exceptional items and amortisation of intangible assets

+----------------------------+--------------+--+-------------+--+----------+-----------+

| | Six months | | Six months | | Year ended |

| | ended | | ended | | |

+----------------------------+--------------+--+-------------+--+----------------------+

| | 31 March | | 31 March | | 30 September |

+----------------------------+--------------+--+-------------+--+----------------------+

| | 2009 | | 2008 | | 2008 |

+----------------------------+--------------+--+-------------+--+----------+

| | Unaudited | | Unaudited | | Audited |

+----------------------------+--------------+--+-------------+--+----------+

| | GBP000 | | GBP000 | | GBP000 |

+----------------------------+--------------+--+-------------+--+----------+

| Loss on legacy final | 1,006 | | - | | - |

| account settlement | | | | | |

+----------------------------+--------------+--+-------------+--+----------+

| Redundancy costs | - | | - | | 1,471 |

+----------------------------+--------------+--+-------------+--+----------+

| Costs in relation to BB&EA | - | | - | | 1,168 |

| pension scheme | | | | | |

+----------------------------+--------------+--+-------------+--+----------+

| Profit on disposal of | - | | - | | (122) |

| plant fleet | | | | | |

+----------------------------+--------------+--+-------------+--+----------+

| Total exceptional items | 1,006 | | - | | 2,517 |

+----------------------------+--------------+--+-------------+--+----------+

| Amortisation of intangible | 162 | | 124 | | 248 |

| assets | | | | | |

+----------------------------+--------------+--+-------------+--+----------+

| | 1,168 | | 124 | | 2,765 |

+----------------------------+--------------+--+-------------+--+----------+-----------+

Exceptional items comprise GBP1,006,000 in respect of a final account settlement

on the last of the basket of legacy construction contracts, which were

originally provided against in 2005. Amortisation charges relate to the fair

value ascribed to intangible assets other than goodwill arising from the

acquisitions of Seymour (C.E.C) Holdings Limited and C. & A. Pumps Limited.

Note 3. Income tax expense

+------------------------------+----------------+-------------+-----------+

| | Six months | Six months | Year |

| | ended | ended | ended 30 |

| | 31 March | 31 March | September |

+------------------------------+----------------+-------------+-----------+

| | 2009 | 2008 | 2008 |

+------------------------------+----------------+-------------+-----------+

| | Unaudited | Unaudited | Audited |

+------------------------------+----------------+-------------+-----------+

| | GBP000 | GBP000 | GBP000 |

+------------------------------+----------------+-------------+-----------+

| Current tax: | | | |

+------------------------------+----------------+-------------+-----------+

| UK corporation tax on | - | (569) | (159) |

| profits for the period | | | |

+------------------------------+----------------+-------------+-----------+

| Adjustments in respect of | - | - | (409) |

| previous periods | | | |

+------------------------------+----------------+-------------+-----------+

| | - | (569) | (568) |

+------------------------------+----------------+-------------+-----------+

| Foreign tax | - | - | (51) |

+------------------------------+----------------+-------------+-----------+

| Total current tax | - | (569) | (619) |

+------------------------------+----------------+-------------+-----------+

| Deferred tax | (107) | - | (863) |

+------------------------------+----------------+-------------+-----------+

| Income tax expense | (107) | (569) | (1,482) |

+------------------------------+----------------+-------------+-----------+

The Group has unused tax losses available to carry forward against future

taxable profits, although a significant element of these losses relates to

activities which are not forecast to generate the level of profits needed to

utilise these losses. A related deferred tax asset of GBP3,660,000 (2008:

GBP3,990,000) has been recognised to the extent considered reasonable by the

directors.

Note 4. Earnings per share

+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| | | 6 months ended 31 March | | 6 months ended 31 March | Year ended 30 September |

+----------+----------+--------------------------------+----------+-------------------------------------------+--------------------------------+

| | | | 2009 | | | | 2008 | | | | 2008 | |

+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| | | Earnings | EPS | DEPS | | Earnings | EPS | DEPS | | Earnings | EPS | DEPS |

+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| | | GBP000 | Pence | Pence | | GBP000 | Pence | Pence | | GBP000 | Pence | Pence |

+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| Earnings before | 3,124 | 5.22 | 5.05 | | 3,484 | 5.82 | 5.68 | | 7,298 | 12.18 | 11.87 |

| exceptional costs | | | | | | | | | | | |

| and amortisation | | | | | | | | | | | |

+---------------------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| Exceptional costs | (886) | (1.48) | (1.43) | | (124) | (0.21) | (0.20) | | (2,038) | (3.40) | (3.32) |

| and amortisation | | | | | | | | | | | |

+---------------------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| Basic earnings per | 2,238 | 3.74 | 3.62 | | 3,360 | 5.61 | 5.47 | | 5,260 | 8.78 | 8.55 |

| share | | | | | | | | | | | |

+---------------------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | | |

+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | | |

+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

| Weighted average | | 59,899 | 61,878 | | | 59,899 | 61,392 | | | 59,899 | 61,497 |

| number of shares | | | | | | | | | | | |

| (000's) | | | | | | | | | | | |

+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+----------+

The dilutive affect of share options is to increase the number of shares by

1,979,000 (March 2008: 1,598,000) and reduce the basic earnings per share by

0.12p (March 2008: 0.14p; September 2008: 0.23p).

Note 5. Dividends

The proposed interim dividend is 1.0p per share (2008 1.0p). This will be paid

out of the Company's available distributable reserves to shareholders on the

register on 5 June 2009, payable on 6 July 2009. In accordance with IAS 1,

dividends are recorded only when paid and are shown as a movement in equity

rather than as a charge in the income statement.

Note 6. Reconciliation of movements in total equity

+--------------------------+------------------+---------------+-------------+

| | Six months ended | Six months | Year ended |

| | | ended | |

+--------------------------+------------------+---------------+-------------+

| | 31 March | 31 March | 30 |

| | 2009 | 2008 | September |

| | | | 2008 |

+--------------------------+------------------+---------------+-------------+

| | Unaudited | Unaudited | Audited |

+--------------------------+------------------+---------------+-------------+

| | GBP000 | GBP000 | GBP000 |

+--------------------------+------------------+---------------+-------------+

| Profit for the period | 2,238 | 3,360 | 5,260 |

+--------------------------+------------------+---------------+-------------+

| Dividends | (1,196) | (719) | (1,317) |

+--------------------------+------------------+---------------+-------------+

| | 1,042 | 2,641 | 3,943 |

+--------------------------+------------------+---------------+-------------+

| Other recognised gains | 1,279 | 20 | 193 |

| and losses for the | | | |

| period | | | |

+--------------------------+------------------+---------------+-------------+

| Movement in share based | 90 | 68 | 136 |

| payments reserve | | | |

+--------------------------+------------------+---------------+-------------+

| Net movement on total | 2,411 | 2,729 | 4,272 |

| equity | | | |

+--------------------------+------------------+---------------+-------------+

| Opening total equity | 14,281 | 10,009 | 10,009 |

+--------------------------+------------------+---------------+-------------+

| Closing total equity | 16,692 | 12,738 | 14,281 |

+--------------------------+------------------+---------------+-------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SFSFMASUSEDI

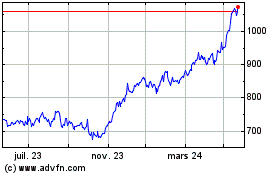

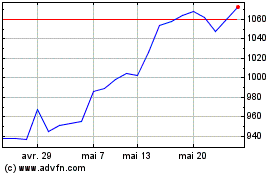

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024