TIDMRWS

RNS Number : 4112W

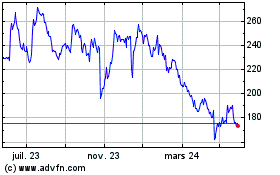

RWS Holdings PLC

12 December 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014 (as it

forms part of Retained EU Law as defined in the European Union

(Withdrawal) Act 2018).

For immediate release 12 December 2023

RWS Holdings plc

Results for the year ended 30 September 2023

Encouraging progress with growth initiatives, new client wins

and efficiency drive,

partly mitigating a challenging market

RWS Holdings plc ("RWS", "the Group", "the Company"), a unique

world-leading provider of technology-enabled language, content and

intellectual property services, today announces its final results

for the year ended 30 September 2023 ("FY23").

Financial overview

2023 2022 Change

Revenue GBP733.8m GBP749.2m -2%

Gross margin 46.3% 46.7% -40bps

Adjusted profit before

tax(1) GBP120.1m GBP135.7m -11%

Profit/(Loss) before tax GBP(10.9)m GBP83.2m -113%

Adjusted basic earnings

per share(1) 23.3p 26.6p -12%

Basic earnings per share (7.1)p 16.1p -144%

Dividend:

Proposed final 9.80p 9.50p +3%

Total for year 12.20p 11.75p +4%

Cash conversion(1) 74.0% 92.7% -1900bps

Net cash(2) GBP23.6m GBP71.9m -67.2%

Group highlights

-- Strategic progress, client wins and efficiency drive

mitigation of challenging market backdrop:

-- New business wins and strong retention across all divisions

and in a range of end markets, including aviation, e-commerce,

engineering, manufacturing, government/defence, mining, software

and technology

-- Continuing successful focus on higher growth segments

delivered GBP20m of incremental revenue (FY22: GBP5m), notably

TrainAI (data services), eLearning, Linguistic Validation and

Patent Attorney initiatives

-- As announced in June 2023, delivered a run rate GBP25m cost

savings to support FY24 profitability whilst investing in growth

initiatives

-- Invested GBP40m in capex in line with our strategy to drive

growth levers and deliver transformation

-- Increasing proportion of work going through our AI-enabled

Language eXperience Delivery platform ("LXD")

-- Integration of Propylon, content management business acquired

in July, on track and progressing well

Financial performance

-- Reported revenue declined by c.2% year-on-year and organic

constant currency ("OCC")(3) revenue by c.6%, reflecting reduced

client activity in a challenging market environment

-- As anticipated, OCC revenue decline slowed from c.7% in the

first half to c.5% in the second half, with improving trends across

our services divisions

-- Gross margin broadly maintained at 46.3% (FY22: 46.7%),

reflecting price recovery of rising costs and efficiency benefits

from greater use of LXD, partially offset by some changes in

language and client mix

-- Adjusted profit before tax ("Adjusted PBT")(1) declined 12%,

reflecting reduced activity in some end markets, offset by in-year

cost savings achieved and the benefits of our foreign exchange

hedging programme

-- Adjusted PBT(1) margin of 16.4%, down from 18.1% in FY22,

after investments in growth initiatives and transformation

-- Macroeconomic challenges and higher cost of capital through

increased market interest rates resulted in a non-cash exceptional

goodwill impairment charge of GBP62.4m against our technology

division which contributed to a reported loss before tax of

GBP10.9m

-- Other principal adjusting items, consistent with prior year,

included amortisation of acquired intangibles of GBP38.8m (FY22:

GBP34.4m) and exceptional items relating to restructuring and

integration of GBP22.6m (FY22: GBP12.5m)

-- Continued strong underlying cash generation, with 74% cash

conversion(1) (lower figure driven primarily by the timing of tax

payments and continued investment in our R&D and Group

transformation programmes)

-- Net cash(2) of c.GBP23.6m at 30 September 2023 (FY22:

GBP71.9m), after GBP46.3m of dividends, GBP31.5m of acquisition

costs, GBP19.4m of share repurchases and GBP40.3m of capex

-- Recommended final dividend of 9.80p per share (FY22: 9.50p),

giving total dividend of 12.20p (FY22: 11.75p), a 4% increase

Language Services

-- Revenues of GBP329.8m declined by 4% on a reported basis

(FY22: GBP342.1m) and by 7% on an OCC(3) basis, driven by reduced

activity as clients adjusted to more challenging conditions in

their own markets

-- Won all retender processes with global technology clients

-- Client retention and satisfaction remained high, with TrainAI

and eLearning growth initiatives both performing well, providing

momentum into FY24

IP Services

-- Revenues of GBP104.8m declined 2% on a reported basis (FY22:

GBP107.2m) and by 4% on an OCC(3) basis, driven by reductions in

client activity

-- Volumes recovered in the second half, as anticipated, as the

launch of the Unitary Patent on 1 June 2023 resulted in the release

of some of the backlog of IP work

-- Strong performance in both the Patent Attorney and Worldfile segments

Regulated Industries

-- Revenues of GBP162.5m declined by 6% on a reported basis

(FY22: GBP173.0m) and by 9% on an OCC (3) basis

-- Positive progress with Linguistic Validation (clinical stage)

offset by reduced activity at the regulatory stage amongst some

Life Sciences clients; we expect volumes to increase as products

move through to the regulatory approval and launch stages in due

course

-- The Financial and Legal Services segments performed well,

driven by Financial Services clients ensuring compliance with

PRIIPS regulations

Language and Content Technology

-- Revenues of GBP136.7m increased by 8% on a reported basis

(FY22: GBP126.9m) and decreased 1% on an OCC(3) basis

-- Encouraging new client wins across the products, with strong

second half bookings for Language Weaver (linguistic AI), including

its largest ever cloud SaaS contract, worth more than $1m over

three years

-- SaaS licence revenue growth of 23% which became a tailwind

for the Group on a run rate basis in the second half, delivering a

more predictable revenue profile for the division

Current trading and outlook

-- As previously announced, the macroeconomic environment

remains challenging with several temporary headwinds, however we

are also seeing opportunities for the Group to strengthen

leadership in our markets, particularly in AI-enabled solutions

-- Benefit of GBP25m cost actions and efficiency improvements to support profitability in FY24

-- Developments in AI and Large Language Models are creating

clear growth opportunities for the Group; the positive response to

the beta launch of Evolve, Language Weaver's pioneering linguistic

AI innovation, in November further cements our strong position in

helping clients safely harness the benefits of AI

-- In October we announced the acquisition of ST Communications,

a long-term language partner of RWS, which has given us a presence

in Africa and significantly deepened our expertise in more than 40

African languages

-- In line with our capital allocation policy, the share

repurchase programme, announced in June, is progressing as

planned

-- Overall, trading in the current year has been in line with the Board's expectations

Ian El-Mokadem, CEO of RWS, commented:

"Against a backdrop of ongoing global uncertainty, we made

positive progress with our medium-term strategy during FY23. Our

growth initiatives are contributing meaningful incremental revenue

and we reinforced our partnerships with several global technology

clients through successful outcomes in all significant retenders.

With the acquisition of Propylon and, shortly after the year end,

ST Communications, we have enhanced the Group's offerings,

capabilities and geographical reach.

"This progress has partially mitigated the impact of a

challenging market environment which has led to reduced activity in

several end markets and ongoing price pressure. Nevertheless,

retention levels remained high, we won new clients and we remain

confident that activity levels will recover as our clients' markets

normalise. We took effective action to ensure that our cost base

matches current levels of activity and we continue to identify

further efficiency opportunities in our transformation programmes,

whilst investing to support our growth initiatives.

"At our AI and Technology Teach-In in October we demonstrated

our longstanding expertise and capability and, in line with our

strategy, we continued to invest in AI during the year, including

the successful launch of the TrainAI proposition, the incorporation

of several AI features into Trados and increasing its use in our

production platform, the LXD. The recent launch of Evolve, a unique

combination of human and artificial intelligence, has the potential

to revolutionise translation processes by significantly reducing

the time it takes to achieve near human quality output.

"Notwithstanding the temporary headwinds in some of our markets,

the Group remains highly resilient. We have a compelling range of

AI-enabled solutions with the enterprise-grade security, quality

and privacy that clients are actively seeking and we are

successfully pivoting into higher growth segments, which is

supporting improving trends across all our services divisions. We

continue to transform the Group into a scalable platform to support

growth and profitability.

"Our global scale and reach and diverse portfolio of solutions,

clients and end markets are complemented by a unique combination of

market-leading expertise and technology. With clear structural

drivers of demand for our products and services and a strong

balance sheet and cash generation supporting investment in organic

and acquisition opportunities, we are confident in the long-term

prospects of the Group."

RWS Holdings plc

Ian El-Mokadem, Chief Executive Officer

Candida Davies, Chief Financial Officer 01753 480200

MHP (Financial PR Advisor) rws@mhpc.com

Katie Hunt / Eleni Menikou / Catherine Chapman 020 3128 8100

07884 494112

Numis (Nomad & Joint Broker)

Stuart Skinner / Kevin Cruickshank / Will Baunton 020 7260 1000

Berenberg (Joint Broker)

Ben Wright / Toby Flaux / Alix Mecklenburg-Solodkoff 020 3207 7800

The person responsible for releasing this announcement is Jane

Hyde, General Counsel and Company Secretary.

About RWS:

RWS Holdings plc is a unique, world-leading provider of

technology-enabled language, content and intellectual property

services. Through content transformation and multilingual data

analysis, our combination of AI-enabled technology and human

expertise helps our clients to grow by ensuring they are understood

anywhere, in any language.

Our purpose is unlocking global understanding. By combining

cultural understanding, client understanding and technical

understanding, our services and technology assist our clients to

acquire and retain customers, deliver engaging user experiences,

maintain compliance and gain actionable insights into their data

and content.

Over the past 20 years we've been evolving our own AI solutions

as well as helping clients to explore, build and use multilingual

AI applications. With 40+ AI-related patents and more than 100

peer-reviewed papers, we have the experience and expertise to

support clients on their AI journey.

We work with over 80% of the world's top 100 brands, more than

three-quarters of Fortune's 20 'Most Admired Companies' and almost

all of the top pharmaceutical companies, investment banks, law

firms and patent filers. Our client base spans Europe, Asia

Pacific, Africa and North and South America. Our 65+ global

locations across five continents service clients in the automotive,

chemical, financial, legal, medical, pharmaceutical, technology and

telecommunications sectors.

Founded in 1958, RWS is headquartered in the UK and publicly

listed on AIM, the London Stock Exchange regulated market

(RWS.L).

For further information, please visit: www.rws.com .

Forward-looking statements

This announcement contains certain statements that are

forward-looking. These include statements regarding our intentions,

beliefs or current expectations and those of our officers,

Directors and employees concerning, amongst other things, our

results of operations, financial condition, liquidity, prospects,

growth, strategies and the business we operate. By their nature,

these statements involve uncertainty since future events and

circumstances can cause results and developments to differ

materially from those anticipated. The forward-looking statements

reflect knowledge and information available at the date of

preparation of this document and, unless otherwise required by

applicable law, RWS undertakes no obligation to update or review

these forward-looking statements. Nothing in this announcement

should be construed as a profit forecast. RWS and its Directors

accept no liability to third parties in respect of this document

save as would arise under English law.

1. RWS uses adjusted results as key performance indicators as

the directors believe these provide a more consistent measure of

operating performance. The definitions for these key performance

indicators can be found in the Glossary.

2. Net cash comprises cash and cash equivalents less loans but

before deducting lease liabilities.

3. OCC: adjusted to reflect a like-for-like comparison between

actual and prior year and assumes constant currency across both

reported periods.

CHAIRMAN'S STATEMENT

INTRODUCTION

RWS continued to implement its medium-term strategy during FY23,

pivoting successfully into higher growth segments, making progress

in its transformation programme and building on its longstanding

capability to further deploy AI into its products and operations.

The Group operates in attractive markets with a combined global

size estimated at more than GBP47bn(1) and a strong set of demand

drivers. RWS's specialist knowledge and experience across all

aspects of the content life cycle enable the Group to meet a broad

range of client needs in multiple end markets. The Group's scale,

reputation and highly diversified client base have helped it to

maintain leading positions in a range of highly fragmented

markets.

PERFORMANCE

The Group delivered GBP733.8m of revenue for the year, a decline

of approximately 2% compared with the prior year (FY22: GBP749.2m).

This reflected a continuing challenging economic environment, which

resulted in reduced activity in a number of our end markets. While

we have taken action to ensure that our cost base matches current

levels of activity, we remain confident that activity levels will

recover in due course. RWS continued to demonstrate considerable

resilience, highlighting the defensive qualities of a business that

is well-diversified across end markets, geographies and the

solutions that it provides.

The Group recorded a loss before tax of GBP10.9m (FY22: profit

of GBP83.2m), largely due to impairment charges of GBP62.4m.

Adjusted profit before tax declined to GBP120.1m (FY22: GBP135.7m),

reflecting reduced revenues and planned investments in growth and

transformation. These have been partly mitigated by client price

increases, foreign exchange gains of GBP13.0m from the Group's

hedging programme and effective cost control, in particular the

implementation of significant cost actions announced at the half

year and the further migration of translation volumes through the

Language eXperience Delivery ("LXD"), our production platform.

The Group continues to have a strong balance sheet, with net

assets of GBP987.3m (FY22: GBP1,141.7m) at 30 September 2023 which

included net cash of GBP23.6m (FY22: GBP71.9m). The reduction in

net assets reflects impairment charges of GBP62.4m and decreasing

foreign currency denominated net assets by GBP60.3m, mainly due to

the weakening US Dollar.

PEOPLE AND BOARD

At 30 September 2023 RWS employed 7,910 full-time equivalents

across 67 locations in 33 countries (FY22: 7,761). Our agile

working policy facilitated a mix of regular face-to-face contact to

support effective collaboration with the advantage of the benefits

of technology in delivering time and energy savings from a

reduction in commuting. With cost-of-living concerns in many of our

locations, the Group's positive approach to flexible working has

been appreciated by colleagues across the world. We continued to

consider the viability of some of our locations and were able to

further reduce the number of offices by c.7%, with associated

savings in property and related costs.

Against a difficult macroeconomic environment background, it has

been a challenging year for the Group and I would like to

recognise, on behalf of the Board, the significant efforts by all

our teams across the world in continuing to deliver high quality

services and products to our clients. During the year the Group

continued to support those colleagues impacted by the ongoing

conflict in Ukraine. In February, following the earthquake in

Türkiye and Syria, we immediately provided additional support to

our home-based team members and their families in Türkiye. The RWS

Foundation made donations of GBP13,000 to the humanitarian appeal

and colleague donations raised more than GBP7,500. After the year

end, in light of the conflict in the Middle East, we moved quickly

to provide additional support for colleagues in our Lebanon

office.

Candida Davies was appointed the Group's Chief Financial Officer

and joined the Board at the start of the financial year on 3

October 2022. She brings deep expertise in finance, strategy and

business transformation and a wealth of international experience in

executing and integrating significant corporate transactions. In

order to ensure a smooth handover of responsibilities, Candida

worked closely with Rod Day, who continued as a member of the Board

and as Deputy Chief Financial Officer until 31 December 2022 when,

as planned, he left the Group. I would like to thank Rod for the

significant contribution he made during his year with the

Group.

On 3 October 2022 Jane Hyde joined the Executive Team as General

Counsel and Company Secretary, taking overall responsibility for

the Group's legal, governance and risk functions. She has an

outstanding record in advising public companies and has held a mix

of private practice and in-house general counsel roles alongside

commercial and compliance roles in international organisations,

including De La Rue plc, JPMorgan Cazenove and Nomura

International. The Group's legal team now reports directly to Jane.

She also leads the company secretarial and risk management

activities for the Group.

On 2 October 2023, Andrew Brode stepped down as Chairman. Andrew

has been fundamental to RWS's success since leading a buyout in

1995 and has overseen a series of significant milestones, from

listing the Group on AIM in 2003 to overseeing significant growth

in revenues and profits, driven both by the underlying business and

a series of acquisitions. I would like to thank Andrew for his

dedication to the Group, without which we would not have achieved

our market-leading position. The Board, and everyone at RWS, owes

Andrew a huge debt of gratitude for his contribution over many

years and we look forward to continuing to benefit from his wise

counsel as a Non-executive Director.

SUSTAINABILITY AND ESG

RWS remains fully committed to achieving the highest standards

in Environmental, Social and Governance ("ESG") in its business

activities and interactions with stakeholders. We made further

progress during the year towards becoming a truly sustainable

business and for the second year we have published a separate ESG

report, which sets out our progress in detail. The report is

available to download from the Group's website

www.rws.com/about/corporate-sustainability/.

DIVID

The Group continues to deliver its progressive dividend policy

and this marks the 20th year in succession that we have increased

the dividend. The Group remains highly cash generative and,

notwithstanding our share repurchase and investment programmes,

both of which will last into FY24, we will continue to deliver high

levels of cash conversion.

The Board therefore recommends a final dividend of 9.8p per

share. Together with the interim dividend of 2.4p per share, this

will result in a total dividend of 12.2p for the year, an increase

of 4% compared with FY22. Subject to final approval at the AGM, the

final dividend will be paid on 23 February to shareholders on the

register at 26 January 2024.

SUMMARY

The Group has continued to make solid progress in delivering its

medium-term strategy, particularly in relation to its growth

initiatives, transformation programmes and portfolio expansion.

This progress has helped to mitigate some of the effects of a

challenging market environment, which has dampened demand and

increased price pressure in some of our end verticals in the last

12 months.

We are well-positioned to take advantage of developments in AI

and technology and the long-term drivers of demand for our products

and services are clear. We are leaders in the majority of markets

that we serve and are confident of the opportunities for growth.

The Group remains highly cash generative and has a strong balance

sheet.

With our global reach, diverse set of end markets and high

levels of client retention and satisfaction, I am confident in the

Group's long-term prospects. I would like to thank Andrew for his

support during my first 18 months with RWS and I look forward to

working with him and the rest of the Board as we continue to

deliver on our strategy.

Julie Southern

CHAIRMAN

11 December 2023

(1) Sources: OC&C, Slator, CSA, WIPO, EPO, Companies House (2021)

CHIEF EXECUTIVE OFFICER'S REVIEW

INTRODUCTION

We have made steady progress with our medium-term strategy

against a backdrop of ongoing global uncertainty. We are delivering

incremental revenue from our growth initiatives, winning new logos

and achieving more efficient delivery of services through our

Language eXperience Delivery platform. This progress has partially

mitigated the impact of a challenging market environment which has

led to reduced activity in several end markets.

Our clients come first and we are proud to continue to have high

retention rates and see further improvements to our Net Promoter

Score. As we look ahead to the coming year and beyond, we will

continue to invest in our AI-powered products and services and help

guide clients through their own AI journey.

PROGRESS IN RELATION TO OUR MEDIUM-TERM STRATEGY

In 2022 we launched a new Group strategy and plan for the next

phase of the Group's development. Eighteen months later our

strategy remains robust and valid and the Group continues to make

solid progress.

We continue to be confident in the structural drivers of demand

for our products and services and the strength of the solutions

that we provide. This is demonstrated by the encouraging number of

new business wins in the period across all divisions, high levels

of retention and satisfaction across our existing client base and

the positive outcomes from several tender processes involving our

largest enterprise clients.

Our growth initiatives, including Linguistic Validation and

eLearning, have continued to build well and our data services

proposition, TrainAI, was well received when it launched in

February, with some encouraging client wins in the early part of

the second half. This progress has helped to mitigate some of the

effects of a challenging environment which has resulted in reduced

activity in a number of our end markets.

The actions we took throughout the year to improve efficiency

and maintain profitability have helped to protect margin -

particularly the cost actions that we announced at our interim

results. We saw some progress in pricing (particularly within our

Language and Content Technology division), our transformation

programmes and expanding our portfolio.

In July we completed the acquisition of Propylon Holdings

Limited ("Propylon"), a content management technology business

headquartered in Dublin, Ireland. Propylon's component content

management system is used by governments, standards bodies, legal

publishers and regulated firms to address the complexities involved

with drafting, managing, publishing and updating legal and

legislative content. Shortly after the end of FY23 we announced the

acquisition of ST Communications, a long-term language partner of

RWS, which has given us a presence in Africa and access to

significant expertise in more than 40 African languages.

Integration of both businesses has started well and is proceeding

to plan.

Our strategy identified technology and AI as being critical to

our future and the explosion in generative AI and Large Language

Models ("LLMs") has reinforced that view. Our longstanding AI

capabilities date back to 2003, and ever since we have been

pioneering in neural machine translation, AI data services and

AI-functionality in our Tridion and Trados products. Our continued

investments and the rapid development in AI and LLMs place us in a

strong position to benefit internally from AI and create clear

growth opportunities for the Group.

During the year we invested in improving our sales

effectiveness. Following a successful pilot within IP Services we

extended the programme to other divisions, with a focus on

implementing more rigorous processes around sales activity and

accountability. We also reviewed and sharpened our approach to

account management, introducing a single Group-wide approach to

account planning and development. This will support our

cross-selling efforts as we look to provide more of our solutions

to our largest clients.

In line with our medium-term strategy we continue to invest in

our transformation. In January we successfully migrated to a single

collaboration platform, giving the Group an enhanced ability to

communicate and work together more effectively. We have also made

progress in HR and Finance transformation, with the first phase of

our new HR platform having gone live in early December 2023.

Shortly after the end of the year we implemented the first phase of

the new finance operating model, including shared service centres

in Brno (Czechia), Bangalore (India) and Shenzhen (China).

The transformation of our IP Services division has also

progressed well. The division's translation operations team became

part of the Language eXperience Delivery ("LXD") platform and

shortly after the year end the LXD started to process IP Services

content. We have also consolidated our vendor data and contracts,

generating savings for the Group.

AI AT RWS

At RWS, we have been AI pioneers for many years. Since first

launching statistical machine translation in 2003 and later

developing one of the world's most advanced neural machine

translation platforms, our expert linguists and elite scientists

have continued to redefine the limits of machine translation. Since

2016, we've been a trusted data training and services partner to

the world's leading tech companies on their AI development,

providing the linguistic expertise, cultural insight and quality

data that power their success. Whether clients are exploring,

building or using AI, we have AI solutions and AI-enabled products

to support them on their AI journey.

Our strategy recognises the role of AI and technology in driving

growth and efficiency - both for our clients and for our internal

deployment.

Our LXD platform, which provides clients with access to more

than 1,750 in-house language specialists and more than 35,000

freelancers, relies on our AI-powered technologies, including

Language Weaver and Trados, to deliver further improvements in our

services. Almost two-thirds of all words translated by the LXD are

translated first by Language Weaver, our AI-powered neural machine

translation platform.

PEOPLE, CULTURE AND ORGANISATION

RWS remains a great place to work and we are proud to have

nurtured an inclusive and diverse environment where everyone has

the opportunity to be their best and be part of a global team.

In a challenging environment, a clear focus is more important

than ever and the business has adopted the acronym EDGE to ensure

that all colleagues are clear about the Group's priorities. EDGE

stands for Efficient Delivery, Growth and Engagement. Our cadence

of communications provides context, rationale and examples that

bring each of these three components to life, from our CEO-led

communications and our monthly company newsletter, to updates about

our transformation programmes and via the regular town hall events

that take place across divisions and functions.

A major part of developing our culture and fostering an

inclusive environment is our annual Group-wide Engagement Survey.

This year marked the third year in which we have asked all

colleagues for insight into their experience at RWS, looking at

what's working well and what can be improved with regard to

collaboration, engagement, inclusion, growth and development,

leadership and living the Group's values. This year's survey

achieved a response rate of 84% (FY22: 85%) and a 61% (FY22: 69%)

favourable colleague engagement score. We fully recognise that the

external challenges we experienced in FY23 and the difficult

decisions we had to take in response have impacted our overall

colleague engagement score. However we have confidence that we can

make positive progress in the year ahead. Encouragingly our highest

scoring area was Trust and Respect (83% favourable), alongside our

diverse culture, relationships with managers and corporate

sustainability. In parallel, I am pleased to report a further

improvement in our voluntary colleague attrition rate(2) to 11.9%

for the year (FY22: 15.9%).

To further encourage colleagues to adopt our values and

demonstrate their relevance, this year we launched our 'Ambassador

Awards' which is our all-colleague recognition programme. Twice a

year each of our divisions, the LXD and our Group functions

nominate one colleague or team as their best example of each of the

four values. These 24 half-year winners received a financial reward

and their stories are published and promoted internally to

recognise their exceptional contribution. This programme proved

extremely popular and we received more than 750 entries during the

year.

A regular rhythm of company communications to all colleagues,

where we provide updates on client and team successes,

organisational changes and product launches, are complemented by a

monthly all colleague newsletter.

In January 2023 we undertook a significant information

technology migration project, giving everyone across the business

the ability to communicate effectively and share information on a

single instance of Microsoft Teams and Outlook. We also implemented

Viva Engage, a social channel, where all colleagues can now easily

share content and join discussions across the Group.

Our eLearning platform MyLX has continued to provide colleagues

with learning and development opportunities. MyLX offers a

comprehensive range of more than 360,000 training modules provided

by Skillsoft, giving everyone the opportunity to improve their

skills and personal development. The platform also allowed us to

roll out training in our Code of Conduct, a new information

security module and, for the first time, our global health and

safety programme. At the end of the year we had a 98% completion

rate for all compliance training across the Group.

In June we again brought together our Senior Leadership Team in

the UK to remind ourselves of our organisational purpose and values

and to review and assess progress on our medium-term strategy. This

aims to align our most senior team with our organisational goals

before bringing everything to life throughout the business under

this group's combined leadership.

We appointed Daniel Bennett as President of our IP Services

division on 10 November 2022, overseeing the Group's full suite of

innovation lifecycle management services, including patent

translation and filing, renewals and IP research studies. We

announced on 28 September 2023 that Daniel would be leaving the

business to pursue other opportunities. Daniel has been

instrumental in driving the success of IP Services over the past

year by navigating the team through the launch of the Unitary

Patent, fostering a more growth-oriented culture and realigning the

IP leadership team.

With Andrew Brode stepping back from Chairman to become a

Non-executive Director, I would like to thank him personally for

the significant support he has given me during my first two years

as CEO of the Group and very much look forward to continuing to

benefit from his wise counsel.

OPERATING REVIEW

Language Services

Client retention and satisfaction remain high, several

successful tender processes and growth initiatives performing well,

offset by reduced activity

The Language Services division represented 45% of Group revenues

in the year (FY22: 46%). Revenues of GBP329.8m were 3.6% lower year

on year on a reported basis (FY22: GBP342.1m) and saw a 7% decrease

on an organic constant currency basis.

We are proud that client retention and satisfaction remained

high and we were encouraged by positive outcomes following tender

processes with several of our global technology clients, albeit we

continued to see reduced activity from some clients as they

adjusted to more challenging conditions in their own markets.

The Strategic Solutions Group continued to win new clients in

both the Major Accounts and GoGlobal segments, including Norse

Atlantic Airways, for whom we have recently delivered multilingual

booking websites and online experiences across any device or

channel, using a combination of our language services expertise and

our Tridion solution.

In our Enterprise Internationalisation Group ("EIG"), which

serves global technology enterprises, we were encouraged to have

completed a three-year contract renewal for one of our largest

clients in the first half and, in the early months of the second

half, were pleased by the positive outcomes of other tender

processes. Clients within the EIG consistently provide high NPS

scores and ratings (particularly in 'partnering' and 'delivering')

and continue to be delighted with the services and solutions we

provide.

With regards to the division's growth initiatives, eLearning

performed well throughout the year and we have seen some success in

cross-selling the solution to clients in the Regulated Industries

division. In February we launched TrainAI, a refreshed proposition

focused on the range of data services that we have been providing

to several of our largest technology clients since 2016. This is

focused on helping organisations ensure that their own AI models

are trained with dependable and responsible data and encompasses

data collection, annotation and validation services. The service is

backed by a global community of more than 100,000 annotators and

linguists.

We have been encouraged by the market's reception to TrainAI and

the sales and marketing drive which is supporting the launch led to

some wins early in the second half. Four of our major clients have

approved us to train data for the next stage of their AI

programmes, giving a strong expectation of further momentum. These

programmes will provide us with strong references amongst the data

services buyer landscape and are expected to lead to growth in this

developing area.

We were also pleased to complete the beta launch of HAI, a

product within GoGlobal, which will enable clients with ad-hoc

translation requests to upload documentation for rapid translation.

We anticipate the full launch of HAI in early 2024.

The division's adjusted operating profit(3) was GBP39.4m (FY22:

GBP53.3m) on a reported basis, reflecting the reduction in top-line

revenues and unfavourable language and client mix, partially

mitigated by effective cost control.

Regulated Industries

Linguistic Validation growth initiative performing well, reduced

activity among certain clients in life sciences, while financial

services experienced solid revenues, largely driven by regulatory

changes

The Regulated Industries division accounted for 22% of Group

revenues in the year (FY22: 23%). Revenues of GBP162.5m decreased

by 6.1% year on year on a reported basis (FY22: GBP173.0m) and

decreased by 9% on an organic constant currency basis.

Several life sciences clients continue to show softness due to

the impact of new legislation in the USA, such as the Inflation

Reduction Act, on product pipelines and due to delays at regulatory

authorities; however, we expect volumes to increase as bottlenecks

resolve and as products move through the regulatory approval

process in due course. Revenues were also impacted year-on-year by

the loss of a major Contract Research Organisation ("CRO")

client.

In the Life Sciences vertical our focus on clinical operations

has brought positive progress. The continued strength of our

Linguistic Validation ("LV") proposition supported our pivot to

clinical work and has resulted in multiple wins, including a

significant programme with a top 5 pharmaceutical company. Building

on our LV strength, we have introduced technology-enabled

solutions, such as our new electronic Certificate of Display

Equivalence ("eCoDE") Comparison tool. The eCoDE tool will

revolutionise the electronic Clinical Outcome Assessment ("eCOA")

screen review process using AI, increasing accuracy and further

reducing timelines for eCOA projects.

We continue to participate in the Critical Path Institute's eCOA

Consortium to help drive the science, best practice and adoption of

eCOA within clinical trials. An eCOA replaces the traditional

paper-based approach to collecting patient results and feedback in

clinical trials and studies.

The growth in patient recruitment services has also contributed

to progress in the clinical space with significant new wins. We

expect this will be an area of continued expansion going forward

and we have continued to leverage our relationships with major

global pharmaceutical clients to expand in the APAC region, an area

with high growth potential.

We have secured a major programme awarded for pharmacovigilance

at a leading CRO as well as a top German pharma company. We also

secured a world-renowned hospital systems provider as a new major

client, reflecting our continued leadership in the healthcare

space.

In the financial and legal services vertical, we saw solid

revenues driven by Packaged Retail Investment and Insurance

Products ("PRIIPS") regulatory requirements. We won several new

clients, including a major European retail bank and a key

investment banking client. We also saw expansion with some existing

clients, including a large programme with a European general

insurance provider. We are extending our technology offering in

financial services to expand our footprint and increase client

retention in the vertical.

The division's adjusted operating profit(3) decreased 27.5% to

GBP22.9m (FY22: GBP31.6m) on a reported basis. This reflected the

reduction in top-line revenue and the impact of the loss of the CRO

client, partially mitigated by cost actions through the year.

Language and Content Technology

Encouraging new client wins across portfolio, proportion of

annual technology licences revenue continues to grow

The Language and Content Technology ("L&CT") division

accounted for 19% of Group revenues in the year (FY22: 17%).

Revenues of GBP136.7m were 7.7% higher year on year on a reported

basis (FY22: GBP126.9m) and saw a 1% decrease on an organic

constant currency basis.

In FY22 we appointed general managers to have full ownership and

accountability for four principal product areas - Language Weaver,

Trados, Tridion/Fonto and Contenta - which drove a more focused

approach. The division's growth plan resulted in a refined

go-to-market model for each product, and we are pleased with the

progress made across all product areas.

We have had some encouraging new client wins, with Language

Weaver continuing to make good progress with strong second half

bookings, including its largest ever Cloud SaaS contract, worth

more than a million dollars over three years. Overall, SaaS

revenues as a proportion of annual technology licences revenue

continued to grow. The cumulative benefit from this transition over

recent years is now a tailwind and is delivering, as intended, a

more predictable revenue profile for the division in the

future.

We are also pleased to have launched a new version of Trados in

July, alongside a number of new features and functionality to help

language specialists and localisation teams be more productive. We

saw encouraging momentum for SaaS versions of Trados with bookings

significantly increasing year-on-year. We experienced triple digit

growth in the principal activity indicators of Trados - number of

projects, files and words translated.

In July 2023 we announced the acquisition of Dublin-based

Propylon, a provider of content creation, management and publishing

solutions for the government, legal, assurance, audit and

publishing industries. The integration of Propylon is progressing

well and its platform joins RWS's portfolio of dedicated solutions

for aerospace and defence (Contenta), manufacturing, high-tech and

life sciences (Tridion Docs) and the market-leading XML editor

(Fonto).

In the second half, new Tridion releases (both the Sites and the

Docs versions of the product) contributed to further progress in

the division. Contenta also announced the launch of LiveContent 6.0

(the latest version of its LiveContent solution), a highly flexible

cloud-ready architecture for distribution management of technical

publications, technician feedback and analytical data insights.

At the end of the period, we delivered a significant up-sell of

two of our content technology products (Tridion and Fonto) to an

existing major client in life sciences and we continue to win new

logos across a range of end markets, including defence, government,

software and infrastructure.

The division's adjusted operating profit(3) was broadly flat at

GBP37.0m (FY22: GBP37.6m) on a reported basis, the higher

proportion of SaaS revenues and ongoing planned investments

offsetting the impact of higher top-line revenues.

IP Services

Successfully managed the impact of the Unitary Patent and

improved sales effectiveness, giving strong foundation for FY24

The IP Services division represented 14% of Group revenues in

the year (FY22: 14%). Revenues of GBP104.8m were 2.2% lower year on

year on a reported basis (FY22: GBP107.2m) and 4% lower on an

organic constant currency basis. Following the introduction of the

Unitary Patent ("UP") by the European Patent Office, the division

delivered 2% organic constant currency growth in Q4.

While revenues in FY23 were slightly down on the prior year,

mostly due to the delayed introduction of the UP until 1 June, this

was partially offset by strong growth in Worldfile revenue,

particularly in the first half of the year, and a rebounding of

Eurofile revenues during Q4.

We were encouraged by strong progress in one of our declared

growth initiatives, penetrating the Patent Attorneys market, and we

anticipate being able to build on several significant wins in

FY24.

Our Japan and China operations delivered mixed results during

FY23, with growth in the latter underpinned by a number of renewals

with large Chinese corporates. This was offset by weakness in our

Japan operations stemming from patent grant delays with a major

client.

The IP Research division experienced tougher trading during the

year, mostly due to a significant reduction in work with a key

client, however we saw several new business wins in the last

quarter that we anticipate to ramp up into FY24.

We strengthened the division's management team and we have

developed a clear roadmap for expansion into patent maintenance

activities. Additionally, investment has been put into initiating

our Leading for Growth programme, building on our account

management success and appointing regional heads of sales, aimed at

driving consistent sales leadership coaching and metrics across the

division and the acquisition of a number of global new logo

clients.

The division's adjusted operating profit(3) was GBP27.7m (FY22:

GBP30.1m) on a reported basis, reflecting the reduction in top-line

revenues together with planned investments in our business to

position us for future growth, partially offset by tight cost

control.

SUSTAINABILITY AND ESG

Sustainability is core to the way we operate. Our work for our

clients gives us a natural global perspective and deep

understanding of the impact of what we do. Over the past year we

have made significant progress in becoming One RWS where we:

-- understand we need to reduce our carbon footprint to ensure the future of the planet

-- are proud of our diversity and celebrate our cultural and

technical expertise, enabling us to share a deep understanding of

client industries and local cultures

-- strive to create a world where understanding is more universal for everyone

-- are focused on ensuring that combination of technology and

cultural expertise helps our clients grow by ensuring they are

understood anywhere

Significant progress has been achieved in each of our four

corporate sustainability pillars - our people, our community, our

environment and our governance - which remain at the centre of our

purpose to unlock global understanding.

Our 2023 engagement survey shows that 79% of colleagues believe

that RWS fosters environmentally friendly practices, 82% of

colleagues believe they can report unethical practices without fear

of negative consequences and 78% believe RWS is taking action to be

socially responsible.

Both directly and through The RWS Foundation, we have partnered

with a number of community organisations such as CLEAR Global, have

undertaken fundraising to support the people affected by the

devastating earthquakes in Türkiye and Syria and have progressed

our focus on education, partnering with over 700 universities and

sponsoring language students via the RWS-Brode Scholarship

programme.

We hold ourselves to high accountability standards. As a result

in FY22 we improved the accuracy of our carbon footprint by

improving our data collection and Greenhouse Gas ("GHG") emissions

to include both our operations and supply chain, and committed to

setting carbon reduction targets which are aligned with the Science

Based Targets initiative ("SBTi"). This was further improved in

FY23 and the new targets have been submitted to the SBTi for

validation and will be published once validated.

In April the Group successfully managed the impact of a cyber

incident after unauthorised access was gained to a legacy

application. The UK's Information Commissioner closed its

investigation into the breach in early May with no further

action.

We also proudly support the Ten Principles of the United Nations

Global Compact on human rights, labour, environment and

anti-corruption. We remain committed to making the UN Global

Compact and its principles part of the strategy, culture and

day-to-day operations of our Group and to engaging in collaborative

projects which advance the broader development goals of the United

Nations, particularly the Sustainable Development Goals.

We are proud of the accomplishments to date, none of which would

have been possible without the unwavering dedication of our

colleagues around the globe. To understand and respond to our

clients' needs, we believe it is imperative to employ a workforce

which reflects the many communities to which we provide

services.

CURRENT TRADING AND OUTLOOK

A challenging economic outlook and wider global economic

uncertainty has seen reduced activity from many clients across

several end markets. However we are confident that volumes will

return in due course, given the five core demand drivers in our

market. In particular, growth in AI and the continued explosion of

content will give us opportunities.

Progress against our medium-term strategy is working. We are

pivoting into higher growth segments via our growth initiatives,

investing in transformation and developing our portfolio.

We will continue to focus on ensuring efficient delivery across

all parts of the Group. To further support our focus on cost

efficiency, no change will be made to base salary levels for

Executive Directors and our senior leadership team. Where salary

increases are awarded, these will be focused on our lowest paid

colleagues.

We are clear that AI is not a headwind, and instead provides an

opportunity for both us and our clients. As illustrated at our AI

and Technology Teach-In in October, we believe that developments in

AI have been positive for RWS and will continue to support our

growth and efficiency in FY24 and beyond. We were also pleased to

have announced in November 2023 the beta launch of Evolve, a new

capability within Language Weaver that enables almost human-like

quality in our machine translation output.

As we look to the future, our people, scale, geographic reach

and advanced AI-powered technologies and services, put us in a

strong position to further strengthen our leadership in the

market.

Ian El-Mokadem

CHIEF EXECUTIVE OFFICER

11 December 2023

2 Calculated as number of FTE leavers during the financial year,

divided by average number of FTEs during the year, noting the

constraints imposed by having multiple HR systems.

3 Adjusted operating profit is stated before amortisation and

impairment of acquired intangibles, acquisition costs, share-based

payments expense and exceptional items. See Note 4

CHIEF FINANCIAL OFFICER'S REVIEW

INTRODUCTION

The Group has made significant progress during 2023 with

management initiatives to improve efficiency and maintain

profitability. The Group has added to its technology portfolio with

the acquisition of Propylon, managed to maintain strong cash

generation during the period despite a continuing challenging

market environment and initiated its first share repurchase

programme. The Group's transformation programme sets a strong

platform for further progress in 2024 and beyond.

During 2023 total revenue declined by 2%, adjusted operating

profit by 11%, and adjusted profit before tax by 11%. Despite the

challenging macroeconomic environment, our key growth levers, such

as Linguistic Validation, eLearning and TrainAI have performed well

and we continue to invest behind these levers to drive future

growth. We are also investing to transform our back office

efficiency to better leverage scale. We are encouraged by the

ongoing opportunities for efficiency gains through the use of AI

and our cost-reduction programmes which aim to mitigate the impact

of cost inflation. The Group continued to enhance its portfolio

with the acquisition of Propylon Holdings Limited, whose content

management system is used by governments, standards bodies, legal

publishers and regulated firms.

The Group continues to be highly cash generative, with cash

generated from operations of GBP107.5m during the period,

notwithstanding acquisitions and costs associated with

restructuring and integration. Net cash excluding lease liabilities

declined in the period from GBP71.9m to GBP23.6m, reflecting the

consideration paid for acquisitions of GBP31.5m and a further

GBP19.4m paid for the share repurchase programme.

Reflecting the macro challenges in the last year and the higher

cost of capital through increasing market interest rates, an

impairment charge of GBP62.4m has been recognised in the period

relating to goodwill in respect of the Group's Language and Content

Technology division.

REVENUE

Overall in FY23 the Group generated revenues of GBP733.8m, which

is 2% lower than FY22. This was due to the impact of challenging

economic conditions and reduced activity in our end markets, partly

offset by GBP13m of benefits from our foreign exchange hedging

programme and a stronger average US Dollar rate in the period which

supported revenues in local sterling currency. On an organic

constant currency ("OCC") basis revenues are 6% lower than those

achieved in FY22.

In divisional terms, Language Services recorded GBP329.8m in

revenue, a 4% decrease in total revenue and 7% on an OCC basis.

Client retention and satisfaction remain high, albeit we continue

to see reduced volume from certain clients in some end markets as

they adjust to more challenging conditions. The TrainAI and

eLearning growth initiatives both performed well and provide

momentum going forwards. Regulated Industries recorded GBP162.5m in

revenue, a decrease of 6%, although a decline of 9% on an OCC basis

year-on-year. Positive progress has been made with Linguistic

Validation and, while some Life Sciences clients continued to

deliver reduced levels of activity, we expect volumes to increase

as more products move through regulatory approval. Language and

Content Technology had total revenue of GBP136.7m, an increase of

8% year on year and a decrease of 1% on an OCC basis. Reported

organic growth was 3% ahead of prior year. IP Services recorded

GBP104.8m in revenue, a decrease of 2% on prior year and 4% on an

OCC basis. The introduction of the Unitary Patent in June has

resulted in the release of some of the backlog of IP work,

providing momentum moving forwards.

The majority of the Group revenue, categorised by geography, is

in the US market, which accounts for 54% of the total. No one

client accounts for more than 10% of Group revenue.

GROSS PROFIT

Gross profit decreased by 3% to GBP339.5m, delivering a gross

margin of 46.3%, down slightly from 46.7% in the prior year.

Delivery of the significant cost actions announced in June is

nearing completion and we continue to identify further

opportunities for efficiency gains through our transformation

programmes, including by increasing the proportion of work

undertaken through our Language eXperience Delivery platform and

the use of artificial intelligence ("AI") internally.

ADMINISTRATIVE EXPENSES

Administrative expenses have increased to GBP346.4m (2022:

GBP263.9m). Administrative expenses as a percentage of revenue have

increased from 35% to 47%, which reflects the impact of the

impairment charge related to the Group's Language and Content

Technology CGU of GBP62.4m, together with the cost to achieve the

efficiency programmes implemented during the period. Adjusted

administrative expenses (gross profit less adjusted operating

profit) increased by GBP4.0m to GBP215.7m.

Amortisation of acquired intangibles was GBP38.8m (2022:

GBP34.4m). This included additional amortisation for Fonto and

Propylon intangible assets, together with the impact of exchange

rate movements during the period. Amortisation of non-acquired

intangibles was GBP18.1m (2022: GBP15.7m), reflecting an increase

in capitalised software development costs.

Exceptional costs of GBP22.6m were incurred during the year,

which includes GBP12.3m for restructuring and integration costs in

relation to the Group's cost reduction programme, GBP5.5m for Group

transformation costs and GBP4.8m related to legacy payments.

Acquisition costs of GBP5.1m were primarily related to the

contingent consideration and purchase of Propylon Holdings Limited

during the period and contingent consideration for the purchase of

Liones Holding B.V. in the prior period.

FINANCE COSTS

Net finance costs were GBP4.0m (2022: GBP3.1m), with the year-

on-year increase due primarily to an increase of GBP1.2m in

interest payable on external debt, reflecting higher interest rates

and increased borrowings. The Group has a US$220m Revolving Credit

Facility ("RCF") maturing on 3 August 2026, with an option to

extend maturity to 3 August 2027. This gives us further flexibility

as we continue to grow the business and seek selective acquisitions

to enhance the Group's capabilities and geographic reach.

PROFIT BEFORE TAX

The Group reported a loss before tax of GBP10.9m (2022: profit

of GBP83.2m), the decline having been driven by impairment charges,

lower revenues and client activity, together with increases in

exceptional charges related to the Group's cost reduction

initiative. These have been partially offset by foreign exchange

gains of GBP13.0m from our Group hedging programme and the release

of management bonuses during the period.

ADJUSTED PROFIT BEFORE TAX

Adjusted profit before tax ("Adjusted PBT") is stated before

amortisation and impairment of acquired intangibles, share-based

payment expense, acquisition costs and exceptional items. The Group

uses adjusted results as a key performance indicator, as the

Directors believe that these provide a more consistent and

meaningful measure of the Group's underlying performance across

financial periods. The Adjusted PBT of GBP120.1m (Adjusted PBT

margin: 16.4%) recorded in the period has decreased from GBP135.7m

(Adjusted PBT margin: 18.1%) in the prior year.

TAX CHARGE

The Group's tax charge for the year was GBP16.8m (2022:

GBP20.5m). The adjusted tax charge for the period was GBP29.6m

(2022: GBP32.1m) representing an effective adjusted tax rate of

24.6% compared with 23.7% in the prior financial year. The rise in

the effective rate largely reflects the increase in the UK tax rate

from 19% to 25% in April 2023 and, to a lesser extent, tax rates in

overseas countries which are higher than the UK tax rate.

EARNINGS PER SHARE AND DIVID

Basic earnings per share for the financial year decreased from

16.1p to (7.1)p, a decrease of 144%, while adjusted basic earnings

per share decreased from 26.6p to 23.3p, representing a decrease of

12%, which reflects the after tax impact of significant adjusting

items this financial year including the cost reduction and

transformation programmes. The weighted average number of ordinary

shares in issue for basic and adjusted basic earnings decreased

from 389.4m to 388.2m, principally due to the proportionate impact

of the ordinary shares repurchased through the share repurchase

programme.

A final dividend for the financial year ended 30 September 2023

of 9.8 pence per share has been proposed, equivalent to GBP37.4m,

while an interim dividend of 2.4 pence per share, equivalent to

GBP9.3m, was paid during the financial period. A final dividend for

the year ended 30 September 2022 of 9.5 pence per share, equivalent

to GBP36.8m, was paid in this financial period.

The proposed total dividend for the year of 12.2 pence per share

represents a 4% increase on the total dividend relative to the

prior financial period of 11.75 pence per share.

BALANCE SHEET AND WORKING CAPITAL

Net assets at 30 September 2023 decreased by GBP154.4m to

GBP987.3m. The main drivers of this decrease was the impairment of

goodwill of GBP62.4m and decreasing foreign currency denominated

net assets by GBP60.3m, mainly due to the weakening US Dollar.

Current assets at 30 September 2023 of GBP290.2m have decreased

by GBP35.7m on the prior financial year. This includes a decrease

in trade and other receivables of GBP8.2m and in cash and cash

equivalents balances of GBP25.0m to GBP76.2m.

Current liabilities have also decreased to GBP182.6m at 30

September 2023, a decrease of GBP21.0m, primarily due to a decrease

in trade and other payables balances of GBP15.8m. Non-current

liabilities have increased by GBP14.9m, reflecting a net increase

in loan balances under our RCF of GBP23.3m and an increase in

provisions of GBP4.8m, partly offset by a decrease in lease

liabilities of GBP11.3m, trade and other payables of GBP1.2m and

deferred tax of GBP0.7m.

CASH FLOW

Cash generated from operations was GBP129.2m, GBP19.6m less than

the prior year, when cash generated was GBP148.8m. Operating cash

flow before movements in working capital and provisions decreased

from GBP157.5m to GBP130.9m. The net working capital outflow of

GBP1.7m has decreased by GBP7.0m from the prior financial year's

outflow of GBP8.7m. This has been driven by improvement in working

capital management.

Significant cash outflows from investing activities included net

cash consideration for the acquisition of Propylon Holdings Limited

of GBP25.1m, contingent and deferred consideration of GBP6.4m for

prior period acquisitions of Iconic and Liones Holding B.V. and

purchases of intangible software of GBP36.5m.

The Group announced a share repurchase programme during the

period and has repurchased GBP19.4m of shares at the balance sheet

date. The programme is progressing as planned and is in line with

our capital allocation policy. Cash flows from other financing

activities included dividends paid within the financial year ended

30 September 2023 of GBP46.3m.

Cash balances at the financial year end amounted to GBP76.2m,

with external borrowings of GBP52.6m, excluding lease liabilities,

resulting in a net cash position of GBP23.6m (2022: GBP101.2m cash

and external borrowings of GBP29.3m, resulting in net cash of

GBP71.9m). Net debt including lease liabilities was GBP9.9m (2022:

net cash of GBP25.2m).

POST BALANCE SHEET EVENTS

On 3 October 2023 the Group acquired ST Comms Language

Specialists Proprietary Limited, a Cape Town based language

services provider. The acquisition has been funded from existing

cash resources and is in line with the Group's strategy to actively

pursue acquisitions that have the potential to accelerate delivery

of its medium-term plans.

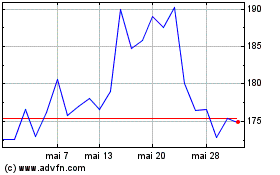

The Group has continued its share repurchase programme and from

1 October 2023 to 8 December 2023 has purchased a further 6,252,443

shares at an average price of 234.3p per share.

Candida Davies

CHIEF FINANCIAL OFFICER

11 December 2023

Consolidated Statement of Comprehensive Income

for the year ended 30 September 2023

2023 2022

Note GBPm GBPm

Revenue 733.8 749.2

Cost of sales (394.3) (399.0)

-------- --------

Gross profit 339.5 350.2

Administrative expenses (346.4) (263.9)

-------- --------

Operating (loss)/ profit (6.9) 86.3

Analysed as:

Adjusted operating profit: 123.8 138.5

Amortisation of acquired intangibles (38.8) (34.4)

Impairment losses 9 (62.4) -

Acquisition costs (5.1) (2.1)

Share based payment expense (1.8) (3.2)

Exceptional items 5 (22.6) (12.5)

-------- --------

Operating (loss)/ profit (6.9) 86.3

Finance income 0.6 0.2

Amortisation of capitalised exceptional

finance costs 5 (0.3) (0.3)

Finance costs (4.3) (3.0)

-------- --------

(Loss)/ profit before tax (10.9) 83.2

Taxation 6 (16.8) (20.5)

-------- --------

(Loss)/ profit for the year attributable

to the owners of the Parent (27.7) 62.7

Other comprehensive (expense)/ income

Items that may be reclassified to profit

or loss:

(Loss)/ gain) on retranslation of quasi

equity loans (net of deferred tax) (1.9) 6.1

(Loss)/ gain on retranslation of foreign

operations (60.3) 107.3

Gain/ (loss) on hedging (net of deferred

tax) 2.0 (6.7)

-------- --------

Total other comprehensive (expense)/ income (60.2) 106.7

Total comprehensive (expense)/ income

attributable to owners of the Parent (87.9) 169.4

-------- --------

Basic earnings per ordinary share (pence

per share) 8 (7.1) 16.1

Diluted earnings per ordinary share (pence

per share) 8 (7.1) 16.0

--------------------------------------------- ------ -------- --------

Consolidated Statement of Financial Position

as at 30 September 2023

2023 2022

Note GBPm GBPm

Non-current assets

Goodwill 9 608.6 692.6

Intangible assets 10 359.4 385.4

Property, plant and equipment 27.5 31.3

Right-of-use assets 27.5 39.0

Non-current income tax receivable 1.4 1.0

Deferred tax assets 6 1.2 1.1

-------- --------

1,025.6 1,150.4

Current assets

Trade and other receivables 212.3 220.5

Income tax receivable 1.7 4.2

Cash and cash equivalents 12 76.2 101.2

-------- --------

290.2 325.9

-------- --------

Total assets 1,315.8 1,476.3

-------- --------

Current liabilities

Trade and other payables 149.8 165.6

Lease liabilities 9.9 11.8

Foreign exchange derivatives - 0.6

Income tax payable 15.3 22.7

Provisions 7.6 2.9

-------- --------

182.6 203.6

-------- --------

Non-current liabilities

Loans 11 52.6 29.3

Lease liabilities 23.6 34.9

Trade and other payables 2.3 3.5

Provisions 9.7 4.9

Deferred tax liabilities 6 57.7 58.4

-------- --------

145.9 131.0

-------- --------

Total liabilities 328.5 334.6

-------- --------

Total net assets 987.3 1,141.7

-------- --------

Capital and reserves attributable to owners

of the Parent

Share capital 3.8 3.9

Share premium 54.5 54.4

Share based payment reserve 5.3 6.0

Reverse acquisition reserve (8.5) (8.5)

Merger reserve 624.4 624.4

Foreign currency reserve 33.7 95.9

Hedge reserve (3.5) (5.5)

Retained earnings 277.6 371.1

-------- --------

Total equity 987.3 1,141.7

--------------------------------------------- ----- -------- --------

Consolidated Statement of Changes in Equity

for the year ended 30 September 2023

Other Total

Share reserves attributable

Share premium (see Retained to owners

capital account below) earnings of Parent

Note GBPm GBPm GBPm GBPm GBPm

At 30 September 2021 3.9 54.2 602.4 350.4 1,010.9

Profit for the year - - - 62.7 62.7

Loss on hedging - - (6.7) - (6.7)

Gain on retranslation of quasi

equity loans - - 6.1 - 6.1

Gain on retranslation of foreign

operations - - 107.3 - 107.3

--------- --------- ---------- ----------- ---------------

Total comprehensive income

for the year - - 106.7 62.7 169.4

Issue of shares - 0.2 - - 0.2

Deferred tax on unexercised

share options - - - (0.1) (0.1)

Dividends - - - (41.9) (41.9)

Equity-settled share based

payments charge - - 3.2 - 3.2

--------- --------- ---------- ----------- ---------------

At 30 September 2022 3.9 54.4 712.3 371.1 1,141.7

Loss for the year - - - (27.7) (27.7)

Gain on hedging - - 2.0 - 2.0

Loss on retranslation of quasi

equity loans - - (1.9) - (1.9)

Loss on retranslation of foreign

operations - - (60.3) - (60.3)

--------- --------- ---------- ----------- ---------------

Total comprehensive (expense)/

income for the year - - (60.2) (27.7) (87.9)

Issue of shares - 0.1 - - 0.1

Deferred tax on unexcercised

share options 6 - - - (0.2) (0.2)

Deferred consideration settlement - - (2.5) - (2.5)

Dividends 7 - - - (46.3) (46.3)

Purchase of own shares (0.1) - - (19.3) (19.4)

Equity-settled share based

payments charge - - 1.8 - 1.8

--------- --------- ---------- ----------- ---------------

At 30 September 2023 3.8 54.5 651.4 277.6 987.3

----------------------------------- ------- --------- --------- ---------- ----------- ---------------

Other reserves

Share Reverse Merger Foreign Total

based acquisition reserve currency Hedge other

payment reserve GBPm reserve reserve reserves

reserve GBPm GBPm GBPm GBPm

GBPm

At 30 September 2021 2.8 (8.5) 624.4 (17.5) 1.2 602.4

Other comprehensive (expense)/

income for the year - - - 113.4 (6.7) 106.7

Equity-settled share based

payments charge 3.2 - - - - 3.2

---------- -------------- ---------- ----------- ---------- -----------

At 30 September 2022 6.0 (8.5) 624.4 95.9 (5.5) 712.3

Other comprehensive (expense)/income

for the year - - - (62.2) 2.0 (60.2)

Equity-settled share based

payments charge 1.8 - - - - 1.8

Deferred Consideration settlement (2.5) - - - - (2.5)

---------- -------------- ---------- ----------- ---------- -----------

At 30 September 2023 5.3 (8.5) 624.4 33.7 (3.5) 651.4

-------------------------------------- ---------- -------------- ---------- ----------- ---------- -----------

Consolidated Statement of Cash Flows

for the year ended 30 September 2023

Note 2023 2022

GBPm GBPm

Cash flows from operating activities

(Loss)/ profit before tax (10.9) 83.2

Adjustments for:

Depreciation of property, plant and equipment 7.3 7.1

Amortisation of intangible assets 10 56.9 50.1

Impairment losses 9 62.4 -

Depreciation of right-of-use assets 9.4 10.8

Share-based payment expense 1.8 3.2

-------------------------------------------------- ------ ------- -------

Net finance costs 4.0 3.1

Operating cash flow before movements in working

capital 130.9 157.5

(Increase) in trade and other receivables (2.3) (5.6)

Increase/ (decrease) in trade and other payables

and provisions 0.6 (3.1)

-------------------------------------------------- ------ ------- -------

Cash generated from operations 129.2 148.8

Income tax paid (21.7) (21.3)

-------------------------------------------------- ------ ------- -------

Net cash inflow from operating activities 107.5 127.5

-------------------------------------------------- ------ ------- -------

Cash flows from investing activities

Interest received 0.6 0.1

Acquisition of subsidiary, net of cash acquired 13 (31.5) (14.1)

Purchases of property, plant and equipment (3.8) (5.3)

Purchases of intangibles (software) 10 (36.5) (24.3)

-------------------------------------------------- ------ ------- -------

Net cash outflows from investing activities (71.2) (43.6)

-------------------------------------------------- ------ ------- -------

Cash flows from financing activities

Proceeds from borrowings 49.0 -

Repayment of borrowings (25.0) (25.5)

Transaction costs relating to debt refinancing - (1.5)

Interest paid (2.6) (1.4)

Lease liability payments (including interest

charged of GBP1.1m (2022: GBP1.3m)) (11.9) (13.1)

Proceeds from the issue of share capital 0.1 0.2

Purchase of own shares (19.4) -

Dividends paid 7 (46.3) (41.9)

-------------------------------------------------- ------ ------- -------

Net cash outflow from financing activities (56.1) (83.2)

-------------------------------------------------- ------ ------- -------

Net (decrease)/ increase in cash and cash

equivalents (19.8) 0.7

-------------------------------------------------- ------ ------- -------

Cash and cash equivalents at beginning of

the year 101.2 92.5

Exchange (losses)/ gains on cash and cash

equivalents (5.2) 8.0

-------------------------------------------------- ------ ------- -------

Cash and cash equivalents at end of the year 12 76.2 101.2

-------------------------------------------------- ------ ------- -------

Notes to the Consolidated Financial Statements

1. Accounting policies

Basis of accounting and preparation of financial statements

The financial information is extracted from the Group's

consolidated financial statements for the year ended 30 September

2023, which were approved by the Board of Directors on 11 December

2023.

RWS Holdings plc ("the Parent Company") is a public company,

limited by shares, incorporated and domiciled in England and Wales

whose shares are publicly traded on AIM, the London Stock Exchange

regulated market.

The financial information set out in this announcement does not

constitute the Company's statutory accounts for the year ended 30

September 2023. Statutory accounts for 2022 have been delivered to

the registrar of companies, and those for 2023 will be delivered in

due course. The auditor has reported on those accounts; their

reports were (i) unqualified, (ii) did not include a reference to

any matters to which the auditor drew attention by way of emphasis

without qualifying their report and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

The principal accounting policies adopted in the preparation of

the consolidated financial statements are set out below and within

the Notes to which they relate to provide context to users of the

financial statements. The policies have been consistently applied

to both years presented, unless otherwise stated.

The potential climate change-related risks and opportunities to

which the Group is exposed, as identified by Management, are

disclosed in the the Group's Annual Report and Accounts .

Management has assessed the potential financial impacts relating to

the identified risks and exercised judgement in concluding that

there are no further material financial impacts of the Group's

climate-related risks and opportunities on the financial

statements. These judgements will be kept under review by