TIDMSCGL

RNS Number : 6984A

Sealand Capital Galaxy Limited

27 September 2022

For release: 07.00, 27 September 2022

Sealand Capital Galaxy Limited

("Sealand" or the "Company")

Unaudited Interim Results

Sealand Capital Galaxy Limited (LSE: SCGL) announces that it has

today published its unaudited Interim Results for the six months

ended 30 June 2022 with respect to the Company and its subsidiaries

(the "Group").

Nelson Law, Executive Chairman of the Company commented:

" Our proven capabilities in acting as a bridge between European

merchants, mainly of accessible but luxury items, and Chinese

consumers, means that we remain excellently placed to continue

benefitting from the growing popularity of ecommerce, particularly

in China, and changing behaviors in the ecommerce ecosystem. Our

commercial and logistical systems and infrastructure are in place

and are capable of adapting to rapid changes in ecommerce trends

and behaviours. Our strong ties with Tmall, and with merchants of

high quality goods, will also contribute to our continued success

."

-Ends-

Enquiries:

Sealand Capital Galaxy Limited

Law Chung Lam Nelson, Executive + 44 (0) 753 795

Chairman 9788

Novum Securities Limited

+ 44 (0) 20 7399

David Coffman 9400

Notes to Editors:

The Company's Shares are traded on the Official List of the

London Stock Exchange's main market for listed securities under the

ticker SCGL.

Further information on Sealand is available on its website http://www.scg-ltd.com/

SEALAND CAPITAL GALAXY LIMITED

MANAGEMENT DISCUSSION AND ANALYSIS

Sealand Capital Galaxy Limited is a company acting as a special

purpose acquisition company. The Group is engaged in digital

marketing, mobile payment and other IT related business. Today it

announces its results for the six months ended 30 June 2022.

Business Review

Since April 2020, the Covid-19 pandemic had a significant

negative impact on the Group's business, but the Group is pleased

to report that is has now turned a corner, notwithstanding the

other new challenges facing virtually all economies, such as high

energy prices, inflation, and slowing growth rates.

The Group's presence on Tmall, via products for which it has

exclusive licences in mainland China, Hong Kong, and Macau,

continues to drive profits. These include Carter Beauty, Czech

& Speake, Heath London, HH Simonsen, Inari, Living Garden

Honey, Missguided Beauty, Silllk Aromas Beauty, and The Gruff

Stuff. Tmall is a leading Chinese-language website for

business-to-consumer online retail, allowing local Chinese and

international businesses to sell brand name goods to consumers in

greater China.

The Group is delighted to report that its ecommerce segment

delivered a profit of GBP13,118. Although many shoppers have been

eager to leave the house and return to stores where they are able,

behaviour patterns have changed since the onset of the pandemic.

Online shopping has come to serve a distinct purpose, and the

Directors believe this trend will continue in the long term.

Consumers can have whatever they want, whenever they want it,

on-demand and digitally. Shoppers increasingly expect e-retailers

to provide a sophisticated, personalised shopping experience, which

the Group is successfully doing.

In addition, the way in which we present information to online

shoppers mirrors consumers' increasing time conducting research.

Simply put, we are providing more information for shoppers. There

is now a greater emphasis on the shopper researching everything

about a product in order to make an informed decision.

The type of goods that we offer to shoppers are also precisely

the type of items we consider they are currently seeking online.

Just as we saw in the aftermath of the 2007 financial crisis,

consumers appear to be putting very large purchases on hold, while

continuing to spend on small luxuries such as upscale cosmetics

brands, and other daily luxury items which they consider

affordable. This trend is in line with the brands for which we have

exclusive licences, and we expect to see this to continue into

2023.

The momentum for online shopping is now considered to be

unstoppable and we continue to keep a strong focus on the evolution

of digital buying. For example, livestream shopping (i.e. brands

using livestreams to promote and sell products) is picking up

speed, and we continue to monitor advances to ensure that our

capabilities match the modern digital marketplace which consumers

continue to expect.

Our work with influencers in China has also proven to be the

correct strategy and continues to underpin our success. Younger

generations find authenticity and trust in different places than

older generations; predominantly they trust their peers and they

trust influencers.

Financial Review

During the six months ended 30 June 2022, the loss attributable

to ordinary shareholders was GBP226,910 (2021: GBP98,643), and the

revenue for the period was GBP76,071 (2021: GBP39,184). The loss

has widened because of an accrual of director's fees of GBP99,000

(the considerable majority of which have not been paid) and an

issue of shares valued at GBP27,000 to settle some professional

fees.

Prospects

Ecommerce continues to provide a lucrative and vital part of the

future of our business. By understanding the trends of today and

seeing where they are headed, we are preparing ourselves for

continued future growth in ecommerce. An increasing number of

people are engaging in online shopping, and more engagement means

more potential customers with unique interests and needs. This

creates many opportunities for merchants looking to engage with

ecommerce for the first time or to reinvigorate their efforts,

which will amplify our contact with merchants. Our proven

capabilities in acting as a bridge between European merchants,

mainly of accessible but luxury items, and Chinese consumers, means

that we remain excellently placed to continue benefitting from the

growing popularity of ecommerce, particularly in China, and

changing behaviors in the ecommerce ecosystem. Our commercial and

logistical systems and infrastructure are in place and are capable

of adapting to rapid changes in ecommerce trends and behaviours.

Our strong ties with Tmall, and with merchants of high quality

goods, will also contribute to our continued success.

Going Concern

As at 30 June 2022, the Group has cash and cash equivalent

balances of GBP13,031 and net current liabilities and net

liabilities of GBP1,258,755.

The directors' cash-flow projections for the forthcoming 12

months conclude there will be a need for additional cash resources.

The directors are in discussions with some parties that may raise

further equity and/or loans. There is no certainty that any such

funds will be forthcoming or the price and other terms will be

acceptable.

Directors

The following directors served during the six months ended 30

June 2022:

Mr Chung Lam Nelson Law (Chairman and Chief Financial Officer)

Mr Geoffrey John Griggs (Non-executive Director)

I would like to thank my colleagues for their continued

perseverance and commitment towards reaching the Groups'

objectives.

Chung Lam Nelson Law

Chairman

26 September 2022

SEALAND CAPITAL GALAXY LIMITED

PRINCIPAL RISKS AND UNCERTAINTIES

The Board regularly monitors exposure to risks and uncertainties

that it considers key as set out below.

Covid-19

In common with a lot of other businesses based in China, an

important challenge currently facing the Group is dealing with the

COVID-19 pandemic, although there are encouraging signs that the

effect of this is diminishing in the Group's main markets.

Going forward, the virus may however impact the Group's

transactional revenue streams and this is carefully considered by

the Board on a regular basis.

Acquisitions and investments

Part of the Group's strategy is to acquire and make strategic

investments in complementary businesses as appropriate

opportunities arise. The risks the Group may face should it acquire

or invest in complementary businesses include:

- Difficulties with the integration and assimilation of the acquired business;

- Diversion of the attention of the Group's management team from other business concerns;

- Loss of key employees of any acquired business;

- Acquisitions or investments may require the Group to expend

significant amounts of cash, which could result in the Group's

inability to use the funds for other business purposes;

- If the Group funds acquisitions through issuances of ordinary

shares, the interests of its shareholders will be diluted, which

may cause the market price of the ordinary shares to decline.

- There is no guarantee that the Directors will be able to

complete acquisitions of complementary companies on acceptable

terms. Failure to do so over an extended period would limit the

Directors' ability to carry out their strategy and would reduce the

long-term prospects of the Group.

To mitigate the risks in respect of acquisitions and

investments, the Group carries out due diligence and produces cash

flow projections to ensure that any target is a suitable strategic

fit and is financially sound. Staff are also trained to effectively

manage the integration of acquisitions.

Competition

The majority of the Group's work for existing or new clients or

on new projects is won competitively. The Group may face

significant competition, including from larger companies which have

greater capital and other resources and may result in some margin

erosion. There is no assurance that the Group will be able to

compete successfully in such a marketplace in the future.

Financial Risks

The Group financial risks including foreign exchange risk,

interest rate risk, credit risk, liquidity risk and cash flow risk

are carefully monitored by the Board.

Chung Lam Nelson Law

Chairman

26 September 202 2

SEALAND CAPITAL GALAXY LIMITED

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors confirm that to the best of their knowledge:

(a) the condensed set of financial statements, which has been

prepared in accordance with IAS 34 "Interim Financial Reporting",

gives a true and fair view of the assets, liabilities, financial

position and loss of the Group as a whole as required by DTR 4.2.4R

subject to the comment on the going concern position of the

Group.

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months of the year and a description of

principal risks and uncertainties for the remaining six months of

the year); and

( c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

By order of the Board

Chung Lam Nelson Law

Chairman

26 September 202 2

SEALAND CAPITAL GALAXY LIMITED

UNAUDITED CONSOLIDATED STATEMENT OF PROFIT OR LOSS

FOR THE SIX MONTHSED 30 JUNE 202 2

Six months Six months

ended ended

30 June 30 June

202 2 202 1

(Unaudited) (Unaudited)

Note GBP GBP

Revenue 5 76 , 071 39,184

( 35,280

Cost of services (62,953) )

Gross profit 13,118 3,904

Other income 5 16,313 8,288

( 237 ,5

Administrative expenses 35 ) (160,515)

( 1,0 46

Finance cost s ) (467 )

Gain on bargain purchase of

a subsidiary - 3,839

Gain on disposal of a subsidiary 7,644 -

Share of results of an associate - 274

Loss before tax 6 (201,526) (144,677)

Income tax expense - (575)

--------------- ---------------

Loss for the period (201,526) (145,252)

=============== ===============

Attributable to:

Equity holders of the Company (226,910) (98,643)

Non-controlling interests 25,384 (46,609)

--------------- ---------------

(201,526) (145,252)

=============== ===============

Loss per share attributable

to equity holders of the Company

Pence Pence

Basic and diluted 8 (*) (*)

=============== ===============

* L ess than 0.001 pence

The notes to the financial statements form an integral part of

these financial statements.

SEALAND CAPITAL GALAXY LIMITED

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 202 2

Six months Six months

ended ended

30 June 30 June

202 2 202 1

(Unaudited) (Unaudited)

Note GBP GBP

Loss for the period (201,526) (145,252)

Other comprehensive income

Items not to be reclassified subsequently

to profit or loss:

* Share of other comprehensive income of an associate - (72)

Items to be reclassified subsequently

to profit or loss:

* Exchange differences on translation of foreign

operations (86,249) 26,853

--------------- ---------------

Other comprehensive income for the

year, net of tax (86,249) 26,781

--------------- ---------------

Total comprehensive loss for the

period (287,775) (118,471)

=============== ===============

Attributable to:

Equity holders of the Company (287,823) (80,868)

Non-controlling interests 48 (37,603)

(287,775) (118,471)

=============== ===============

The notes to the financial statements form an integral part of

these financial statements.

SEALAND CAPITAL GALAXY LIMITED

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 30 JUNE 202 2

At At

30 June 31 December

202 2 202 1

(Unaudited) (Audited)

Note GBP GBP

Non-current assets

Property, plant and equipment 9 - 15,650

--------------- ---------------

Current assets

Inventories 10 112,478 81,823

Prepayments and other receivables 69,678 66,520

Trade receivables 38,876 15,123

Cash and cash equivalents 13,031 8,198

--------------- ---------------

234,063 171,664

--------------- ---------------

Current liabilit ies

Trade payables 125,233 81,743

Other payables and accrued expense

s 535,635 459,317

Amount due to a director 830,959 649,621

Finance lease liabilities 11 991 14,750

--------------- ---------------

1,492,818 1,205,431

--------------- ---------------

Net current liabilities (1,258,755) (1,033,767)

--------------- ---------------

Total assets less current liabilities (1,258,755) (1,018,767)

--------------- ---------------

Net liabilities (1,258,755) (1,018,117)

=============== ===============

Capital and reserves

Share capital 12 60,060 59,569

Reserve s (953,428) (692,114)

--------------- ---------------

Total equity attributable to equity

shareholders of the Company (893,368) (632,545)

Non-controlling interests (365,387) (385,572)

--------------- ---------------

Total equity (1,258,755) (1,018,117)

=============== ===============

The notes to the f inancial s tatements form an integral part of

these financial statements.

SEALAND CAPITAL GALAXY LIMITED

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2021

Attributable to equity holders of the Company

Share-based

Share Share payment Accumulated Exchange Non-controlling Total

capital premium reserve losses r eserve Total interests equity

GBP GBP GBP GBP GBP GBP GBP GBP

---------------- ---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Six m onths

ended 30 June

202 2

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

At 1 January

202 2

(Audited) 59,569 6,660,898 357,417 (7,715,246) 4,817 (632,545) (385,572) (1,018,117)

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Loss for the

period - - - (226,910) - (226,910) 25,384 (201,526)

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Exchange

differences

arising

on

translation - - - - (60,913) (60,913) (25,336) (86,249)

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Total

comprehensive

loss/(income) - - - (226,910) (60,913) (287,823) 48 (287,775)

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Issue of

ordinary

shares 491 26,509 - - - 27,000 - 27,000

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Disposal of a

subsidiary - - - - - - 20,137 20,137

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

At 3 0 June

2022

(Unaudited) 60,060 6,687,407 357,417 (7,942,156) (56,096) (893,368) (365,387) (1,258,755)

========== =========== ============= ============== =========== =========== ================== =============

Six m onths

ended 30 June

202 1

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

At 1 January

2021

(Audited) 50,983 6,012,444 - (6,775,080) 14,963 (696,690) (296,005) (992,695)

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Loss for the

period - - - (98,643) - (98,643) (46,609) (145,252)

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Exchange

differences

arising

on

translation - - - - 17,775 17,775 9,006 26,781

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Total

comprehensive

loss/(income) - - - (98,643) 17,775 (80,868) (37,603) (118,471)

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

Issue of

ordinary

shares 621 89,379 - - - 90,000 - 90,000

---------- ----------- ------------- -------------- ----------- ----------- ------------------ -------------

At 3 0 June

2021

(Unaudited) 51,604 6,101,823 - (6,873,723) 32,738 (687,558) (333,608) (1,021,166)

========== =========== ============= ============== =========== =========== ================== =============

The notes to the financial statements form an integral part of

these financial statements.

SEALAND CAPITAL GALAXY LIMITED

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 202 2

Six months Six months

ended ended

30 June 30 June

202 2 202 1

(Unaudited) (Unaudited)

GBP GBP

CASH FLOWS FROM OPERATING ACTIVITIES

Loss before tax (201,526) (144,677)

Adjustments for:

Depreciation 16,373 17,488

Gain on disposal of a subsidiary (7,644) -

Gain on bargain purchase of a subsidiary - (3,839)

Share of profit of an associate - (274)

Interest expenses 1,025 467

Bank interest income (10) (4)

--------------- ---------------

Operating cash flows before movements

in working capital (191,782) (130,839)

Increase in inventories (30,655) -

In crease in prepayments and other

receivables (1,746) (83,145)

(In crease ) / de crease in trade

receivables and contract assets (23,753) 14,379

Increase in amount due to a director 180,197 3,920

Increase in trade payables 40,361 46,441

Increase in other payables and accrued

expenses 106,288 44,059

--------------- ---------------

78,910 (105,185)

Payment of interest portion of lease

liabilities (1,025) (467)

Income tax paid - (575)

--------------- ---------------

Net cash generated from/(used in)

operating activities 77,885 (106,227)

--------------- ---------------

CASH FLOWS FROM INVESTING ACTIVITIES

Cash outflow in respect of the disposal (143) -

of a subsidiary

Net cash inflow from acquisition

of a subsidiary - 43,192

Interest income received 10 4

--------------- ---------------

Net cash (used in)/generated from

investing activities (133) 43,196

--------------- ---------------

CASH FLOWS FROM FINANCING ACTIVITIES

Issue of ordinary shares 27,000 90,000

Payment of principal portion of lease

liabilities (15,508) (13,308)

--------------- ---------------

Net cash generated from financing

activities 11,492 76,692

--------------- ---------------

Net in crease in cash and cash equivalents 89,244 13,661

Foreign exchange realignment (84,411) 26,635

Cash and cash equivalents at 1 January 8,198 16,002

--------------- ---------------

Cash and cash equivalents at 30

June 13,031 56,298

=============== ===============

The notes to the financial statements form an integral part of

these financial statements.

SEALAND CAPITAL GALAXY LIMITED

NOTES TO UNAUDITED INTERIM RESULTS

FOR THE SIX MONTHSED 30 JUNE 202 2

1. GENERAL INFORMATION

Sealand Capital Galaxy Limited (the "Company") was incorporated

in the Cayman Islands on 22 May 2015 as an exempted Company with

limited liability under the Companies Law of the Cayman Islands.

The registered office of the Company is Willow House, PO Box 709,

Cricket Square, Grand Cayman, KY1-1107, Cayman Islands. These

unaudited consolidated interim financial statements comprise the

Company and its subsidiaries (together referred to as the

"Group").

The Company's nature of operations is to act as a special

purpose acquisition c ompany.

The Group engaged in digital marketing and other IT and

e-Commerce related businesses.

2. BASIS OF PREPARATION

The unaudited consolidated interim financial statements for the

six months ended 30 June 202 2 have been prepared in accordance

with the International Accounting Standard ("IAS") No. 34 "Interim

Financial Reporting" issued by the International Accounting

Standards Board ("IASB"). These unaudited consolidated interim

financial statements were not reviewed or audited by our

auditor.

The consolidated interim financial information has been prepared

in accordance with the same accounting policies adopted in the 202

1 annual financial statements extracted, except for the accounting

policy changes that are expected to be reflected in the 202 2

annual financial statements.

The preparation of the interim financial information in

conformity with IAS 34 requires management to make judgements,

estimates and assumptions that affect the application of policies

and reported amounts of assets and liabilities, income and expenses

on a year to date basis. Actual results may differ from these

estimates.

This consolidated interim financial information contains

consolidated financial statements and selected explanatory notes.

The notes include an explanation of events and transactions that

are significant to an understanding of the changes in financial

position and performance of the Group since the 202 1 annual

financial statements. The consolidated interim financial statements

and notes thereon do not include all of the information required

for a full set of financial statements prepared in accordance with

International Financial Reporting Standards ("IFRSs").

3. GOING CONCERN

The directors' cash projections for the forthcoming 12 months

conclude that there will be a need for additional cash resources to

fully implement the business plans. The directors are in discussion

with a number of individuals that may lead to further equity and/or

loans being raised. There is no certainty that any such funds will

be forthcoming or the price and other terms will be acceptable.

4. SEGMENT INFORMATION

The Chief Operating Decision Maker ("CODM") has been identified

as the executive director of the Company who reviews the Group's

internal reporting in order to assess performance and allocate

resources. The CODM has determined the operating segments based on

these reports.

For management purposes, the Group is organised into business

units based on their products and services and has reportable

operating segments as follows:

(a) The digital marketing and payment segment includes services

on enlisting merchants to mobile payment gateways and providing

digital advertising services; and

(b) The software development and support segment includes sales

and distribution of mobile games and all other I.T. related

development and support services operated under Rightyoo.

(c) The e-commerce segment includes sales of goods through

internet and provision for consultancy services related to

e-commerce.

SEALAND CAPITAL GALAXY LIMITED

NOTES TO UNAUDITED INTERIM RESULTS

FOR THE SIX MONTHSED 30 JUNE 202 2

4. SEGMENT INFORMATION - CONTINUED

Digital marketing

and payment Software

development and

support e-Commerce Unallocated Total

GBP GBP GBP GBP GBP

Six months ended 30

June 2022

(Unaudited)

Revenue ` 776 - 75,295 - 76,071

====================== ====================== ============== =============== =============

Segment

profit/(loss) (19,264) - 13,118 (195,380) (201,526)

====================== ====================== ============== =============== =============

Assets 30,984 - 165,559 37,520 234,063

====================== ====================== ============== =============== =============

Liabilities 295,767 - 139,944 1,057,107 1,492,818

====================== ====================== ============== =============== =============

Six months ended 30

June 2021

(Unaudited)

Revenue 39,067 - 117 - 39,184

====================== ====================== ============== =============== =============

Segment loss (92,154) (20,284) (22,099) (10,715) (145,252)

====================== ====================== ============== =============== =============

Assets 174,003 5,184 33,802 103,653 316,642

====================== ====================== ============== =============== =============

Liabilities 352,561 93,426 15,107 876,714 1,337,808

====================== ====================== ============== =============== =============

5. REVENUE AND OTHER INCOME

Six months Six months

ended ended

30 June 30 June

202 2 202 1

(Unaudited) (Unaudited)

GBP GBP

REVENUE

Advertising services 775 33,337

Commission income 669 2,161

Sales of goods 74,627 3,686

--------------- ---------------

76,071 39,184

=============== ===============

OTHER INCOME

Bank interest income 10 4

Others 16,303 8,284

16,313 8,288

=============== ===============

SEALAND CAPITAL GALAXY LIMITED

NOTES TO UNAUDITED INTERIM RESULTS

FOR THE SIX MONTHSED 30 JUNE 202 2

6. LOSS BEFORE TAX

Six months Six months

ended ended

30 June 30 June

202 2 202 1

(Unaudited) (Unaudited)

GBP GBP

Loss before tax has been arrived

at after charging:

Depreciation - Owned assets and

right of use assets 16,373 17,488

=============== ===============

7. EMPLOYEES

The average number of employees during the period was made up as

follows:

Six months Six months

ended ended

30 June 30 June

202 2 202 1

(Unaudited) (Unaudited)

Directors 2 3

=============== ===============

Staff 2 11

=============== ===============

Directors' remuneration 99,000 -

=============== ===============

8. BASIC AND DILUTED LOSS PER SHARE

Basic loss per share is calculated by dividing the loss

attributable to the Company's owners of GBP 226,910 (2021:

GBP98,643) by the weighted average number of 598,081,125 ordinary

shares (2021: 512,968,277) in issue during the six months ended 30

June 2022.

Diluted loss per share was the same as basic loss per share as

no potential dilutive ordinary shares were outstanding for both the

six months ended 30 June 2022 and 2021.

9. PROPERTY, PLANT AND EQUIPMENT

Office Leasehold Right

equipment improvement of use Total

assets

GBP GBP GBP GBP

At 1 January 202

2 (Audited) - 1,159 14,491 15,650

Depreciation for

the period - (1,212) (15,161) (16,373)

Exchange differences - 53 670 723

At 30 June 202 2 - - - -

(Unaudited)

============= ============== ========== ==========

SEALAND CAPITAL GALAXY LIMITED

NOTES TO UNAUDITED INTERIM RESULTS

FOR THE SIX MONTHS ENDED 30 JUNE 202 2

10. INVENTORIES

At At

30 June 31 December

2022 2021

GBP GBP

(Unaudited) (Audited)

Finished goods 112,478 81,823

============= ==============

11. LEASE LIABILITIES

The total minimum lease liabilities under finance leases and

their present values at the reporting date are as follows:

At At 31 December

30 June 2021

2022

GBP GBP

(Unaudited) (Audited)

Current portion:

Gross finance lease liabilities 1,028 14,823

Finance expense not recognised (37) (73)

------------- ----------------

991 14,750

============= ================

The net finance lease liabilities

are analysed as follows:

* Not later than 1 year 991 14,750

============= ================

12. SHARE CAPITAL

Number GBP

Ordinary s hares issued and

fully paid

At 1 January 202 2 (Audited) 595,694,385 59,569

Issue of ordinary shares 4,909,091 491

-------------- --------

At 30 June 202 2 (Unaudited) 600,603,476 60,060

============== ========

In April 2022, the Company allotted and issued 4,909,091

ordinary shares of GBP0.0001 each to settle the professional fees

of the Group.

1 3 . RELATED PARTY TRANSACTIONS

(a) Details of the compensation of key management personnel are

disclosed in Note 7 to the unaudited interim results.

(b) Apart from the balances with related parties at the end of

the reporting period disclosed elsewhere in the financial

statements, the Company had not entered into any significant

related party transactions for the six months ended 30 June

2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LFMFTMTBTBLT

(END) Dow Jones Newswires

September 27, 2022 02:00 ET (06:00 GMT)

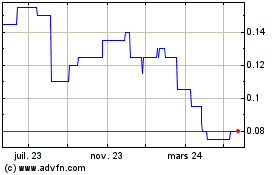

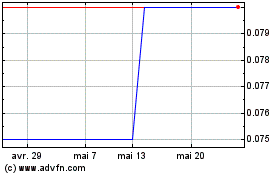

Sealand Capital Galaxy (LSE:SCGL)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Sealand Capital Galaxy (LSE:SCGL)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024