TIDMSFE

RNS Number : 7526N

Safestyle UK PLC

27 September 2023

27(th) September 2023

Safestyle UK plc

("Safestyle" or the "Group")

Interim Results 2023

Safestyle UK plc (AIM: SFE), the leading UK-focused retailer and

manufacturer of PVCu replacement windows and doors for the

homeowner market, today announces its interim results for the six

months ended 2 July 2023(1) (H1).

Financial and operational highlights

GBPm H1 2023 H1 2022 H1 23

v H1 22

% change

--------

Revenue 74.1 78.3 (5.3%)

-------- -------- ----------

Gross Profit 16.2 19.4 (16.1%)

-------- -------- ----------

Gross margin % 21.92% 24.75% (283 bps)

-------- -------- ----------

Underlying (loss) before taxation(2) (6.0) (1.4) (323.8%)

-------- -------- ----------

Non-underlying items(3) (0.7) (1.4) 86.5%

-------- -------- ----------

(Loss) before taxation (6.7) (2.8) (135.8%)

-------- -------- ----------

EPS - Basic (3.9)p (1.5)p n/a

-------- -------- ----------

Net cash(4) 1.0 13.0 n/a

-------- -------- ----------

Interim dividend per share - 0.4p n/a

-------- -------- ----------

1) The interim financial statements are presented for the

period ended on the closest Sunday to the end of June.

This date was 2 July 2023 for the current reporting period

and 3 July 2022 for the prior period. All references made

2) throughout to H1 2023 are for the period 2 January 2023

to 2 July 2023 and references to H1 2022 are for the period

3 January 2022 to 3 July 2022.

Underlying (loss) before taxation is defined as reported

(loss) before taxation before non-underlying items and

is included as an alternative performance measure in order

to aid users in understanding the ongoing performance of

the Group.

3) Non-underlying items consist of non-recurring costs, share-based

payments and the Commercial Agreement amortisation.

4) Net cash is cash and cash equivalents less borrowings.

A reconciliation between the terms used in the above table and

those in the financial statements can be found in the Financial

Review.

Business outlook

The trading context of the UK economy and consumer confidence

remains extremely difficult. Encouragingly, inflation is beginning

to show some signs of moderating, but that follows a period of

sustained high inflation. The impact of significantly higher

interest rates than expected is clearly impacting consumers'

disposable income.

As reported in our Trading Update on the 19(th) September 2023,

whilst our order intake went according to plan in early August, the

period since mid-August has been challenging with independent

indicators of market health, such as online search activity,

showing that the current market is performing at c.24% below the

July and August levels of 2022. Pleasingly, our order intake has

not fallen this far, being down c.11% YoY which shows our product

offering is withstanding wider market pressures better than

others.

We continue to attempt to stimulate demand and purchase intent

through a combination of our online activity, the deployment of our

upgraded website, discount management and our commitment to a

leading consumer finance portfolio.

The Group continues to engage with its stakeholders to discuss

ways to strengthen the balance sheet in order to support its

recovery and help facilitate future growth and a further update

will be provided in due course.

Looking further ahead, the Board maintains that growth recovery

prospects are strong and data of an ageing housing stock in need of

repair underpins this. The Board highlights the progress described

above in the Group's strategic priorities, its transformation and

market share growth as signs that there remains a compelling

opportunity for the business to capitalise on a market recovery and

achieve its medium-term targets.

Commenting on the results, Rob Neale, CEO said:

"As has been widely reported, the first half of 2023 saw

continued economic uncertainty and depressed consumer confidence,

which resulted in another challenging period for the business. I

would like to thank our hard-working people for their ongoing

dedication and resilience during this time. As outlined in our most

recent trading update, we have continued to work hard to mitigate

these ongoing headwinds and we remain focused on delivering on our

strategic efficiency and cost reduction programme that will deliver

annualised reductions of c.GBP2.8m.

I am pleased that we continue to grow our market share and I

remain confident that the business is well-positioned to deliver a

strong recovery when macro conditions improve. The volume of the

UK's aging housing stock in need of repair remains one of the most

compelling opportunities for the business in the medium-term and I

believe that the progress made against our core strategic

priorities will stand us in good stead as we look to the future as

the UK's market leader."

Enquiries:

Safestyle UK plc via FTI Consulting

Rob Neale, Chief Executive Officer

Phil Joyner, Chief Financial Officer

Zeus (Nominated Adviser & Joint Broker) Tel: 0203 829 5000

Dan Bate / James Edis (Investment Banking)

Dominic King (Corporate Broking)

Liberum Capital Limited (Joint Broker) Tel: 0203 100 2100

Jamie Richards / William King

FTI Consulting (Financial PR) Tel: 0203 727 1000

Alex Beagley / Sam Macpherson / Amy Goldup

About Safestyle UK plc

The Group is the leading retailer and manufacturer of PVCu

replacement windows and doors to the UK homeowner market. For more

information please visit www.safestyleukplc.co.uk or

www.safestyle-windows.co.uk .

CEO's Statement

Overview

The market represented an increasingly challenging backdrop as

we moved through the latter stages of 2022 into 2023. Late 2022

forecasts by the Construction Products Association ('CPA') for the

2023 market were for single digit declines and these 2023 forecasts

have steadily deteriorated to -11% as we have moved through a

tougher year than expected.

Market activity has been impacted by rising inflation, which has

continued to remain higher than economic forecasters expected and

consequential higher interest rates have resulted. This has put

even greater pressure on our customers' disposable incomes,

weakened consumer confidence and increased the cost of providing

our market-leading finance products.

Within this context, it is pleasing that we have made market

share gains and it is clear that these trading difficulties are

reducing capacity in our sector which represents an opportunity for

a strong recovery when conditions improve.

We have responded to this far more challenging context with a

number of actions to reduce our cost base and strike the balance

between volume and price actions which have been necessary to

mitigate our own rising input cost pressures and costs of

generating enquiries. Our response has inevitably resulted in

reduced levels of investment in some of our strategic priorities.

However, as I will cover below, it is pleasing to report that

despite this, we have continued to make measurable progress on many

of our strategic priorities.

Before I expand on our first half performance, I once again want

to recognise all of Safestyle's people. We are transforming our

business and our culture and our people are at the heart of this. I

have said it many times, but I believe that their resilience, skill

and commitment makes a huge difference. I thank all our people for

their ongoing contribution.

Trading and financial performance

Our revenue for the first half of the year declined by 5.3% to

GBP74.1m with frames installed volume of 79,546 representing a

reduction of 15.8% versus H1 2022. It is notable that the number of

orders installed reduced by less; an 8.3% reduction to 20,120

orders installed versus H1 22. The remaining balance of the total

frames volume decline came from an 8.4% reduction in the average

number of frames per order.

This decline in frames per order/basket size is consistent with

the wider FENSA market trends for this metric; consumers are

reducing the number of products they purchase which we attribute to

the pressure on disposable income. Measured price actions to

address inflationary pressures mitigated a large part of the

overall volume shortfall, with promotional activity to drive

enquiries, conversion and ultimately volume also being components

of our response.

Maintaining accessibility for large purchases in this market is

critical. We have carefully managed our consumer finance offering

to keep a leading portfolio with compelling affordability options.

This has come at an increased cost this year due to higher funding

costs from our partners which are linked to interest base rate

rises. However, it is a critical component of our value positioning

and an important point of difference to many of our competitors and

thus a margin investment that we believe it is important to

continue to make.

Our order book in the first half of the year reduced by 5.8%

during the period and ended the period 22.1% lower than the end of

H1 22. We have made some improvements to how orders flow through

our business to optimise performance and customer fulfilment, but

comparatives from recent times have been stronger than historical

norms.

Moving beyond our order intake and topline performance, input

costs across all categories including materials, people costs,

energy, fuel and lead generation continued to increase in the first

half. Within our material costs are higher costs for PVCu profile

from our new supplier, Liniar, who we transitioned to at the end of

2022 for supply chain assurance and improved quality. This

important relationship is working well and presents further range

expansion opportunities that we are actively exploring. Most

importantly, this change has mitigated what was an ever-present

risk of supply disruption with our previous partner who has since

confirmed they will exit the market in September.

Operating expenses include the costs of continuing with our

brand investment activity with a GBP1.4m TV and radio campaign

across February and March. Pleasingly, on the back of this

activity, we have seen further increases in our brand awareness

which is covered in more detail below.

Our other operating expenses for the first half increased versus

H1 2022, largely as a result of inflation. However, our exit rate

for operating expenses at the end of the first half is materially

lower as a result of our cost reduction and restructuring programme

that we enacted in response to the deteriorating market. These

actions are expected to deliver annualised reductions of

c.GBP2.8m.

Strategic priorities

Continuing to make progress on our strategic priorities remains

critical to our long-term aspirations. Whilst the trading context

has inevitably slowed down the pace and level of our investment, I

am pleased that we have made demonstrable progress against many of

the targets I shared in our 2022 Annual Report. As I stated then,

these targets were shared to enable transparent measurement of the

progress being made towards our medium-term goals. I reiterate

these targets below and have shared our progress against these

underneath.

-- Against our accelerating growth plans, we aim for a further

increase in unprompted brand awareness. We are also working

towards opening new sales branches and growing our market

share further versus FY22.

-- To progress on transforming the customer experience ,

we are targeting an installation 'On Time In Full' ('OTIF')

improvement, a reduction in open complaints and an improvement

in our contact centre call answer rate.

-- As we drive operational performance , our aim is that

all installation depot management will have completed

role model depot training, factory output per hour worked

increases and that our exit rate cost of quality has reduced

over 2022.

-- Our sustainability targets for FY23 which form part of

the journey to our 2025 goals are to achieve waste to

landfill of 3.5%, a mileage per frame installed reduction

and a further 1.5% reduction in our CO(2) per frame measure.

-- For our two enablers, starting with our People initiatives,

we are targeting an increase in our gender balance as

well as reducing our employee turnover. Within IT our

objectives are to deliver further Safestyle and Beam website

developments, a new HR system and to be progressing with

our multiyear CRM programme.

Accelerating growth: Driving our brand awareness is a key

element of our market share growth strategy and we have built on

the investment in 2022 with another material campaign in Q1 2023.

This follows a protracted pause in brand investment from 2018 which

resulted in a deterioration in our brand awareness that the last 18

months has reversed. Pleasingly, the latest campaign increased

brand awareness to 22% from 19% at the end of last year.

Alongside this above the line activity, we have been developing

our new website which represents a more modern, efficient and

optimised version of our current website. This was launched at the

start of September 2023 and we expect this more engaging customer

experience to drive improvements in our enquiry to order

metrics.

We have also continued to develop our sales branch network and

opened a new sales branch in Yeovil in July 2023.

I am confident that the above activities will deliver

demonstrable results in the medium-term and have already

contributed to our first half market share gains of 2.3% versus H1

22. When market conditions improve, I believe that we are in an

increasingly strong position to help consumers through their

important decision-making and purchase journey.

Transforming the customer experience: Our mission is to deliver

a great customer experience every time. This multi-year approach is

based on ensuring our customers are at the heart of how we operate,

designing and implementing robust business processes, supported by

modern IT systems and effective training.

Our focus this year has been to continue to drive improved

customer service response levels alongside the introduction of a

new system and process to manage customer complaints.

In reference to performance versus targets, our 'OTIF'

performance has improved by 1.9% and our call answer rate has also

increased by 8.2% versus the end of last year. Whilst the number of

open complaints has increased this year, which is in part

attributable to the improvements being made in our systems, the

processes now in place will more accurately capture complaints,

which will enable better response times and therefore a better

customer outcome.

Driving performance: This strategic priority targets delivering

consistency and improved results through standardisation, training,

best practice alignment and innovation across our three initiatives

of 'getting it right', 'levelling up' and 'capacity and

productivity.'

Our Role Model Depot management training programme was completed

in the first half of the year and we have commenced the rollout of

a stock management system which will ultimately be deployed across

our entire depot network to drive visibility, accuracy and better

facilitate us meeting our commitments to our customers.

Our Safestyle Academy adult fast-track installer training

programme continues to see last year's cohort progress through the

various training levels with some already having graduated to

become qualified window fitters. We plan to have a new cohort join

us at the end of the year. Alongside this course, we are now

deploying the academy to other areas of the business.

Leveraging sustainability and embedding compliance: We have set

the highly-ambitious target of zero waste to landfill by 2025 and I

am delighted to report that our ongoing programme of marginal gains

continued to reduce our waste to landfill metric from 5% last year

to 3.8% in the first half of the year. This is becoming an

increasingly important component of a customer's choice alongside

our value proposition and I believe that we are setting the

standard for the wider market in this regard.

As we reported in our 2022 Annual Report, we have a carbon

offset programme in place with one of our partners. This will

exceed all the carbon that our business processes produce. We

remain committed to continuing to report our pre and post-carbon

offset performance to clearly capture our progress on reducing our

own emissions as well as the impact of our offset initiatives.

Our pre-carbon offset CO(2) emissions per frame increased in the

first half versus the prior year by 4.9%. This is predominantly a

reflection of a dilution in the frames per order metric. We are

proud to report that our post-carbon offset emissions per frame is

better than net zero meaning the sum of the carbon offset credits

we receive exceeds the carbon emissions our business produces.

We will always maintain a focus on maintaining our greatly

improved compliance record. Our ongoing health and safety

performance remains excellent and our membership of the Institute

of Sales Professionals continues.

IT: Our IT strategy is designed to drive productivity, improve

the customer experience, support growth and reduce cost. We

upgraded some of our business critical systems in the first half of

the year as well as rolling out new tools to help us further

support the customer experience. We are also on track with the

implementation of a new HR system and our new website launch.

People : I am pleased that we have made important progress on

our People agenda in the first half of the year as we continue to

bring the transformation of our people experience and customer

experience closer together. In the first half of 2023 we completed

the roll out of our Role Model Depot programme, began to cascade

our new sales training module "Purpose", and further enhanced our

technical training offering. As we develop our DEIB strategy, we

have implemented equality and diversity monitoring into our

recruitment process and delivered our 4th Women in Safestyle forum.

We also launched our new Employee Assistance Programme as part of

our wellbeing strategy development.

Looking forward, in July we launched "Your Safestyle, Your

Voice" - our first, company-wide engagement survey. In addition to

celebrating the things we do well for our people, the action plans

stemming from this are intended to form an integral part of our

operating plan and people agenda for 2024 as we strive to make

Safestyle an even better place to work.

Our progress can also be measured by a 7.9% reduction in

employee turnover since H1 22 and a 4.6% increase in our women to

men gender balance ratio. We are pleased with progress, whilst also

recognising the opportunity that driving this forward

represents.

New business development

In the first half of the year, we have continued the test and

learn development phase for our new brand - Beam. We continue to

investigate how, through a digital platform, we can provide what

consumers require in spite of the infrequent, bespoke nature and

technical complexity of this offering that most consumers find

daunting. I am pleased to report that the feedback from customers

who have engaged on this journey to date has been excellent.

Ventures such as this represent opportunities to access additional

consumers in ways that will complement our existing core Safestyle

value brand.

Rob Neale

Chief Executive Officer

27 September 2023

Financial Review

H1 2023 H1 2022

Non-underlying Non-underlying

Underlying items(1) Total Underlying items Total

------------ --------------- --------- ------------ --------------- --------- -------------

Financials GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 H1 23 v H1

22 change in

underlying %

------------ --------------- --------- ------------ --------------- --------- -------------

Revenue 74,115 74,115 78,250 78,250 (5.3%)

------------ --------------- --------- ------------ --------------- --------- -------------

Cost of sales (57,868) (57,868) (58,886) (58,886) 1.7%

------------ --------------- --------- ------------ --------------- --------- -------------

Gross profit 16,247 16,247 19,364 19,364 (16.1%)

------------ --------------- --------- ------------ --------------- --------- -------------

Other operating

expenses(2) (21,222) (715) (21,937) (19,943) (1,429) (21,372) (6.4%)

------------ --------------- --------- ------------ --------------- --------- -------------

Operating (loss) (4,975) (715) (5,690) (579) (1,429) (2,008) (759.1)%

------------ --------------- --------- ------------ --------------- --------- -------------

Finance costs (1,008) (1,008) (833) (833) (21.0%)

------------ --------------- --------- ------------ --------------- --------- -------------

(Loss) before

taxation (3) (5,983) (715) (6,698) (1,412) (1,429) (2,841) (323.8%)

------------ --------------- --------- ------------ --------------- --------- -------------

Taxation 1,333 807

------------ --------------- --------- ------------ --------------- --------- -------------

(Loss) for the

period (5,365) (2,034)

------------ --------------- --------- ------------ --------------- --------- -------------

Basic EPS (pence

per share) (3.9)p (1.5)p

------------ --------------- --------- ------------ --------------- --------- -------------

Diluted EPS (pence

per share) (3.9)p (1.5)p

------------ --------------- --------- ------------ --------------- --------- -------------

Cash and cash

equivalents 4,041 17,327

------------ --------------- --------- ------------ --------------- --------- -------------

Borrowing facility (3,071) (4,305)

------------ --------------- --------- ------------ --------------- --------- -------------

Net cash(4) 970 13,022

------------ --------------- --------- ------------ --------------- --------- -------------

KPIs H1 2023 H1 2022 H1 23

v H1 22

change

Gross margin %(5) 21.92% 24.75% (283 bps)

-------- -------- ----------

Average Order Value

(GBP inc VAT) 4,505 4,300 4.8%

-------- -------- ----------

Average Frame Price

(GBP ex VAT) 950 832 14.2%

-------- -------- ----------

Frames installed (units) 79,546 94,525 (15.8%)

-------- -------- ----------

Orders installed 20,120 21,946 (8.3%)

-------- -------- ----------

Frames per order 3.95 4.31 (8.4%)

-------- -------- ----------

As reported in the CEO's statement, the replacement windows and

doors market has declined significantly during H1 23, with the

market dropping 11.8% in Q2 vs Q1 (as measured by FENSA) as a

result of the widely reported rising cost of living and economic

uncertainty in the UK . In a first half that has seen our market

share increase by 2.3% vs H1 22, our frames installed volume has

reduced by 15.8%.

The Group invested GBP1.4m in TV, which has significantly

increased brand awareness, and has also been exposed to cost

inflation and the increased cost of offering our market leading

suite of consumer finance products.

As a result of the above, the Group made an underlying loss

before taxation of GBP(6.0)m for the period. Net cash reduced to

GBP1.0m from the year end position of GBP8.0m with this reduction

in line with the trading performance for the period.

As part of its capital allocation policy, the Group paid a final

dividend of 0.1p per share.

Financial and KPI headlines

-- H1 revenue reduction of 5.3% to GBP74.1m.

-- Orders installed decreased by 8.3% to 20,120 and frames

installed decreased by 15.8% to 79,546.

-- Average frame price increased by 14.2% to GBP950 in H1

23 to help offset cost inflation. The mix of higher priced

composite guard doors increased year on year from 6.6%

to 7.0% which represents a small positive mix effect on

the average frame price.

-- Finance subsidy costs have increased by GBP1.0m due to

increased interest rates.

-- Gross profit reduced by 16.1% to GBP16.2m, which is largely

attributable to the lower volume, inflationary cost push

and increased utility rates. Gross margin percentage(5)

decreased by (283)bps vs H1 22 to 21.92% with increased

lead generation costs and the consequential under-recovery

of semi-fixed costs being the key drivers.

-- Underlying other operating expenses(2) for the period

increased by GBP1.3m (6.4%) versus H1 22. TV investment

increased by GBP0.4m and IT costs increased by GBP0.4m

following annualisation of investments made during 2022

in what remains a key enabler for our strategic agenda.

-- Finance costs have increased by GBP0.2m in the period,

mainly as a result of the increased discount unwind on

provisions due to the increased discount rates at the

end of H1 23 vs H1 22.

-- Net cash(4) reduced to GBP1.0m versus GBP8.0m at the end

of last year which reflects the trading performance described

above.

(1) See the non-underlying items section in this Financial

Review

(2) Underlying other operating expenses are defined in

the 'Underlying performance measures' section below and

the reconciliation between this measure and the GAAP measure

is shown in the 'Financials' table at the front of this

Financial Review

(3) Underlying (loss) before taxation is defined in the

'Underlying performance measures' section below and the

reconciliation between this measure and the GAAP measure

is shown in the 'Financials' table at the front of this

Financial Review

(4) Net cash is cash and cash equivalents less borrowings

(5) Gross margin % is gross profit divided by revenue

Underlying performance measures

In the course of the last five years, the Group has encountered

a series of unprecedented and unusual challenges. These gave rise

to a number of significant non-underlying items in 2018 including a

Commerical Agreement which will become fully amortised in 2023. The

impact of COVID-19 in 2020 has also given rise to a material

non-underlying item in the form of a holiday pay accrual which is

described in detail below.

Consequently, adjusted measures of underlying other operating

expenses and underlying (loss) before taxation have been presented

as the primary measures of financial performance. Adoption of these

measures results in non-underlying items being excluded to enable a

meaningful evaluation of the performance of the Group compared to

prior periods.

These alternative measures are entirely consistent with how the

Board monitors the financial performance of the Group and the

underlying (loss) before taxation is the basis of the performance

targets for incentive plans for the Executive Directors and senior

management team.

Non-underlying items consist of non-recurring costs, share based

payments and Commercial Agreement amortisation. A full breakdown of

these items is shown below. Non-recurring costs are excluded

because they are not expected to repeat in future years. These

costs are therefore not included in the Group's primary performance

measures as they would distort how the performance and progress of

the Group is assessed and evaluated.

Share based payments are subject to volatility and fluctuation

and are excluded from the primary performance measures as such

changes year to year would again potentially distort the evaluation

of the Group's performance year to year.

Finally, Commercial Agreement amortisation is also excluded from

the primary performance measures because the Board believes that

exclusion of this enables a better evaluation of the Group's

underlying performance year to year.

Revenue

Revenue for the period was GBP74.1m compared to GBP78.3m for H1

22, representing a decline of 5.3% in the period. This was driven

by the market-led reduction of frames installed in the period of

15.8% versus H1 22 to 79,546 frames, which was offset to a degree

by an increase in the average frame price of 14.2% to GBP950 (H1

22: GBP832).

The other factors driving the revenue reduction are explained

below:

-- The growth in the average frame price was supported to

a degree by an increased mix of higher average-priced

composite guard doors which rose to 7.0% of the total

installed volumes (H1 22: 6.6%).

-- Having achieved cost neutrality last year, finance subsidy

costs increased by GBP1.0m as higher interest rates increase

the cost of offering consumer finance. The Group remains

focused on ensuring that it has a market-leading set of

affordability options available to customers.

-- The average number of frames per order reduced by 8.4%

to 3.95 (H1 22: 4.31). We attribute the continued reduction

in this metric to reduced consumer confidence as a result

of the well-documented economic uncertainty and cost of

living increases in the UK. When combined with the 8.3%

reduction in order volume, total frames installed reduced

by 15.8%.

-- Overall, as a result of price gains being partially offset

by lower average frames per order, the average order value

improved by 4.8% to GBP4,505 (H1 22: GBP4,300).

Gross profit

Gross profit was GBP16.2m, a reduction of 16.1% over H1 22,

while the gross margin percentage declined by (283) bps to 21.92%

(H1 22: 24.75%).

The reduction in installation volumes described above was the

key driver of the year on year reduction in gross profit. The

additional elements behind the reduction in these metrics are as

follows:

-- Inflationary cost increases linked to labour, scaffolding,

PVCu profile and steel along with increased utility costs

represent an increase of GBP6.2m which was recovered through

sales price increases.

-- As described in the CEO's statement, the cost of lead

generation rose in the period due to the overall weaker

replacement windows and doors market increasing online

search costs. The increased cost of lead generation over

H1 22 equates to a GBP1.5m year on year increase.

-- The closing order book reduced by 5.8% during the period

and by 22.1% in comparison to H1 22 which was unusually

high in part due to the interruption to operations caused

by the January 2022 cyber attack along with a stronger

order intake. The benefit of the reduction in the order

book largely offsets the increased cost of lead generation

as described above.

Underlying other operating expenses

Underlying other operating expenses were GBP21.2m (H1 22:

GBP19.9m) which includes TV investment of GBP1.4m and is an

increase of GBP1.3m (6.4%) over H1 22. The key factors behind this

increase were as follows:

-- The Q1 23 brand investment activity was an increase of

GBP0.4m over H1 22. As described in the CEO's statement,

this investment drove an increase in brand awareness and

we believe it is a key factor behind the H1 23 market

share growth.

-- The investment in upgrading and implementing new IT systems

is key to our strategic agenda and this represents a GBP0.4m

increase over H1 22.

-- Wage inflation through a 6.7% annual pay rise for most

of our staff at the start of the period has been largely

offset through headcount management actions.

-- Our cost reduction and restructuring programme will deliver

a GBP2.8m annualised decrease versus Q1 23 run rate.

Underlying (loss) before taxation

Underlying (loss) before taxation was GBP(6.0)m (H1 22: loss of

GBP(1.4)m). This loss is before the non-underlying items described

below.

Non-underlying items

A total of GBP0.7m has been separately treated as non-underlying

items for the year (H1 22: GBP1.4m).

The current period's costs consist of GBP0.3m of non-recurring

costs (H1 22: GBP0.9m), a GBP0.2m share based payment charge (H1

22: GBP0.3m) and GBP0.2m (H1 22: GBP0.2m) of Commercial Agreement

(Intangible Asset) amortisation. The table below shows the full

breakdown of these items:

H1 23 H1 22

GBP000 GBP000

--------------------- --------

Holiday pay accrual (214) (72)

--------------------- --------

RSA related costs - 12

--------------------- --------

Litigation Costs 26 23

--------------------- --------

Restructuring and operational costs 500 96

--------------------- --------

Modification of vacant right-of-use assets

and liabilities - (112)

--------------------- --------

Impairment of vacant right-of-use assets - 27

--------------------- --------

Cyber incident related costs - 945

--------------------- --------

Total non-recurring costs (note 4) 312 919

--------------------- --------

Commercial Agreement amortisation 230 226

--------------------- --------

Equity settled share based payments charges 173 284

--------------------- --------

Total non-underlying items 715 1,429

--------------------- --------

The holiday pay accrual release represents a release for part of

an accrual made at the end of 2020 which arose as a result of the

impact of the shutdown of operations and resultant extension of

2020 leave entitlement until March 2023 for some employees. This

increased the level of deferred holiday entitlement of our people

at the end of 2020 which was recognised as an accrual in 2020 and

has now fully reversed in 2023. This item was excluded from the

Group's underlying performance measures to ensure the performance

of the business is not skewed by both the expense in 2020 or its

subsequent use.

The Group incurred GBP0.5m (H1 22: GBP0.1m) of restructuring and

non-recurring operational costs. These costs predominantly relate

to the remuneration arrangements for employees leaving the business

under the cost reduction and restructuring programme implemented in

the period.

As reported in the last four years, the Commercial Agreement

arose as a result of an agreement entered into with Mr M Misra

which encompassed a five year non-compete agreement and the

provision of services by Mr Misra in support of the continued

recovery of Safestyle. The Group agreed consideration with Mr Misra

subject to the satisfaction of both clear performance conditions by

him over five years and Safestyle's trading performance in

2019.

The non-compete element of the Commercial Agreement was

accounted for as an intangible asset on the basis that it is an

identi able, non-monetary item without physical substance, which is

within the control of the entity and is capable of generating

future economic bene ts for the entity. The intangible asset was

measured based on the fair value of the consideration that the

Group expects to issue under the terms of the agreement and is

being amortised over 5 years which matches the term of the

non-compete arrangement.

The items classified as non-recurring costs in the Consolidated

Income Statement, the share based payment charges and the

amortisation of the intangible asset created as a result of the

Commerical Agreement reached in 2018 have all been excluded from

the underlying (loss) before taxation performance measure to enable

a meaningful evaluation of the performance of the Group from year

to year.

Earnings per share

Basic earnings per share for the period were a loss of (3.9)p

compared to a loss of (1.5)p in H1 22. The basis for these

calculations is detailed in note 5.

Net cash and cashflow

The Group's net cash reduced by GBP7.0m during the period,

closing at GBP1.0m compared to GBP8.0m at the end of 2022. GBP3.5m

of the Group's GBP7.5m revolving credit facility was drawn at the

end of the period to cover the intra-month working capital

movements.

The Group's previous borrowing facility was replaced in January

2023 with a GBP7.5m revolving credit facility that can be utilised

as required to support the Group's working capital needs. This

facility is in place until 31 December 2026. As a result, the

GBP4.5m term loan was repaid in January 2023.

Net cashflow from operating activities, including the cashflow

impact of non-underlying items, was a GBP4.3m outflow (H1 22:

GBP3.7m inflow). The outflow for H1 23 reflects the trading

performance for the period along with the working capital impact of

reduced payment terms from Liniar, our mew PVCu profile

provider.

Capital expenditure of GBP0.5m reduced from GBP0.9m in H1 22

with investment levels being managed across the Group.

During the period, the Group paid a final dividend of 0.1p per

share resulting in a GBP0.1m outflow (H1 22: nil).

Dividends

The Board have not declared an interim dividend as a result of

the first half losses sustained by the Group.

Phil Joyner

Chief Financial Officer

27 September 2023

Consolidated Income Statement

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

2nd Jul 3rd Jul 1st Jan

2023 2022 2023

Note GBP000 GBP000 GBP000

Revenue 74,115 78,250 154,315

Cost of sales (57,868) (58,886) (116,441)

Gross profit 16,247 19,364 37,874

Expected credit losses expensed (420) (348) (293)

Other operating expenses (21,517) (21,024) (44,371)

Operating (loss) (5,690) (2,008) (6,790)

Finance costs 6 (1,008) (833) (1,756)

---------- ---------- ----------

(Loss) before taxation (6,698) (2,841) (8,546)

Underlying (loss) before

taxation before non-recurring

costs, Commercial Agreement

amortisation and share based

payments (5,983) (1,412) (4,428)

Non-recurring costs 4 (312) (919) (3,644)

Share based payments (173) (284) (22)

Commercial Agreement amortisation (230) (226) (452)

(Loss) before taxation (6,698) (2,841) (8,546)

----------------------------------- ----- ---------- ----------

Taxation 1,333 807 2,035

(Loss) after taxation (5,365) (2,034) (6,511)

Other comprehensive income - - -

---------- ---------- ----------

Total comprehensive (loss)

for the period attributable

to equity shareholders (5,365) (2,034) (6,511)

========== ========== ==========

Earnings Per Share

Basic (pence per share) 5 (3.9p) (1.5p) (4.7p)

Diluted (pence per share) 5 (3.9p) (1.5p) (4.7p)

Consolidated Statement of Financial Position

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

2nd Jul 3rd Jul 1st Jan

2023 2022 2023

Note GBP000 GBP000 GBP000

Assets

Intangible assets - Trademarks 504 504 504

Intangible assets - Goodwill 20,758 20,758 20,758

Intangible assets - Software 1,289 1,103 1,305

Intangible assets - Other 150 606 380

Property, plant and equipment 9,696 10,589 10,024

Right-of-use assets 10,779 10,578 9,416

Deferred taxation asset 4,326 1,847 2,984

---------- ---------- ------------

Non-current assets 47,502 45,985 45,371

Inventories 4,552 5,457 3,939

Current taxation asset 114 - 114

Trade and other receivables 5,741 6,985 5,106

Cash and cash equivalents 4,041 17,327 12,369

---------- ---------- ------------

Current assets 14,448 29,769 21,528

Total assets 61,950 75,754 66,899

========== ========== ============

Equity

Called up share capital 1,389 1,389 1,389

Share premium account 89,495 89,495 89,495

Profit and loss account (1,467) 9,127 3,856

Common control transaction

reserve (66,527) (66,527) (66,527)

22,890 33,484 28,213

Liabilities

Trade and other payables 7 21,305 23,400 21,069

Lease liabilities 4,293 4,332 4,154

Corporation taxation

liabilities - 159 -

Provision for liabilities

and charges 1,508 1,333 1,338

Borrowing facility - - 4,372

---------- ---------- ------------

Current liabilities 27,106 29,224 30,933

Provision for liabilities

and charges 2,121 2,219 2,160

Lease liabilities 6,762 6,522 5,593

Borrowing facility 3,071 4,305 -

---------- ---------- ------------

Non-current liabilities 11,954 13,046 7,753

Total liabilities 39,060 42,270 38,686

========== ========== ============

Total equity and liabilities 61,950 75,754 66,899

========== ========== ============

Consolidated Statement of Changes in Equity

Share capital Share premium Profit and loss Common control Total equity

account transaction reserve

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 2nd January

2022 1,386 89,495 10,893 (66,527) 35,247

Total comprehensive

(loss) for the period - - (2,034) - (2,034)

Transactions with

owners recorded

directly in equity:

Issue of new shares 3 - (3) - -

Deferred taxation

asset taken to

reserves - - (13) - (13)

Equity settled share

based payment

transactions - - 284 - 284

Balance at 3rd July

2022 1,389 89,495 9,127 (66,527) 33,484

-------------- -------------- ---------------------- ---------------------- -------------

Total comprehensive

(loss) for the period - - (4,477) - (4,477)

Transactions with

owners recorded

directly in equity:

Deferred taxation

asset taken to

reserves - - 23 - 23

Dividends - - (555) - (555)

Equity settled share

based payment

transactions - - (262) - (262)

Balance at 1st January

2023 1,389 89,495 3,856 (66,527) 28,213

-------------- -------------- ---------------------- ---------------------- -------------

Total comprehensive

(loss) for the period - - (5,365) - (5,365)

Transactions with

owners recorded

directly in equity:

Deferred taxation

asset taken to

reserves - - 9 - 9

Dividends - - (140) - (140)

Equity settled share

based payment

transactions - - 173 - 173

-------------- -------------- ---------------------- ---------------------- -------------

Balance at 2nd July

2023 1,389 89,495 (1,467) (66,527) 22,890

============== ============== ====================== ====================== =============

Consolidated Statement of Cash Flows

Unaudited Unaudited Audited

6 months ended 6 months ended 12 months ended

Note 2nd Jul 3rd Jul 2022 1st Jan 2023

2023

GBP000 GBP000 GBP000

Cash flows from operating activities

(Loss) for the period (5,365) (2,034) (6,511)

Adjustments for:

Depreciation of plant, property and

equipment 645 699 1,368

Depreciation of right-of-use assets 1,929 1,851 3,729

Amortisation of intangible fixed assets 431 438 875

Impairment of right-of-use assets - 27 27

Modification of right-of-use assets and

liabilities - (112) (113)

Finance expense 6 1,008 833 1,756

Equity settled share based payments charge 173 284 22

Taxation (credit) (1,333) (807) (2,035)

------------------ ---------------- ------------------

(2,512) 1,179 (882)

(Increase) / decrease in inventories (613) (159) 1,359

(Increase) in trade and other receivables (635) (2,105) (226)

Increase in trade and other payables 7 236 5,348 3,017

(Decrease) / increase in provisions (145) 8 (226)

------------------ ---------------- ------------------

(1,157) 3,092 3,924

Other interest (paid) (600) (599) (1,274)

Taxation (paid) - - (159)

------------------ ---------------- ------------------

Net cash (outflow) / inflow from operating

activities (4,269) 3,672 1,609

------------------ ---------------- ------------------

Net cash (outflow) from investing activities

Acquisition of property, plant and equipment (315) (477) (730)

Acquisition of intangible fixed assets (188) (445) (709)

Net cash (outflow) from investing activities (503) (922) (1,439)

Cash flows from financing activities

Proceeds from loans and borrowings 3,500 - -

Repayment of loans and borrowings (4,934) - -

Dividends paid (140) - (555)

Payment of lease liabilities (1,982) (1,774) (3,597)

------------------ ---------------- ------------------

Net cash (outflow) from financing activities (3,556) (1,774) (4,152)

Net (outflow) / inflow in cash and cash

equivalents (8,328) 976 (3,982)

Cash and cash equivalents at start of period 12,369 16,351 16,351

Cash and cash equivalents at end of period 4,041 17,327 12,369

================== ================ ==================

Notes to the interim financial information

1 General information and basis of preparation

The interim financial information for the six months ended 2nd

July 2023 and for the six months ended 3rd July 2022 does not

constitute statutory financial statements and is neither reviewed

nor audited. The comparative figures for the period ended 3(rd)

July 2022 are not the Group's consolidated statutory accounts for

that financial year but are extracted from those accounts which

have been reported on by the Group's auditor and delivered to the

Registrar of Companies. The report of the auditor was (i)

unqualified and (ii) did not contain a statement with reference to

Articles 113B of Companies (Jersey) Law 1991

The condensed consolidated interim financial information for the

period ended 2nd July 2023 has been prepared in accordance with IAS

34, 'Interim financial reporting' as adopted by the European

Union.

Selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in financial position and performance of the Group since

the last annual consolidated financial statements as at and for the

year ended 1st January 2023.

The condensed consolidated interim financial information should

be read in conjunction with the annual financial statements for the

year ended 1st January 2023 which have been prepared in accordance

with International Financial Reporting Standards ("IFRS") as

adopted by the European Union.

The accounting policies adopted in the condensed interim

financial information are consistent with those set out in the

financial statements for the year ended 1st January 2023.

Period-end

These interim financial statements are presented for the first

26 weeks of the financial year which ended on 2nd July 2023 for the

current year and ended on the 3rd July 2022 for the first half

comparative period of the prior year. All references made

throughout these accounts for H1 23 are for the period 2nd January

2023 to 2nd July 2023. References to H1 22 are for the period 3rd

January 2022 to 3rd July 2022.

2 Going concern

The financial statements are prepared on a going concern basis

which the Directors believe to be appropriate for the following

reasons.

The Group made a statutory loss of GBP(5.4)m in the 6 months to

2 July 2023 (June 22: GBP(2.0)m loss) and had net current

liabilities of GBP12.7m (June 2022: GBP0.5m net assets). As

described in the CEO's statement and the Financial Review, H1 23's

trading was significantly impacted by the challenging market and

economic environment within the UK and specifically within the RMI

market. During the period, the Group's net cash position reduced

from GBP8.0m to GBP1.0m predominantly due to the trading losses in

the period along with the revised payment terms linked to the

transition to a new key supplier to secure the supply chain. The

Directors' forecasts are that year-end net debt is expected to be

between GBP(5.5)m and GBP(6.5)m as a result of the ongoing

challenging trading conditions described in the CEO's

Statement.

Consequently, as described in the Business Outlook , the Group

has commenced discussions with its stakeholders to strengthen the

balance sheet at this time. There has been a good level of

engagement in this process and the Directors believe that they have

sufficient options available in order to conclude that the Group

will have adequate liquidity against forecast downside scenarios

through to the end of the going concern period (31 December

2024).

As the Group is still in discussion with its stakeholders and

requires such discussions to be concluded positively, the Directors

consider at this time that a material uncertainty exists that may

cast significant doubt on the Group's ability to continue as a

going concern. Notwithstanding this, the Directors believe that

based on the progress made to date, there is good reason to believe

that sufficient stakeholder support will be obtained in a timely

fashion and that the Group's working capital and liquidity position

can be managed effectively to ensure that the Group can continue to

realise its assets and discharge its liabilities in the normal

course of business. Accordingly, they have adopted the going

concern basis of accounting.

3 Significant accounting policies

Revenue recognition

The Group earns revenues from the design, manufacture, delivery

of, and installation of domestic double-glazed replacement windows

and doors.

There are five main steps followed for revenue recognition:

- Identifying the contract with a customer

- Identifying the performance obligations

- Determining the transaction price

- Allocating the transaction price to the performance obligations; and

- Recognising revenue when or as an entity satisfied performance obligations.

The various stages of the performance obligations are the

design, manufacture, delivery and installation of domestic

double-glazed replacement windows and doors.

In applying the principle of recognising revenue related to

satisfaction of performance obligations under IFRS 15, the Group

considers that the final end product is dependent upon a number of

services in the process that may be capable of distinct

identifiable performance obligations. However, where obligations

are not separately identifiable, in terms of a customer being

unable to enjoy the benefit in isolation, the standard allows for

these to be combined. The Group considers that in the context of

the contracts held these are not distinct. As such the performance

obligations are treated as one combined performance obligation and

revenue is recognised in full, at a point in time, being on

completion of the installation. Revenue is shown net of discounts,

sales returns, charges for the provision of consumer credit and VAT

and other sales related taxes. Revenue is measured based on the

consideration specified in a contract with a customer.

There is no identifiable amount included in the final price for

a warranty, as the Group provides a guarantee on all

installations.

Payments received in advance are held within other creditors as

a contract liability. The final payment is due on installation.

A survey fee is paid at the point of agreeing the contract and

the customer has up to 14 days, defined in the contract to change

their minds. If the customer changes their mind after this cooling

off period, the Group has the right to retain this survey fee and

as such revenue for this is recognised at the point in time that

this becomes non-refundable.

The Group offers consumer finance products from a range of

providers whilst acting as a credit broker and not the lender. The

Group earns commission and pays subsidies for its role as a credit

broker. As the Group is acting as the agent and not the principal,

commission is not disclosed as a separate income stream.

In addition to the above, the Group recognises revenue from the

sale of materials for recycling. The revenue is recognised when the

materials are collected by the recycling company which represents

the completion of the performance obligation. The Group has

determined that this revenue is derived from its ordinary

activities and as such this balance is recognised within

revenue.

Non-recurring items

Items that are either material because of their nature,

non-recurring or whose significance is sufficient to warrant

separate disclosure and identification within the consolidated

financial statements are referred to as non-recurring items. The

separate reporting of non-recurring items is important to provide

an understanding of the Group's underlying performance.

4 Non-recurring costs

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

2nd July 3rd July 1st January

2023 2022 2023

Non-recurring costs consist

of the following: GBP000 GBP000 GBP000

Holiday pay accrual (release) (214) (72) (46)

RSA related costs - 12 -

Litigation Costs 26 23 131

Restructuring and operational

costs 500 96 473

Modification of right-of-use

assets and liabilities - (112) (113)

Impairment of vacant right-of-use

assets - 27 27

Cyber incident related

costs - 945 953

Operational project costs - - 1,663

Former CEO retirement

costs - - 556

312 919 3,644

---------------------- ---------- ------------

The holiday pay accrual arose as a result of the impact of the

shutdown of operations and resultant extension of 2020 leave

entitlement which, for some employees, was up to March 2023. The

release in the current reporting period represents a

partial-unwinding of the original accrual booked in 2020 due to the

deferred holiday subsequently taken in the year.

RSA related costs are the employer related taxes associated with

the issue of Restricted Share Award scheme during the year.

Litigation costs are mainly expenses incurred as a result of an

ongoing legal dispute between the Group and an ex-agent. These

costs are predominantly legal advisor's fees.

Restructuring and operational costs are expenses incurred,

including redundancy payments, as a result of changes being made to

reduce the cost structure to the business.

Modification of right-of-use assets and liabilities relate to

the closure of the properties identified as right-of-use assets

during the period.

Impairment of right-of-use assets relate to the closure of the

properties identified as assets under IFRS 16.

Cyber incident related costs are costs directly incurred and

associated with the cyber-attack that took place in January 2022.

Immediately following the attack, there was a short term impact on

the Group's operations as it implemented business continuity

workarounds whist it recovered its systems.

At the end of 2022 the Group transitioned to a new provider of

PVCu profile, Liniar. The Group incurred a one-off cost of GBP1.7m

due to the incremental costs of transitioning to the new profile

and the impairment of the remaining stock held that was specific to

the old profile which will no longer be sold to customers.

The charge of GBP0.6m in 2022 represents the costs of the

previous CEO, Mike Gallacher's, remuneration arrangements following

his retirement from the Board on 14 December 2022.

For further detail on the 2022 non-recurring charges, please

refer to the 2022 Annual Report.

5 Earnings per share

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

2nd July 3rd July 1st January

2023 2022 2023

Basic (loss) per share

(pence) (3.9p) (1.5p) (4.7p)

Diluted (loss) per share

(pence) (3.9p) (1.5p) (4.7p)

Basic earnings per share

The calculation of basic earnings per share has been based on the

following loss attributable to ordinary shareholders and weighted-average

number of shares outstanding.

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

2nd July 3rd July 2022 1st January

2023 2023

GBP000 GBP000 GBP000

(Loss) attributable to

ordinary shareholders (5,365) (2,034) (6,511)

=============== =============== ==============

Weighted-average number

of ordinary shares (basic)

No of shares No of shares No of shares

'000 '000 '000

In issue during the period 138,867 138,628 138,748

=============== =============== ==============

As a loss has been recorded for the period, the shares are not

considered to have a dilutive effect.

6 Finance costs

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

2nd July 3rd July 1st January

2023 2022 2023

GBP000 GBP000 GBP000

On borrowing costs 399 327 727

Unwind of discount on

provisions 276 161 341

On lease liabilities 333 345 688

1,008 833 1,756

---------- ---------- -------------

7 Trade Payables

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

2nd July 3(rd) July 1st January

2023 2022 2023

GBP000 GBP000 GBP000

Trade payables 7,869 9,112 8,512

Other taxation and social

security costs 4,074 4,465 3,649

Other creditors and deferred

income 4,253 5,901 4,298

Accruals 5,109 3,922 4,610

21,305 23,400 21,069

---------- ----------- -------------

Trade payables represents the total amounts payable by the Group

as part of normal business operations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UNORROKUKUUR

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

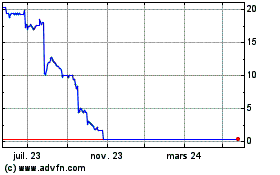

Safestyle Uk (LSE:SFE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Safestyle Uk (LSE:SFE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024