TIDMSPSY TIDMSPSC

RNS Number : 4418T

Spectra Systems Corporation

20 March 2023

Spectra Systems Corporation

Audited results for the twelve months ended 31 December 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF REGULATION (EU) NO 596/2014 WHICH

IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018, AS AMED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Spectra Systems Corporation (the "Company"), a leader in

machine-readable high speed banknote authentication, brand

protection technologies, and gaming security software, is pleased

to announce its results for the twelve months ended 31 December

2022.

Financial highlights:

-- Revenue of $19,627k (2021: $16,592k) up 18%

-- Adjusted EBITDA (1) up 17% at $8,077k (2021: $6,896k)

-- Adjusted PBTA (1) up 17% to $7,765k (2021: 6,622k)

-- Adjusted earnings(2) per share up 21% to US 14.5 cents (2021: US 12.0 cents)

-- Cash generated from operations of $8,040k (2021: $8,084k)

-- The Board are declaring an increased annual dividend of

US$0.115 per share to be paid in June 2023

-- Strong, debt-free balance sheet, with cash (3) of $17,496k (2021: $16,775k) at 31 December

-- Buy-back of 500,000 shares during 2022 at a total cost of US$807k

(1) Before stock compensation expense and excludes

noncontrolling interest

(2) Before amortization and stock compensation expense, excludes

noncontrolling interest

(3) Does not include $500,000 (2021: $1,099k) of restricted cash

and investments

Operational highlights:

-- Continued momentum towards customer acceptance of latest pre-production sensor units.

-- Completed supply chain mitigation program with central bank

worth $1.3mm for preparation and given go ahead for production in

2022 at 21% price increase.

-- Increased sales efforts for polymer substrates with

appointment of Global Sales Director for Banknote Technology and

launch of enhanced website.

-- Central bank request to provide large quantities of Fusion

substrate for a large print trial ongoing in 2023.

-- Continued strong sales of K-cup optical materials through a second large customer.

-- Increased operational efficiency in software security group

by launching a new tool to significantly improve our ability to

manage customer support.

Commenting on the results, Nabil Lawandy, Chief Executive

Officer, said:

Company's earnings and revenues are up substantially over 2021

both due to strong sales which would in themselves had enabled the

company to exceed market expectations and which were further

increased due to over-manufacturing of covert materials for a

Central Bank. Improved financial planning has been put in place for

2023. Our cash position remains strong due to sensor development

milestones and prepayments as well as additional sales in optical

and covert materials. In addition, information from one of our

major licensees as well as improved visibility on current sensor

life have allowed us to write-off inventory which we anticipate

will not contribute to future sales.

Spectra Systems, with our proven track record of developing

solutions for our customers in record time, has capitalized on the

environment that was created by the Covid-19 pandemic. We have

successfully completed a supply chain mitigation program with a

central bank customer by manufacturing in-house a previously

commercially sourced chemical. This effort has resulted in payment

for the development as well as an approval to manufacture material

starting in Q4 of 2022 at a higher price.

On the materials front, our revenue from K-cup printers

continues to be strong and we began testing with a third printer in

Canada in 2022. Taggant material orders from a central bank

customer were again at high levels, further bolstering consumable

revenue.

"The Board therefore believes that the Company is on track to

achieve record earnings and meet market expectations for 2023."

Spectra Systems Corporation Tel: +1 (0)401 274 4700

Dr. Nabil Lawandy, Chief Executive Officer

WH Ireland Limited (Nominated Adviser and Tel: +44 (0)20 7220 1650

Joint Broker)

Chris Fielding/James Bavister/Andrew de Andrade

(Corporate Finance) Tel: +44 (0)20 3328 5665

Allenby Capital Limited (Joint Broker)

Nick Naylor/James Reeve (Corporate Finance)

Amrit Nahal (Sales and Corporate Broking)

The person responsible for arranging the release of this

announcement on behalf of the Company is Dr. Nabil Lawandy, Chief

Executive Officer of the Company.

Chief Executive Officer's statement

Introduction

We are delighted to report that we significantly outperformed

the 2021 results while our year end cash position is the highest in

the Company's history.

Revenue for the year was up 18% at $19,627k (2021: $16,592k),

primarily driven by pre-production development contracts as well as

ongoing demand for our materials to meet production for our

long-standing central bank customer.

The adjusted EBITDA (before stock compensation expense) for the

year increased 17%, to $8,077 k compared to the prior year of

$6,896k.

Having generated cash from operations of $8,040k (2021: $8,084k)

, cash at the period end was $17,496k (2021: $16,775k) , excluding

$500,000 of restricted cash and investments (2021: $1,099k). This

is notwithstanding $5,004k paid to shareholders during June in the

form of the Company's dividend of $0.11 per share and $807k used

for buying back 500,000 shares.

Review of Operations

Physical and Software Authentication Business

The Authentication Systems business generated revenue of

$18,164k (2021: $14,718k) and Adjusted EBITDA of $8,005k (2021:

$6,556k). Authentication Systems revenues were driven by sales of

covert materials and the funding of a new in-house capability and

facility to combat supply chain issues relating to one of our

central bank customers. Authentication Systems revenue was further

increased by milestone payments which are part of the sensor

development program with one of our long-standing central bank

customers. We continue to advance through the acceptance process

with this central bank with the delivery of preproduction units of

our latest sensor in late 2024. In addition, revenue from optical

and security phosphour materials remained strong while licence

payments from our licensee continued with on time payments and at

the contracted value.

Through our vertically integrated manufacturing we have been

able to produce high quality conducting and opacified polymer

substrate for evaluation by central banks, ink suppliers and

printing organizations. We have produced a large number of print

ready sheets for a Middle Eastern central bank print trial which

has resulted in an additional large scale print trial scheduled for

Q2 2023. The Company has formed a close working relationship with

the largest commercial printer of polymer banknotes and is

developing a house note which will incorporate both our Fusion(TM)

machine readable security as well as their newest public security

feature. The objective of this joint development will produce

polymer banknotes of the highest quality for a joint marketing

effort.

We are increasing our sales and marketing efforts for Fusion(TM)

as well as our full suite of banknote products having introduced

Fusion at the Banknote Conference and appointed a UK based Global

Director of Sales for Banknote Technology.

With the TruBrand(TM) authentication product having been

successfully introduced into the Chinese tobacco market in 2019

annually and for use in stationary products in 2021, we have

completed two successful gravure tests with another large supplier

of cigarettes in China and plan to additional print tests in Q1 of

2023 with two additional tobacco companies in China. We continue to

expand our search for new TruBrand(TM) customers outside of China,

including with a major Japanese printer and a partnership with a

company in India bidding on authentication of both dairy products,

as well as transit certificates, and with our multinational Fusion

polymer partner for labels. We have also developed smartphone

readable security threads to further expand the palette of target

applications and potential partners. In addition, we continue to

work with a printer for a well-respected French luxury brand to

help protect their products sold in China using authentication

technology we acquired several years ago.

Our K-cup materials business has grown significantly after a new

customer began purchasing our products during 2021. In 2022, we

began a new testing program with a Canada based K-cup lid printer

which we expect will produce revenues in Q2 2023.

On the software security side of the Company's business, the

Secure Transactions Group generated an Adjusted EBITDA of $72k

(2021: $340k) on revenue of $1,463k (2021: $1,874k). The 2022

results are in line with expectations as we continue development of

a new software platform. While this development

continues, we are focusing on the online lottery sector which

grew during the pandemic through a partnership with NextGen

Lotteries.

Finally, the Company has received several additional patents on

authentication technology in Africa, China, and EU which protects

our position in covert authentication as well as polymer substrates

technology and machine readability

Banknote Cleaning and Disinfection Business

We have sold our first Banknote Disinfection System (BDS) for

use by an Asian central bank. The unit will be installed in the Q1

2023 and the terms included a 30% up-front payment as well as a

follow-on service agreement. As this system is scalable from

250,000 notes to over five million notes in a single cycle of one

hour, we have the ability to accommodate a large spread of

potential customer requirements. With this first unit sold, we are

ramping up our sales and marketing process to other central banks

as well as the casino industry. We do not expect this product to

significantly contribute to revenue until another Covid outbreak or

the emergence of another rapidly spreading pathogen.

Solaris BioSciences Investment Asset

In December 2020, the Company made an investment in Solaris

BioSciences, whose results are consolidated by the Company. The

technology is entirely optical and has evolved rapidly over the

last months of 2022 and Q1 2023. The technology is now capable of

point of care measurement of plasma viscosity, cancer markers,

lipid content, and LDL in microliters of blood. During H1 2022,

Solaris BioSciences Holdings was formed as a UK company and has

obtained EIS status with HMRC to expand the base of investment

opportunities to the UK.

Corporate Governance

Spectra Systems is an AIM listed company and has always worked

to abide by best practices as advised by both our bankers as well

as our shareholders. Recently ISS has issued certain

recommendations regarding board composition, committee assignments,

and option grants.

Our board has comprised the same Directors since our listing

except for the addition of Mr. Jeremy Fry (UK based) who replaced

Mr. Martin Jaskel after his untimely passing away. In order to add

a new dimension to the board, Dr. Barbara Paldus joined the board

in H2 2022 as an Independent Non-Executive Director. She has

extensive entrepreneurial experience, particularly in technology

solutions, which will be of immense value to Spectra.

With the addition of this new board member, Dr. Nabil Lawandy

exited the Audit Committee assignment as there is now a suitable

replacement to share the burden of committee assignments.

With regards to Director option grants, the Company has adopted

a new policy which will allow new Directors to receive a one-time

option grant upon joining the board of directors. Going forward, no

Directors will be issued new options beyond the ones received at

joining the board. This is a compromise position relative to USA

standards and UK guidance that Non-Executive Directors hold no

options.

Strategy

The Company's strategy for increasing revenue and earnings

continues to be focused on selling more products to existing

customers as well as opening new sales channels for the full

spectrum of our product offering. We have had very good success in

upselling existing central bank customers and commercially

exploiting supply chain and pandemic related issues as part of our

strategy. Examples of these successes are the expansion of sensor

capabilities for exotic counterfeits, the development and first

sale of a banknote disinfection machine, and the commencement of a

program with our customer to deal with supply chain issues now and

going forward.

Our strategy for growing our newest and potentially

transformative technology for polymer banknotes is based on

validation, followed by commemorative banknote contract and then a

full banknote denomination contract. The validation is focused on

three major stakeholders in the polymer banknote industry: the ink

manufacturers, the commercial printers, and the state printworks.

Our primary targets are central banks which are currently using

paper substrates and are contemplating a transition to polymer as

well as central banks who have decided not to use polymer for

higher denominations due to security concerns.

With regards to our optical materials and brand authentication

products, we continue to propose to both central banks and overt

security suppliers the concept of upgrading such features to

incorporate public and machine-readable security. Our recent

development of smartphone readable security threads will expand the

opportunities of the technology to passports and secure documents.

The strategy behind this approach is based around partnering with

current contract holders who can benefit from our technology and

materials to upsell their existing customers.

Finally, with our strong cash position, we do explore possible

mergers and acquisitions which can immediately open doors to

implement our upselling strategy, expand our customer base or

strengthen our supply chain for Fusion polymer substrate. The

exploration of such opportunities is now becoming more viable at

larger scales as we expect to have even more significant cash

resources through the successful delivery of the major central bank

sensor contract.

Prospects

The Company continues to have a multitude of new short-term and

long-term prospects. The short-term opportunities are expected in

the 2023-2025 period and the long-term opportunities are expected

in the 2025-2030-time frame.

The near-term opportunities are:

o Completion of sensor development and revenue recognition of

development payments

o New online Quality Control system contract

o First sensor shipments to a central bank

o TruBrand(TM) revenue reaching $1m per annum levels

o Increased sales of our newest phosphour products

o Expansion of our gaming software business in Canada and other

non-USA customers and in the online lottery market

o Opportunity to bid in a polymer banknote tender

o A commemorative note series using our Fusion polymer

substrate

The longer-term opportunities are:

o Supply of upgraded sensors worth up to $50MM in hardware to a

central bank customer

o Supply of Fusion(TM) polymer substrate and sensors to a

central bank for one or more banknote denominations

o Further increase of covert authentication materials by a

current or new central bank customer

The combination of these prospects, both short and long-term,

has positioned the Company to continue its revenue and earnings

growth over the coming years. We continue to develop cutting edge

technologies to remain the technology leader in the authentication

industry and to offer our shareholders growth through innovation

for both new and existing customers.

Dividend

With the Company having an eighth year of sustainable profits,

reaching their highest levels since its admission to trading on

AIM, and having sufficient resources to execute on its growth plans

with its existing cash reserves, the Board is delighted to again

issue an increased dividend. Our dividend policy takes account of

the Group's profitability, underlying growth, and maintenance of

sufficient cash reserves. The Board therefore intends to pay an

annual dividend of US$0.115 per share on or about June 23, 2023 to

shareholders of record as of June 5, 2023.

Nabil M. Lawandy

Chief Executive Officer

March 21, 2023

Consolidated statements of income

for the years ended 31 December:

2022 2021

Audited Audited

USD '000 USD '000

Revenue

Product $ 11,208 $ 9,281

Service 6,681 5,524

Licence and royalty 1,738 1,787

------------- --------------------------

Total revenues 19,627 16,592

Cost of sales 7,351 6,069

------------- --------------------------

Gross profit 12,276 10,523

Operating expenses

Research and development 1,507 1,399

General and administrative 3,023 2,743

Sales and marketing 753 471

------------- --------------------------

Total operating expenses 5,283 4,613

------------- --------------------------

Operating profit 6,993 5,910

Interest income 17 40

Loss on sale of equipment -- (19)

Foreign currency income (loss) (8) 12

------------- --------------------------

Profit before taxes 7,002 5,943

Income tax expense 901 878

------------- --------------------------

Net income 6,101 5,065

Net loss attributable to noncontrolling

interest (46) (98)

------------- --------------------------

Net income attributable to

Spectra Systems Corporation $ 6,147 $ 5,163

============= ==========================

Earnings per share

Basic $ 0.14 $ 0.11

Diluted $ 0.13 $ 0.11

All of the Group's operations are continuing

Consolidated statements of comprehensive income

for the years ended 31 December:

2022 2021

Audited Audited

USD '000 USD '000

Net income $ 6,101 $ 5,065

Other comprehensive income

(loss)

Unrealized gain(loss) on currency

exchange (45) 10

Reclassification for realized

(gain)loss in net income 8 (12)

------------- -------------

Total other comprehensive

loss (37) (2)

Comprehensive income 6,064 5,063

Net loss attributable to noncontrolling

interest (46) (98)

------------- -------------

Comprehensive income attributable

to Spectra Systems Corporation $ 6,110 $ 5,161

============= =============

Consolidated balance sheets

as of 31 December:

2022 2021

Audited Audited

USD '000 USD '000

Current assets

Cash and cash equivalents $ 17,496 $ 16,775

Trade receivables, net of allowance 3,677 2,242

Unbilled and other receivables 1,133 630

Inventory 1,599 1,944

Prepaid expenses 760 298

Total current assets 24,665 21,889

Non-current assets

Property, plant and equipment,

net 2,102 1,439

Operating lease right of use

assets, net 1,217 972

Intangible assets, net 7,055 7,161

Restricted cash and investments 500 500

Deferred tax assets 1,881 1,080

Other assets 597 111

--------------------- ----------------------

Total non-current assets 13,352 11,263

Total assets $ 38,017 $ 33,152

===================== ======================

Current liabilities

Accounts payable $ 929 $ 490

Accrued expenses and other liabilities 504 512

Operating lease liabilities,

short term 298 286

Taxes payable 684 262

Deferred revenue 4,626 2,184

--------------------- ----------------------

Total current liabilities 7,041 3,734

Non-current liabilities

Operating lease liabilities,

long term 975 739

Deferred revenue 1,679 758

--------------------- ----------------------

Total non-current liabilities 2,654 1,497

Total liabilities 9,695 5,231

--------------------- ----------------------

Stockholders' equity

Common stock 450 453

Additional paid in capital -

common stock 53,178 53,833

Accumulated other comprehensive

loss (174) (137)

Accumulated deficit (25,727) (26,870)

Total Spectra Systems stockholders'

equity 27,727 27,279

Noncontrolling interest 595 642

--------------------- ----------------------

Total liabilities and stockholders'

equity $ 38,017 $ 33,152

===================== ======================

Statements of cash flows

for the year ended 31 December:

2022 2021

Audited Audited

USD '000 USD '000

Cash flows from operating activities

Net income $ 6,101 $ 5,065

Adjustments to reconcile net

income to net cash provided by

operating activities:

Depreciation and amortization 917 831

Stock based compensation expense 142 71

Lease amortization expense 287 274

Deferred taxes (801) 320

Allowance for doubtful accounts (4) -

Provision for excess and obsolete

inventory 694 494

Loss on sale of equipment - 19

Changes in operating assets

and liabilities

Accounts receivables (1,428) 346

Unbilled and other receivables (503) (153)

Inventory (349) 356

Prepaid expenses (463) (25)

Other assets (500) -

Accounts payable 441 (44)

Operating leases (285) (265)

Accrued expenses and other liabilities 417 71

Deferred revenue 3,374 72

------------- -------------

Net cash provided by operating

activities 8,040 8,084

Cash flows from investing activities

Restricted cash and investments - 599

Payment of patent and trademark

costs (476) (471)

Proceeds from sale of equipment - 36

Purchases of property, plant

and equipment (988) (76)

------------- -------------

Net cash provided (used) in

investing activities (1,464) 88

Cash flows from financing activities

Dividends paid (5,004) (4,302)

Repurchase of shares (807) (1,170)

Proceeds from exercise of stock

options 6 38

------------- -------------

Net cash used in financing activities (5,805) (5,434)

Effect of exchange rate on cash

and cash equivalents (50) (1)

------------- -------------

Net increase in cash and cash

equivalents 721 2,737

Cash and cash equivalents ,

beginning of year 16,775 14,038

------------- -------------

Cash and cash equivalents ,

end of year $ 17,496 $ 16,775

============= =============

Notes to financial information

1. Basis of preparation

This report was approved by the Directors on the 16(th) day of

March 2023.

This financial information has been prepared using the

recognition and measurement principles of US Generally Accepted

Accounting Principles. The Group has not elected to apply IAS 34

Interim Financial Reporting.

The principal accounting policies used in preparing the interim

results are those the Company expects to apply in its financial

statements for the year ending 31 December 2022 and are unchanged

from those disclosed in the Company's Annual Report for the year

ended 31 December 2021.

2. Earnings per share

The calculation of basic earnings per share is based on the net

income divided by the weighted average number of common shares

outstanding. Diluted earnings per share is calculated by

considering the dilutive impact of common stock equivalents under

the treasury stock method as if they were converted into common

stock as of the beginning of the period or as of the date of grant,

if later. Excluded from the calculation of diluted earnings per

common share for the years ended 31 December 2022 and 2021 were

186,773 and 125,425 shares, respectively, related to stock options

because their exercise prices would render them anti-dilutive. The

following table shows the calculation of basic and diluted earnings

per common share.

Full Year Full Year

to 31 Dec to 31 Dec

2022 2021

Numerator:

Net income $ 6,147,374 $ 5,162,830

Denominator:

Weighted average common shares 45,189,208 45,353,550

Effect of dilutive securities:

Stock Options 2,132,610 2,385,480

--------------------- ----------------

Diluted weighted average common

shares 47,321,818 47,739,030

===================== ================

Earnings per common share:

Basic: $ 0.14 $ 0.11

===================== ================

Diluted: $ 0.13 $ 0.11

===================== ================

3. Copies of this statement are available to the public on the

Company's website at http://www.spsy.com .

4. Nature of financial information

The Preliminary Announcement set out above is an extract from

the forthcoming Annual Report and Accounts and does not represent

statutory accounts for Spectra Systems Corporation. The statutory

accounts of Spectra Systems Corporation in respect of the period

ended 31 December 2022 will be delivered to the Registrars of

Companies before the Company's Annual General Meeting.

It is anticipated that the Annual Report and Accounts will be

circulated to shareholders of Spectra Systems Corporation by April

2023.

Appendix - Reconciliation of Non-GAAP measures

The Company publishes certain additional information in a

non-statutory format in order to provide readers with an increased

insight into the underlying performance of the business.

Reconciliations to the GAAP measures are shown in the following

tables:

2022 2021

USD '000 USD '000

Adjusted earnings before interest, taxes,

depreciation and amortization (EBITDA):

Operating profit $ 6,993 $ 5,910

Depreciation 321 307

Amortization 594 524

Stock compensation 142 71

Operating loss - noncontrolling

interest 46 101

Stock compensation - noncontrolling

interest (19) (17)

Adjusted EBITDA $ 8,077 $ 6,896

Adjusted profit before taxes and

amortization (PBTA):

Profit before taxes $ 7,002 $ 5,943

Amortization 594 524

Stock compensation 142 71

Operating loss - noncontrolling

interest 46 101

Stock compensation - noncontrolling

interest (19) (17)

Adjusted PBTA $ 7,765 $ 6,622

Adjusted earnings per share:

Adjusted PBTA $ 7,765 $ 6,622

Income tax expense (901) (878)

Adjusted earnings $ 6,864 $ 5,744

Diluted weighted average common

shares 47,321,818 47,739,030

Adjusted earnings per share $ 0.145 $ 0.120

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SFUFDUEDSESD

(END) Dow Jones Newswires

March 20, 2023 03:00 ET (07:00 GMT)

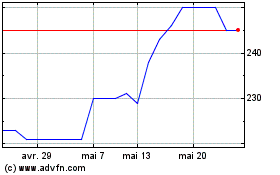

Spectra Systems (LSE:SPSY)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Spectra Systems (LSE:SPSY)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025