TIDMTBLD

RNS Number : 6916X

tinyBuild, Inc.

21 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, TO OR FOR THE ACCOUNT OR BENEFIT OF US PERSONS, AS

DEFINED IN REGULATION S PROMULGATED UNDER THE US SECURITIES ACT OF

1933, AS AMED (THE "US SECURITIES ACT"), OR IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF

SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

For immediate release

21 December 2023

tinyBuild, Inc.

(the "Company" and together with its subsidiaries "tinyBuild" or

the "Group")

Results of Placing, Private Placement, Subscription and

intention to launch Open Offer

tinyBuild (AIM:TBLD), a premium video games publisher and

developer with global operations, is pleased to announce that

further to the announcement earlier today (the "Launch

Announcement"), the Company has conditionally raised gross proceeds

of US$12.0 million at 5 pence per share (the "Issue Price")

via:

-- A total of 31,416,902 Private Placement Shares having been

conditionally subscribed for by Atari at the Issue Price, raising

gross proceeds of US$2.0 million for the Company

-- A total of 153,080,000 Subscription Shares having been

conditionally subscribed for and a total of 4,000,000 Placing

Shares having been conditionally placed pursuant to the Placing and

the Subscription at the Issue Price, raising gross proceeds of

US$10.0 million for the Company

Having agreed to underwrite the Open Offer pursuant to the terms

of the Subscription Agreement, Alex Nichiporchik, tinyBuild's CEO,

may subscribe for additional Subscription Shares depending on the

level of take-up of entitlements by qualifying stockholders in the

Open Offer. This may increase his current subscription for

153,080,000 Subscription Shares post the Open Offer to between

54.0% and 59.1% of the enlarged issued share capital, subject to

the take-up in the Open Offer.

The Issue Price represents a premium of 100% to the closing

price on 20 December 2023 (being the latest practicable time prior

to the announcement of the Placing). The net proceeds of the

Placing are expected to be supplemented by additional proceeds of

up to US$2.16 million to be raised pursuant to the Open Offer.

The net proceeds raised by the Company pursuant to the Placing,

Private Placement and Subscription are c.US$11.0 million and any

additional funds raised through the Open Offer shall be used for

general working capital purposes by the Company. Together the

Placing, Private Placement, Subscription and Open Offer are

referred to as the "Fundraise".

Open Offer

Pusuant to the Open Offer, qualifying stockholders will have an

opportunity to subscribe for up to an aggregate of 33,979,706 Open

Offer Shares at the Issue Price, to raise up to c.US$2.16 million

(before expenses), on the basis of 1 Open Offer Share for every 6

Shares held on the Record Date.

In addition, the Open Offer presents qualifying shareholders

with an opportunity, provided that they take up their Basic

Entitlements in full, to apply for additional Open Offer Shares

through the Excess Application Facility.

The Open Offer entitlements will be represented by the ISIN

USU8884H1116, along with Excess Open Offer entitlements under ISIN

USU8884H1298.

Entitlements will not be listed to any exchange, and are

expected to be credited to the accounts of qualifying stockholders

on or around the 27 December 2023. The Open Offer period is

expected to operate until 11am on 17 January 2024.

The CEO cannot participate in the Open Offer but has the ability

to take up shares that are not subscribed for in the Open Offer

through the Subscription.

The Open Offer is conditional on the passing of stockholder

resolutions at a special meeting of stockholders of the

Company.

Further details on the Open Offer will be contained in the

Circular, which is expected to be posted to stockholders on or

around 22 December 2023 and will be available on the Company's

website.

Conditional Fundraise and notice of Special Meeting

The Fundraise is conditional, inter alia, upon:

1) the passing without amendment of all the Resolutions at the Special Meeting;

2) the Company having complied with its obligations and having

satis ed all conditions under the Placing Agreement, which fall to

be performed on or satis ed prior to Admission;

3) Admission occurring by no later than 8.00 a.m. on 19 January

2024 or such later time and date (being not later than 8.00 a.m. on

31 January 2024) as Joh. Berenberg, Gossler & Co. KG

("Berenberg") and the Company may agree;

4) in the opinion of Berenberg acting in good faith there not

having been a material adverse change since the date of the Placing

Agreement (whether or not foreseeable at the date of the Placing

Agreement).

As set out in detail in the Launch Announcement earlier today,

the Fundraise is conditional, inter alia, upon the passing of each

of the Resolutions at the Special Meeting.

A Special Meeting is therefore being convened at the of ces of

Goodwin Procter (UK) LLP, 100 Cheapside, London EC2V 6DY, United

Kingdom at 12 noon on 18 January 2024 for the purposes of seeking

approval of the Resolutions. The formal Notice of Special Meeting

will be set out at the end of the Circular which is expected to be

posted to stockholders on or around 22 December 2023.

If the Resolutions are not passed at the Special Meeting, the

Fundraise will not take place and the proceeds of the Fundraise

will not be received by the Company.

If the Company does not receive the proceeds of the Fundraise,

the Company would have to again seek other forms of emergency

financing. Whilst the CEO has indicated he is willing to support

the Company, no terms have been agreed beyond the proposed

Subscription and the Company is unable to provide any assurance

that alternative financing could be secured. Failure to secure

alternative forms of finance at all or on commercially acceptable

terms could have a material adverse effect on the Group's business,

financial condition, prospects, capital resources, cash flows,

share price, liquidity, results and/or future operations. In

particular, failure to conclude the Fundraise will materially

compromise the Group's ability to meet its financial obligations as

they fall due and, in the opinion of the Board, likely result in

the Group entering into a chapter 11 bankruptcy or some other form

of insolvency procedure under which the prospects for recovery of

value, if any, by stockholders would be uncertain.

Application for Admission

Application will be made to the London Stock Exchange for the

Placing Shares, the Private Placement Shares, the Subscription

Shares and such number of Open Offer Shares as are subscribed for

in the Open Offer to be admitted to trading on AIM. Subject to,

inter alia, approval of the Resolutions at the Special Meeting,

Admission is expected to take place, and dealings in the Placing

Shares, the Private Placement Shares the Subscription Shares and

such number of Open Offer Shares as are subscribed for are expected

to commence, at 8.00 a.m. on 19 January 2024 (or such later time

and/or date as may be agreed between the Company and Berenberg,

being no later than 8.00 a.m. on 31 January 2024). No temporary

documents of title will be issued.

Capitalised terms not defined in this announcement have the

meanings given to them in the Launch Announcement.

Alex Nichiporchik, Chief Executive Officer of tinyBuild,

commented:

"We are pleased to welcome Atari as a strategic investor of

tinyBuild. Atari is a timeless brand and its support validates the

current strategic plan for tinyBuild."

Wade Rosen, Chairman and CEO of Atari, commented:

"tinyBuild is an amazing company, with industry leading games

and benefiting from an expansive fan base. Atari is excited to

participate in the current capital transaction as tinyBuild's

approach to the indie games market is in line with Atari's

long-term approach."

For further information please contact:

tinyBuild, Inc investorrelations@tinybuild.com

Alex Nichiporchik - Chief Executive Officer

Giasone (Jaz) Salati - Chief Financial

Officer

Michael Schauble - Chief Commercial Officer

Berenberg (Nominated Advisor and Sole Tel: +44 (0) 20 3207

Broker) 7800

Mark Whitmore, Ciaran Walsh, Milo Bonser

SEC Newgate (Financial PR) tinybuild@secnewgate.co.uk

Robin Tozer, Harry Handyside, Molly Gretton +44 (0)7540 106366

The person responsible for releasing this announcement is

Giasone Salati, Chief Financial Officer.

tinyBuild, Inc. LEI: 2138002FIMZYDVU3BD12

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this Announcement.

Important Notices

No action has been taken by the Company, Berenberg or any of

their respective affiliates, or any person acting on its or their

behalf that would permit an offer of the Placing Shares or

possession or distribution of this Announcement or any other

offering or publicity material relating to such Placing Shares in

any jurisdiction where action for that purpose is required. Persons

into whose possession this Announcement comes are required by the

Company and Berenberg to inform themselves about, and to observe,

such restrictions.

No prospectus, offering memorandum, offering document or

admission document has been or will be made available in connection

with the matters contained in this Announcement and no such

prospectus is required (in accordance with the Prospectus

Regulation (EU) 2017/1129 (the "Prospectus Regulation") or the

Prospectus Regulation as it forms part of UK domestic law by virtue

of the European Union Withdrawal Act 2018 (the "UK Prospectus

Regulation") as applicable )) to be published. Persons needing

advice should consult a qualified independent legal adviser,

business adviser, financial adviser or tax adviser for legal,

financial, business or tax advice.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT, IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE, FORWARDING OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO THE UNITED STATES OF AMERICA, ITS TERRITORIES AND POSSESSIONS,

ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA

(COLLECTIVELY, THE "UNITED STATES"), AUSTRALIA, CANADA, THE

REPUBLIC OF SOUTH AFRICA OR JAPAN OR ANY OTHER JURISDICTION IN

WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS

NOT AN OFFER OF SECURITIES IN ANY JURISDICTION. THIS ANNOUNCEMENT

HAS NOT BEEN APPROVED BY THE LONDON STOCK EXCHANGE, NOR IS IT INTED

THAT IT WILL BE SO APPROVED.

This Announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States, Canada, Australia, the Republic of South Africa, Japan or

any other jurisdiction in which the same would be unlawful. No

public offering of the Placing Shares is being made in any such

jurisdiction.

The securities referred to herein have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "Securities Act"), or with any securities regulatory

authority of any State or other jurisdiction of the United States,

and may not be offered, sold or transferred directly or indirectly

in or into the United States except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the Securities Act and in compliance with the securities laws of

any State or any other jurisdiction of the United States.

Accordingly, the Placing Shares are being offered and sold by the

Company only outside the United States in "offshore transactions"

(as such terms are defined in Regulation S under the Securities Act

("Regulation S")) in accordance with, and in reliance on, the safe

harbour from registration provided by Rule 903(b)(3), or Category

3, of Regulation Sand otherwise in accordance with applicable. The

securities referred to herein are subject to the conditions listed

under Rule 903(b)(3), or Category 3, of Regulation S. Under

Category 3, offering restrictions (as defined under Regulation S)

are in place and additional restrictions are imposed on resales of

the securities referred to herein. Further, hedging transactions in

the securities referred to herein may not be conducted unless in

compliance with the US Securities Act. No public offering of

securities is being made in the United States.

This Announcement is for information purposes only and is

directed only at persons whose ordinary activities involve them in

acquiring, holding, managing and disposing of investments (as

principal or agent) for the purposes of their business and who have

professional experience in matters relating to investments and are:

(a) if in a member state of the European Economic Area (the "EEA"),

persons who are qualified investors, within the meaning of Article

2(E) of the Prospectus Regulation ("Qualified Investors"); or (b)

if in the United Kingdom, 'Qualified Investors' within the meaning

of Article 2(E) Of the UK Prospectus Regulation and who are also:

(i) persons who fall within the definition of "investment

professionals" in Article 19(5) of the Financial Services And

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

"Order"), or (ii) persons who fall within Article 49(2)(a) to (d)

(high net worth bodies companies, unincorporated associations, etc)

of the Order, or (c) persons to whom it may otherwise be lawfully

communicated, and in all cases who are capable of being categorised

as a professional client or an eligible counterparty for the

purposes of the FCA conduct of business rules, (all such persons

referred to in (a), (b) and (c) above together being referred to as

"Relevant Persons").

Any investment or investment activity to which this Announcement

relates is available in the EEA or the United Kingdom only to

Relevant Persons and will be engaged in only with Relevant Persons.

This Announcement must not be acted on or relied on by persons in

the EEA or the United Kingdom who are not Relevant Persons.

In Canada, no prospectus has been filed with any securities

commission or similar regulatory authority in respect of the

Placing Shares. No such securities commission or similar regulatory

authority in Canada has reviewed or in any way passed upon the

merits of any proposed offering of the Placing Shares and any

representation to the contrary is an offence; no prospectus has

been lodged with, or registered by, the Australian Securities and

Investments Commission or the Japanese Ministry of Finance; the

relevant clearances have not been, and will not be, obtained for

the South Africa Reserve Bank or any other applicable body in the

Republic of South Africa in relation to the Placing Shares and the

Placing Shares have not been, nor will they be, registered under or

offering in compliance with the securities laws of any state,

province or territory of Australia, Canada, the Republic of South

Africa or Japan. Accordingly, the Placing Shares may not (unless an

exemption under the relevant securities laws is applicable) be

offered, sold, resold or delivered, directly or indirectly, in or

into Australia, Canada, the Republic of South Africa, or Japan or

any other jurisdiction in which such activities would be

unlawful.

This Announcement contains forward-looking statements.

Forward-looking statements are not historical facts but are based

on certain assumptions of management regarding our present and

future business strategies and the environment in which we will

operate, which the Company believes to be reasonable but are

inherently uncertain, and describe the Company's future operations,

plans, strategies, objectives, goals and targets and expectations

and future developments in the markets. Forward-looking statements

typically use terms such as "believes", "projects", "anticipates",

"expects", "intends", "plans", "may", "will", "would", "could" or

"should" or similar terminology. Any forward-looking statements in

this Announcement are based on the Company's current expectations

and, by their nature, forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond the

Company's control, that could cause the Company's actual results

and performance to differ materially from any expected future

results or performance expressed or implied by any forward-looking

statements. As a result, you are cautioned not to place undue

reliance on such forward-looking statements. Past performance

should not be taken as an indication or guarantee of future

results, and no representation or warranty, express or implied, is

made regarding future performance. Some of the information is still

in draft form and will only be finalised, if legally verifiable, at

a later date. The Company undertakes no obligation to release the

results of any revisions to any forward-looking statements in this

Announcement that may occur due to any change in its expectations

or to reflect events or circumstances after the date of this

Announcement, unless required to do so by applicable law or

regulation, and the parties named above disclaim any such

obligation.

Berenberg and its affiliates may have engaged in transactions

with, and provided various commercial banking, investment banking,

financial advisory transactions and services in the ordinary course

of their business with the Company and/or its affiliates for which

they would have received customary fees and commissions. Berenberg

and its affiliates may provide such services to the Company and/or

its affiliates in the future.

This Announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by

Berenberg or by any of its affiliates or any person acting on its

or their behalf as to, or in relation to, the accuracy or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed.

This Announcement does not constitute a recommendation

concerning any investor's investment decision with respect to the

Placing. Any indication in this Announcement of the price at which

ordinary shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. The price of shares

and any income expected from them may go down as well as up and

investors may not get back the full amount invested upon disposal

of the shares. Past performance is no guide to future performance.

The contents of this Announcement are not to be construed as legal,

business, financial or tax advice. Each investor or prospective

investor should consult his, her or its own legal adviser, business

adviser, financial adviser or tax adviser for legal, financial,

business or tax advice.

The Placing Shares to be issued or sold pursuant to the Placing

will not be admitted to trading on any stock exchange other than

the London Stock Exchange.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this Announcement.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

Berenberg is authorised and regulated by the German Federal

Financial Supervisory Authority and is authorised, and subject to

limited regulation by, the FCA in the United Kingdom. Berenberg is

acting exclusively for the Company and no one else in connection

with the contents of this Announcement and other matters described

in this Announcement and will not regard any other person as its

client in relation to the content of this Announcement and other

matters described in this Announcement and will not be responsible

to anyone other than the Company for providing the protections

afforded to its clients or for providing advice to any other person

in relation to the content of this Announcement or any other

matters referred to in this Announcement.

Notice to Distributors

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that the Placing Shares are: (i)

compatible with an end target market of retail investors and

investors who meet the criteria of professional clients and

eligible counterparties as defined in paragraph 3 of the FCA

Handbook Conduct of Business Sourcebook; and (ii) eligible for

distribution through all distribution channels to professional

clients and eligible counterparties (the "UK Target Market

Assessment").

Notwithstanding the UK Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom.

The UK Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the UK Target Market Assessment, Berenberg

will only procure investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the UK Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of the UK Product Governance Requirements; or (b)

a recommendation to any investor or group of investors to invest

in, or purchase, or take any other action whatsoever with respect

to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Capitalised terms used but not defined in this Announcement have

the meaning given in the Placing Announcement unless otherwise

stated.

The information below set out in accordance with the requirement

of Market Abuse Regulation (EU) NO. 596/2014, including as it forms

part of domestic law in the United Kingdom by virtue of the

European Union (Withdrawal) Act 2018 provides further detail.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIFEMFAFEDSEFE

(END) Dow Jones Newswires

December 21, 2023 13:17 ET (18:17 GMT)

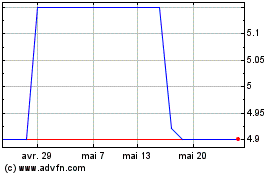

Tinybuild (LSE:TBLD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Tinybuild (LSE:TBLD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024