Tekcapital plc Acquisition of InventionEvaluator.com (1405N)

23 Juillet 2014 - 3:51PM

UK Regulatory

TIDMTEK

RNS Number : 1405N

Tekcapital plc

23 July 2014

Tekcapital plc

("Tekcapital" or "the Company")

Tekcapital Acquires InventionEvaluator.com

to Support and Expand Corporate and University IP Service

offerings

Tekcapital plc (AIM: TEK), an international provider of

technology and IP services, is pleased to announce the acquisition

of InventionEvaluator.com ("Invention Evaluator") and related

intellectual property assets, including its website and client list

(the "Acquisition") from Keon Research LLC and Ion Corp Pty

Limited. The Acquisition is expected to be earnings enhancing in

its first full year under Tekcapital's ownership and add forward

revenue and profit to the Company in the near-term.

Strategic Rationale

As set out in its IPO Admission Document, as part of

Tekcapital's growth strategy, the Company has been seeking to add

additional services and expand its business, both organically and

through accretive acquisitions. The Directors believe that the

Acquisition meets this criterion and adds an important new product

that is a useful follow-on service to Tekcapital's existing service

offering and will also be sold as a stand-alone product.

Tekcapital's existing offering provides its retained clients

with a complete turnkey solution to locate, screen and acquire

technologies available for acquisition from the world's leading

universities and research institutions across 160 countries. Once a

suitable technology acquisition opportunity has been identified,

the Company evaluates the IP through its expert Science Advisory

Board and can then, if required, act as an intermediary between the

client and the university or research institution with a view to

the acquisition or licensing of the specific technology.

Invention Evaluator will integrate with Tekcapital's existing

offering and enable Tekcapital to provide its clients with in-depth

analytical reports that assess the commercial potential of new

technologies and intellectual properties ("IP"). The bespoke

reports enable companies and universities world-wide to make more

informed decisions regarding investments in new technologies. For

Tekcapital's existing customers, Invention Evaluator's reports will

allow them to better understand the market potential for a new

technology acquisition candidate. In addition to Tekcapital's

existing and target customer base of IP acquisitive companies, the

Directors believe that Invention Evaluator's product will be of

interest to universities and research institutions and as a result

will expand Tekcapital's relationships with these

organisations.

Invention Evaluator was launched in 2010 by a company owned and

operated by Dr. Michael Manion. Invention Evaluator has to-date

served about 250 clients world-wide. Following the completion of

the Acquisition, Dr. Manion and his team will continue to provide

Invention Evaluator reports exclusively for Tekcapital.

Terms of the acquisition

Consideration in respect of the acquisition will be satisfied by

the issue of 879,770 new ordinary shares in Tekcapital plc (the

"Consideration Shares"). The Consideration Shares will be subject

to lockup restrictions preventing their sale for a period of 12

months from the date of completion. Following completion of the

Acquisition, the assets will be held via Tekcapital's wholly owned

U.S. subsidiary, Tekcapital LLC. Under the ownership of its

developer, Invention Evaluator had not yet become profitable.

Within the overall suite of Tekcapital's offering it will be given

a wider market exposure and the aim is for it to contribute

significantly.

Application has been made for the Consideration Shares to be

admitted to trading on AIM and dealings are expected to commence on

29 July 2014.

Total voting rights

Following admission of the Consideration Shares, Tekcapital's

total issued and voting share capital will comprise of 23,383,747

ordinary shares. This figure may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, securities of the Company.

Commenting on the acquisition, Dr. Clifford Gross, Executive

Chairman of Tekcapital plc, said:

"We are very pleased to announce the acquisition of

InventionEvaluator.com and believe that this unique service will be

of benefit to current and future clients seeking to understand the

marketplace value of new technology acquisitions.

"This transaction underscores our commitment to growing our

business through the acquisition of synergistic, scalable services

that help our clients profit from university technologies."

Dr. Michael Manion, the founder of Invention Evaluator,

added:

"We are enthusiastic about the transaction and believe that by

working with Tekcapital we will be able to grow faster and

penetrate additional markets with our service offering."

To learn more about Invention Evaluator please visit

www.inventionevaluator.com

- ENDS-

For further information please contact:

Tekcapital Plc via FTI Consulting, LLP

Clifford Gross, Executive Chairman cgross@tekcapital.com

Malcolm Groat, Finance Director mgroat@tekcapital.com

Northland Capital Partners Limited (NOMAD & Broker) +44 (0) 20 7382 1100

Louis Castro / Lauren Kettle (Corporate Finance) lcastro@northlandcp.co.uk

John Howes / Alice Lane (Corporate Broking)

Optiva Securities Limited (Co-Broker) +44 (0) 20 3137 1904

Jeremy King / Vishal Balasingham jeremy.king@optivasecurities.com

FTI Consulting, LLP +44 (0) 20 3727 1000

Chris Lane / Emma Appleton / Roger Newby chris.lane@fticonsulting.com

* * * * *

About Tekcapital plc - The World's Largest University Network

for Open Innovation

Tekcapital helps clients profit from new, university-developed

intellectual properties. With our proprietary discovery search

engine, linked to 3,300+ universities in 160 countries, coupled

with expert scientific review, we provide a turn-key service to

make it easy for clients to find and acquire the IP they need to

create a competitive advantage. Tekcapital plc is listed on the AIM

market of the London Stock Exchange (AIM: symbol TEK) and is

headquartered in Oxford, in the UK. For more information, please

visit www.tekcapital.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQUOVORSRABUAR

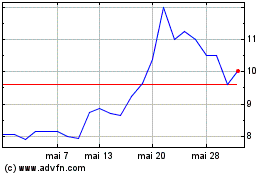

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024