Tekcapital plc Trading Update (6313X)

21 Novembre 2014 - 8:00AM

UK Regulatory

TIDMTEK

RNS Number : 6313X

Tekcapital plc

21 November 2014

21 November2014

Tekcapital Plc

("Tekcapital", "the Company" or "the Group")

Trading update

- Tekcapital announces strategy to purchase disruptive IP

opportunities for future value creation -

Tekcapital plc (AIM: TEK), an international provider of

technology and intellectual property services, is pleased to

provide the following update on trading for the year ending 30

November 2014.

Tekcapital is making solid progress against many of the

strategic objectives set out at the time of the Group's admission

to AIM. The Group continues to scale the business and has secured

several new clients in the North American market, including three

within the Fortune 1000 spanning the automotive, healthcare and

food and beverage industries, with negotiations continuing with a

number of potential additional customers. As of 20 November 2014,

the Group had secured 15 retained clients, which represents growth

of over 100 per cent since the Group joined AIM in Q2 2014.

The Group has not yet completed any technology transfers and now

considersthere to be less predictability on the timing of such

revenues than anticipated at the time of the IPO. In light of this,

the Directors have been focusing on adding new clients with

recurring monthly revenue and implementing a per report, variable

costs structure that is scalable while reducing fixed operating

costs. This has reduced the Company's monthly fixed costs

considerably, as a result of which, while revenue for the year will

be significantly lower than anticipated, the loss at an operating

level is likely to be broadly in line with market expectations.

Through the acquisition of Invention Evaluator, announced on 23

July 2014, the Group has added an additional service for clients

seeking to determine the marketability of new technologies they are

considering investing in. In the month of October 2014, the Group

received paid orders for 89 Invention Evaluator reports. This

strong order book compares to 36 reports sold in the month of

October 2013 and management anticipates orders for November 2014 to

be above the levels in the same month in 2013.

To enhance the Group's ability to address new client needs, Dr.

Alan Naidoff has recently been appointed as an additional Managing

Director of Technology Transfer. Dr. Naidoff was formerly the

Director, Discovery Transactions, Business Development &

Licensing at Merck Sharp & Dohme Corp.

Tekcapital, through the combination of its Innovation Discovery

Network ("IDN") and leveraging the knowledge of its Science

Advisory Board to evaluate specific IP opportunities, has

unrivalled access to a significant number of potentially disruptive

technologies. Given this insight and the ability to immediately

source and acquire these IP opportunities, Tekcapital will now seek

to augment its offering by entering into agreements with

universities and research centres to purchase the exclusive

licences for certain potentially disruptive Intellectual Property

rights. The Group intends to fund these highly selective

acquisitions by the issuance of new shares in Tekcapital and, where

appropriate, may also satisfy the purchase consideration from

existing cash resources.

All potential acquisitions will be carefully evaluated and will

not utilise a significant portion of the Group's cash balances. The

Group anticipates that any acquisition will be of a modest

expenditure and will not have a material impact on the Group's cash

position over time. Tekcapital will realise value from these

technologies by seeking to sell-on the rights to these unique

assets to businesses and commercial enterprises.

Commenting on the announcement, Dr. Clifford Gross, Executive

Chairman of Tekcapital plc, said:

"Tekcapital is delivering against the strategy that we set out

when we joined AIM earlier this year. Notwithstanding that we have

not yet closed our first technology transfer, we have significantly

increased our retained customer base and the fact that globally

recognisable Fortune 1000 companies are working with us we believe

is testament to both the need for our offering and our

professionalism. We are currently in contract negotiations with a

number of companies in the US, Europe and Asia which we expect to

have a significant impact on total client numbers, a key metric for

the Company, in future reporting periods. Additionally, the

acquisition of Invention Evaluator has expanded our service

offering and client base and is already generating top line revenue

and profit. We remain confident on the future growth prospects of

our unique business and the strategic opportunities before us."

For further information please contact:

Tekcapital Plc +44 (0) 1865 261445

Malcolm Groat, Finance Director mgroat@tekcapital.com

Northland Capital Partners Limited

(NOMAD & Broker) +44 (0) 20 7382 1100

William Vandyk / Lauren Kettle (Corporate

Finance) lkettle@northlandcp.co.uk

John Howes / Alice Lane (Corporate

Broking)

Optiva Securities Limited (Co-Broker) +44 (0) 20 3137 1904

Jeremy King / Vishal Balasingham jeremy.king@optivasecurities.com

FTI Consulting, LLP +44 (0) 20 3727 1000

Chris Lane / Emma Appleton / Roger

Newby tekcapital@fticonsulting.com

Tekcapital plc - The World's Largest University Network for Open

Innovation

Tekcapital helps clients profit from new, university-developed

intellectual properties. With our proprietary discovery search

engine, linked to 3,300+ universities in 160 countries, coupled

with expert scientific review, we provide a turn-key service to

make it easy for clients to find and acquire the IP they need to

create a competitive advantage. Tekcapital plc is listed on the AIM

market of the London Stock Exchange (AIM: symbol TEK) and is

headquartered in Oxford, in the UK. For more information, please

visit www.tekcapital.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTPGGGCGUPCPUU

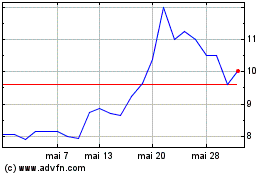

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024