TIDMTEK

RNS Number : 6743X

Tekcapital plc

14 August 2018

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

14 August 2018

Tekcapital plc

("Tekcapital", "the Company" or "the Group")

Half Yearly Report

for the period ending 31 May 2018

Tekcapital plc (AIM: TEK) a UK intellectual property (IP)

investment group focused on creating marketplace value from

university technology announces its results for the six month

period ended 31 May 2018.

Financial highlights

-- Total revenue of US$1,278,413

o Revenue from services increased by c. 29% to US$639,561 (H1

2017: $495,876(1) ) reflecting continued growth of technology

transfer services

o Net increase of US$638,852 in fair value of portfolio

companies

-- Profit before tax of US$105,996 compared to profit of

US$1,554,796 in H1 2017, with the change primarily due to

first-time recognition of fair value of portfolio companies in H1

2017.

-- Cash balance of US$1,418,889 (30 November 2017:US$1,797,729) and no debt

-- Net assets up 35% at 31 May 2018: US$10,746,031 (H1 2017: 7,974,906)

-- Net asset per share at 31 May 2018: US$0.25 (H1 2017: US$0.19).

Operational highlights: Corporate

-- Investment in the Latin America market has resulted in the

expansion of Invention Evaluator (IE) sales and business

relationships with the following universities and

organisations:

o Universidad San Sebastian

o Universidad Mayor

o Fundacion COPEC

o Universidad Adolfo Ibañez

o Andes Pacific Technology Access Hub

o Corfo (Chilean economic development agency)

o Universidad Federico Santa María

o INACAP

o Universidad Santiago de Chile

-- Global expansion of our technology transfer services was

aided by the addition of new lines of sales:

o Invention Evaluator has developed a new report at the request

of StartUp Chile, the leading startup accelerator in Latin America.

Start-Up Chile supports several hundred companies a year, and these

reports would assist their start-up companies on an on-going basis.

Management believes this new IE report will further strengthen

growth in services revenue in future periods.

o Successfully developed and delivered an advanced technology

commercialization programme in Santiago, Chile with HUB APTA and

the Chilean Biotechnology Association. This programme will provide

training services, Invention Evaluator reports and our software

apps to our Chilean customers. The programme included participants

from 13 Chilean research universities and two other research

institutions. The sponsor of this unique programme was the Chilean

government Agency CORFO, the main Chilean agency focused on

entrepreneurship, innovation and competitiveness. University

training programmes represent a new line of service business for

Tekcapital, and we are optimistic about delivering more of them in

future periods.

-- Tekcapital has recently appointed Michael S Rosen as Managing

Director of Academic & Entrepreneurship Training to accelerate

the growth of our Latin America business. Mr. Rosen has worked with

leading research universities where he has trained university

faculty on the creation of start-ups. Previously, he held senior

management positions with Fortune 500 companies such as Pfizer,

Bristol-Myers Squibb and Searle/Monsanto. Mr. Rosen also spent 12

years as President/CEO of European and U.S. biotech and medical

device companies. He is fluent in both Spanish and Portuguese.

Operational highlights: Portfolio Companies

-- Belluscura has reported continued progress with its portable

oxygen concentrator (POC) programme. The POC market is currently

projected to reach US$1.7b by 2022. Belluscura plans to file a

510(K) application with the US FDA in 2018. Tekcapital's ownership

interest in Belluscura is now 8,129,488 shares, representing

approximately 33% of the issued share capital.

-- During the reporting period, Belluscura plc completed a

private funding round raising gross proceeds of US$1.33 million, by

way of a placing (the Belluscura Placing) of a total of 7,388,179

new ordinary shares of GBP0.13p each (the Belluscura Placing

Shares). Tekcapital has invested US$250,000 in the private

placement and converted loans to Belluscura of US$210,090 to

equity. Tekcapital also received a three-year warrant to purchase

1,273,078 new shares in Belluscura at GBP0.13p per share.

-- As announced on 5 February 2018, Belluscura also added a Vice

President of Operations, Dr. Paul Bray, PhD. Amongst other duties

Dr. Bray is working on the FDA clearance process. To learn more,

please visit www.belluscura.com.

-- Lucyd pte ltd ("Lucyd") completed a Token Generation event

(TGE) to secure contributions of approximately $6m for the

development of augmented reality (AR) smartglasses and execution of

its business plan. Lucyd is seeking to introduce a prototype AR

product in March 2019. The market for AR is expected to grow to

US$36.4b by 2023 according to Greenlight Insights. Lucyd recently

announced it has appointed Gina Avila as Global Marketing

Manager.

-- Lucyd pte ltd announced on 4 July 2018 that Lucyd Pte Ltd has

appointed Dr Ira A. Clement, a licensed optometrist, as a science

advisor.

-- Lucyd has filed a new Patent Application No. 16/022,097 to

improve the utility of Augmented Reality glasses. The application

is directed to smartglasses, with prescription lenses, and methods

to control the presentation and display of information related to

mobile device tasks that can be performed with these

smartglasses.

-- On August 3, 2018 Lucyd launched an eShop to make it easy for

anyone to acquire advanced prescription eyewear or smart glasses

and to create, share and experience AR content. The eShop is the

first online optics store to provide prescription filled, bone

conducting, Bluetooth enabled eyeglasses that enable the wearer to

answer their phone, listen to music and communicate with Siri(R) or

other similar AI apps. To learn more, please visit

www.lucyd.co.

-- Salarius has developed a patented process for producing

nano-particle edible salt crystals. Independent tests have shown

that the use of its edible salt crystals for topical food

applications can deliver the same taste but half of the sodium

versus traditional salt. The mission of Salarius is to

commercialize low-sodium Microsalt to improve the nutritional

content of food and the health of individuals worldwide. To achieve

this mission, the company is exploring the launch of both a

low-sodium table salt and the establishment of a reduced sodium

snack brand. The low sodium ingredient market is estimated to reach

US$1.76bn by 2025 according to Future Market Insights.(2)

-- Salarius announced on 22 May 2018 that it has also added

Eduardo Souchon and Steve McCready to its board of directors, both

with relevant Fortune 500 company experience.

-- Victor H. Manzanilla has been appointed as CEO of Salarius as

announced on 1 August 2018. Mr Manzanilla has previously served as

founder of VHM Global Research, Marketing Director of Office Depot

(office products chain with approximately 1,400 stores) and Brand

Manager at Procter & Gamble (NYSE: PG) amongst other executive

positions. Additionally, Mr Manzanilla has purchased 2.5% of the

shares of Salarius through his consulting firm VHM Global Research

for $50,000.

Dr. Clifford Gross, Chairman said: 'We are pleased to report

successful half-year performance for the Group, which has noted

increases in service revenue while achieving important development

milestones for the successful commercialization of technologies for

three of its portfolio companies. We believe our unique approach of

acquiring and commercialising university IP innovations, coupled

with providing a range of IP value creation services to

universities and corporates, has uniquely positioned us to create

market value from university discoveries more efficiently than

traditional IP investment companies.'

For further information, please contact:

Tekcapital Plc Via Walbrook PR

Clifford M. Gross, Ph.D.

finnCap Ltd (Nominated Adviser and Joint

Broker) +44 (0) 20 7220 0500

Geoff Nash/ Max Bullen-Smith (Corporate

Finance)

Camille Gouchez (ECM)

Dowgate Capital Stockbrokers (Joint Broker) +44 (0) 1293 517744

David Poutney / James Serjeant

Walbrook PR Ltd +44 (0) 20 7933 8780

Paul Cornelius / Helen Cresswell / Sam tekcapital@walbrookpr.com

Allen

Tekcapital plc - The World's Largest University Network for Open

Innovation

Tekcapital's objective is to create value from investing in new,

university-developed intellectual properties. Additionally, using

its proprietary discovery search engine, linked to 4,500+

universities in 160 countries, coupled with expert scientific

review, Tekcapital provides a range of IP investment services to

make it easy for organisations to find, evaluate and acquire

university-developed technology. Tekcapital plc is quoted on the

AIM market of the London Stock Exchange (AIM: symbol TEK) and is

headquartered in Oxford, in the UK. For more information, please

visit www.tekcapital.com.

LEI: 213800GOJTOV19FIFZ85

CHAIRMAN STATEMENT

Summary

Tekcapital is passionate about creating value from university

intellectual property ("IP"). During the past half-year we have

made good progress.

The Group seeks to create value from its ability to identify and

acquire promising new university IP, which management believes is

ready to be commercialised, in addition to providing technology

transfer investment services. In the first half of 2018, we

continued to increase our revenues from services while undertaking

significant efforts to improve the value of our portfolio

companies.

We delivered the following technology transfer investment

services for our corporate and university clients which provided

revenue from services of US$639,561 in the period, excluding our

portfolio companies and product sales:

Invention Discovery Identify university IP available for

license. Our bespoke reports create a pipeline of compelling

university IP for potential acquisition or licensing candidates

Invention Evaluator Assess the market potential of new

technology. An on-line service providing objective analysis for new

IP

Vortechs Group Technology transfer experts for hire. More than a

decade of experience in finding the right technology transfer

professionals for universities and others, worldwide

IP Search App Global university IP search app. Instantly search

worldwide university PCT (Patent Corporate Treaty) applications and

patents on your smartphone.

TEK Training Services Foundational training to individuals,

professional teams, new tech transfer offices and government

agencies to enhance their ability to commercialize university

innovations.

These services provide the dual benefit of strengthening our IP

supplier network, which we view as a competitive advantage, while

generating service revenues to reduce our operating expenses. These

services include our original Invention Discovery service,

strengthened by two business and product acquisitions and the

development of a new search App.

In 2018, the Group has continued systematic offering and

geographical expansion, resulting in the increase in service

revenue. The Group's investment in new markets, such as Latin

American, as well as new offerings including university trainings

and IE startup reports provides further growth opportunities.

Tekcapital also recently added Michael S Rosen, an executive with

relevant experience gathered in Fortune 500 companies, as Managing

Director of Academic & Entrepreneurship Training to accelerate

growth of our Latin America business. The Group's goal is to

continue to expand its current services in Latin America and

Europe.

In addition to the above, the Group seeks to create value from

its ability to identify and acquire promising new university IP,

which management believes is ready to be commercialised. This is

achieved through the establishment of portfolio companies coupled

with the acquisition of the proprietary IP rights. Our goal as a

business is to use our global university network, combined with our

science advisory board, to acquire the rights to additional high

value intellectual properties. Utilising these properties, we then

seek to produce meaningful returns on invested capital that exceed

our cost of capital.

Consistent with these objectives, our portfolio companies have

developed materially during the reporting period.

We are sincerely appreciative of our dedicated, creative and

hardworking team that is continuously striving to enhance the value

of Tekcapital and thankful to our shareholders for their interest,

patience and support.

Current Trading and Outlook

Having continued to develop and expand Tekcapital's existing

business, the Board is confident that continued investment in

growth and our portfolio companies remains the right strategy.

Further, we believe that we are executing on our strategy and this

is likely to result in further increases in returns on invested

capital, and profitability in the future. Whilst it is clear that

the Company is progressing well we anticipate fluctuations in our

net asset values from period to period due to individual portfolio

company performance, valuations and changes in market conditions

and macro-economic financial conditions.

Because of the quickening pace of innovation, an increasing

number of companies are making ever faster and more disruptive use

of innovative ideas sourced exogenously. We believe this should

result in increased service revenues in the future and enhancement

of the combined value of our portfolio companies.

Dr Clifford M Gross

Chairman and CEO

13 August 2018

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 May 2018

Notes Six months Six months Year ended

ended 31 May ended 31 30 November

2018 May 2017 2017

Unaudited Unaudited Audited

US$ US$ US$

Continuing Operations

Revenue from services 639,561 495,876 813,714

Revenue from products - 139,453 139,453

Net unrealised profit

on the revaluation of

investments 8 638,852 2,944,193 6,083,225

Profit on derecognition

of subsidiaries - 226,656 226,656

-------------- ------------------- -------------

Total Revenue 1,278,413 3,806,178 7,263,048

Cost of sales (371,774) (502,618) (692,610)

Gross Profit 906,639 3,303,560 6,570,438

Administrative expenses (800,643) (1,748,764) (2,417,284)

Operating Profit/(Loss) 105,996 1,554,796 4,153,154

Finance income - - -

Gain/(Loss) before taxation 105,996 1,554,796 4,153,154

Income tax expense 5 (1,194) (1,406) (1,406)

-------------- -------------------

Gain/(Loss) after taxation 104,802 1,553,390 4,151,748

============== =================== =============

Other comprehensive income/(loss)

Foreign exchange gain/(loss) (51,796) 359,983 424,230

Total comprehensive income/(loss) 53,006 1,913,373 4,575,978

============== =================== =============

Gain/(Loss) attributable

to:

Equity holders of the

parent 104,802 1,785,585 4,487,533

Non-controlling interests - (232,195) (335,785)

-------------- ------------------- -------------

104,802 1,553,390 4,151,748

Total comprehensive income/(loss)

attributable to:

Equity holders of the

parent 53,006 2,041,863 4,808,059

Non-controlling interests - (128,490) (232,081)

-------------- ------------------- -------------

53,006 1,913,373 4,575,978

Gain/(Loss) per share 6

Basic earnings per share 0.002 0.044 0.108

Diluted earnings per

share 0.002 0.043 0.108

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 May 2018

Notes As at 31 As at 31 As at 30 November 2017

May 2018 May 2017

Unaudited Unaudited Audited

US$ US$ US$

Assets

Non-current assets

Intangible assets 7 838,769 841,727 838,769

Financial assets at fair value through profit and

loss 8 8,411,856 4,148,349 7,307,696

Property, plant and equipment 41,435 4,624 6,005

----------- ---------------- -----------------------

9,292,060 4,994,700 8,152,470

Current Assets

Trade and other receivables 345,157 440,711 963,911

Inventory - - -

Cash and cash equivalents 1,418,889 3,135,803 1,797,729

----------- ---------------- -----------------------

1,764,046 3,576,514 2,761,640

Total Assets 11,056,106 8,571,214 10,914,110

=========== ================ =======================

Liabilities

Current liabilities

Trade and other payables 309,575 595,808 237,649

Current income tax liabilities 500 500 500

Loans and borrowings - - -

----------- ---------------- -----------------------

Total liabilities 310,075 596,308 238,149

Net Assets 10,746,031 7,974,906 10,675,961

Equity

Share capital 9 264,221 264,221 264,221

Share premium 9 9,271,098 9,271,098 9,271,098

Retained earnings 1,053,692 (1,704,982) 931,826

Translation reserve 229,189 216,738 280,985

Merger reserve (72,169) (72,169) (72,169)

Total equity attributable to equity holders of the

parent 10,746,031 7,974,906 10,675,961

Non-controlling interests - - -

Total Equity and Liabilities 11,056,106 8,571,214 10,914,110

=========== ================ =======================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 31 May 2018

Attributable to equity holders of the parent

---------------------------------------------

Share Share Translation Merger Retained Total Non-controlling Total

capital Premium Reserve Reserve Earnings interest Equity

US$ US$ US$ US$ US$ US$ US$ US$

Unaudited

Balance at 1

December 2017 264,221 9,271,098 280,985 (72,169) 931,826 10,675,961 - 10,675,961

Comprehensive

income

Profit for the

period - - - - 104,802 104,802 - 104,802

Other

comprehensive

income - - (51,796) - - (51,796) - (51,796)

Share based

payments - - - - 17,064 17,064 - 17,064

Issue of - - - - - - - -

ordinary shares

Warrants - - - - - - - -

exercised

Balance at 31 May

2018 264,221 9,271,098 229,189 (72,169) 1,053,692 10,746,031 - 10,746,031

======== ========== ============ ========= ============ =========== ================ ===========

Unaudited

Balance at 1

December 2016 228,052 6,377,383 (39,540) (72,169) (3,778,052) 2,715,674 421,400 3,137,074

Comprehensive

income

Profit for the

period - - - - 1,785,585 1,785,585 (232,195) 1,553,390

Other

comprehensive

income - - 256,278 - - 256,278 103,705 359,983

Share based

payments - - - - 31,868 31,868 - 31,868

Issue of ordinary

shares 34,879 2,814,385 - - - 2,849,264 - 2,849,264

Warrants

exercised 1,290 79,330 - - - 80,620 - 80,620

New funds into

non-controlling

interest - - - - - - 323,300 323,300

(Loss)/Gain

arising from

change in

non-controlling

interest - - - - 255,617 255,617 (255,617) -

Elimination of

NCI as a result

of change in the

accounting

policy - - - - - - (360,593) (360,593)

-------- ---------- ------------ --------- ------------ ----------- ---------------- -----------

Balance at 31 May

2017 264,221 9,271,098 216,738 (72,169) (1,704,982) 7,974,906 - 7,974,906

======== ========== ============ ========= ============ =========== ================ ===========

Share Share Translation Merger Retained Earnings Total Non-controlling Total

capital Premium Reserve Reserve interest Equity

US$ US$ US$ US$ US$ US$ US$ US$

Audited

Balance at 30

November 2016 228,052 6,377,383 (39,540) (72,169) (3,778,052) 2,715,674 421,400 3,137,074

Share issue 34,879 3,017,010 3,051,889 3,051,889

Cost of share

issue - (202,625) - - - (202,625) - (202,625)

Gain/(loss) for

the year - - - - 4,487,533 4,487,533 (335,785) 4,151,748

Other

comprehensive

income - - 320,525 - - 320,525 103,705 424,230

Share based

payments - - - - 70,318 70,318 - 70,318

Warrants

exercised 1,290 79,330 - - - 80,620 - 80,620

New funds into

non-controlling

interest - - - - - - 323,300 323,300

Gain/(loss)

arising from

change in NCI - - - - 152,026 152,026 (152,026) -

Derecognition of

NCI as a result

of change in the

accounting

policy - - - - - - (360,593) (360,593)

-------- ---------- ------------ --------- ------------------- ----------- ---------------- -----------

Balance at 30

November 2017 264,221 9,271,098 280,985 (72,169) 931,826 10,675,961 - 10,675,961

-------- ---------- ------------ --------- ------------------- ----------- ---------------- -----------

Share capital represents the amount subscribed for share capital

at nominal value.

Share premium represents the amount subscribed for share capital

in excess of nominal value and net of any directly attributable

issue costs.

The merger reserve arose on the share for share exchange

undertaken by the Company with Tekcapital Europe Limited on 18

February 2014.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 31 May 2018

Six months Six months For the

ended ended year ended

Group Note 31 May 2018 31 May 30 Nov

2017 2017

US $ US $ US $

------------------------------------ -------- ----------------------- ------------- ------------

Cash flows from operating

activities

Cash used in operations (345,397) (1,363,134) (2,739,179)

Taxation paid (1,994) (1,406) (2,206)

Net cash used in operating

activities (347,391) (1,364,540) (2,741,385)

---------------------------------------------- ----------------------- ------------- ------------

Cash flows from investing

activities

Deemed disposal of subsidiary,

net of cash acquired - (596,176) (596,176)

Purchases of property, plant

and equipment (44,558) (3,733) (15,755)

Purchases of intangible assets - (43,132) (43,277)

Interest received - - -

Net cash used in investing

activities (44,558) (643,041) (655,208)

Cash flows from financing

activities

Proceeds from issuance of

ordinary shares - 3,051,889 3,051,889

Costs of raising finance - (202,625) (202,625)

Proceeds from the exercise

of warrants - 80,620 80,620

Cash from non-controlling

interest - 323,300 323,300

Net cash from financing activities - 3,253,184 3,253,184

---------------------------------------------- ----------------------- ------------- ------------

Net (decrease)/increase in

cash and cash equivalents (391,950) 1,245,603 (143,410)

Cash and cash equivalents

at beginning of year 1,797,729 1,839,603 1,839,603

Exchange gain/(loss) on cash

and cash equivalents 13,110 50,597 (101,536)

Cash and cash equivalents

at end of year 1,418,889 3,135,803 1,797,729

---------------------------------------------- ----------------------- ------------- ------------

Notes to the financial information

1. General information

Tekcapital PLC is a company incorporated in England and Wales

and domiciled in the UK. The address of the registered office is 12

New Fetter Lane, London, United Kingdom, EC4A 1JP. The Company is a

public limited company, which is listed on the AIM market of the

London Stock Exchange in 2014.

The principal accounting policies applied in the preparation of

these consolidated financial statements are set out below. These

policies have been consistently applied to all the years presented,

unless otherwise stated.

2. Basis of preparation

The financial information for the six months ended 31 May 2018

set out in this interim financial information is unaudited and does

not constitute statutory financial statements.

The interim condensed financial information has been presented

in US Dollars ("$").

3. Accounting policies

3.1 Statement of compliance

The accounting policies applied by the Group in these unaudited

half year results are consistent with those applied in the annual

financial statements for the year ended 30 November 2017.

The financial statements of Tekcapital PLC Group have been

prepared in accordance with International Financial Reporting

Standards (IFRS) and IFRS Interpretations Committee (IFRS IC) as

adopted by the European Union and the Companies Act 2006 applicable

to companies reporting under IFRS. The financial statements have

been prepared under the historical cost convention.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It

requires management to exercise its judgement in the process of

applying the Group's accounting policies. The areas involving a

higher degree of judgment or complexity, or areas where assumptions

and estimates are significant to the consolidated financial

statements are disclosed in note 4 of the FY 2017 accounts. The

estimates have not changed since then other than addition of the

new estimates related to valuation of Salarius Ltd as disclosed in

Note 8, including relevant sensitivity analysis.

4. Going concern

The Group meets its day to day working capital requirements

through its service offerings, bank facilities and monies raised in

follow-on offerings. The Group's forecasts and projections indicate

that the Group has sufficient cash reserves to operate within the

level of its current facilities, if the group forecasts are not

achieved the Directors are confident that additional funds could be

raised through equity issues if required. After making enquiries,

the Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future.

The Company therefore continues to adopt the going concern basis

in preparing both its consolidated financial statements and for its

own financial statements.

5. Taxation

Immaterial charge of $1,194 has arisen in the six-month period

ended 31 May 2018 (31 May 2017: $1,406).

6. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of Ordinary Shares outstanding during the period.

Diluted earnings per share is calculated by dividing the

earnings attributable to ordinary shareholders by the sum of

weighted average number of (1) Ordinary Shares outstanding during

the period and (2) Ordinary Shares to be issued assuming exercise

of outstanding stock options with intrinsic value above $0 at 31

May 2018.

Six months Six months Year ended 30 November 2017

ended 31 May 2018 ended 31 May 2017

US$ US$ US$

Profits/(Losses) attributable to

equity holders of the Company 104,802 1,785,585 4,487,533

Weighted average number of Ordinary

Shares in issue:

Basic 42,654,707 41,001,118 41,512,012

Diluted 42,654,707 41,264,580 41,718,262

Basic profit (loss) per share ($) 0.002 0.044 0.108

Diluted profit (loss) per share ($) 0.002 0.043 0.108

7. Intangible Assets

Purchased intangible assets

-------------------------------------------------

Website Vortechs Invention

Licenses development US $ Evaluator Total

US $ US $ US $ US $

------------------------------ ----------- ------------- --------- ----------- ----------

Costs

At 1 December 2016 621,871 26,002 500,000 333,815 1,481,688

Additions 35,973 - - 7,159 43,132

Disposals (657,989) (657,989)

At 31 May 2017 - 26,002 500,000 340,974 866,976

------------------------------ ----------- ------------- --------- ----------- ----------

At 1 December 2016 621,871 26,002 500,000 333,815 1,481,688

Additions 36,118 - - 7,159 43,277

Disposals (657,989) (2,205) (660,194)

Exchange difference - 2,119 - - 2,119

At 30 November 2017 - 28,121 500,000 338,769 866,890

------------------------------ ----------- ------------- --------- ----------- ----------

Additions - - - - -

At 31 May 2018 - 28,121 500,000 338,769 866,890

------------------------------ ----------- ------------- --------- ----------- ----------

Accumulated amortisation

and impairment

At 1 December 2016 (51,781) (20,149) - - (71,930)

Amortisation for the

period (20,955) (4,370) - - (25,325)

De-recognition due

to the change in the

accounting policy 72,736 - - - 72,736

Exchange difference - (730) - - (730)

At 31 May 2017 - (25,249) - - (25,249)

------------------------------ ----------- ------------- --------- ----------- ----------

As 1 December 2016 (51,781) (20,149) - - (71,930)

Amortisation for the

period (20,955) (5,994) - - (26,949)

Disposals 72,736 72,736

Foreign currency translation - (1,978) - - (1,978)

At 30 November 2017 - (28,121) - - (28,121)

------------------------------ ----------- ------------- --------- ----------- ----------

Amortisation for the - - - - -

period

De-recognition due - - - - -

to the change in the

accounting policy

Foreign currency translation - - - - -

At 31 May 2018 - (28,121) - - (28,121)

------------------------------ ----------- ------------- --------- ----------- ----------

Net book value

At 31 May 2017 - 753 500,000 340,974 841,727

------------------------------ ----------- ------------- --------- ----------- ----------

At 30 November 2017 - - 500,000 338,769 838,769

------------------------------ ----------- ------------- --------- ----------- ----------

At 31 May 2018 - - 500,000 338,769 838,769

------------------------------ ----------- ------------- --------- ----------- ----------

8. Financial Assets at Fair Value through Profit or Loss

Group's investments in portfolio companies are listed below and

classified as equity instruments. The principal place of business

for portfolio companies listed below is England and Wales.

31 May 1 December Additions Exchange Fair value 31 May

2017 2017 difference gain/(loss) 2018

US $ US $ US $ US $ US $ US $

Lucyd Ltd 183,030 6,023,955 3,766 (11,617) (1,339,359) 4,676,745

Belluscura

Limited 3,676,123 981,762 460,090 (29,351) (6,913) 1,405,588

Salarius Ltd 14,650 15,128 - (253) 1,985,125 2,000,000

Non Invasive

Glucose Tek

Limited 24,657 24,199 - (402) - 23,797

Smart Food

Tek Limited 47,365 44,167 320 (738) - 43,749

eGravitas Limited 150,024 154,535 12,873 (2,390) - 165,018

Frigidus Ltd 52,500 52,968 - (766) - 52,202

eSoma Limited - 10,983 11,914 - - 22,897

Guidant Limited - - 21,860 - - 21,860

Total Balance 4,148,349 7,307,696 510,823 (45,517) 638,853 8,411,856

------------------------------------------------------------------ ---------- ----------- ---------- ------------ ------------- ----------

The valuation techniques used fall under, Level 2 - Observable

techniques, other than quoted prices, and Level 3- Other techniques

as defined by IFRS 13. There has been no transfer between levels

during the period. Fair value measurement hierarchy for financial

assets as at 31 May 2018:

Date of Valuation Significant Significant

observable unobservable

inputs (Level inputs (Level

Total 2) 3)

US $ US $ US $

Salarius Ltd 31 May 2018 2,000,000 - 2,000,000

Belluscura Limited 31 May 2018 1,405,588 1,405,588 -

Lucyd and others 31 May 2018 5,006,268 - 5,006,268

Total Balance 8,411,856 1,405,588 7,006,268

----------------------------------------- ---------- --------------- ---------------

Lucyd Ltd

In accordance with the Group's policy, fair value of Lucyd

Limited as of 31 May 2018 was determined by an external, qualified

valuation expert. The fair value of Lucyd Limited of $4.7m was

determined based on valuation methodology used in the 30 November

2017 valuation and resulted in fair value loss of (US$1,339,359).

This movement is attributed primarily due to volatility of

crypto-currencies (Ethereum and Bitcoin) in which the Lucyd Pte is

holding the majority of funds held.

Belluscura Ltd

During the reporting period, Belluscura plc completed a private

funding round raising gross proceeds of US$1.33 million, by way of

a placing (the Belluscura Placing) of a total of 7,388,179 new

ordinary shares of GBP0.13p each (the Belluscura Placing Shares).

Tekcapital has invested US$250,000 in the private placement and

converted loans to Belluscura of US$210,090 to equity. Tekcapital

also received a three- year warrant to purchase 1,273,078 new

shares in Belluscura at GBP0.13p per share.

Considering Belluscura's valuation as of 30 November 2017 was

based on the most recent funding round share price of GBP0.13p, no

material adjustments to the fair value as of 31 May 2018 were made.

Similarly, given the warrant was granted at GBP0.13p, the most

recent placement price, the management considered the fair value of

the warrant to be immaterial.

Salarius Ltd

Based on commercialisation advancements as of 31 May 2018, an

external valuation of Salarius Ltd was prepared valuing Group's

stake at US$2,000,000. The valuation was based on the IP and

supported with following assumptions:

-- The projected size of the sodium-reduction ingredient market

in 2025. Future Market Insights, a substantial and respected market

research firm, projects the global market for such ingredients to

have revenue of US$1.8bn at that time. The US market is projected

to be 32% of the global market, being US$562m. The snack food

sector is projected to be 26.9% of the US market, being $151m.

-- The Salarius board's forecast assuming penetration of between

1% and 5% of that market by 2025, based on a number of factors:

o Microsalt is a unique product substantially in advance of

alternative, developed, and tested in terms of market acceptability

and ready to market;

o The protection given to the product by its US patent, which

effectively gives Salarius a barrier to entry in the US for 11 more

years;

o The strength and experience of the management team, whose

proven expertise is in the exact areas required to bring the

product to market and build the brand;

o There are no foreseeable manufacturing barriers in the

commercialisation process. Manufacturing will be outsourced, and it

can be clearly foreseen that this is deliverable;

o Other foreseeable challenges for management to deliver

successful commercialisation appear to be well within the abilities

of management to handle.

-- Salarius's forecast of its turnover in 2025 is US$1.51m. This

is equivalent to the lowest end of the market penetration range

quoted above, i.e. 1%.

-- A multiple of 2.8 has been applied to forecast 2025 turnover

to give a valuation at that point of US$4.2m

-- The 2025 valuation of Salarius has then been discounted back

to a present value using a conservative cost of capital of 10%.

That discounted value is US$2.1m, which has been rounded down to

US$2.0m.

-- The valuation of US$2.0m has been further validated by the

share acquisition in July 2018, where as a result of conditions

existing as of 31 May 2018, price of US$50,000 was agreed upon for

the sale of 2.5% stake in Salarius, albeit a related party.

Given early stage of commercialisation, fair value of remaining

portfolio companies was recorded based on the cost of acquired IP,

as their carrying amounts represent a reasonable approximation of

fair value.

Other investments (Nil Gain / Nil loss)

Under level 3 unobservable inputs. In the absence of observable

inputs the directors have considered the entities own data to

determine the fair value, which equates to the original funds

invested. They do not consider that any other available information

would materially change or give a more reliable representation of

the value.

This is the only category of financial instruments measured and

re-measured at fair value.

Description of significant unobservable inputs to valuation:

The significant unobservable input used in the fair value

measurements categorised within Level 3 of the fair value

hierarchy, together with a quantitative sensitivity analysis as at

31 May 2018 are shown as below:

Valuation Significant Estimate Sensitivity of the input

Technique unobservable applied to fair value

input

Lucyd Net Asset Discount to 66% 10% increase to the discount

Treasury tokens factor would decrease

the Lucyd valuation by

$850,000, a 10% reduction

in the discount factor

would increase the Lucyd

valuation by $850,000

Bonus Share 15% A 10% increase to the

bonus shares would decrease

the Lucyd value by $340,000,

a 10% decrease would increase

the Lucyd value by $340,000.

Salarius Market Revenue multiple 2.8 A 10% increase in the

approach, multiple would increase

revenue the Salarius value by

multiple $217,000, a decrease in

the multiple by 10% would

decreased the Salarius

value by $217,000

Discount factor 10% A 5% increase in the discount

factor would decrease

the Salarius value by

$580,000, a 5% decrease

in the discount factor

would increase the value

by $850,000

Market penetration 1% A 1% increase in the market

% penetration estimate would

increase the Salarius

valuation by $2,000,000,

a 1% decrease in the market

penetration estimate would

decrease the value by

$2,000,000.

No sensitivities have been included on the other investments

as their fair value equate to cost.

9. Share Capital

The Company's ordinary shares are of GBP0.004 par value.

All of the Company's issued ordinary shares have full voting,

dividend and capital distribution (including winding up) rights;

they do not confer any rights of redemption. The Company does not

hold any ordinary shares in treasury.

Issued and fully paid Shares Share capital Share premium

Number US$ US$

Ordinary shares of GBP0.004 each

At 1 December 2016 35,421,207 228,052 6,377,383

Shares issued in further public offering 6,968,500 34,879 2,814,385

Shares issued on exercise of warrants 265,000 1,290 79,330

As at 31 May 2017 42,654,707 264,221 9,271,098

=========== ============== ==============

At 1 December 2016 35,421,207 228,052 6,377,383

Shares issued in further public offering 6,968,500 34,879 2,814,385

Shares issued on exercise of warrants 265,000 1,290 79,330

As at 30 November 2017 42,654,707 264,221 9,271,098

=========== ============== ==============

Shares issued in further public offering - - -

Shares issued on exercise of warrants - - -

As at 31 May 2018 42,654,707 264,221 9,271,098

=========== ============== ==============

10. Related party transactions

The Group has taken advantage of the exemption in IAS 24

"related parties" not to disclose transactions with other Group

companies. During the period the Group did not employ any services

of non-Group companies meeting the definition of related

parties.

11. Interim results

The interim results for the six months ended 31 May 2018 will

not be sent to shareholders but will be available from the

Company's website at http://tekcapital.com/investors/.

- Ends -

1 Excluding Belluscura's sales from products deconsolidated as

of May 1, 2017 as a result of the recognition of Group's portfolio

companies at fair value.

2

https://www.fooddive.com/press-release/20151102-sodium-reduction-ingredient-market-revenue-is-expected-to-reach-us-17584/)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR PJMLTMBMBBFP

(END) Dow Jones Newswires

August 14, 2018 02:00 ET (06:00 GMT)

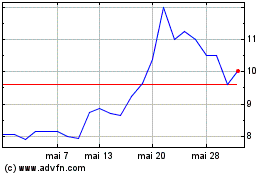

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024