TIDMTEK

RNS Number : 9990T

Tekcapital plc

28 July 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

28 July 2022

Tekcapital plc

("Tekcapital", the "Company" or the "Group")

Unaudited Half-yearly Report for the period ending 31 May

2022

Company delivered record NAV (US$77m) and NAV/share

(US$0.51)

Tekcapital Plc (AIM: TEK), (OTCQB: TEKCF), the UK intellectual

property investment group focused on transforming university

technologies into valuable products that can improve people's

lives, is pleased to announce its results for the six-month period

ended 31 May 2022.

Financial highlights

-- Net Assets increased 13% to US$76.9m (30 November 2021: US$68.1m).

-- NAV per share increased 6% to US$0.51 (30 November 2021: US$0.48).

-- Portfolio valuation increased 16% to US$74.3m (30 November 2021:US$63.9m).

-- Total income was US$8.0m (H1 2021: US$14.5m), driven

primarily by the net increase of US$7.5m in the fair value of

portfolio companies (H1 2021: US$13.8m).

-- Profit after tax: US$6.7m (H1 2021: US$13.0m).

-- Completed US$2.5m share placement during the period (H1 2021: US$5.3m).

Operational highlights: Portfolio Companies

Belluscura(R) Plc ("Belluscura") www.belluscura.com

-- Awarded a Distribution and Pricing Agreement ("DAPA") from

the United States Defense Logistics Agency ("DLA"), one of the

largest buyers in the world, for the X-PLO2R(R).

-- Executed an agreement with InnoMax Medical Technology to

manufacture its X-PLO2R(R) portable oxygen concentrator in China,

which is expected to more than double its manufacturing capacity

whilst accelerating its international expansion. Nearly 100 million

people in China have chronic obstructive pulmonary disease

("COPD"). This cohort is 4X larger than the U.S. COPD

population.

-- Following the agreement, Belluscura completed placement for

GBP5.7 million net of placing expenses to fund the purchase of raw

material inventory and manufacturing non-recurring engineering

costs in connection with the recently announced global

manufacturing agreement in China.

-- Tekcapital owns 14% of shares of Belluscura plc, valued at US$18.9m as of 31 May 2022.

Lucyd(R) Ltd ("Lucyd") www.lucyd.co

-- Innovative Eyewear has filed an S1 registration statement

with the SEC and is seeking to effectuate an IPO to be traded on

the NASDAQ under the ticker: LUCY, which it seeks to consummate as

soon as practicable depending upon market conditions.

-- Announced it has been approved by DICK's Sporting Goods(R) to

provide its Lucyd Lyte(R) smart eyewear on dickssportinggoods.com

and by BestBuy.ca to place its products on Best Buy's Canadian

ecommerce site.

-- Sales growth of its smart eyewear by over 100% in Q1 2022 compared to Q1 2021 [1] .

-- Tekcapital owns 100% of shares of Lucyd Ltd, valued at

US$27.1m as of 31 May 2022. Lucyd Ltd owns approximately 81% of

shares in Innovative Eyewear, Inc. its US operating subsidiary.

Guident Ltd ("Guident") www.guident.co

-- Has been selected as a vendor by the Jacksonville

Transportation Authority (JTA)'s Procurement Review Committee for

JTA Proposal No. P-22-010 entitled "JTA Test Environment" to

provide remote monitoring and control services for three years.

This major project will commence in August 2022.

-- Announced it is working with Airspan Networks (NYSE American:

MIMO) to provide customers with connectivity and software solutions

for autonomous vehicles for smart city applications, using CBRS

(Citizens Broadband Radio Service) spectrum.

-- Announced that it filed its 8th patent application covering

improvements to its remote monitoring and control centre for AVs.

The U.S. patent application #17/579,203 is entitled: "Near

Real-Time Data and Video Streaming System for a Vehicle, Robot or

Drone."

-- Announced that its Regenerative Shock Absorber ("RSA")

prototypes have been fabricated and are being evaluated by

independent test facilities to confirm their performance and

capabilities. Guident is currently in discussions with potential

customers and strategic partners to potentially manufacture and use

their RSA's.

-- Tekcapital owns 100% of shares of Guident Ltd, valued at

US$18.1m as of 31 May 2022. Guident owns approximately 91% of

shares in Guident CORP, its US operating subsidiary.

Salarius(R) Ltd ("Salarius") www.salarius.co

-- Appointed Rick Guiney as CEO. Rick has more than 35 years of

experience in the food industry, including 30+ years as President

& CEO of Classic Snacks, Inc., where he pioneered the ground-up

development of the business and transformed it into a

market-leading direct distribution company in the food industry.

Classic Snacks quickly became a nationwide snack food packager and

distributor to airlines, restaurants, hotels, country clubs, bars,

taverns, and retail private label customers.

-- Appointed Dan Emery as a non-executive member of its board of

directors. Dan has more than 25 years of experience in the food

industry, including 15 years as vice president of sales and

marketing at Pilgrim's Pride, during which time sales grew from

US$970 million to US$8.5 billion, with a balance between retail and

food service.

-- Successfully completed roll-out of SaltMe! crisps to Kroger

Company, the United States largest supermarket by revenue. [2] The

roll-out has been expanded from 1,800 stores to 2,200 stores.

-- Received a VC seed investment of US$400K at $1.29/share, a

29% uplift over its prior period valuation.

-- Tekcapital owns 97.2% ownership of Salarius Ltd, valued at

US$7.0m as of 31 May 2022. Salarius owns approximately 73% of

shares in Microsalt Inc, its US operating subsidiary.

Operational highlights: Corporate

As part of our continuing efforts to develop our team and expand

our services:

-- Tekcapital delivered the English webinar series " Technology Transfer: The Development of New Commercialization Paradigms". The webinar was delivered to more than 60 participants from USA, Canada and South Africa.

-- Tekcapital delivered the Spanish webinar series "The

Development of New Commercialization Paradigms In LATAM." The

webinar was delivered to more than 80 participants from Colombia,

Chile, Mexico and Peru.

-- Tekcapital participated as a sponsor and exhibitor at the

2022 U.S. Central Region meeting held by the Association of

University Technology Managers (AUTM).

-- Tekcapital participated at several networking events held by

PraxisAuril and LicenciArte, where key tech-transfer industry

players connected.

Post period end highlights:

-- MicroSalt(R) announced that it has executed its first bulk

B2B MicroSalt order in the US, placed its SaltMe (TM) brand of

low-sodium potato chips into over 3,000 retail stores nationwide in

the U.S., and begun test marketing the first MicroSalt(R)

salt-shakers for food service, restaurants and retail sale.

-- Salarius Ltd changed its name to MicroSalt Ltd, consistent

with its global strategy to enhance brand recognition for MicroSalt

as it accelerates the growth of its business.

-- Belluscura announced the launch of its Bluetooth(R) enabled,

next generation XPLOR(R) portable oxygen concentrator. The next

generation X-PLOR provides more oxygen by weight than any portable

oxygen concentrator in its class and with its new Nomad Health(TM)

App, patients can connect other Bluetooth(R) devices such as their

iPhone(R) or Android phone, Nonin(R) or Masimo(R) pulse oximeters,

and Fitbit(R) wearables.

-- Belluscura announced that in addition to selling its products

through distributors it has commenced selling its X-PLOR oxygen

concentrators direct to consumers from the following website:

www.xploroxygen.com .

Dr. Clifford M. Gross, Chairman said : "We are glad to report

solid half-year performance for the Group. Our key portfolio

companies are all revenue generating, progressing well, have

capable management, and should reach significant additional

milestones by the end of 2022. We are excited about what we have

achieved in the first half of 2022 and about our potential

near-term growth and performance."

For further information, please contact:

Tekcapital Plc Via Flagstaff

Clifford M. Gross, Ph.D.

SP Angel Corporate Finance LLP

(Nominated Adviser and Broker) +44 (0) 20 3470 0470

Richard Morrison/Charlie Bouverat (Corporate

Finance)

Abigail Wayne / Rob Rees (Corporate Broking)

Flagstaff Strategic and Investor Communications +44 (0) 20 7129 1474

Tim Thompson/Andrea Seymour/Fergus Mellon

About Tekcapital plc

Tekcapital creates value from investing in new,

university-developed discoveries that can enhance people's lives

and provides a range of technology transfer services to help

organisations evaluate and commercialise new technologies.

Tekcapital is quoted on the AIM market of the London Stock Exchange

(AIM: symbol TEK) and is headquartered in the UK. For more

information, please visit www.tekcapital.com .

LEI: 213800GOJTOV19FIFZ85

General Risk Factors and Forward-Looking Statements

This Report is directed only at Relevant Persons and must not be

acted on or relied upon by persons who are not Relevant Persons.

Any other person who receives this Report should not rely or act

upon it. By accepting this Report the recipient is deemed to

represent and warrant that: (i) they are a person who falls within

the above descrip-tion of persons entitled to receive the Report;

(ii) they have read, agreed and will comply with the contents of

this notice. The securities mentioned herein have not been and will

not be, registered under the U.S. Securities Act of 1933, as

amended (the "Securities Act"), or under any U.S. State securities

laws, and may not be offered or sold in the United States of

America or its territories or possessions (the "United States")

unless they are registered under the Securities Act or pursuant to

an exemption from or in a transaction not subject to the

registration requirements of the Securities Act. This Report is not

being made available to persons in Australia, Canada, Japan, the

Republic of Ireland, the Republic of South Africa or any other

jurisdiction in which it may be unlawful to do so, and it should

not be delivered or distributed, directly or indirectly, into or

within any such jurisdictions.

Investors must rely on their own examination of the legal,

taxation, financial and other consequences of an investment in the

Com-pany, including the merits of investing and the risks involved.

Prospective investors should not treat the contents of this Report

as advice relating to legal, taxation or investment matters and are

advised to consult their own professional advisers concerning any

acquisition of shares in the Company. Certain of the information

contained in this Report has been obtained from published sources

prepared by other parties. Certain other information has been

extracted from unpublished sources prepared by other parties which

have been made available to the Company. The Company has not

carried out an independent investigation to verify the accuracy and

completeness of such third-party information. No responsibility is

accepted by the Company or any of its directors, officers,

em-ployees or agents for the accuracy or completeness of such

information.

All statements of opinion and/or belief contained in this Report

and all views expressed represent the directors' own current

as-sessment and interpretation of information available to them as

at the date of this Report. In addition, this Report contains

certain "forward-looking statements", including but not limited to,

the statements regarding the Company's overall objectives and

strategic plans, timetables and capital expenditures.

Forward-looking statements express, as at the date of this Report,

the Company's plans, estimates, valuations, forecasts, projections,

opinions, expectations or beliefs as to future events, results or

performance. Forward-looking statements involve a number of risks

and uncertainties, many of which are beyond the Company's control,

and there can be no assurance that such statements will prove to be

accurate. No assurance is given that such forward looking

statements or views are correct or that the objectives of the

Company will be achieved. Further, valuations of Company's

portfolio investments and net asset value can and will fluctuate

over time due to a wide variety of factors both company specific

and macro-economic. Changes in net asset values can have a

significant impact on revenue and earnings of the Company and its

future prospects. Additionally, the current Coronavirus pandemic

may produce negative economic activities which could reduce the

company's economic performance and the performance of its portfolio

companies in ways that are difficult to quantify at this juncture.

It may cause a downturn in the markets in which the Company

operates, reduce the Company's net asset values, revenue, cash

flow, access to investment capital and other factors which could

negatively impact the Company. As a result, the reader is cautioned

not to place reliance on these statements or views and no

responsibility is accepted by the Company or any of its directors,

officers, employees or agents in respect thereof. The Company does

not undertake to update any forward-looking statement or other

information that is contained in this Report. Neither the Company

nor any of its shareholders, directors, officers, agents, employees

or advisers take any responsibility for, or will accept any

liability whether direct or indirect, express or implied,

contractual, tortious, statutory or otherwise, in respect of, the

accuracy or completeness of the information contained in this

Report or for any of the opinions contained herein or for any

errors, omissions or misstatements or for any loss, howsoever

arising, from the use of this Report. Neither the issue of this

Report nor any part of its contents is to be taken as any form of

contract, commitment or recommendation on the part of the Company

or the directors of the Company. In no circumstances will the

Company be responsible for any costs, losses or expenses incurred

in connection with any appraisal, analysis or investigation of the

Company. This Report should not be considered a recommendation by

the Company or any of its affiliates in relation to any prospective

acquisition or disposition of shares in the Company. No

undertaking, Report, warranty or other assurance, express or

implied, is made or given by or on behalf of the Company or any of

its affiliates, any of its directors, of-ficers or employees or any

other person as to the accuracy, completeness or fairness of the

information or opinions contained in this Report and no

responsibility or liability is accepted for any such information or

opinions or for any errors or omissions.

Intellectual Property Risk Factors

Tekcapital's mission is to create valuable products from

university intellectual property that can improve people's lives.

Therefore, our ability to compete in the market may be negatively

affected if our portfolio companies lose some or all of their

intellectual property rights, if patent rights that they rely on

are invalidated, or if they are unable to obtain other intellectual

property rights. Our success will depend on the ability of our

portfolio companies to obtain and protect patents on their

technology and products, to protect their trade secrets, and for

them to maintain their rights to licensed intellectual property or

technologies. Their patent applications or those of our licensors

may not result in the issue of patents in the United States or

other countries. Their patents or those of their licensors may not

afford meaningful protection for our technology and products.

Others may challenge their patents or those of their licensors by

proceedings such as interference, oppositions and re-examinations

or in litigation seeking to establish the invalidity of their

patents. In the event that one or more of their patents are

challenged, a court may invalidate the patent(s) or determine that

the patent(s) is not enforceable, which could harm their

competitive position and ours. If one or more of our portfolio

company patents are invalidated or found to be unenforceable, or if

the scope of the claims in any of these patents is limited by a

court decision, our portfolio companies could lose certain market

exclusivity afforded by patents owned or in-licensed by us and

potential competitors could more easily bring products to the

market that directly compete with our own. The uncertainties and

costs surrounding the prosecution of their patent applications and

the cost of enforcement or defense of their issued patents could

have a material adverse effect on our business and financial

condition.

To protect or enforce their patent rights, our portfolio

companies may initiate interference proceedings, oppositions,

re-examinations or litigation against others. However, these

activities are expensive, take significant time and divert

management's attention from other business concerns. They may not

prevail in these activities. If they are not successful in these

activities, the prevailing party may obtain superior rights to our

claimed inventions and technology, which could adversely affect

their ability of our portfolio companies to successfully market and

commercialise their products and services. Claims by other

companies may infringe the intellectual property rights on which

our portfolio companies rely, and if such rights are deemed to be

invalid it could adversely affect our portfolio companies and

ourselves as investors in these companies.

From time to time, companies may assert, patent, copyright and

other intellectual proprietary rights against our portfolio

company's products or technologies. These claims can result in the

future in lawsuits being brought against our portfolio companies or

their holding company. They and we may not prevail in any lawsuits

alleging patent infringement given the complex technical issues and

inherent uncertainties in intellectual property litigation. If any

of our portfolio company products, technologies or activities, from

which our portfolio companies derive or expect to derive a

substantial portion of their revenues and were found to infringe on

another company's intellectual property rights, they could be

subject to an injunction that would force the removal of such

product from the market or they could be required to redesign such

product, which could be costly. They could also be ordered to pay

damages or other compensation, including punitive damages and

attorneys' fees to such other company. A negative outcome in any

such litigation could also severely disrupt the sales of their

marketed products to their customers , w hich in turn could harm

their relationships with their customers, their market share and

their product revenues. Even if they are ultimately successful in

defending any intellectual property litigation, such litigation is

expensive and time consuming to address, will divert our

management's attention from their business and may harm their

reputation and ours.

Several of our portfolio companies may be subject to complex and

costly regulation and if government regulations are interpreted or

enforced in a manner adverse to them, they may be subject to

enforcement actions, penalties, exclusion, and other material

limitations on their operations that could have a negative impact

on their financial performance. All of the above listed risks can

have a material, negative affect on our net asset value, revenue,

performance and the success of our business and the portfolio

companies we have invested in.

Chairman's statem ent

Tekcapital brings innovations from laboratory to market. In the

first half of 2022, our key portfolio companies have made

significant progress and as a result, our net assets and net assets

per share ended the period at record levels.

Key portfolio companies

Tekcapital Plc commercialises university intellectual property,

a process known as technology transfer, both for its own portfolio

and as a service for client companies.

We believe that when you couple commercialisation ready,

compelling university IP with strong senior management, you

increase the probability that vibrant companies will emerge, net

assets will grow, returns on invested capital are likely to

increase and exits, if they occur, should happen faster. When we

realise exits, the Group's goal is to distribute a portion of

proceeds as a special dividend to our shareholders.

The Company believes that there is considerable value to be

realised from its current portfolio companies and is continuing to

further assist and invest in these operations. A common theme

across our portfolio companies is that they have proprietary

intellectual property, capable management in our view, and if

successful, can improve the quality of life for the customers they

serve. The Company's key investments include:

-- Salarius ltd (www.salarius.co), of which Tekcapital owns

97.2%, owns approximately 73% of Microsalt Inc., its US operating

subsidiary, which owns a patented process for producing

nano-particle salt crystals ("MicroSalt(R)"), which can reduce

sodium content in snack foods by up to 50.0%, yet provide the same

level of salty flavour found in traditional snacks. Salarius' goal

is to make snack foods healthier. The global sodium reduction

ingredient market is currently estimated to have a market value of

US$ 5.5bn in 2022 and is estimated to show an approximate CAGR of

5.8%, reaching a market value of USD 9.6bn by 2032 [3] .

-- Lucyd ltd (www.lucyd.co), which is wholly owned by

Tekcapital, sells innovative Bluetooth enabled glasses, through its

US subsidiary Innovative Eyewear, Inc. (81% ownership). Innovative

Eyewear Inc. launched its first commercial product in January 2021

after test marketing several prototypes. The company owns 41

pending and granted, design and utility patents for its

Bluetooth(R) enabled sound glasses. We believe Lucyd was the first

company to offer proper prescription glasses online that allow the

wearer to connect to their smartphones and digital assistants.

Their mission is to Upgrade your Eyewear(R) with useful hands-free

technology. In 2019, the largest number of pedestrian injuries were

reported in the past 30 years [4] and every seven minutes a

pedestrian is struck by a car due primarily to both drivers and

pedestrian alike being distracted with their smart phones. Lucyd's

glasses have speakers built into the arms of the glasses which

allows users to make calls and listen to music, whilst maintaining

situational awareness of the traffic around them having nothing

placed in the ears. Additionally, Lucyd has developed a

voice-controlled app called Vyrb(TM) which will enable its

customers and others to respond to posts on Twitter with their

voice, obviating the need to look at their phones or type

responses. Lucyd products are positioned at the intersection of the

eyewear, hearables and digital assistant markets. The U.S. eyewear

market is projected to reach US$29.4bn in 2022 [5] .

-- Guident ltd (www.guident.co), which is wholly owned by

Tekcapital (Guident owns approximately 91% of shares in Guident

Corp., its US operating subsidiary), was established to

commercialise new technology to enhance the utility and safety of

autonomous vehicles ("AVs") and ground-based autonomous delivery

devices. Using its proprietary IP, Guident is developing software

Apps that allow operators of AV's to remotely monitor and control

their vehicles. Remote monitoring and control is a legal

requirement for AV operation in the State of Florida and many other

jurisdictions. We believe ,that in the future, most territories

with AV's will require remote monitoring and control. The

autonomous vehicle market is expected to reach US $65.3 billion by

2027 [6] .

-- Belluscura plc (www.belluscura.com), of which Tekcapital owns

approximately 14%, has developed an improved portable oxygen

concentrator (POC) to provide on-the-go supplemental oxygen. Their

device is smaller, lighter and quieter than most competitive

products and has a replaceable filter cartridge that will allow the

user to upgrade the unit as their disease progresses. The device

was recently cleared for sale by the Food and Drug Administration

("FDA") and Belluscura commenced sales in 2021. As a result of the

global prevalence of Chronic obstructive pulmonary disease (COPD),

the medical portable oxygen market is expected to grow from

US$1.4bn in 2018 to US$5bn by 2030 [7] . This large, anticipated

growth may have a positive impact on portfolio company

Belluscura.

Financial performance

Despite headwinds in the global economy and capital markets, in

H1 2022 Tekcapital continued to create value and increased its net

assets. This was largely due to enhancement of the values of both

MicroSalt and Lucyd. The Group has now demonstrated 5 + years of

consistent growth of Net Assets.

Fundraisings

On 30 May 2022, the Group announced that it had completed a

fundraising of GBP2million (approx.. US$2.5 million) gross proceeds

through the placing of 8,000,000 new ordinary shares with new and

existing investors at a price of 25 pence per share. These funds

are being utilised to further accelerate portfolio company growth

and for working capital.

Current Trading and Outlook

Having continued to develop and expand Tekcapital's existing

business, the Board is confident that continued investment in our

portfolio companies remains the right approach for long-term value

creation. We believe that we are executing on our strategy and this

should result in increases in returns on invested capital as our

portfolio companies continue to mature and some achieve meaningful

exits, which we hope to see in the next 12 months. Whilst it is

clear that the Company is progressing very well, please note that

our net asset values and revenues will fluctuate from period to

period due to individual portfolio company performance, valuations

and changes in market conditions and macro-economic financial

conditions including the recent Coronavirus pandemic and the

Russian invasion of Ukraine. We are grateful for the patience and

support of our shareholders through these challenging events. We

are also sincerely appreciative of our dedicated, creative and

incredibly hardworking team without which, none of the results

reported herein would be possible.

Dr Clifford M Gross

Chairman and CEO

28 July 2022

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 May 2022

Notes Six months Six months Year ended

ended ended 31 May 30 November

31 May 2021 2021

2022

Unaudited Unaudited Audited

US$ US$ US$

Continuing Operations

Revenue from services 368,928 646,770 815,989

Changes in fair value

on financial assets

at fair value though

profit or loss 7 7,478,419 13,780,423 28,096,340

Interest from financial

assets at fair value

through profit or

loss 186,012 - 142,399

Operating expenses (1,349,646) (1,538,923) (2,845,339)

Other income 7 - 68,982 161,094

--------------------------- ------

Operating profit

and profit before

tax 6,683,713 12,957,252 26,370,483

--------------------------- ------ ------------ ---------------------------- ------------------------

Income tax expense 5 (892) (93) (1,813)

--------------------------- ------ ------------ ---------------------------- ------------------------

Profit after tax

for the period 6,682,821 12,957,159 26,368,670

--------------------------- ------ ------------ ---------------------------- ------------------------

Other comprehensive

income

Translation of foreign

operations (272,756) 430,914 16,276

--------------------------- ------ ------------ ---------------------------- ------------------------

Total other comprehensive

income/(loss) (272,756) 430,914 16,276

--------------------------- ------ ------------ ---------------------------- ------------------------

Total comprehensive

income for the period 6,410,065 13,388,073 26,384,946

--------------------------- ------ ------------ ---------------------------- ------------------------

Earnings per share 6

Basic earnings per

share 0.05 0.12 0.22

Diluted earnings per

share 0.05 0.12 0.21

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 May 2022

Notes As at 31 As at 31 As at 30 November 2021

May 2022 May 2021

Unaudited Unaudited Audited

US$ US$ US$

Assets

Non-current assets

Intangible assets 322,463 838,770 364,401

Financial assets at fair value

through profit and loss 7 74,286,140 48,204,492 63,865,432

Property, plant and equipment 17,004 11,317 6,603

----------- ------------------------------- -----------------------

74,625,607 49,054,579 64,236,436

----------- ------------------------------- -----------------------

Current assets

Trade and other receivables 1,865,111 236,446 689,003

Cash and cash equivalents 1,148,375 2,456,493 3,543,762

----------- ------------------------------- -----------------------

3,013,486 2,692,939 4,232,765

Total a ssets 77,639,093 51,747,518 68,469,201

=========== =============================== =======================

Liabilities

Current liabilities

Trade and other payables 539,146 443,194 237,651

Deferred Revenue 169,283 155,221 169,283

----------- ------------------------------- -----------------------

Total liabilities 708,429 598,41 5 406,934

=========== =============================== =======================

Net assets 76,930,664 51,149,10 3 68,062,267

=========== =============================== =======================

Equity

Ordinary shares 834,549 735,625 793,792

Share premium 24,160,000 17,992,484 21,793,644

Retained earnings 51,993,867 31,791,802 45,259,827

Translation reserve 14,417 701,361 287,173

Other reserve (72,169) (72,169) (72,169)

Total equity 76,930,664 51,149,10 3 68,062,267

=========== =============================== =======================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 31 May 2022

Attributable to equity holders of the parent company

-------------------------------------------------------------------------

Ordinary Share Translation Other Retained Total

Group Note Shares Premium Reserve Reserve Earnings Equity

US $ US $ US $ US $ US $ US $

---------------------------- ------ --------- ----------- ------------ --------- ----------- -----------

Balance as at 30 November

2021 793,792 21,793,644 287,173 (72,169) 45,259,827 68,062,267

------------------------------------ --------- ----------- ------------ --------- ----------- -----------

Profit for the year - - - - 6,682,821 6,682,821

Other comprehensive

loss - - (272,756) - - (272,756)

Total comprehensive income

for the year - - (272,756) - 6,682,821 6,410,065

Transactions with owners,

recorded

directly in equity

Share issue 40,486 2,489,878 - - - 2,530,364

Share options exercised 271 4,135 - - - 4,406

Cost of share issue - (127,657) - - - (127,657)

Share based payments - - - - 51,219 51,219

Total transactions

with owners 40,757 2,366,356 - - 51,219 2,458,332

------------------------------------ --------- ----------- ------------ --------- ----------- -----------

At 31 May 2022 (unaudited) 834,549 24,160,000 14,417 (72,169) 51,993,867 76,930,664

------------------------------------ --------- ----------- ------------ --------- ----------- -----------

Balance as at 30 November

2020 521,830 13,211,344 270,447 (72,169) 18,780,012 32,711,464

Profit for the year - - - - 12,957,159 12,957,159

Other comprehensive

income - - 430,914 - - 430,914

Total comprehensive income

for the year - - 430,914 - 12,957,159 13,388,073

Transactions with owners,

recorded

directly in equity

Share issue 213,795 5,082,394 - - - 5,296,189

Cost of share issue - (301,254) - - - (301,254)

Share based payments - - - - 54,631 54,631

Total transactions

with owners 213,795 4,781,140 - - 54,631 5,049,566

------------------------------------ --------- ----------- ------------ --------- ----------- -----------

At 31 May 2021 (unaudited) 735,625 17,992,484 701,361 (72,169) 31,791,802 51,149,103

------------------------------------ --------- ----------- ------------ --------- ----------- -----------

Share capital represents the amount subscribed for share capital

at nominal value.

Share premium represents the amount subscribed for share capital

in excess of nominal value and net of any directly attributable

issue costs.

Translation reserve - foreign exchange differences recognised in

other comprehensive income.

Other reserve - historic other reserve outside of share premium

and translation reserve.

Retained earnings - cumulative net gains and losses recognised

in the consolidated statement of comprehensive income, net of

dividends paid.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 31 May 2022

Six months Six months For the

ended ended year ended

Group Note 31 May 2022 31 May 30 Nov 2021

2021

US $ US $ US $

Unaudited Unaudited

---------------------------------- -------- ------------- ------------------------- -------------

Cash flows from operating

activities

Cash outflows from operations (2,690,356) (1,306,438) (1,812,288)

Taxation paid (892) (94) (1,813)

Net cash outflows from operating

activities (2,691,248) (1,306,532) (1,814,101)

-------------------------------------------- ------------- ------------------------- -------------

Cash flows from investing

activities

Purchase of financial assets

at fair value through profit

and loss (1,058,317) (1,771,901) (3,968,339)

Purchases of property, plant

and equipment - - (2,389)

Net cash outflows from investing

activities (1,058,317) (1,771,901) (3,970,728)

Cash flows from financing

activities

Proceeds from issuance of

ordinary shares 1,396,067 5,296,189 9,416,593

Costs of raising finance (127,657) (301,252) (562,293)

Net cash inflows from financing

activities 1,268,410 4,994,937 8,854,300

-------------------------------------------- ------------- ------------------------- -------------

Net (decrease)/increase

in cash and cash equivalents (2,481,155) 1,916,504 3,069,471

Cash and cash equivalents

at beginning of period/year 3,543,762 538,473 538,473

Exchange gain/(loss) on cash

and cash equivalents 85,768 1,516 (64,182)

Cash and cash equivalents

at end of the period/year 1,148,375 2,456,493 3,543,762

-------------------------------------------- ------------- ------------------------- -------------

During the period Tekcapital plc issued new ordinary shares with

a total value of US$2,530,364. During the period US$1,391,661 was

received in cash and US$1,138,703 included in debtors as at 31 May

2022. Proceeds from the exercise of share options were US$4,406,

giving a total 'Proceeds from issuance of ordinary shares' in the

consolidated statement of cash flows of US$1,396,067.

Notes to the financial information

1. General information

Tekcapital PLC is a company incorporated in England and Wales

and domiciled in the UK. The address of the registered office is 12

New Fetter Lane, London, United Kingdom, EC4A 1JP. The Company is a

public limited company, which has been quoted on the AIM market of

the London Stock Exchange since 2014.

The principal accounting policies applied in the preparation of

this consolidated financial information are set out below. These

policies have been consistently applied to all the periods

presented, unless otherwise stated.

2. Basis of preparation

The financial information for the six months ended 31 May 2022

set out in this interim financial information is unaudited and does

not constitute statutory financial statements. The interim

condensed financial information has been presented in US Dollars

("$").

3. Accounting policies

3.1 Statement of compliance

The accounting policies applied by the Group in these unaudited

half year results are consistent with those applied in the annual

financial statements for the year ended 30 November 2021.

The financial statements of Tekcapital PLC Group have been

prepared in accordance with International Financial Reporting

Standards (IFRS) and IFRS Interpretations Committee (IFRS IC) as

adopted by the European Union and the Companies Act 2006 applicable

to companies reporting under IFRS. The financial statements have

been prepared under the historical cost convention.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It

requires management to exercise its judgement in the process of

applying the Group's accounting policies. The areas involving a

higher degree of judgment or complexity, or areas where assumptions

and estimates are significant to the consolidated financial

statements are disclosed in note 4 of the FY 2021 accounts. The

estimates that changed since then are disclosed in Note 7.

4. Going concern

The Group and the Company meets its day to day working capital

requirements through its service offerings and monies raised

through the issues of equity. The Group's forecasts and projections

indicate that the Group and the Company have sufficient cash

reserves to operate within the level of its current facilities.

Whilst it is the Group's and the Company's intention to rely on the

available cash reserves, future income generated from its growing

service offerings and reductions in its cost base, a negative

variance in the forecasts and projections would make the Group's

ability to continue as a going concern dependent on monetisation of

quoted equity stakes or an additional fund raise. If the Group's

forecasts are not achieved, the Directors would seek to raise the

additional funds through monetisation of the portfolio or equity

issuances. Whilst the COVID-19 epidemic is contributing to

uncertainty in the markets, at the time of approving the accounts

after making enquiries, the Directors are satisfied that the Group

and the Company have adequate resources to continue in operational

existence for the foreseeable future. The Group and the Company

therefore continue to adopt the going concern basis in preparing

both its consolidated financial statements and its own financial

statements.

The Group therefore continues to adopt the going concern basis

for these interim financial statements.

5. Taxation

Immaterial charge of US$892 has arisen in the six-month period

ended 31 May 2022 (31 May 2021: US$94).

6. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of Ordinary Shares outstanding during the period.

Diluted earnings per share is calculated by dividing the

earnings attributable to ordinary shareholders by the sum of

weighted average number of (1) Ordinary Shares outstanding during

the period and (2) Ordinary Shares to be issued assuming exercise

of outstanding stock options with intrinsic value above $0 at 31

May 2022:

Six months ended 31 May 2022 Six months ended 31 May 2021 Year ended 30 November 2021

US$ US$ US$

Profit

attributable

to equity

holders of

the Company 6,682,821 12,957,160 26,368,670

Weighted

average

number of

Ordinary

Shares in

issue:

Basic 141,542,328 108,363,954 120,128,629

Diluted 144,775,661 115,363,954 127,169,725

Basic profit

per share

($) 0.05 0.12 0.22

Diluted

profit per

share ($) 0.05 0.12 0.21

7. Financial Assets at Fair Value through Profit or Loss

The Group's financial assets at fair value through profit and

loss consist of equity investments (2022: US$ 71,060,393, 30

November 2021: US$62,523,658) and convertible loan notes (2022:

US$3,225,747, 30 November 2021: US$1,341,774) totaling

US$74,286,140 (30 November 2021: US$63,865,432).

31 May 1 December Additions Exchange Fair value 31 May

2021 2021 difference gain/(loss) 2022

US $ US $ US $ US $ US $ US $

Guident Limited 22,058,309 18,083,264 - - 18,083,264

Lucyd Ltd 7,910,036 17,345,195 - - 9,726,438 27,071,633

Belluscura

Limited 12,776,400 22,695,518 - - (3,818,321) 18,877,197

Salarius Ltd 3,638,304 4,356,520 1,058,315 - 1,570,303 6,985,138

Smart Food

Tek Limited 43,161 43,161 - - - 43,161

Total Balance 46,426,210 62,523,658 1,058,315 - 7,478,420 71,060,393

------------------------------------------------------------------ ----------- ----------- ---------- ------------ ------------- -----------

The valuation techniques used fall under, Level 1 - Observable

inputs, such as quoted prices, and Level 3- Other techniques as

defined by IFRS 13. These techniques were deemed to be the best

evidence of fair values considering early stage of portfolio

companies.

There have been no transfers between Level 3 and Level 2 for

Group's investment in Lucyd Ltd during the period. Fair value

measurement hierarchy for financial assets as at 31 May 2022 with

comparative amounts as of 30 November 2021:

Total Level 1 Level 2 Level 3

31 May 2022 US$ US$ US$ US$

Belluscura 18,877,197 18,877,197 - -

Lucyd Limited 27,071,633 - - 27,071,633

Guident Limited 18,083,264 - - 18,083,264

Salarius Limited 6,985,138 - - 6,985,138

Smart Food Tek Limited 43,161 - - 43,161

Total Balance 71,060,393 18,877,197 - 52,183,196

------------------------ ------------------ -------------- ------------------------ -----------------

30 November 2021 US$ US$ US$ US$

Belluscura 22,695,518 22,695,518 - -

Lucyd Limited 17,345,195 - - 17,345,195

Guident Limited 18,083,264 - - 18,083,264

Salarius Limited 4,356,520 - - 4,356,520

Smart Food Tek Limited 43,161 - - 43,161

Total Balance 62,523,658 22,695,518 - 39,828,140

------------------------ ------------------ -------------- ------------------------ -----------------

Guident (Nil Gain / Nil loss)

The total fair value remains unchanged from 30 November 2021 and

is based on a Private Placement Memorandum outlining offering of

securities at $1 per unit, with 18,115,942 shares held. Upon review

of business updates in H1 2022, management noted no material events

necessitating revisions.

Salarius (US1.6m gain)

In January 2022, Tekcapital Europe converted $1,058,317 of

convertible loans for 1,058,317 shares at $1 resulting in the

addition of $1,058,317 to the cost basis of its holding in

Microsalt Inc.

In June 2022, Microsalt Inc received an investment of US$400,000

at $1.29 per share. As a result, the group recorded fair value gain

of US$1,570,303 as of 31 May 2022, to reflect the movement from the

previous valuation at $1 to the current valuation at $1.29 per

share.

Lucyd Ltd ($9.7m gain)

The total fair value increased by US$9.7m from 30 November 2021.

In January 2022, Innovative Eyewear Inc. submitted a draft

registration statement with the U.S. Securities and Exchange

Commission (the "SEC"), for a proposed initial public offering

("IPO") of shares of its common stock in the United States. The

agreed upon pricing range of $5.50-$7.50 was determined by the sole

bookrunner of the offering. As such, the management deemed it

appropriate and prudent to use the lower end of the range ($5.50

per share) to value the Group's 4,922,115 shares held in the

company through Lucyd Ltd.

Belluscura ($3.8m loss)

The Group recorded a loss on its holdings in Belluscura, driven

by change in the AIM market listed price of 98p as of 30 November

2021 to 89p as of 31 May 2022.

Other investments (Nil Gain / Nil loss)

Given early stage of commercialisation, the fair value of Smart

Food TEK was recorded based on the cost of acquired IP, as the

carrying amounts represent a reasonable approximation of fair

value.

Under level 3 unobservable inputs. In the absence of observable

inputs, the directors have considered the entities own data to

determine the fair value, which equates to the original funds

invested. They do not consider that any other available information

would materially change or give a more reliable representation of

the value.

This is the only category of financial instruments measured and

re-measured at fair value.

Convertible loan notes

The Group also held multiple convertible loans issued by its

portfolio companies, including:

-- Convertible note issued by Innovative Eyewear Inc, for the

total of US$3,000,000 that bears interest at 10% per annum, which

includes the option to convert the debt into the Company's common

stock at market price. As of May 31, 2022, US$1,801,240 was

outstanding as the convertible note receivable. No conversions

occurred during the period.

-- Convertible note issued by Guident Ltd, for the total of

US$1,000,000 that bears interest at 10% per annum, which includes

the option to convert the debt into the Company's common stock at

market price. As of May 31, 2022, US$972,037 was outstanding as the

convertible note receivable. No conversions occurred during the

period.

-- Convertible note issued by Microsalt Inc, for the total of

US$2,000,000 that bears interest at 10% per annum, which includes

the option to convert the debt into the Company's common stock at

market price. As of May 31, 2022, US$456,091 was outstanding as the

convertible note receivable. During the period, Microsalt Inc

converted related party borrowings totaling $1,058,317 into

1,058,317 shares of common stock at $1 each.

8. Related party transactions

The Group has taken advantage of the exemption in IAS 24

"related parties" not to disclose transactions with other Group

companies. During the period the Group did not employ any services

of non-Group companies meeting the definition of related

parties.

9. Interim results

The interim results for the six months ended 31 May 2022 will

not be sent to shareholders but will be available from the

Company's website at http://tekcapital.com/investors/.

- Ends -

[1]

https://www.sec.gov/Archives/edgar/data/0001808377/000182912622012073/innovativeeye_s1a.htm

[2]

https://www.supermarketnews.com/retail-financial/top-25-supermarket-operators-sales

[3]

https://www.futuremarketinsights.com/reports/sodium-reduction-ingredient-market

[4] https://www.caranddriver.com/news/a31136893/pedestrian-deaths-increase-2019/

[5]

https://www.statista.com/outlook/cmo/eyewear/united-states

[6]

https://www.statista.com/statistics/428692/projected-size-of-global-autonomous-vehicle-market-by-vehicle-type/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR RRMLTMTJTBTT

(END) Dow Jones Newswires

July 28, 2022 02:00 ET (06:00 GMT)

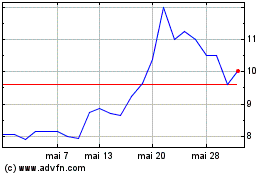

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024