TIDMUKW

RNS Number : 3193H

Greencoat UK Wind PLC

27 July 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO, THE UNITED STATES (INCLUDING ITS

TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE

DISTRICT OF COLUMBIA), AUSTRALIA, NEW ZEALAND, CANADA, THE REPUBLIC

OF SOUTH AFRICA OR JAPAN.

27 July 2023

GREENCOAT UK WIND PLC

(the "Company")

Half year results to 30 June 2023, Net Asset Value and Dividend

Announcement

Greencoat UK Wind PLC today announces the half year results for

the period to 30 June 2023.

Greencoat UK Wind PLC is the leading listed renewable

infrastructure fund, invested in UK wind farms. The Company's aim

is to provide investors with an annual dividend that increases in

line with RPI inflation while preserving the capital value of its

investment portfolio in the long term on a real basis through

reinvestment of excess cash flow.

The Company provides investors with the opportunity to

participate directly in the ownership of UK wind farms, so

increasing the resources and capital dedicated to the deployment of

renewable energy and the reduction of greenhouse gas emissions.

Highlights

-- The Group's investments generated 2,088GWh of renewable electricity.

-- Net cash generation (Group and wind farm SPVs) was GBP 204.0 million .

-- Acquisition of Dalquhandy wind farm increased the portfolio

to 46 operating wind farm investments and net generating capacity

to 1,652MW as at 30 June 2023.

-- Agreed to acquire a net 13.7 per cent stake in London Array

offshore wind farm, with the transaction expected to complete on 31

July 2023.

-- The Company declared total dividends of 4.38 pence per share with respect to the period.

-- Aggregate Group Debt was GBP2,000 million as at 30 June 2023,

equivalent to 34 per cent of GAV.

Commenting on today's results, Lucinda Riches, Chairman of

Greencoat UK Wind, said :

"I am pleased to report another strong performance in the first

half, extending our track record of attractive dividends and

returns. Cash generation was strong and dividend cover for the

period was 2.1x. Since IPO, the Company has increased its dividend

in line with RPI every year with excess cash generation being

reinvested to drive NAV growth above RPI, now delivering returns to

investors of 10%.

"We continue to leverage our scale and financial strength to

grow the portfolio with high quality investments including that of

Dalquhandy in the period. Looking ahead to the remainder of the

year, we already have a strong pipeline of additions to our

portfolio through our investment in London Array and completing on

our committed investments, South Kyle and Kype Muir Extension.

These investments will add 355MW of net generating capacity

increasing the portfolio to over 2GW.

"The outlook for the Group is extremely encouraging. We operate

in a mature and growing asset class and with our market leading

position and self funding business model, we are well placed to

capitalise on NAV accretive investment opportunities and continue

delivering superior returns to shareholders."

Net Asset Value

The Company announces that its unaudited Net Asset Value as at

30 June 2023 is GBP3,843.9 million (165.8 pence per share). The

Company's June 2023 Factsheet is available on the Company's

website, www.greencoat-ukwind.com .

Dividend Announcement

The Company also announces a quarterly dividend of 2.19 pence

per share in respect of the period from 1 April 2023 to 30 June

2023.

Dividend Timetable

Ex-dividend date: 10 August 2023

Record date: 11 August 2023

Payment date: 25 August 2023

Key Metrics

As at 30 June 2023:

Market capitalisation GBP 3,345.6 million

Share price 144.3 pence

Dividends with respect to the period GBP 101.6 million

Dividends with respect to the period per share 4.38 pence

GAV GBP 5,843.9 million

NAV GBP 3,843.9 million

NAV per share 165.8 pence

The Company's 2023 Half Year Report is available on the

Company's website, www.greencoat-ukwind.com , and can also be

inspected on the National Storage Mechanism website,

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Details of the conference call for analysts and investors:

There will be a conference call at 9.00am today for analysts and

investors. Analysts and investors can register

and watch the event at: https://www.netroadshow.com/events/login?show=ed784d86&confId=53665 .

Presentation materials will be posted on the Company's website,

www.greencoat-ukwind.com , from 9.00am.

For further information, please contact:

Greencoat UK Wind PLC 020 7832 9400

Stephen Lilley

Laurence Fumagalli

Headland 020 3805 4822

Stephen Malthouse

Rob Walker

Charlie Twigg

ukwind@headlandconsultancy.com

All capitalised terms are defined in the list of defined terms

below unless separately defined.

Chairman's Statement

I am pleased to present the Half Year Report of Greencoat UK

Wind PLC for the six months ended 30 June 2023.

Performance

Portfolio generation for the period was 2,088GWh, 18 per cent

below budget owing to low wind. Net cash generated by the Group and

wind farm SPVs was GBP204.0 million and dividend cover for the

period was 2.1x.

The portfolio provides renewable electricity for 1.8 million

homes and avoided the emission of 0.8 million tonnes of CO(2) in

the period.

Dividends and Returns

The Company's aim is to provide investors with an attractive and

sustainable dividend that increases in line with RPI while

preserving capital on a real basis. In line with this aim, in every

one of the last 10 years since listing, the Company increased its

stated dividend target for 2023 by RPI to 8.76 pence. It has paid a

quarterly dividend of 2.19 pence per share with respect to Q1 2023

and has declared a dividend of the same amount per share with

respect to Q2 2023, giving a total of 4.38 pence per share for the

period (compared to 3.86 pence per share for the first half of

2022).

NAV per share decreased in the period from 167.1 pence per share

on 31 December 2022 to 165.8 pence per share on 30 June 2023,

reflecting an increase in discount rates and lower short term power

prices offset by higher short term inflation and valuation gains

from recent and committed investments.

In line with the higher interest rate environment, the Company

has continued to increase its discount rate and thus returns to

investors. The forecast 10 per cent return to investors (net of all

costs) includes reinvestment of excess cash generation (dividend

cover) in addition to the dividend yield. Since listing, the

Company has reinvested GBP806 million of excess cash generation

(dividend cover) and paid GBP836 million of dividends (aggregate

historical dividend cover being 2.0x).

Investment

During the period, the Group invested GBP51.5 million to acquire

Dalquhandy wind farm from BayWa, increasing net generating capacity

to 1,652MW. During the period, the Group also provided a further

GBP4.5 million of construction finance to the Kype Muir Extension

wind farm project (target commissioning in Q3 2023).

In Q3 2023, the Group will invest GBP444 million into London

Array offshore wind farm and GBP320 million into South Kyle wind

farm, which the Group are acquiring from Orsted and Vattenfall

respectively. Along with Kype Muir Extension completion, 355MW of

net generating capacity will be added to the portfolio.

Outlook

The Company is investing in a mature and growing market, and the

Board believes that there should continue to be further

opportunities for investments that are beneficial to shareholders.

The Company will continue to maintain a strictly disciplined

approach to acquisitions, only investing when it is considered to

be in the interests of shareholders to do so. At the same time, we

will also look at opportunistic disposals, given the current

environment we are operating in.

The principal risk and uncertainties of the Group and its

investee companies are unchanged from those detailed in the

Company's Annual Report to 31 December 2022 and remain the most

likely to affect the Group and its investee companies in the second

half of the year. A summary of these may be found below.

The Board and Governance

At the AGM on 28 April 2023, Nick Winser assumed the role of

Senior Independent Director. Shonaid Jemmett-Page also retired and

I, on behalf of the whole Board, would like to thank her for the

excellent job she has done chairing the Company. I am delighted to

have taken over as Chairman, and look forward to working with the

rest of the Board and the Investment Manager to deliver continued

shareholder value.

On 1 May 2023 Jim Smith joined the Board and has extensive

experience in the electricity industry, including in offshore wind

asset management.

Lucinda Riches C.B.E.

Chairman

26 July 2023

Investment Manager's Report

Investment Portfolio

As at 30 June 2023, the Group owned investments in a diversified

portfolio of 46 operating UK wind farms totalling 1,652MW, powering

1.8 million homes and avoiding the emission of 2.1 million tonnes

of CO(2) per annum. A further 355MW of investments are due to

complete in Q3 2023, which will increase the portfolio to over

2GW.

Operating and Financial Performance

Portfolio generation in the period was 2,088 GWh, 18 per cent

below budget owing to low wind. Portfolio availability was above

budget.

Net cash generated by the Group and wind farm SPVs was GBP 204.0

million and dividend cover for the period was 2.1x.

For the six months ended

Group and wind farm SPV cash flows 30 June 2023

------------------------------------------------- -------------------------

GBP'000

Net cash generation (1) 204,020

Dividends paid (95,517)

Acquisitions (55,936)

Acquisition costs (226)

Equity issuance -

Equity issuance costs -

Net amounts drawn under debt facilities 290,000

Upfront finance costs (4,609)

Movement in cash (Group and wind farm SPVs) 337,732

Opening cash balance (Group and wind farm SPVs) 160,851

------------------------------------------------- -------------------------

Closing cash balance (Group and wind farm SPVs) 498,583

Net cash generation 204,020

Dividends 95,517

Dividend cover 2.1x

------------------------------------------------- -------------------------

(1) Alternative Performance Measure as defined below.

The following tables provide further detail in relation to net

cash generation of GBP 204.0 million:

For the six months ended

Net Cash Generation - Breakdown 30 June 2023

--------------------------------- -------------------------

GBP'000

Revenue 400,591

Operating expenses (90,100)

Tax (36,670)

SPV level debt interest (9,148)

SPV level debt amortisation (26,595)

Other (197)

--------------------------------- -------------------------

Wind farm cash flow 237,881

Management fee (17,141)

Operating expenses (1,237)

Ongoing finance costs (17,675)

Other 1,623

--------------------------------- -------------------------

Group cash flow (34,430)

VAT (Group and wind farm SPVs) 569

Net cash generation 204,020

--------------------------------- -------------------------

For the six months

Net Cash Generation - Reconciliation to Net ended

Cash Flows from Operating Activities 30 June 2023

---------------------------------------------- -------------------

GBP'000

Net cash flows from operating activities (1) 220,152

Movement in cash balances of wind farm SPVs (9,845)

Repayment of shareholder loan investment (1) 11,388

Finance costs (1) (22,284)

Upfront finance costs (2) 4,609

---------------------------------------------- -------------------

Net cash generation 204,020

---------------------------------------------- -------------------

(1) Condensed Consolidated Statement of Cash Flows.

(2) GBP4,350k facility arrangement fees plus GBP467k

professional fees per note 12 to the financial statements less

GBP208k movement in other finance costs payable per note 11 to the

financial statements.

Investment and Gearing

On 6 June 2023, the Group acquired Dalquhandy wind farm from

BayWa for consideration of GBP51.5 million.

During the period, the Group provided a further GBP4.5 million

of construction finance to the Kype Muir Extension wind farm

project (target commissioning Q3 2023). As at 30 June 2023, the

Group's total investment in Kype Muir Extension (including accrued

interest) was GBP44.9 million. The Group has entered into

arrangements to acquire a 49.9 per cent stake in Kype Muir

Extension, once fully commissioned, for a headline consideration of

GBP51.4 million. The construction loan will be repaid in full upon

acquisition.

On 24 July 2023, the Group announced that, together with other

funds managed by the Investment Manager, it would acquire a 25 per

cent stake in London Array offshore wind farm from Orsted. Other

owners are RWE (30 per cent), CDPQ (25 per cent) and Masdar (20 per

cent). The investment is scheduled to complete on 31 July 2023 and

the Group's total investment in London Array is expected to be

GBP444 million, comprising an equity investment of GBP394 million

(13.7 per cent net stake) and GBP50 million loan investment.

On 31 August 2023, the Group will acquire South Kyle wind farm

from Vattenfall for consideration of GBP320 million (commitment

made in 2020). South Kyle was officially opened on 13 June by

Laurence Fumagalli, on behalf of the Company and Anna Borg,

Vattenfall CEO.

All of the above investments are materially accretive to NAV,

with committed investments (South Kyle and Kype Muir Extension)

valued at GBP132.5 million as at 30 June 2023, above the investment

consideration.

On 29 June 2023, the Company utilised GBP640 million of new term

loan commitments from new and existing lenders and on 30 June 2023,

prepaid GBP150 million of term loans maturing in November and

December 2023 and GBP200 million drawn under the RCF.

The Group is very well capitalised to complete on its near term

investments. Cash balances (Group and wind farm SPVs) as at 30 June

2023 were GBP499 million with zero drawn under the GBP600 million

RCF.

Gearing as at 30 June 2023 was 34 per cent of GAV, with a

weighted cost of debt of 4.08 per cent across a spread of

maturities (November 2024 to March 2036):

Facility Maturity date Loan principal Loan margin Swap rate All-in rate

GBP 000 % / SONIA %

%

----------- --------------- --------------- ------------ ----------------- ------------

RCF 29 Oct 24 - 1.7500 5.0000 ([1]) 6.7500

NAB 4 Nov 24 50,000 1.1500 1.0610 2.2110

CBA 14 Nov 24 50,000 1.3500 0.8075 2.1575

CBA 6 Mar 25 50,000 1.5500 1.5265 3.0765

CIBC 3 Nov 25 100,000 1.5000 1.5103 3.0103

ANZ 3 May 26 75,000 1.4500 5.9240 7.3740

NAB 1 Nov 26 75,000 1.5000 1.5980 3.0980

NAB 1 Nov 26 25,000 1.5000 0.8425 2.3425

CIBC 14 Nov 26 100,000 1.4000 0.8132 2.2132

Lloyds 9 May 27 150,000 1.6000 5.6510 7.2510

CBA 4 Nov 27 100,000 1.6000 1.3680 2.9680

ABN AMRO 2 May 28 100,000 1.7500 5.0430 6.7930

ANZ 3 May 28 75,000 1.7500 5.3790 7.1290

Barclays 3 May 28 100,000 1.7500 4.9880 6.7380

AXA 31 Jan 30 125,000 - - 3.0300

AXA 31 Jan 30 75,000 1.7000 1.4450 3.1450

AXA 28 Apr 31 25,000 - - 6.4340

AXA 28 Apr 31 115,000 1.8000 5.0000 ([1]) 6.8000

Hornsea 1 31 Mar 36 610,000 - - 2.6000

---------------

2,000,000 Weighted average 4.0800

(1) Facility pays SONIA as variable rate

Given the leading market position of the Group and the

Investment Manager, there is no shortage of investment

opportunities, further fuelled by the challenging fundraising

environment affecting all buyers (in both public and private

markets). Thus the Investment Manager regularly reviews the

portfolio for potential disposals, with a view to recycling capital

into NAV accretive investments.

Net Asset Value

The following table sets out the movement in NAV from 31

December 2022 to 30 June 2023. The key components are discussed in

detail below.

GBP'000 Pence per share

---------- ----------------

NAV as at 31 December 2022 3,873,228 167.1

Net cash generation 204,020 8.8

Dividend (95,517) (4.1)

Power price (158,595) (6.8)

Inflation 188,224 8.1

Discount rate (263,252) (11.4)

Committed investments 132,507 5.7

Depreciation and other (36,669) (1.6)

NAV as at 30 June 2023 3,843,947 165.8

---------------------------- ---------- ----------------

Reconciliation of Statutory Net Assets to Reported NAV

As at As at

30 June 2023 31 December 2022

GBP'000 GBP'000

------------------------------- -------------- ------------------

Operating portfolio 5,172,618 5,458,334

Construction portfolio 44,938 39,414

Committed investments 132,507 -

Cash (wind farm SPVs) 131,223 141,068

------------------------------- -------------- ------------------

Fair value of investments (1) 5,481,286 5,638,816

Cash (Group) 367,360 19,783

Other relevant liabilities (4,699) (5,867)

------------------------------- -------------- ------------------

GAV 5,843,947 5,652,732

Aggregate Group Debt (1) (2,000,000) (1,779,504)

------------------------------- -------------- ------------------

NAV 3,843,947 3,873,228

Reconciling items - -

------------------------------- -------------- ------------------

Statutory net assets 3,843,947 3,873,228

Shares in issue 2,318,483,353 2,318,089,989

NAV per share (pence) 165.8 167.1

------------------------------- -------------- ------------------

(1) Includes limited recourse debt at Hornsea 1, not included in

the Condensed Consolidated Statement of Financial Position.

Power Price

Long term power price forecasts are provided by a leading market

consultant, updated quarterly, and may be adjusted by the

Investment Manager where more conservative assumptions are

considered appropriate. Short term power price assumptions reflect

the forward curve as at 3 July 2023.

A conservative 20 per cent discount (10 per cent for offshore)

is applied to power price assumptions in all years to reflect that

wind generation typically earns a lower price than the base load

power price. This compares to the 4 per cent discount to the base

load power price achieved by the portfolio in the period

(GBP104.06/MWh average achieved price versus GBP108.40/MWh average

N2EX index price).

In addition to the 20 per cent discount, a further discount is

applied to reflect the terms of each PPA. The price of some PPAs is

expressed as a percentage of a given price index, whereas other

PPAs include a fixed GBP/MWh discount to the price index. Other

PPAs pay a fixed GBP/MWh price for power.

The following table shows the assumed power price (post 20 per

cent discount pre PPA discount) and also the price post a

representative PPA discount (90 per cent x index price).

GBP/MWh (real 2022) 2023 2024 2025 2026 2027 2028 2029 2030

------ ------ ------ ------ ------ ------ ------ ------

Pre PPA discount 78.93 81.14 67.67 56.10 57.60 57.60 57.60 59.04

Post representative PPA discount 71.04 73.03 60.90 50.49 51.84 51.84 51.84 53.14

2031 2032 2033 2034 2035 2036 2037 2038 2039 2040

------ ------ ------ ------ ------ ------ ------ ------ ------ ------

Pre PPA discount 58.08 57.68 58.00 58.72 56.40 57.36 56.56 53.36 53.92 54.00

Post representative PPA discount 52.27 51.91 52.20 52.85 50.76 51.62 50.90 48.02 48.53 48.60

2041 2042 2043 2044 2045 2046 2047 2048 2049 2050

------ ------ ------ ------ ------ ------ ------ ------ ------ ------

Pre PPA discount 51.76 50.40 48.88 48.96 49.04 48.40 47.84 48.00 49.84 46.48

Post representative PPA discount 46.58 45.36 43.99 44.06 44.14 43.56 43.06 43.20 44.86 41.83

2051 2052 2053 2054 2055 2056 2057 2058 2059 2060

------ ------ ------ ------ ------ ------ ------ ------ ------ ------

Pre PPA discount 46.72 45.12 45.68 45.44 43.76 42.80 40.48 39.20 39.76 39.84

Post representative PPA discount 42.05 40.61 41.11 40.90 39.38 38.52 36.43 35.28 35.78 35.86

The portfolio benefits from a substantial fixed revenue base.

Furthermore, most fixed revenues are index linked (RPI in the case

of ROCs, CPI in the case of CFDs etc).

The fixed revenue base means that dividend cover is robust in

the face of extreme downside power price sensitivities. A dividend

that continues to increase with RPI is covered down to GBP10/MWh

over the next 5 years.

2024 2025 2026 2027 2028

-------- -------- -------- -------- --------

RPI increase (%) 7.0 3.5 3.5 3.5 3.5

Dividend (pence / share) 9.37 9.70 10.04 10.39 10.76

Dividend (GBP 000) 217,316 224,922 232,794 240,942 249,375

Dividend cover (x)

Base case 2.3 2.4 2.3 2.4 2.4

GBP50/MWh 1.8 1.9 2.0 2.0 2.1

GBP40/MWh 1.6 1.7 1.8 1.8 1.8

GBP30/MWh 1.4 1.5 1.5 1.5 1.5

GBP20/MWh 1.2 1.3 1.3 1.2 1.2

GBP10/MWh 1.0 1.1 1.0 1.0 0.9

All numbers illustrative. Power prices real 2022, pre PPA

discounts.

The Group's strategy remains to maintain an appropriate balance

between fixed and merchant revenue. To the extent that merchant

revenues were to increase as a proportion of total revenues then

new fixed price PPAs would be entered into. However, it is likely

that an appropriate revenue balance would be maintained through the

acquisition of new fixed revenue streams (for example, offshore

wind CFD assets).

Inflation

The base case assumes the following values for December

inflation each year:

2023 2024-2030 2031 onwards

RPI 7 per cent 3.5 per cent 2.5 per cent

CPI 5 per cent 2.5 per cent 2.5 per cent

If December 2023 RPI is 7 per cent this implies average RPI over

2023 of 10 per cent (13 per cent falling to 7 per cent over the

course of the year). Similarly, 2024 RPI starting at 7 per cent and

falling to 3.5 per cent by year end implies average RPI over 2024

of 5 per cent. Average RPI over 2025 is 3.5 per cent etc.

Average RPI over a year is important as this figure drives ROC

prices. The ROC price is inflated annually from 1 April each year

based on the previous year's average RPI. For example, based on the

assumptions in the table above, we assume a 10 per cent increase in

the ROC price from 1 April 2024.

CFD prices are also inflated annually from 1 April each year.

However, in the case of CFDs, the price is inflated based on

January CPI.

Given the explicit inflation linkage of a substantial proportion

of portfolio revenue (ROCs, CFDs, certain PPAs) and the implicit

inflation linkage inherent in power prices, there is a strong link

between inflation and portfolio return.

Over the long term, 1 per cent higher inflation means 1 per cent

higher IRR (all else being equal).

In the short term, a one off increase in inflation (for example,

a 10 per cent increase in the ROC price) leads to a ratchet-like

increase in portfolio cash flows that lock in for all future

years.

Interest rates (and therefore discount rates) are correlated

with inflation. It is important to appreciate the inflation linked

nature of the portfolio cash flows and that changes in discount

rates (associated with changes in interest rates) are broadly

offset by changes in inflation.

Returns

Discount rates must increase to reflect the higher interest rate

environment.

For the 30 June 2023 NAV, the discount rate was increased by a

further 1 per cent. The levered portfolio IRR now stands at 11 per

cent. This is now materially higher than at IPO over a decade

ago.

Given that the Company's ongoing charges ratio is less than 1

per cent, the net return to investors (assuming investment at NAV)

is thus 10 per cent.

The 10 per cent net return is also inflation linked, as

described above.

A 10 per cent inflation linked return should be very attractive

versus other investment opportunities. The Company's 10 year track

record demonstrates relatively low volatility and the historical

and projected dividend cover is robust. By investing in operating

UK wind farms (higher returning than European or solar generation

assets, and lower risk than batteries or development assets), the

Company aims to continue to generate consistent superior risk

adjusted returns.

A total return of 10 per cent and a dividend yield of 5 per cent

would imply NAV growth of 5 per cent. The total return is more

important than the dividend yield, which depends on the chosen

dividend policy (the Company could have a different combination of

dividend yield and NAV growth).

Excess cash generation (dividend cover) is reinvested to drive

NAV growth. Therefore the size of dividend cover is important; it

is not just a question of "covered or not covered". The business

model is self funding and does not rely on further equity

issuance.

Since IPO, aggregate historical dividend cover has been 1.9x and

the Group has reinvested GBP786 million and has delivered NAV

growth significantly in excess of RPI.

Outlook

There are currently approximately 29GW of operating UK wind

farms (15GW onshore plus 14GW offshore). In monetary terms, the

29GW of operating UK wind farms amounts to approximately GBP100

billion. The Group's market share is approximately 6 per cent. As

at 30 June 2023, the average age of the portfolio was 7 years

(versus 5 years at IPO in March 2013).

Given the leading market position of the Group and the

Investment Manager, there is no shortage of investment

opportunities, further fuelled by the challenging fundraising

environment affecting all buyers (in both public and private

markets). The Group is very well capitalised and the business model

is self funding.

The assumptions underpinning NAV are conservative. The portfolio

is robust in the face of downside power price sensitivities and

remains exposed to significant upside (power prices, inflation,

asset life extension, asset optimisation, new revenue streams,

interest rate cycle etc).

The levered portfolio IRR of 11 per cent and net return to

investors of 10 per cent should be very attractive versus other

investment opportunities. Directors and senior management of the

Investment Manager invested GBP1,645,680 over the period.

In general, the outlook for the Group is extremely

encouraging.

Statement of Directors' Responsibilities

The Directors acknowledge responsibility for the interim results

and approve this Half Year Report. The Directors confirm that to

the best of their knowledge:

a) the condensed financial statements have been prepared in

accordance with IAS 34 "Interim Financial Reporting" and give a

true and fair view of the assets, liabilities and financial

position and the profit of the Group as required by DTR 4.2.4R;

b) the interim management report, included within the Chairman's

Statement and Investment Manager's Report, includes a fair review

of the information required by DTR 4.2.7R, being the significant

events of the first half of the year and the principal risks and

uncertainties for the remaining six months of the year; and

c) the condensed financial statements include a fair review of

the related party transactions, as required by DTR 4.2.8R.

The Responsibility Statement has been approved by the Board.

Lucinda Riches C.B.E.

Chairman

26 July 2023

Condensed Consolidated Statement of Comprehensive Income

(unaudited)

For the six months ended 30 June 2023

For the six months ended For the six months ended

Note 30 June 2023 30 June 2022

GBP'000 GBP'000

--------------------------------------------------------- ----- ------------------------- -------------------------

Investment income 3 238,031 323,438

Unrealised movement in fair value of investments 8 (132,574) 258,752

Other income 864 990

--------------------------------------------------------- ----- ------------------------- -------------------------

Total income and unrealised movement 106,321 583,180

Operating expenses 4 (18,751) (16,509)

Investment acquisition costs (226) (577)

--------------------------------------------------------- ----- ------------------------- -------------------------

Operating profit 87,344 566,094

Finance expense 12 (21,858) (14,497)

--------------------------------------------------------- ----- ------------------------- -------------------------

Profit for the period before tax 65,486 551,597

Tax 5 - -

--------------------------------------------------------- ----- ------------------------- -------------------------

Profit for the period after tax 65,486 551,597

Profit and total comprehensive income attributable to:

Equity holders of the Company 65,486 551,597

Earnings per share

--------------------------------------------------------- ----- ------------------------- -------------------------

Basic and diluted earnings from continuing operations in

the period (pence) 6 2.82 23.80

--------------------------------------------------------- ----- ------------------------- -------------------------

The accompanying notes form an integral part of the financial

statements.

Condensed Consolidated Statement of Financial Position

(unaudited)

As at 30 June 2023

Note 30 June 2023 31 December 2022

GBP'000 GBP'000

-------------------------------------------------- ----- ------------- -----------------

Non current assets

Investments at fair value through profit or loss 8 4,871,286 4,959,312

-------------------------------------------------- ----- ------------- -----------------

4,871,286 4,959,312

Current assets

Receivables 10 2,040 2,487

Cash and cash equivalents 367,360 19,783

-------------------------------------------------- ----- ------------- -----------------

369,400 22,270

Current liabilities

Loans and borrowings 12 - (150,000)

Payables 11 (6,739) (8,354)

-------------------------------------------------- ----- ------------- -----------------

Net current assets/(liabilities) 362,661 (136,084)

Non current liabilities

Loans and borrowings 12 (1,390,000) (950,000)

Net assets 3,843,947 3,873,228

-------------------------------------------------- ----- ------------- -----------------

Capital and reserves

Called up share capital 14 23,185 23,181

Share premium account 14 2,471,142 2,470,396

Retained earnings 1,349,620 1,379,651

-------------------------------------------------- ----- ------------- -----------------

Total shareholders' funds 3,843,947 3,873,228

-------------------------------------------------- ----- ------------- -----------------

Net assets per share (pence) 15 165.8 167.1

-------------------------------------------------- ----- ------------- -----------------

Authorised for issue by the Board of Greencoat UK Wind PLC

(registered number 08318092) on 26 July 2023 and signed on its

behalf by:

Lucinda Riches C.B.E. Caoimhe Giblin

Chairman Director

The accompanying notes form an integral part of the financial

statements.

Condensed Consolidated Statement of Changes in Equity

(unaudited)

For the six months ended 30 June 2023

For the six months ended Share Share Retained

30 June 2023 Note capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ---- ------------------- ------------------ ------------------ ------------------

Opening net assets

attributable

to shareholders (1 January

2023) 23,181 2,470,396 1,379,651 3,873,228

Issue of share capital 14 4 746 - 750

Profit and total comprehensive

income for the period - 65,486 65,486

Interim dividends paid in

the period 7 - - (95,517) (95,517)

Closing net assets

attributable

to shareholders 23,185 2,471,142 1,349,620 3,843,947

------------------------------- ---- ------------------- ------------------ ------------------ ------------------

The total reserves distributable by way of a dividend as at 30

June 2023 were GBP768,751,535.

For the six months ended Share Share Retained

30 June 2022 Note capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------ -------------------- ------------------ ------------------ ---------------

Opening net assets attributable

to shareholders (1 January

2023) 23,171 2,468,940 601,588 3,093,699

Issue of share capital 6 744 - 750

Share issue costs - (34) - (34)

Profit and total comprehensive

income for the period - - 551,597 551,597

Interim dividends paid in

the period - - (86,326) (86,326)

Closing net assets attributable

to shareholders 23,177 2,469,650 1,066,859 3,559,686

--------------------------------------- -------------------- ------------------ ------------------ ---------------

The total reserves distributable by way of a dividend as at 30

June 2022 were GBP540,760,772.

The accompanying notes form an integral part of the financial

statements.

Condensed Consolidated Statement of Cash Flows (unaudited)

For the six months ended 30 June 2023

For the six months ended For the six months ended

Note 30 June 2023 30 June 2022

GBP'000 GBP'000

--------------------------------------------------------- ----- ------------------------- -------------------------

Net cash flows from operating activities 16 220,152 309,426

Cash flows from investing activities

Acquisition of investments 8 (55,936) (70,386)

Investment acquisition costs (226) (1,953)

Repayment of shareholder loan investments 8 11,388 5,272

--------------------------------------------------------- ----- ------------------------- -------------------------

Net cash flows from investing activities (44,774) (67,067)

Cash flows from financing activities

Payment of issue costs - (42)

Amounts drawn down on loan facilities 12 640,000 200,000

Amounts repaid on loan facilities 12 (350,000) (250,000)

Net finance costs (22,284) (11,621)

Dividends paid 7 (95,517) (86,326)

--------------------------------------------------------- ----- ------------------------- -------------------------

Net cash flows from financing activities 172,199 (147,989)

Net increase in cash and cash equivalents during the

period 347,577 94,370

Cash and cash equivalents at the beginning of the period 19,783 4,801

Cash and cash equivalents at the end of the period 367,360 99,171

--------------------------------------------------------- ----- ------------------------- -------------------------

The accompanying notes form an integral part of the financial

statements.

Notes to the Unaudited Condensed Consolidated Financial

Statements

For the six months ended 30 June 2023

1. Significant accounting policies

Basis of accounting

The condensed consolidated financial statements included in this

Half Year Report have been prepared in accordance with IAS 34

"Interim Financial Reporting". The same accounting policies,

presentation and methods of computation are followed in these

condensed consolidated financial statements as were applied in the

preparation of the Group's consolidated annual financial statements

for the year ended 31 December 2022 and are expected to continue to

apply in the Group's consolidated financial statements for the year

ended 31 December 2023.

The Group's consolidated annual financial statements were

prepared on the historic cost basis, as modified for the

measurement of certain financial instruments at fair value through

profit or loss, and in accordance with UK adopted international

accounting standards.

These condensed financial statements do not include all

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

consolidated annual financial statements for the year ended 31

December 2022. The audited annual accounts for the year ended 31

December 2022 have been delivered to the Registrar of Companies.

The audit report thereon was unmodified.

Review

This Half Year Report has not been audited or reviewed by the

Company's Auditor in accordance with the International Standards on

Auditing (ISAs) (UK) or International Standard on Review

Engagements (ISREs).

Going concern

As at 30 June 2023, the Group had net current assets of GBP

362.7 million (31 December 2022: net current liabilities of

GBP136.1 million) and cash balances of GBP367.4 million (31

December 2022: GBP19.8 million) which are sufficient to meet

current obligations as they fall due.

The Directors have reviewed Group forecasts and projections

which cover a period of at least 12 months from the date of

approval of this report, taking into account foreseeable changes in

investment and trading performance, which show that the Group has

sufficient financial resources to continue in operation for at

least the next 12 months from the date of approval of this

report.

On the basis of this review, and after making due enquiries, the

Directors have a reasonable expectation that the Company and the

Group have adequate resources to continue in operational existence

until at least July 2024. Accordingly, they continue to adopt the

going concern basis in preparing the financial statements.

Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The chief operating decision maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board, as a whole. The key

measure of performance used by the Board to assess the Group's

performance and to allocate resources is the total return on the

Group's net assets, as calculated under IFRS, and therefore no

reconciliation is required between the measure of profit or loss

used by the Board and that contained in the financial

statements.

For management purposes, the Group is organised into one main

operating segment, which invests in wind farm assets.

All of the Group's income is generated within the UK.

All of the Group's non-current assets are located in the UK.

Seasonal and cyclical variations

The Group's results do not vary significantly during reporting

periods as a result of seasonal activity.

2. Investment management fees

Under the terms of the Investment Management Agreement, the

Investment Manager is entitled to a combination of a Cash Fee and

an Equity Element from the Company.

The Cash Fee and Equity Element are calculated quarterly in

advance, as disclosed on page 74 of the Company's Annual Report for

the year ended 31 December 2022.

Investment management fees paid or accrued in the period were as

follows:

For the six months ended For the six months ended

30 June 2023 30 June 2022

GBP'000 GBP'000

---------------- ------------------------- -------------------------

Cash Fee 15,777 13,718

Equity Element 750 750

----------------

16,527 14,468

---------------- ------------------------- -------------------------

As at 30 June 2023, total amounts payable to the Investment

Manager were GBPnil (31 December 2022: GBP1,364,170).

3. Investment Income

For the six months ended For the six months ended

30 June 2023 30 June 2022

GBP'000 GBP'000

-------------------------------------------------- ------------------------- -------------------------

Dividends received (note 17) 208,286 297,483

Interest on shareholder loan investment received 29,745 25,955

238,031 323,438

-------------------------------------------------- ------------------------- -------------------------

4. Operating expenses

For the six For the six

months ended months ended

30 June 2023 30 June 2022

GBP'000 GBP'000

---------------------------------------- -------------- --------------

Management fees (note 2) 16,527 14,468

Group and SPV administration fees 608 439

Non-executive Directors' fees 160 178

Other expenses 1,328 1,309

Fees to the Company's Auditor:

for audit of the statutory financial

statements 124 111

for other audit related services 4 4

---------------------------------------- -------------- --------------

18,751 16,509

---------------------------------------- -------------- --------------

The fees to the Company's Auditor for the period ended 30 June

2023 include GBP 4,290 (30 June 2022: GBP4,173) payable in relation

to a limited review of the Half Year Report and estimated accruals

proportioned across the year for the audit of the statutory

financial statements.

5. Taxation

Taxable income during the period was offset by management

expenses and the tax charge for the period ended 30 June 2023 is

GBP nil (30 June 2022: GBPnil).

6. Earnings per share

For the six months ended For the six months ended

30 June 2023 30 June 2022

---------------------------------------------------------------- ------------------------- -------------------------

Profit attributable to equity holders of the Company - GBP'000 65,486 551,597

Weighted average number of ordinary shares in issue 2,318,296,118 2,317,381,121

---------------------------------------------------------------- ------------------------- -------------------------

Basic and diluted earnings from continuing operations in the

period (pence) 2.82 23.80

---------------------------------------------------------------- ------------------------- -------------------------

Dilution of the earnings per share as a result of the Equity

Element of the investment management fee as disclosed in note 2

does not have a significant impact on the basic earnings per

share.

7. Dividends declared with respect to the period

Interim dividends paid during the period ended 30 June 2023 Dividend per share Total dividend

pence GBP'000

------------------------------------------------------------- ------------------- ---------------

With respect to the quarter ended 31 December 2022 1.93 44,742

With respect to the quarter ended 31 March 2023 2.19 50,775

4.12 95,517

------------------------------------------------------------- ------------------- ---------------

Interim dividends declared after 30 Dividend

June 2023 and not accrued in the period per share Total dividend

pence GBP'000

------------------------------------------ ----------- ---------------

With respect to the quarter ended 30

June 2023 2.19 50,780

2.19 50,780

------------------------------------------ ----------- ---------------

As disclosed in note 18, on 26 July 2023 , the Board approved a

dividend of 2.19 pence per share with respect to the quarter ended

30 June 2023, bringing the total dividends declared with respect to

the period to 4.38 pence per share. The record date for the

dividend is 11 August 2023 and the payment date is 25 August 2023

.

8. Investments at fair value through profit or loss

For the period ended 30 June 2023 Loans Equity interest Total

GBP'000 GBP'000 GBP'000

----------------------------------------------------- ---------- ---------------- ----------

Opening balance 1,087,081 3,872,231 4,959,312

Additions 45,356 10,580 55,936

Repayment of shareholder loan investments (note 17) (11,388) - (11,388)

Unrealised movement in fair value of investments 2,521 (135,095) (132,574)

----------------------------------------------------- ---------- ---------------- ----------

1,123,570 3,747,716 4,871,286

----------------------------------------------------- ---------- ---------------- ----------

For the period ended 30 June 2022 Loans Equity interest Total

GBP'000 GBP'000 GBP'000

-------------------------------------------------- -------- ---------------- ----------

Opening balance 924,748 3,117,797 4,042,545

Additions (1) 50,397 19,831 70,228

Repayment of shareholder loan investments (5,272) - (5,272)

Unrealised movement in fair value of investments 1,018 257,734 258,752

-------------------------------------------------- -------- ---------------- ----------

970,891 3,395,362 4,366,253

-------------------------------------------------- -------- ---------------- ----------

(1) Includes a true-up receivable at Glen Kyllachy of

GBP158k.

Fair value measurements

As disclosed on pages 78 and 79 of the Company's Annual Report

for the year ended 31 December 2022 , IFRS 13 "Fair Value

Measurement" requires disclosure of fair value measurement by

level. The level of fair value hierarchy within the financial

assets or financial liabilities ranges from level 1 to level 3 and

is determined on the basis of the lowest level input that is

significant to the fair value measurement.

The fair value of the Group's investments is ultimately

determined by the underlying net present values of the SPV

investments. Due to their nature, they are always expected to be

classified as level 3 as the investments are not traded and contain

unobservable inputs. There have been no transfers between levels

during the period.

Sensitivity analysis

The fair value of the Group's investments is GBP4,871,286,111

(31 December 2022: GBP4,959,311,361). The analysis below is

provided to illustrate the sensitivity of the fair value of

investments to an individual input, while all other variables

remain constant. The Board considers these changes in inputs to be

within reasonable expected ranges. This is not intended to imply

the likelihood of change or that possible changes in value would be

restricted to this range.

Input Change in input Change in fair value of investments Change in NAV per share

--------------- ----------------- ------------------------------------ ------------------------

GBP'000 pence

Discount rate + 0.5 per cent (167,189) (7.2)

- 0.5 per cent 176,917 7.6

Inflation - 0.5 per cent (166,598) (7.2)

+ 0.5 per cent 175,538 7.6

Energy yield 10 year P90 (334,251) (14.4)

10 year P10 333,854 14.4

Power price - 10 per cent (311,587) (13.4)

+ 10 per cent 300,530 13.0

Asset life - 5 years (285,671) (12.3)

+ 5 years 185,783 8.0

The sensitivities above are assumed to be independent of each

other. Combined sensitivities are not presented.

9. Unconsolidated subsidiaries, associates and joint ventures

The following table shows subsidiaries of the Group acquired

during the period. As the Company is regarded as an investment

entity under IFRS, this subsidiary has not been consolidated in the

preparation of the financial statements:

Ownership interest as at

Investment Place of business 30 June 2023

------------ ------------------- -------------------------

Dalquhandy Scotland 100 %

There are no other changes to the unconsolidated subsidiaries or

the associates and joint ventures of the Group as disclosed on

pages 80 and 81 of the Company's Annual Report for the year ended

31 December 2022.

Guarantees and counter-indemnities provided by the Group during

the period on behalf of its investments are as follows:

Amount

Provider of security Investment Beneficiary Nature Purpose GBP'000

---------------------- ------------ ------------- ------------------- ----------------- --------------

The Company Dalquhandy BT Guarantee PPA 5,897

Holdco Dalquhandy BayWa Counter-indemnity Decommissioning 2,525

8,422

--------------------------------------------------------------------------------------- --------------

There were no other material changes to guarantees and

counter-indemnities provided by the Group, as disclosed on page 82

of the Company's Annual Report for the year ended 31 December 2022.

The fair value of these guarantees and counter-indemnities provided

by the Group are considered to be GBPnil (30 June 2022:

GBPnil).

10. Receivables

30 June 2023 31 December 2022

GBP'000 GBP'000

----------------------- ------------- -----------------

Amounts due from SPVs 1,222 1,648

VAT receivable 370 527

Prepayments 199 122

Other receivables 249 190

2,040 2,487

----------------------- ------------- -----------------

11. Payables

31 December

30 June 2023 2022

GBP'000 GBP'000

----------------------------------- ------------- ------------

Loan interest payable 4,905 5,490

Commitment fee payable 564 402

Letter of credit fees payable

(note 12) 103 324

Other finance costs payable 208 -

Investment management fee payable - 1,364

Other payables 959 774

6,739 8,354

----------------------------------- ------------- ------------

12. Loans and borrowings

30 June 2023 31 December 2022

GBP'000 GBP'000

--------------------------- ------------- -----------------

Opening balance 1,100,000 950,000

Revolving credit facility

Drawdowns - 260,000

Repayments (200,000) (310,000)

Term debt facilities

Drawdowns 640,000 200,000

Repayments (150,000) -

Closing balance 1,390,000 1,100,000

--------------------------- ------------- -----------------

Reconciled as:

Current liabilities - 150,000

Non current liabilities 1,390,000 950,000

For the six months ended For the six months ended

30 June 2023 30 June 2022

GBP'000 GBP'000

--------------------------- ------------------------- -------------------------

Loan interest 15,046 11,586

Facility arrangement fees 4,350 -

Commitment fees 1,390 1,748

Letter of credit fees 471 -

Professional fees 467 1,076

Other facility fees 134 87

Finance expense 21,858 14,497

--------------------------- ------------------------- -------------------------

The loan balance as at 30 June 2023 has not been adjusted to

reflect amortised cost, as the amounts are not materially different

from the outstanding balances.

There are no changes to the terms of the Company's revolving

credit facility as disclosed on page 84 of the Company's Annual

Report for the year ended 31 December 2022. As at 30 June 2023, the

balance of this facility was GBPnil (31 December 2022: GBP200

million), accrued interest was GBPnil (31 December 2022: GBP52,675)

and the outstanding commitment fee payable was GBP466,575 (31

December 2022: GBP401,753).

The Company also has a GBP100 million letter of credit facility

in place with Lloyds, of which GBP81.2 million was utilised as at

30 June 2023 (31 December 2022: GBP72.8 million). The fee for this

facility is 1.25 per cent of utilised amounts and the fee payable,

as at 30 June 2023 was GBP102,935 (31 December 2022:

GBP324,221).

During the period, the Company entered into new term debt

arrangements with ABN AMRO, ANZ, AXA, Barclays and Lloyds,

totalling GBP640 million. Details of the new facilities are

outlined in the table below.

On 30 June 2023, the Company repaid principal of GBP150 million

relating to the NAB and CBA facilities with maturity dates in

November 2023 and December 2023, respectively.

The Company's term debt facilities and associated interest rate

swaps, with various maturity dates, are set out in the below

table:

Swap rate

Provider Maturity date Loan principal Loan margin / SONIA All-in rate

GBP'000 % % %

---------- --------------- ---------------------- ------------ ------------ ------------

NAB 4 Nov 24 50,000 1.15 1.0610 2.2110

CBA 14 Nov 24 50,000 1.35 0.8075 2.1575

CBA 6 Mar 25 50,000 1.55 1.5265 3.0765

CIBC 3 Nov 25 100,000 1.50 1.5103 3.0103

ANZ 3 May 26 75,000 1.45 5.9240 7.3740

NAB 1 Nov 26 75,000 1.50 1.5980 3.0980

NAB 1 Nov 26 25,000 1.50 0.8425 2.3425

CIBC 14 Nov 26 100,000 1.40 0.8133 2.2133

Lloyds 9 May 27 150,000 1.60 5.6510 7.2510

CBA 4 Nov 27 100,000 1.60 1.3680 2.9680

ABN AMRO 2 May 28 100,000 1.75 5.0430 6.7930

ANZ 3 May 28 75,000 1.75 5.3790 7.1290

Barclays 3 May 28 100,000 1.75 4.9880 6.7380

AXA 31 Jan 30 125,000 3.0300

AXA 31 Jan 30 75,000 1.70 1.4450 3.1450

AXA 28 Apr 31 25,000 6.4430

AXA 28 Apr 31 115,000 1.80 5.0000([1]) 6.8000

1,390,000

-------------------------- ---------------------- ------------ ------------ ------------

([1]) Facility pays SONIA as variable rate

13. Contingencies and commitments

In April 2020, the Group announced that it had agreed to acquire

South Kyle wind farm project for a headline consideration of GBP320

million. The investment is scheduled to complete on 31 August

2023.

In December 2020, the Group entered into an agreement to acquire

49.9 per cent of the Kype Muir Extension wind farm project for a

headline consideration of GBP51.4 million, to be paid once the wind

farm is fully operational (target Q3 2023). The Group also agreed

to provide construction finance of up to GBP47 million, of which

GBP 44.9 million had been utilised as at 30 June 2023.

The committed investments of South Kyle and Kype Muir Extension

were valued at GBP132.5 million above the investment consideration

as at 30 June 2023.

14. Share capital - ordinary shares of GBP0.01

Six months to 30 June 2023

Number

Issued and fully of shares Share Share

Date paid issued capital premium Total

GBP'000 GBP'000 GBP'000

-------------- -------------------- -------------- --------- ---------- ----------

1 January

2023 2,318,089,989 23,181 2,470,396 2,493,577

Shares issued to the Investment

Manager

True-up of 2022

and

3 February Q1 2023 Equity

2023 Element 167,923 2 373 375

Q2 2023 Equity

5 May 2023 Element 225,441 2 373 375

393,364 4 746 750

30 June

2023 2,318,483,353 23,185 2,471,142 2,494,327

------------------------------------ -------------- --------- ---------- ----------

15. Net assets per share

30 June 2023 31 December 2022

---------------------------------- -------------- -----------------

Net assets - GBP'000 3,843,947 3,873,228

Number of ordinary shares issued 2,318,483,353 2,318,089,989

---------------------------------- -------------- -----------------

Total net assets - pence 165.8 167.1

---------------------------------- -------------- -----------------

16. Reconciliation of operating profit for the period to net cash from operating activities

For the six months ended For the six months ended

30 June 2023 30 June 2022

GBP'000 GBP'000

----------------------------------------------------------- ------------------------- -------------------------

Operating profit for the period 87,344 566,094

Adjustments for:

Unrealised movement in fair value of investments (note 8) 132,574 (258,752)

Investment acquisition costs 226 577

Decrease in receivables 470 1,534

Decrease in payables (1,212) (777)

Equity Element of Investment Manager's fee (note 2) 750 750

Net cash flows from operating activities 220,152 309,426

----------------------------------------------------------- ------------------------- -------------------------

17. Related party transactions

During the period, the Company increased its loan to Holdco by

GBP 400,000 (30 June 2022: GBP411,425) and Holdco settled amounts

of GBP150,647,425 (30 June 2022: GBP 163,866,761 ). The amount

outstanding at the period end was GBP 2,193,467,789 (31 December

2022: GBP2,343,715,214).

The below table shows dividends received in the period from the

Group's investments.

For the six months ended For the six months ended

30 June 2023 30 June 2022

GBP'000 GBP'000

------------------------ ------------------------- -----------------------------

Humber Holdco (1) 30,239 29,722

Clyde 27,038 38,556

Hornsea 1 Holdco(2) 17,921 -

Walney Holdco (3) 11,383 9,366

Stronelairg Holdco (4) 11,189 24,640

Brockaghboy 9,045 9,791

Hoylake (5) 8,156 2,961

ML Wind (6) 7,595 10,241

North Hoyle 7,547 14,186

SYND Holdco (7) 6,969 11,670

Braes of Doune 6,735 14,380

Rhyl Flats 6,237 8,184

Dunmaglass Holdco (8) 5,688 9,362

Little Cheyne Court 4,264 5,412

Fenlands (9) 3,954 11,300

Andershaw 3,482 6,913

Windy Rig 3,244 7,093

Douglas West 3,040 8,644

Tappaghan 2,966 5,933

Maerdy 2,789 5,427

Twentyshilling 2,734 -

Slieve Divena 2,727 4,602

Corriegarth 2,484 17,054

Bishopthorpe 2,395 4,721

Bicker Fen 2,326 4,550

Glen Kyllachy 2,131 2,500

Slieve Divena 2 2,040 3,991

Screggagh 1,930 3,871

Stroupster 1,862 1,000

Crighshane 1,655 4,020

Langhope Rig 1,621 4,924

Cotton Farm 966 1,913

Church Hill 940 3,124

Bin Mountain 908 2,202

Carcant 866 1,909

Kildrummy 616 2,221

Earl's Hall Farm 604 1,100

208,286 297,483

------------------------ ------------------------- -----------------------------

(1) The Group's investment in Humber Gateway is held through

Humber Holdco.

(2) The Group's investment in Hornsea 1 is held through Hornsea

1 Holdco.

(3) The Group's investment in Walney is held through Walney

Holdco.

(4) The Group's investment in Stronelairg is held through

Stronelairg Holdco.

(5) The Group's investment in Burbo Bank Extension is held

through Hoylake.

(6) The Group's investments in Middlemoor and Lindhurst are held

through ML Wind.

(7) The Group's investments in Drone Hill, North Rhins, Sixpenny

Wood and Yelvertoft are held through SYND Holdco.

(8) The Group's investment in Dunmaglass is held through

Dunmaglass Holdco.

(9) The Group's investments in Deeping St. Nicholas, Glass Moor,

Red House and Red Tile are held through Fenlands.

The table below shows the Group's shareholder loans with the

wind farm investments.

Accrued

interest

Loans at at 30

Loans at 1 January Loans advanced in the Loan repayments in the 30 June June

2023(1) period (2) period 2023 2023 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ------------------- ----------------------- ----------------------------- ---------- --------- -----------

Andershaw 32,641 - (1,466) 31,175 470 31,645

Church Hill 13,830 - (803) 13,027 132 13,159

Clyde 71,503 - - 71,503 965 72,468

Corriegarth 42,553 - - 42,553 420 42,973

Crighshane 20,497 - (662) 19,835 204 20,039

Dalquhandy - 40,878 - 40,878 168 41,046

Douglas West 43,248 - (1,177) 42,071 410 42,481

Dunmaglass

Holdco (3) 56,864 - - 56,864 851 57,715

Glen Kyllachy 48,776 - (1,132) 47,644 456 48,100

Hornsea 1

Holdco (4) 109,475 - - 109,475 39 109,514

Hoylake (5) 178,120 - - 178,120 - 178,120

Kype Muir

Extension 39,415 5,523 - 44,938 - 44,938

Slieve Divena 2 21,378 - (706) 20,672 209 20,881

Stronelairg 86,619 - - 86,619 1,296 87,915

Tom nan Clach 73,709 - (5,442) 68,267 218 68,485

Twentyshilling 32,190 - - 32,190 313 32,503

Walney Holdco

(6) 172,727 - - 172,727 1,732 174,459

Windy Rig 36,772 - - 36,772 357 37,129

1,080,317 46,401 (11,388) 1,115,330 8,240 1,123,570

---------------- ------------------- ----------------------- ----------------------------- ---------- --------- -----------

(1) Excludes accrued interest at 31 December 2022 of

GBP6,763,541.

(2) Includes capitalised interest of GBP1.05 million for Kype

Muir Extension.

(3) The Group's investment in Dunmaglass is held through

Dunmaglass Holdco.

(4) The Group's investment in Hornsea 1 is held through Hornsea

1 Holdco.

(5) The Group's investment in Burbo Bank Extension is held

through Hoylake.

(6) The Group's investment in Walney is held through Walney

Holdco.

18. Subsequent events

On 24 July 2023, the Group announced that, together with other

funds managed by the Investment Manager, it would acquire a net

13.7 per cent stake in London Array offshore wind farm for GBP394

million plus an associated loan investment of GBP50 million. The

transaction is expected to complete on 31 July 2023.

On 26 July 2023 , the Board approved a dividend of 2.19 pence

per share with respect to the quarter ended June 2023. The record

date for the dividend is 11 August 2023 and the payment date is 25

August 2023 .

Company Information

Directors (all non-executive) Registered Company Number

Lucinda Riches C.B.E (Chairman) 08318092

Martin McAdam

Caoimhe Giblin Registered Office

Nick Winser C.B.E. 5(th) Floor

20 Fenchurch Street

London

Jim Smith (1) EC3M 3BY

Shonaid Jemmett-Page (2)

Investment Manager

Schroders Greencoat LLP

4th Floor, The Peak Registered Auditor

5 Wilton Road BDO LLP

London 55 Baker Street

SW1V 1AN London

W1U 7EU

Administrator and Company Secretary

Ocorian Administration (UK) Limited

Unit 4, The Legacy Building Joint Broker

Northern Ireland Science Park RBC Capital Markets

Queen's Road 100 Bishopsgate

Belfast London

BT3 9DT EC2N 4AA

Depositary

Ocorian Depositary (UK) Limited

Unit 4, The Legacy Building Joint Broker

Northern Ireland Science Park Jefferies International Limited

Queen's Road 100 Bishopsgate

Belfast London

BT3 9DT EC2N 4JL

Registrar

Computershare Limited

The Pavilions

Bridgewater Road

Bristol

BS99 6ZZ

(1) Appointed to the Board with effect from 1 May 2023.

(2) Retired from the Board with effect from 28 April 2023.

Defined Terms

ABN AMRO means ABN AMRO Bank N.V.

Aggregate Group Debt means the Group's proportionate share of

outstanding third party borrowings

AGM means Annual General Meeting of the Company

Alternative Performance Measure means a financial measure other

than those defined or specified in the applicable financial

reporting framework

Andershaw means Andershaw Wind Power Limited

ANZ means Australia and New Zealand Banking Group Limited

AXA means funds managed by AXA Investment Managers UK

Limited

Barclays means Barclays Bank PLC

BDO LLP means the Company's Auditor as at the reporting date

Bicker Fen means Bicker Fen Windfarm Limited

Bin Mountain means Bin Mountain Wind Farm (NI) Limited

Bishopthorpe means Bishopthorpe Wind Farm Limited

Board means the Directors of the Company

Braes of Doune means Braes of Doune Wind Farm (Scotland)

Limited

Breeze Bidco means Breeze Bidco (TNC) Limited

Brockaghboy means Brockaghboy Windfarm Limited

Burbo Bank Extension means Hoylake Wind Limited, Greencoat Burbo

Extension Holding (UK) Limited, Burbo Extension Holding Limited and

Burbo Extension Limited

Carcant means Carcant Wind Farm (Scotland) Limited

Cash Fee means the cash fee that the Investment Manager is

entitled to under the Investment Management Agreement

CBA means Commonwealth Bank of Australia

CFD means Contract For Difference

Church Hill means Church Hill Wind Farm Limited

CIBC means Canadian Imperial Bank of Commerce

Clyde means Clyde Wind Farm (Scotland) Limited

CO(2) means carbon dioxide

Company means Greencoat UK Wind PLC

Corriegarth means Corriegarth Wind Energy Limited

Cotton Farm means Cotton Farm Wind Farm Limited

CPI means the Consumer Price Index

Crighshane means Crighshane Wind Farm Limited

Dalquhandy means Dalquhandy Wind Farm Limited

Deeping St. Nicholas means Deeping St. Nicholas wind farm

Douglas West means Douglas West Wind Farm Limited

Drone Hill means Drone Hill Wind Farm Limited

DTR means the Disclosure Guidance and Transparency Rules

sourcebook issued by the Financial Conduct Authority

Dunmaglass means Dunmaglass Holdco and Dunmaglass Wind Farm

Dunmaglass Holdco means Greencoat Dunmaglass Holdco Limited

Dunmaglass Wind Farm means Dunmaglass Wind Farm Limited

Earl's Hall Farm means Earl's Hall Farm Wind Farm Limited

Equity Element means the ordinary shares issued to the

Investment Manager under the Investment Management Agreement

EU means the European Union

Fenlands means Fenland Windfarms Limited

GAV means Gross Asset Value

GB means Great Britain consisting of England, Scotland and

Wales

Glass Moor means Glass Moor wind farm

Glen Kyllachy means Glen Kyllachy Wind Farm Limited

Group means Greencoat UK Wind PLC and Greencoat UK Wind Holdco

Limited

Holdco means Greencoat UK Wind Holdco Limited

Hornsea 1 means Hornsea 1 Holdco and Hornsea 1 Limited

Hornsea 1 Holdco means Jupiter Investor TopCo Limited

Hoylake means Hoylake Wind Limited

Humber Gateway means Humber Holdco and Humber Wind Farm

Humber Holdco means Greencoat Humber Limited

Humber Wind Farm means RWE Renewables UK Humber Wind Limited

IAS means International Accounting Standard

IFRS means International Financial Reporting Standards

Investment Management Agreement means the agreement between the

Company and the Investment Manager

Investment Manager means Schroders Greencoat LLP

IPO means Initial Public Offering

IRR means Internal Rate of Return

Kildrummy means Kildrummy Wind Farm Limited

Kype Muir Extension means Kype Muir Extension Wind Farm

Langhope Rig means Langhope Rig Wind Farm Limited

Lindhurst means Lindhurst Wind Farm

Little Cheyne Court means Little Cheyne Court Wind Farm

Limited

London Array means London Array Limited

Lloyds means Lloyds Bank PLC

Maerdy means Maerdy Wind Farm Limited

Middlemoor means Middlemoor Wind Farm

ML Wind means ML Wind LLP

NAB means National Australia Bank

Nanclach means Nanclach Limited

NAV means Net Asset Value

NAV per Share means the Net Asset Value per Ordinary Share

North Hoyle means North Hoyle Wind Farm Limited

North Rhins means North Rhins Wind Farm Limited

PPA means Power Purchase Agreement entered into by the Group's

wind farms

RBC means the Royal Bank of Canada

RBS International means the Royal Bank of Scotland International

Limited

Red House means Red House wind farm

Red Tile means Red Tile wind farm

Review Section means the front end review section of this report

(including but not limited to the Chairman's Statement and the

Investment Manager's Report)

Rhyl Flats means Rhyl Flats Wind Farm Limited

ROC means Renewable Obligation Certificate

RPI means the Retail Price Index

Santander means Santander Global Banking and Markets

Screggagh means Screggagh Wind Farm Limited

Sixpenny Wood means Sixpenny Wood Wind Farm Limited

Slieve Divena means Slieve Divena Wind Farm Limited

Slieve Divena 2 means Slieve Divena Wind Farm No. 2 Limited

SONIA means the Sterling Overnight Index Average

South Kyle means South Kyle Wind Farm Limited

SPVs means the Special Purpose Vehicles which hold the Group's

investment portfolio of underlying wind farms

Stronelairg means Stronelairg Holdco and Stronelairg Wind

Farm

Stronelairg Holdco means Greencoat Stronelairg Holdco

Limited

Stronelairg Wind Farm means Stronelairg Wind Farm Limited

Stroupster means Stroupster Caithness Wind Farm Limited

SYND Holdco means SYND Holdco Limited

Tappaghan means Tappaghan Wind Farm (NI) Limited

Tom nan Clach means Breeze Bidco and Nanclach

TSR means Total Shareholder Return

Twentyshilling means Twentyshilling Limited

UK means the United Kingdom of Great Britain and Northern

Ireland

Walney means Walney Holdco and Walney Wind Farm

Walney Holdco means Greencoat Walney Holdco Limited

Walney Wind Farm means Walney (UK) Offshore Windfarms

Limited

Windy Rig means Windy Rig Wind Farm Limited

Yelvertoft means Yelvertoft Wind Farm Limited

Alternative Performance Measures

Performance Measure Definition

Aggregate Group Debt The Group's proportionate share of outstanding

third party

borrowings

-----------------------------------------------

GAV Gross Asset Value

-----------------------------------------------

NAV Net Asset Value

-----------------------------------------------

NAV per share The Net Asset Value per ordinary share

-----------------------------------------------

Net cash generation The operating cash flow of the Group

and wind farm SPVs

-----------------------------------------------

Total Shareholder Return The movement in share price, combined

with dividends paid, on the assumption

that these dividends have been reinvested

-----------------------------------------------

Principal Risks and Uncertainties

The principal risks and uncertainties affecting the Group were

identified in detail in the Company's Annual Report to 31 December

2022, summarised as follows:

-- dependence on the Investment Manager;

-- financing risk; and

-- risk of investment returns becoming unattractive.

Also, the principal risks and uncertainties affecting the

investee companies were identified in detail in the Company's

Annual Report to 31 December 2022, summarised as follows:

-- changes in Government policy on renewable energy;

-- a decline in the market price of electricity;

-- risk of low wind resource;

-- lower than expected asset life; and

-- health and safety and the environment.

The principal risks outlined above remain the most likely to

affect the Group and its investee companies in the second half of

the year.

Cautionary Statement

The Review Section of this report has been prepared solely to

provide additional information to shareholders to assess the

Company's strategies and the potential for those strategies to

succeed. These should not be relied on by any other party or for

any other purpose.

The Review Section may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will" or "should" or,

in each case, their negative or other variations or comparable

terminology.

These forward-looking statements include all matters that are

not historical facts. They appear in a number of places throughout

this document and include statements regarding the intentions,

beliefs or current expectations of the Directors and the Investment

Manager concerning, amongst other things, the investment objectives

and Investment Policy, financing strategies, investment

performance, results of operations, financial condition, liquidity,

prospects, and distribution policy of the Company and the markets

in which it invests.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance. The Company's actual investment performance, results

of operations, financial condition, liquidity, distribution policy

and the development of its financing strategies may differ

materially from the impression created by the forward-looking

statements contained in this document.

Subject to their legal and regulatory obligations, the Directors

and the Investment Manager expressly disclaim any obligations to

update or revise any forward-looking statement contained herein to

reflect any change in expectations with regard thereto or any

change in events, conditions or circumstances on which any

statement is based.

In addition, the Review Section may include target figures for

future financial periods. Any such figures are targets only and are

not forecasts.

This Half Year Report has been prepared for the Company as a

whole and therefore gives greater emphasis to those matters which

are significant in respect of Greencoat UK Wind PLC and its

subsidiary undertakings when viewed as a whole.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QQLFLXDLZBBL

(END) Dow Jones Newswires

July 27, 2023 02:00 ET (06:00 GMT)

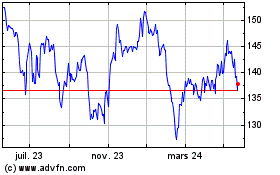

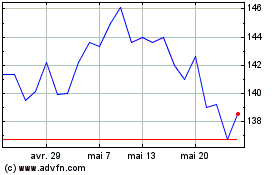

Greencoat Uk Wind (LSE:UKW)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Greencoat Uk Wind (LSE:UKW)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024