TIDMWINK

RNS Number : 7510U

M Winkworth Plc

08 April 2021

M Winkworth Plc

Audited final results for the year to 31 December 2020

M Winkworth plc ("Winkworth" or the "Company"), the leading

franchisor of real estate agencies, is pleased to announce its

results for the year ended 31 December 2020.

Highlights for the year

-- Franchised office network revenue of GBP47.7 million (2019: GBP48.3 million)

-- Revenues of GBP6.41 million (2019: GBP6.42 million)

-- Profit before taxation GBP1.53 million (2019: GBP1.63 million)

-- Year-end cash balance of GBP4.66 million (2019: GBP3.57 million)

-- Rental income 50% of total revenues (2019: 51%)

-- Two new franchises opened

-- Dividends of 6.68p declared (2019: 7.8p)

Dominic Agace, CEO of the Company, commented: "Our business

model was tested by extreme conditions in 2020 and proven to be

very robust. The benefits of local expertise, highly motivated

managers and a state-of-the-art digital platform meant that we were

quick to emerge from lockdown and improve our market share. While

challenges remain, we expect to see an increase in activity in 2021

and we are well positioned to further grow our network and respond

to the evolving needs of our customers."

For further information please contact:

M Winkworth Plc Tel : 020 7355 0206

Dominic Agace (Chief Executive Officer)

Andrew Nicol (Chief Financial Officer)

Milbourne (Public Relations) Tel : 07903 802545

Tim Draper

Shore Capital Ltd (NOMAD and Broker) Tel : 020 7408 4090

Robert Finlay

David Coaten

Henry Willcocks

About Winkworth

Winkworth is the leading London franchisor of residential real

estate agencies with a pre-eminent position in the mid to upper

segments of the sales and lettings markets. The franchise model

allows entrepreneurial real estate professionals to provide the

highest standards of service under the banner of a long-established

brand name and to benefit from the support and promotion that

Winkworth offers.

Winkworth is admitted to trading on the AIM Market of the London

Stock Exchange.

For further information please visit: www.winkworthplc.com

Chairman's Statement

We have delivered a positive set of results for 2020, especially

in view of the shutdown of sales in the second quarter of the year.

Management and lettings activity held up well and was carefully

managed throughout the lockdown. Clearly, the close relationship

between the local office teams and their clients and tenants has

been an important factor and maintaining the revenue from this

business line reflects well on our systems and training.

During both the first and second lockdowns, the benefit of our

outlets being in key locations was once again proven. Our local

experience meant that we were able to perform valuations remotely

and it was noticeable that, on the lifting of lockdown, our clients

were delighted to meet us in a controlled environment. We believe

that this relationship helped to power our recovery, which confirms

our confidence in Winkworth's high street presence. It is not our

intention to develop remote working - this pandemic has

demonstrated that our business is reliant on teamwork and good

communications.

In recent months we have seen some reduction in interest in

lettings and, in particular, there has been lower demand in central

London, especially in the foreign student market. As families

re-plan their lives, however, the market has swung back towards

sales. This has been driven by buyers seeking extra room for

workspace and gardens, while still maintaining access to central

London. Our country offices have experienced an influx of new

buyers, while in the suburbs we have been inundated with buyers

seeking additional or outside space. We expect this trend to

continue.

We acted with caution during the first lockdown but progressed

with the projects in hand such as the improvements to our knowledge

and regulation hub, which we use to deliver our support services

and training to our franchisees, and further upgrades to our

website. We will be adding new franchises in 2021 and will continue

to use the Company's substantial resources to attract and back

entrepreneurial estate agents in key growth areas of Southern

England, acting opportunistically as opportunities arise.

Winkworth ended the year with no debt and a healthy cash balance

of GBP4.66m after paying dividends for 2020 of 6.68p per share. The

reduction in quarterly payments on the previous year reflected

restraint in the face of the unpredictable fluctuations in trading

due to lockdowns. Our offices have now been open since mid-May of

last year and, after a rebound in sales activity in the second

half, we have experienced strong momentum going into the first

quarter of this year. Having repaid the furlough money received

from the government for franchisor staff, the board remains

committed to paying a quarterly dividend and restoring its

progressive dividend policy.

Simon Agace

Non-Executive Chairman

7 April 2021

CEO's Statement

After the dramatic shutdown of the property market in March last

year, following the first lockdown when all non-essential sales

were suspended, the property market bounced back strongly once

trading resumed.

The pandemic brought a new set of buyers to the market, driven

by a desire to change their living conditions after several months

of working from home. It effectively brought forward moves that may

well have been up to five years away, as people pushed for more

space in suburban London or moved to the country.

This new influence, boosted by a stamp duty holiday, led to a

surge in sales in the second half of the year, creating a logjam in

conveyancing and extending transaction times considerably as the

system struggled to cope with demand. All our markets benefitted

from this with the exception of central London, where a lack of

international travel and the repatriation of much of the

international community limited demand in sales.

We further improved our strong position in the marketplace and

ranked 2(nd) in London with a market share of 4.53%, having

increased our share of SSTC properties in 2020 by 0.35%(1). From a

national perspective the results were also good as we saw our

market share of SSTC properties increasing, climbing by another

place in the UK rankings to 11(th) in 2020.

The rentals and management side of the business was little

affected in the first half of the year, with lettings income

proving resilient as many tenants stayed put and renewals business

increased. Over the course of the second half of the year our

London rentals saw some weakness, but country rentals progressed

well. Once again, our management fees continued to grow as

landlords chose our management service to guide them through a

rapidly changing regulatory environment, growing by 6% and

accounting for 21% of group revenue (2019: 20%).

In central London, the pandemic had a more immediate impact on

rentals demand due not only to a lack of international travel, but

also to students and young professionals returning to family homes

in the country. Whereas our outer London rentals revenues were

broadly unchanged on 2019, central London rents declined by up to

20% in certain areas in 2020 and our overall London revenues fell

by 4%. Our country rental income, however, grew by 12%.

In 2020, gross revenues of the franchised network of GBP47.7m

were broadly flat year-on-year (2019: GBP48.3m). Sales income was

unchanged at GBP23.8m (2019: GBP23.8m) while Lettings and

Management fell by 2% to GBP23.9m (2019: GBP24.4m), producing an

equal revenue split between these two activities compared to a

ratio of 45% Sales and 55% Lettings and Management at the end of

H1.

Winkworth's revenues were flat at GBP6.41m (2019: GBP6.42m) and

profit before taxation was 6% lower at GBP1.53m (2019: GBP1.63m).

The Group's cash position at year end increased to GBP4.66m (2019:

GBP3.57m). Dividends of 6.68p were declared for the year (2019:

7.8p).

Despite the challenging market conditions, we were able to open

two new franchises in Long Melford and Bagshot, with a new office

in Hellesdon falling into 2021. We have several further offices

scheduled to open in 2021 and maintain our target of opening five

new offices per year.

Tooting, in which we made an investment in 2019, continued to

show promising growth, with revenues up by 17%. Having started the

year ranking second in the area by market share of sales agreed, it

ended it ranking consistently as the leading agent. Tooting is now

the 13th largest office in the Winkworth network by gross

revenue.

As we pursue the strategy of backing talented operators, and

where appropriate taking an equity position to deliver more than

the 8% franchise return, in 2020 we took a second step by investing

in the Crystal Palace office. Having mapped target markets and

identified individuals who we believe can make a significant

contribution to our business, we have further developments in the

pipeline. We will incentivize these individuals with the prospect

of earning equity in the office or offices that they manage.

Last year saw a resurgence of merger and acquisition activity in

the sector and some consolidation amongst our peers. We believe

that this will provide us with an opportunity to attract new

franchisees and managers looking for an opportunity to strike out

on their own. The strength of our brand, our ongoing investment in

the digital platform, our compliance solutions, and the support

that we provide from our central office are all powerful selling

points for dynamic entrepreneurs.

Outlook

Sparked by the stamp duty holiday on purchases up to GBP500,000,

demand has remained strong throughout the recent lockdown and there

is a considerable backlog of transactions to be cleared. The

government has signaled its intention to continue to support

homeownership, extending the existing stamp duty holiday until June

and on purchases up to GBP250,000 until September, as well as

committing to help first time buyers by providing guarantee support

on 95% mortgages.

With a successful vaccination campaign making great progress,

and as travel and nonessential shops and hospitality open again, we

expect the residential sales market to continue to show healthy

momentum. After several years in the doldrums due to Brexit

uncertainty, and backed by a proactively supportive government, the

prospects look positive, albeit that affordability constraints in

London will limit price growth.

We expect the appeal of owning property in central London to

return. With prices having come off some 15% since 2014, and with

Brexit and its initial uncertainty now behind us, we would expect

central London to regain its safe haven status and attract

significant investment once international travel resumes.

As cities re-open in 2021, we would also expect rentals demand

to recover as young professionals return to city living and the

re-opening of borders brings back international students, reversing

some of the price declines seen in 2020. Supply may be limited by

landlords selling down their portfolios after the difficulties of

the last 12 months and as the stricter legislative requirements to

which they are now required to adhere to discourage marginal

participants. While these elements should help activity and rental

prices to recover, it may take several years for urban rents to

surpass 2019 levels.

Growth in rental prices in the country may slow as demand eases

slightly and the support for 95% LTV mortgages from the government

encourages tenants into the sales market, but we believe that

activity will hold up well, albeit with more measured price growth

of around 3%.

In the first quarter we have seen a strong uptick in sales

agreed and a very encouraging increase in applications for both

sales and rentals. We anticipate an increase in transactions this

year and Winkworth is set to benefit from this, as a more active

market encourages agents to set up and manage their own agency.

Franchising under a top-quality name is the safest and quickest way

to do this. We also see the opportunity to accelerate our growth by

financially supporting talented agents and increasing our market

share in high potential areas, thus enhancing our returns.

(1) Source: TwentyCI

Dominic Agace

Chief Executive Officer

7 April 2021

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE YEARED 31 DECEMBER 2020

2020 2019

Notes GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue 6,406 6,416

Cost of sales (1,137) (1,320)

--------- ---------

GROSS PROFIT 5,269 5,096

48 -

Administrative expenses (3,921) (3,561)

Negative goodwill 119 68

--------- ---------

OPERATING PROFIT 1,515 1,603

Finance costs (22) (29)

Finance income 39 54

--------- ---------

PROFIT BEFORE TAXATION 1,532 1,628

Tax 4 (295) (320)

--------- ---------

PROFIT AND TOTAL COMPREHENSIVE INCOME FOR

THE YEAR 1,237 1,308

========= =========

Profit and total comprehensive income attributable

to:

Owners of the parent 1,169 1,285

Non-controlling interests 68 23

--------- ---------

1,237 1,308

====== ======

Notes

Earnings per share expressed in pence per 6 2020 2019

share: GBP GBP

Basic 9.18 10.09

Diluted 9.14 10.06

--------- ---------

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31 December 2020

2020 2019

Notes GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Intangible assets 850 668

Property, plant and equipment 827 607

Prepaid assisted acquisitions support 338 541

Investments 71 43

Trade and other receivables 307 372

--------- ---------

2,393 2,231

--------- ---------

CURRENT ASSETS

Trade and other receivables 911 913

Cash and cash equivalents 4,661 3,571

--------- ---------

5,572 4,484

--------- ---------

TOTAL ASSETS 7,965 6,715

========= =========

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 64 64

Share based payment reserve 8 51 51

Retained earnings 5,147 4,867

--------- ---------

5,262 4,982

Non-controlling interests 165 97

--------- ---------

TOTAL EQUITY 5,427 5,079

--------- ---------

LIABILITIES

NON-CURRENT LIABILITIES

Trade and other payables 512 294

Deferred tax 90 66

--------- ---------

CURRENT LIABILITIES 602 360

Trade and other payables 1,756 1,085

Corporation tax payable 180 191

--------- ---------

1,936 1,276

TOTAL LIABILITIES 2,538 1,636

--------- ---------

TOTAL EQUITY AND LIABILITIES 7,965 6,715

========= =========

M Winkworth PLC

Consolidated Statement of Changes

in Equity

for the Year Ended 31 December

2020

Called

up

share Retained Share Other Non-controlling Total

capital earnings premium reserves Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January 2019 64 4,550 - 51 4,665 - 4,665

Changes in equity

Dividends - (968) - - (968) - (968)

Acquired with subsidiary - - - - - 74 74

Profit and total comprehensive

income - 1,285 - - 1,285 23 1,308

------- -------- ------- -------- ------- --------------- -------

Balance at 31 December 2019 64 4,867 - 51 4,982 97 5,079

------- -------- ------- -------- ------- --------------- -------

Changes in equity

Dividends - (889) - - (889) - (889)

Profit and total comprehensive

income - 1,169 - - 1,169 68 1,237

------- -------- ------- -------- ------- --------------- -------

Balance at 31 December 2020 64 5,147 - 51 5,262 165 5,427

======= ======== ======= ======== ======= =============== =======

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2020

2020 2019

Notes GBP'000 GBP'000

Cash flows from operating activities

Profit before tax 1,532 1,628

Depreciation charges 555 573

Reduction in fair value of fixed asset

investments - 10

Impairment of intangible 66 -

Negative goodwill (119) (68)

FV uplift on investment (28) -

Finance costs 22 29

Finance income (39) (54)

1,989 2,118

Increase in trade and other receivables 67 (1,464)

Increase/(decrease) in trade and other

payables 706 1,621

--------- --------------

Cash generated from operations 2,762 2,275

Tax paid (313) (255)

--------- --------------

Net cash from operating activities 2,449 2,020

--------- --------------

Cash flows from investing activities

Purchase of intangible fixed assets (142) (170)

Purchase of tangible fixed assets (82) (9)

Assisted acquisitions support (17) (98)

Cash acquired on acquisition - 116

Cash paid to acquire subsidiary - (23)

Interest received 39 54

--------- --------------

Net cash from investing activities (202) (130)

--------- --------------

Cash flows from financing activities

Principal paid on lease liabilities (246) (257)

Interest paid on lease liabilities (22) (29)

Equity dividends paid (889) (968)

--------- --------------

Net cash from financing activities (1,157) (1,254)

========= ==============

Increase/(decrease) in cash and cash equivalents 1,090 636

Cash and cash equivalents at beginning

of year 3,571 2,935

--------- --------------

Cash and cash equivalents at end of year 4,661 3,571

========= ==============

WINKWORTH PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2020

1. STATUTORY INFORMATION

M Winkworth Plc is a public company, registered in England and

Wales and listed on AIM. The company's registered number and

registered office address can be found on the Company Information

page.

2. ACCOUNTING POLICIES

Basis of preparation

The financial statements have been prepared under the historical

cost convention, with the exception of financial instruments as set

out below, and in accordance with International Financial Reporting

Standards adopted by the European Union ("IFRS"). The financial

statements are presented in pound sterling, which is also the

company's functional currency. The following principal accounting

policies have been applied consistently in dealing with items which

are considered material in relation to the financial

statements.

Going concern

The directors have, at the time of approving the financial

statements, a reasonable expectation that the group has adequate

resources to continue in operational existence for the foreseeable

future.

Although Covid-19 will inevitably continue to have an impact on

the market over the remainder of 2021, the directors have outlined

on page 6 the risks which the group may be faced with, and how they

intend on mitigating these risks. This demonstrates that the group

has sufficient working capital for the foreseeable future.

The group has a strong cash base and no borrowings, with a high

level of discretionary expenditure, which can be cut at short

notice. Income would need to fall substantially for a prolonged

period, beyond six months, before a cash shortfall arose, at which

point stronger measures would be taken to cut costs. Thus they

continue to adopt the going concern basis of accounting in

preparing the accounts.

Revenue

Revenue represents the value of commissions and subscriptions

due to the group under franchise agreements, together with the

value of fees earned by its subsidiary lettings business. Revenue

in respect of commissions due on house sales is recognised at the

point of the relevant property sale having been completed by the

franchisee. Revenue in respect of commissions due on lettings,

property management and administration services is recognised in

the period to which the services relate. The group earns a straight

8% by value on all sales and lettings income generated by the

franchisees.

In Tooting Estates Limited and Crystal Palace Estates Limited,

revenue in respect of commissions due on house sales is recognised

on completion. Revenue in respect of commissions due on lettings

and property management is recognised over the life of the rental

agreement.

3. SEGMENTAL REPORTING

The board of directors, as the chief operating decision making

body, review financial information and make decisions about the

group's business and have identified a single operating segment,

that of estate agency and related services and the franchising

thereof.

The directors believe that there are two material revenue

streams relevant to estate agency franchising.

2020 2019

GBP'000 GBP'000

Revenue

Corporate owned offices 1,083 498

Management service fees 5,323 5,918

------- -------

6,406 6,416

4. TAXATION

Analysis of tax expense

2020 2019

GBP'000 GBP'000

Current tax:

Taxation 302 311

Adjustment re previous years (3) 6

------- -------

Total current tax 299 317

Deferred tax (4) 3

------- -------

Total tax expense in consolidated statement of profit

or loss and other comprehensive

Income 295 320

======= =======

Factors affecting the tax expense

The tax assessed for the year is higher than the standard rate

of corporation tax in the UK. The difference is explained

below:

2020 2019

GBP'000 GBP'000

Profit before income tax 1,532 1,628

------- -------

Profit multiplied by the standard rate of corporation

tax in the UK of 19% (2019 - 19%) 291 309

Effects of:

Expense not deductible for tax purposes 3 10

Adjustment in respect of prior periods (3) 6

Depreciation in excess of capital allowances 5 11

Income not taxable - (13)

Other movements (1) (3)

------- -------

Tax expense 295 320

======= =======

5. DIVIDENDS

2020 2019

GBP'000 GBP'000

Ordinary shares of 0.5p each 889 968

======= =======

6. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during

the period.

2020

Earnings Weighted Per-share

average amount

number of

shares

GBP'000 '000 pence

Basic EPS

Earnings attributable to ordinary shareholders 1,169 12,733 9.18

Effect of dilutive securities - 57 -

--------- ----------- ----------

Diluted EPS

Diluted earnings 1,169 12,790 9.14

========= =========== ==========

2019

Earnings Weighted Per-share

average amount

number of

shares

GBP'000 '000 pence

Basic EPS

Earnings attributable to ordinary

shareholders 1,285 12,733 10.09

Effect of dilutive securities - 37 -

--------- ----------- ----------

Diluted EPS

Diluted earnings 1,285 12,770 10.06

========= =========== ==========

7. CALLED UP SHARE CAPITAL

2020 2019

Authorised: GBP'000 GBP'000

20,000,000 Ordinary shares of 0.5p 100 100

========= ===========

2020 2019

Issued and f GBP GBP

u lly paid:

12,733,238 Ordinary shares of 0.5p 64 64

========= ===========

8. RESERVES

Retained earnings are earnings retained by the Company not paid out in dividends.

Share premium is the premium paid on shares purchased in the

Company.

Other reserves are the fair value equity components recognised

over the vesting period of share based payments.

9. POST BALANCE SHEET EVENTS

On 13 January 2021, M Winkworth Plc declared dividends of 1.8p

per share for the fourth quarter of 2020.

On 23 March 2021, the Heads of Terms were signed in relation to

Winkworth Franchising Limited's acquisition of a further 35% of

Tooting Estates Limited, which operates the Winkworth franchise in

the Tooting area, for GBP136,963.

10. FINANCIAL INFORMATION

The financial information contained within this announcement for

the year ended 31 December 2020 is derived from but does not

comprise statutory financial statements within the meaning of

section 434 of the Companies Act 2006. Statutory accounts for the

year ended 31 December 2019 have been filed with the Registrar of

Companies and those for the year ended 31 December 2020 will be

filed following the Company's annual general meeting. The auditors'

reports on the statutory accounts for the years ended 31 December

2020 and 31 December 2019 are unqualified, do not draw attention to

any matters by way of emphasis, and do not contain any statements

under section 498 of the Companies Act 2006.

11. ANNUAL REPORT AND ACCOUNTS

Copies of the annual report and accounts for the year ended 31

December 2020 together with the notice of the Annual General

Meeting to be held at the offices of M Winkworth Plc on 11 May

2021, will be posted to shareholders shortly and will be available

to view and download from the Company's website at

www.winkworthplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UPUQUCUPGGBM

(END) Dow Jones Newswires

April 08, 2021 02:00 ET (06:00 GMT)

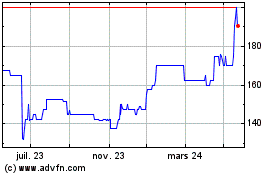

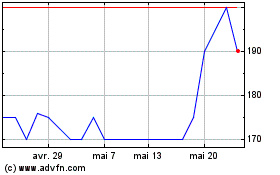

M Winkworth (LSE:WINK)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

M Winkworth (LSE:WINK)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025