TIDMZOO

RNS Number : 1311V

Zoo Digital Group PLC

30 November 2023

30 November 2023

ZOO DIGITAL GROUP PLC

("ZOO" the "Group" or the "Company")

INTERIM RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2023

ZOO Digital Group plc (LON: ZOO), a world-leading provider of

cloud-based localisation and digital media services to the global

entertainment industry, today announces its unaudited financial

results for the six months ended 30 September 2023 ("H1 FY24").

Summary

Key Financials

-- Revenues decreased by 58% to $21.4 million (H1 FY23: $51.4

million) primarily as a result of the Hollywood writers' and

actors' strikes

-- Gross profit decreased by 87% to $2.1 million (H1 FY23: $16.5 million)

-- Adjusted LBITDA(1) of $7.1 million (H1 FY23: EBITDA of $7.3 million)

-- Operating loss of $10.9 million (H1 FY23: $3.8 million operating profit)

-- Completed in April 2023 an equity fundraise of GBP12.5

million ($15.5 million) for the proposed acquisition of a trusted

partner in Japan

-- Cash balance of $16.8 million at period end (H1 FY23: $10.8 million)

Operational Highlights

-- Localisation revenues fell by 58%

-- Media services revenue fell by 61%

-- Freelancer network declined slightly to 11,745 (H1 FY23: 12,343)

-- Strategic international investments in Korea and Turkey, and

launch of Chennai facility post period, as ZOO continues to align

with major customers' growth plans

-- Continuing development and integration of ZOOstudio with customer operations

-- Leading standard of customer satisfaction maintained - retained sales KPI was 99.5%

-- Post period, named APAC Netflix Preferred Fulfilment Partner

of the year for outstanding results in this programme including an

on-time delivery rate of 99.5%

Outlook and Post Period Events

-- Resolution of writers' and actors' strikes in September and November respectively

-- Following a subdued first half, commenced second half with a

stronger order book from major customers

-- Expect to deliver progressively stronger sequential

performance in each of Q3 and Q4, with significant increase in

sales in FY25

-- Expect to achieve at least break-even at EBITDA level in Q4

and return to profitability in FY25 in line with current market

expectations

-- In regular dialogue with the vendor of the proposed target in Japan

(1) adjusted for share-based payments.

Stuart Green, CEO of ZOO Digital, commented:

"The year to date has been overshadowed by the first joint

strike of Hollywood actors and writers in more than 60 years. This

temporary disruption has had a significant impact across our sector

and the wider media and entertainment industry, resulting in

artificially low production volumes in the short-term. While this

has had a significant impact on our financial performance, we have

taken targeted measures to conserve cash while positioning the

business to recover rapidly once orders return to more usual

levels.

"As the streaming industry focuses increasingly on

profitability, we are already seeing evidence that major buyers are

relying on fewer vendors and prioritising those with end-to-end

capacity and scale. This puts ZOO in a strong position to process

higher volumes of work from customers over time, particularly as we

make strategic investments in customers' high-priority growth

regions.

"With the resolution of the strikes, we look to the future with

optimism and anticipate a phased return of orders in the second

half, accelerating into FY25. We remain confident in the industry's

long-term structural growth drivers and our role as a trusted

partner to many of the world's largest entertainment

companies."

For further enquiries, please contact:

+44 (0) 114 241

ZOO Digital Group plc 3700

Stuart Green - Chief Executive Officer

Phillip Blundell - Chief Finance Officer

Kam Bansil - Investor Relations

Stifel Nicolaus Europe Limited (Nominated Adviser +44 (0) 20 7710

and Joint Broker) 7600

Fred Walsh / Erik Anderson / Tom Marsh / Richard

Short

+44 (0) 20 7496

Singer Capital Markets (Joint Broker) 3000

Shaun Dobson / Asha Chotai

+44 (0) 207 457

Instinctif Partners (Financial PR) 2020

Matthew Smallwood / Joe Quinlan zoo@instinctif.com

Analyst and Investor Presentations

An interim results presentation will be made available on the

Company's website at www.zoodigital.com .

The Company will be hosting an in-person event for analysts at

9:30am GMT on Thursday 30 November at the offices of Instinctif

Partners in London. Analysts are invited to register to attend by

contacting ZOO@instinctif.com .

In addition, a live-streamed investor presentation will take

place at 5:00pm GMT on Thursday 30 November. Participants can

register at the following link: www.zoodigital.com/interims2024

About ZOO Digital Group plc:

ZOO Digital supports major Hollywood studios and streaming

services to globalise their content and reach audiences everywhere,

by providing leading, technology-enabled localisation and media

services.

Founded in 2001, ZOO Digital operates from hubs in Los Angeles,

London, Dubai, Turkey, South Korea, India, Denmark and Spain with a

development and production centre in Sheffield, UK.

The Group provides media services through its platforms that

include: ZOOsubs, ZOOdubs and ZOOstudio. Its full-service

proposition delivers the end-to-end services required to prepare

both original and catalogue content for digital distribution; these

services include dubbing, subtitling & captioning, metadata

creation & localisation, mastering, artwork localisation and

media processing. Alongside this offering, ZOO also provides its

customers with management platforms and strategic solutions to

support their own internal globalisation operations.

ZOO is a go-to service partner for media businesses looking to

globalise their content across different territories, languages and

distribution platforms. Using its innovative technology-enabled

approach, ZOO helps its customers to reduce time to market, lower

costs and deliver high quality products to their global audiences.

The business has frameworks in place with all major Hollywood

studios and streaming services. Its customers include Disney,

NBCUniversal, HBO and Paramount Global.

ZOO's competitive advantage arises from three interlinking

factors - the leading role it has played in the digital

transformation of its sector; the world class proprietary platforms

that it develops to enable this transformation; and the global

supply chain of thousands of freelancers, working collaboratively

in ZOO's platforms, which delivers services that scale easily to

meet demand. These factors combine to make ZOO uniquely placed to

capitalise on new market opportunities in a fast-paced and

constantly evolving industry.

www.zoodigital.com

CHAIRMAN AND CHIEF EXECUTIVE'S STATEMENT

Overview

The first half of FY24 saw an unprecedented period of

disruption, not only for ZOO, but for the film and TV entertainment

industry more widely. The Company has taken necessary steps to

mitigate the impact of this short-term disruption while ensuring we

are well positioned to recover strongly and win market share.

Market

In the early months of calendar 2023, all major US media

corporations undertook strategic reviews, prompted by the rapidly

shifting economic landscape for entertainment as consumers migrate

away from network television. The hiatus of new projects that this

caused was compounded by industrial action in Hollywood as writers

and then actors went on strike - the first joint industrial action

in more than 60 years - effectively bringing all film and TV

production projects to a halt for a period of six months.

Since FY22 the work that ZOO received from its customers

consisted predominantly of localisation and media services applied

to newly created content. Consequently, the disruption has had a

significant adverse impact on order volumes received during the

period, not only by ZOO, but also by all its major competitors.

This temporary industry-wide hiatus is clearly reflected in ZOO's

financial results for the FY24 H1 period.

Prior to the industrial action, in April 2023 the Company

successfully completed an oversubscribed placing of GBP12.5 million

($15.5 million) for the proposed acquisition of a trusted partner

in Japan - a strategic growth market for content and localisation

budgets. Given the subsequent industry-wide disruption that

followed, the Board decided to place the acquisition on hold, to

enable it to maintain a strong balance sheet. Meanwhile, we have

continued to have regular positive dialogue with the vendor.

The leadership of the Writers' Guild of America, which

represents 11,500 screenwriters, voted on 27 September 2023 to end

its strike following resolution of the labour dispute, thereby

paving the way for resumption of preparation of new scripts.

However, restarting productions was contingent on actors returning

to work which was finally resolved on 9 November 2023 when the

leadership of the Screen Actors Guild - American Federation of

Television and Radio Artists (SAG-AFTRA) agreed contract terms for

the next three-year period for its 160,000 members. This was the

longest strike in the union's history and its repercussions have

been far-reaching across the industry, not only in the US but in

the UK and many other countries where local actors are often

members of SAG-AFTRA as well as local unions (such as Equity in the

UK). Practically every discipline in the wider entertainment

ecosystem is affected when actors take industrial action including,

of course, those services supplied by ZOO.

Insofar as the Board is aware, major players have not sought to

address the content shortfall through the period of the strikes

with back catalogue material, but rather have elected to preserve

budgets for the creation of localised versions of newly produced

original programmes. Consequently, the projects on which ZOO worked

during the first half year have been related predominantly to

titles that were filmed prior to the actors' strike, together with

some content produced internationally.

With the recent ending of strikes, we can now look ahead to a

resumption of productions and restoration of previous typical

volumes of new titles; however, the pace of this recovery remains

unclear at present. Resuming a typical project will require

reassembling and scheduling a cast and crew of potentially hundreds

of people, and there will be competition for accessing the sound

stages that are necessary for studio recording. Talented crew

members will be in high demand and given the number of jobs lost

from the industry as individuals sought alternative sources of

employment, this will create a bottleneck. It will require a period

of planning before each project can resume and so the period of

recovery is likely to extend over several months. Therefore, while

ZOO can expect assignments in the near term relating to some new

programming, it seems likely that full resumption of former levels

of work will not take place until FY25.

Throughout calendar 2023 major entertainment industry players

have implemented significant changes in their operations, including

cost cutting, a return to licensing of content that has until

recently been used as a competitive differentiator, greater

exploitation of advertising such as through the launch of

ad-supported subscription tiers and Free Ad-supported Streaming TV

(FAST) channels, refinement of go-to-market strategies, bundling

with other services, and many other initiatives that, in

combination, should enable these businesses to reach streaming

profitability sooner. Recent quarterly earnings reports from major

media companies indicate good progress in this respect.

Overall, the Board believes that these changes will be

beneficial to ZOO. Several major buyers have elected to contract

their vendor pools, thereby requiring fewer studio personnel to

manage these relationships. In one case a client has reduced its

vendor pool for localisation and media services from around 15 to

five including ZOO. In all such situations where vendor programmes

have been revised ZOO is either confirmed as an on-going partner or

expects to be selected once the review process is complete.

As large buyers choose to concentrate work on a smaller number

of vendors, there is a growing preference for those that are able

to provide an end-to-end (E2E) service, namely, to offer all

necessary media services together with subtitling and dubbing

across all required languages. ZOO is one of few providers with

this capability and scale.

The pace at which ZOO's former levels of revenue will be

restored is dependent on both the recovery of the entertainment

industry generally and more specifically the media localisation

sector. However, the Company's success will depend on its ability

to continue to deliver services of the highest calibre. In this

regard, through the recent period of uncertainty and disruption,

ZOO has maintained consistently high performance metrics as

measured and reported by its customers. Indeed, in November ZOO was

named APAC Netflix Preferred Fulfilment Partner of the year having

achieved outstanding results in this programme including an on-time

delivery rate of 99.5%.

Operations

The significant impact of the temporary industry disruption in

the first half is clearly reflected in the Company's financial KPIs

for the period:

-- Revenue fell to $21.4 million (FY23 H1: $51.4 million)

-- Adjusted LBITDA(1) margin 33.0% (FY23 H1 EBITDA 14.2%)

-- OPEX as a % of revenue 60.7% (FY23 H1: 24.6%)

-- Operating Loss margin 51.0% (FY23 H1: profit 7.4%)

The impact on profitability is a result in part of the time

taken to implement cost savings, but also the strategic intent of

the Board to retain a level of resources that exceeds short term

demand so that recovery can be rapid once industry production

resumes.

-- Number of freelancers(2) 11,745 (FY23 H1: 12,343)

-- Retained Sales(3) 99.5% (FY23 H1: 99.0%)

The number of freelancers available to ZOO declined slightly in

the period due, in part, to some individuals choosing to leave the

industry and find alternative employment as a result of the wider

disruption.

(1) Adjusted for share-based payments.

(2) The number of active freelance workers in ZOO's systems who

are engaged directly.

(3) Proportion of client revenues retained from one year to the

next.

In addition to cash conservation measures, the Board has focused

on several steps to improve operational efficiency. The fit out of

a new facility located in the Southern India city of Chennai was

completed in the period, a process that began in FY23. Covering

11,000 square feet across two floors, the new production facility

is equipped with leading technology, opens opportunities for South

Indian-language content and distribution into South Indian markets,

and will serve as a location from which to operate certain services

to fulfil work for clients in the US and elsewhere.

The reduced level of orders has provided an opportunity to

enhance training materials and to cross-train staff across multiple

workflows and client processes. The Company's ZOO Academy programme

serves as a resource for the development of skillsets both by

internal staff and freelancers across multiple roles and

disciplines.

In addition to establishing a stronger presence in India, ZOO

has also continued to expand its international presence for dubbing

through investments in partners. This includes a further investment

in ZOO Turkey and establishing a presence in Iberia with facilities

in Madrid and Valencia which now operate as a primary hub for ZOO's

operations in Spain and Portugal. Further similar investments are

planned to expand the Company's capability in other strategic

locations.

While ZOO remains committed to extending this international

presence to an operation in Japan, which is and will continue to be

a strategic growth market for entertainment content, the Company

has not yet made a binding agreement to acquire the proposed target

for which capital was raised in the equity fundraise announced in

April. The view of the Board is that further proof of business

recovery and a strong balance sheet are necessary before it would

be prudent to enter a binding contract. Accordingly, we remain in

regular dialogue with the vendor.

A major factor in the dispute between unions and studios has

been in relation to the application of Artificial Intelligence

(AI). The key terms of the agreements reached with both writers and

actors include a range of safeguards around use of such

technologies to ensure that human talent is not exploited, and is

both fairly compensated and credited with all creative

contributions made to motion pictures and TV content. These

safeguards extend to the practice of preparing adaptations of

scripts for other languages and the creation of dubbed soundtracks.

The frameworks are designed to ensure that the benefits of new

technologies can be exploited but in ways that are fair and

sustainable.

As a long-standing and proven innovator in the sector, ZOO is

uniquely placed to capitalise on benefits afforded by AI in

multiple applications within the realms of subtitling and dubbing

and, moreover, has been proactively engaged in research and

development of technologies that the Board anticipates will yield

commercial and operating benefits in the future. ZOO's strategy is

to leverage such technology where appropriate to augment and assist

traditional processes rather than to displace or obviate the need

for skilled human talent, which includes specialist media

translators, actors, and directors. Consequently, the Board regards

the AI revolution that is unfolding as an opportunity for ZOO to

broaden its capabilities and cement its leadership position within

the sector.

While the recent period of disruption has brought about

significant change across the entertainment industry, the strategic

imperatives that set ZOO apart from its competitors remain as

relevant and important as ever. Through the period of recovery that

lies ahead the Company will continue its strategic focus on its

stated priorities:

-- innovation - by continuing to develop transformational technologies;

-- scalability - by developing and nurturing its freelancer

pool, including the development of training courses available

through ZOO Academy;

-- collaboration - in multiple areas, including AI-related

research, industry partnerships for dubbing and academic

partnerships with educational institutions;

-- customer focus - through the strengthening of its E2E

offering and provision of the ZOOstudio platform; and

-- talent - continuing with the global growth plan to expand the

talent pool with broader language-specific expertise and

reputation.

People

To conserve cash while navigating the industry hiatus, 118 team

members, representing 20% of the combined UK/US workforce, sadly

left the business in the period through redundancies and attrition.

Due to the uncertainty around the duration of the strikes and the

time taken to undertake employee consultation, this process was not

completed until early November. As a result, both direct and

indirect staff costs will be materially reduced throughout the

second half compared to the first.

As part of this exercise, a rebalancing of staffing across

locations has been undertaken to provide adequate resources for

growth regions and languages. A guiding principle has been to

maintain industry-leading performance metrics, with monthly

customer reports confirming that this has been achieved. Despite

the headcount reductions and savings implemented, the staff

retained across all service lines has the capacity to deliver, as

of the commencement of the second half, a greater volume of work

than current orders require. However, and particularly now that

strikes have ended, the Board has carefully considered the recovery

of the business and has chosen to retain capacity, with a

consequent cost, so that the Company can respond to customers'

needs and grow quickly when work resumes and capture market share,

thereby delivering superior profitability in the medium to

long-term.

The Board is enormously grateful to staff for their patience,

resilience, and dedication throughout what has been an

unprecedented challenging and difficult period for the

entertainment industry and the ZOO business. With industrial action

now at an end, we know that we can rely on staff embracing the

influx of work that we are confident lies ahead, and continuing to

deliver the high quality and innovation for which we are

renowned.

Outlook

Following a period of disruption that has lasted around nine

months since February 2023, the stage is now set for a recovery

that, over the medium term, should see ZOO returning to the levels

of business achieved in FY23 and continuing its growth from there.

Due to the time taken to plan and mobilise resources for each

production project, the Board expects the Company to deliver

progressively stronger sequential performance in each of Q3 and Q4,

with significant expansion of sales commencing from Q1 FY25.

Despite the low levels of project activities in the period, the

Company has continued its dialogue with customers throughout the

first half and all indications are that ZOO remains a valued

partner and will be a beneficiary as business resumes. In several

cases, relationships with senior customer contacts have been

strengthened and multiple new opportunities are expected to open

during the second half.

The Board remains focused to achieve at least break-even at

EBITDA level in Q4 and to return to profitability in FY25,

expanding ZOO's market share and prominence as a leading provider

of premium localisation and media services to the global

entertainment industry.

FINANCIAL REVIEW

Revenues of $21.4 million were 58% below the same period last

year (H1 FY23: $51.4 million). The shutdown in Hollywood from May

to November 2023 caused by the writers' and actors' strikes

resulted in an almost complete curtailment of orders to ZOO and its

competitors.

Gross profit decreased from $16.5 million to $2.1 million in the

period, reflecting the revenue reduction and the Board's decision

to maintain production capacity during the strikes. Gross margin

fell to 10% due to the significant deterioration in direct staff

utilisation. This is reinforced by direct staff costs rising from

21% of revenues to 55%.

Operating expenses increased 2.5% to $13.0 million (H1 FY23:

$12.7 million) as we continued to invest in infrastructure to

support our long-term revenue goals. This included our new

facilities in Korea and Chennai. This is reflected in OPEX as a

percentage of revenue, which increased from 25% of revenue to

60.7%. We continued to invest in our R&D programme where

expenditure increased 67% in the period.

Adjusted LBITDA of $7.1 million compares to a profit of $7.3

million last year as a direct result of the revenue decrease

without any significant reduction in OPEX, people or R&D. This

is also reflected in the operating loss of $10.9 million.

The loss before tax for the period was $10.1 million, which

compares to a profit of $3.5 million last year. The loss includes

the gain of $1.1 million attributed to the original 51% investment

in Korea when we completed the acquisition of the remaining 49% in

April 2023.

The cash balance as of 30 September 2023 was $16.8 million after

the completion of paying off short-term operating leases (H1 FY23:

$10.8 million before short-term operating leases of $0.3 million).

The increase was driven by the fundraise in April 2023 offsetting

the operating losses. This was further impacted by the outflow of

$4.0 million from investing activities and $1.2 million repayment

of leases in the period. The investing activities comprised R&D

of $1.5 million and CAPEX of $1.4 million. The CAPEX was used to

extend the production capacity in both India and Korea. The Group

purchased the remaining 49% of the investment in Korea for $0.2

million, and took a 30% stake in Estudios AM in Spain for $0.9

million, both investments following the stated strategy to build

international capacity to support our customers when the expected

growth in media localisation spend by our global media customers

returns.

The Group remains financially strong with net cash of $16.8

million at the end of September 2023 and no debt. This is further

enhanced by an unused $5.0 million debt facility with HSBC. Over

the coming months the Board is focused on aligning costs and

revenues to reach break-even in Q4 FY24.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(UNAUDITED)

for the six months ended 30 September 2023

Unaudited Unaudited Audited

6 months 6 months

to to Year ended

30 Sep

2023 30 Sep 2022 31 Mar 2023

$000 $000 $000

======================================= =========== ============= =============

Revenue 21,408 51,422 90,260

Cost of sales (19,329) (34,941) (56,327)

--------------------------------------- ----------- ------------- -------------

Gross Profit 2,079 16,481 33,933

Other operating income - 8

Operating expenses (12,988) (12,671) (25,860)

--------------------------------------- ----------- ------------- -------------

Operating (loss)/profit (10,909) 3,810 8,081

--------------------------------------- ----------- ------------- -------------

Analysed as

EBITDA before share-based payments (7,094) 7,286 15,466

Share based payments (286) (970) (1,650)

Depreciation (2,506) (1,768) (3,973)

Amortisation (1,023) (738) (1,762)

--------------------------------------- ----------- ------------- -------------

(10,909) 3,810 8,081

--------------------------------------- ----------- ------------- -------------

Share of profit of associates

and JVs 1,100 - 146

Finance income 165 - 8

Exchange loss on borrowings (100) - 247

Other finance cost (340) (299) (620)

--------------------------------------- ----------- ------------- -------------

Total finance cost (275) (299) (365)

--------------------------------------- ----------- ------------- -------------

(Loss)/Profit before taxation (10,084) 3,511 7,862

Tax on (Loss)/profit (152) (147) 370

--------------------------------------- ----------- ------------- -------------

(Loss)/profit and total comprehensive

income for the period attributable

to equity holders of the parent (10,236) 3,364 8,232

--------------------------------------- ----------- ------------- -------------

Profit per ordinary share

--------------------------------------- ----------- ------------- -------------

(10.60)

- basic cents 3.80 cents 9.30 cents

--------------------------------------- ----------- ------------- -------------

(10.60)

- diluted cents 3.46 cents 8.30 cents

--------------------------------------- ----------- ------------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

As at 30 September 2023

Unaudited Unaudited Audited

as at 30 as at 30 as at 31

Sep 2023 Sep 2022 Mar 2023

$000 $000 $000

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

ASSETS

Non-current assets

Property, plant and equipment 14,092 12,952 14,736

Intangible assets 13,443 9,746 10,341

Investments 4,709 3,819 4,300

Deferred tax assets 1,708 1,842 1,664

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

33,952 28,359 31,041

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

Current assets

Trade and other receivables 7,742 15,092 16,532

Contract assets 4,831 3,600 4,836

Cash and cash equivalents 16,783 10,818 11,839

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

29,356 29,510 33,207

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

Total assets 63,308 57,869 64,248

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

LIABILITIES

Current liabilities

Trade and other payables (12,828) (17,338) (19,746)

Contract liabilities (571) (521) (693)

Borrowings (1,445) (741) (1,408)

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

(14,844) (18,600) (21,847)

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

Non-current liabilities

Borrowings and other payables (6,945) (8,579) (7,268)

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

Total liabilities (21,789) (27,179) (29,115)

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

Net assets 41,519 30,690 35,133

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

EQUITY

Equity attributable to equity

holders of the parent

Called up share capital 1,284 1,178 1,179

Share premium reserve 70,683 55,727 55,797

Other reserves 12,320 12,320 12,320

Share option reserve 4,690 3,625 4,391

Capital redemption reserve 6,753 6,753 6,753

Merger reserve 1,326 - -

Convertible loan note reserve - 5,471

Foreign exchange translation

reserve (992) (992) (992)

Accumulated losses (54,496) (53,339) (44,266)

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

41,568 30,743 35,182

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

Interest in own shares (49) (53) (49)

-------------------------------------------------------------------------- --------------------

Attributable to equity holders 41,519 30,690 35,133

-------------------------------------------------------------------------- -------------------- --------------------- ---------------------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(UNAUDITED)

for the six months ended 30 September

2023

Foreign Convertible

Share exchange loan Share Capital Interest

Ordinary premium translation note option redemption Merger Other Accumu-lated in own

shares reserve reserve reserve reserve reserve reserve reserves losses shares Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000 $000

--------------- --------- -------- ------------ ------------ -------- ------------ -------- --------- ------------- --------- ---------

Balance at

1 April 2022 1,174 55,665 (992) 5,471 2,619 6,753 - 12,320 (57,969) (49) 24,992

--------------- --------- -------- ------------ ------------ -------- ------------ -------- --------- ------------- --------- ---------

Issue of

share capital 4 - - - - - - - - - 4

Share options

exercised - 62 - - 36 - - - - - 98

Share-based

payments - - - - 970 - - - - - 970

Foreign

exchange

translation - - - - - - - - - (4) (4)

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Transactions

with owners 4 62 - 1,006 - - - - (4) 1,068

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Profit for

the period - - - - - - - - 3,364 - 3,364

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Total

comprehensive

income for

the period - - - - - - - - 3,364 - 3,364

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Balance at

30 September

2022 1,178 55,727 (992) 5,471 3,625 6,753 - 12,320 (54,605) (53) 29,424

Share options

exercised - 70 - - 86 - - - - - 156

Share-based

payments - - - - 680 - - - - - 680

Foreign

exchange

translation - - - - - - - - - 4 4

Transfer

of CLN - - - (5,471) - - - - 5,471 - -

Issue of

share capital 1 - - - - - - - - 1

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Transactions

with owners 1 70 - (5,471) 766 - - - 5,471 4 841

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Profit for

the period - - - - - - - - 4,868 - 4,868

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Total

comprehensive

income for

the period - - - - - - - - 4,868 - 4,868

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Balance at

31 March

2023 1,179 55,797 (992) 4,391 6,753 - 12,320 (44,266) (49) 35,133

Share based

payments - - - - 286 - - - - - 286

Foreign

exchange

translation - - - - - - - - 6 - 6

Share options

exercised - - - - 13 - - - - - 13

Issue of

share capital 105 15,604 - - - - 1,326 - - - 17,035

Transaction

costs

incurred - (718) - - - - - - - (718)

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Transactions

with owners 105 14,886 - - 299 - 1,326 - - 16,616

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Loss for

the period - - - - - - - - (10,236) - (10,236)

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Total

comprehensive

income for

the period - - - - - - - - (10,230) - (10,230)

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

Balance at

30 September

2023 1,284 70,683 (992) 4,690 6,753 1,326 12,320 (54,496) (49) 41,519

=============== ========= ======== ============ ============ ======== ============ ======== ========= ============= ========= =========

CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

for the six months ended 30 September 2023

30 Sep

2023 30 Sep 2022 31 Mar 2023

Unaudited Unaudited Audited

6 months 6 months

to to Year ended

30 Sep

2023 30 Sep 2022 31 Mar 2023

$000 $000 $000

=========================================== =========== ============= =============

Cash flows from operating activities

Operating (loss)/profit for the

period (10,909) 3,810 8,081

Finance income 165 - 8

Depreciation 2,506 1,768 3,973

Amortisation 1,023 738 1,762

Share based payments 286 970 1,650

Disposal of property, plant and

equipment (12) -

Changes in working capital:

(Increases)/decreases in trade

and other receivables 9,346 10,976 5,251

Increases/(decreases) in trade

and other payables (7,048) (10,541) (5,219)

------------------------------------------- ----------- ------------- -------------

Cash flow from operations (4,643) 7,721 15,506

Tax (paid)/received (196) (147) 196

------------------------------------------- -----------

Net cash flow from operating activities (4,839) 7,574 15,702

------------------------------------------- ----------- ------------- -------------

Investing Activities

Purchase of intangible assets (20) (41) (60)

Capitalised development costs (1,512) (904) (2,163)

Purchase of subsidiaries (net of

cash acquired) (240) - -

Purchase of investments (905) 339 -

Purchase of property, plant and

equipment (1,362) (1,355) (4,706)

Payment of deferred consideration - - (1,300)

------------------------------------------- -----------

Net cash flow from investing activities (4,039) (1,961) (8,229)

------------------------------------------- ----------- ------------- -------------

Cash flows from financing activities

Repayment of borrowings (123) (219) (477)

Repayment of principal under lease

liabilities (710) (536) (748)

Finance cost (342) (42) (630)

Share options exercised 13 36 254

Issue of share capital (net of

costs) 14,984 4 5

-------------------------------------------

Net cash flow from financing 13,822 (757) (1,596)

------------------------------------------- ----------- ------------- -------------

Net Increase in cash and cash equivalents 4,944 4,856 5,877

------------------------------------------- ----------- ------------- -------------

Cash and cash equivalents at the

beginning of the period 11,839 5,962 5,962

------------------------------------------- ----------- ------------- -------------

Cash and cash equivalents at the

end of the period 16,783 10,818 11,839

------------------------------------------- ----------- ------------- -------------

NOTES

General information

ZOO Digital Group plc ('the Company') and its subsidiaries

(together 'the Group') provide end-to-end cloud-based localisation

and media services to the global entertainment industry and

continue with on-going research and development to enhance the

Group's core offerings. The Group has operations in the UK, the US,

India and South Korea.

The Company is a public limited company which is listed on the

Alternative Investment Market and is incorporated and domiciled in

the UK. The address of the registered office is Castle House, Angel

Street, Sheffield. The registered number of the Company is

3858881.

This condensed consolidated financial information is presented

in US dollars, the currency of the primary economic environment in

which the Group operates.

The interim accounts were approved by the board of directors on

29 November 2023 .

This consolidated interim financial information has not been

audited.

Basis of preparation

The consolidated financial statements of ZOO Digital Group plc

and its subsidiary undertakings for the period ending 31 March 2024

will be prepared in accordance with UK adopted international

accounting standards and the requirements of the Companies Act

2006.

This Interim Report has been prepared in accordance with UK AIM

listing rules which require it to be presented and prepared in a

form consistent with that which will be adopted in the annual

accounts having regard to the accounting standards applicable to

such accounts. It has not been prepared in accordance with IAS 34

"Interim Financial Reporting".

The policies applied are consistent with those set out in the

annual report for the year ended 31 March 2023, and have been

consistently applied, unless stated otherwise.

This condensed consolidated financial information is for the six

months ended 30 September 2023. It has been prepared with regard to

the requirements of IFRS. It does not constitute statutory accounts

as defined in S343 of the Companies Act 2006. It does not include

all of the information required for full annual financial

statements, and should be read in conjunction with the consolidated

financial statements of the Group for the year ended 31 March 2023

which contained an unqualified audit report and have been filed

with the Registrar of Companies. They did not contain statements

under s498 of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2023 annual financial statements, except for those that

relate to new standards and interpretations effective for the first

time for periods beginning on (or after) 1 April 2023 and will be

adopted in the 2024 financial statements. There are no standards

materially impacting the Group that will be required to be adopted

in the annual financial statements for the year ending 31 March

2024.

Basis of Consolidation

The consolidated financial statements of ZOO Digital Group plc

include the results of the Company and its subsidiaries. Subsidiary

accounting policies are amended where necessary to ensure

consistency within the Group and intra group transactions are

eliminated on consolidation.

Going concern

The Group's financial statements are prepared on a going concern

basis despite the losses incurred in the period. The Group

continues to have a strong order pipeline and has significant cash

reserves, and its results reflect predominantly the impact of the

Hollywood writers' strike which is anticipated to be short term

and, as at the date of approval of these financial statements, has

finished.

Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting regularly reviewed by the group's chief

operating decision maker to make decisions about resource

allocation to the segments and to assess their performance.

Software

Localisation Media services Services Total

FY24 FY23 FY24 FY23 FY24 FY23 FY24 FY23

H1 H1 H1 H1 H1 H1 H1 H1

$000 $000 $000 $000 $000 $000 $000 $000

======================== ======= ======= ========= ======== ======== ======== ======== ========

Revenue 13,471 32,325 7,065 18,241 872 856 21,408 51,422

Segment contribution 2,282 8,533 2,676 9,870 689 766 5,647 19,169

Unallocated cost of

sales (3,568) (2,688)

================================= ======= ========= ======== ======== ======== ======== ========

Gross profit 2,079 16,481

================================= ======= ========= ======== ======== ======== ======== ========

Gross profit

% 17% 26% 38% 54% 79% 89% 10% 32%

Functional and presentation currency

Items included in the financial statements of each of the

Group's entities are measured using the currency of the primary

economic environment in which the entity operates ('the functional

currency'). The consolidated financial statements are presented in

US Dollars which is the Group's functional and presentation

currency.

Transactions and balances

Transactions in foreign currencies are recorded at the

prevailing rate of exchange in the month of the transaction.

Foreign exchange gains or losses resulting from the settlement of

such transactions and from the translation of monetary assets and

liabilities denominated in foreign currencies at the year-end

exchange rates are recognised in the income statement.

Group companies

The results and financial positions of all Group entities that

use a functional currency different from the presentation currency

are translated into the presentation currency as follows:

-- assets and liabilities for each entity are translated at the

closing rate at the period end date;

-- income and expenses for each Statement of Comprehensive

Income item are translated at the prevailing monthly exchange rate

for the month in which the income or expense arose and all

resulting exchange rate differences are recognised in other

comprehensive income with the foreign exchange translation

reserve.

Earnings per share

Earnings per share is calculated based upon the profit or loss

on ordinary activities after tax for each period divided by the

weighted average number of shares in issue during the period.

Weighted average number

of shares for basic & diluted 30 Sep 31 Mar

profit per share 2023 30 Sep 2022 2023

===============================

No. of

No. of shares No. of shares shares

=============================== ============== =============== ==========

Basic 96,560,892 88,518,335 88,835,890

Diluted 107,012,875 97,103,550 99,287,873

Where the Group has recorded a loss, diluted earnings per share

is equal to basic earnings per share.

Alternative performance measure

Adjusted EBITDA is a key performance measure for the Group and

is derived as follows,

$000 Unaudited Unaudited Audited

6 months 6 months Year to

to 30 Sep to 30 Sep 31 Mar 2023

2023 2022

Profit/(Loss) before taxation (10,084) 3,511 7,862

Add back

Finance costs 275 299 365

Share based payments 286 970 1,650

Depreciation and Amortisation 3,529 2,506 5,735

Share of profit of associates

and JVs (1,100) - (146)

Adjusted EBITDA (7,094) 7,286 15,466

Acquisition of Whatsub Pro Inc.

On 11 April 2023 the Group acquired 49% of the ordinary share

capital of Whatsub Pro Inc ("Korea"), a company incorporated in

South Korea, which took the Group's ownership from 51% to 100% of

the ownership of Korea. Korea was previously accounted for as a

joint venture, and the step acquisition results in ownership of a

subsidiary which is to be accounted for as a business combination

under IFRS 3.

The 49% acquisition was satisfied by way of a payment of

$200,000 together with the issue of 550,000 1p ordinary shares in

the Company. The total consideration was therefore $1,533,000.

As a result of Korea being previously recognised as a joint

venture, the Group's financial statements reflects the disposal of

the joint venture at its carrying value of $552,000 for proceeds of

$1,596,000 (being a pro-rata fair value determined by reference to

the consideration paid for 49%). This resulted in a profit of

$1,044,000 which is included within the Group's share of profits

from joint ventures in its Income Statement.

The Group has not yet completed its assessment of fair values

acquired, although it does not anticipate any separable intangible

assets will be recognised on this business combination. Based on

the net assets reported by Korea on its acquisition date of

$621,000, the Group has provisionally recognised goodwill of

$2,592,000 on this transaction, which is included on the Statement

of Financial Position within intangible assets.

Further Copies

Copies of the Interim Report for the six months ended 30

September 2023 will be available, free of charge, for a period of

one month from the registered office of the Company at Castle

House, Angel Street, Sheffield, S3 4LN or from the Group's website:

www.zoodigital.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKCBNFBDDFDB

(END) Dow Jones Newswires

November 30, 2023 02:00 ET (07:00 GMT)

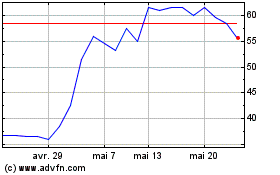

Zoo Digital (LSE:ZOO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Zoo Digital (LSE:ZOO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025