UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. ___)*

Atlantic

Coastal Acquisition Corp. II

(Name of Issuer)

Series A common stock, par value $0.0001 per share

(Title of Class of Securities)

04845A108

(CUSIP Number)

Shahraab Ahmad

Atlantic Coastal Acquisition Management II LLC

6 St Johns Lane, Floor 5

New York, NY 10013

(248)

890-7200

with a copy to:

Stephen Ashley

Pillsbury Winthrop Shaw Pittman LLP

31 West 52nd Street

New

York, NY 10019

(212) 858-1000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

April 18, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

| CUSIP No. 04845A108 |

|

Schedule 13D |

|

Page

2

of 9 Pages |

|

|

|

|

|

|

|

| (1) |

|

Names of reporting persons

Atlantic Coastal Acquisition Management II LLC |

| (2) |

|

Check the appropriate box

if a member of a group (see instructions) (a) ☐ (b) ☐

|

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see

instructions): WC |

| (5) |

|

Check if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or

organization Delaware,

USA |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

0 |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

7,199,999 |

|

|

|

|

|

|

|

| (11) |

|

Aggregate amount beneficially owned by each reporting person:

7,199,999 |

| (12) |

|

Check if the aggregate

amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class

represented by amount in Row (11): 65.8% |

| (14) |

|

Type of reporting person

(see instructions): OO |

|

|

|

|

|

| CUSIP No. 04845A108 |

|

Schedule 13D |

|

Page

3

of 9 Pages |

|

|

|

|

|

|

|

| (1) |

|

Names of reporting persons

Shahraab Ahmad |

| (2) |

|

Check the appropriate box

if a member of a group (see instructions) (a) ☐ (b) ☐

|

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see

instructions): WC |

| (5) |

|

Check if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or

organization

Cyprus |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

0 |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

7,199,999 |

|

|

|

|

|

|

|

| (11) |

|

Aggregate amount beneficially owned by each reporting person:

7,199,999 |

| (12) |

|

Check if the aggregate

amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class

represented by amount in Row (11): 65.8% |

| (14) |

|

Type of reporting person

(see instructions): IN |

|

|

|

|

|

| CUSIP No. 04845A108 |

|

Schedule 13D |

|

Page

4

of 9 Pages |

Item 1. Security and Issuer.

The class of equity security to which this statement on Schedule 13D relates is the Series A common stock, par value $0.0001 per share

(the “Series A Common Stock”), of Atlantic Coastal Acquisition Corp. II, a Delaware corporation (the “Issuer”). The address of the principal executive offices of the Issuer is 6 St Johns Lane, Floor 5, New York, NY

10013. Information given in response to each item shall be deemed incorporated by reference in all other items, as applicable.

Item 2.

Identity and Background.

(a) This Statement is being filed jointly on behalf of the following persons (collectively,

the “Reporting Persons”):

(i) Atlantic Coastal Acquisition Management II LLC, a Delaware limited

liability company (the “Sponsor”); and

(ii) Mr. Shahraab Ahmad

(“Mr. Ahmad”), Managing Member of the Sponsor and Chief Executive Officer and Chairman of the Board of Directors of the Issuer.

The agreement among the Reporting Persons relating to the joint filing of this Statement is attached to this Statement as Exhibit I.

7,199,999 shares of Series A Common Stock are held directly by the Sponsor (the “Shares”).

(b) The Sponsor’s address for its principal place of business is 6 St Johns Lane, Floor 5, New York, NY 10013.

Mr. Ahmad’s address is 49 Cathcart Road, London, UK SW10 9JE.

(c) The principal business of each of the Reporting

Persons is investing in securities.

(d) None of the Reporting Persons has, during the last five years, been convicted in a

criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) None of the Reporting Persons has,

during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of which such person was, or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, Federal or state securities laws or finding any violation with respect to such laws.

(f) The Sponsor is a Delaware limited liability company. Mr. Ahmad is a citizen of the Republic of Cyprus.

Item 3. Source and Amount of Funds or Other Consideration.

See Item 4 of this Schedule 13D, which information is incorporated herein by reference.

Item 4. Purpose of Transaction.

In October 2021, the Sponsor purchased 7,187,500 shares of the Issuer’s Series B common stock (“Series B Common Stock”) for an

aggregate price of $25,000. On January 13, 2022, the Company effectuated a 1.044-for-1 stock split, resulting in an aggregate of 7,503,750 Series B Common Stock

outstanding. On January 18, 2022, the underwriters partially exercised their over-allotment option and the remaining unexercised portion of over-allotment option was forfeited, an aggregate of 3,750 Series B Common Stock were forfeited,

resulting in an aggregate of 7,500,000 founder shares (such 7,500,000 shares the “Founder Shares”) outstanding held by the initial stockholders. Of these Founder Shares, 250,000 are in the possession of the independent directors of the

Issuer after being transferred to them as compensation for their service on the Issuer’s board of directors and 50,000 are in the possession of Apeiron Investment Group Ltd after being transferred as compensation for its services as an advisor.

|

|

|

|

|

| CUSIP No. 04845A108 |

|

Schedule 13D |

|

Page

5

of 9 Pages |

On January 19, 2022, the Issuer consummated its Initial Public Offering (the

“IPO”) of 30,000,000 units, each consisting of one share of common stock and one-half of one warrant to purchase one share of common stock for $11.50 per share, which amount includes the exercised

portion of the 3,900,000 units that were subject to the underwriters’ over-allotment option.

In a private placement (the

“Private Placement”) that occurred simultaneously with the consummation of the IPO, the Sponsor purchased an aggregate of 13,850,000 warrants (“Private Placement Warrants”) at $1.00 per Private Placement Warrant, generating total

proceeds of $13,850,000. A portion of the proceeds from the sale of the Private Placement Warrants were added to the net proceeds from the IPO deposited in the Issuer’s SPAC trust account (the “Trust Account”). If the Issuer does not

complete a business combination within the period (the “Combination Period”) allowed by Issuer’s amended and restated certificate of incorporation (as amended on April 18th, 2023,

the “Current Charter”), the Private Placement Warrants will expire worthless. The Private Placement Warrants are non-redeemable for cash and exercisable on a cashless basis so long as they are held

by the initial purchasers or their permitted transferees.

Pursuant to Letter Agreements (as defined below) described in Item 6 of this

Schedule 13D, which information is incorporated herein by reference, each of the Sponsor and Mr. Ahmad, among others, agreed: (1) to waive their redemption rights with respect to their Founder Shares and public shares, insofar as rights

would enable them to receive funds from the Trust Account, in connection with the completion of the Issuer’s initial business combination or any amendment to the provisions of the Issuer’s amended and restated certificate of incorporation

relating to the Issuer’s pre-initial business combination activity and related stockholders’ rights; and (2) to waive their rights to liquidating distributions from the Trust Account with

respect to any Founder Shares they hold, if the Issuer fails to complete its initial business combination within the Combination Period from closing of the IPO (although they will be entitled to liquidating distributions from the Trust Account with

respect to any shares of Series A Common Stock included as part of the units sold in the IPO they hold if the Issuer fails to complete its initial business combination within the prescribed time frame). Under the Current Charter, the shares of

Series B Common Stock can be converted into Series A Common Stock at any time at the option of the holder, on a one-for-one basis, subject to adjustment for stock

splits, stock dividends, reorganizations, recapitalizations and the like.

In the interest of extending the Combination Period, which was

set to expire on April 19, 2023, and maintaining flexibility to retain stockholders and meet NASDAQ continued listing requirements following any stockholder redemptions in connection with a vote to extend the Combination Period, the Issuer

amended its charter to extend the Combination Period and allow its holders of Founder Shares, including the Sponsor, to convert their Series B Common Stock shares into Series A Common Stock. On April 18, 2023, the Sponsor elected to convert

7,199,999 of its 7,200,000 shares of Series B Common Stock into 7,199,999 shares of Series A Common Stock pursuant to the terms of the Current Charter. Through this conversion, the Sponsor agreed that it would (i) not vote any shares of Series

A Common Stock that it receives by converting Series B Common Stock into Series A Common Stock until after the closing of a business combination and (ii) not have redemption rights or otherwise be entitled to any distribution from the Trust

Account by virtue of the Sponsor’s ownership of Series A Common Stock that it receives by converting Series B Common Stock into Series A Common Stock. The election to convert is qualified in its entirety by reference to the full text of such

conversion agreement (the “Share Conversion Election Notice”), a copy of the notice of which is filed as Exhibit III hereto.

The source of funds for the acquisitions described above was the working capital of the Sponsor. The securities owned by the Reporting Persons

have been acquired for investment purposes. The Reporting Persons may acquire additional securities of the Issuer, and, subject to the agreements described below in Item 6, retain or sell all or a portion of the securities then held in the open

market or in privately negotiated transactions. The Reporting Persons intend to review their investment in the Issuer on a continuing basis. Any actions the Reporting Persons might undertake with respect to securities of the issuer may be made at

|

|

|

|

|

| CUSIP No. 04845A108 |

|

Schedule 13D |

|

Page

6

of 9 Pages |

any time and from time to time without prior notice and will be dependent upon the Reporting Persons’ review of numerous factors, including, but not limited to: an ongoing evaluation of the

Issuer’s business, financial condition, operations and prospects; price levels of the Issuer’s securities; general market, industry and economic conditions; the relative attractiveness of alternative business and investment opportunities;

and other future developments.

As Chairman of the Board of Directors and Chief Executive Officer of the Issuer, Mr. Ahmad may be

involved in making material business decisions regarding the Issuer’s policies and practices and may be involved in the consideration of various proposals considered by the Issuer’s board of directors.

Other than as described above and in Item 6 of this Schedule 13D, the Reporting Persons do not currently have any plans or proposals that

relate to, or would result in, any of the matters listed in Item 4, although, depending on the factors discussed herein, the Reporting Persons may change their purpose or formulate different plans or proposals with respect thereto at any time.

Item 5. Interest in Securities of the Issuer.

(a), (b) The responses of the Reporting Persons with respect to Rows 7 through 13 of the respective cover pages of the individual

Reporting Persons to this Schedule 13D are incorporated herein by reference.

The Reporting Persons’ aggregate percentage of

beneficial ownership is approximately 65.8% of the outstanding shares of the Series A Common Stock. Calculations of the percentage of the shares of Series A Common Stock beneficially owned assume 10,935,691 shares of Series A Common Stock

outstanding, based on information included in the Issuer’s Current Report on Form 8-K filed on April 18, 2023.

The Sponsor may be deemed to have beneficial ownership of 7,199,999 shares of Series A Common Stock. Mr. Ahmad may be deemed to have

beneficial ownership of 7,199,999 shares of Series A Common Stock.

Sponsor:

| |

(i) |

Amount beneficially owned: 7,199,999 |

| |

(ii) |

Percent of Class: 65.8% |

| |

(iii) |

Sole power to vote or to direct the vote: 0 |

| |

(iv) |

Shared power to vote or to direct the vote: 0 |

| |

(v) |

Sole power to dispose or to direct the disposition of: 0 |

| |

(vi) |

Shared power to dispose or to direct the disposition of: 7,199,999 |

Mr. Ahmad:

| |

(i) |

Amount beneficially owned: 7,199,999 |

| |

(ii) |

Percent of Class: 65.8% |

| |

(iii) |

Sole power to vote or to direct the vote: 0 |

| |

(iv) |

Shared power to vote or to direct the vote: 0 |

| |

(v) |

Sole power to dispose or to direct the disposition of: 0 |

| |

(vi) |

Shared power to dispose or to direct the disposition of: 7,199,999 |

Each of the Reporting Persons expressly disclaims beneficial ownership of all of the shares of Series A Common Stock included in this Schedule

13D, other than the shares of Series A Common Stock held of record by such Reporting Person, and the filing of this Schedule 13D shall not be construed as an admission that any such person is, for the purposes of sections 13(d) or 13(g) of

the Exchange Act of 1934, as amended, the beneficial owner of any securities covered by this Schedule 13D.

|

|

|

|

|

| CUSIP No. 04845A108 |

|

Schedule 13D |

|

Page

7

of 9 Pages |

(c) During the 60 days preceding the date of this Schedule 13D, the Reporting Persons

have not effected any transactions in the Series A Common Stock.

(d) To the best knowledge of the Reporting Persons, no one other

than the Reporting Persons, or the partners, members, affiliates or shareholders of the Reporting Persons, is known to have the right to receive, or the power to direct the receipt of, dividends from, or proceeds from the sale of, the shares of

Series A Common Stock reported herein as beneficially owned by the Reporting Persons.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to the Securities of the Issuer.

Series B Common Stock

In October 2021,

the Reporting Persons purchased 7,187,500 Founder Shares for an aggregate purchase price of $25,000, or approximately $0.0035 per share.

In January 2022, the Issuer consummated its IPO of 30,000,000 units, each consisting of one share of common stock and one-half of one redeemable warrant to purchase one share of common stock for $11.50 per share, which amount includes the exercised portion of the 3,900,000 units that were subject to the underwriters’ 45-day over-allotment option. The underwriters partially exercised their over-allotment option and the remaining unexercised portion of over-allotment option were forfeited, an aggregate of 3,750 founder shares were

forfeited, resulting in an aggregate of 7,500,000 founder shares outstanding held.

On April 18, 2023, the Reporting Persons elected

to convert 7,199,999 shares of Series B Common Stock owned by them into an aggregate of 7,199,999 shares of Series A Common Stock pursuant to the terms of the Current Charter. The terms of such conversion are described further below under the

section “Share Conversion Election Notice.”

Letter Agreements

In connection with the IPO, the Sponsor and each member of the Issuer’s board of directors and each of its executive officers (including

Mr. Ahmad as director and chief executive officer of the Issuer) entered into letter agreements (collectively, the “Letter Agreements”), pursuant to which they agreed: (1) to waive their redemption rights with respect to their

Founder Shares and public shares, insofar as rights would enable them to receive funds from the Trust Account, in connection with the completion of the Issuer’s initial business combination or any amendment to the provisions of its amended and

restated certificate of incorporation relating to the Issuer’s pre-initial business combination activity and related stockholders’ rights; and (2) to waive their rights to liquidating

distributions from the Trust Account with respect to any Founder Shares they hold, if the Issuer fails to complete its initial business combination within the Combination Period from closing of the IPO (although they will be entitled to liquidating

distributions from the Trust Account with respect to any shares of Series A Common Stock included as part of the units sold in the IPO they hold if the Issuer fails to complete its initial business combination within the prescribed time frame).

The foregoing description of the Letter Agreements is qualified in its entirety by reference to the full text of such agreement, a copy of the

form of which is filed as Exhibit II hereto.

Private Placement Warrant Purchase Agreement

On January 13, 2022, the Sponsor purchased an aggregate of 13,850,000 warrants for an aggregate purchase price of $13,850,000 that

occurred simultaneously with the closing of the IPO. Each whole warrant entitles its holder to purchase one whole share of Series A Common Stock at an exercise price of $11.50 per share.

|

|

|

|

|

| CUSIP No. 04845A108 |

|

Schedule 13D |

|

Page

8

of 9 Pages |

The foregoing description of the Private Placement Warrant Purchase Agreement is qualified in

its entirety by reference to the full text of such agreement, a copy of which is filed as Exhibit III hereto.

Share Conversion Election Notice

On April 18, 2023, the Issuer adopted the Current Charter. On April 18, 2023, the Sponsor sent a notice to the Issuer (the

“Share Conversion Election Notice”) electing to convert 7,199,999 of its shares of Series B Common Stock into 7,199,999 Series A Common Stock. The Sponsor agreed to not vote any shares of Series A Common Stock that it receives by virtue of

the Share Conversion Election Notice until after the closing of a business combination. The Sponsor also agreed that it would not have redemption rights by virtue of its ownership of Series A Common Stock that it received as a result of the Share

Conversion Election Notice nor is it otherwise entitled to any distribution from the Issuer’s Trust Account as a result of its ownership of such shares acquired pursuant to the Share Conversion Election Notice.

The foregoing description of the Share Conversion Election Notice is qualified in its entirety by reference to the full text of such notice, a

copy of which is filed as Exhibit IV hereto.

Registration Rights Agreement

On January 13, 2022, the holders of the Founder Shares (and any shares of Series A Common Stock issuable upon conversion of the Founder

Shares), Private Placement Warrants (and any shares of Series A Common Stock issuable upon the exercise of the Private Placement Warrants), and warrants (and any shares of Series A Common Stock issuable upon exercise of such warrants) that may be

issued upon conversion of working capital loans entered into a registration rights agreement (the “Registration Rights Agreement”) pursuant to which they have registration rights to require the Issuer to register such securities for resale

(in the case of the Founder Shares, only after conversion to Series A Common Stock). The holders of the majority of these securities are entitled to make up to three demands, excluding short form demands, that the Issuer register such securities. In

addition, the holders have certain “piggy-back” registration rights with respect to registration statements filed subsequent to the completion of a business combination and rights to require the Issuer to register for resale such

securities pursuant to Rule 415 under the Securities Act. The Issuer will bear the expenses incurred in connection with the filing of any such registration statements.

The foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the full text of such agreement, a

copy of which is filed as Exhibit V hereto.

Indemnification Agreement

In connection with its IPO, the Issuer entered into an indemnification agreement (“Indemnification Agreement”) with each of its

executive officers and directors (including Mr. Ahmad), pursuant to which the Issuer agreed to indemnify and advance certain expenses such persons, to the fullest extent permitted by applicable law, if such persons are or are threatened to be

made a party to certain proceedings by reason of their service to the Issuer.

The foregoing description of the Indemnification Agreement

is qualified in its entirety by reference to the full text of such agreement, a copy of which is filed as Exhibit VI hereto.

Non-Redemption Agreements

On or about April 4, 2023 the Sponsor entered into agreements (“Non-Redemption Agreements”) with several unaffiliated third parties in exchange for them agreeing not to redeem certain of the common stock of the Issuer held by them at a meeting called by the Issuer to

extend the time the Issuer had to consummate an initial business combination. Pursuant to the Non-Redemption Agreements, the Sponsor has agreed to assign to each third party the lesser of a certain amount of

shares, which varies among each third party, and (ii) 9.9% of the Series A common stock outstanding after such meeting. This assignment was subject to the conditions that an initial business combination is consummated and the investor executed a

joinder to the Letter Agreement.

|

|

|

|

|

| CUSIP No. 04845A108 |

|

Schedule 13D |

|

Page

9

of 9 Pages |

The foregoing description of the Non-Redemption

Agreements is qualified in its entirety by reference to the full text of the form of such agreements, a copy of which is filed as Exhibit VII hereto.

Item 7. Materials to be Filed as Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

|

|

|

|

|

| Exhibit I |

|

Joint Filing Agreement, dated as of April 20, 2023, by and between the Reporting Persons. |

|

|

| Exhibit II |

|

Letter Agreement between the Issuer, the Sponsor, and Mr. Ahmad, among others (incorporated by reference to Exhibit 10.4 to the Issuer’s Current Report on Form 8-K, File No. 001-4224, filed on January 19, 2022). |

|

|

| Exhibit III |

|

Private Placement Warrant Purchase Agreement between the Issuer and the Sponsor (incorporated by reference to Exhibit 10.1 to the Issuer’s Current Report on Form 8-K, file No. 001-41224, filed on January 19, 2022). |

|

|

| Exhibit IV |

|

Share Conversion Election Notice, dated as of April 18, 2023, by and between Sponsor and Mr. Ahmad. |

|

|

| Exhibit V |

|

Form of Registration Rights Agreement by and among the Issuer, the Sponsor, and security holders (incorporated by reference to Exhibit 10.3 to the Issuer’s Current Report on Form 8-K,

File No. 001-41224, filed on January 19, 2022). |

|

|

| Exhibit VI |

|

Form of Indemnity Agreement by the Issuer, the Sponsor, and Mr. Ahmad, among others (incorporated by reference to Exhibit 10.6 to the Issuer’s Registration Statement on Form S-1/A,

File No. 333-261459, filed on December 20, 2021). |

|

|

| Exhibit VII |

|

Form of Non-Redemption Agreement, dated as of April 4, between Sponsor and certain public stockholders (incorporated by reference to Exhibit 10.1 of the Issuer’s Current Report on

Form 8-K, File No. 001-41224, filed on April 5, 2023). |

SIGNATURES

After reasonable inquiry and to the best knowledge and belief of the undersigned, such person certifies that the information set forth in this Statement with

respect to such person is true, complete and correct.

Dated: April 20, 2023

|

|

|

| Atlantic Coastal Acquisition Management II LLC |

|

|

| By: |

|

/s/ Shahraab Ahmad |

| Name: Shahraab Ahmad |

| Title: Managing Member |

|

|

|

| Shahraab Ahmad |

|

|

| By: |

|

/s/ Shahraab Ahmad |

| Name: Shahraab Ahmad |

[Signature Page to Schedule 13D]

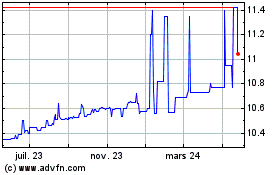

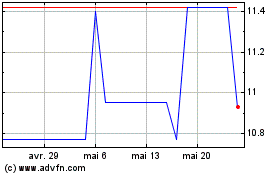

Atlantic Coastal Acquisi... (NASDAQ:ACAB)

Graphique Historique de l'Action

De Déc 2024 à Déc 2024

Atlantic Coastal Acquisi... (NASDAQ:ACAB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024