Shareholders Approve Yadkin Valley Financial's Merger With American Community Bancshares

17 Avril 2009 - 12:29AM

Marketwired

Shareholders of Yadkin Valley Financial Corporation (NASDAQ: YAVY)

and American Community Bancshares, Inc. (NASDAQ: ACBA) today

approved the merger of American Community Bancshares, Inc., with

and into Yadkin Valley Financial Corporation. The mergers of both

the holding companies and the subsidiary banks are expected to

close on April 17, 2009.

The combined company will have total assets of over $2.0

billion.

"We are delighted that our shareholders supported this merger,

and we look forward to completing the integration process that has

been underway since the end of last year," said Bill Long,

President and Chief Executive Officer of Yadkin Valley Financial.

"The American Community banking team aligns culturally with our

organization, and we believe the integration process will be

smooth. I am confident that the merger between our companies will

enhance shareholder value and provide long-term benefits for our

shareholders, customers, employees, and the communities we

serve."

"Our partnership with Yadkin Valley Financial will provide us

access to the capital, technology and expertise in the products and

services that we need to truly take advantage of the outstanding

opportunities in our market," said Randy Helton, President and

Chief Executive Officer of American Community Bancshares. "We have

a high degree of confidence in the Yadkin team to join our two

organizations and continue building a great North Carolina banking

franchise that will best serve employees, customers and

shareholders."

About Yadkin Valley Financial Corporation

Yadkin Valley Financial Corporation is the holding company for

Yadkin Valley Bank and Trust Company, a full service community bank

providing services in 29 branches throughout its four regions in

North Carolina. The Yadkin Valley Bank region serves Ashe, Forsyth,

Surry, Wilkes, and Yadkin Counties, and operates a loan production

office in Wilmington, NC. The Piedmont Bank region serves Iredell

and Mecklenburg Counties. The High Country Bank region serves Avery

and Watauga Counties. The Cardinal State Bank region serves Durham,

Orange, and Granville Counties. The Bank provides mortgage lending

services through its subsidiary, Sidus Financial, LLC,

headquartered in Greenville, North Carolina. Securities brokerage

services are provided by Main Street Investment Services, Inc., a

Bank subsidiary with four offices located in the branch

network.

About American Community Bancshares

American Community Bancshares, headquartered in Charlotte, NC,

is the holding company for American Community Bank. American

Community Bank is a full service community bank, headquartered in

Monroe, NC, with nine North Carolina offices located in the fast

growing Union and Mecklenburg counties and four South Carolina

offices located in York and Cherokee counties. The Bank provides a

wide assortment of traditional banking and financial services

offered with a high level of personal attention. American Community

Bancshares website is www.americancommunitybank.com. American

Community Bancshares stock is traded on the NASDAQ Capital Market

under the symbol "ACBA."

FORWARD LOOKING STATEMENTS

This filing contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include but are not limited to (1) statements about

the benefits of the combination of Yadkin Valley and American

Community, including future financial and operating results, cost

savings, and enhanced revenues, (2) statements with respect to

Yadkin Valley's and American Community's plans, objectives,

expectations and intentions and other statements that are not

historical facts, and (3) other statements identified by words such

as "believes," "expects," "anticipates," "estimates," "intends,"

"plans," "targets," and "projects," as well as similar expressions.

These statements are based upon the current beliefs and

expectations of Yadkin Valley's and American Community's management

and are subject to significant risks and uncertainties that could

cause actual results to differ materially from those anticipated in

the forward-looking statements. Such risks and uncertainties

include, without limitation: (1) expected revenue synergies and

cost savings from the combination may not be fully realized or

realized within the expected time frame; (2) revenues following the

combination may be lower than expected; (3) competitive pressures

among depository and other financial institutions may increase

significantly and have an effect on pricing, spending, third-party

relationships and revenues; (4) the strength of the United States

economy in general and the strength of the local economies in which

the combined company will conduct operations may be different than

expected resulting in, among other things, a deterioration in the

credit quality or a reduced demand for credit, including the

resultant effect on the combined company's loan portfolio and

allowance for loan losses; (5) the rate of delinquencies and

amounts of charge-offs, the level of allowance for loan loss, the

rates of loan growth, or adverse changes in asset quality in either

Yadkin Valley's or American Community's loan portfolio, which may

result in increased credit risk-related losses and expenses; (6)

changes in the U.S. legal and regulatory framework; and (7) adverse

conditions in the stock market, the public debt market and other

capital markets (including changes in interest rate conditions) and

the impact of such conditions on the combined company, (8) any

matters that could prevent or delay the closing of the planned

merger, and (9) those matters discussed in the "Risk Factors"

section of the Annual Report on Form 10-K filed by Yadkin Valley

with the SEC on March 31, 2009.

For additional information contact: Yadkin Valley Financial

Corporation: William A. Long President and CEO Edwin E. Laws CFO

(336) 526-6300 American Community Bancshares, Inc. Randy P. Helton

President and CEO Dan R. Ellis, Jr. CFO (704) 225-8444 Megan

Malanga Nvestcom Investor Relations (954) 781-4393 Email

Contact

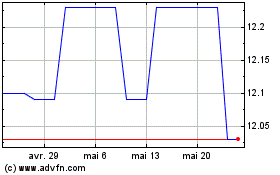

Ace Global Business Acqu... (NASDAQ:ACBA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

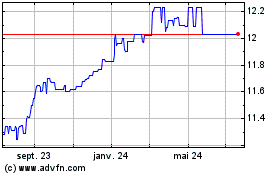

Ace Global Business Acqu... (NASDAQ:ACBA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024