0001810182false00018101822023-12-222023-12-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 22, 2023

ALX ONCOLOGY HOLDINGS INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-39386 |

85-0642577 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

323 Allerton Avenue, South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(650) 466-7125

Registrant’s Telephone Number, Including Area Code

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.001 per share |

|

ALXO |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 22, 2023, ALX Oncology Holdings Inc. (the “Company”) and its indirectly wholly-owned subsidiary, ALX Oncology Inc. (“Borrower”) entered into the Third Amendment to Loan and Security Agreement (the “Third Amendment”) by and among the Company as a guarantor, the Borrower, Oxford Finance LLC ("Oxford”), as collateral agent (“Agent”), and the lenders party thereto. The Third Amendment amends the Loan Agreement, dated as of October 27, 2022, among Agent, the lenders party thereto (the “Lenders”), Borrower, Holdings and the other guarantors party thereto (as amended, the “Loan Agreement”).

The Third Amendment amends the Loan Agreement to, among other things, (i) extend the draw period for the Term A Loans from December 31, 2023 to June 30, 2024, (ii) as a condition for the funding of any Term A Loans after the effective date of the Third Amendment, require that the Phase 2 portion of the ASPEN-06 study in gastric/gastroesophageal junction cancer either remains ongoing or the achievement of a milestone related to the development of the ASPEN-06 study, and (iii) include a contingency fee in the amount of $600,000 payable to the Lenders, in accordance with their pro rata shares, if Borrower prepays any of the loans under the Loan Agreement other than in connection with a refinancing of the Loan Agreement with the Lenders and their affiliates.

The foregoing description of the Third Amendment does not purport to be complete and is qualified in its entirety by the terms and conditions of the Third Amendment, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information related to the Loan Agreement set forth in Item 1.01 above is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

ALX ONCOLOGY HOLDINGS INC. |

|

|

|

|

Date: December 26, 2023 |

|

By: |

/s/ Peter Garcia |

|

|

|

Peter Garcia |

|

|

|

Chief Financial Officer and Secretary |

2

Exhibit 10.1

THIRD AMENDMENT TO LOAN AND SECURITY AGREEMENT

THIS THIRD AMENDMENT TO LOAN AND SECURITY AGREEMENT (this “Amendment”) is entered into as of December 22, 2023, by and among OXFORD FINANCE LLC, a Delaware limited liability company with an office located at 115 South Union Street, Suite 300, Alexandria, VA 22314 (“Oxford”), as collateral agent (in such capacity, “Collateral Agent”), the Lenders party hereto including Oxford in its capacity as a Lender, OXFORD FINANCE CREDIT FUND II LP, by its manager Oxford Finance Advisors, LLC with an office located at 115 South Union Street, Suite 300, Alexandria, VA 22314, and SILICON VALLEY BANK, a division of First-Citizens Bank & Trust Company, with an office located at 3003 Tasman Drive, Santa Clara, CA 95054 (“Bank” or “SVB”) (each a “Lender” and collectively, the “Lenders”), ALX ONCOLOGY INC., a Delaware corporation with offices located at 323 Allerton Avenue, South San Francisco, CA 94080 (“Borrower”), and ALX ONCOLOGY HOLDINGS INC., a Delaware corporation with offices located at 323 Allerton Avenue, South San Francisco, CA 94080 (together with each other Person party hereto as a Guarantor, individually and collectively, jointly and severally, “Guarantor”).

A. Collateral Agent, Credit Parties and Lenders have entered into that certain Loan and Security Agreement dated as of October 27, 2022, as amended by that certain Consent and First Amendment to Loan and Security Agreement dated as of December 22, 2022, as amended by that certain Second Amendment to Loan and Security Agreement dated as of May 31, 2023, and as amended herein (as so amended and as further amended, supplemented or otherwise modified from time to time, the “Loan Agreement”), pursuant to which Lenders have provided to Borrower certain loans in accordance with the terms and conditions thereof.

B. Credit Parties, Collateral Agent and the Required Lenders desire to amend certain provisions of the Loan Agreement as provided herein and subject to the terms and conditions set forth herein.

Agreement

NOW, THEREFORE, in consideration of the promises, covenants and agreements contained herein, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, Credit Parties, the Required Lenders and Collateral Agent hereby agree as follows:

1.Definitions. Capitalized terms used but not defined in this Amendment shall have the meanings given to them in the Loan Agreement.

2.Amendments to Loan Agreement.

2.1 Section 2.2(a) (Term Loans; Availability). Section 2.2(a)(i) of the Loan Agreement is hereby amended and restated in its entirety as follows:

“(i) Subject to the terms and conditions of this Agreement, the Lenders agree, severally and not jointly, to make term loans to Borrower in an aggregate principal amount of up to Fifty Million Dollars ($50,000,000.00) to be disbursed in an amount equal to Ten Million Dollars ($10,000,000.00) on the Effective Date according to each Lender’s Term A Loan Commitment as set forth on Schedule 1.1 hereto, with the remaining amount available to be disbursed during the Term A Draw Period, in up to four (4) additional single advances according to each Lender’s Term A Loan Commitment as set forth on Schedule 1.1 hereto (such term loans on the Effective Date and thereafter are hereinafter referred to singly as a “Term A Loan”, and collectively as the “Term A Loans”). Each disbursement of Term A Loans after the Effective Date shall be in an aggregate principal amount of at least Ten Million Dollars ($10,000,000.00) and, unless the entire remaining amount of the Term A Loan Commitment will be disbursed at such disbursement, in a denomination that is a whole number multiple of Ten Million Dollars ($10,000,000.00). After repayment, no Term A Loan may be re‑borrowed. If the Term A Draw Period terminates on June 30, 2024 pursuant to clause (i) of the definition of “Term A Draw Period”, one half of any remaining amount of the Term A Loan Commitment on June 30, 2024 shall be added to the Term B Loan Commitment (such additional amount, the “Additional Term B Loan Commitment Amount”) effective as of July 1, 2024 and one half of any remaining amount of the Term A Loan Commitment on June 30, 2024 shall be added to the Term C Loan Commitment (such additional amount, the “Additional Term C Loan Commitment Amount”) effective as of July 1, 2024.”

2.2 Section 2.2(c) (Mandatory Prepayments). Section 2.2(c) of the Loan Agreement is hereby amended and restated in its entirety as follows:

“(c) Mandatory Prepayments. If the Term Loans are accelerated following the occurrence of an Event of Default, Borrower shall immediately pay to Lenders, payable to each Lender in accordance with its respective Pro Rata Share, an amount equal to the sum of: (i) all outstanding principal of the Term Loans plus accrued and unpaid interest thereon through the prepayment date, (ii) the Final Payment, (iii) the Prepayment Fee, (iv) the Contingency Fee (if any), plus (v) all other Obligations that are due and payable, including Lenders’ Expenses and interest at the Default Rate with respect to any past due amounts. Notwithstanding (but without duplication with) the foregoing, on the Maturity Date, if the Final Payment had not previously been paid in full in connection with the prepayment of the Term Loans in full, Borrower shall pay to Collateral Agent, for payment to each Lender in accordance with its respective Pro Rata Share, the Final Payment in respect of the Term Loans.”

2.3 Section 2.2(d) (Permitted Prepayment of Term Loans). Section 2.2(d) of the Loan Agreement is hereby amended and restated in its entirety as follows:

“(d) Permitted Prepayment of Term Loans.

(i)Borrower shall have the option to prepay all, but not less than all, of the Term Loans advanced by the Lenders under this Agreement, provided Borrower (i) provides written notice to Collateral Agent of its election to prepay the Term Loans at least ten (10) days prior to such prepayment (which notice may be conditioned upon the consummation of a financing or other events and may be revoked by Borrower in writing if such condition has not or will not occur on the proposed prepayment date), and (ii) pays to the Lenders on the date of such prepayment, payable to each Lender in accordance with its respective Pro Rata Share, an amount equal to the sum of (A) all outstanding principal of the Term Loans plus accrued and unpaid interest thereon through the prepayment date, (B) the Final Payment, (C) the Prepayment Fee, (D) the Contingency Fee (if any), plus (E) all other Obligations that are due and payable, including Lenders’ Expenses and interest at the Default Rate with respect to any past due amounts.

(ii)Notwithstanding anything herein to the contrary, Borrower shall also have the option to prepay part of Term Loans advanced by the Lenders under this Agreement, provided Borrower (i) provides written notice to Collateral Agent of its election to prepay the Term Loans at least ten (10) days prior to such prepayment (which notice may be conditioned upon the consummation of a financing or other events and may be revoked by Borrower in writing if such condition has not or will not occur on the proposed prepayment date), (ii) prepays such part of the Term Loans in a denomination that is a whole number multiple of Ten Million Dollars ($10,000,000.00), and (iii) pays to the Lenders on the date of such prepayment, payable to each Lender in accordance with its respective Pro Rata Share, an amount equal to the sum of (A) the portion of outstanding principal of such Term Loans plus all accrued and unpaid interest thereon through the prepayment date, (B) the applicable Final Payment, (C) all other Obligations that are then due and payable, including Lenders’ Expenses and interest at the Default Rate with respect to any past due amounts, (D) the applicable Prepayment Fee with respect to the portion of such Term Loans being prepaid, (E) the Contingency Fee (if any), and (F) without duplication, any fee that would have otherwise been due pursuant to Section 2.2(d)(i). For the purposes of clarity, any partial prepayment shall be applied pro-rata to all outstanding amounts under each Term Loan, and shall be applied pro-rata within each Term Loan tranche to reduce amortization payments under Section 2.2(b) on a pro-rata basis.”

2.4 Section 2.5(f) (Contingency Fee). Subsection 2.5(f) is hereby added to the end of Section 2.5 of the Loan Agreement as follows:

“(f) Contingency Fee. The Contingency Fee, when due hereunder, to be shared between the Lenders in accordance with their respective Pro Rata Shares.”

2.5 Section 3.2(g) (Term A Milestone). Subsection 3.2(g) is hereby added to the end of Section 3.2 of the Loan Agreement as follows:

“(g) solely with respect to the funding of any Term A Loans after the Third Amendment Effective Date, the achievement of the Term A Milestone.”

-2-

2.6 Section 13 (Definitions). The following defined terms in Section 13 of the Loan Agreement are amended and restated as follows:

“Obligations” are all of Credit Party’s obligations to pay when due any debts, principal, interest, Lenders’ Expenses, the Prepayment Fee, the Contingency Fee, the Final Payment, and other amounts Credit Party owes the Lenders now or later, in connection with, related to, following, or arising from, out of or under, this Agreement or, the other Loan Documents, or otherwise, including, without limitation, all obligations relating to letters of credit (including reimbursement obligations for drawn and undrawn letters of credit), cash management services, and foreign exchange contracts, if any, and including interest accruing after Insolvency Proceedings begin (whether or not allowed) and debts, liabilities, or obligations of Credit Party assigned to the Lenders and/or Collateral Agent, and the performance of Credit Party’s duties under the Loan Documents.

“Term A Draw Period” is the period commencing on the Effective Date and ending on the earlier of (i) June 30, 2024 and (ii) the occurrence of an Event of Default.

2.7 Section 13 (Definitions). The following defined terms are added to Section 13 of the Loan Agreement in appropriate alphabetical order:

“Contingency Fee” is, with respect to any Term Loan subject to prepayment prior to the Maturity Date, whether by mandatory or voluntary prepayment, acceleration or otherwise, an additional fee equal to Six Hundred Thousand Dollars ($600,000.00) payable to the Lenders in accordance with their respective Pro Rata Shares; provided that the Contingency Fee shall be zero dollars ($0) if such prepayment is made in connection with a refinancing of this Agreement with Oxford and Bank and any of their respective Affiliates.

“Term A Milestone” means Borrower’s delivery to Collateral Agent and Lenders of evidence, satisfactory to Collateral Agent and Lenders in their sole but reasonable discretion, that the Phase 2 portion of the ASPEN-06 study in Gastric/Gastroesophageal Junction Cancer either (i) remains ongoing or (ii) has reported positive data that is sufficient to initiate a pivotal study or move to a Biologics License Application submission as the immediate next step.

“Third Amendment Effective Date” is December 22, 2023.

2.8 Schedule 1.1 (Commitments). The footnote to Schedule 1.1 is hereby amended and restated in its entirety as follows:

“** If the Term A Draw Period terminates on June 30, 2024 pursuant to clause (i) of the definition of “Term A Draw Period”, (a) the Additional Term B Loan Commitment Amount shall be added to the Term B Loan Commitment effective as of July 1, 2024 and pro rata in accordance with the Commitment Percentage for the Term B Loans and (b) the Additional Term C Loan Commitment Amount shall be added to the Term C Loan Commitment effective as of July 1, 2024 and pro rata in accordance with the Commitment Percentage for the Term C Loans.”

-3-

3.Limitation of Amendment.

3.1 The amendments set forth in Section 2 above are effective for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, or (b) otherwise prejudice any right, remedy or obligation which Lenders or any Credit Party may now have or may have in the future under or in connection with any Loan Document, as amended hereby.

3.2 This Amendment shall be construed in connection with and as part of the Loan Documents and all terms, conditions, representations, warranties, covenants and agreements set forth in the Loan Documents are hereby ratified and confirmed and shall remain in full force and effect.

4.Representations and Warranties. To induce Collateral Agent and the Required Lenders to enter into this Amendment, each Credit Party hereby represents and warrants to Collateral Agent and the Required Lenders on the date hereof as follows:

4.1 Immediately after giving effect to this Amendment (a) the representations and warranties contained in the Loan Documents are true, accurate and complete in all material respects as of the date hereof (except to the extent such representations and warranties relate to an earlier date, in which case they are true and correct in all material respects as of such date) and (b) no Event of Default has occurred and is continuing;

4.2 Such Credit Party has the corporate power and authority to execute and deliver this Amendment and to perform its obligations under the Loan Agreement;

4.3 The organizational documents of such Credit Party delivered to Collateral Agent on the Effective Date, and updated pursuant to subsequent deliveries by or on behalf of such Credit Party to the Collateral Agent, remain true, accurate and complete and have not been amended, supplemented or restated and are and continue to be in full force and effect;

4.4 The execution and delivery by such Credit Party of this Amendment and the performance by such Credit Party of its obligations under the Loan Agreement, do not contravene (i) any material law or regulation binding on or affecting such Credit Party, (ii) any material contractual restriction with a Person binding on such Credit Party, (iii) any order, judgment or decree of any court or other governmental or public body or authority, or subdivision thereof, binding on such Credit Party, or (iv) the organizational documents of such Credit Party;

4.5 The execution and delivery by such Credit Party of this Amendment and the performance by such Credit Party of its obligations under the Loan Agreement, do not require any order, consent, approval, license, authorization or validation of, or filing, recording or registration with, or exemption by any governmental or public body or authority, or subdivision thereof, binding on such Credit Party, except as already has been obtained or made; and

4.6 This Amendment has been duly executed and delivered by such Credit Party and is the binding obligation of such Credit Party, enforceable against such Credit Party in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, liquidation, moratorium or other similar laws of general application and equitable principles relating to or affecting creditors’ rights.

5.Release by Credit Parties.

5.1 FOR GOOD AND VALUABLE CONSIDERATION, each Credit Party hereby forever relieves, releases, and discharges Collateral Agent and each Lender and their respective present or former employees, officers, directors, agents, representatives, attorneys, and each of them, from any and all claims, debts, liabilities, demands, obligations, promises, acts, agreements, costs and expenses, actions and causes of action, of every type, kind, nature, description or character whatsoever, whether known or unknown, suspected or unsuspected, absolute or contingent, arising out of or in any manner whatsoever connected with or related to facts, circumstances, issues, controversies or claims existing or arising from the beginning of time through and including the date of execution of this Amendment

-4-

solely to the extent such claims arise out of or are in any manner whatsoever connected with or related to the Loan Documents, the Recitals hereto, any instruments, agreements or documents executed in connection with any of the foregoing or the origination, negotiation, administration, servicing and/or enforcement of any of the foregoing (collectively “Released Claims”).

5.2 In furtherance of this release, each Credit Party expressly acknowledges and waives the provisions of California Civil Code Section 1542 (and any similar provision under the laws of any state), which states:

“A general release does not extend to claims THAT the creditor OR RELEASING PARTY does not know or suspect to exist in his or her favor at the time of executing the release AND THAT, if known by him or her, WOULD HAVE materially affected his or her settlement with the debtor OR RELEASED PARTY.”

5.3 By entering into this release, each Credit Party recognizes that no facts or representations are ever absolutely certain and it may hereafter discover facts in addition to or different from those which it presently knows or believes to be true, but that it is the intention of such Credit Party hereby to fully, finally and forever settle and release all matters, disputes and differences, known or unknown, suspected or unsuspected in relation to the Released Claims; accordingly, if such Credit Party should subsequently discover that any fact that it relied upon in entering into this release was untrue, or that any understanding of the facts was incorrect, such Credit Party shall not be entitled to set aside this release by reason thereof, regardless of any claim of mistake of fact or law or any other circumstances whatsoever. Each Credit Party acknowledges that it is not relying upon and has not relied upon any representation or statement made by Collateral Agent or Lenders with respect to the facts underlying this release or with regard to any of such party’s rights or asserted rights.

6.Loan Document. Credit Parties, Lenders and Collateral Agent agree that this Amendment shall be a Loan Document. Except as expressly set forth herein, the Loan Agreement and the other Loan Documents shall continue in full force and effect without alteration or amendment. This Amendment and the Loan Documents represent the entire agreement about this subject matter and supersede prior negotiations or agreements.

7.Effectiveness. This Amendment shall be deemed effective upon the due execution and delivery to Collateral Agent and Lenders of this Amendment by each party hereto.

8.Counterparts. This Amendment may be executed in any number of counterparts, each of which shall be deemed an original, and all of which, taken together, shall constitute one and the same instrument. Delivery by electronic transmission (e.g. “.pdf”) of an executed counterpart of this Amendment shall be effective as a manually executed counterpart signature thereof.

9.Governing Law. This Amendment and the rights and obligations of the parties hereto shall be governed by and construed in accordance with the laws of the State of California.

[Balance of Page Intentionally Left Blank]

-5-

IN WITNESS WHEREOF, the parties hereto have caused this Third Amendment to Loan and Security Agreement to be executed as of the date first set forth above.

|

|

|

BORROWER: |

|

|

|

|

|

ALX ONCOLOGY INC. |

|

|

|

|

|

|

|

|

By /s/ Peter Garcia |

|

|

Name: Peter Garcia |

|

|

Title: Chief Financial Officer |

|

|

|

|

|

|

|

|

GUARANTOR: ALX ONCOLOGY HOLDINGS INC. By /s/ Peter Garcia |

|

|

Name: Peter Garcia Title: Chief Financial Officer COLLATERAL AGENT AND LENDER: |

|

|

|

|

|

OXFORD FINANCE LLC |

|

|

|

|

|

|

By /s/ Colette H. Featherly |

|

|

Name: Colette H. Featherly |

|

|

Title: Senior Vice President {signature pages continue} |

|

|

|

|

|

|

|

|

[Signature Page to Third Amendment to Loan and Security Agreement]

|

|

|

LENDERS: |

|

|

OXFORD FINANCE CREDIT FUND II LP By: Oxford Finance Advisors, LLC, its manager By /s/ Colette H. Featherly Name: Colette H. Featherly Its: Senior Vice President OXFORD FINANCE FUNDING 2023-1 LLC By /s/ Colette H. Featherly Name: Colette H. Featherly Title: Secretary |

|

|

FIRST-CITIZENS BANK & TRUST COMPANY |

|

|

|

|

|

|

By /s/ Peter Sletteland |

|

|

Name: Peter Sletteland |

|

|

Title: Managing Director |

|

|

[Signature Page to Third Amendment to Loan and Security Agreement]

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

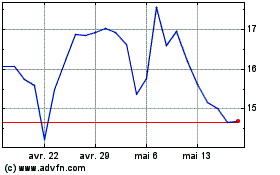

ALX Oncology (NASDAQ:ALXO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

ALX Oncology (NASDAQ:ALXO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024