APA Corporation Provides Second-Quarter 2024 Supplemental Information and Schedules Results Conference Call for August 1 at 10 a.m. Central Time

11 Juillet 2024 - 11:03PM

APA Corporation (Nasdaq: APA) today provided supplemental

information regarding certain second-quarter 2024 financial and

operational results. This information is intended only to provide

additional information regarding current estimates management

believes will affect results for the second-quarter 2024. It is

provided to assist investors, analysts and others in formulating

their own estimates, and is not intended to be a comprehensive

presentation of all factors that will affect second-quarter 2024

results. Actual results and the impact of factors identified here

may vary depending on the impact of other factors not identified

here and are subject to finalization of the financial reporting

process for second-quarter 2024.

|

Estimated Average Realized Prices – 2Q24 |

|

|

Oil (bbl) |

NGL (bbl) |

Natural Gas (Mcf) |

|

United States |

$80.50 |

$21.50 |

$0.30 |

|

International |

$84.00 |

$43.00 |

$4.00 |

|

Egypt tax barrels: |

38 MBoe/d |

|

Realized loss on commodity derivatives (before tax): |

$6 million |

|

Dry hole costs (before tax): |

~$55 million |

|

Net gain on oil and gas purchases and sales (before

tax): Includes gain on natural gas purchased and sold to

Cheniere. |

$130 million |

* Dry hole cost represents $35 million of cost incurred for

previously announced Alaskan exploration wells, and approximately

$20 million associated with drilling in Egypt

Production update

APA curtailed approximately 78 MMcf/d of U.S. natural gas

production in the second quarter in response to weak or negative

Waha hub prices. APA also curtailed an estimated 7,600 barrels per

day of natural gas liquids during the quarter, which were mostly

associated with the voluntary gas curtailments. Previous second

quarter guidance issued in May contemplated curtailments of ~50

MMcf/d of natural gas and ~5 Mb/d of NGLs.

Asset sales update

In May, APA announced agreements to divest non-core assets in

the Midland Basin (primarily non-operated minerals) and East

Texas (Austin Chalk / Eagle Ford). These sales packages

closed in June, which was earlier than previously expected,

resulting in an approximate 2.0 Mboe/d (30% oil), reduction to

APA’s second quarter U.S. production. Aggregate net proceeds from

the asset sales, after closing adjustments, were approximately $660

million.

Transaction, reorganization and separation

costs

During the second quarter, APA incurred Transaction,

Reorganization and Separation cash costs of approximately $95

million, the vast majority of which were associated with the

acquisition of Callon Petroleum on April 1. Note that Transaction,

Reorganization and Separation costs will not impact adjusted EPS

and adjusted EBITDAX but will affect cash flow.

DD&A

APA did not previously provide second-quarter DD&A guidance

due to the acquisition of Callon Petroleum. Based on current best

estimates, APA believes second-quarter DD&A will be

approximately $590 million.

Weighted-average shares outstanding

The estimated weighted-average basic common shares for the

second quarter is 371 million, compared with a weighted average of

302 million shares in the first-quarter 2024. The second quarter

share count increase reflects the issuance of approximately 69

million shares associated with the acquisition of Callon Petroleum

on April 1. APA repurchased 1.5 million shares at an average price

of $28.71 per share, during the second quarter.

Second-quarter 2024 earnings call

APA will host a conference call to discuss its second-quarter

2024 results at 10 a.m. Central time, Thursday, August 1. The

conference call will be webcast from APA’s website at

www.apacorp.com and investor.apacorp.com. Following the conference

call, a replay will be available for one year on the “Investors”

page of the company’s website.

About APA

APA Corporation owns consolidated subsidiaries that explore for

and produce oil and natural gas in the United States, Egypt and the

United Kingdom and that explore for oil and natural gas offshore

Suriname and elsewhere. APA posts announcements, operational

updates, investor information and press releases on its website,

www.apacorp.com.

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking

statements can be identified by words such as “anticipates,”

“intends,” “plans,” “seeks,” “believes,” “continues,” “could,”

“estimates,” “expects,” “goals,” “guidance,” “may,” “might,”

“outlook,” “possibly,” “potential,” “projects,” “prospects,”

“should,” “will,” “would,” and similar references to future

periods, but the absence of these words does not mean that a

statement is not forward-looking. These statements include, but are

not limited to, statements about future plans, expectations, and

objectives for operations, including statements about our capital

plans, drilling plans, production expectations, asset sales, and

monetizations. While forward-looking statements are based on

assumptions and analyses made by us that we believe to be

reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties which could cause our actual

results, performance, and financial condition to differ materially

from our expectations. See “Risk Factors” in APA’s Form 10-K for

the year ended December 31, 2023, and in our quarterly reports on

Form 10-Q, filed with the Securities and Exchange Commission for a

discussion of risk factors that affect our business. Any

forward-looking statement made in this news release speaks only as

of the date on which it is made. Factors or events that could cause

our actual results to differ may emerge from time to time, and it

is not possible for us to predict all of them. APA and its

subsidiaries undertake no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future development or otherwise, except as may be required by

law.

Contacts

Investor: (281) 302-2286

Gary

ClarkMedia: (713)

296-7276 Alexandra

Franceschi Website: www.apacorp.com

APA-F

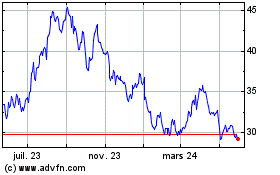

APA (NASDAQ:APA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

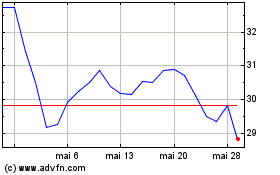

APA (NASDAQ:APA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025