Filed Pursuant to Rule 424(b)(3)

Registration No. 333-279799

PROSPECTUS

ATIF Holdings Limited

2,290,000 Ordinary Shares

This prospectus relates

to the offering and resale by the selling stockholders identified herein of an aggregate of 2,290,000 ordinary shares, par value

$0.001 per share, of ATIF Holdings Limited (“ATIF BVI”). We will not receive any proceeds from the sale of our ordinary

shares by the selling stockholders in the offering described in this prospectus. The shares being offered (i) were issued and sold

to the selling stockholders in a private placement offering (“Private Placement”), pursuant to purchase agreements at a

purchase price of $1.23 per ordinary share, which were entered into on April 16, 2024 and April 18, 2024 and (ii) were issued to Mr.

Jun Liu, President, Chief Executive Officer and Chairman of the Board of Directors of the Company pursuant to a deferred salary

conversion agreement (“Deferred Salary Conversion Agreement”) entered into between Mr. Jun Liu and the Company.

Pursuant to the Deferred Salary Conversion Agreement, the Company agreed to issue and Mr. Liu agreed to accept 384,478 ordinary

shares (“Deferred Salary Debt Shares”), $0.001 par value, in lieu of an unpaid salary of $349,875 owed to Mr. Liu

at a per share price of $0.91 which was the Nasdaq consolidated closing bid price per share of the Company’s ordinary shares

on April 29, 2024

The selling stockholders may

sell the ordinary shares on any national securities exchange or quotation service on which the securities may be listed or quoted at the

time of sale, in the over-the-counter market, in one or more transactions otherwise than on these exchanges or systems, such

as privately negotiated transactions, or using a combination of these methods, and at fixed prices, at prevailing market prices at the

time of the sale, at varying prices determined at the time of sale, or at negotiated prices. See the disclosure under the heading “Plan

of Distribution” elsewhere in this prospectus for more information about how the selling stockholders may sell or otherwise dispose

of their ordinary shares hereunder. We may amend or supplement this prospectus from time to time by filing amendments or supplements as

required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are not offering any shares

of ordinary shares under this prospectus and will not receive any proceeds from the sale or other disposition of the shares covered hereby.

See “Use of Proceeds” beginning on page 12 of this prospectus.

The selling stockholders may

sell any, all or none of the securities offered by this prospectus and we do not know when or in what amount the selling stockholders

may sell their ordinary shares hereunder following the effective date of this registration statement.

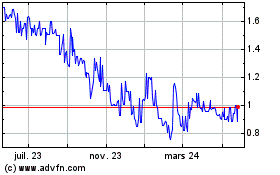

ATIF BVI’s ordinary shares, par value US$0.001 per share (“ordinary

shares”) are listed on the Nasdaq Capital Market under the symbol “ATIF.” On June 12, 2024, the closing price of ATIF’s

ordinary shares was $0.8003 per share.

The securities offered by this

prospectus involve a high degree of risks. ATIF BVI is a holding company incorporated in British Virgin Islands. As a holding company

with no material operations of its own, ATIF BVI conducts a substantial amount of its operations through its subsidiaries in U.S. We conduct

our operations in the U.S. through our 100% ownership interest in ATIF USA, a California corporation.

Our ordinary shares may be

prohibited from trading on a national exchange or “over-the-counter” markets under the Holding Foreign Companies Accountable

Act (the “HFCAA”) if the Public Company Accounting Oversight Board (“PCAOB”) determines that it is unable to

inspect or fully investigate our auditor and as a result the exchange where our securities are traded may delist our securities. Furthermore,

on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which

was signed into law on December 29, 2022, amending the HFCAA and requiring the SEC to prohibit an issuer’s securities from trading

on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive

years. Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the PCAOB was unable to

inspect or investigate completely certain named registered public accounting firms headquartered in mainland China and Hong Kong. On

December 15, 2022, the PCAOB announced that it has secured complete access to inspect and investigate registered public accounting firms

headquartered in mainland China and Hong Kong and voted to vacate the previous 2021 Determination Report to the contrary. Our independent

registered public accounting firm is headquartered in Denver, Colorado and has been inspected by the PCAOB on a regular basis and as

such, it is not affected by or subject to the PCAOB’s Determination Report. Notwithstanding the foregoing, in the future,

if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide audit documentations located

in China to the PCAOB for inspection or investigation, you may be deprived of the benefits of such inspection which could result in limitation

or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and

trading on “over-the-counter” markets, may be prohibited under the HFCAA and AHFCAA and/or PCAOB may consider the need to

issue new determinations consistent with the HFCAA and Rule 6100.

ATIF BVI is a holding company incorporated

in British Virgin Islands. You will be purchasing the ordinary shares of ATIF BVI, the holding company with U.S. and offshore subsidiaries

and affiliates pursuant to this registration statement. You are not directly investing in any of our Affiliated Entities. “ATIF

USA” means ATIF Inc., a California corporation and a wholly-owned subsidiary of ATIF BVI. “ATIF Investment” shall hereinafter

refer to ATIF Investment Limited, a BVI company and wholly-owned subsidiary of ATIF.. “ATIF BD” shall hereinafter refer to

ATIF BD LLC, a California limited liability company and wholly-owned subsidiary of ATIF USA. ATIF Business Consulting LLC, a California

limited liability company (“ATIF Consulting”) is a wholly-owned subsidiary of ATIF USA. ATIF Business Management LLC, a California

limited liability company (“ATIF Management”), is a wholly-owned subsidiary of ATIF USA. All references to the “we,”

“us,” “our,” “Company,” “Group,” “registrant” or similar terms used in this

registration statement refer to ATIF, ATIF USA, ATIF Investment, ATIF Consulting, ATIF Management, and ATIF BD, unless the context

otherwise indicates. “Affiliated Entities” shall refer to the ATIF USA, ATIF Consulting, ATIF Management, ATIF Investment,

and ATIF BD.

Following the relocation of

our headquarters and the termination of the VIE agreements on January 4, 2021, along with the transfer of equity interest in Huaya on

May 31, 2022, we currently do not have any significant operation in China and Hong Kong. See “The Company – Recent Development”

on page 2. Our customers are primarily located in the U.S., Mexico, mainland China and Hong Kong. With respect to our China and Hong Kong-based

clients, we believe those clients are subject to legal and operational risks associated with having a significant portion of their operations

in mainland China and Hong Kong, including risks related to the legal, political and economic policies of the Chinese government, the

relations between China and the United States, and changes in Chinese laws and regulations. Recently, the PRC government initiated a series

of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice,

including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas,

adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. On December 28,

2021, thirteen governmental departments of the PRC, including the Cyberspace Administration of China (the “CAC”), issued the

Cybersecurity Review Measures, which became effective on February 15, 2022. The Cybersecurity Review Measures provide that an online platform

operator, which possesses personal information of at least one million users, must apply for a cybersecurity review by the CAC if it intends

to be listed in foreign countries. As advised by our PRC counsel, Yuan Tai Law Offices, we do not believe that we are subject to the cybersecurity

review by the CAC. In addition, as of the date of this prospectus, we have not been involved in any investigations on cybersecurity review

initiated by any PRC regulatory authority, nor have we received any inquiry, notice, or sanction related to cybersecurity review under

the Cybersecurity Review Measures. As of the date of this prospectus, no relevant laws or regulations in the PRC explicitly require us

to seek approval from the China Securities Regulatory Commission (the “CSRC”) or any other PRC governmental authorities for

our overseas listing or securities offering plan, nor have we (including any of our subsidiaries) received any inquiry, notice, warning

or sanctions regarding our planned offering of securities from the CSRC or any other PRC governmental authorities. See “Risk

Factors – Changes in the policies of the PRC government could have a significant impact upon our ability to operate profitably in

the PRC” on page 14. Also as of the date of this prospectus, we do not believe we are in a monopolistic position in the business

consultancy industry. However, since these statements and regulatory actions by the PRC government are newly published and official guidance

and related implementation rules have not been issued, it is highly uncertain what the potential impact such modified or new laws and

regulations will have on our daily business operations, the ability of our Chinese clients to accept foreign investments and list on a

U.S. or non-Chinese exchange. The Standing Committee of the National People’s Congress (the “SCNPC”) or other PRC regulatory

authorities may in the future promulgate laws, regulations or implementing rules that would require our clients or any of their subsidiaries

to obtain regulatory approval from Chinese authorities before listing in the U.S. These risks could result in a material change in our

services for the China and Hong Kong-based clients and potentially the value of our securities being registered herein for sale. The CSRC

regulatory risks could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and

cause the value of such securities to significantly decline or be worthless.

Under our current corporate

structure, to fund any liquidity requirements an entity in our corporate group may have, an Affiliated Entity may rely on dividend payments

from ATIF BVI and ATIF BVI may receive distributions or cash transfers from an Affiliated Entity. Additionally, the transfer of funds

and assets between ATIF BVI and the Affiliated Entities is not subject to any Chinese currency exchange restrictions. As of the date of

this prospectus, none of ATIF BVI’s subsidiaries has made any dividends or distributions to ATIF BVI and nor has ATIF BVI made any

dividends or distributions to its shareholders or subsidiaries. We intend to keep any future earnings to finance the expansion of our

business, and we do not anticipate any cash dividends will be paid in the foreseeable future. If ATIF BVI determines to pay dividends

on any of its Ordinary Shares in the future, as a holding company, it may derive funds for such distribution from its own cash position

or contributions from its subsidiaries. As of the date of this prospectus, no transfer of non-cash assets has occurred between ATIF BVI

and any of its subsidiaries. Since our inception in 2015, no transfers, dividends, or distributions to ATIF BVI’s shareholders have

been made. ATIF BVI and its subsidiaries have made transfers of cash to meet the respective entities’ working capital requirements.

As of January 31, 2024, ATIF BVI transferred and lent ATIF USA $3,017,000. As of the date of this prospectus, neither ATIF BVI nor its

subsidiaries has a cash management policy. See “The Company- Cash Distribution” on page 4 and “Summary

Consolidate Financial Date” on page 11.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated June 13, 2024

Table of Contents

You should rely only on

the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone

to provide you with information different from that contained or incorporated by reference into this prospectus. If any person does provide

you with information that differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No

dealer, salesperson, or other person is authorized to give any information or to represent anything not contained in this prospectus.

You should assume that the information contained in this prospectus or any prospectus supplement is accurate only as of the date on the

front of the document and that any information contained in any document we have incorporated by reference is accurate only as of the

date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or

any sale of a security. These documents are not an offer to sell or a solicitation of an offer to buy these securities by anyone in any

jurisdiction in which such offer or solicitation is not authorized, or in which the person is not qualified to do so or to any person

to whom it is unlawful to make such offer or solicitation.

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the SEC utilizing a “shelf” registration process. Under this shelf process, the

selling stockholders may sell the securities described in this prospectus in one or more offerings. You should read both this prospectus

and any prospectus supplement together with additional information described under the heading “Where You Can Find More Information.”

We have not, and the selling

stockholders have not, authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus.

We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. We

are not, and the selling stockholders are not, making an offer to sell these securities in any jurisdiction where the offer or sale is

not permitted. You should not assume that the information contained or incorporated by reference in this prospectus is accurate as of

any date other than their respective dates.

Other Pertinent Information

ATIF BVI is a holding company

incorporated in British Virgin Islands. You will be purchasing the ordinary shares of ATIF BVI, the holding company with U.S. and offshore

subsidiaries and affiliates pursuant to this registration statement. You are not directly investing in any of our Affiliated Entities.

Unless otherwise indicated

or the context requires otherwise, references in this prospectus to:

| |

● |

“ATIF BVI” shall hereinafter refer to ATIF Holdings Limited, a British Virgin Islands business company. |

| |

● |

“ATIF USA” shall hereinafter refer to ATIF Inc., a California corporation and a wholly-owned subsidiary of ATIF. |

| |

● |

“ATIF Investment” shall hereinafter refer to ATIF Investment Limited, a British Virgin Islands business company and a wholly-owned subsidiary of ATIF. |

| |

● |

“ATIF BD” shall hereinafter refer to ATIF BD LLC, a California limited liability company and a wholly-owned subsidiary of ATIF USA. |

| |

● |

“ATIF Consulting” shall hereinafter refer to ATIF Business Consulting LLC, a California LLC and a wholly-owned subsidiary of ATIF USA. |

| |

● |

“ATIF Management” shall hereinafter refer to ATIF Business Management LLC, a California LLC and wholly-owned subsidiary of ATIF USA. |

| |

● |

“we,”

“us,” “Company,” “Group,” or the “registrant” or similar terms used in this

registration statement refer to ATIF, ATIF USA, ATIF Investment, ATIF Consulting, ATIF Management, and ATIF BD, unless the context

otherwise indicates. |

| |

● |

“Affiliated Entities” shall refer to the ATIF USA, ATIF Consulting, ATIF Management, ATIF Investment and ATIF BD. |

| |

● |

“China” or “PRC” are to the People’s Republic of China, including Hong Kong and Macau; however the only time such jurisdictions are not included in the definition of PRC and China is when we reference to the specific laws that have been adopted by the PRC. The same legal and operational risks associated with operations in China also apply to operations in Hong Kong. The term “Chinese” has a correlative meaning for the purpose of this prospectus; |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

and information incorporated by reference in this prospectus include forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, or the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934, as amended,

or the “Exchange Act.” These statements are based on our management’s beliefs and assumptions and on information currently

available to our management. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals,

targets, or future development and/or otherwise are not statements of historical fact.

All statements in this prospectus

and the documents and information incorporated by reference in this prospectus that are not historical facts are forward-looking statements.

We may, in some cases, use terms such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would,” or similar expressions or the negative of such

items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking statements

are made based on management’s beliefs, estimates, and opinions on the date the statements are made and ATIF undertakes no obligation

to update forward-looking statements if these beliefs, estimates, and opinions or other circumstances should change, except as may be

required by applicable law. Although ATIF believes that the expectations reflected in the forward-looking statements are reasonable, ATIF

cannot guarantee future results, levels of activity, performance, or achievements.

SUMMARY

This summary highlights

certain information appearing elsewhere in this prospectus and in the documents we incorporate by reference into this prospectus. The

summary is not complete and does not contain all of the information that you should consider before investing in our ordinary shares.

After you read this summary, you should read and consider carefully the entire prospectus and any prospectus supplement and the more detailed

information and financial statements and related notes that are incorporated by reference into this prospectus and any prospectus supplement.

If you invest in our shares, you are assuming a high degree of risk.

About Us – Business

Overview

We

are a British Virgin Islands business company. We are a business consulting company providing financial consulting services to

small and medium-sized enterprises (“SMEs”) and prior to August 1, 2022, our Affiliated Entity ATIF USA, managed a private

equity fund with approximately $1.3 million assets under management (“AUM”). Since our inception in 2015, the main focus of

our consulting business has been providing comprehensive going public consulting services designed to help SMEs become public companies

on suitable stock markets and exchanges. Our goal is to become an international financial consulting company with clients and offices

throughout North America and Asia. In order to expand our business with a flexible business concept and reach our goal of high growth

revenue and strong profit growth, on January 4, 2021, we opened an office in California, USA, through our wholly owned subsidiary ATIF

USA. Our clients located within United States are serviced by ATIF USA. ATIF BVI relies on a professional

service team, who is rich in business consulting experiences, extensive social relations, and international integrated services, to make

the IPO process as easy as possible for its clients. We operate with competitive fee schedules and in the cases of clients with attractive

financial performance and/or great growth potential, we would offer the option of paying no fees upfront.

To

mitigate the potential risks arising from the PRC government provision of new guidance to and restrictions on China-based companies raising

capital offshore, we decided to divest our PRC subsidiaries. As of May 31, 2022, we completed the transfer of our equity interest in ATIF

Limited, a Hong Kong corporation (“ATIF HK”) and Huaya Consulting (Shenzhen) Co., Ltd., corporation formed under the laws

of the PRC (“Huaya”) to Mr. Pishan Chi, our former director and CEO, for no consideration.

We

have primarily focused on helping clients going public on the national stock exchanges and OTC Markets in the U.S. As of the date of this

prospectus, we have provided financial consulting services to SMEs in the United States, Mexico, China and Hong Kong.

Corporate Structure

The

following diagram illustrates our current corporate structure:

Private Placement

On April 16, 2024, the

Company entered into a Securities Purchase Agreement (the “April 16 Purchase Agreement”) with a non- U.S investor named in

the Purchase Agreement (the “Purchaser”), pursuant to which the Company agreed to sell an aggregate of 1,092,512 newly issued

ordinary shares of the Company, $0.001 par value per ordinary share (the “Ordinary Shares”) at a purchase price of $1.23 per

share (the “April 16 Private Placement”). In connection with the Private Placement, the Company received gross proceeds in

the amount of $1,343,789.76.

On April 18, 2024, the

Company entered into two securities purchase agreements (the “April 18 Purchase Agreements”) in a private placement (the “April

18 Private Placement”) of the Company’s newly issued ordinary shares, par value $0.001 per ordinary share, with one (1) U.S.

accredited investor, as defined under Rule 501 of Regulation D, and one (1) non-U.S. investor (individually, an “Investor”

and collectively, the “Investors”), at the purchase price of $1.23 per ordinary share. The Company received gross proceeds

in the amount of $1,000,002.38 in connection with the Private Placement.

Each of the April 18

Purchase Agreements and April 16 Purchase Agreement contained customary representations, warranties and covenants by the parties for offerings

of similar sizes. The Company agreed that within a reasonable time after the Closing, the Company shall file a registration statement

on Form S-3 (or other appropriate form if the Company is not then S-3 eligible) providing for the resale by the Investors of the purchased

ordinary shares. We are filing the registration statement of which this prospectus forms a part to satisfy this obligation.

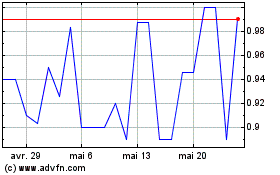

On April 29, 2024, the Company entered into a

deferred salary conversion agreement (“Deferred Salary Conversion Agreement”) with Mr. Jun Liu, the president, chief

executive officer and chairman of the board of directors of the Company.

Pursuant to the Agreement, the Company agreed

to issue and Mr. Liu agreed to accept 384,478 ordinary shares (“Deferred Salary Debt Shares”), $0.001 par value in

lieu of an unpaid salary of $349,875 owed to Mr. Liu at a per share price of $0.91 which was the Nasdaq consolidated closing bid price

per share of the Company’s ordinary shares on April 29, 2024.

Recent Regulatory Developments

We

are subject to a wide variety of complex laws and regulations in the United States and other jurisdictions in which we operate. The laws

and regulations govern many issues related to our business practices, including those regarding consumer protection, worker classification,

wage and hour, sick pay and leaves of absence, anti-discrimination and harassment, whistleblower protections, background checks, privacy,

data security, intellectual property, health and safety, environmental, competition, fees and payments, pricing, product liability and

disclosures, property damage, communications, employee benefits, taxation, unionization and collective bargaining, contracts, arbitration

agreements, class action waivers, terms of service, and accessibility of our website.

These

laws and regulations are constantly evolving and may be interpreted, applied, created, superseded, or amended in a manner that could harm

our business. These changes may occur immediately or develop over time through judicial decisions or as new guidance or interpretations

are provided by regulatory and governing bodies, such as federal, state and local administrative agencies. As we expand our business into

new markets or introduce new features or offerings into existing markets, regulatory bodies or courts may claim that we are subject to

additional requirements, or that we are prohibited from conducting business in certain jurisdictions. This section summarizes the principal

regulations applicable to our business.

Regulation on Intellectual

Property Rights

Regulations on trademarks

The

Trademark Law of the People’s Republic of China was adopted at the 24th meeting of the Standing Committee of the Fifth National

People’s Congress on August 23, 1982. Three amendments were made on February 22, 1993, October 27, 2001, and August 30,

2013, respectively. The last amendment was implemented on May 1, 2014. The regulations on the implementation of the trademark law

of the People’s Republic of China were promulgated by the State Council of the People’s Republic of China on August 3,

2002, and took effect on September 15, 2002. It was revised on April 29, 2014 and April 23, 2019. The PRC Trademark Office under

the State Administration of Market Regulation handles trademark registrations and grants a term of 10 years to registered trademarks and

another 10 years if requested upon expiration of the first or any renewed 10-year term. Trademark license agreements must be filed with

the PRC Trademark Office for record. The PRC Trademark Law has adopted a “first-to-file” principle with respect to trademark

registration. Where a trademark to be registered is identical or similar to another trademark which has already been registered or been

subject to a preliminary examination and approval for use on the same kind of or similar goods or services, the application for registration

of such trademark may be rejected. Any person applying for the registration of a trademark may not prejudice the existing right first

obtained by others, nor may any person register in advance a trademark that has already been used by another party and has already gained

a “sufficient degree of reputation” through such party’s use. After receiving an application, the PRC Trademark Office

will make a public announcement if the relevant trademark passes the preliminary examination. During the three months after this public

announcement, any person entitled to prior rights and any interested party may file an objection against the trademark. The PRC Trademark

Office’s decisions on rejection, objection, or cancellation of an application may be appealed to the PRC Trademark Review and Adjudication

Board, whose decision may be further appealed through judicial proceedings. If no objection is filed within three months after the public

announcement or if the objection has been overruled, the PRC Trademark Office will approve the registration and issue a registration certificate,

at which point the trademark is deemed to be registered and will be effective for a renewable 10-year period, unless otherwise revoked.

For licensed use of a registered trademark, the licensor shall file record of the licensing with the PRC Trademark Office, and the licensing

shall be published by the PRC Trademark Office. Failure of the licensing of a registered trademark shall not be contested against a good

faith third party.

Regulations on domain

names

In

accordance with the Measures for the Administration of Internet Domain Names, which was promulgated by the Ministry of Industry and Information

Technology (the “MIIT”) on August 24, 2017 and came into effect on November 1, 2017, the Implementing Rules of China Internet

Network Information Center on Domain Name Registration, which was promulgated by China Internet Network Information Center (the “CNNIC”)

on May 28, 2012 and came into effect on May 29, 2012, and the Measures of the China Internet Network Information Center on Domain Name

Dispute Resolution, which was promulgated by CNNIC on September 1, 2014 and came into effect on the same date, domain name registrations

are handled through domain name service agencies established under relevant regulations, and an applicant becomes a domain name holder

upon successful registration, and domain name disputes shall be submitted to an organization authorized by CNNIC for resolution. Besides,

the MIIT is in charge of the administration of PRC internet domain names. The domain name registration follows a first-to-file principle.

Applicants for registration of domain names shall provide true, accurate, and complete information of their identities to domain name

registration service institutions. In accordance with the Notice from the Ministry of Industry and Information Technology on Regulating

the Use of Domain Names in Internet Information Services, which was promulgated by the MIIT on November 27, 2017 and came into effect

on January 1, 2018, Internet access service providers shall verify the identity of each Internet information service provider, and shall

not provide services to any Internet information service provider which fails to provide real identity information. The applicant will

become the holder of such domain names upon completion of the registration procedure. As of July 31, 2020, we had completed registration

of five domain names, “atifcn.com,” “atifchina.com,” “atifus.com,” and “dpoex.com,”

in the PRC and became the legal holder of such domain names.

PRC Laws and Regulations

Relating to Foreign Exchange

General administration

of foreign exchange

The principal regulations

governing foreign currency exchange in China are the Administrative Regulations on Foreign Exchange of the People’s Republic of

China, which was promulgated by the State Council on January 29, 1996, which took effect on April 1, 1996 and was subsequently amended

on January 14, 1997 and August 5, 2008, and the Administrative Regulations on Foreign Exchange Settlement, Sales and Payment which was

promulgated by the People’s Bank of China, or the PBOC, on June 20, 1996 and took effect on July 1, 1996 (the “Foreign Exchange

Regulations”). Under these regulations, payments of current account items, such as profit distributions and trade and service-related

foreign exchange transactions, can be made in foreign currencies without prior approval from the SAFE, by complying with certain procedural

requirements. By contrast, approval from or registration with appropriate government authorities is required where RMB is to be converted

into foreign currency and remitted out of China to pay capital account items such as the repayment of foreign currency-denominated loans,

direct investment overseas and investments in securities or derivative products outside of the PRC.

Circular No. 75,

Circular No. 37, and Circular No. 13

Circular

37 was released by SAFE on July 4, 2014, and abolished Circular 75 which had been in effect since November 1, 2005. Pursuant

to Circular 37, a PRC resident should apply to SAFE for foreign exchange registration of overseas investments prior to the establishment

or control of an offshore special purpose vehicle, or SPV, using his or her legitimate domestic or offshore assets or interests. SPVs

are offshore enterprises directly established or indirectly controlled by domestic residents for the purpose of investment and financing

by utilizing domestic or offshore assets or interests they legally hold. Following any significant change in a registered offshore SPV,

such as capital increase, reduction, equity transfer or swap, consolidation or division involving domestic resident individuals, the domestic

individuals shall amend the registration with SAFE. Where an SPV intends to repatriate funds raised after completion of offshore financing

to the PRC, it shall comply with relevant PRC regulations on foreign investment and foreign debt management. A foreign-invested enterprise

established through return investment shall complete relevant foreign exchange registration formalities in accordance with the prevailing

foreign exchange administration regulations on foreign direct investment and truthfully disclose information on the actual controller

of its shareholders.

If

any shareholder who is a PRC resident (as determined by Circular 37) holds any interest in an offshore SPV and fails to fulfil the required

foreign exchange registration with the local SAFE branches, the PRC subsidiaries of that offshore SPV may be prohibited from distributing

their profits and dividends to their offshore parent company or from carrying out other subsequent cross-border foreign exchange activities.

The offshore SPV may also be restricted in its ability to contribute additional capital to its PRC subsidiaries. Where a domestic resident

fails to complete relevant foreign exchange registration as required, fails to truthfully disclose information on the actual controller

of the enterprise involved in the return investment or otherwise makes false statements, the foreign exchange control authority may order

them to take remedial actions, issue a warning, and impose a fine of less than RMB300,000 (approximately $43,000) on an institution or

less than RMB50,000 (approximately $7,300) on an individual.

Circular

13 was issued by SAFE on February 13, 2015, and became effective on June 1, 2015. Pursuant to Circular 13, a domestic resident

who makes a capital contribution to an SPV using his or her legitimate domestic or offshore assets or interests is no longer required

to apply to SAFE for foreign exchange registration of his or her overseas investments. Instead, he or she shall register with a bank in

the place where the assets or interests of the domestic enterprise in which he or she has interests are located if the domestic resident

individually seeks to make a capital contribution to the SPV using his or her legitimate domestic assets or interests; or he or she shall

register with a local bank at his or her permanent residence if the domestic resident individually seeks to make a capital contribution

to the SPV using his or her legitimate offshore assets or interests. The qualified bank will directly examine the applications and accept

registrations under the supervision of SAFE.

As

of the date of this prospectus, some of our PRC shareholders have not completed registrations in accordance with Circular 37. The failure

of such PRC shareholders to comply with the registration procedures may subject each of the shareholders to warnings and fines. If the

registration formalities cannot be processed retrospectively, then the repatriation of the financing funds, profits, or any other interests

of those PRC shareholders obtained through special purpose vehicles, for use in China, would be prohibited.

Permissions from

the PRC Authorities to Issue Our Ordinary Shares to Foreign Investors

Recently,

the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly

enforcement. As advised by our PRC counsel, Yuan Tai Law Offices, as of the date of the registration statement, we are not directly subject

to these regulatory actions or statements, as we have not implemented any monopolistic behavior and our business does not involve the

large-scale collection of user data, implicate cybersecurity, or involve any other type of restricted industry.

As

of the date of the registration statement, none of our subsidiaries is currently required to obtain regulatory approvals or permissions

from the CSRC, the CAC, or any other relevant PRC regulatory authorities for their business operations, our offering (including the sales

of securities to foreign investors) and our listing in the U.S. under any existing PRC law, regulations or rules, nor we have received

any inquiry, notice, warning, sanctions or regulatory objection to our business operations, our offering and listing in the U.S. from

the CSRC, the CAC, or other PRC regulatory authorities.

On

November 14, 2021, CAC released the Regulations on Network Data Security (draft for public comments) and accepted public comments until

December 13, 2021. The draft Regulations on Network Data Security provide that data processors refer to individuals or organizations that

autonomously determine the purpose and the manner of processing data. If a data processor that processes personal data of more than one

million users intends to list overseas, it shall apply for a cybersecurity review. In addition, data processors that process important

data or are listed overseas shall carry out an annual data security assessment on their own or by engaging a data security services institution,

and the data security assessment report for the prior year should be submitted to the local cyberspace affairs administration department

before January 31 of each year. On December 28, 2021, the Measures for Cybersecurity Review (2021 version) was promulgated and took effect

on February 15, 2022, which iterates that any “online platform operator” controlling personal information of more than one

million users which seeks to list in a foreign stock exchange should also be subject to cybersecurity review. As advised by our PRC counsel,

Yuan Tai Law Offices, we are not an “operator of critical information infrastructure” or “large-scale data processor”

as mentioned above. However, PRC regulations relating to personal information protection and data protection, it has been clarified

in the relevant provision that the processing of PRC individual’s personal information outside China will also under the jurisdiction

of the PRC Personal Information Protection Law and if data processing outside China harms the national security, public interests or the

rights and interests of citizens or organizations of the PRC, legal responsibilities will also be investigated. In addition, neither the

Company nor its subsidiaries is an operator of any “critical information infrastructure” as defined under the PRC Cybersecurity

Law and the Security Protection Measures on Critical Information Infrastructure. However, Measures for Cybersecurity Review (2021 version)

was recently adopted and the Network Internet Data Protection Draft Regulations (draft for comments) is in the process of being formulated

and the Opinions remain unclear on how it will be interpreted, amended and implemented by the relevant PRC governmental authorities.

There

remains uncertainties as to when the final measures will be issued and take effect, how they will be enacted, interpreted or implemented,

and whether they will affect us. If we inadvertently conclude that the Measures for Cybersecurity Review (2021 version) do not apply to

us, or applicable laws, regulations, or interpretations change and it is determined in the future that the Measures for Cybersecurity

Review (2021 version) become applicable to us, we may be subject to review when conducting data processing activities, and may face challenges

in addressing its requirements and make necessary changes to our internal policies and practices. We may incur substantial costs in complying

with the Measures for Cybersecurity Review (2021 version), which could result in material adverse changes in our business operations and

financial position. If we are not able to fully comply with the Measures for Cybersecurity Review (2021 version), our ability to offer

or continue to offer securities to investors may be significantly limited or completely hindered, and our securities may significantly

decline in value or become worthless.

On

December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of

Securities by Domestic Enterprises (Draft for Comments) (the “Draft Administrative Provisions”) and the Measures for the Overseas

Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures,”

collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listing”). The Draft Rules Regarding

Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination

criteria for indirect overseas listing in overseas markets. Among other things, if a domestic enterprise intends to conduct any follow-on

offering in an overseas market, the record-filing obligation is with a major operating entity incorporated in the PRC and such filing

obligation shall be completed within three working days after the completion of the offering. The required filing materials shall include

but not limited to: filing report and relevant commitments and domestic legal opinions. The Draft Rules Regarding Overseas Listing, if

enacted, may subject us to additional compliance requirement in the future. Any failure of us to fully comply with new regulatory requirements

may significantly limit or completely hinder our ability to offer or continue to offer our ordinary shares, cause significant disruption

to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and

results of operations and cause our ordinary shares to significantly decline in value or become worthless.

As

further advised by our PRC counsel, as of the date of the registration statement, no effective laws or regulations in the PRC explicitly

require us to seek approval from the CSRC or any other PRC governmental authorities for our overseas listing or securities offering plans,

nor has our Company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding our overseas listing and offering

of securities from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC

government are newly published and official guidance and related implementation rules have not been issued, it is highly uncertain what

the potential impact such modified or new laws and regulations will have on us. The Standing Committee of the National People’s

Congress (the “SCNPC”) or other PRC regulatory authorities may in the future promulgate laws, regulations or implementing

rules that requires our Company, or any of our subsidiaries to obtain regulatory approval from Chinese authorities before conducting securities

offerings in the U.S. Even though, we have terminated our VIE structure, we cannot rule out the possibility that the formal regulation

will require the companies listed which have/had PRC interests to submit registration or filings to CSRC retrospectively. If any of our

subsidiaries or the holding company were required to obtain approval in the future and were denied permission from PRC authorities to

conduct securities offerings in the U.S., our ability to conduct our business may be materially impacted, we will not be able to continue

listing on any U.S. exchange, continue to offer securities to investors, the interest of the investors may be materially adversely affected

and our ordinary shares may significantly decrease in value or become worthless.

Laws and Regulations

Relating to Employment and Social Welfare in the U.S. and PRC

U.S. Labor and Employment

Laws

Various

federal and state labor laws govern our relationship with our employees and affect operating costs. These laws include

minimum wage requirements, overtime pay, unemployment tax rates, workers’ compensation rates, citizenship requirements and sales

taxes. Additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits such

as those to be imposed by recently enacted legislation in California, increased tax reporting and tax payment requirements for employees

who receive gratuities, or a reduction in the number of states that allow tips to be credited toward minimum wage requirements could harm

our operating results.

The

Federal Americans with Disabilities Act prohibits discrimination on the basis of disability in public accommodations and employment. Although

our office is designed to be accessible to the disabled, we could be required to make modifications to our office to provide service to,

or make reasonable accommodations for, disabled persons.

Labor Law of the PRC

Pursuant

to the Labor Law of the PRC, which was promulgated by the Standing Committee of the NPC on July 5, 1994, with an effective date of

January 1, 1995, and was last amended on December 29, 2018, and the Labor Contract Law of the PRC, which was promulgated on June 29,

2007, became effective on January 1, 2008, and was last amended on December 28, 2012, with the amendments coming into effect

on July 1, 2013, enterprises and institutions shall ensure the safety and hygiene of a workplace, strictly comply with applicable

rules and standards on workplace safety and hygiene in China, and educate employees on such rules and standards. Furthermore,

employers and employees shall enter into written employment contracts to establish their employment relationships. Employers are required

to inform their employees about their job responsibilities, working conditions, occupational hazards, remuneration, and other matters

with which the employees may be concerned. Employers shall pay remuneration to employees on time and in full accordance with the commitments

set forth in their employment contracts and with the relevant PRC laws and regulations. Until May 31, 2022, before we transfer all our

equity interest in Huaya, Huaya has entered into written employment contracts with all its employees and performed its obligations required

under the relevant PRC laws and regulations.

PRC Social Insurance and Housing Fund

As

required under the Regulation of Insurance for Labor Injury implemented on January 1, 2004, and amended in 2010, the Provisional Measures

for Maternity Insurance of Employees of Corporations implemented on January 1, 1995, the Decisions on the Establishment of a Unified Program

for Pension Insurance of the State Council issued on July 16, 1997, the Decisions on the Establishment of the Medical Insurance Program

for Urban Workers of the State Council promulgated on December 14, 1998, the Unemployment Insurance Measures promulgated on January 22,

1999, the Interim Regulations Concerning the Collection and Payment of Social Insurance Premiums implemented on January 22, 1999, and

the Social Insurance Law of the PRC, which was promulgated by the Standing Committee of the NPC on October 28, 2010, became effective

on July 1, 2011, and last amended on December 29, 2018, employers in the PRC shall provide their employees with welfare schemes covering

basic pension insurance, basic medical insurance, unemployment insurance, maternity insurance, and occupational injury insurance. Huaya

has deposited the social insurance fees in full for all the employees in compliance with the relevant regulations since June 2019 to May

31,2022.

In

accordance with the Regulations on Management of Housing Provident Fund, which were promulgated by the State Council on April 3,

1999, and last amended on March 24, 2019, employers must register at the designated administrative centers and open bank accounts

for depositing employees’ housing funds. Employer and employee are also required to pay and deposit housing funds, with an amount

no less than 5% of the monthly average salary of the employee in the preceding year in full and on time.

U.S. Data Protection

and Privacy Laws

California

has several laws protecting the literary works read by California residents. The California Reader Privacy Act protects information about

the books California residents read from electronic services. Such information cannot be disclosed except pursuant to an individual’s

affirmative consent, a warrant or court order with limited exceptions, such as imminent danger of serious injury. California Education

Code Section 99122 requires for-profit postsecondary educational institutions to post a social media privacy policy on their website.

The

Digital Millennium Copyright Act (DMCA) provides relief for claims of circumvention of copyright protected technologies and includes a

safe harbor intended to reduce the liability of online service providers for hosting, listing, or linking to third-party content that

infringes copyrights of others.

The

Communications Decency Act provides that online service providers will not be considered the publisher or speaker of content provided

by others, such as individuals who post content on an online service provider’s website.

The

California Consumer Privacy Act (CCPA), which went into effect on January 1, 2020, provides consumers the right to know what personal

data companies collect, how it is used, and the right to access, delete, and opt out of the sale of their personal information to third

parties. It also expands the definition of personal information and gives consumers increased privacy rights and protections for that

information. The CCPA also includes special requirements for California consumers under the age of 16.

The

California Privacy Rights Act (CPRA), Virginia Consumer Data Protection Act (CDPA) and Colorado Privacy Act (CPA) all will come into effect

on January 1, 2023. These laws provide consumers with the right to know what personal data companies collect, how it is used, and the

right to access, delete, and opt out of the sale of their personal information to third parties. The CPRA also includes special requirements

for California consumers under the age of 16.

The Holding Foreign Companies Accountable

Act

On May 20, 2020, the U.S.

Senate passed the Holding Foreign Companies Accountable Act (“HFCAA”) requiring a foreign company to certify it is not owned

or controlled by a foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign auditor not

subject to PCAOB inspection. On December 18, 2020, the Holding Foreign Companies Accountable Act or HFCAA was signed into law. On September

22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which became law in December 2020 and prohibits foreign companies from

listing their securities on U.S. exchanges if the company has been unavailable for PCAOB inspection or investigation for three consecutive

years. As a result of the HFCAA, trading in ATIF BVI’s securities may be prohibited if the PCAOB determines that it cannot inspect

or fully investigate ATIF BVI’s auditor. Furthermore, in June 2021, the Senate passed the AHFCAA, which was signed into law on December

29, 2022, reducing the time period for delisting of foreign companies under the HFCAA to two consecutive years, instead of three years.

Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the PCAOB was unable to inspect

or investigate completely certain named registered public accounting firms headquartered in mainland China and Hong Kong. Our independent

registered public accounting firm is headquartered in Denver, Colorado, and has been inspected by the PCAOB on a regular basis and as

such, it is not affected by or subject to the PCAOB’s 2021 Determination Report. On August 26, 2022, the SEC issued a statement

announcing that the PCAOB signed a Statement of Protocol with the CSRC and the Ministry of Finance of the People’s Republic of China

governing inspections and investigations of audit firms based in China and Hong Kong, jointly agreeing on the need for a framework. On

December 15, 2022, the PCAOB announced that it has secured complete access to inspect and investigate registered public accounting firms

headquartered in mainland China and Hong Kong and voted to vacate the previous 2021 Determination Report to the contrary. Notwithstanding

the foregoing, in the future, if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide

audit documentations located in China to the PCAOB for inspection or investigation, you may be deprived of the benefits of such inspection

which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading

on the national exchange and trading on “over-the-counter” markets, may be prohibited under the HFCAA and AHFCAA and/or PCAOB

may consider the need to issue new determinations consistent with the HFCAA and Rule 6100.

The recent developments would

add uncertainties to our offering and we cannot assure you whether Nasdaq would apply additional and more stringent criteria to us after

considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training,

or sufficiency of resources, geographic reach, or experience as it relates to our audit.

ENFORCEABILITY OF CIVIL LIABILITIES

We

were incorporated under the laws of British Virgin Islands because there are certain benefits associated with being a British Virgin Islands

business company, such as political and economic stability, an effective judicial system, a favorable tax system, the absence of foreign

exchange control of currency exchange control or currency restriction and the availability of professional and support services. The British

Virgin Islands, however, has a less developed body of securities laws as compared to the United States and provides significantly less

protection for investors than the United States.

A significant portion of our

customers are located in China and Hong Kong. In addition, three out of our five directors are nationals or residents of PRC and all or

a significant portion of their assets are located outside the United States. As a result, it may be difficult for investors to effect

service of process within the United States upon these persons, or to enforce against them judgments obtained in United States courts,

including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United

States.

Ogier,

our counsel with respect to the laws of the British Virgin Islands, and Yuan Tai Law Offices, our counsel with respect to PRC law, have

advised us that there is uncertainty as to whether the courts of the British Virgin Islands or PRC would (i) recognize or enforce judgments

of United States courts obtained against us or our directors or officers predicated upon the civil liability provisions of the securities

laws of the United States or any state in the United States or (ii) entertain original actions brought in the British Virgin Islands or

PRC against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States.

Ogier has

further advised us that there is currently no statutory enforcement or treaty between the United States and the British Virgin Islands

providing for enforcement of judgments. A judgment obtained in the United States, however, may be recognized and enforced in the courts

of the British Virgin Islands at common law, without any re-examination on the merits of the underlying dispute, by an action commenced

on the foreign judgment debt in the Commercial Division of the Eastern Caribbean Supreme Court in the British Virgin Islands, provided

such judgment: (i) is given by a foreign court of competent jurisdiction; (ii) is final; (iii) is not in respect of taxes, a fine or a

penalty; and (iv) was not obtained in a manner and is not of a kind the enforcement of which is contrary to natural justice or public

policy of the British Virgin Islands. Furthermore, it is uncertain that British Virgin Islands courts would enforce: (1) judgments of

U.S. courts obtained in actions against us or other persons that are predicated upon the civil liability provisions of the U.S. federal

securities laws; or (2) original actions brought against us or other persons predicated upon the Securities Act. Ogier has

informed us that there is uncertainty with regard to British Virgin Islands law relating to whether a judgment obtained from the U.S.

courts under civil liability provisions of the securities laws will be determined by the courts of the British Virgin Islands as penal

or punitive in nature.

Yuan Tai Law Offices has advised

us that there is uncertainty as to whether judgments of courts in the United States based upon the civil liability provisions of the securities

laws of the United States or any state or territory of the United States will be recognized or enforced by the PRC courts, and there is

doubt as to whether the PRC courts will enter judgments in original actions brought in the PRC courts based solely on the civil liability

provisions of these securities laws. An in personam final and conclusive judgment in the federal or state courts of the United States

under which a fixed or ascertainable sum of money is payable may generally be enforced as a debt in the PRC courts under the common law

as long as it is established that the PRC courts have jurisdiction over the judgment debtor. However, the PRC courts are unlikely to enforce

a foreign judgment if (a) the foreign judgment is inconsistent with a prior local judgment that is binding on the same parties; (b) the

enforcement of the foreign judgment would contravene the public policy of PRC; (c) the proceedings in which the foreign judgment was obtained

were contrary to principles of natural justice; (d) the foreign judgment was obtained by fraud; or (e) the enforcement of the foreign

judgment amounts to the direct or indirect enforcement of a foreign penal, revenue or other public law.

In particular, the PRC Courts

may potentially not allow the enforcement of any foreign judgment for a sum payable in respect of taxes, fines, penalties or other similar

charges, including the judgments of courts in the United States based upon the civil liability provisions of the securities laws of the

United States or any state or territory of the United States. In respect of civil liability provisions of the United States federal and

state securities law which permit punitive damages against us and our directors or executive officers, we are unaware of any decision

by the PRC courts which has considered the specific issue of whether a judgment of a United States court based on such civil liability

provisions of the securities laws of the United States or any state or territory of the United States is enforceable in PRC.

RISK FACTORS

Investing in our securities

involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and other

factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports on Form

10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this prospectus.

Additionally you should also consider the risks set forth below.

If

we fail to comply with the continued listing requirements of NASDAQ, we would face possible delisting, which would result in a limited

public market for our shares and make obtaining future debt or equity financing more difficult for us.

As previously reported, on May 20, 2024, the “Company received

a letter from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock

Market LLC (“Nasdaq”) notifying the Company that, based upon the closing bid price of the Company’s ordinary

shares, , par value $0.001 per share, for the prior 30 consecutive business days, the Company no

longer met the requirement to maintain a minimum bid price of $1 per share (the “Minimum Bid Price Requirement”), as set forth

in Nasdaq Listing Rule 5550(a)(2).

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has

been given 180 calendar days, or until November 18, 2024, to regain compliance with the Minimum Bid Price Requirement. If at any time

before November 18, 2024, the bid price of the Company’s ordinary shares closes at $1.00 per ordinary share or more for a minimum

of 10 consecutive business days, the Staff will provide written confirmation that the Company has achieved compliance.

If at any time before November

18, 2024, the bid price of the Company’s ordinary shares stock closes at or above $1.00 per share for a minimum of, subject to the

Staff’s discretion, 10 consecutive business days, Nasdaq will provide written notification that the Company has achieved compliance

with the Minimum Bid Price Requirement.

If

the Company does not regain compliance with the Minimum Bid Price Requirement by November 18, 2024, the Company may be afforded a second

180 calendar day period to regain compliance. To qualify, the Company would be required to notify Nasdaq of its intent to cure the deficiency

during the second compliance period, by effecting a reverse stock split, if necessary. Following a transfer to The Nasdaq Capital Market,

the Company will be afforded the second 180 calendar day period to regain compliance, unless it does not appear to Nasdaq that it is possible

for the Company to cure the deficiency. If the Company does not regain compliance with the Minimum Bid Price Requirement by the end of

the compliance period (or the second compliance period, if applicable), the Company’s ordinary shares will become subject to delisting.

In the event that the Company receives notice that its ordinary shares is being delisted, the Nasdaq listing rules permit the Company

to appeal a delisting determination by the Staff to a hearings panel.

The

Company intends to monitor the closing bid price of its ordinary shares and may, if appropriate, consider available options to regain

compliance with the Minimum Bid Price Requirement, including initiating a reverse stock split. However, there can be no assurance that

the Company will be able to regain compliance with the Minimum Bid Price Requirement or will otherwise be in compliance with other Nasdaq

Listing Rules.

Stockholders’ Equity Requirement

As previously reported on November 22, 2023, the

Company received a letter from Nasdaq (the Stockholder Equity Letter), regarding its non-compliance with the minimum stockholders’

equity requirement for continued listing on the Nasdaq Capital Market. The letter notified the Company that its stockholders’ equity,

reported at $1,539,353 in the Annual Report on Form 10-K for the period ending July 31, 2023, did not meet the Nasdaq Capital Market’s

minimum stockholders’ equity requirement of $2,500,000 for continued listing as per Nasdaq Listing Rule 5550(b)(1) (the Stockholders’

Equity Requirement). Nasdaq gave the Company until January 8, 2024, to submit a plan to regain compliance with the minimum stockholders’

equity requirement under Nasdaq Listing Rule 5550(b)(1).

As

previously reported in a Current Report on Form 8-K April 16, 2024 the Company entered into a Securities Purchase Agreement (the “Purchase

Agreement”) with a non- U.S investor named in the Purchase Agreement (the “Purchaser”), pursuant to which the Company

agreed to sell an aggregate of 1,092,512 newly issued ordinary shares of the Company, $0.001 par value per ordinary share (the “Ordinary

Shares”) at a purchase price of $1.23 per share (the “Private Placement”). In connection with the Private Placement,

the Company received gross proceeds in the amount of $1,343,789.76. As previously reported in a Current Report on Form 8-K, on April 18,

2024, the Company entered into two securities purchase agreements (the “April 18 Purchase Agreements”) in a private placement

(the “April 18 Private Placement”) of the Company’s newly issued ordinary shares, par value $0.001 per ordinary share,

with one (1) U.S. accredited investor, as defined under Rule 501 of Regulation D, and one (1) non-U.S. investor (individually, an “Investor”

and collectively, the “Investors”), at the purchase price of $1.23 per ordinary share. The Company received gross proceeds

in the amount of $1,000,002.38 in connection with the April 18 Private Placement.

As

previously reported in a Form 8-K, on April 29, 2024, the Company entered into a deferred salary conversion agreement (“Deferred

Salary Conversion Agreement”) with Mr. Jun Liu, the president, chief executive officer and chairman of the board of directors

of the Company. Pursuant to the Agreement, the Company issued 384,478 ordinary shares to Mr. Liu (“Deferred Salary Debt Shares”),

$0.001 par value in lieu of an unpaid salary of $349,875 owed to Mr. Liu at a per share price of $0.91 which was the Nasdaq consolidated

closing bid price per share of the Company’s ordinary shares on April 29, 2024.

On May 16, 2024, Nasdaq granted the Company an

extension of time until May 20, 2024 to provide evidence of compliance, by filing a Current Report on Form 8-K which includes (1) disclosure

of Nasdaq’s deficiency letter and the specific deficiency or deficiencies cited; (2) a description of the completed transaction

or event that enabled the Company to satisfy the stockholders’ equity requirement for continued listing; (3) an affirmative statement

that, as of the date of the report, the Company believes it has regained compliance with the stockholders’ equity requirement based

upon the specific transaction or event referenced in item (2) above; and (4) a disclosure stating that Nasdaq will continue to monitor

the Company’s ongoing compliance with the stockholders’ equity requirement and, if at the time of its next periodic report

the Company does not evidence compliance, that it may be subject to delisting.

Thus, in total, the Company believes its shareholders’

equity as of April 30, 2024, on a pro forma basis after giving effect to the transactions described above would be $2,683,042.

As of May 16, 2024, the Company believes it has

regained compliance with the stockholders’ equity requirement based upon the specific transactions and events referenced above.

Nasdaq will continue to monitor the Company’s ongoing compliance with the stockholders’ equity requirement, and if at the

time of its next periodic report, which will be its annual report on Form 10-K for the year ended July 31, 2024, the Company does not

evidence compliance, it may be subject to delisting.

There can be no assurance that the company will continue to have a

minimum stockholders’ equity of $2,500,000 and satisfy Nasdaq’s requirements for continued listing under Nasdaq Listing Rule

5550(b)(1), the Stockholders’ Equity Requirement. If we fail to satisfy any of Nasdaq’s continued listing requirements, Nasdaq

may take steps to delist our ordinary shares, which could have a materially adverse effect on our ability to raise additional funds as

well as the price and liquidity

If the

Company fails to regain compliance with Nasdaq’s Listing Rules, we could be subject to suspension and delisting proceedings. If

our securities lose their status on The NASDAQ Capital Market, our securities would likely trade in the over-the-counter market. If our

securities were to trade on the over-the-counter market, selling our securities could be more difficult because smaller quantities of

securities would likely be bought and sold, transactions could be delayed, and security analysts’ coverage of us may be reduced.

In addition, in the event our securities are delisted, broker-dealers have certain regulatory burdens imposed upon them, which may discourage

broker-dealers from effecting transactions in our securities, further limiting the liquidity of our securities. These factors could result

in lower prices and larger spreads in the bid and ask prices for our securities. Such delisting from The NASDAQ Capital Market and continued

or further declines in our share price could also greatly impair our ability to raise additional necessary capital through equity or debt

financing, and could significantly increase the ownership dilution to shareholders caused by our issuing equity in financing or other

transactions.

In order to regain compliance

with Nasdaq’s Minimum Bid Price Requirement, the Company may effect a Reverse Split of its ordinary shares which could result in

a significant devaluation of the Company’s’ market capitalization and trading price.

A Reverse Stock Split could result

in a significant devaluation of the Company’s market capitalization and trading price of the ordinary shares, and we cannot assure

you that a Reverse Stock Split will increase our stock price and have the desired effect of increasing the market price of the ordinary

shares such that the market price of our ordinary shares meets Nasdaq’s Minimum Bid Price Requirement.

The Company may effect a reverse

stock split (the “Reverse Stock Split”) to regain compliance with the Minimum Bid Price Requirement. The Company’s

Board expects that a Reverse Stock Split of the outstanding ordinary shares will increase the market price of the ordinary shares. However,

the Company cannot be certain whether the Reverse Stock Split would lead to a sustained increase in the trading price or the trading market

for the ordinary shares. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance

that:

| |

● |

the market price per share of the ordinary shares after the Reverse Stock Split will rise in proportion to the reduction in the number of pre-split shares of ordinary shares outstanding before the Reverse Stock Split; |

| |

● |

the Reverse Stock Split will result in a per share price that will attract brokers and investors, including institutional investors, who do not trade in lower priced securities; |

| |

● |

the Reverse Stock Split will result in a per share price that will increase the Company’s ability to attract and retain employees and other service providers; |

| |

● |

the market price per post-split share will be sufficient to satisfy the Minimum Bid Price Requirement and |

| |

● |

the Reverse Stock Split will increase the trading market for the ordinary shares, particularly if the stock price does not increase as a result of the reduction in the number of shares of ordinary shares available in the public market. |

The market price of the ordinary shares Stock will also be based on the

Company’s performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split

is consummated and the trading price of the ordinary shares declines, the percentage decline as an absolute number and as a percentage

of the Company’s overall market capitalization may be greater than what would occur in the absence of the Reverse Stock Split. Furthermore,

the liquidity of the ordinary shares could be adversely affected by the reduced number of shares that would be outstanding after the Reverse

Stock Split and this could have an adverse effect on the price of the ordinary shares. If the market price of the shares of ordinary shares

declines subsequent to the effectiveness of the Reverse Stock Split, this will detrimentally impact the Company’s market capitalization

and the market value of the Company’s public float.

The sale of a substantial

amount of our ordinary, including resale of the shares of ordinary stock held by the selling stockholders in the public market, could

adversely affect the prevailing market price of our ordinary shares.

We are registering for resale 2,290,000 ordinary shares. Sales of substantial

amounts of our ordinary shares in the public market, or the perception that such sales might occur, could adversely affect the market

price of our ordinary shares. We cannot predict if and when selling stockholders may sell such shares in the public market.

The Reverse Stock Split may not help generate

additional investor interest.

There can be no assurance that the Reverse Stock Split

will result in a per share price that will attract institutional investors or investment funds or that such share price will satisfy the

investing guidelines of institutional investors or investment funds. As a result, the trading liquidity of our ordinary shares may not

necessarily improve.

USE OF PROCEEDS

We will not receive any of the proceeds from any sale or other disposition

of the shares of ordinary shares stock covered by this prospectus. All proceeds from the sale of the shares will be paid directly to the

selling stockholders.

SELLING STOCKHOLDERS

The ordinary stock being offered

by the selling stockholders are those issued to the selling stockholders. For additional information regarding the issuances of that ordinary

stock, see the description of the Private Placement in “Summary - Private Placement” above. We are registering the

ordinary shares in order to permit the selling stockholders to offer the ordinary shares for resale from time to time. The selling stockholder,

other than Jun Liu, has not had any material relationship with us within the past three years. The selling stockholder is not a broker-dealer

or an affiliate of a broker-dealer.

The table below lists the

selling stockholder and other information regarding the beneficial ownership of the ordinary shares held by the selling stockholders.

The second column lists the number of ordinary shares beneficially owned by the selling stockholder, based on its ownership of the ordinary

shares, as of the date of this prospectus, on an as converted basis.

The third column lists the

ordinary shares being offered by this prospectus by the selling stockholder.

This prospectus generally

covers the resale of the sum of the number of ordinary shares issued to the selling stockholders in the description of the Private Placement

referenced above.

The fourth column assumes the sale of all of the ordinary shares offered by the selling stockholders pursuant to this prospectus.

| Name of Selling Stockholder | |

Number of ordinary shares Owned Prior to Offering (1) | | |

Maximum Number of ordinary shares to be Sold Pursuant to this Prospectus | | |