Autolus Therapeutics plc (Nasdaq: AUTL), a clinical-stage

biopharmaceutical company developing next-generation programmed T

cell therapies, today announced its operational and financial

results for the quarter ended March 31, 2023.

“It has been a busy quarter as we continue to

execute on delivering on our obe-cel strategy in order to bring

this innovative and potentially transformative treatment to an

underserved adult Acute Lymphoblastic Leukemia (ALL) patient

population,” said Dr. Christian Itin, Chief Executive

Officer of Autolus. “We look forward to presenting data

from all patients treated in the FELIX study in an oral

presentation at the 2023 American Society of Clinical Oncology

(ASCO) Annual Meeting, as well as data at the European Hematology

Association (EHA) 2023 Congress, both in June, with longer term

follow up data expected at the American Society of Hematology (ASH)

meeting at the end of the year.”

“Meanwhile, we continue to advance plans for the

submission of a BLA for obe-cel at the end of the year and working

towards commercial launch in 2024, subject to required regulatory

approval. Post period end we selected Cardinal Health as the US

commercial distribution partner for obe-cel and we continue to

build out our own commercial infrastructure as we look to on-board

centers over the course of this year. Our purpose-built commercial

manufacturing facility is on track for the commencement of Good

Manufacturing Practice (GMP) operations in H2 2023 with an initial

capacity of up to 2,000 batches per year, which we predict will be

sufficient to serve global demand in adult ALL.”

Key obe-cel Updates:

- Obecabtagene autoleucel (obe-cel)

in relapsed / refractory (r/r) adult ALL – The FELIX Study

- Oral presentations of the FELIX

pivotal study to be presented at ASCO and EHA. The Company expects

data from the FELIX study to form the basis of a BLA submission for

obe-cel to the FDA at the end of 2023 and plans to present longer

term follow up data and subgroup analysis data at the American

Society of Hematology (ASH) meeting in late 2023, as well as at

medical conferences in H1 2024.

Obe-cel trials in collaboration with

University College London

- Obe-cel in r/r adult B-ALL patients

– Phase 1 ALLCAR19 Study

- Long term follow-up data were

presented at the Tandem Meetings: Transplantation & Cellular

Therapy Meetings of the American Society for Transplantation and

Cellular Therapy (ASTCT) and the Center for International Blood

& Marrow Transplant Research (CIBMTR). The data demonstrated

that 35% of adult B-ALL patients remained in complete remission at

a median follow up of 36 months without the need for additional

anti-leukemia therapy.

- Obe-cel in r/r B-NHL and CLL

patients – Phase 1 ALLCAR19 Extension Study

- Data presented at the ASH meeting

in December 2022 demonstrated the potentially best-in-class profile

of obe-cel supported by the data observed in B-cell non-Hodgkin

lymphoma (NHL), with continued high levels of clinical activity

paired with an encouraging tolerability profile across diffuse

large B-cell lymphoma (DLBCL), mantle cell lymphoma (MCL),

follicular lymphoma (FL) and chronic lymphocytic leukemia (CLL).

Patients continue to be enrolled into the study and the Company

expects to publish the full results in a peer-reviewed

journal.

- Obe-cel in Primary CNS Lymphoma

patients – Phase 1 CAROUSEL Study

- Data presented at the EHA meeting

in June 2022 demonstrated first activity in primary CNS lymphoma.

The study is fully enrolled, and the Company expects to publish the

full results in a peer-reviewed journal.

- AUTO1/22 in pediatric B-ALL patients – Phase 1 CARPALL Study

- Data presented at the European

Society for Blood and Marrow Transplantation (EBMT) Annual Meeting

in April 2023 by the Company’s UCL collaborators, showed favorable

safety profile and good efficacy in a heavily pre-treated cohort of

patients. Importantly, there were no observed antigen negative

relapses observed as of the data cut-off date, indicating that the

combining of our optimized CD22 CAR design with the CD19 CAR used

in obe-cel may be effective in preventing antigen-loss driven

relapse in pediatric B-ALL. The preclinical data supporting this

program was published in Molecular Therapy in March 2023.

Early-stage pipeline – leveraging

academic collaborations to generate opportunity for non-dilutive

funding

- AUTO4 in T Cell Lymphoma patients –

Phase 1/2 LibrA T1 Study

- Autolus has optimized the

manufacturing process for AUTO4 and is enrolling additional

patients into the trial to evaluate this manufacturing change. The

next update is planned as an oral presentation at the International

Conference on Malignant Lymphoma in June 2023.

- AUTO8 in Multiple Myeloma – Phase 1

MCARTY Study

- AUTO8 is a next-generation product

candidate for multiple myeloma, which comprises two independent

CARs for the multiple myeloma targets, BCMA and CD19. In

collaboration with UCL, the Company initiated a study in Q1 2022.

Patients continue to be enrolled and initial data is expected in

2023.

- AUTO6NG in Neuroblastoma

- AUTO6NG contains a CAR that targets

GD2 alongside additional programming modules to enhance the

activity and persistence. In collaboration with UCL, the Company is

planning on initiating a clinical trial of AUTO6NG in 2023.

Key Operational Updates during Q1

2023

- The Company’s new 70,000 square

foot commercial manufacturing facility in Stevenage, UK has

continued to progress on track. Key equipment installation and

validation were completed by Autolus in Q1 2023 enabling

operational qualifications commencing in Q2 2023. Activities are on

track for the commencement of GMP operations in H2 2023. The

facility has been designed for a capacity of 2,000 batches per year

with the option to expand capacity as needed.

- Autolus is on schedule to complete

the development work and report generation for the Chemistry

Manufacturing and Controls (CMC) package planned to be submitted to

the FDA. All work including process qualification activities in the

new Stevenage facility is on track for submission of a BLA by the

end of 2023.

- Announced a collaboration with

Cabaletta Bio in January 2023. Autolus received an upfront payment

for non-exclusive access to the RQR8 safety switch for use in

Cabaletta’s CD19-CAR T cell therapy program for the treatment of

autoimmune disease, with the potential for near term option

exercise fees and development and regulatory milestone payments. In

addition, Autolus is entitled to receive royalties on net sales of

all Cabaletta cell therapy products that incorporate the RQR8

safety switch.

- Announced two changes to the Board

of Directors. The Company’s non-executive Chairman, John H.

Johnson, who has held the role since September 2021, will not stand

for re-election at Autolus’ upcoming annual shareholder meeting.

Additionally, Dr. Jay T. Backstrom, who has served on Autolus’

Board of Directors since August 2020, stepped down from Autolus’

Board of Directors at the end of February 2023.

- Dr. Lucinda Crabtree will step down

as CFO in August 2023. A search for a successor is under way.

Post Period End:

- Autolus selected Cardinal Health to

provide core distribution capabilities required for U.S.

commercialization of CAR T-cell therapies. Under the proposed

agreement, Cardinal Health 3PL Services will establish essential

capabilities for Autolus to commercialize a CAR T-cell therapy in

the US, including a depot model that allows Autolus to maintain

custody and physically position product closer to treatment sites

during finalization of product release, with the goal of shortening

vein-to-delivery times. In addition, Cardinal Health will help

provide seamless order-to-cash capabilities.

- Autolus hosted a Virtual Capital

Markets Day on Thursday, April 27, 2023, where members of the

Executive Management Team and Key Opinion Leaders presented on the

obe-cel commercial opportunity and positioning. A replay of the

event is available on the Autolus website.

- In April 2023 Autolus announced

data from the AUTO1/22 in a clinical trial of pediatric ALL

patients at the EBMT Annual Meeting. This followed the publication

of the preclinical work supporting this program in March in

Molecular Therapy, ‘Dual targeting of CD19 and CD22 against B-ALL

using a novel high sensitivity aCD22 CAR.’

- In April 2023 Autolus announced the

publication of a paper in Molecular Therapy Nucleic Acids, ‘Novel

Fas-TNFR chimeras that prevent Fas ligand-mediated kill and

signal synergistically to enhance CAR T-cell efficacy. The

paper outlined how Fas-CD40 chimera can render T cell therapies

resistant to FasL-mediated cell death and improve their

effectiveness against solid tumors.

- In April 2023, Autolus moved funds

to additional highly rated liquid money market funds. The limit to

any one counterparty is less than 25% of the Company’s total cash

and cash equivalents balance.

Financial Results for the First Quarter Ended March 31,

2023

Cash and cash equivalents and restricted cash at

March 31, 2023, totaled $343.4 million, as compared to cash of

$382.8 million at December 31, 2022.

Net total operating expenses for the three

months ended March 31, 2023, were $43.1 million, which included

license revenue income of $1.3 million, as compared to net total

operating expenses of $41.8 million, which included grant income

of $0.2 million, for the same period in 2022.

Research and development expenses decreased by

$2.7 million to $31.3 million for the three months ended March 31,

2023 from $34.0 million for the three months ended March 31, 2022

primarily due to:

-

a decrease of $5.5 million in clinical trial and manufacturing

costs which is offset by an increase of $0.8 million in

manufacturing material costs due to increased validation activities

undertaken, primarily relating to our obe-cel clinical product

candidate,

-

a decrease of $0.2 million in depreciation and amortization related

to property, plant and equipment and intangible assets due to the

reduction in our depreciable asset base,

-

a decrease of $0.1 million in legal fees and professional

consulting fees in relation to our research and development

activities,

-

an increase of $1.4 million in salaries and other employment

related costs including share-based compensation expense, which was

mainly driven by an increase in the number of employees engaged in

research and development activities,

-

an increase of $0.7 million related to information technology

infrastructure and support for information systems related to the

conduct of clinical trials and manufacturing operations, and

-

an increase of $0.2 million in facilities costs related to our new

manufacturing facility, the "Nucleus", in Stevenage, United Kingdom

as well increase in costs related to maintaining our current leased

properties.

General and administrative expenses increased by

$1.3 million to $9.3 million for the three months ended March 31,

2023 from $8.0 million for the three months ended March 31, 2022

primarily due to:

-

an increase of $0.7 million in salaries and other employment

related costs including share-based compensation expenses, which

was mainly driven by an increase in the number of employees engaged

in general and administrative activities,

-

an increase of $0.7 million in commercial readiness costs due to

increased commercial readiness activities being undertaken,

-

an increase of $0.1 in general office supplies and expenses

facilities costs due to the increase in space utilized for general

and administrative activities,

-

a decrease of $0.2 million primarily related to a reduction in

directors' and officers' liability insurance premiums, legal and

professional fees.

For the three months ended March 31, 2023,

we recognized a loss on disposal of property and equipment of $3.8

million related to fixed assets no longer being utilized in the

manufacturing facility exited in Stevenage, United Kingdom. There

were no such disposals for the three months ended March 31,

2022.

Other income, net decreased to $0.8 million from

$0.9 million for the three months ended March 31, 2023 and

2022, respectively. The decrease of $0.1 million is primarily due

to the recognition of a lease termination loss arising from the

termination and exit of one of our manufacturing suites in

Stevenage, United Kingdom.

Interest income increased to $3.4 million for

the three months ended March 31, 2023, as compared to $28,000 for

the three months ended March 31, 2022. The increase in interest

income of $3.4 million primarily relates to the increase in

interest rates on our interest-bearing bank accounts and short-term

investments during the three months ended March 31, 2023 as

compared to the three months ended March 31, 2022.

Interest expense increased to $4.9 million for

the three months ended March 31, 2023 as compared to $1.8 million

for the three months ended March 31, 2022. Interest expense is

primarily related to the liability for future royalties and sales

milestones, net associated with our strategic collaboration

agreement with Blackstone.

Net loss attributable to ordinary shareholders

was $39.8 million for the three months ended March 31, 2023,

compared to $37.1 million for the same period in 2022. The basic

and diluted net loss per ordinary share for the three months ended

March 31, 2023, totaled $(0.23) compared to a basic and diluted net

loss per ordinary share of $(0.41) for the three months ended March

31, 2022.

Autolus estimates that its current cash and

cash equivalents on hand and anticipated future milestone payment

from Blackstone will extend the Company’s runway into 2025.

|

Unaudited Financial Results for the Quarter Ended March 31,

2023 |

|

Condensed Consolidated Balance Sheet |

|

(In thousands, except share and per share amounts) |

| |

| |

|

March 31 |

|

December 31 |

| |

|

2023 |

|

2022 |

| Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

343,027 |

|

|

$ |

382,436 |

|

|

Restricted cash |

|

|

328 |

|

|

|

325 |

|

|

Prepaid expenses and other current assets |

|

|

50,530 |

|

|

|

43,010 |

|

|

Total current assets |

|

|

393,885 |

|

|

|

425,771 |

|

| Non-current

assets: |

|

|

|

|

|

Property and equipment, net |

|

|

34,667 |

|

|

|

35,209 |

|

|

Prepaid expenses and other non-current assets |

|

|

465 |

|

|

|

2,176 |

|

|

Operating lease right-of-use assets, net |

|

|

26,861 |

|

|

|

23,210 |

|

|

Long-term deposits |

|

|

1,821 |

|

|

|

1,832 |

|

|

Deferred tax asset |

|

|

2,272 |

|

|

|

2,076 |

|

| Total

assets |

|

|

459,971 |

|

|

|

490,274 |

|

| Liabilities and

shareholders' equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

|

353 |

|

|

|

531 |

|

|

Accrued expenses and other liabilities |

|

|

34,463 |

|

|

|

40,797 |

|

|

Operating lease liabilities, current |

|

|

4,821 |

|

|

|

5,038 |

|

|

Total current liabilities |

|

|

39,637 |

|

|

|

46,366 |

|

| Non-current

liabilities: |

|

|

|

|

|

Operating lease liabilities, non-current |

|

|

22,495 |

|

|

|

19,218 |

|

|

Liability related to future royalties and sales milestones,

net |

|

|

130,805 |

|

|

|

125,900 |

|

|

Other long-term payables |

|

|

114 |

|

|

|

116 |

|

| Total

liabilities |

|

|

193,051 |

|

|

|

191,600 |

|

| |

|

|

|

|

| |

|

|

|

|

| Shareholders'

equity: |

|

|

|

|

|

Ordinary shares, $0.000042 par value; 290,909,783 authorized as of

March 31, 2023 and December 31, 2022; 173,074,510 shares

issued and outstanding at March 31, 2023 and December 31,

2022 |

|

|

8 |

|

|

|

8 |

|

|

Deferred shares, £0.00001 par value; 34,425 shares authorized,

issued and outstanding at March 31, 2023 and December 31,

2022 |

|

|

— |

|

|

|

— |

|

|

Deferred B shares, £0.00099 par value; 88,893,548 shares

authorized, issued and outstanding at March 31, 2023 and

December 31, 2022 |

|

|

118 |

|

|

|

118 |

|

|

Deferred C shares, £0.000008 par value; 1 share authorized, issued

and outstanding at March 31, 2023 and December 31, 2022 |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

1,010,041 |

|

|

|

1,007,625 |

|

|

Accumulated other comprehensive loss |

|

|

(33,257 |

) |

|

|

(38,898 |

) |

|

Accumulated deficit |

|

|

(709,990 |

) |

|

|

(670,179 |

) |

| Total shareholders'

equity |

|

|

266,920 |

|

|

|

298,674 |

|

| Total liabilities and

shareholders' equity |

|

$ |

459,971 |

|

|

$ |

490,274 |

|

| |

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations and

Comprehensive Loss (unaudited) |

|

(In thousands, except share and per share amounts) |

| |

| |

|

Three Months Ended March 31, |

| |

|

2023 |

|

2022 |

|

Grant income |

|

$ |

— |

|

|

$ |

166 |

|

| License revenue |

|

|

1,292 |

|

|

— |

|

| Operating

expenses: |

|

|

|

|

|

Research and development |

|

|

(31,344 |

) |

|

|

(33,963 |

) |

|

General and administrative |

|

|

(9,284 |

) |

|

|

(7,987 |

) |

|

Loss on disposal of property and equipment |

|

|

(3,768 |

) |

|

|

— |

|

| Total operating

expenses, net |

|

|

(43,104 |

) |

|

|

(41,784 |

) |

|

Other income, net |

|

|

782 |

|

|

|

860 |

|

|

Interest income |

|

|

3,446 |

|

|

|

28 |

|

|

Interest expense |

|

|

(4,905 |

) |

|

|

(1,790 |

) |

| Total other expense,

net |

|

|

(677 |

) |

|

|

(902 |

) |

| Net loss before income

tax |

|

|

(43,781 |

) |

|

|

(42,686 |

) |

| Income tax benefit |

|

|

3,970 |

|

|

|

5,624 |

|

| Net loss attributable

to ordinary shareholders |

|

|

(39,811 |

) |

|

|

(37,062 |

) |

| Other comprehensive

loss: |

|

|

|

|

| Foreign currency exchange

translation adjustment |

|

|

5,641 |

|

|

|

(7,455 |

) |

| Total comprehensive

loss |

|

$ |

(34,170 |

) |

|

$ |

(44,517 |

) |

| |

|

|

|

|

| Basic and diluted net loss per

ordinary share |

|

$ |

(0.23 |

) |

|

$ |

(0.41 |

) |

| Weighted-average basic and

diluted ordinary shares |

|

|

173,825,825 |

|

|

|

90,914,175 |

|

| |

|

|

|

|

|

|

|

|

Conference CallManagement will

host a conference call and webcast at 8:30 am EDT/1:30 pm BST

to discuss the company’s financial results and provide a general

business update. Conference call participants should pre-register

using this link to receive the dial-in numbers and a personal PIN,

which are required to access the conference call.

A simultaneous audio webcast and replay will be

accessible on the events section of Autolus’ website.

About Autolus Therapeutics

plcAutolus is a clinical-stage biopharmaceutical company

developing next-generation, programmed T cell therapies for the

treatment of cancer. Using a broad suite of proprietary and modular

T cell programming technologies, the Company is engineering

precisely targeted, controlled and highly active T cell therapies

that are designed to better recognize cancer cells, break down

their defense mechanisms and eliminate these cells. Autolus has a

pipeline of product candidates in development for the treatment of

hematological malignancies and solid tumors. For more information,

please visit www.autolus.com.

About

obe-cel (AUTO1)Obe-cel is a CD19 CAR T cell

investigational therapy designed to overcome the limitations in

clinical activity and safety compared to current CD19 CAR T cell

therapies. Designed to have a fast target binding off-rate to

minimize excessive activation of the programmed T cells, obe-cel

may reduce toxicity and be less prone to T cell exhaustion, which

could enhance persistence and improve the ability of the programmed

T cells to engage in serial killing of target cancer cells. In

collaboration with Autolus’ academic partner, UCL, obe-cel is

currently being evaluated in a Phase 1 clinical trials for B-NHL.

Autolus has progressed obe-cel to the FELIX trial, a pivotal trial

for adult ALL.

About obe-cel

FELIX clinical trialAutolus’ Phase 1b/2 clinical

trial of obe-cel is enrolling adult patients with relapsed /

refractory B-precursor ALL. The trial had a Phase 1b component

prior to proceeding to the single arm, Phase 2 clinical trial. The

primary endpoint is overall response rate, and the secondary

endpoints include duration of response, MRD negative CR rate and

safety. The trial is designed to enroll approximately 100 patients

across 30 of the leading academic and non-academic centers in the

United States, United Kingdom and Europe.

[NCT04404660]

About AUTO1/22AUTO1/22 is a

novel dual targeting CAR T cell based therapy candidate based on

obe-cel. It is designed to combine the enhanced safety, robust

expansion and persistence seen with the fast off rate CD19 CAR from

obe-cel with a high sensitivity CD22 CAR to reduce antigen negative

relapses. This product candidate is currently in a Phase 1 clinical

trial for patients with r/r pediatric ALL. [NCT02443831]

About AUTO4AUTO4 is a

programmed T cell product candidate in clinical development for T

cell lymphoma, a setting where there are currently no approved

programmed T cell therapies. AUTO4 is specifically designed to

target TRBC1 derived cancers, which account for approximately 40%

of T cell lymphomas, and is a complement to the AUTO5 T cell

product candidate, which is in pre-clinical development.

About AUTO5AUTO5 is a

programmed T cell product candidate in pre-clinical development for

T cell lymphoma, a setting where there are currently no approved

programmed T cell therapies. AUTO5 is specifically designed to

target TRBC2 derived cancers, which account for approximately 60%

of T cell lymphomas, and is a complement to the AUTO4 T cell

product candidate currently in clinical development.

About AUTO6NGAUTO6NG is a next

generation programmed T cell product candidate in pre-clinical

development. AUTO6NG builds on preliminary proof of concept

data from AUTO6, a CAR targeting GD2-expression cancer cell

currently in clinical development for the treatment of

neuroblastoma. AUTO6NG incorporates additional cell programming

modules to overcome immune suppressive defense mechanisms in the

tumor microenvironment, in addition to endowing the CAR T cells

with extended persistence capacity. AUTO6NG is currently in

pre-clinical development for the potential treatment of both

neuroblastoma and other GD2-expressing solid tumors.

About AUTO8AUTO8 is our

next-generation product candidate for multiple myeloma which

comprises two independent CARs for the multiple myeloma targets,

BCMA and CD19. We have developed an optimized BCMA CAR which is

designed for improved killing of target cell that express BCMA at

low levels. This has been combined with fast off rate CD19 CAR from

obe-cel. We believe that the design of AUTO8 has the potential

to induce deep and durable responses and extend the durability of

effect over other BCMA CARs currently in development.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are

statements that are not historical facts, and in some cases can be

identified by terms such as "may," "will," "could," "expects,"

"plans," "anticipates," and "believes." These statements include,

but are not limited to, statements regarding the continued

development of Autolus’ AUTO1/22 program; the status of clinical

trials (including, without limitation, expectations regarding the

data that is being presented, the expected timing of data releases

and development, as well as completion of clinical trials) and

development timelines for the Company’s product candidates. Any

forward-looking statements are based on management's current views

and assumptions and involve risks and uncertainties that could

cause actual results, performance, or events to differ materially

from those expressed or implied in such statements. These risks and

uncertainties include, but are not limited to, the risks that

Autolus’ preclinical or clinical programs do not advance or result

in approved products on a timely or cost effective basis or at all;

the results of early clinical trials are not always being

predictive of future results; the cost, timing, and results of

clinical trials; that many product candidates do not become

approved drugs on a timely or cost effective basis or at all; the

ability to enroll patients in clinical trials; possible safety and

efficacy concerns; and the impact of the ongoing COVID-19 pandemic

on Autolus’ business. For a discussion of other risks and

uncertainties, and other important factors, any of which could

cause Autolus’ actual results to differ from those contained in the

forward-looking statements, see the section titled "Risk Factors"

in Autolus' Annual Report on Form 20-F filed with the Securities

and Exchange Commission on March 7, 2023, as well as discussions of

potential risks, uncertainties, and other important factors in

Autolus' subsequent filings with the Securities and Exchange

Commission. All information in this press release is as of the date

of the release, and Autolus undertakes no obligation to publicly

update any forward-looking statement, whether as a result of new

information, future events, or otherwise, except as required by

law.

Contact:

Julia Wilson+44 (0) 7818

430877j.wilson@autolus.com

Susan A. NoonanS.A. Noonan

Communications+1-917-513-5303susan@sanoonan.com

Alexandra

Deschner+32-490-58-35-23a.deschner@autolus.com

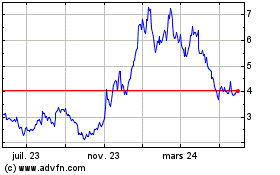

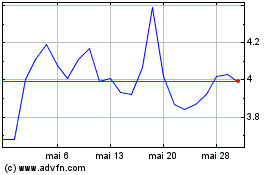

Autolus Therapeutics (NASDAQ:AUTL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Autolus Therapeutics (NASDAQ:AUTL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025