0001897982false00018979822025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 4, 2025

ASPEN TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-41400 | | 87-3100817 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 20 Crosby Drive, | Bedford, | MA | | 01730 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (781) 221-6400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common stock, $0.0001 par value per share | | AZPN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On February 4, 2025, Aspen Technology, Inc. (the “Company”) issued a press release announcing financial results for the second quarter of fiscal year 2025, ended December 31, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ASPEN TECHNOLOGY, INC. |

| | |

| | | |

Date: February 4, 2025 | By: | /s/ David Baker |

| | | David Baker |

| | | Senior Vice President and Chief Financial Officer |

Exhibit 99.1

Contacts:

| | | | | | | | |

| Media Contact | | Investor Contact |

| Len Dieterle | | William Dyke |

| Aspen Technology | | Aspen Technology |

| +1 781-221-4291 | | +1 781-221-5571 |

| len.dieterle@aspentech.com | | ir@aspentech.com |

Aspen Technology Announces Financial Results for the

Second Quarter of Fiscal 2025

Bedford, Mass. – February 4, 2025 - Aspen Technology, Inc. (“AspenTech” or the “Company”) (NASDAQ: AZPN), a global leader in industrial software, today announced financial results for its second quarter in fiscal 2025, ended December 31, 2024.

Second Quarter Fiscal Year 2025 and Recent Business Highlights

•Annual contract value1 (“ACV”) was $964.9 million for the second quarter of fiscal 2025, increasing 9.2% year over year and 2.5% quarter over quarter.

•Cash flow from operations was $38.1 million and free cash flow was $36.4 million in the second quarter of fiscal 2025. A reconciliation of GAAP to non-GAAP results is presented in the financial tables included in this press release.

Second Quarter Fiscal Year 2025 Financial Results Summary

AspenTech’s total revenue was $303.6 million in the second quarter of fiscal 2025, compared to $257.2 million in the second quarter of fiscal 2024. Total revenue in the period included license and solutions revenue of $188.2 million, compared to $152.5 million in the second quarter of fiscal 2024, maintenance revenue of $90.6 million, compared to $85.1 million in the second quarter of fiscal 2024, and services and other revenue of $24.7 million, compared to $19.6 million in the second quarter of fiscal 2024. Bookings2 was $307.5 million in the second quarter of fiscal 2025, compared to $233.4 million in the second quarter of fiscal 2024.

Income from operations was $9.0 million in the second quarter of fiscal 2025, compared to a loss from operations of $49.2 million in the second quarter of fiscal 2024. Non-GAAP income from operations was $149.0 million in the second quarter of fiscal 2025, compared to $88.7 million in the second quarter of fiscal 2024. Net income was $20.3 million, or $0.32 per diluted share, in the second quarter of fiscal 2025, compared to a net loss of $21.5 million, or $0.34 per diluted share, in the second quarter of fiscal 2024. Non-GAAP net income was $131.1 million, or $2.06 per diluted share, in the second quarter of fiscal 2025, compared to $87.8 million, or $1.37 per diluted share, in the second quarter of fiscal 2024.

AspenTech had cash and cash equivalents of $181.8 million as of December 31, 2024, compared to $237.0 million as of June 30, 2024. The decrease in cash and cash equivalents during this period was due to the impact of share repurchase activity under the Company’s fiscal 2025 share repurchase authorization in the first quarter of fiscal 2025 and a net use of cash of $36.5 million in the second quarter of fiscal 2025 for the purchase of Open Grid Systems Limited. Under its revolving credit facility, AspenTech had no borrowings and $194.5 million available as of December 31, 2024.

AspenTech generated $38.1 million in cash flow from operations and $36.4 million in free cash flow in the second quarter of fiscal 2025, compared to $29.8 million in cash flow from operations and $29.2 million in free cash flow in the second quarter of fiscal 2024.

Conference Call and Fiscal 2025 Business Outlook

As a result of AspenTech entering into an Agreement and Plan of Merger (the “Merger Agreement”) with Emerson Electric Co. (“Emerson”) and Emersub CXV, Inc. (the “Purchaser”) on January 26, 2025, AspenTech will not host an earnings conference call for its second quarter fiscal 2025 results nor provide future guidance. For more information on the Merger Agreement, please refer to AspenTech’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 27, 2025.

Footnotes

1.ACV is the estimate of the annual value of the Company’s portfolio of term license and software maintenance and support, or SMS, contracts, the annual value of SMS agreements purchased with perpetual licenses and the annual value of standalone SMS agreements purchased with certain legacy term license agreements, which have become an immaterial part of the Company’s business. All ACV numbers presented in this press release exclude ACV associated with the Company’s Russia business for all periods presented.

2.Bookings is the total value of customer term license and perpetual license SMS contracts signed and delivered in the current period, less the value of such contracts signed in the current period where the initial licenses and SMS agreements are not yet deemed delivered, plus the term license contracts and perpetual license SMS contracts signed in a previous period for which the initial licenses are deemed delivered in the current period.

About AspenTech

Aspen Technology, Inc. (NASDAQ: AZPN) is a global software leader helping industries at the forefront of the world’s dual challenge meet the increasing demand for resources from a rapidly growing population in a profitable and sustainable manner. AspenTech solutions address complex environments where it is critical to optimize the asset design, operation and maintenance lifecycle. Through our unique combination of deep domain expertise and innovation, customers in asset-intensive industries can run their assets safer, greener, longer and faster to improve their operational excellence. To learn more, visit AspenTech.com.

Additional Information and Where to Find it

No tender offer for the shares of the Company has commenced at this time. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of the Company, nor is it a substitute for the tender offer materials that Emerson and the Purchaser will file with the SEC upon the commencement of the offer. A solicitation and offer to buy outstanding shares of the Company will only be made pursuant to the tender offer materials that Emerson and the Purchaser intend to file with the SEC. At the time the tender offer is commenced, Emerson and the Purchaser will file tender offer materials on Schedule TO and the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 and a transaction statement on Schedule 13E-3 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS), THE SOLICITATION/RECOMMENDATION STATEMENT AND THE SCHEDULE 13E-3 WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE (AND EACH AS IT MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS OF THE COMPANY SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES OF COMMON STOCK IN THE TENDER OFFER. The tender offer materials (including the Offer to Purchase and the related Letter of Transmittal), the Solicitation/Recommendation Statement and the Schedule 13E-3 will be made available for free at the SEC’s website at www.sec.gov. In addition, free copies of these materials (if and when they become available) will be made available by the Company by mail to Aspen Technology, Inc., 20 Crosby Dr., Bedford, MA 01730, Attn: Investor Relations, by email at IR@aspentech.com or on the Company’s internet website at https://ir.aspentech.com.

Forward-Looking Statements

This communication contains forward-looking statements related to the Company, Emerson and the proposed acquisition by Emerson of the outstanding shares of common stock of the Company that Emerson does not already own (the “Transaction”), which involve substantial risks and uncertainties. Forward-looking statements include any statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “goal,” “may,” “might,” “plan,” “predict,” “project,” “seek,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions.

Forward-looking statements reflect current beliefs and expectations; however, these statements involve inherent risks and uncertainties, including with respect to consummating the Transaction and any competing offers or acquisition proposals for the Company, uncertainties as to how many of the Company’s stockholders will tender their stock in the tender offer, the effects of the Transaction (or the announcement thereof) on the Company’s stock price, relationships with key third parties or governmental entities, transaction costs, risks that the Transaction disrupts current plans and operations or adversely affects employee retention, potentially diverting management’s attention from the Company’s ongoing business operations, changes in the Company’s business during the period between announcement and closing of the Transaction, and any legal proceedings that may be instituted related to the Transaction. Actual results could differ materially due to various factors, risks and uncertainties. Among other things, there can be no guarantee that the Transaction will be completed in the anticipated timeframe or at all, that the conditions required to complete the Transaction will be met, that any event, change or other circumstance that could give rise to the termination of the definitive agreement for the Transaction will not occur or that Emerson will realize the expected benefits of the Transaction; and other risks listed under the heading “Risk Factors” in the Company’s periodic reports filed with the SEC, including Current Reports on Form 8-K, Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, as well as the Schedule 14D-9 and Schedule 13E-3 that may be filed by the Company and the Schedule TO and related tender offer documents that may be filed by Emerson. You should not place undue reliance on these statements. All forward-looking statements are based on information currently available to the Company, and the Company disclaims any obligation to update the information contained in this communication as new information becomes available.

© 2025 Aspen Technology, Inc. AspenTech, aspenONE, asset optimization and the Aspen leaf logo are trademarks of Aspen Technology, Inc. All rights reserved. All other trademarks not owned by AspenTech are property of their respective owners.

Use of Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures” under the rules of the SEC. Non-GAAP financial measures are not based on a comprehensive set of accounting rules or principles. This non-GAAP information supplements, and is not intended to represent a measure of performance in accordance with, disclosures required by generally accepted accounting principles, or GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP. A reconciliation of GAAP to non-GAAP results is included in the financial tables included in this press release.

Management considers both GAAP and non-GAAP financial results in managing AspenTech’s business. As the result of adoption of new licensing models, management believes that a number of AspenTech’s performance indicators based on GAAP, including revenue, gross profit, operating income and net income, should be viewed in conjunction with certain non-GAAP and other business measures in assessing AspenTech’s performance, growth and financial condition. Accordingly, management utilizes a number of non-GAAP and other business metrics, including the non-GAAP metrics set forth in this press release, to track AspenTech’s business performance.

| | | | | | | | | | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) |

| | | | | | | |

| Three Months Ended December 31, | | Six Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (Dollars and Shares in Thousands, Except per Share Data) |

| Revenue: | | | | | | | |

| License and solutions | $ | 188,248 | | | $ | 152,463 | | | $ | 289,907 | | | $ | 301,111 | |

| Maintenance | 90,577 | | | 85,056 | | | 181,263 | | | 170,024 | |

| Services and other | 24,730 | | | 19,644 | | | 48,262 | | | 35,336 | |

| Total revenue | 303,555 | | | 257,163 | | | 519,432 | | | 506,471 | |

| Cost of revenue: | | | | | | | |

| License and solutions | 61,197 | | | 67,326 | | | 124,851 | | | 138,903 | |

| Maintenance | 12,159 | | | 10,647 | | | 22,847 | | | 20,848 | |

| Services and other | 20,908 | | | 16,960 | | | 42,013 | | | 33,242 | |

| Total cost of revenue | 94,264 | | | 94,933 | | | 189,711 | | | 192,993 | |

| Gross profit | 209,291 | | | 162,230 | | | 329,721 | | | 313,478 | |

| Operating expenses: | | | | | | | |

| Selling and marketing | 117,961 | | | 122,240 | | | 243,622 | | | 244,618 | |

| Research and development | 48,115 | | | 53,145 | | | 98,115 | | | 106,821 | |

| General and administrative | 33,745 | | | 36,088 | | | 66,753 | | | 71,494 | |

| Restructuring costs | 484 | | | — | | | 8,210 | | | — | |

| Total operating expenses | 200,305 | | | 211,473 | | | 416,700 | | | 422,933 | |

| Income (loss) from operations | 8,986 | | | (49,243) | | | (86,979) | | | (109,455) | |

| Other expense, net | (8,905) | | | (199) | | | (6,864) | | | (6,029) | |

| Interest income, net | 16,481 | | | 12,283 | | | 33,657 | | | 26,333 | |

| Income (loss) before benefit for income taxes | 16,562 | | | (37,159) | | | (60,186) | | | (89,151) | |

| Benefit for income taxes | (3,779) | | | (15,659) | | | (20,063) | | | (33,126) | |

| Net income (loss) | $ | 20,341 | | | $ | (21,500) | | | $ | (40,123) | | | $ | (56,025) | |

| Net income (loss) per common share: | | | | | | | |

| Basic | $ | 0.32 | | | $ | (0.34) | | | $ | (0.63) | | | $ | (0.88) | |

| Diluted | $ | 0.32 | | | $ | (0.34) | | | $ | (0.63) | | | $ | (0.88) | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 63,259 | | | 63,699 | | | 63,252 | | | 64,009 | |

| Diluted | 63,638 | | | 63,699 | | | 63,252 | | | 64,009 | |

| | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

| | | |

| December 31, 2024 | | June 30, 2024 |

| | | |

| (Dollars in Thousands, Except Share Data) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 181,814 | | | $ | 236,970 | |

| Accounts receivable, net | 133,043 | | | 115,533 | |

| Current contract assets, net | 471,294 | | | 409,177 | |

| Prepaid expenses and other current assets | 27,910 | | | 27,441 | |

| Receivables from related parties | 69,670 | | | 78,483 | |

| Prepaid income taxes | 9,347 | | | 8,462 | |

| Total current assets | 893,078 | | | 876,066 | |

| Property, equipment and leasehold improvements, net | 17,270 | | | 17,389 | |

| Goodwill | 8,356,307 | | | 8,328,201 | |

| Intangible assets, net | 3,960,147 | | | 4,184,750 | |

| Non-current contract assets, net | 546,664 | | | 515,106 | |

| Contract costs | 27,180 | | | 24,903 | |

| Operating lease right-of-use assets | 91,874 | | | 96,034 | |

| Deferred income tax assets | 5,369 | | | 6,989 | |

| Other non-current assets | 38,901 | | | 22,269 | |

| Total assets | $ | 13,936,790 | | | $ | 14,071,707 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 11,202 | | | $ | 8,099 | |

| Accrued expenses and other current liabilities | 78,718 | | | 100,167 | |

| Due to related parties | 19,958 | | | 47,449 | |

| Current operating lease liabilities | 10,734 | | | 13,125 | |

| Income taxes payable | 26,979 | | | 44,249 | |

| Current contract liabilities | 120,820 | | | 124,312 | |

| Total current liabilities | 268,411 | | | 337,401 | |

| Non-current contract liabilities | 50,032 | | | 27,512 | |

| Deferred income tax liabilities | 727,913 | | | 790,687 | |

| Non-current operating lease liabilities | 84,863 | | | 84,875 | |

| Other non-current liabilities | 28,464 | | | 18,377 | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value Authorized—600,000,000 shares Issued— 65,514,052 and 65,367,159 shares Outstanding— 63,305,569 and 63,251,495 shares | 7 | | | 7 | |

| Additional paid-in capital | 13,309,255 | | | 13,277,851 | |

| Accumulated deficit | (91,285) | | | (51,162) | |

| Accumulated other comprehensive loss | (13,803) | | | (7,261) | |

Treasury stock, at cost — 2,208,483 and 2,115,664 shares of common stock | (427,067) | | | (406,580) | |

| Total stockholders’ equity | 12,777,107 | | | 12,812,855 | |

| Total liabilities and stockholders’ equity | $ | 13,936,790 | | | $ | 14,071,707 | |

| | | | | | | | | | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) |

| | | | | | | |

| Three Months Ended December 31, | | Six Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (Dollars in Thousands) |

| Cash flows from operating activities: | | | | | | | |

| Net income (loss) | $ | 20,341 | | | $ | (21,500) | | | $ | (40,123) | | | $ | (56,025) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 124,780 | | | 123,167 | | | 247,636 | | | 246,386 | |

| Reduction in the carrying amount of right-of-use assets | 3,990 | | | 3,370 | | | 7,951 | | | 6,932 | |

| Net foreign currency losses | 8,989 | | | 274 | | | 6,869 | | | 6,168 | |

| Stock-based compensation | 14,582 | | | 16,211 | | | 29,396 | | | 32,910 | |

| Deferred income taxes | (33,512) | | | (43,130) | | | (65,960) | | | (94,210) | |

| Provision for uncollectible receivables | 2,006 | | | 1,597 | | | 2,497 | | | 3,385 | |

| Other non-cash operating activities | 1,199 | | | (648) | | | 941 | | | (629) | |

| Changes in assets and liabilities: | | | | | | | |

| Accounts receivable | (31,352) | | | (40,126) | | | (18,465) | | | (10,709) | |

| Contract assets | (81,808) | | | (33,864) | | | (100,659) | | | (57,926) | |

| Contract costs | (433) | | | (1,896) | | | 852 | | | (3,059) | |

| Lease liabilities | (3,376) | | | (3,338) | | | (6,417) | | | (7,108) | |

| Prepaid expenses, prepaid income taxes, and other assets | (16,378) | | | (584) | | | (22,334) | | | (17,606) | |

| Accounts payable, accrued expenses, income taxes payable and other liabilities | 11,404 | | | 4,523 | | | (25,648) | | | 9,258 | |

| Contract liabilities | 17,704 | | | 25,771 | | | 17,203 | | | (10,959) | |

| Net cash provided by operating activities | 38,136 | | | 29,827 | | | 33,739 | | | 46,808 | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of property, equipment and leasehold improvements | (1,111) | | | (500) | | | (3,133) | | | (1,437) | |

| Payments for business acquisitions, net of cash acquired | (36,490) | | | — | | | (36,490) | | | (8,273) | |

| Payments for equity method investments | (116) | | | (423) | | | (146) | | | (521) | |

| Payments for capitalized computer software development costs | (634) | | | (131) | | | (634) | | | (131) | |

| Payments for asset acquisitions | — | | | — | | | — | | | (12,500) | |

| Net cash used in investing activities | (38,351) | | | (1,054) | | | (40,403) | | | (22,862) | |

| Cash flows from financing activities: | | | | | | | |

| Issuance of shares of common stock, net of taxes | 4,731 | | | 4,635 | | | 10,993 | | | 7,920 | |

| Repurchases of common stock | (2,220) | | | (72,105) | | | (22,707) | | | (186,329) | |

| Payment of tax withholding obligations related to restricted stock | (3,813) | | | (11,905) | | | (8,448) | | | (13,843) | |

| Net transfers (to) from Parent Company | (29,256) | | | 64,865 | | | (20,420) | | | 68,755 | |

| Payments of debt issuance costs | (705) | | | — | | | (812) | | | — | |

| Net cash used in financing activities | (31,263) | | | (14,510) | | | (41,394) | | | (123,497) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (4,209) | | | (4,050) | | | (945) | | | (10,905) | |

| (Decrease) increase in cash, cash equivalents and restricted cash | (35,687) | | | 10,213 | | | (49,003) | | | (110,456) | |

| Cash, cash equivalents and restricted cash, beginning of period | 235,152 | | | 120,540 | | | 248,468 | | | 241,209 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 199,465 | | | $ | 130,753 | | | $ | 199,465 | | | $ | 130,753 | |

| | | | | | | |

| Reconciliation of cash, cash equivalents and restricted cash: | | | | | | | |

| Cash and cash equivalents | $ | 181,814 | | | $ | 130,753 | | | $ | 181,814 | | | $ | 130,753 | |

| Restricted cash in other non-current assets | 17,651 | | | — | | | 17,651 | | | — | |

| Total cash, cash equivalents and restricted cash | $ | 199,465 | | | $ | 130,753 | | | $ | 199,465 | | | $ | 130,753 | |

| | | | | | | | | | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES Reconciliation of GAAP to Non-GAAP Results of Operations and Cash Flows (Unaudited) |

| | | | | | | |

| Three Months Ended December 31, | | Six Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (Dollars and Shares in Thousands, Except per Share Data) |

| Total expenses | | | | | | | |

| GAAP total expenses (a) | $ | 294,569 | | | $ | 306,406 | | | $ | 606,411 | | | $ | 615,926 | |

| Less: | | | | | | | |

| Stock-based compensation (b) | (14,582) | | | (16,211) | | | (29,396) | | | (32,910) | |

| Amortization of intangibles (c) | (122,286) | | | (121,565) | | | (243,875) | | | (243,152) | |

| Acquisition and integration planning related fees | (2,641) | | | (125) | | | (3,046) | | | 130 | |

Restructuring costs3 | (484) | | | — | | | (8,210) | | | — | |

| | | | | | | |

| Non-GAAP total expenses | $ | 154,576 | | | $ | 168,505 | | | $ | 321,884 | | | $ | 339,994 | |

| | | | | | | |

| Income (loss) from operations | | | | | | | |

| GAAP income (loss) from operations | $ | 8,986 | | | $ | (49,243) | | | $ | (86,979) | | | $ | (109,455) | |

| Plus: | | | | | | | |

| Stock-based compensation (b) | 14,582 | | | 16,211 | | | 29,396 | | | 32,910 | |

| Amortization of intangibles (c) | 122,286 | | | 121,565 | | | 243,875 | | | 243,152 | |

| Acquisition and integration planning related fees | 2,641 | | | 125 | | | 3,046 | | | (130) | |

Restructuring costs3 | 484 | | | — | | | 8,210 | | | — | |

| | | | | | | |

| Non-GAAP income from operations | $ | 148,979 | | | $ | 88,658 | | | $ | 197,548 | | | $ | 166,477 | |

| | | | | | | |

| Net income (loss) | | | | | | | |

| GAAP net income (loss) | $ | 20,341 | | | $ | (21,500) | | | $ | (40,123) | | | $ | (56,025) | |

| Plus: | | | | | | | |

| Stock-based compensation (b) | 14,582 | | | 16,211 | | | 29,396 | | | 32,910 | |

| Amortization of intangibles (c) | 122,286 | | | 121,565 | | | 243,875 | | | 243,152 | |

| Acquisition and integration planning related fees | 2,641 | | | 125 | | | 3,046 | | | (130) | |

Restructuring costs3 | 484 | | | — | | | 8,210 | | | — | |

| Less: | | | | | | | |

| Income tax effect on Non-GAAP items (d) | (29,234) | | | (28,621) | | | (59,436) | | | (57,257) | |

| | | | | | | |

| Non-GAAP net income | $ | 131,100 | | | $ | 87,780 | | | $ | 184,968 | | | $ | 162,650 | |

| | | | | | | |

| Diluted income (loss) per share | | | | | | | |

| GAAP diluted income (loss) per share | $ | 0.32 | | | $ | (0.34) | | | $ | (0.63) | | | $ | (0.88) | |

| Plus: | | | | | | | |

| Stock-based compensation (b) | 0.23 | | | 0.25 | | | 0.46 | | | 0.51 | |

| Amortization of intangibles (c) | 1.92 | | | 1.90 | | | 3.84 | | | 3.78 | |

| Acquisition and integration planning related fees | 0.04 | | | — | | | 0.05 | | | — | |

Restructuring costs3 | 0.01 | | | — | | | 0.13 | | | — | |

| Impact of diluted shares | — | | | 0.01 | | | (0.01) | | | 0.01 | |

| Less: | | | | | | | |

| Income tax effect on Non-GAAP items (d) | (0.46) | | | (0.45) | | | (0.93) | | | (0.89) | |

| | | | | | | |

| Non-GAAP diluted income per share | $ | 2.06 | | | $ | 1.37 | | | $ | 2.91 | | | $ | 2.53 | |

| | | | | | | |

| Shares used in computing Non-GAAP diluted income per share | 63,638 | | | 64,008 | | | 63,590 | | | 64,343 | |

(3) AspenTech incurred restructuring costs as a result of its workforce reduction and Russian business exit, which were both announced in August 2024. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Six Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (Dollars in Thousands) |

| Free Cash Flow | | | | | | | |

| Net cash provided by operating activities (GAAP) | $ | 38,136 | | | $ | 29,827 | | | $ | 33,739 | | | $ | 46,808 | |

| Purchases of property, equipment and leasehold improvements | (1,111) | | | (500) | | | (3,133) | | | (1,437) | |

| Payments for capitalized computer software development costs | (634) | | | (131) | | | (634) | | | (131) | |

| Free cash flow (non-GAAP) | $ | 36,391 | | | $ | 29,196 | | | $ | 29,972 | | | $ | 45,240 | |

| | | | | | | |

| (a) GAAP total expenses | | | | | | | |

| Total costs of revenue | $ | 94,264 | | | $ | 94,933 | | | $ | 189,711 | | | $ | 192,993 | |

| Total operating expenses | 200,305 | | | 211,473 | | | 416,700 | | | 422,933 | |

| GAAP total expenses | $ | 294,569 | | | $ | 306,406 | | | $ | 606,411 | | | $ | 615,926 | |

| | | | | | | |

| (b) Stock-based compensation expense was as follows: | | | | | | | |

| Cost of license and solutions | $ | 578 | | | $ | 602 | | | $ | 1,129 | | | $ | 1,282 | |

| Cost of maintenance | 893 | | | 729 | | | 1,780 | | | 1,217 | |

| Cost of services and other | 1,430 | | | 360 | | | 2,475 | | | 858 | |

| Selling and marketing | 2,382 | | | 2,707 | | | 5,312 | | | 5,649 | |

| Research and development | 3,306 | | | 3,719 | | | 6,306 | | | 8,272 | |

| General and administrative | 5,993 | | | 8,094 | | | 12,394 | | | 15,632 | |

| Total stock-based compensation | $ | 14,582 | | | $ | 16,211 | | | $ | 29,396 | | | $ | 32,910 | |

| | | | | | | |

| (c) Amortization of intangible assets was as follows: | | | | | | | |

| Cost of license and solutions | $ | 48,860 | | | $ | 48,035 | | | $ | 97,062 | | | $ | 96,070 | |

| Selling and marketing | 73,426 | | | 73,552 | | | 146,813 | | | 147,082 | |

| Total amortization of intangible assets | $ | 122,286 | | | $ | 121,587 | | | $ | 243,875 | | | $ | 243,152 | |

| | | | | | | |

(d) The income tax effect on non-GAAP items for the three and six months ended December 31, 2024 and 2023, respectively, is calculated utilizing the Company’s combined US federal and state statutory tax rate as following: |

| U.S. Statutory Rate | 21.79 | % | | 21.79 | % | | 21.79 | % | | 21.79 | % |

v3.25.0.1

Cover Page

|

Feb. 04, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 04, 2025

|

| Entity Registrant Name |

ASPEN TECHNOLOGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41400

|

| Entity Tax Identification Number |

87-3100817

|

| Entity Address, Address Line One |

20 Crosby Drive,

|

| Entity Address, City or Town |

Bedford,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01730

|

| City Area Code |

781

|

| Local Phone Number |

221-6400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

AZPN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001897982

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

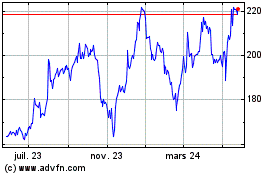

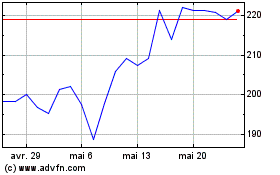

Aspen Technology (NASDAQ:AZPN)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

Aspen Technology (NASDAQ:AZPN)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025