- BLA submission for AT132 for the treatment of

XLMTM on-track for mid-2020; MAA on-track for second half of

2020

- Continued progress in Pompe Disease, DMD and

DM1 pipeline programs: AT845 IND submitted and clinical start-up

activities underway; AT702 IND on track for first quarter 2020

submission

- Strong balance sheet with September 30, 2019

cash, cash equivalents and marketable securities of $351.5

million

Audentes Therapeutics, Inc. (Nasdaq: BOLD), a leading AAV-based

genetic medicines company focused on developing and commercializing

innovative products for serious rare neuromuscular diseases, today

reported its financial results for the third quarter ended

September 30, 2019, and provided an update on the company’s recent

achievements and anticipated upcoming milestones.

“2019 has been marked by significant progress across our

portfolio, including the recent positive data update from our

ASPIRO study at the 24th International Annual Congress of the World

Muscle Society,” stated Matthew R. Patterson, Chairman and Chief

Executive Officer. “AT132 continues to show a promising safety and

efficacy profile in patients with XLMTM, with the first seven

treated patients now ventilator independent, and we remain on track

to submit the BLA for AT132 in mid-2020.”

Mr. Patterson continued, “Beyond AT132, we are excited about the

significant momentum building across our entire pipeline of

development candidates. Importantly, we met a major milestone with

the submission of our IND for AT845 for the treatment of Pompe

disease and remain on track to submit the first IND in our DMD

program in the first quarter of next year. With these and other

anticipated milestones in our DMD and DM1 programs, we look forward

to 2020 as a year of important catalysts for the company and the

advancement of our potentially best and first-in-class genetic

medicines for devastating neuromuscular diseases.”

Recent Achievements & Upcoming Key Events:

AT132 for X-linked Myotubular Myopathy (XLMTM):

- On-track to submit a Biologics Licensing Application (BLA) in

the United States in mid-2020 and a Marketing Authorization

Application (MAA) in Europe in the second half of 2020.

- Presented positive data from the ASPIRO dose escalation cohorts

at the 24th International Annual Congress of the World Muscle

Society. The first seven treated patients were ventilator

independent and all patients were making progress against

clinically meaningful developmental milestones with four patients

walking independently or with support.

- AT132 continues to be generally well-tolerated with a

manageable safety profile across both dose cohorts.

AT845 for Pompe Disease:

- Submitted a US Investigational New Drug application (IND) for

AT845 in the third quarter of 2019; application is currently

undergoing review with the U.S. Food & Drug Administration

(FDA).

- Clinical trial site start-up activities underway; initiating a

screening study with US trial sites to accelerate patient

identification for enrollment into planned Phase 1/2 study.

- Plan to present non-clinical data at WORLD Symposium in

February 2020.

AT702/AT753/AT751 for Duchenne Muscular Dystrophy (DMD):

- IND-enabling dose ranging and toxicology studies underway for

AT702; on-track for first quarter 2020 IND submission and plan to

initiate a clinical study in the second quarter of 2020.

- Held productive face-to-face meeting with FDA to discuss a

platform approach to vectorized exon skipping for DMD, which

proposes to streamline nonclinical, chemistry, manufacturing and

controls (CMC) and clinical development of a common snRNA backbone

combined with unique exon-targeting oligonucleotide sequences to

address multiple DMD genotypes.

- AT753 exon 53 targeting oligonucleotide sequence selected;

manufacturing underway to support IND-enabling preclinical studies

to be initiated this quarter.

- AT751 exon 51 targeting oligonucleotide screening underway;

plan to initiate IND-enabling preclinical studies in the first

quarter of 2020.

AT466 for Myotonic Dystrophy (DM1):

- In vivo vector screening studies continuing to progress.

- Plan to submit IND in 2020.

Manufacturing:

- Process performance qualification (PPQ) campaign in progress

and facility pre-approval inspection (PAI) readiness on track in

support of mid-2020 BLA submission for AT132.

- Plasmid manufacturing facility GMP readiness activities

complete; GMP plasmid production to begin this quarter with initial

runs supporting AT702 clinical supply manufacturing.

Third Quarter 2019 Financial Results

- Cash Position: As of September 30, 2019, cash, cash

equivalents and marketable securities were $351.5 million.

- Research and Development Expenses: Research and

development expense was $37.6 million for the three months ended

September 30, 2019, compared to $29.9 million for the same period

in 2018, an increase of $7.7 million. The increase was primarily

attributable to higher program expenses for AT845, new programs

AT466 and AT702 initiated in 2019, and additional R&D headcount

to advance clinical and pre-clinical programs. Included in R&D

expense for the three months ended September 30, 2019 was $3.0

million of non-cash stock-based compensation expense, compared to

$2.6 million in the same period in 2018. For the nine months ended

September 30, 2019, research and development expense was $114.8

million compared to $76.2 million for the same period in 2018.

- General and Administrative Expenses: General and

administrative expense was $10.2 million for the three months ended

September 30, 2019, compared to $7.8 million for the same period in

2018. The increase was primarily attributable to headcount

increases and infrastructure investment to support growth. Included

in G&A expense for the three months ended September 30, 2019

was $2.7 million of non-cash stock-based compensation expense,

compared to $2.0 million in the same period in 2018. For the nine

months ended September 30, 2019, general and administrative expense

was $32.0 million compared to $20.6 million for the same period in

2018.

- Net Loss: Net loss was $45.7 million for the three

months ended September 30, 2019 compared to $36.3 million for the

same period in 2018. Basic and diluted net loss per share for the

three months ended September 30, 2019, was $1.00 compared with

$0.97 for the same period in 2018. For the nine months ended

September 30, 2019, net loss was $139.9 million, compared to $93.2

million for the same period in 2018. Basic and diluted net loss per

share for the nine months ended September 30, 2019 was $3.14,

compared with $2.57 for the same period in 2018.

Conference Call

At 4:30 p.m. Eastern Time today, Audentes management will host a

conference call and a simultaneous webcast to discuss its third

quarter 2019 financial results and provide a corporate update. To

access a live webcast of the conference call, please visit the

Events & Presentations page within the Investors + Media

section of the Audentes website at www.audentestx.com.

Alternatively, please call (833) 659-8620 (U.S.) or (409) 767-9247

(international) and dial the conference ID# 8575077 to access the

call.

A replay of the webcast will be available on the Audentes

website for approximately 30 days.

About Audentes Therapeutics, Inc.

Audentes Therapeutics (Nasdaq: BOLD) is a leading AAV-based

genetic medicines company focused on developing and commercializing

innovative products for serious rare neuromuscular diseases. We are

leveraging our AAV gene therapy technology platform and proprietary

manufacturing expertise to develop programs across three

modalities: gene replacement, vectorized exon skipping, and

vectorized RNA knockdown. Our product candidates are showing

promising therapeutic profiles in clinical and preclinical studies

across a range of neuromuscular diseases. Audentes is a focused,

experienced and passionate team driven by the goal of improving the

lives of patients.

For more information regarding Audentes, please visit

www.audentestx.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995, including, but not

limited to the expected benefits of the company's product

candidates, the timing and nature of regulatory filings for the

company’s product candidates, the timing of the company’s

presentation of non-clinical data and the timing and nature of the

company’s preclinical studies, clinical trials and manufacturing

activities. All statements other than statements of historical fact

are statements that could be deemed forward-looking statements.

Although the company believes that the expectations reflected in

such forward-looking statements are reasonable, the company cannot

guarantee future events, results, actions, levels of activity,

performance or achievements, and the timing and results of

biotechnology development and potential regulatory approval is

inherently uncertain. Forward-looking statements are subject to

risks and uncertainties that may cause the company's actual

activities or results to differ significantly from those expressed

in any forward-looking statement, including risks and uncertainties

related to the company's ability to advance its product candidates,

obtain regulatory approval of and ultimately commercialize its

product candidates, the timing and results of preclinical and

clinical trials, the company’s ability to fund development

activities and achieve development goals, establish and scale-up

manufacturing processes that comply with regulatory requirements,

and protect intellectual property and other risks and uncertainties

described under the heading "Risk Factors" in documents the company

files from time to time with the Securities and Exchange

Commission. These forward-looking statements speak only as of the

date of this press release, and the company undertakes no

obligation to revise or update any forward-looking statements to

reflect events or circumstances after the date hereof.

Selected Financial Information

Amounts in thousands except share and per

share data

Operating Results

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Unaudited Operating expenses: Research and development

$

37,636

$

29,918

$

114,772

$

76,157

General and administrative

10,189

7,817

31,960

20,617

Total operating expenses

47,825

37,735

146,732

96,774

Loss from operations

(47,825

)

(37,735

)

(146,732

)

(96,774

)

Interest income, net

2,112

1,509

6,937

3,662

Other expense, net

(28

)

(65

)

(101

)

(117

)

Net loss

$

(45,741

)

$

(36,291

)

$

(139,896

)

$

(93,229

)

Net loss per share, basic and diluted

$

(1.00

)

$

(0.97

)

$

(3.14

)

$

(2.57

)

Shares used in computing net loss per share, basic and diluted

45,543,354

37,359,877

44,538,676

36,302,803

Selected Balance Sheet Data

September 30, 2019 December 31, 2018 Unaudited Cash, cash

equivalents, marketable securities and restricted cash

$

355,212

$

418,055

Total assets

$

441,508

$

472,555

Total liabilities

$

58,049

$

29,801

Total stockholders' equity

$

383,459

$

442,754

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191107005986/en/

Audentes Contacts:

Investor Contact: Andrew Chang

415.818.1033 achang@audentestx.com

Media Contact: Sarah Spencer

415.957.2020 sspencer@audentestx.com

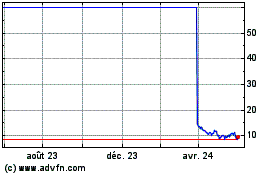

Boundless Bio (NASDAQ:BOLD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

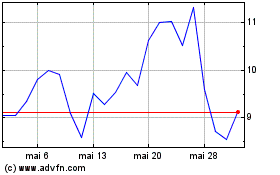

Boundless Bio (NASDAQ:BOLD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024