- Cancer immunotherapy companies are

beneficially disrupting status quo cancer treatments by deploying

body’s own immune system to fight disease

- ETF offers diversified exposure to both

pharmaceutical and clinical-stage biotechnology companies with

immunotherapy focus

Today the Loncar Cancer Immunotherapy ETF (Nasdaq: CNCR)

celebrates its one-year anniversary of trading.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20161014005084/en/

The first and only exchange-traded fund (ETF) to exclusively

hold shares of public companies that are dedicated to immunotherapy

research and development, CNCR is based on the Loncar Cancer

Immunotherapy Index, an innovative index developed by biotechnology

investor and Loncar Investments CEO Brad Loncar.

“Cancer immunotherapy is an important sector in biotechnology

that is transforming how many cancers are treated,” Loncar said. “I

am grateful for the opportunity to support companies and

researchers that work hard every day to improve the lives of

courageous patients who battle cancer disease.”

As of quarter end on 9/30/2016, CNCR had $23,176,170 in assets

and there were 900,000 shares outstanding. Below is the

standardized performance versus its benchmark (Nasdaq Biotechnology

Index) since the fund’s inception.

Standardizedperformanceas of 9/30/2016

1 MTH 3 MTH 6 MTH

1 YR Since Inception CNCR NAV

+6.94% +13.19% +18.50% -

+3.00% CNCR Market Value +7.18%

+13.55% +18.94% -

+3.24%

NasdaqBiotechnology Index

+3.02% +12.93% +11.01%

-3.20%

Performance data quoted represents past performance; past

performance does not guarantee future results. The investment

return and principal value of an investment will fluctuate so that

an investor’s shares, when redeemed, may be worth more or less than

their original cost. Current performance of the Fund may be lower

or higher than the performance quoted. Performance data current to

the most recent month end may be obtained by calling 800-617-0004.

Gross Expense Ratio: 0.79 percent.

The fund includes both large pharmaceutical and growth-oriented

biotechnology companies that are leading in this disruptive

approach to cancer treatment. Its top 10 holdings are: Agenus (5.13

percent weighting, ticker: AGEN), bluebird bio (5.05 percent

weighting, ticker: BLUE), Xencor (4.77 percent weighting, ticker:

XNCR), Newlink Genetics (4.62 percent weighting, ticker: NLNK),

Bellicum (4.44 percent weighting, ticker: BLCM), CytomX

Therapeutics (4.14 percent weighting, ticker: CTMX), Five Prime

Therapeutics (3.75 percent weighting, ticker: FPRX), Advaxis (3.69

percent weighting, ticker: ADXS), Incyte (3.55 percent weighting,

ticker: INCY), AstraZeneca (3.52 percent weighting, ticker: AZN).

Twenty-three of the holdings are growth companies, while the

remaining seven are large-cap, value equities.

“Over the last year, cancer immunotherapy research has received

meaningful investment from government, philanthropy, and the

private sector,” said J. Garrett Stevens, CEO of Exchange Traded

Concepts. “We are proud to be a small part of that through our fund

and thank all investors who have participated in it since it began

trading.”

Loncar Investments is an official partner of the Cancer Research

Institute (CRI), the world’s only nonprofit organization dedicated

exclusively to harnessing the immune system’s power to conquer all

cancers. To learn about how to give to CRI, please visit here.

About Exchange Traded Concepts: ETC is carving out a

niche as a portal to launch new, custom exchange-traded funds

efficiently and cost-effectively through a complete turnkey

solution. ETC is a private-label ETF advisor with passive and

active exemptive relief from the Securities and Exchange Commission

(SEC) to launch both domestic and international equity exchange

traded funds under the Investment Company Act of 1940. For more

information, please go to www.exchangetradedconcepts.com.

About Loncar Investments: Loncar Investments, LLC, the

provider of the Loncar Cancer Immunotherapy Index, is committed to

making the biotechnology space more approachable to a wider range

of investors. The company is principally owned by biotech investor

and analyst Brad Loncar. Mr. Loncar manages a biotech-focused

family portfolio from his Lenexa, Kansas office. He can be followed

on Twitter at @bradloncar and his commentary is available at

www.loncarblog.com.

Opinions expressed are those of ETC, Loncar Investments and

their partners and are subject to change, not guaranteed, and

should not be considered investment advice.

Investing involves risk; Principal loss is possible. The Fund

will invest in immunotherapy companies which are highly dependent

on the development, procurement and marketing of drugs and the

protection and exploitation of intellectual property rights. A

company's valuation can also be greatly affected if one of its

products is proven or alleged to be unsafe, ineffective or

unprofitable. The costs associated with developing new drugs can be

significant, and the results are unpredictable. The process for

obtaining regulatory approval by the U.S. Food and Drug

Administration or other governmental regulatory authorities is long

and costly and there can be no assurance that the necessary

approvals with be obtained and maintained. The Fund may invest in

foreign securities, which involve political, economic, currency

risk, greater volatility, and differences in accounting methods.

The Fund is non-diversified meaning it may concentrate its assets

in fewer individual holdings than a diversified fund. Therefore,

the Fund is more exposed to individual stock volatility than a

diversified fund. The Fund invests in smaller companies which may

have more limited liquidity and greater volatility compared to

larger companies. The Fund is not actively managed and may be

affected by a general decline in market segments related to the

index. The fund invests in securities included in, or

representative of securities included in, the index, regardless of

their investment merits . The performance of the fund may diverge

from that of the Index and may experience tracking error to a

greater extent than a fund that seeks to replicate an

index.

The Fund's investment objectives, risks, charges and expenses

must be considered carefully before investing. The summary and

statutory prospectuses contain this and other important information

about the investment company, and may be obtained by calling

800.617.0004 or visiting www.loncarfunds.com. Read it carefully

before investing.

Fund holdings are subject to change and should not be considered

a recommendation to buy or sell any security.

The Loncar Cancer Immunotherapy Index is an index of 30

securities that have a strategic focus on the area of cancer

immunotherapy, or harnessing the immune system to fight cancer.

Quotes for the index can be found under the symbol “LCINDX” on the

Bloomberg Professional service and other financial data

providers.

The NASDAQ Biotechnology Index contains 183 securities of

NASDAQ-listed companies classified according to the Industry

Classification Benchmark as either Biotechnology or Pharmaceuticals

which also meet other eligibility criteria. The NASDAQ

Biotechnology Index is calculated under a modified

capitalization-weighted methodology.

One may not directly invest in an index.

Diversification does not assure a profit nor protect against

loss in a declining market.

The SEC does not approve or disapprove of any investment.

(www.sec.gov).

Exchange Traded Concepts, LLC serves as the investment advisor

to the Fund. The Loncar Cancer Immunotherapy ETF is distributed by

Quasar Distributors, LLC, which is not affiliated with Exchange

Traded Concepts, LLC or any of its affiliates.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161014005084/en/

for Nasdaq ETF VenturesLauren Davis,

610-228-2103ise@gregoryfca.com

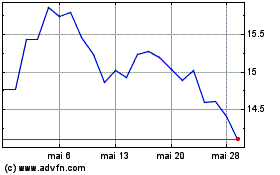

ETF Series Solutions Tru... (NASDAQ:CNCR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

ETF Series Solutions Tru... (NASDAQ:CNCR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025