- Ending ARR grows 32% year-over-year to reach $3.86 billion,

adding $218 million in net new ARR

- Grows GAAP net income more than 5x year-over-year and record

non-GAAP net income grows 45% year-over-year

- Delivers record Q2 operating cash flow of $327 million and

record Q2 free cash flow of $272 million

CrowdStrike Holdings, Inc. (Nasdaq: CRWD), today announced

financial results for the second quarter fiscal year 2025, ended

July 31, 2024.

“Working with customers to recover from the July 19th incident,

we emerge as an even more resilient and even more customer-obsessed

CrowdStrike, continuing to aggressively invest in innovation. Our

second quarter demonstrates the resilience of our business and

platform – with LogScale Next-Gen SIEM, Identity Protection, and

Cloud Security eclipsing $1 billion in combined ending ARR,” said

George Kurtz, CrowdStrike’s chief executive officer and co-founder.

“In response to rising point product complexity and an elevated

threat environment, organizations are increasingly focused on

consolidating their cybersecurity vendors into a streamlined

platform that delivers better security outcomes, which is

CrowdStrike Falcon. Our vision and mission of stopping breaches

remains unchanged.”

Commenting on the company’s financial results, Burt Podbere,

CrowdStrike’s chief financial officer, added, “For the second

quarter we delivered strong growth in revenue, operating profit and

net income demonstrating our focused execution. Our market

opportunity remains unchanged, and we believe our continued

commitment to customers and innovation will drive even more Falcon

platform adoption, protecting our customers from rapidly evolving

cyber threats and enabling us to achieve our long-term

targets.”

Second Quarter Fiscal 2025 Financial Highlights

- Revenue: Total revenue was $963.9 million, a 32%

increase, compared to $731.6 million in the second quarter of

fiscal 2024. Subscription revenue was $918.3 million, a 33%

increase, compared to $690.0 million in the second quarter of

fiscal 2024.

- Annual Recurring Revenue (ARR) grew 32% year-over-year

to $3.86 billion as of July 31, 2024, of which $217.6 million was

net new ARR added in the quarter.

- Subscription Gross Margin: GAAP subscription gross

margin was 78% in the second quarter of fiscal 2025 and fiscal

2024. Non-GAAP subscription gross margin was 81%, compared to 80%

in the second quarter of fiscal 2024.

- Income/Loss from Operations: GAAP income from operations

was $13.7 million, compared to a loss of $15.4 million in the

second quarter of fiscal 2024. Non-GAAP income from operations was

$226.8 million, compared to $155.7 million in the second quarter of

fiscal 2024.

- Net Income Attributable to CrowdStrike: GAAP net income

attributable to CrowdStrike was $47.0 million, compared to $8.5

million in the second quarter of fiscal 2024. GAAP net income per

share attributable to CrowdStrike, diluted, was $0.19, compared to

$0.03 in the second quarter of fiscal 2024. Non-GAAP net income

attributable to CrowdStrike was $260.8 million, compared to $180.0

million in the second quarter of fiscal 2024. Non-GAAP net income

attributable to CrowdStrike per share, diluted, was $1.04, compared

to $0.74 in the second quarter of fiscal 2024.

- Cash Flow: Net cash generated from operations was $326.6

million, compared to $244.8 million in the second quarter of fiscal

2024. Free cash flow was $272.2 million, compared to $188.7 million

in the second quarter of fiscal 2024.

- Cash and Cash Equivalents was $4.04 billion as of July

31, 2024.

Recent Highlights

- CrowdStrike’s module adoption rates were 65%, 45% and 29% for

five or more, six or more and seven or more modules, respectively,

as of July 31, 20241.

- Exceeded $1 billion in total sales over the lifetime of its

partnership with CDW Corporation, and achieved CDW’s Diamond Level

Partner Status.

- Set a new speed benchmark for cybersecurity threat detection,

identifying and alerting on a sophisticated eCrime adversary attack

in just four minutes during the closed-book MITRE Engenuity's

ATT&CK Evaluations: Managed Services-Round 2.

- Named a Leader in The Forrester Wave: Cybersecurity Incident

Response Services, Q2 2024 report2.

- Announced a strategic partnership with Hewlett Packard

Enterprise to secure end-to-end AI innovation, including large

language models, accelerated by NVIDIA.

- Partnered with technology distributors Ingram Micro, M3Corp and

Tecnología Especializada Asociada de México to accelerate adoption

of the AI-native CrowdStrike Falcon platform across Latin

America.

- Won five awards in the SC Awards Europe 2024, the most of any

vendor in this year’s competition; Won for Best Cloud Security

Solution, Best Endpoint Solution, Best AI Solution, Best Threat

Intelligence Technology and Best Incident Response Solution.

Financial Outlook

CrowdStrike is providing the following guidance for the fiscal

third quarter of fiscal 2025 (ending October 31, 2024) and full

fiscal year 2025 (ending January 31, 2025). CrowdStrike’s revenue

guidance for the fiscal year 2025 includes an estimated $30 million

subscription revenue impact in each of the remaining fiscal

quarters as a result of incentives related to our customer

commitment package. In addition, fiscal year 2025 revenue guidance

includes an estimated impact in the high-single digit millions to

professional services revenue in the second half of fiscal year

2025 as a result of incentives related to our customer commitment

package.

Guidance for non-GAAP financial measures excludes stock-based

compensation expense, amortization expense of acquired intangible

assets (including purchased patents), amortization of debt issuance

costs and discount, mark-to-market adjustments on deferred

compensation liabilities, legal reserve and settlement charges or

benefits, Channel File 291 Incident related costs,

acquisition-related provision (benefit) for income taxes, losses

(gains) and other income from strategic investments,

acquisition-related expenses (credits), net, and losses (gains)

from deferred compensation assets. The company has not provided the

most directly comparable GAAP measures because certain items are

out of the company's control or cannot be reasonably predicted.

Accordingly, a reconciliation for non-GAAP income from operations,

non-GAAP net income attributable to CrowdStrike, and non-GAAP net

income per share attributable to CrowdStrike common stockholders is

not available without unreasonable effort.

Q3 FY25

Guidance

Full Year FY25

Guidance

Total revenue

$979.2 - $984.7 million

$3,890.0 - $3,902.2 million

Non-GAAP income from operations

$166.7 - $170.8 million

$774.7 - $783.9 million

Non-GAAP net income attributable to

CrowdStrike

$201.2 - $205.2 million

$908.8 - $918.0 million

Non-GAAP net income per share attributable

to CrowdStrike common stockholders, diluted

$0.80 - $0.81

$3.61 - $3.65

Weighted average shares used in computing

non-GAAP net income per share attributable to common stockholders,

diluted

252 million

252 million

These statements are forward-looking and actual results may

differ materially as a result of many factors. Refer to the

Forward-Looking Statements safe harbor below for information on the

factors that could cause the company's actual results to differ

materially from these forward-looking statements.

Conference Call Information

CrowdStrike will host a conference call for analysts and

investors to discuss its earnings results for the second quarter of

fiscal 2025 and outlook for its fiscal third quarter and fiscal

year 2025 today at 2:00 p.m. Pacific time (5:00 p.m. Eastern time).

A recorded webcast of the event will also be available for one year

on the CrowdStrike Investor Relations website

ir.crowdstrike.com.

Date:

August 28, 2024

Time:

2:00 p.m. Pacific time / 5:00 p.m. Eastern

time

Webcast link:

crowdstrike-fiscal-second-quarter-2025-results-conference-call.open-exchange.net/registration

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks and uncertainties, including statements regarding

CrowdStrike’s future growth, and future financial and operating

performance, including CrowdStrike’s financial outlook for the

third quarter fiscal 2025, fiscal year 2025, and beyond. There are

a significant number of factors that could cause actual results to

differ materially from statements made in this press release,

including: risks associated with the Channel File 291 Incident,

which occurred on July 19, 2024; risks associated with managing

CrowdStrike’s rapid growth; CrowdStrike’s ability to identify and

effectively implement necessary changes to address execution

challenges; risks associated with new products and subscription and

support offerings, including the risk of defects, errors, or

vulnerabilities; CrowdStrike's ability to respond to an intensely

competitive market; length and unpredictability of sales cycles;

CrowdStrike’s ability to attract new and retain existing customers;

CrowdStrike’s ability to successfully integrate acquisitions; the

failure to timely develop and achieve market acceptance of new

products and subscriptions as well as existing products and

subscriptions and support; CrowdStrike’s ability to collaborate and

integrate its products with offerings from other parties to deliver

benefits to customers; industry trends; rapidly evolving

technological developments in the market for security products and

subscription and support offerings; and general market, political,

economic, and business conditions, including those related to a

deterioration in macroeconomic conditions, inflation, geopolitical

uncertainty and conflicts, public health crises and volatility in

the banking and financial services sector.

Additional risks and uncertainties that could affect

CrowdStrike’s financial results are included in the filings

CrowdStrike makes with the Securities and Exchange Commission

(“SEC”) from time to time, particularly under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations”, including CrowdStrike’s most

recently filed Annual Report on Form 10-K, most recently filed

Quarterly Report on Form 10-Q and subsequent filings.

You should not rely on these forward-looking statements, as

actual outcomes and results may differ materially from those

contemplated by these forward-looking statements as a result of

such risks and uncertainties. All forward-looking statements in

this press release are based on information available to

CrowdStrike as of the date hereof, and CrowdStrike does not assume

any obligation to update the forward-looking statements provided to

reflect events that occur or circumstances that exist after the

date on which they were made.

Use of Non-GAAP Financial Information

CrowdStrike believes that the presentation of non-GAAP financial

information provides important supplemental information to

management and investors regarding financial and business trends

relating to CrowdStrike’s financial condition and results of

operations. For further information regarding these non-GAAP

measures, including the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures,

please refer to the financial tables below, as well as the

“Explanation of Non-GAAP Financial Measures” section of this press

release.

Channels for Disclosure of Information

CrowdStrike intends to announce material information to the

public through the CrowdStrike Investor Relations website

ir.crowdstrike.com, SEC filings, press releases, public conference

calls, and public webcasts. CrowdStrike uses these channels, as

well as social media and its blog, to communicate with its

investors, customers, and the public about the company, its

offerings, and other issues. It is possible that the information

CrowdStrike posts on social media and its blog could be deemed to

be material information. As such, CrowdStrike encourages investors,

the media, and others to follow the channels listed above,

including the social media channels listed on CrowdStrike’s

investor relations website, and to review the information disclosed

through such channels. Any updates to the list of disclosure

channels through which CrowdStrike will announce information will

be posted on the investor relations page on CrowdStrike’s

website.

Definition of Module Adoption Rates

1.

Module adoption rates are calculated by

taking the total number of customers with five or more, six or

more, and seven or more modules, respectively, divided by the total

number of subscription customers (excluding Falcon Go customers).

Falcon Go customers are defined as customers who have subscribed

with the Falcon Go bundle, a package designed for organizations

with 100 endpoints or less.

Reports Referenced

2.

The Forrester Wave™: Cybersecurity

Incident Response Services, Q2 2024

About CrowdStrike Holdings

CrowdStrike (Nasdaq: CRWD), a global cybersecurity leader, has

redefined modern security with the world’s most advanced

cloud-native platform for protecting critical areas of enterprise

risk – endpoints and cloud workloads, identity and data.

Powered by the CrowdStrike Security Cloud and world-class AI,

the CrowdStrike Falcon® platform leverages real-time indicators of

attack, threat intelligence, evolving adversary tradecraft and

enriched telemetry from across the enterprise to deliver

hyper-accurate detections, automated protection and remediation,

elite threat hunting and prioritized observability of

vulnerabilities.

Purpose-built in the cloud with a single lightweight-agent

architecture, the Falcon platform delivers rapid and scalable

deployment, superior protection and performance, reduced complexity

and immediate time-to-value.

CrowdStrike: We stop breaches.

For more information, please visit: ir.crowdstrike.com

CrowdStrike, the CrowdStrike logo, and other CrowdStrike marks

are trademarks and/or registered trademarks of CrowdStrike, Inc.,

or its affiliates or licensors. Other words, symbols, and company

product names may be trademarks of the respective companies with

which they are associated.

CROWDSTRIKE HOLDINGS,

INC.

Condensed Consolidated

Statements of Operations

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Revenue

Subscription

$

918,257

$

689,972

$

1,790,429

$

1,341,147

Professional services

45,615

41,654

94,479

83,059

Total revenue

963,872

731,626

1,884,908

1,424,206

Cost of revenue

Subscription (1)(2)

199,910

153,306

389,567

295,406

Professional services (1)

37,491

29,611

72,837

56,741

Total cost of revenue

237,401

182,917

462,404

352,147

Gross profit

726,471

548,709

1,422,504

1,072,059

Operating expenses

Sales and marketing (1)(2)(4)(6)

355,471

282,916

705,585

564,023

Research and development (1)(3)(4)(6)

250,908

179,362

486,157

358,427

General and administrative

(1)(2)(3)(4)(5)(6)

106,434

101,804

210,168

184,438

Total operating expenses

712,813

564,082

1,401,910

1,106,888

Income (loss) from operations

13,658

(15,373

)

20,594

(34,829

)

Interest expense(7)

(6,549

)

(6,444

)

(13,060

)

(12,831

)

Interest income

51,526

36,638

97,376

67,159

Other income (expense), net(8)(9)

(1,031

)

(1,734

)

6,625

(1,504

)

Income before provision for income

taxes

57,604

13,087

111,535

17,995

Provision for income taxes

10,914

4,611

18,581

9,020

Net income

46,690

8,476

92,954

8,975

Net income (loss) attributable to

non-controlling interest

(323

)

4

3,121

12

Net income attributable to CrowdStrike

$

47,013

$

8,472

$

89,833

$

8,963

Net income per share attributable to

CrowdStrike common stockholders:

Basic

$

0.19

$

0.04

$

0.37

$

0.04

Diluted

$

0.19

$

0.03

$

0.36

$

0.04

Weighted-average shares used in computing

net income per share attributable to CrowdStrike common

stockholders:

Basic

244,091

237,911

243,249

237,174

Diluted

251,265

242,144

250,724

241,383

____________________________

(1) Includes stock-based compensation expense as follows (in

thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Subscription cost of revenue

$

16,732

$

10,132

$

30,648

$

19,098

Professional services cost of revenue

7,344

5,745

13,617

10,375

Sales and marketing

57,405

51,442

109,663

87,181

Research and development

75,851

46,985

142,593

91,366

General and administrative

43,545

50,473

87,481

87,613

Total stock-based compensation expense

$

200,877

$

164,777

$

384,002

$

295,633

(2) Includes amortization of acquired intangible assets,

including purchased patents, as follows (in thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Subscription cost of revenue

$

5,389

$

3,581

$

10,434

$

7,161

Sales and marketing

602

446

1,205

977

General and administrative

346

75

693

138

Total amortization of acquired intangible

assets

$

6,337

$

4,102

$

12,332

$

8,276

(3) Includes acquisition-related expenses (credit), net as

follows (in thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Research and development

$

—

$

—

$

477

$

371

General and administrative

535

(3

)

2,682

(73

)

Total acquisition-related expenses

(credits), net

$

535

$

(3

)

$

3,159

$

298

(4) Includes mark-to-market adjustments on deferred compensation

liabilities as follows (in thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Sales and marketing

$

108

$

32

$

143

$

35

Research and development

134

13

146

14

General and administrative

8

7

21

7

Total mark-to-market adjustments on

deferred compensation liabilities

$

250

$

52

$

310

$

56

(5) Includes legal reserve and settlement charges as follows (in

thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

General and administrative

$

—

$

2,097

$

—

$

2,097

Total legal reserve and settlement

charges

$

—

$

2,097

$

—

$

2,097

(6) Includes Channel File 291 Incident related costs such as

legal fees, remediation costs, and sensor testing costs, among

others, as follows (in thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Sales and marketing

$

3,093

$

—

$

3,093

$

—

Research and development

1,001

—

1,001

—

General and administrative

1,038

—

1,038

—

Total Channel File 291 Incident related

costs

$

5,132

$

—

$

5,132

$

—

(7) Includes amortization of debt issuance costs and discount as

follows (in thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Interest expense

$

547

$

547

$

1,093

$

1,093

Total amortization of debt issuance costs

and discount

$

547

$

547

$

1,093

$

1,093

(8) Includes gains (losses) and other income from strategic

investments as follows (in thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Other income (expense), net

$

(646

)

$

8

$

6,242

$

24

Total gains (losses) and other income from

strategic investments

$

(646

)

$

8

$

6,242

$

24

(9) Includes gains on deferred compensation assets as follows

(in thousands):

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

Other income, net

$

250

$

52

$

310

$

56

Total gains on deferred compensation

assets

$

250

$

52

$

310

$

56

CROWDSTRIKE HOLDINGS,

INC.

Condensed Consolidated Balance

Sheets

(in thousands)

(unaudited)

July 31, 2024

January 31, 2024

Assets

Current assets:

Cash and cash equivalents

$

4,038,536

$

3,375,069

Short-term investments

—

99,591

Accounts receivable, net of allowance for

credit losses

661,045

853,105

Deferred contract acquisition costs,

current

251,246

246,370

Prepaid expenses and other current

assets

230,821

183,172

Total current assets

5,181,648

4,757,307

Strategic investments

58,246

56,244

Property and equipment, net

648,474

620,172

Operating lease right-of-use assets

45,897

48,211

Deferred contract acquisition costs,

noncurrent

341,539

335,933

Goodwill

721,996

638,041

Intangible assets, net

115,686

114,518

Other long-term assets

88,988

76,094

Total assets

$

7,202,474

$

6,646,520

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

21,067

$

28,180

Accrued expenses

101,300

125,896

Accrued payroll and benefits

205,429

234,624

Operating lease liabilities, current

17,031

14,150

Deferred revenue

2,348,464

2,270,757

Other current liabilities

35,028

23,672

Total current liabilities

2,728,319

2,697,279

Long-term debt

743,238

742,494

Deferred revenue, noncurrent

744,733

783,342

Operating lease liabilities,

noncurrent

31,704

36,230

Other liabilities, noncurrent

63,890

50,086

Total liabilities

4,311,884

4,309,431

Commitments and contingencies

Stockholders’ Equity

Common stock, Class A and Class B

123

121

Additional paid-in capital

3,824,897

3,364,328

Accumulated deficit

(969,003

)

(1,058,836

)

Accumulated other comprehensive loss

(3,102

)

(1,663

)

Total CrowdStrike Holdings, Inc.

stockholders’ equity

2,852,915

2,303,950

Non-controlling interest

37,675

33,139

Total stockholders’ equity

2,890,590

2,337,089

Total liabilities and stockholders’

equity

$

7,202,474

$

6,646,520

CROWDSTRIKE HOLDINGS,

INC.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Six Months Ended July

31,

2024

2023

Operating activities

Net income

$

92,954

$

8,975

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

88,936

56,184

Amortization of intangible assets

12,332

8,276

Amortization of deferred contract

acquisition costs

147,851

112,877

Non-cash operating lease cost

7,167

6,331

Stock-based compensation expense

384,002

295,633

Deferred income taxes

(1,929

)

(352

)

Realized gains on strategic

investments

(6,227

)

—

Non-cash interest expense

1,785

1,531

Accretion of short-term investments

purchased at a discount

2,285

—

Changes in operating assets and

liabilities, net of impact of acquisitions

Accounts receivable, net

192,060

86,718

Deferred contract acquisition costs

(158,333

)

(122,007

)

Prepaid expenses and other assets

(63,224

)

(26,338

)

Accounts payable

(72

)

(2,982

)

Accrued expenses and other liabilities

7,968

4,935

Accrued payroll and benefits

(29,432

)

(30,161

)

Operating lease liabilities

(7,113

)

(6,475

)

Deferred revenue

38,859

152,528

Net cash provided by operating

activities

709,869

545,673

Investing activities

Purchases of property and equipment

(88,937

)

(102,681

)

Capitalized internal-use software and

website development costs

(24,995

)

(25,975

)

Purchases of strategic investments

(2,702

)

(12,177

)

Proceeds from sales of strategic

investments

10,895

—

Business acquisitions, net of cash

acquired

(96,381

)

—

Purchases of intangible assets

—

(500

)

Proceeds from maturities and sales of

short-term investments

97,300

250,000

Purchases of deferred compensation

investments

(1,209

)

(876

)

Proceeds from sales of deferred

compensation investments

41

—

Net cash (used in) provided by investing

activities

(105,988

)

107,791

Financing activities

Proceeds from issuance of common stock

upon exercise of stock options

2,464

4,125

Proceeds from issuance of common stock

under the employee stock purchase plan

56,099

45,432

Distributions to non-controlling interest

holders

(4,085

)

—

Capital contributions from non-controlling

interest holders

5,500

8,088

Net cash provided by financing

activities

59,978

57,645

Effect of foreign exchange rates on cash,

cash equivalents and restricted cash

(1,040

)

1,083

Net increase in cash, cash equivalents and

restricted cash

662,819

712,192

Cash, cash equivalents and restricted

cash, at beginning of period

3,377,597

2,456,924

Cash, cash equivalents and restricted

cash, at end of period

$

4,040,416

$

3,169,116

CROWDSTRIKE HOLDINGS,

INC.

GAAP to Non-GAAP

Reconciliations

(in thousands, except

percentages)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

GAAP subscription revenue

$

918,257

$

689,972

$

1,790,429

$

1,341,147

GAAP professional services revenue

45,615

41,654

94,479

83,059

GAAP total revenue

$

963,872

$

731,626

$

1,884,908

$

1,424,206

GAAP subscription gross profit

$

718,347

$

536,666

$

1,400,862

$

1,045,741

Stock based compensation expense

16,732

10,132

30,648

19,098

Amortization of acquired intangible

assets

5,389

3,581

10,434

7,161

Non-GAAP subscription gross profit

$

740,468

$

550,379

$

1,441,944

$

1,072,000

GAAP subscription gross margin

78

%

78

%

78

%

78

%

Non-GAAP subscription gross margin

81

%

80

%

81

%

80

%

GAAP professional services gross

profit

$

8,124

$

12,043

$

21,642

$

26,318

Stock based compensation expense

7,344

5,745

13,617

10,375

Non-GAAP professional services gross

profit

$

15,468

$

17,788

$

35,259

$

36,693

GAAP professional services gross

margin

18

%

29

%

23

%

32

%

Non-GAAP professional services gross

margin

34

%

43

%

37

%

44

%

Total GAAP gross margin

75

%

75

%

75

%

75

%

Total Non-GAAP gross margin

78

%

78

%

78

%

78

%

GAAP sales and marketing operating

expenses

$

355,471

$

282,916

$

705,585

$

564,023

Stock based compensation expense

(57,405

)

(51,442

)

(109,663

)

(87,181

)

Amortization of acquired intangible

assets

(602

)

(446

)

(1,205

)

(977

)

Mark-to-market adjustments on deferred

compensation liabilities

(108

)

(32

)

(143

)

(35

)

Channel File 291 Incident related

costs

(3,093

)

—

(3,093

)

—

Non-GAAP sales and marketing operating

expenses

$

294,263

$

230,996

$

591,481

$

475,830

GAAP sales and marketing operating

expenses as a percentage of revenue

37

%

39

%

37

%

40

%

Non-GAAP sales and marketing operating

expenses as a percentage of revenue

31

%

32

%

31

%

33

%

CROWDSTRIKE HOLDINGS,

INC.

GAAP to Non-GAAP

Reconciliations (continued)

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

GAAP research and development operating

expenses

$

250,908

$

179,362

$

486,157

$

358,427

Stock based compensation expense

(75,851

)

(46,985

)

(142,593

)

(91,366

)

Acquisition-related expenses, net

—

—

(477

)

(371

)

Mark-to-market adjustments on deferred

compensation liabilities

(134

)

(13

)

(146

)

(14

)

Channel File 291 Incident related

costs

(1,001

)

—

(1,001

)

—

Non-GAAP research and development

operating expenses

$

173,922

$

132,364

$

341,940

$

266,676

GAAP research and development operating

expenses as a percentage of revenue

26

%

25

%

26

%

25

%

Non-GAAP research and development

operating expenses as a percentage of revenue

18

%

18

%

18

%

19

%

GAAP general and administrative operating

expenses

$

106,434

$

101,804

$

210,168

$

184,438

Stock based compensation expense

(43,545

)

(50,473

)

(87,481

)

(87,613

)

Acquisition-related credits (expenses),

net

(535

)

3

(2,682

)

73

Amortization of acquired intangible

assets

(346

)

(75

)

(693

)

(138

)

Mark-to-market adjustments on deferred

compensation liabilities

(8

)

(7

)

(21

)

(7

)

Legal reserve and settlement charges

—

(2,097

)

—

(2,097

)

Channel File 291 Incident related

costs

(1,038

)

—

(1,038

)

—

Non-GAAP general and administrative

operating expenses

$

60,962

$

49,155

$

118,253

$

94,656

GAAP general and administrative operating

expenses as a percentage of revenue

11

%

14

%

11

%

13

%

Non-GAAP general and administrative

operating expenses as a percentage of revenue

6

%

7

%

6

%

7

%

GAAP income (loss) from operations

$

13,658

$

(15,373

)

$

20,594

$

(34,829

)

Stock based compensation expense

200,877

164,777

384,002

295,633

Amortization of acquired intangible

assets

6,337

4,102

12,332

8,276

Acquisition-related expenses (credits),

net

535

(3

)

3,159

298

Mark-to-market adjustments on deferred

compensation liabilities

250

52

310

56

Legal reserve and settlement charges

—

2,097

—

2,097

Channel File 291 Incident related

costs

5,132

—

5,132

—

Non-GAAP income from operations

$

226,789

$

155,652

$

425,529

$

271,531

GAAP operating margin

1

%

(2

)%

1

%

(2

)%

Non-GAAP operating margin

24

%

21

%

23

%

19

%

CROWDSTRIKE HOLDINGS,

INC.

GAAP to Non-GAAP

Reconciliations (continued)

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

GAAP net income attributable to

CrowdStrike

$

47,013

$

8,472

$

89,833

$

8,963

Stock based compensation expense

200,877

164,777

384,002

295,633

Amortization of acquired intangible

assets

6,337

4,102

12,332

8,276

Acquisition-related expenses (credits),

net

535

(3

)

3,159

298

Amortization of debt issuance costs and

discount

547

547

1,093

1,093

Mark-to-market adjustments on deferred

compensation liabilities

250

52

310

56

Legal reserve and settlement charges

—

2,097

—

2,097

Channel File 291 Incident related

costs

5,132

—

5,132

—

Gains (losses) and other income from

strategic investments attributable to CrowdStrike

323

(4

)

(3,121

)

(12

)

Gains on deferred compensation assets

(250

)

(52

)

(310

)

(56

)

Non-GAAP net income attributable to

CrowdStrike

$

260,764

$

179,988

$

492,430

$

316,348

Weighted-average shares used in computing

GAAP basic net income per share attributable to CrowdStrike common

stockholders

244,091

237,911

243,249

237,174

GAAP basic net income per share

attributable to CrowdStrike common stockholders

$

0.19

$

0.04

$

0.37

$

0.04

GAAP diluted net income per share

attributable to CrowdStrike common stockholders

$

0.19

$

0.03

$

0.36

$

0.04

Stock-based compensation

0.80

0.68

1.53

1.22

Amortization of acquired intangible

assets

0.03

0.02

0.05

0.03

Acquisition-related expenses (credits),

net

—

—

0.01

—

Amortization of debt issuance costs and

discount

—

—

—

—

Mark-to-market adjustments on deferred

compensation liabilities

—

—

—

—

Legal reserve and settlement charges

—

0.01

—

0.01

Channel File 291 Incident related

costs

0.02

—

0.02

—

Gains (losses) and other income from

strategic investments attributable to CrowdStrike

—

—

(0.01

)

—

Gains on deferred compensation assets

—

—

—

—

Other1

—

—

—

0.01

Non-GAAP diluted net income per share

attributable to CrowdStrike common stockholders

$

1.04

$

0.74

$

1.96

$

1.31

Weighted-average shares used to calculate

Non-GAAP diluted net income per share attributable to CrowdStrike

common stockholders

251,265

242,144

250,724

241,383

__________________________

1. For periods in which the Company had

diluted non-GAAP net income per share attributable to CrowdStrike

common stockholders, the sum of the impact of individual

reconciling items may not total to diluted Non-GAAP net income per

share attributable to CrowdStrike common stockholders because of

rounding differences.

CROWDSTRIKE HOLDINGS,

INC.

GAAP to Non-GAAP

Reconciliations (continued)

(in thousands, except

percentages)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2024

2023

2024

2023

GAAP net cash provided by operating

activities

$

326,641

$

244,781

$

709,869

$

545,673

Purchases of property and equipment

(39,254

)

(40,417

)

(88,937

)

(102,681

)

Capitalized internal-use software and

website development costs

(14,516

)

(15,073

)

(24,995

)

(25,975

)

Purchases of deferred compensation

investments

(600

)

(586

)

(1,209

)

(876

)

Proceeds from sales of deferred

compensation investments

(41

)

—

(41

)

—

Free cash flow

$

272,230

$

188,705

$

594,687

$

416,141

GAAP net cash (used in) provided by

investing activities

$

(54,890

)

$

41,760

$

(105,988

)

$

107,791

GAAP net cash provided by financing

activities

$

62,496

$

49,737

$

59,978

$

57,645

GAAP net cash provided by operating

activities as a percentage of revenue

34

%

33

%

38

%

38

%

Purchases of property and equipment as a

percentage of revenue

(4

)%

(6

)%

(5

)%

(7

)%

Capitalized internal-use software and

website development costs as a percentage of revenue

(2

)%

(2

)%

(1

)%

(2

)%

Purchases of deferred compensation

investments as a percentage of revenue

—

%

—

%

—

%

—

%

Proceeds from sale of deferred

compensation investments

—

%

—

%

—

%

—

%

Free cash flow margin

28

%

26

%

32

%

29

%

Explanation of Non-GAAP Financial Measures

In addition to determining results in accordance with U.S.

generally accepted accounting principles (“GAAP”), CrowdStrike

believes the following non-GAAP measures are useful in evaluating

its operating performance. CrowdStrike uses the following non-GAAP

financial information to evaluate its ongoing operations and for

internal planning and forecasting purposes. CrowdStrike believes

that non-GAAP financial information, when taken collectively, may

be helpful to investors because it provides consistency and

comparability with past financial performance and facilitates

period-to-period comparisons of operations, as these measures

eliminate the effects of certain variables unrelated to

CrowdStrike’s overall operating performance. However, non-GAAP

financial information is presented for supplemental informational

purposes only, has limitations as an analytical tool, and should

not be considered in isolation or as a substitute for financial

information presented in accordance with GAAP.

Other companies, including companies in CrowdStrike’s industry,

may calculate similarly titled non-GAAP measures differently or may

use other measures to evaluate their performance, all of which

could reduce the usefulness of CrowdStrike’s non-GAAP financial

measures as tools for comparison.

Investors are encouraged to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures

and not rely on any single financial measure to evaluate

CrowdStrike’s business.

Non-GAAP Subscription Gross Profit and Non-GAAP Subscription

Gross Margin

CrowdStrike defines non-GAAP subscription gross profit and

non-GAAP subscription gross margin as GAAP subscription gross

profit and GAAP subscription gross margin, respectively, excluding

stock-based compensation expense, and amortization of acquired

intangible assets.

Non-GAAP Income from Operations

CrowdStrike defines non-GAAP income from operations as GAAP

income (loss) from operations excluding stock-based compensation

expense, amortization of acquired intangible assets (including

purchased patents), acquisition-related expenses (credits), net,

mark-to-market adjustments on deferred compensation liabilities,

legal reserve and settlement charges or benefits, and Channel File

291 Incident related costs.

Non-GAAP Net Income Attributable to CrowdStrike

The company defines non-GAAP net income attributable to

CrowdStrike as GAAP net income attributable to CrowdStrike

excluding stock-based compensation expense, amortization of

acquired intangible assets (including purchased patents),

acquisition-related expenses (credits), net, amortization of debt

issuance costs and discount, mark-to-market adjustments on deferred

compensation liabilities, legal reserve and settlement charges or

benefits, Channel File 291 Incident related costs,

acquisition-related provision (benefit) for income taxes, losses

(gains) and other income from strategic investments, and losses

(gains) on deferred compensation assets.

Non-GAAP Net Income per Share Attributable to CrowdStrike

Common Stockholders, Diluted

CrowdStrike defines non-GAAP net income per share attributable

to CrowdStrike common stockholders, as non-GAAP net income

attributable to CrowdStrike divided by the weighted-average shares

outstanding, which includes the dilutive effect of potentially

dilutive common stock equivalents outstanding during the

period.

Free Cash Flow

Free cash flow is a non-GAAP financial measure that CrowdStrike

defines as net cash provided by operating activities less purchases

of property and equipment, capitalized internal-use software and

website development costs, purchases of deferred compensation

investments, and proceeds from sale of deferred compensation

investments. CrowdStrike monitors free cash flow as one measure of

its overall business performance, which enables CrowdStrike to

analyze its future performance without the effects of non-cash

items and allow CrowdStrike to better understand the cash needs of

its business. While CrowdStrike believes that free cash flow is

useful in evaluating its business, free cash flow is a non-GAAP

financial measure that has limitations as an analytical tool, and

free cash flow should not be considered as an alternative to, or

substitute for, net cash provided by operating activities in

accordance with GAAP. The utility of free cash flow as a measure of

CrowdStrike’s liquidity is further limited as it does not represent

the total increase or decrease in CrowdStrike’s cash balance for

any given period. In addition, other companies, including companies

in CrowdStrike's industry, may calculate free cash flow differently

or not at all, which reduces the usefulness of free cash flow as a

tool for comparison.

Explanation of Operational Measures

Annual Recurring Revenue

ARR is calculated as the annualized value of CrowdStrike’s

customer subscription contracts as of the measurement date,

assuming any contract that expires during the next 12 months is

renewed on its existing terms. To the extent that CrowdStrike is

negotiating a renewal with a customer after the expiration of the

subscription, CrowdStrike continues to include that revenue in ARR

if CrowdStrike is actively in discussion with such an organization

for a new subscription or renewal, or until such organization

notifies CrowdStrike that it is not renewing its subscription.

Magic Number

Magic Number is calculated by performing the following

calculation for the most recent four quarters and taking the

average: annualizing the difference between a quarter’s

Subscription Revenue and the prior quarter’s Subscription Revenue,

and then dividing the resulting number by the previous quarter’s

Non-GAAP Sales & Marketing Expense. Magic Number = Average of

previous four quarters: ((Quarter GAAP Subscription Revenue – Prior

Quarter GAAP Subscription Revenue) x 4) / Prior Quarter Non-GAAP

Sales & Marketing Expense.

Free Cash Flow Rule of 40

Free cash flow rule of 40 is calculated by taking the current

quarter total revenue year over year growth rate percentage and

summing it with the current quarter free cash flow margin

percentage.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240828420412/en/

Investor Relations Contact CrowdStrike Holdings, Inc.

Maria Riley, Vice President of Investor Relations

investors@crowdstrike.com 669-721-0742

Press Contact CrowdStrike Holdings, Inc. Jake Schuster,

Senior Director, Public Relations & Media Strategy

press@crowdstrike.com

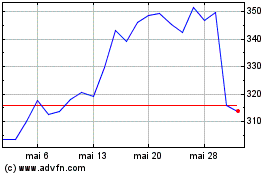

CrowdStrike (NASDAQ:CRWD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

CrowdStrike (NASDAQ:CRWD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024