Pursuant to this prospectus

supplement and the accompanying base prospectus, we are offering directly to one of our content partners 132,744 shares of our Class A

common stock at a per-share purchase price of $1.13, to be paid through the cancellation of an aggregate of $150,000 of fees, expenses

and interest owed by us and related to the transactions described in this prospectus supplement. See “Prospectus Supplement Summary

- Recent Developments – Content Agreement Supplement and Exchange Agreement.”

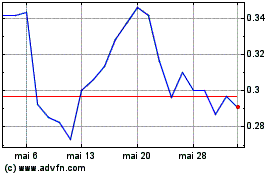

Our Class A common stock

is listed on the Nasdaq Global Market under the symbol “CSSE.” On June 28, 2023, the last reported sale price of our Class A

common stock was $1.19 per share.

We will pay the expenses incurred

in registering the shares, including legal and accounting fees. See “Plan of Distribution.”

Delivery of the shares of Class A common

stock will be made on or about June 30, 2023.

NOTE ON FORWARD-LOOKING STATEMENTS

The statements contained in this prospectus supplement,

the accompanying base prospectus and in the documents incorporated by reference herein and therein that are not purely historical are

forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs,

intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations

of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,”

“believes,” “continues,” “could,” “estimates,” “expects,” “intends,”

“may,” “might,” “plans,” “possible,” “potential,” “predicts,”

“projects,” “should,” “would” and similar expressions may identify forward-looking statements, but

the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus supplement

and in the documents incorporated by reference in this prospectus supplement may include, for example, statements about:

| · | our limited operating history; |

| · | our financial performance, including our ability to generate revenue; |

| · | our ability to integrate the operations of Redbox into the operations of our overall company as a result of our acquisition of Redbox

(the “Redbox Acquisition”) in August 2022; |

| · | the outbreak of the novel coronavirus (“COVID-19”), including the measures to reduce its spread, and the impact on the

economy and demand for our services, which may precipitate or exacerbate other risks and uncertainties our financial performance,

including our ability to generate revenue; |

| · | potential effects of a challenging economy, for example, on the demand for our advertising and marketing services, on our clients’

financial condition and on our business or financial condition; |

| · | the ability of our content offerings to achieve market acceptance; |

| · | the impact of increased competition; |

| · | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| · | our potential ability to obtain additional financing when and if needed; |

| · | our ability to protect our intellectual property; |

| · | our ability to complete strategic acquisitions, including joint ventures and co-production arrangements; |

| · | our ability to manage growth and integrate acquired operations; |

| · | uninterrupted service by the third-party service providers we rely on for the distribution of our content and delivery of ad impressions; |

| · | the potential liquidity and trading of our securities; |

| · | downward revisions to, or withdrawals of, our credit ratings by third-party rating agencies; |

| · | regulatory or operational risks; and |

| · | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing. |

The forward-looking statements contained in this

prospectus supplement, the accompanying base prospectus and in the documents incorporated by reference herein and therein are based on

current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future

developments will be those that have been anticipated. These forward-looking statements involve numerous risks, uncertainties (some of

which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those

expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those risk factors

incorporated by reference or described in the section titled “Risk Factors.” Should one or more of these risks or uncertainties

materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these

forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise, except as may be required under applicable securities laws.

PROSPECTUS SUPPLEMENT SUMMARY

The information below is only a summary of more detailed information

included elsewhere or incorporated by reference in this prospectus supplement and accompanying base prospectus. This summary may not contain

all the information that is important to you or that you should consider before making a decision to invest in our Class A common

stock. Please carefully read this entire prospectus supplement, including the risk factors set forth in the base prospectus to which this

prospectus supplement relates, this prospectus supplement, and our Annual Report on Form 10-K for the year ended December 31, 2022, as

amended, as well as the information incorporated by reference in this prospectus supplement and the accompanying base prospectus.

General

Chicken Soup for the Soul Entertainment provides

premium content to value-conscious consumers. We are one of the largest advertising-supported video-on-demand (AVOD) companies in the

US, with three flagship AVOD streaming services: Redbox, Crackle, and Chicken Soup for the Soul. In addition, we operate Redbox Free Live

TV, a free ad-supported streaming television (FAST) service with over 160 channels as well as a transactional video-on-demand (TVOD) service,

and a network of approximately 32,000 kiosks across the U.S. for DVD rentals. To provide original and exclusive content to its viewers,

we create, acquire, and distribute films and TV series through our Screen Media and Chicken Soup for the Soul TV Group subsidiaries. The

company’s best-in-class ad sales organization is known to advertisers as Crackle Plus, a sales platform of unique scale and differentiated

reach. Crackle Plus combines the ad inventory of our owned-and-operated networks and inventory with over 15 other premium AVOD partners

who have chosen us to represent them in the marketplace. Across Redbox, Crackle, Chicken Soup for the Soul and Screen Media, we have access

to almost 70,000 content assets. Chicken Soup for the Soul Entertainment is a subsidiary of Chicken Soup for the Soul, LLC, which publishes

the famous books series and produces super-premium pet food under the Chicken Soup for the Soul brand name.

Our AVOD services boast approximately 50 million

monthly active users and are distributed through every major distribution platform including Roku, Amazon Fire TV, Samsung, Vizio, Xbox,

and PlayStation. Our consumers view content produced through our various television production affiliates, acquired by Screen Media, or

licensed from Sony Pictures Television (SPT), Lionsgate, Paramount, Fox, Warner Bros. Discovery, Disney and more than 100 other production

and distribution companies, as well as through our media partners. Crackle is among the most watched independent AVOD streaming

services and has multiple branded FAST networks, all of which offer consumers free TV series and movies. Crackle is known for premium

original and acquired content that delivers audiences of scale across a demographic spectrum.

Through our recently launched Chicken Soup for

the Soul AVOD streaming service and FAST channel, we offer original and acquired unscripted lifestyle and scripted series and theatrical

content that appeals to women and families.

The acquisition of Redbox in August 2022 added

another established brand and leading home entertainment provider to the Chicken Soup for the Soul Entertainment portfolio of companies.

For more than 20 years, Redbox has focused on providing U.S. customers with the best value in entertainment and the most choice in how

they consume it, through physical media and/or digital services. Through its physical media business, consumers can rent or purchase new-release

DVDs and Blu-ray Discs® from its nationwide network of approximately 32,000 self-service kiosks. In the recent past, Redbox transformed

from a pure-play DVD rental company to a multi-faceted entertainment company, providing additional value and choice to consumers through

multiple digital products across a variety of content windows. The Redbox digital business includes Redbox On Demand, a TVOD service offering

digital rental and purchase of new release and catalog movies; Redbox Free On Demand, an AVOD service providing free movies and TV shows

on demand; and Redbox Free Live TV, a FAST service providing consumers access to over 160 linear channels. Chicken Soup for the Soul Entertainment

also generates revenue through its Redbox Service business by providing installation, merchandising and break-fix services to other kiosk

operators, and via Crackle Plus, selling third-party display advertising within Redbox’s mobile app, website, and e-mails, as well

as display and digital advertising at the kiosk.

Screen Media manages one of the industry’s

largest independently owned television and film libraries consisting of approximately 20,000 films and television episodes. Screen Media

also acquires approximately 10 to 20 new feature films and a few hundred genre titles each year. Screen Media provides content for the

Crackle Plus portfolio and also distributes its library to other exhibitors and third-party networks to generate additional revenue and

operating cash flow. Our Halcyon Television subsidiary manages the extensive film and television library we acquired from Sonar Entertainment

in 2021. This library is distributed by Screen Media and contains more than 1,000 titles, and 4,000 hours of programming, ranging from

classics, including The Little Rascals, Laurel & Hardy and Blondie (produced by

Hal Roach Studios), to acclaimed epic event mini-series such as Lonesome Dove and Dinotopia. Our Halcyon

library titles have received 446 Emmy Award nominations, 105 Emmy Awards and 15 Golden Globe Awards. In March of 2022, Screen Media

acquired 1091 Pictures that added approximately 4,000 films and episodes of licensed content as well as established FAST and AVOD channels

in genre specific verticals with approximately 1 billion yearly ad-impressions.

Chicken Soup for the Soul Television Group houses

our film and television production activities and produces or co-produces original content for Crackle Plus as well as content for other

third-party networks. This group’s production efforts are conducted through a number of affiliates, including Landmark Studio Group

Chicken Soup for the Soul Studios, Indian-centric Locomotive Global Inc., and Halcyon Studios, which was formed in connection with

our acquisition of the assets of Sonar Entertainment. Halcyon Studios develops, produces, finances, and distributes high-caliber scripted

content for our company for all platforms across a broad spectrum in the U.S. and internationally, including premium series such as Hunters (Amazon

Prime) and Mysterious Benedict Society (Disney+).

Collectively, Screen Media and Chicken Soup for

the Soul Television Group enable us to acquire, produce, co-produce and distribute content, including our original and exclusive content,

in support of our streaming services. We believe that we are the only scaled independent AVOD business with the proven capability to acquire,

create and distribute original programming, and that we have one of the largest libraries of company-owned and third-party content in

the AVOD industry. We believe this differentiation is important as consumers materially shift their viewing habits from traditional network-scheduled,

linear and broadcast viewing to individual, personalized on-demand viewing in response to the ever-growing availability of high-speed

content delivery across devices.

The U.S. market for AVOD and FAST saw record revenues

approaching $17 billion in 2022 up approximately 40% from 2021. The industry projections have these revenues growing to $31 billion by

2027 in the U.S. and closer to $70 billion worldwide. At the same time, advertising spending on traditional linear television networks

is expected to decline as more viewers transition from pay television subscriptions to connected TV (CTV) viewing. For these reasons,

interest in the AVOD business model is increasing, evidenced by traditional linear network operators increasingly seeking to acquire or

launch AVOD networks to maintain access to viewers making this transition and established SVOD players expanding their offerings to include

a hybrid AVOD that in most cases still requires a subscription fee. We believe free AVOD networks will continue to accelerate growth,

particularly as consumers seek affordable programming alternatives to multiple SVOD offerings.

Our Strategy

We believe our company is in a differentiated position

within the growing and evolving television industry, as we execute our strategy to become the leading provider of premium entertainment

for value-conscious consumers. We identified the trends favoring the growth of free AVOD streaming services in 2015 and began building

our direct-to-consumer (DTC) offering in 2017, including the development of our original content production strategy. Since then, with

Crackle and Chicken Soup for the Soul, we have built premier ad-supported streaming services that deliver utility and value to viewers

and advertisers. With the addition of Redbox, we have added an iconic and beloved brand that enhances our existing leadership in the AVOD

landscape. Redbox’s connected TV app boasts a robust and integrated ad-supported VOD and free live TV (FAST) service. Redbox’s

DVD rental kiosks and connected TV transactional VOD businesses are positioned to capitalize on the post-COVID resurgence of theatricals

at the box-office. This combination of assets elevates our newly combined company within the marketplace to a top five AVOD business and

top four TVOD platform. We believe Chicken Soup for the Soul Entertainment has the advantage of being unencumbered by the often-conflicting

strategic choices and priorities faced by diversified media companies that own both legacy linear television networks and VOD streaming

services intended to compete with legacy networks. We are singularly focused on the value-conscious consumer and serving that consumer

with unique and differentiated offerings that feature a range of mass-appeal and thematic content, a focus on original and exclusive content,

and which employ innovative user platforms and data analytics to deliver more personalized viewing experiences and more engaging advertising.

We are executing on our strategy in multiple ways:

| · | Content: Maximize transactional revenue and cost-effectively grow our production business, our content library, and our ownership

of content rights. |

| o | Transactional revenue. As films exit the theatrical window, they enter the home video window in which we are dominant

player offering rentals and sales across both physical and TVOD. We are focused on maximizing and accelerating transactional content revenue

for both our Redbox physical and digital businesses. As the volume, quality and cadence of significant theatrical releases returns to

pre-COVID levels, we expect to drive DVD rentals and sales higher at our vast national kiosk network, as well as continue growing our

TVOD rentals and sales. |

| o | Original & exclusive programming. Our focus on “original and exclusive” content, supported by our

distribution and production business, is designed to distinguish our AVOD network brands among viewers. We are able to add to our existing

broad base of content without the significant capital outlay of a traditional television or film studio by producing new originals at

low cost through creative partnerships, such as our popular series Going from Broke from executive producer Ashton Kutcher,

and Inside The Black Box, our innovative and award-winning look inside black Hollywood. |

| o | Content acquisition and rights ownership. Through Screen Media, we continue to acquire the rights to additional exclusive

content. This strategy reduces our reliance on content licensing, which leads to lower costs of revenue and increased gross margin and

provides us with wider distribution opportunities to generate additional revenue. When economically attractive, we often, from time to

time, choose to sell all or a subset of rights of an individual title in our content library to generate funds to keep our overall investment

in content cost effective and maximize returns to our investors. We consider all sources of content recoupment revenue, including ancillary

revenues and intellectual property infringement. |

| · | Advertising: Utilize technology and data to deliver innovative advertising formats and relevant ads that engage viewers. |

| o | Advertiser-desired audience profile. We believe we enjoy strong relationships with leading advertisers based on our demographic

reach, our sales approach, and our commitment to premium content and innovative, engaging ad formats. Our networks offer advertisers a

desirable target audience. For example, the average age of our Crackle viewers is 33, compared to 58 for traditional broadcast networks,

and 54 for advertising-supported cable networks. We estimate that 32% of our viewers fall in the 18-34 age demographic. |

| o | Diverse sales channels. We employ a diverse and targeted advertising sales strategy, using direct, local reseller and

programmatic sales channels to provide us with optionality based on market conditions. Most of our advertising revenues are derived from

direct sales and local reseller agreements, which we believe give us greater margin contribution and control over our advertising avails

than is possible with traditional programmatic advertising. The majority of our programmatic advertising sales are sold by our direct

sales force and executed programmatically, providing greater insights and data to our customers, resulting in higher-than-normal programmatic

CPMs. |

| o | Technology investment. As we grow our portfolio of streaming services, we continue to upgrade our entire suite of streaming

applications to add value for advertisers and enhance the user experience, including more intuitive navigation, enhanced video players,

seamless ad insertion and better content recommendation engines. As we execute on these initiatives, we believe we will be positioned

to increase both overall advertising sales and ad insertion rates, firmly establishing our streaming services as a compelling option for

advertisers compared to traditional linear broadcast or cable networks. |

| · | Direct-to-consumer (DTC): Grow distribution to gain new viewers and employ sophisticated data analytics to deliver more compelling

experiences. |

| o | Content and Distribution. We exploit our growing libraries of premium content to grow and retain viewers on our streaming

services. To augment audience acquisition, we have engaged in distribution arrangements with an increasing number of media platforms including

Roku, Amazon Fire, Vizio, Samsung, LG and others, as well as increased advertising and branding on and off media platforms. For example,

we have distribution partnerships with Vizio and Hisense for Crackle and Redbox buttons on millions of new television remote controls

sold over the next year, which increases consumer awareness of Crackle and Redbox and guides them directly to our connected TV apps. |

| o | New Genre-Specific Networks. With the addition of Redbox, we now own and operate 15 clearly branded, curated and widely

distributed FAST channels. As we grow our content libraries, we are also continuously evaluating opportunities to create new thematic

AVOD and FAST networks that focus on certain genres and types of programming, and we expect these networks to deliver more targeted advertising

opportunities to marketers. |

| o | Personalized Viewer Experiences. As we grow our audience, we are creating a large, valuable data base that we use to better

understand what our viewers watch and how they engage with advertising. We are increasingly investing in capabilities to manage and analyze

our data with the goal of better personalizing viewer experiences and enabling targeted advertising. |

| · | Business-to-business (B2B): Accelerate revenue for the Company’s B2B initiatives in key areas. |

| o | Redbox Service Business. Redbox supports its 32,000-strong DVD kiosk network with a nationwide field team that handles

on-site break-fix and maintenance along with the stocking of merchandise. In 2016, to maximize personnel, resources, and generate new

revenue, Redbox began using its kiosk team to also service third-party kiosks. This initial test of capabilities has flourished and is

now a sophisticated and fast-growing service business for multiple third-party companies with thousands of kiosks, including ecoATM and

Coinstar. We are focused on the growth of the Redbox Service Business and expect the strength of its positive trajectory to continue. |

| o | Crackle Plus. As the first AVOD of scale, Crackle has always been in a leadership position. But we realized several years

ago that smaller independent AVODs were disadvantaged in the marketplace. Without scale and a volume of impressions, some players struggled

to gain the attention of agencies and clients. As AVODs approached our Company for assistance in ad sales, we found there was a healthy,

growing and profitable business in representing third-party networks and their inventory with advertisers. Crackle Plus now manages ad

sales for over 16 other AVODs. We expect the number of partners to continue to grow, which benefits the Company’s scale and revenue,

as well as our affiliated AVODs. |

| o | Screen Media Ventures (SMV). While Screen Media’s primary goal is to acquire content for our owned-and-operated

networks, SMV’s distribution team works with our networks to optimally window content and license it to third parties wherever possible.

Through this strategy, SMV has become a leading content provider for third-party streaming and linear networks. The Company expects to

continue this fly-wheel of content acquisitions that leads to monetization through content licensing. |

Recent Developments

Content Agreement Supplement and Exchange Agreement

In June 2023, we entered into a content agreement

supplement and exchange agreement (“Exchange Agreement”) with Come Out Fighting Films, LLC (“COF LLC”) and Deano

Productions LLC, a member of COF LLC (“Deano”), relating to a distribution agreement (“Distribution Agreement”),

dated as of August 6, 2021 (and amended February 23, 2022), between our subsidiary, Redbox, as distributor, and Vantage Media International,

LLC, as sales agent, for COF LLC, as grantor of distribution rights, for the motion picture entitled Come Out Fighting.

Under the terms of the Exchange Agreement, among

other provisions, Deano has been provided with the right to require us to pay to Deano up to an aggregate of $1,550,000 in minimum guaranteed

payments with respect to the film through, at the election of Deano in certain circumstances, the issuance of shares of our Class A common

stock and/or Series A preferred based on the trailing five-day average last sale prices of such securities ending on the trading day immediately

prior to the date of such election by Deano. The allocation of shares of our Class A common stock and Series A preferred stock for the

dollar amount so issuable to Deano upon any such election shall be at the discretion of Deano. As of the date of this prospectus, Deano

has made no election and no such securities have been issued, but should Deano make such an election, we will file a prospectus supplement

from time to time with respect to any shares of Class A common stock or Series A preferred stock to be so issued to Deano. In addition,

regardless of any such exercise, we have agreed to issue shares of our Class A common stock to Deano having an aggregate market value

of $150,000 (based on the trailing five-day average last sale price of our Class A common stock ending on the trading day immediately

prior to the date of this prospectus supplement) as payment for interest on such minimum guaranteed payments, and related legal fees and

expenses under the Exchange Agreement and Distribution Agreement. This prospectus supplement accordingly relates to the 132,744 shares

of our Class A common stock being purchased by Deano as payment for such interest, fees and expenses.

Corporate Information

We are a Delaware corporation, with principal executive

offices located at 132 E. Putnam Avenue, Cos Cob, Connecticut 06807. Our telephone number at that address is (855) 398-0443. Additional

information about CSSE and its subsidiaries is included in documents incorporated by reference into this prospectus supplement. See “Where

You Can Find More Information.”

THE OFFERING

| Issuer: |

Chicken Soup for the Soul Entertainment Inc. |

| Common stock offered by us: |

132,744 shares of our Class A common stock |

| Common stock to be outstanding following the offer |

30,831,796 shares of common stock.

The number of shares of our common

stock to be outstanding immediately after this offering is based on 23,044,546 shares of our Class A common stock and 7,654,506

shares of our outstanding Class B common stock outstanding as of the date of this prospectus supplement prior to such offering. Our

Class B common stock is convertible into shares of our Class A common stock on a one-for-one basis at any time upon the election

of the holders thereof. Holders of shares of Class A common stock and Class B common stock have substantially identical rights,

except that holders of shares of Class A common stock are entitled to one vote per share and holders of shares of Class B common

stock are entitled to ten votes per share. Holders of shares of Class A common stock and Class B common stock vote together

as a single class on all matters (including the election of directors) submitted to a vote of stockholders, unless otherwise required

by law or our charter.

Unless otherwise indicated, outstanding share amounts set forth

herein exclude an aggregate of 1,511,046 shares of Class A common stock reserved for future issuance upon the exercise

of options at a weighted average exercise price of $14.89 per share and an aggregate of 6,027,719 shares of Class A common stock

reserved for future issuance up on exercise of outstanding warrants at a weighted average exercise price of $30.54 per share.

|

| Use of Proceeds: |

We will not derive any cash proceeds from the issuance of the shares of Class A common stock in this offering, but an aggregate of $150,000 otherwise payable by us will be deemed paid, allowing us to use such capital for our working capital. |

| Risk Factors: |

Investing in our Class A common stock involves a high degree of

risk. Please carefully read the information contained in and incorporated by reference under the heading “Risk Factors”

beginning on page 19 of the base prospectus to which this prospectus supplement relates, on page S-9 of this prospectus supplement,

and the risk factors set forth in our Annual Report on

Form 10-K for the year ended December 31, 2022, as amended.

|

| Nasdaq Global Market symbol: |

“CSSE” |

RISK FACTORS

An investment in our securities involves

a high degree of risk. Before investing in our ordinary shares, you should carefully consider the risk factors set forth below and in

the accompanying base prospectus, together with the other information in this prospectus supplement, the accompanying base prospectus,

and the information incorporated by reference herein and therein as set forth in our filings with the SEC, including our most recent Annual

Report on Form 10-K for the year ended December 31, 2022, as amended, as filed with the SEC. If any of such risks or uncertainties occurs,

our business, financial condition, and operating results could be materially and adversely affected. Additional risks and uncertainties

not currently known to us or that we currently deem immaterial also may materially and adversely affect our business operations. As a

result, the trading price of our Ordinary Shares could decline and you could lose all or a part of your investment.

Risks Related to the Offering

Future sales or issuances of our common

stock or convertible securities in the public markets, or the perception of such sales, could depress the trading price of our common

stock.

The sale of a substantial

number of shares of our common stock or other equity-related securities in the public markets, or the perception that such sales could

occur, could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity

securities. We may sell large quantities of our common stock at any time pursuant to our existing committed equity financing agreement

or our at-the-market sales agreement. We cannot predict the effect that future sales of common stock or other equity-related securities

would have on the market price of our common stock.

We will require additional capital funding,

the receipt of which may impair the value of our common stock

Our future capital requirements

depend on many factors. We will need to raise additional capital through public or private equity or debt offerings, credit facilities,

or through arrangements with strategic partners or other sources in order to operate our business. There can be no assurance that additional

capital will be available when needed or on terms satisfactory to us, if at all. To the extent we raise additional capital by issuing

equity securities, our stockholders may experience substantial dilution and the new equity securities may have greater rights, preferences

or privileges than our then currently outstanding securities.

We do not intend to pay any dividends on

our ordinary shares at this time.

We have not regularly paid

cash dividends on our common stock to date. The payment of cash dividends on our common stock in the future will be dependent upon our

revenue and earnings, if any, capital requirements, and general financial condition, as well as the limitations on dividends and distributions

that exist under the laws and regulations of Delaware, and will be within the discretion of our board of directors. It is the present

intention of our board of directors to retain all earnings, if any, for use in our business operations and, accordingly, our board of

directors does not anticipate declaring any dividends on our common stock in the foreseeable future. As a result, any gain you will realize

on our common stock will result solely from the appreciation of such shares.

Nasdaq may delist our Class A common stock

from quotation on its exchange, which could limit investors’ ability to sell and purchase our securities and subject us to additional

trading restrictions.

Our Class A common stock is

currently listed on the Nasdaq Global Market under the trading symbol “CSSE.” Nasdaq requires minimum of US$1.00 per share

bid price for continued inclusion on Nasdaq under Nasdaq Listing Rule 5550(a)(2). If our Class A common stock is not listed on Nasdaq

at any time after this offering, we could face significant material adverse consequences, including:

| · | a limited availability of market quotations for our securities; |

| · | a determination that our Class A common stock is “penny stock” which will require brokers

trading in our shares to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading

market for our ordinary shares; |

| · | a limited amount of news and analyst coverage for our company; and |

| · | a decreased ability to issue additional securities or obtain additional financing in the future. |

USE OF PROCEEDS

We will not derive any cash proceeds from the issuance of the shares

of Class A common stock in this offering, but an aggregate of $150,000 otherwise payable by us will be deemed paid, allowing us to use

amounts otherwise required to pay same for our working capital.

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following discussion is a summary of the material U.S. federal

income tax consequences of the acquisition, ownership and disposition of our common stock issued pursuant to this offering. This discussion

is not a complete analysis of all potential U.S. federal income tax consequences relating thereto, and does not address the effect of

any U.S. federal non-income tax laws, such as the estate or gift tax laws, or any tax consequences arising under any state,

local or foreign tax laws. This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the “Code”), Treasury

Regulations promulgated thereunder, judicial decisions and published rulings and administrative pronouncements of the U.S. Internal Revenue

Service (the “IRS”), all as in effect as of the date of this offering. These authorities may change or be subject to differing

interpretations, possibly retroactively, resulting in U.S. federal income tax consequences different from those discussed below. We have

not requested and will not request a ruling from the IRS with respect to the statements made and the conclusions reached in the following

summary, and there can be no assurance that the IRS will agree with such statements and conclusions or that a court will not take a contrary

position.

This discussion is limited

to holders who purchase our shares pursuant to this offering and who hold our common stock as a “capital asset” within

the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all of the U.S.

federal income tax consequences that may be relevant to a particular holder in light of such holder’s particular circumstances,

including the impact of the alternative minimum tax or the unearned income Medicare contribution tax. This discussion also does not address

consequences relevant to holders subject to special rules under the U.S. federal income tax laws, including, without limitation:

| · | U.S. expatriates and certain former citizens or long-term residents of the United States; |

| · | persons holding the shares as part of a hedge, straddle or other risk reduction strategy or as part of a conversion transaction or

other integrated investment; |

| · | banks, insurance companies and other financial institutions; |

| · | brokers, dealers or traders in securities; |

| · | “controlled foreign corporations,” “passive foreign investment companies” and corporations that accumulate

earnings to avoid U.S. federal income tax; |

| · | partnerships or other entities or arrangements treated as partnerships for U.S. federal income tax purposes (and investors therein); |

| · | tax-exempt organizations or governmental organizations; |

| · | persons deemed to sell our common stock under the constructive sale provisions of the Code; |

| · | persons for whom our common stock constitute “qualified small business stock” within the meaning of Section 1202

of the Code; |

| · | persons who hold or receive our shares pursuant to the exercise of any employee stock option or otherwise as compensation; |

| · | persons subject to special tax accounting rules as a result of any item of gross income with respect to our common stock being

taken into account in an “applicable financial with respect our common stock being taken into account in an “applicable financial

statement” (as defined in the Code); |

| · | “qualified foreign pension funds” as defined in Section 897(l)(2) of the Code and entities all of the interests

of which are held by qualified foreign pension funds; and |

| · | tax-qualified retirement plans. |

If a partnership

or an entity or arrangement that is classified as a partnership for U.S. federal income tax purposes holds our common stock, the U.S.

federal income tax treatment of a partner will generally depend on the status of the partner, the activities of the partnership and certain

determinations made at the partner level. Partnerships holding our common stock and the partners in such partnerships are urged to consult

their tax advisors as to particular U.S. federal income tax consequences to them of the acquisition, ownership and disposition of our

common stock.

PROSPECTIVE INVESTORS SHOULD CONSULT THEIR TAX ADVISORS REGARDING THE

U.S. FEDERAL INCOME TAX CONSEQUENCES TO THEM OF ACQUIRING, OWNING AND DISPOSING OF OUR COMMON STOCK IN THEIR PARTICULAR CIRCUMSTANCES,

AS WELL AS ANY TAX CONSEQUENCES ARISING UNDER ANY STATE, LOCAL OR FOREIGN TAX LAWS AND ANY OTHER U.S. FEDERAL TAX LAWS.

Tax considerations applicable to U.S. holders

Definition

of a U.S. holder

For

purposes of this discussion, a “U.S. holder” is any beneficial owner of our common stock that for U.S. federal income

tax purposes is, or is treated as, any of the following:

| · | an individual citizen or resident of the United States; |

| · | a corporation created or organized under the laws of the United States, any state thereof or the District of Columbia; |

| · | an estate, the income of which is subject to U.S. federal income tax regardless of its source; or |

| · | a trust (1) whose administration is subject to the primary supervision of a U.S. court and which has one or more U.S. persons

who have the authority to control all substantial decisions of the trust, or (2) that has a valid election in effect under applicable

Treasury Regulations to be treated as a U.S. person. |

Distributions

We do not anticipate paying

any cash dividends on our common stock in the foreseeable future. However, if we do make cash or other property distributions on our common

stock, such distributions will constitute dividends for U.S. federal income tax purposes to the extent paid out of our current or accumulated

earnings and profits, as determined for U.S. federal income tax purposes. Amounts not treated as dividends for U.S. federal income tax

purposes will constitute a return of capital to the extent of the holder’s tax basis in our common stock, and, thereafter, as gain

on the sale or other disposition of our common stock, which is taxed as described under “—Sale or other taxable disposition

of our common stock” below.

Dividends received by

a corporate U.S. holder may be eligible for a dividends received deduction, subject to applicable limitations. Dividends received by certain non-corporate U.S.

holders, including individuals, are generally taxed at the preferential applicable capital gains rate provided certain holding period

and other requirements are satisfied.

Sale or other taxable

disposition of our common stock

Upon the sale or other

taxable disposition of our common stock, a U.S. holder generally will recognize capital gain or loss equal to the difference between (i) the

amount of cash and the fair market value of any property received upon the sale or other taxable disposition and (ii) such U.S. holder’s

adjusted tax basis in the common stock. Such capital gain or loss will be long-term capital gain or loss if the U.S. holder’s holding

period in such common stock is more than one year at the time of the sale or other taxable disposition. Long-term capital gains recognized

by certain non-corporate U.S. holders, including individuals, generally will be subject to preferential rates of U.S. federal

income tax. The deductibility of capital losses is subject to certain limitations.

Information reporting

and backup withholding

A U.S. holder may be subject

to information reporting and backup withholding when such holder receives payments on our common stock (including constructive dividends)

or receives proceeds from the sale or other taxable disposition of our common stock. Certain U.S. holders are exempt from backup withholding,

including corporations and certain tax-exempt organizations. A U.S. holder will be subject to backup withholding if such holder

is not otherwise exempt and such holder:

| · | fails to furnish the holder’s taxpayer identification number, which for an individual is ordinarily his or her social security

number; |

| · | furnishes an incorrect taxpayer identification number; |

| · | is notified by the IRS that the holder previously failed to properly report payments of interest or dividends; or |

| · | fails to certify under penalties of perjury that the holder has furnished a correct taxpayer identification number and that the IRS

has not notified the holder that the holder is subject to backup withholding. |

Backup withholding is

not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a U.S.

holder’s U.S. federal income tax liability, provided the required information is timely furnished to the IRS. U.S. holders should

consult their tax advisors regarding their qualification for an exemption from backup withholding and the procedures for obtaining such

an exemption.

Tax considerations applicable to non-U.S. holders

For purposes of this discussion,

a “non-U.S. holder” is a beneficial owner of our common stock that is neither a U.S. holder nor an entity treated as

a partnership for U.S. federal income tax purposes.

Distributions

We do not anticipate paying

any cash dividends in the foreseeable future. However, if we do make cash or other property distributions on our common stock, such distributions

of cash or property on our common stock will constitute dividends for U.S. federal income tax purposes to the extent paid from our current

or accumulated earnings and profits, as determined under U.S. federal income tax principles. Amounts not treated as dividends for U.S.

federal income tax purposes will constitute a return of capital and first be applied against and reduce a non-U.S. holder’s

adjusted tax basis in its common stock, but not below zero. Any excess will be treated as capital gain and will be treated as described

below in the section relating to the sale or disposition of our common stock. Because we may not know the extent to which a distribution

is a dividend for U.S. federal income tax purposes at the time it is made, for purposes of the withholding rules discussed below

we or the applicable withholding agent may treat the entire distribution as a dividend.

Subject to the discussions

below on backup withholding and foreign accounts, dividends paid to a non-U.S. holder of our common stock that are not effectively

connected with the non-U.S. holder’s conduct of a trade or business within the United States will be subject to U.S. federal

withholding tax at a rate of 30% of the gross amount of the dividends (or such lower rate specified by an applicable income tax treaty).

Non-U.S. holders

will be entitled to a reduction in or an exemption from withholding on dividends as a result of either (a) an applicable income tax

treaty or (b) the non-U.S. holder holding our common stock in connection with the conduct of a trade or business within

the United States and dividends being effectively connected with that trade or business. To claim such a reduction in or exemption from

withholding, the non-U.S. holder must provide the applicable withholding agent with a properly executed (a) IRS Form W-8BEN or W-8BEN-E (or

other applicable documentation) claiming an exemption from or reduction of the withholding tax under the benefit of an income tax treaty

between the United States and the country in which the non-U.S. holder resides or is established, or (b) IRS Form W-8ECI stating

that the dividends are not subject to withholding tax because they are effectively connected with the conduct by the non-U.S. holder

of a trade or business within the United States, as may be applicable. These certifications must be provided to the applicable withholding

agent prior to the payment of dividends and must be updated periodically. Non-U.S. holders that do not timely provide the applicable

withholding agent with the required certification, but that qualify for a reduced rate under an applicable income tax treaty, may obtain

a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS.

If dividends paid to a non-U.S. holder

are effectively connected with the non-U.S. holder’s conduct of a trade or business within the United States (and, if

required by an applicable income tax treaty, the non-U.S. holder maintains a permanent establishment in the United States to

which such dividends are attributable), then, although exempt from U.S. federal withholding tax (provided the non-U.S. holder

provides appropriate certification, as described above), the non-U.S. holder will be subject to U.S. federal income tax on such

dividends on a net income basis at the regular graduated U.S. federal income tax rates. In addition, a non-U.S. holder that

is a corporation may be subject to a branch profits tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty)

on its effectively connected earnings and profits for the taxable year that are attributable to such dividends, as adjusted for certain

items. Non-U.S. holders should consult their tax advisors regarding their entitlement to benefits under any applicable income

tax treaty.

Sale or other disposition

of our common stock

Subject to the discussion

below regarding backup withholding, a non-U.S. holder generally will not be subject to U.S. federal income tax on

any gain realized upon the sale or other disposition of our common stock, unless:

| · | the gain is effectively connected with the non-U.S. holder’s conduct of a trade or business in the United States,

and, if required by an applicable income tax treaty, is attributable to a permanent establishment maintained by the non-U.S. holder

in the United States; |

| · | the non-U.S. holder is a nonresident alien individual present in the United States for 183 days or more during the taxable

year of disposition, and certain other requirements are met; or |

| · | our common stock constitute U.S. real property interests (“USRPIs”) by reason of our status as a U.S. real property holding

corporation (“USRPHC”) for U.S. federal income tax purposes. |

Gain described in the

first bullet point above will generally be subject to U.S. federal income tax on a net income basis at the regular graduated U.S. federal

income tax rates. A non-U.S. holder that is a foreign corporation also may be subject to a branch profits tax at a rate of 30%

(or such lower rate specified by an applicable income tax treaty) on such effectively connected gain, as adjusted for certain items.

A non-U.S. holder

described in the second bullet point above will be subject to U.S. federal income tax at a rate of 30% (or such lower rate specified by

an applicable income tax treaty) on any gain derived from the disposition, which may be offset by certain U.S. source capital losses of

the non-U.S. holder (even though the individual is not considered a resident of the United States) provided the non-U.S. holder

has timely filed U.S. federal income tax returns with respect to such losses.

With respect to the third

bullet point above, we believe we are not currently and do not anticipate becoming a USRPHC. Because the determination of whether we are

a USRPHC depends on the fair market value of our USRPIs relative to the fair market value of our other business assets and our non-U.S. real

property interests, however, there can be no assurance we are not a USRPHC or will not become one in the future.

Non-U.S. holders

should consult their tax advisors regarding potentially applicable income tax treaties that may provide for different rules.

Information reporting

and backup withholding

Subject to the

discussion below on foreign accounts, a non-U.S. holder will not be subject to backup withholding with respect to

distributions on our common stock we make to the non-U.S. holder, provided the applicable withholding agent does not have

actual knowledge or reason to know such holder is a United States person and the holder certifies its non-U.S. status,

such as by providing a valid IRS Form W-8BEN, W-8BEN-E or W-8ECI, or other applicable certification.

However, information returns generally will be filed with the IRS in connection with any distributions (including deemed

distributions) made on our common stock to the non-U.S. holder, regardless of whether any tax was actually withheld.

Copies of these information returns may also be made available under the provisions of a specific treaty or agreement to the tax

authorities of the country in which the non-U.S. holder resides or is established.

Information reporting

and backup withholding may apply to the proceeds of a sale or other taxable disposition of our common stock within the United States,

and information reporting may (although backup withholding generally will not) apply to the proceeds of a sale or other taxable disposition

of our common stock outside the United States conducted through certain U.S.-related financial intermediaries, in each case, unless the

beneficial owner certifies under penalty of perjury that it is a non-U.S. holder on IRS Form W-8BEN or W-8BEN-E, or

other applicable form (and the payor does not have actual knowledge or reason to know that the beneficial owner is a U.S. person) or such

owner otherwise establishes an exemption. Proceeds of a disposition of our common stock conducted through a non-U.S. office

of a non-U.S. broker generally will not be subject to backup withholding or information reporting.

Backup withholding is

not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a non-U.S. holder’s

U.S. federal income tax liability, provided the required information is timely furnished to the IRS.

Additional withholding

tax on payments made to foreign accounts

Withholding taxes may

be imposed under the Foreign Account Tax Compliance Act (“FATCA”) on certain types of payments made to non-U.S. financial

institutions and certain other non-U.S. entities. Specifically, a 30% withholding tax may be imposed on dividends (including

deemed dividends) paid on our common stock, or (subject to the proposed Treasury Regulations discussed below) gross proceeds from the

sale or other disposition of our common stock paid to a “foreign financial institution” or a “non-financial foreign

entity” (each as defined in the Code), unless (1) the foreign financial institution undertakes certain diligence and reporting

obligations, (2) the non-financial foreign entity either certifies it does not have any “substantial United States

owners” (as defined in the Code) or furnishes identifying information regarding each substantial United States owner, or (3) the

foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules. If the

payee is a foreign financial institution and is subject to the diligence and reporting requirements in (1) above, it must enter into

an agreement with the U.S. Department of the Treasury requiring, among other things, that it undertake to identify accounts held by certain

“specified United States persons” or “United States-owned foreign entities” (each as defined in the Code), annually

report certain information about such accounts, and withhold 30% on certain payments to non-compliant foreign financial institutions

and certain other account holders. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with

the United States governing FATCA may be subject to different rules.

Under the applicable Treasury

Regulations and administrative guidance, withholding under FATCA generally applies to payments of dividends (including deemed dividends).

Because we may not know the extent to which a distribution is a dividend for U.S. federal income tax purposes at the time it is made,

for purposes of these withholding rules we or the applicable withholding agent may treat the entire distribution as a dividend. While

withholding under FATCA would have applied also to payments of gross proceeds from the sale or other disposition of our common stock on

or after January 1, 2019, proposed Treasury regulations eliminate FATCA withholding on payments of gross proceeds entirely. Taxpayers

generally may rely on these proposed Treasury Regulations until final Treasury Regulations are issued. Prospective investors should consult

their tax advisors regarding the potential application of these withholding provisions.

PLAN OF DISTRIBUTION

We are offering directly

to one of our content partners 132,744 shares of our Class A common stock at a per-share purchase price of $1.13, to be paid through the

cancellation of an aggregate of $150,000 of fees, expenses and interest owed by us and related to the transactions described in this prospectus.

See above under “Prospectus Supplement Summary - Recent Developments – Content Agreement Supplement and Exchange Agreement.”

We will sell directly to our

content provider all of the shares of Class A common stock offered by this prospectus supplement. No underwriters or agents were engaged

by us for this transaction.

We negotiated the offering

price for the shares in this offering with our content supplier, with same being based on the average last sales price for the five consecutive

trading days ending immediately prior to the date of this prospectus supplement, rounded down to nearest whole cent.

We currently anticipate that

the closing of the sale of the shares offered hereby will occur on or about June 30, 2023. On such closing date, interest on minimum guaranteed

payments and legal fees and related expenses owed by us to our content partner in an amount equal to the aggregate purchase price of the

shares being sold by us to the content partner ($150,000) will be deemed cancelled, and we will deliver the shares being sold on such

closing date.

The estimated offering expenses

payable by us are approximately $3,000, which includes the placement legal, accounting and printing costs, listing fees, and various other

expenses associated with registering and issuing the shares.

EXPENSES

The following table

sets forth the costs and expenses payable by us, other than placement agent fees, in connection with registering the securities offered

hereby. All amounts listed below are estimates.

| | |

Itemized expense | |

| SEC registration fee | |

$ | 1.20 | * |

| Legal fees and expenses | |

$ | 1,000.00 | |

| Accounting fees and expenses | |

| 1,000.00 | |

| Transfer agent and registrar fees | |

$ | 500.00 | |

| Miscellaneous | |

$ | 500.00 | |

| Total | |

$ | 3,001.20 | |

* Previously paid.

Transfer Agent

The

transfer agent for our common stock is Continental Stock Transfer & Trust Company.

Listing on Nasdaq

Our Class A

common stock is listed on The Nasdaq Global Market under the symbol “CSSE”.

LEGAL MATTERS

The validity of the securities offered will be passed on for

us by our counsel, Graubard Miller, New York, New York. Graubard Miller and certain of its partners and their family members own shares

of the Class A common stock and Class W warrants to purchase shares of Class A common stock of CSSE and certain Class B

membership interests in Chicken Soup for the Soul Holdings, LLC, our ultimate parent company.

EXPERTS

The consolidated financial statements of Chicken Soup for the Soul

Entertainment Inc. and subsidiaries as of and for the years ended December 31, 2022 and 2021, are incorporated by reference

in this prospectus supplement to our Annual Report on Form 10-K for the year ended December 31, 2022, as amended, in reliance upon the

report of Rosenfield and Company, PLLC, independent registered public accounting firm, which are incorporated by reference herein, and

upon the authority of said firm as experts in accounting and auditing.

The consolidated financial statements of Sonar

Entertainment, Inc. as of and for the years ended December 31, 2020 and 2019 are incorporated by reference in this prospectus

supplement to our Current Report on Form 8-K filed with the SEC on June 11, 2021 (as amended thereafter), have been audited

by Moss Adams LLP, independent auditors, as stated in their report (which expresses an unmodified opinion and includes an emphasis-of-matter

paragraph relating to going concern). Such financial statements of such firm have been incorporated by reference given upon their authority

as experts in accounting and auditing.

The consolidated financial statements of Redbox

Entertainment, Inc. as of December 31, 2021 and 2020 and for each of the three years in the period ended December 31,

2021 incorporated by reference in this prospectus supplement to our Amendment No. 1 to Current Report on Form 8-K filed with the SEC on

August 15, 2022 (as amended thereafter) have been so incorporated by reference in reliance upon the report of Grant Thornton LLP, independent

registered public accountants, upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and other reports and other information

with the SEC under the Exchange Act. You may read and copy any reports, statements or other information filed by us at the SEC’s

public reference room at 100 F Street, N.E., Washington, D.C. 20549. Our filings with the SEC are also available to the public from commercial

document retrieval services and at the SEC’s website at www.sec.gov.

We make available free of charge on our internet

website at https://ir.cssentertainment.com/ our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current

reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable after we electronically file such material

with, or furnish it to, the SEC. Information contained on our website is not incorporated by reference into this prospectus supplement

and you should not consider such information as part of this prospectus supplement.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” into

this prospectus certain information that we file with the SEC, which means that we can disclose important information to you by referring

you to other documents separately filed by us with the SEC that contain such information. The information we incorporate by reference

is considered to be part of this prospectus and information we later file with the SEC will automatically update and supersede the information

in this prospectus. The following documents filed by us with the SEC pursuant to Section 13(a) of the Exchange Act and any of

our future filings under Sections 13(a), 13(c), 14 or 15 (d) of the Exchange Act, except for information furnished under Item

2.02 or 7.01 of Current Report on Form 8-K, or exhibits related thereto, made before the termination of the offering are incorporated

by reference herein:

| · | Quarterly Report on Form 10-Q for the three months ended March 31,

2023, filed with the SEC on May 15, 2023; |

| · | our Current Reports on Form 8-K, including the Current Reports on Form 8-K or amendments thereto filed on each of April

3, 2023, April 4,

2023, April 4, 2023, April

6, 2023, April 6,

2023, April 21,

2023, May 18, 2023, June

16, 2023 and June 28, 2023, and |

| · | our Definitive Proxy Statement for our Annual Meeting of Stockholders filed with the SEC on May 17, 2023. |

Any statement contained herein or in any document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this prospectus

to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated

by reference herein modifies or replaces such statement. Any such statement so modified or superseded shall not be deemed to constitute

a part of this prospectus, except as so modified or superseded.

We

will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or

documents that have been incorporated by reference in the prospectus contained in the registration statement but not delivered with the

prospectus, other than an exhibit to these filings unless we have specifically incorporated that exhibit by reference into the filing,

upon written or oral request and at no cost to the requester. Requests should be made by writing or telephoning us at the following address:

Chicken Soup for the Soul Entertainment Inc.

132 E Putnam Ave

Cos Cob, CT

203-861-4000

BASE PROSPECTUS

$1,000,000,000

COMMON STOCK, PREFERRED STOCK, WARRANTS,

DEBT SECURITIES AND UNITS (For Issuance)

and

1,798,956 shares of 9.75% Series A cumulative

redeemable

perpetual preferred stock

Offered by Selling Stockholder

We will offer and sell from time to time shares of common stock, shares

of preferred stock, warrants, debt securities and/or units comprised of one or more of the other classes of securities offered hereby,

at a maximum aggregate offering size not to exceed $1,000,000,000. The securities may be offered separately, together, or in series, and

in amounts, at prices and on other terms to be determined at the time of each offering. We will provide the specific terms of the securities

to be sold in a prospectus supplement.

We may sell the securities directly to investors, to or through underwriters

or dealers or through agents designated from time to time, among other methods. The prospectus supplement for each offering will describe

in detail the specific plan of distribution for the securities. The prospectus supplement also will set forth the price to the public

of such securities, any placement agent’s fees or underwriter’s discounts and commissions, and the net proceeds we expect

to receive from the sale of the securities.

This prospectus also covers an offering for resale by a selling securityholder

of up to 1,798,956 shares of our 9.75% Series A cumulative redeemable perpetual preferred stock (“Series A preferred stock”)

issued to the selling securityholder in connection with our repurchase of such holder’s equity interest in Crackle Plus LLC and

the reimbursement of certain expenses incurred by selling securityholder in connection with the creation of Crackle Plus. All such shares

of Series A preferred stock may be offered for resale or otherwise disposed of by the selling securityholder as set forth under the

caption “Selling Securityholder” beginning on page 25 of this prospectus, including its pledgees, assignees, or

successors-in-interest.

We will not receive any proceeds from the sale

or other disposition of the Series A preferred stock by the selling securityholder.

The selling securityholder may be deemed to be an “underwriter”

within the meaning of the Securities Act. We will pay the expenses of registering the holder’s shares of Series A preferred

stock for resale (including the selling stockholder’s legal fees, subject to an agreed cap), but all selling commissions and other

similar expenses incurred by the selling securityholder will be paid by the selling securityholder.

Our Class A common stock is listed for trading on the Nasdaq Global

Market under the symbol “CSSE,” our Series A Preferred Stock is listed for trading on the Nasdaq Global Market under

the symbol “CSSEP,” and our 9.50% Notes Due 2025 (“2025 Notes”) are listed for trading on the Nasdaq Global Market

under the symbol “CSSEN”. On June 9, 2021, the last reported sale prices of our Class A common stock, Series A

preferred stock and 2025 Notes were $33.41, $28.22 and $26.50, respectively.

In addition to our Class A common stock, we have outstanding Class B

common stock. Our Class B common stock is not publicly traded and it is controlled and beneficially owned by our chief executive

officer. Holders of shares of Class A common stock and Class B common stock have substantially identical rights, except that

holders of shares of Class A common stock are entitled to one vote per share and holders of shares of Class B common stock are

entitled to ten votes per share. Holders of shares of Class A common stock and Class B common stock vote together as a single

class on all matters (including the election of directors) submitted to a vote of stockholders, unless otherwise required by law or our

charter. Each share of Class B common stock may be converted into a share of Class A common stock at any time at the election

of the holder.

We are an “emerging growth company” as defined in the

Jumpstart Our Business Startups Act of 2012 and have elected to comply with certain reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See

“Risk Factors” on page 19 in this prospectus, any prospectus supplements, and in our annual report on Form 10-K

for the year ended December 31, 2020, for a discussion of information that should be considered in connection with an investment

in our securities.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this prospectus is June 24, 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with

the Securities and Exchange Commission (“SEC”) using a “shelf” registration process. Under this shelf process,

we may, from time to time, sell or issue any of the combination of securities described in this prospectus in one or more offerings with

a maximum aggregate offering size of up to $1,000,000,000. In addition, the selling securityholder may sell, in one or more offerings

pursuant to this prospectus, up to an aggregate of 1,798,956 shares of our Series A preferred stock, as described in this prospectus.

This prospectus provides you with a general description of the securities

we or the selling securityholder may offer. Each time we sell securities off of the “shelf”, we will provide a prospectus

supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or

change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus

supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus and any prospectus

supplement, together with the additional information described below under the heading “Where You Can Find More Information”

and “Information Incorporated by Reference.”

You should rely only on the information contained or incorporated by

reference in this prospectus and any prospectus supplement relating to a particular offering. We and the selling securityholder have not

authorized anyone to provide you with different information and, if provided, such information or representations must not be relied upon

as having been authorized by us or the selling securityholder. Neither this prospectus nor any prospectus supplement nor any related issuer

free writing prospectus shall constitute an offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction

in which it is unlawful for such person to make such an offering or solicitation. This prospectus does not contain all of the information

included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration

statement, including its exhibits.

You should not assume that the information appearing in this prospectus

is accurate as of any date other than the date on the front cover of this prospectus. You should not assume that the information contained

in any prospectus supplement or in the documents incorporated by reference herein or therein is accurate as of any date other than the

respective dates of those documents. Our business, financial condition, results of operations, and prospects may have changed since that

date.

CERTAIN CORPORATE INFORMATION AND DEFINITIONS

Our company, Chicken Soup for the Soul Entertainment, Inc., is

referred to in this prospectus as “CSSE,” the Company,” or “we” or similar pronouns. References to:

| |

· |

“CSS Productions” means Chicken Soup for the Soul Productions, LLC, our immediate parent; |

| |

· |

“CSS” means Chicken Soup for the Soul, LLC, our intermediate parent company; |

| |

· |

“CSS Holdings” means Chicken Soup for the Soul Holdings, LLC, the parent company of CSS and our ultimate parent company; |

| |

· |

“Screen Media” means Screen Media Ventures, LLC, a wholly owned subsidiary of CSSE; |

| |

· |

“A Plus” means A Sharp Inc. (d/b/a A Plus), a wholly owned subsidiary of CSSE; |

| |

· |

“Pivotshare” means Pivotshare, Inc., a wholly owned subsidiary of CSSE; |

| |

· |

“Crackle Plus” means Crackle Plus, LLC, a wholly owned subsidiary of CSSE which was originally formed by CSSE and CPE Holdings, Inc. (an affiliate of Sony Pictures Television Inc.); |

| |

· |

“Landmark Studio Group” means Landmark Studio Group, a majority owned subsidiary of CSSE; |

| |

· |

“Halcyon Television” means Halcyon Television LLC, a wholly owned subsidiarity of CSSE; |

| |

· |

“Halcyon Studios” mean Halcyon Studios LLC, a majority owned subsidiary of Halcyon Television: and |

| |

· |

“CSS AVOD” means CSS AVOD Inc., a majority owned subsidiary of CSSE. |

We and our subsidiaries and affiliates have proprietary rights to the

trademarks and trade names used herein, including, among others, Chicken Soup for the Soul®, Crackle®, Popcornflix.com®, Popcornflix

Kids®, Truli®, and FrightPix®. Solely as a matter of convenience, trademarks and trade names referred to herein may or may

not be accompanied with the marks of “TM” or “®”, however, the absence of such marks is not intended to indicate

that the Company or its affiliates or subsidiaries will not assert, to the fullest extent possible under applicable law, their respective

rights to such trademarks and trade names.

PROSPECTUS SUMMARY

This

summary description about us and our business highlights selected information contained elsewhere in this prospectus or incorporated in

this prospectus by reference. This summary does not contain all of the information you should consider before deciding to invest in our

securities. You should carefully read this entire prospectus and any applicable prospectus supplement, including each of the documents

incorporated herein or therein by reference, before making an investment decision. Investors should carefully consider the information

set forth under the caption “Risk Factors” below and appearing elsewhere in our

annual report on Form 10-K for the year ended December 31, 2020, our

quarterly report on Form 10-Q for the quarter ended March 31, 2021, and in those described in documents incorporated

by reference herein filed by us from time to time, and those described in any applicable prospectus supplement.

Overview

Chicken Soup for the Soul Entertainment, Inc. is a leading streaming

video-on-demand (VOD) company. We operate Crackle Plus, a portfolio of ad-supported and subscription-based VOD streaming services, as

well as Screen Media, Halcyon Television, and a number of affiliates that collectively enable us to acquire, produce, co-produce and distribute

content, including our original and exclusive content, all in support of our streaming services.

Crackle Plus is comprised of unique networks, each delivering popular

and original premium content focused on different themes such as family, kids, horror and comedy. Crackle Plus brands include Crackle,

among the most watched ad-supported independent VOD networks, Popcornflix, Popcornflix Kids, Truli, Pivotshare, Españolflix and

FrightPix. As of March 31, 2021, Crackle Plus served more than 30 million monthly active visitors through many distribution platforms

including Roku, Amazon Fire, Vizio and others. These visitors viewed content produced through our various television production affiliates,

acquired by Screen Media, or licensed from Sony Pictures Television (SPT), Lionsgate, Paramount, Fox, Warner Brothers and more than 100

other production and distribution companies. For the period ended March 31, 2021, viewers of Crackle Plus networks have access to

more than 10,800 films and 22,000 episodes of licensed or company-owned original or exclusive programming. Additionally, the Company’s

original and exclusive programming made up approximately 18.4% of total ad impressions served in 2020.

Screen Media manages one of the industry’s largest independently

owned television and film libraries consisting of approximately 1,350 feature films and 275 episodes of television programming. Screen

Media also acquires between 10 and 20 new films each year. Screen Media provides content for the Crackle Plus portfolio and also distributes

its library to other exhibitors and third-party networks to generate additional revenue and operating cash flow.

Halcyon Television, our company’s new subsidiary, manages the

extensive film and television library recently acquired from Sonar Entertainment. This library is distributed by Screen Media. The library

contains more than 1,000 titles, and 4,000 hours of programming, ranging from classics, including The Little Rascals,

Laurel & Hardy and Blondie (produced by Hal Roach Studios), to acclaimed epic event mini-series such as Lonesome

Dove and Dinotopia. Our Halcyon library titles have received 446 Emmy Award nominations, 105 Emmy Awards and 15 Golden

Globe Awards. Halcyon Television, and its subsidiary, Halcyon Studios, are headed by David Ellender. Ellender and his team have

developed, produced, financed and distributed shows such as The Shannara Chronicles (MTV/Netflix), Taboo (BBC/FX), The

Son (AMC), Mr. Mercedes (DirecTV), Das Boot (Sky Europe), Hunters (Amazon Prime), Alien Xmas (Netflix)

and Mysterious Benedict Society (Disney+). Halcyon Studios, a subsidiary of Halcyon Television, will continue developing and producing

the current and future high-caliber content for all platforms across a broad spectrum in the U.S. and internationally.

Chicken Soup for the Soul’s various television production activities

are done through a number of affiliates including Landmark Studio Group, its Chicken Soup for the Soul Unscripted division, and APlus.com,