Chicken Soup for the Soul Entertainment Announces Timing of Regular Monthly Dividend for October for Series A Cumulative Redeemable Perpetual Preferred Stock

18 Septembre 2023 - 2:30PM

Business Wire

Chicken Soup for the Soul Entertainment Inc. (Nasdaq: CSSE,

CSSEP, CSSEL, CSSEN), one of the largest providers of premium

content to value-conscious consumers, today announced the timing

for the payment of its declared regular monthly dividend of $0.2031

per share of its 9.75% Series A Cumulative Redeemable Perpetual

Preferred Stock for October 2023. The dividend will be payable on

or around October 15, 2023 to holders of record as of September 30,

2023. The dividend will be paid in cash.

About Chicken Soup for the Soul Entertainment

Chicken Soup for the Soul Entertainment (Nasdaq: CSSE) provides

premium content to value-conscious consumers. The company is one of

the largest advertising-supported video-on-demand (AVOD) companies

in the US, with three flagship AVOD streaming services: Redbox,

Crackle, and Chicken Soup for the Soul. In addition, the company

operates Redbox Free Live TV, a free ad-supported streaming

television service (FAST), with nearly 180 FAST channels as well as

a transaction video on demand (TVOD) service, and a network of

approximately 29,000 kiosks across the US for DVD rentals. To

provide original and exclusive content to its viewers, the company

creates, acquires, and distributes films and TV series through its

Screen Media and Chicken Soup for the Soul TV Group subsidiaries.

Chicken Soup for the Soul Entertainment is a subsidiary of Chicken

Soup for the Soul, LLC, which publishes the famous book series and

produces super-premium pet food under the Chicken Soup for the Soul

brand name.

Note Regarding Use of Non-GAAP Financial Measures

Our consolidated financial statements are prepared in accordance

with generally accepted accounting principles in the United States

(“U.S. GAAP”). We use a non-GAAP financial measure to evaluate our

results of operations and as a supplemental indicator of our

operating performance. The non-GAAP financial measure that we use

is Adjusted EBITDA. Adjusted EBITDA (as defined below) is

considered a non-GAAP financial measure as defined by Regulation G

promulgated by the SEC under the Securities Act of 1933, as

amended. Due to the significance of non-cash and non-recurring

expenses recognized during the years ended December 31, 2022 and

2021, and six months ended June 30, 2023 and 2022, and the

likelihood of material non-cash, non-recurring, and acquisition

related expenses to occur in future periods, we believe that this

non-GAAP financial measure enhances the understanding of our

historical and current financial results as well as provides

investors with measures used by management for the planning and

forecasting of future periods, as well as for measuring performance

for compensation of executives and other members of management.

Further, we believe that Adjusted EBITDA enables our board of

directors and management to analyze and evaluate financial and

strategic planning decisions that will directly affect operating

decisions and investments. We believe this measure is an important

indicator of our operational strength and performance of our

business because it provides a link between operational performance

and operating income. It is also a primary measure used by

management in evaluating companies as potential acquisition

targets. We believe the presentation of this measure is relevant

and useful for investors because it allows investors to view

performance in a manner similar to the method used by management.

We believe it helps improve investors’ ability to understand our

operating performance and makes it easier to compare our results

with other companies that have different capital structures or tax

rates. In addition, we believe this measure is also among the

primary measures used externally by our investors, analysts and

peers in our industry for purposes of valuation and comparing our

operating performance to other companies in our industry.

The presentation of Adjusted EBITDA should not be construed as

an inference that our future results will be unaffected by unusual,

infrequent or non-recurring items or by non-cash items. This

non-GAAP financial measure should be considered in addition to,

rather than as a substitute for, our actual operating results

included in our condensed consolidated financial statements.

We define Adjusted EBITDA as consolidated operating income

(loss) adjusted to exclude interest, taxes, depreciation,

amortization (including tangible and intangible assets), film

library amortization and related costs (film library amortization,

film library revenue shares and participation costs, theatrical

release costs) as well as amortization for certain program rights,

acquisition-related costs, consulting fees related to acquisitions,

dividend payments, non-cash share-based compensation expense, and

adjustments for other unusual and infrequent in nature identified

charges, including transition related expenses. Adjusted EBITDA is

not an earnings measure recognized by U.S. GAAP and does not have a

standardized meaning prescribed by GAAP; accordingly, Adjusted

EBITDA may not be comparable to similar measures presented by other

companies. We believe Adjusted EBITDA to be a meaningful indicator

of our performance that management uses and believes provides

useful information to investors regarding our financial condition

and results of operations. The most comparable GAAP measure is

operating income (loss).

A reconciliation of net loss to Adjusted EBITDA will be provided

in the company’s Quarterly Report on Form 10-Q for the three and

six months ended June 30, 2023 filed on or about August 14, 2023,

under the section thereof entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations –

Reconciliation of Unaudited Historical Results to Adjusted

EBITDA.”

Forward-Looking Statements and Available Information

This press release includes forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements are statements that are not historical facts. These

statements are based on various assumptions, whether or not

identified in this press release, and on the current expectations

of management and are not predictions of actual performance. Such

assumptions involve a number of known and unknown risks and

uncertainties, including but not limited to risks relating to our

core strategy, operating income and margin, seasonality, liquidity,

including cash flows from operations, available funds, and access

to financing sources, free cash flows, revenues, net income,

profitability, stock price volatility, future regulatory changes,

price changes, ability to achieve and sustain market acceptance of

our content streaming services and other content offerings, ability

to recruit and retain officers, key employees, or directors,

ability to protect our intellectual property, ability to complete

and integrate into our existing operations future strategic

acquisitions, ability to manage growth, ability to pay dividends

and our debt obligations, as well as evolving regulatory or other

operational risks, and risks presented by changing general market

conditions impacting demand for our services. For a more complete

description of these and other risks and uncertainties, please

refer to Item 1A (Risk Factors) in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022 filed with the SEC

on March 31, 2023, as amended. If any of these risks materialize or

our assumptions prove incorrect, actual results could differ

materially from the results implied by the forward-looking

statements contained in this press release. Information regarding

the acquisition of Redbox and related transactions is qualified by

reference to the Company’s Current Reports on Form 8-K filed with

the SEC on May 11, 2022 as amended May 12, 2022, June 6, 2022,

August 12, 2022, November 14, 2022 and thereafter from time to

time, and all exhibits filed with respect to such reports. The

forward-looking statements contained in this press release speak

only as of the date hereof and the Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230918964861/en/

INVESTOR RELATIONS Zaia Lawandow Chicken Soup for the

Soul Entertainment Zlawandow@chickensoupforthesoul.com

MEDIA Peter Binazeski Chicken Soup for the Soul

Entertainment Corporate pbinazeski@chickensoupforthesoul.com

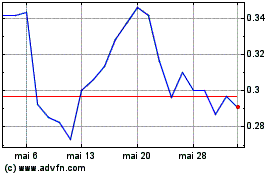

Chicken Soup for the Sou... (NASDAQ:CSSE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Chicken Soup for the Sou... (NASDAQ:CSSE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025